Key Insights

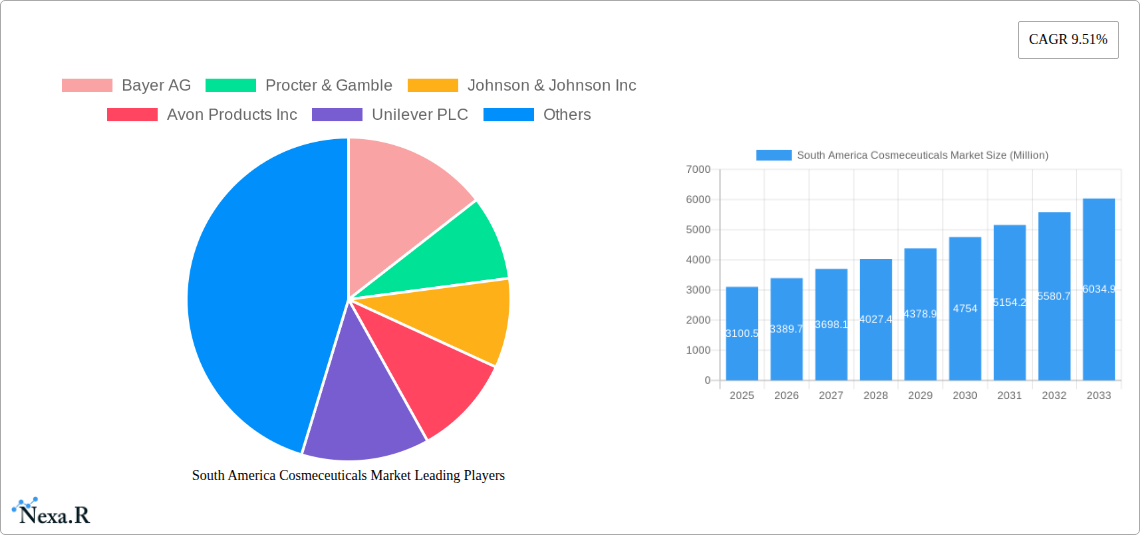

The South America Cosmeceuticals Market is poised for substantial growth, projected to reach approximately $4,955.1 million by 2033, with a robust Compound Annual Growth Rate (CAGR) of 9.51% from 2025 to 2033. This expansion is primarily fueled by a growing consumer awareness of the efficacy of cosmeceutical products that blend cosmetic appeal with therapeutic benefits. Key drivers include an increasing demand for anti-aging solutions, driven by an aging population and a desire for preventative skincare. The rising prevalence of skin concerns like acne, coupled with a heightened emphasis on sun protection, further bolsters market growth. Furthermore, evolving consumer lifestyles and a greater focus on personal wellness are contributing to the uptake of advanced skincare and haircare formulations. The market's dynamism is also influenced by innovative product development, with brands actively introducing sophisticated formulations that address specific dermatological needs.

South America Cosmeceuticals Market Market Size (In Billion)

The market landscape in South America is characterized by diverse consumer preferences and a rapidly expanding distribution network. Online retail is emerging as a significant channel, offering convenience and wider product accessibility, thereby challenging traditional brick-and-mortar outlets like supermarkets and specialist stores. Key product segments within the cosmeceuticals market include skin care, with anti-aging, anti-acne, and sun protection categories showing particular strength. Hair care, lip care, and oral care also represent significant, albeit smaller, segments. Geographically, Brazil and Argentina are anticipated to lead market expansion, benefiting from higher disposable incomes and a strong existing beauty and personal care market. However, the rest of South America is also demonstrating promising growth potential as consumer awareness and purchasing power increase. Restraints, such as the high cost of some advanced formulations and varying regulatory landscapes across countries, may present some challenges, but the overall outlook remains highly positive due to consistent innovation and shifting consumer priorities towards scientifically-backed beauty solutions.

