Key Insights

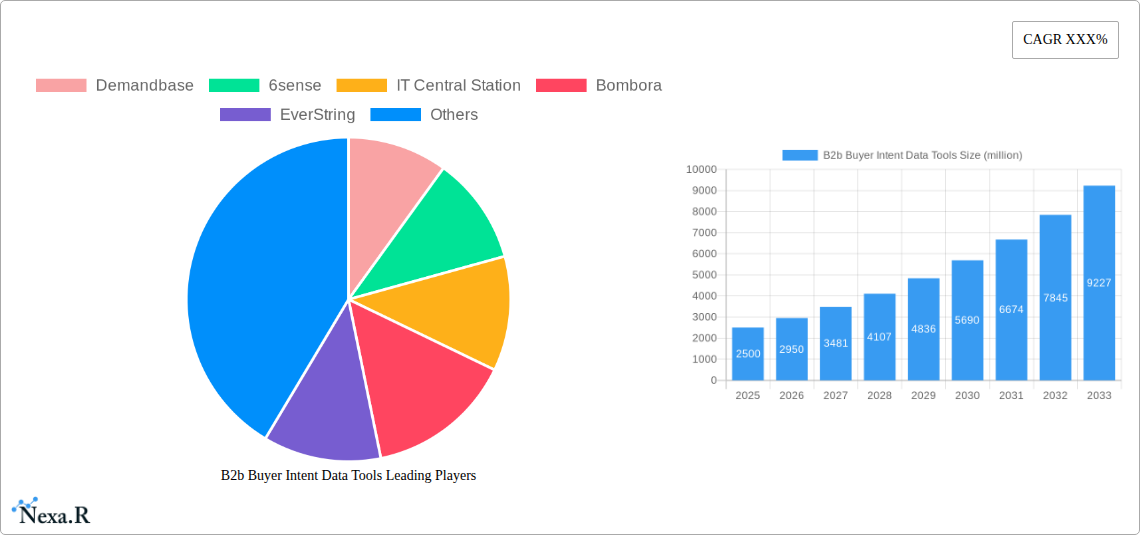

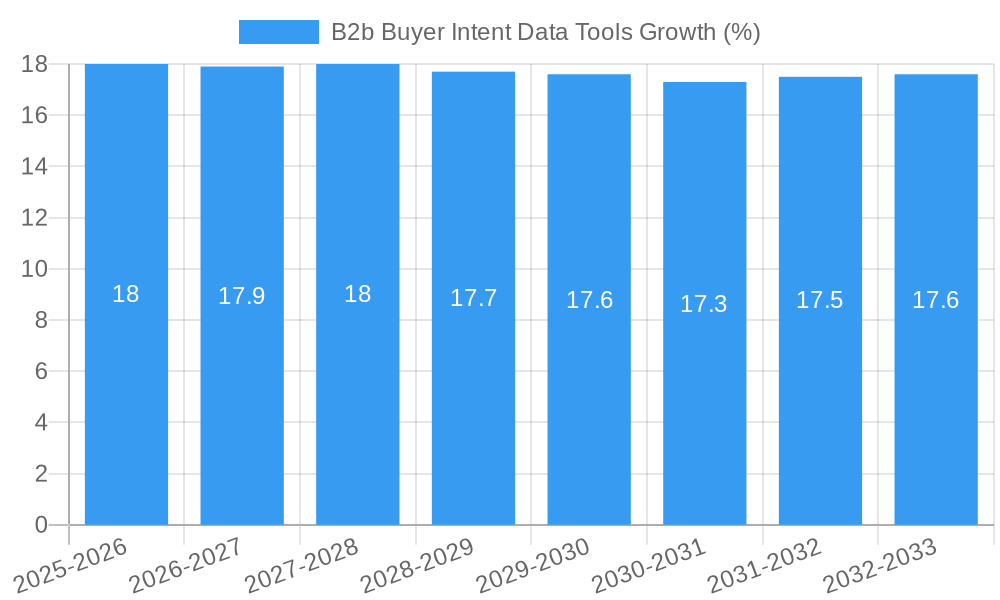

The B2B Buyer Intent Data Tools market is poised for significant expansion, driven by the increasing need for businesses to understand and engage with their target audiences proactively. With an estimated market size of USD 2,500 million in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 18%, reaching an estimated USD 7,000 million by 2033. This robust growth is fueled by the escalating adoption of data-driven marketing strategies and the demand for personalized buyer experiences. Key drivers include the ability of these tools to identify active buying signals, optimize sales outreach, and improve marketing ROI. The shift towards cloud-based solutions is a prominent trend, offering scalability, flexibility, and cost-effectiveness for businesses of all sizes. SMEs, in particular, are increasingly leveraging these tools to level the playing field with larger competitors, gaining deeper insights into customer needs and market dynamics. The ability to precisely target potential customers exhibiting buying intent is revolutionizing B2B sales and marketing, leading to more efficient lead generation and conversion rates.