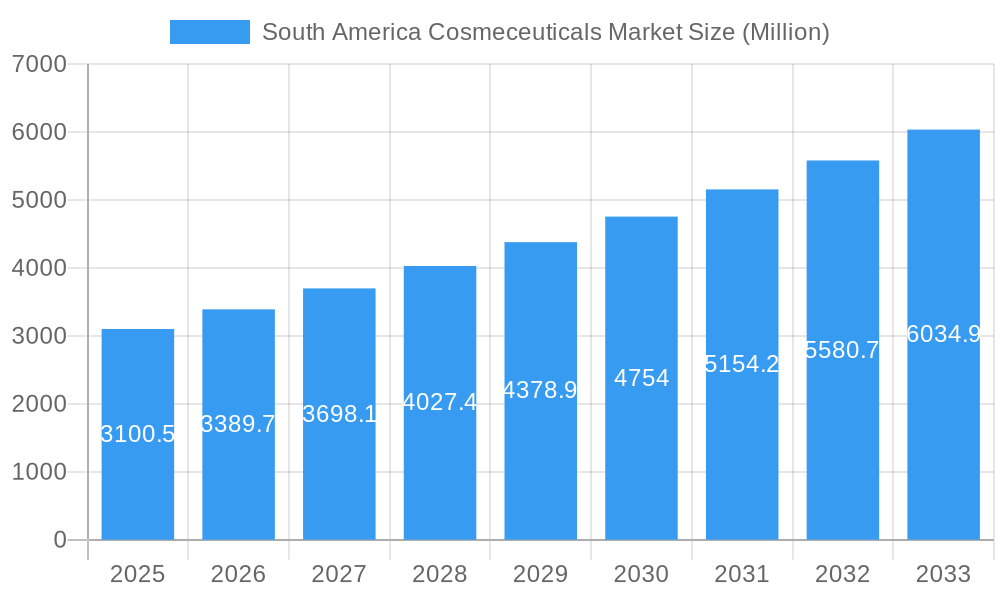

South America Cosmeceuticals Market Company Market Share

South America Cosmeceuticals Market: Growth Drivers, Opportunities, and Key Player Analysis (2019–2033)

This comprehensive report provides an in-depth analysis of the South America cosmeceuticals market, forecasting significant growth driven by increasing consumer awareness of advanced skincare and haircare solutions, a burgeoning middle class, and expanding distribution networks. The report covers the study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025–2033. Historical data from 2019–2024 is also analyzed. We delve into market dynamics, growth trends, dominant segments, product innovations, key challenges, emerging opportunities, and the strategies of major industry players.

South America Cosmeceuticals Market Dynamics & Structure

The South America cosmeceuticals market is characterized by a moderate to high concentration, with global giants and emerging local players vying for market share. Technological innovation, particularly in ingredient formulation and delivery systems for advanced skincare and haircare, is a significant driver. The regulatory landscape, while evolving, generally supports market growth, though varying standards across countries can present complexities. Competitive product substitutes, ranging from traditional cosmetics to prescription-based treatments, influence consumer choices. End-user demographics are shifting towards a younger, more informed consumer base with a greater disposable income, increasingly seeking science-backed beauty solutions. Mergers and acquisitions (M&A) trends indicate strategic consolidation and expansion, with companies acquiring innovative startups or established regional brands to enhance their product portfolios and market reach.

- Market Concentration: Dominated by a few key global players, but with increasing fragmentation due to regional brands.

- Technological Innovation Drivers: Focus on advanced ingredients (peptides, retinoids), natural extracts, and sustainable formulations.

- Regulatory Frameworks: Evolving regulations regarding ingredient safety and efficacy, with increasing emphasis on natural and organic certifications.

- Competitive Product Substitutes: Range from mass-market cosmetics to dermo-cosmetic brands and niche premium products.

- End-User Demographics: Growing demand from millennials and Gen Z for effective, multi-functional products.

- M&A Trends: Acquisitions focused on innovative technologies, sustainable sourcing, and expanding geographical presence. For instance, an estimated 8-12 M&A deals in the last three years have focused on natural ingredient sourcing companies.