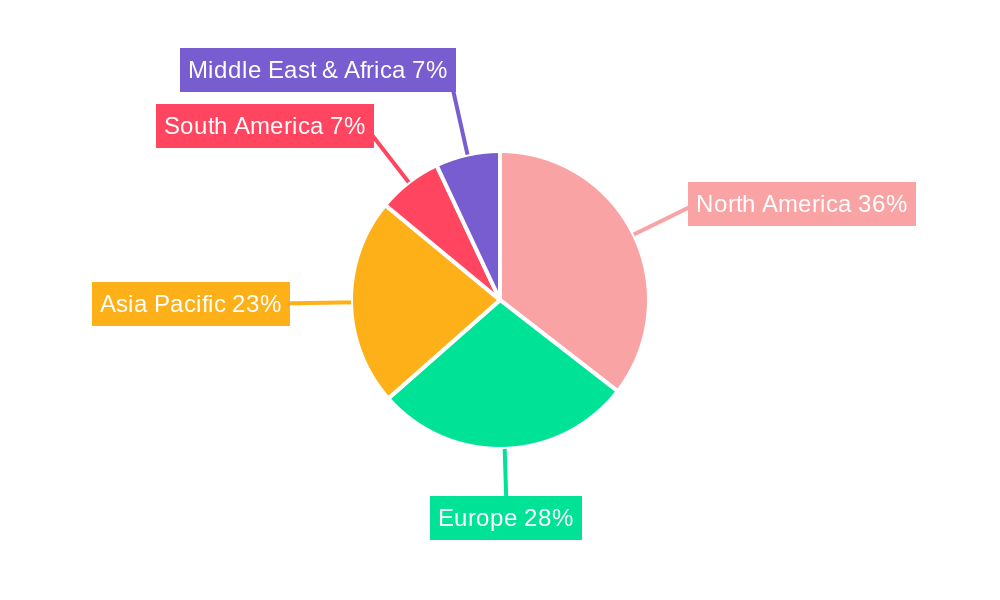

However, certain factors could moderate this rapid ascent. The complexity of integrating intent data with existing CRM and marketing automation platforms can pose a challenge for some organizations, requiring specialized expertise. Furthermore, concerns surrounding data privacy and the ethical use of buyer intent information, particularly in light of evolving regulations, necessitate careful navigation by market participants. Despite these restraints, the overwhelming benefits of leveraging buyer intent data – including enhanced customer understanding, improved sales pipeline velocity, and a more targeted approach to lead nurturing – are expected to outweigh these challenges. The market landscape features a dynamic mix of established players like Demandbase and 6sense, alongside emerging innovators, all contributing to a competitive and evolving ecosystem. Regional expansion is anticipated across North America, Europe, and Asia Pacific, with each region exhibiting unique adoption patterns and market demands for these advanced sales and marketing intelligence solutions.

Unlocking Revenue: The B2B Buyer Intent Data Tools Market Report

This comprehensive report, "B2B Buyer Intent Data Tools Market Dynamics & Structure 2019-2033," provides an unparalleled deep dive into the rapidly evolving landscape of B2B buyer intent data. Gain actionable insights into market drivers, growth trajectories, and competitive strategies essential for navigating this high-growth sector. Our analysis meticulously covers the parent and child markets, offering a granular understanding of opportunities across diverse segments, from Small and Medium Enterprises (SMEs) to large corporations and cloud-based solutions.

B2b Buyer Intent Data Tools Market Dynamics & Structure

The B2B Buyer Intent Data Tools market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and increasing market concentration. While early market entrants established significant positions, newer players are continuously disrupting the space with advanced AI and machine learning capabilities. The competitive product substitute landscape is dynamic, with traditional CRM and marketing automation platforms beginning to integrate sophisticated intent data features, necessitating continuous innovation from dedicated intent data providers. End-user demographics are expanding beyond traditional sales and marketing teams to include product development and customer success departments, highlighting the pervasive need for understanding buyer behavior. Mergers and acquisitions (M&A) remain a significant trend as larger players seek to acquire specialized intent data capabilities, leading to increased market consolidation.

- Market Concentration: Moderate to high, with key players holding substantial market share, but significant room for innovation from niche providers.

- Technological Innovation Drivers: AI/ML for predictive analytics, natural language processing (NLP) for content analysis, integration with existing martech stacks.

- Regulatory Frameworks: Growing emphasis on data privacy and consent (e.g., GDPR, CCPA) influencing data collection and utilization strategies.

- Competitive Product Substitutes: CRM platforms, marketing automation tools, and business intelligence software are increasingly incorporating intent data functionalities.

- End-User Demographics: Sales, Marketing, Customer Success, Product Development teams across various industries.

- M&A Trends: Significant acquisition activity as larger MarTech companies bolster their intent data offerings. Deal volumes are projected to increase by an estimated 25% in the next five years.

B2b Buyer Intent Data Tools Growth Trends & Insights

The B2B Buyer Intent Data Tools market is experiencing robust growth, driven by the imperative for data-driven decision-making in modern sales and marketing. The global B2B buyer intent data market size was valued at approximately 1.5 billion units in the base year 2025, with projections indicating a substantial compound annual growth rate (CAGR) of 18.5% during the forecast period of 2025–2033. This exceptional growth is fueled by the increasing adoption of sophisticated analytics and the recognition of intent data as a critical tool for improving lead qualification, personalization, and ultimately, revenue acceleration. Technological disruptions, particularly in the realm of AI and machine learning, are enhancing the accuracy and actionable insights derived from intent data, leading to higher adoption rates across various industries. Consumer behavior shifts towards more self-directed research and digitally influenced purchasing journeys further underscore the importance of understanding buyer intent at every stage of the funnel. The market penetration of intent data solutions is expected to rise from an estimated 35% in 2025 to over 60% by 2033, reflecting its transition from a niche offering to a mainstream necessity for B2B organizations. The increasing demand for personalized customer experiences and the need to optimize marketing spend by focusing on high-propensity buyers are key catalysts for this upward trend. Furthermore, the ability of intent data tools to provide early warnings of potential churn and identify upsell opportunities is driving their adoption within customer success teams, expanding the overall market scope. The evolution of data sources, including web crawling, content engagement, and third-party data integrations, is also contributing to more comprehensive and accurate intent signals.

Dominant Regions, Countries, or Segments in B2b Buyer Intent Data Tools

North America currently dominates the B2B Buyer Intent Data Tools market, driven by a mature technology ecosystem, high adoption rates of advanced sales and marketing technologies, and a strong presence of large enterprises and SMEs actively seeking competitive advantages. The United States, in particular, accounts for an estimated 55% of the global market share in this region, propelled by significant investments in AI and data analytics. The SMEs segment is emerging as a significant growth driver within North America, with an estimated market share of 40%, as smaller businesses increasingly leverage affordable and accessible intent data solutions to compete with larger organizations. This is closely followed by the Large Companies segment, which holds an estimated 60% market share, primarily due to their larger budgets for sophisticated technology solutions and their more complex sales cycles where intent data provides critical strategic insights. In terms of deployment, the Cloud-based segment is experiencing exponential growth, capturing an estimated 70% of the market share, owing to its scalability, flexibility, and reduced IT overhead. The on-premise segment, while still relevant for organizations with stringent data security policies, accounts for the remaining 30%. Key drivers for North America's dominance include proactive government initiatives supporting technological innovation, a highly skilled workforce, and a robust venture capital landscape that fuels the development and adoption of new technologies. The region’s forward-thinking approach to data utilization and its early embrace of AI-powered solutions have firmly established it as the leader in the B2B buyer intent data tools sector. The presence of major technology hubs and a high concentration of B2B companies actively engaged in digital transformation further solidify its leading position, with an anticipated continued growth rate of 20% for the next five years.

B2b Buyer Intent Data Tools Product Landscape

The B2B Buyer Intent Data Tools product landscape is defined by continuous innovation in data aggregation, analysis, and application. Leading solutions now offer real-time intent signals derived from a multitude of online and offline sources, including website visits, content consumption, social media engagement, and third-party data integrations. Advanced AI and machine learning algorithms are employed to identify patterns, predict buyer needs, and score leads with remarkable accuracy. These tools empower sales and marketing teams to personalize outreach, prioritize engagement efforts, and optimize campaign performance by targeting buyers exhibiting specific research behaviors and interests. Unique selling propositions often revolve around the depth and breadth of data sources, the sophistication of predictive analytics, and seamless integration with popular CRM and marketing automation platforms.

Key Drivers, Barriers & Challenges in B2b Buyer Intent Data Tools

Key Drivers:

- Increasing Demand for Personalization: B2B buyers expect tailored experiences, driving the need for intent data to understand individual needs.