South America Cosmeceuticals Market Growth Trends & Insights

The South America cosmeceuticals market is experiencing robust growth, projected to reach a market size of approximately 18,500 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 7.2% during the forecast period. This expansion is fueled by a confluence of factors, including a significant rise in consumer disposable income and a heightened awareness regarding the benefits of scientifically formulated beauty products that offer therapeutic advantages beyond basic aesthetics. The increasing prevalence of skin concerns such as aging, acne, and sun damage, coupled with a growing desire for preventative and corrective solutions, is directly translating into higher demand for sophisticated cosmeceutical products.

Technological disruptions are playing a pivotal role, with advancements in dermatological research leading to the development of novel active ingredients and enhanced delivery systems. These innovations enable cosmeceuticals to penetrate deeper into the skin, delivering targeted benefits more effectively. Consumers are actively seeking products with proven efficacy, moving away from purely cosmetic formulations towards those that integrate pharmaceutical-grade ingredients and scientific backing. This shift is evident in the growing adoption rates of anti-aging serums, specialized acne treatments, and advanced sun protection products.

Furthermore, evolving consumer behavior patterns, influenced by social media, celebrity endorsements, and access to detailed product information online, are shaping purchasing decisions. There is a discernible trend towards personalized skincare routines, with consumers looking for products that cater to their specific skin types and concerns. This demand for efficacy and personalization is driving the market towards more specialized and high-performance cosmeceutical offerings. The overall market penetration of cosmeceuticals is expected to increase from an estimated 15% in the base year 2025 to over 22% by 2033. This upward trajectory underscores the growing trust and preference consumers are placing on products that bridge the gap between cosmetics and pharmaceuticals, promising visible and tangible results.

Dominant Regions, Countries, or Segments in South America Cosmeceuticals Market

Within the South America cosmeceuticals market, Brazil stands out as the dominant country, driven by its large population, a well-established beauty industry, and a growing middle class with increasing disposable income and a high propensity for beauty product expenditure. The Brazilian consumer is sophisticated and actively seeks out innovative skincare and haircare solutions, contributing significantly to the demand for cosmeceuticals. The country’s robust retail infrastructure, encompassing both traditional channels like supermarkets and hypermarkets, and rapidly expanding online retail platforms, further facilitates the accessibility and adoption of cosmeceutical products.

Among the product types, Skin Care is the leading segment, accounting for an estimated 65% of the total market value. Within the skin care segment, Anti-aging products are experiencing the most rapid growth, driven by an aging population and a societal emphasis on maintaining a youthful appearance. Moisturizers and Sun Protection products also hold significant market share due to increasing awareness of the detrimental effects of environmental factors and the importance of daily skincare routines. The "Other Skin Care Product Types" category is also growing substantially, encompassing specialized treatments for hyperpigmentation, rosacea, and sensitivity.

In terms of distribution channels, Online Retail is emerging as a crucial growth engine, expected to capture over 30% of the market share by 2033. This is attributed to the convenience it offers, the wider product selection, and competitive pricing. However, Supermarket/Hypermarkets still hold a substantial share, providing accessibility to a broad consumer base.

- Dominant Country: Brazil

- Drivers: Large population, increasing disposable income, high beauty spending, strong retail presence.

- Market Share (Brazil): Estimated 45% of the total South America cosmeceuticals market.

- Growth Potential: Continued expansion of premium and specialized product offerings catering to specific Brazilian skin types and concerns.

- Dominant Product Segment: Skin Care

- Sub-segment Dominance: Anti-aging products are the primary growth driver, followed by Moisturizers and Sun Protection.

- Market Share (Skin Care): Approximately 65% of the total market value.

- Innovation Focus: Development of advanced formulations with potent active ingredients and scientific endorsements.

- Dominant Distribution Channel: Online Retail

- Growth Factors: E-commerce penetration, convenience, wider product availability, competitive pricing, and digital marketing strategies.

- Projected Market Share (Online Retail): Exceeding 30% by 2033.

- Impact: Increased accessibility to niche and specialized cosmeceutical brands.

South America Cosmeceuticals Market Product Landscape

The product landscape in the South America cosmeceuticals market is characterized by a strong emphasis on efficacy and scientific innovation. Manufacturers are investing heavily in research and development to incorporate advanced ingredients like peptides, hyaluronic acid, retinol, and potent antioxidants into their formulations. Product applications are diverse, spanning anti-aging, skin brightening, acne treatment, sun protection, and hydration. Performance metrics are increasingly being highlighted, with brands showcasing clinical trial data and consumer satisfaction rates to validate product claims. Unique selling propositions often revolve around patented ingredient complexes, sustainable sourcing, and dermatologist recommendations. Technological advancements are evident in the development of novel delivery systems, such as encapsulated ingredients and liposomal formulations, which enhance product stability and skin penetration, leading to more visible results.

Key Drivers, Barriers & Challenges in South America Cosmeceuticals Market

Key Drivers:

The South America cosmeceuticals market is propelled by several key drivers. A significant factor is the increasing consumer awareness and demand for scientifically proven skincare and haircare products that offer therapeutic benefits. The rising disposable income across many South American nations, particularly Brazil and Argentina, allows consumers to invest more in premium beauty and wellness products. Furthermore, the growing influence of social media and digital platforms educates consumers about advanced ingredients and treatment options, fostering a desire for effective, results-driven solutions. Technological advancements in ingredient innovation and formulation science are also crucial, enabling the development of highly effective cosmeceutical products.

Key Barriers & Challenges:

Despite the positive outlook, the market faces several barriers and challenges. High product pricing compared to conventional cosmetics can be a deterrent for price-sensitive consumers, limiting mass adoption. Stringent and varying regulatory frameworks across different South American countries can create complexities for market entry and product registration, increasing compliance costs. Intense competition from both established global brands and a growing number of local players can lead to price wars and impact profit margins. Supply chain disruptions, particularly in the import of specialized raw materials, can affect production and availability. Moreover, counterfeit products pose a significant challenge, eroding consumer trust and brand reputation.

Emerging Opportunities in South America Cosmeceuticals Market

Emerging opportunities in the South America cosmeceuticals market lie in the growing demand for natural and sustainable ingredients, aligning with global trends and increasing consumer consciousness. The untapped potential in emerging economies within the "Rest of South America" segment presents a significant avenue for market expansion. Furthermore, the development of personalized cosmeceutical solutions, leveraging AI and diagnostic tools, offers a niche for innovative brands. The increasing acceptance of e-commerce for beauty products creates an opportunity for direct-to-consumer (DTC) brands to establish a strong foothold. Finally, the growing focus on men's grooming and cosmeceuticals tailored for male concerns presents another burgeoning area for market development.

Growth Accelerators in the South America Cosmeceuticals Market Industry

Several catalysts are accelerating the long-term growth of the South America cosmeceuticals market. Technological breakthroughs in biotechnology and green chemistry are leading to the development of more effective and sustainable active ingredients. Strategic partnerships between pharmaceutical companies and beauty brands are fostering innovation and bringing scientifically validated products to the market. Market expansion strategies, including targeted product launches and robust marketing campaigns in underserved regions, are further driving growth. The increasing consumer inclination towards preventative skincare and wellness also acts as a significant accelerator, positioning cosmeceuticals as essential components of a healthy lifestyle.

Key Players Shaping the South America Cosmeceuticals Market Market

- Bayer AG

- Procter & Gamble

- Johnson & Johnson Inc

- Avon Products Inc

- Unilever PLC

- Groupe Clarins SA

- L'Oreal Group

- Shiseido Co Ltd

- Beiersdorf AG

Notable Milestones in South America Cosmeceuticals Market Sector

- 2021: Launch of several new anti-aging serums incorporating advanced peptide technology in Brazil and Argentina.

- 2022: Increased investment by multinational corporations in local R&D facilities to cater to specific South American skin types and concerns.

- 2023 (Q1): Significant growth in online sales of dermo-cosmetic products, driven by targeted digital marketing campaigns.