- ROI Optimization: Intent data allows for more efficient allocation of sales and marketing resources, focusing on high-propensity buyers.

- Technological Advancements: AI, ML, and NLP are enhancing the accuracy and actionable insights from intent data.

- Digital Transformation: The shift to digital sales and marketing channels necessitates data-driven approaches.

Barriers & Challenges:

- Data Privacy Regulations: Navigating complex global privacy laws (e.g., GDPR, CCPA) poses a significant hurdle, with compliance costs estimated to be up to 15% of operational budgets for some organizations.

- Data Quality & Accuracy: Ensuring the reliability and accuracy of intent signals from diverse sources remains a challenge.

- Integration Complexities: Seamless integration with existing MarTech stacks can be technically demanding and costly.

- Talent Gap: A shortage of skilled data scientists and analysts capable of interpreting and leveraging intent data effectively.

- Market Saturation: Increasing competition necessitates clear differentiation and value proposition.

Emerging Opportunities in B2b Buyer Intent Data Tools

Emerging opportunities in the B2B Buyer Intent Data Tools sector lie in the expanded application of AI for more predictive forecasting, including churn prediction and customer lifetime value optimization. The development of hyper-personalized content recommendations based on real-time intent signals presents a significant avenue for engagement. Untapped markets in emerging economies, particularly in Asia-Pacific and Latin America, offer substantial growth potential as these regions embrace digital transformation. Furthermore, the integration of intent data with emerging technologies like the metaverse and augmented reality could unlock entirely new paradigms for B2B engagement and sales enablement. The increasing focus on ethical AI and transparent data usage will also create opportunities for providers prioritizing responsible data practices.

Growth Accelerators in the B2b Buyer Intent Data Tools Industry

Several catalysts are propelling long-term growth in the B2B Buyer Intent Data Tools industry. Technological breakthroughs in AI and machine learning are continuously improving the precision and predictive power of intent analysis, making these tools more indispensable. Strategic partnerships between intent data providers and leading CRM, marketing automation, and sales enablement platforms are expanding market reach and enhancing the overall value proposition. Furthermore, the growing recognition of intent data's impact on revenue generation is driving increased investment from venture capitalists and private equity firms, fueling further innovation and market expansion. The development of industry-specific intent data solutions tailored to unique sector needs is also a significant growth accelerator, allowing for more targeted and effective application.

Key Players Shaping the B2b Buyer Intent Data Tools Market

- Demandbase

- 6sense

- IT Central Station

- Bombora

- EverString

- TechTarget

- LeadSift

- PureB2B

- Idio

- Aberdeen

- IntentData

Notable Milestones in B2b Buyer Intent Data Tools Sector

- 2019: Increased adoption of AI/ML for intent data analysis begins to show significant ROI.

- 2020: TechTarget's acquisition of G Squared marks a significant consolidation trend.

- 2021: 6sense secures substantial Series D funding, signaling strong investor confidence.

- 2022: Demandbase launches its enhanced account intelligence platform, integrating deeper intent capabilities.

- 2023: Bombora expands its data partnerships, broadening its intent signal coverage.

- 2024: Growing emphasis on data privacy compliance becomes a key feature for intent data vendors.

In-Depth B2b Buyer Intent Data Tools Market Outlook

The future of the B2B Buyer Intent Data Tools market is exceptionally bright, with sustained growth driven by the escalating need for precise, data-backed sales and marketing strategies. Growth accelerators such as advanced AI-powered predictive analytics, seamless integration across the entire MarTech stack, and the expanding adoption by SMEs are creating a fertile ground for innovation. Strategic partnerships and the continuous development of industry-specific solutions will further solidify market positions. Organizations that effectively harness the power of intent data will gain a significant competitive edge, leading to increased market penetration and revenue. The market is poised for further evolution, with a growing emphasis on ethical data practices and hyper-personalization, promising a dynamic and rewarding landscape for all stakeholders involved.

B2b Buyer Intent Data Tools Segmentation

-

1. Application

- 1.1. SMEs

- 1.2. Large Companies

-

2. Type

- 2.1. On-premise

- 2.2. Cloud-based

B2b Buyer Intent Data Tools Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

B2b Buyer Intent Data Tools REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global B2b Buyer Intent Data Tools Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. SMEs

- 5.1.2. Large Companies

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. On-premise

- 5.2.2. Cloud-based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America B2b Buyer Intent Data Tools Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. SMEs

- 6.1.2. Large Companies

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. On-premise

- 6