- 2023 (Q2): Expansion of specialized skincare ranges addressing hyperpigmentation and sun damage, particularly in urban centers.

- 2024 (Q1): Growing consumer interest in sustainable and ethically sourced cosmeceutical ingredients, leading to product reformulations.

- 2024 (Q3): Several key players reported double-digit growth in their sun protection and acne treatment categories.

In-Depth South America Cosmeceuticals Market Market Outlook

The future outlook for the South America cosmeceuticals market is exceptionally promising, fueled by sustained demand for innovative and effective beauty solutions. Growth accelerators, including ongoing advancements in ingredient technology and a burgeoning consumer focus on personalized wellness, will continue to drive market expansion. Strategic collaborations and market penetration into less saturated regions will further solidify the market's trajectory. The increasing integration of digital platforms for product discovery and purchase, coupled with a growing appreciation for science-backed efficacy, positions cosmeceuticals as indispensable in consumers' beauty routines, promising significant long-term growth and profitability for stakeholders.

South America Cosmeceuticals Market Segmentation

-

1. Product Type

-

1.1. Skin Care

- 1.1.1. Anti-ageing

- 1.1.2. Anti-acne

- 1.1.3. Sun Protection

- 1.1.4. Moisturizers

- 1.1.5. Other Skin Care Product Types

-

1.2. Hair Care

- 1.2.1. Shampoos and Conditioners

- 1.2.2. Hair Colorants and Dyes

- 1.2.3. Other Hair Care Product Types

- 1.3. Lip Care

- 1.4. Oral Care

-

1.1. Skin Care

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarkets

- 2.2. Online Retail

- 2.3. Convenience Stores

- 2.4. Specialist Stores

- 2.5. Others

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

South America Cosmeceuticals Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America Cosmeceuticals Market Regional Market Share

Geographic Coverage of South America Cosmeceuticals Market

South America Cosmeceuticals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness About Effective Skincare; Aggressive Marketing and Advertising Strategies By Brands

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Aging Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Cosmeceuticals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Skin Care

- 5.1.1.1. Anti-ageing

- 5.1.1.2. Anti-acne

- 5.1.1.3. Sun Protection

- 5.1.1.4. Moisturizers

- 5.1.1.5. Other Skin Care Product Types

- 5.1.2. Hair Care

- 5.1.2.1. Shampoos and Conditioners

- 5.1.2.2. Hair Colorants and Dyes

- 5.1.2.3. Other Hair Care Product Types

- 5.1.3. Lip Care

- 5.1.4. Oral Care

- 5.1.1. Skin Care

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarkets

- 5.2.2. Online Retail

- 5.2.3. Convenience Stores

- 5.2.4. Specialist Stores

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Procter & Gamble

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson & Johnson Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Avon Products Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Unilever PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Groupe Clarins SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L'Oreal Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shiseido Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beiersdorf AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: South America Cosmeceuticals Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Cosmeceuticals Market Share (%) by Company 2025

List of Tables

- Table 1: South America Cosmeceuticals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: South America Cosmeceuticals Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Cosmeceuticals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Cosmeceuticals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: South America Cosmeceuticals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: South America Cosmeceuticals Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Cosmeceuticals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Cosmeceuticals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Brazil South America Cosmeceuticals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Argentina South America Cosmeceuticals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of South America South America Cosmeceuticals Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Cosmeceuticals Market?

The projected CAGR is approximately 6.93%.

2. Which companies are prominent players in the South America Cosmeceuticals Market?

Key companies in the market include Bayer AG, Procter & Gamble, Johnson & Johnson Inc, Avon Products Inc, Unilever PLC, Groupe Clarins SA, L'Oreal Group, Shiseido Co Ltd, Beiersdorf AG.

3. What are the main segments of the South America Cosmeceuticals Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness About Effective Skincare; Aggressive Marketing and Advertising Strategies By Brands.

6. What are the notable trends driving market growth?

Growing Aging Population.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Cosmeceuticals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Cosmeceuticals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Cosmeceuticals Market?

To stay informed about further developments, trends, and reports in the South America Cosmeceuticals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence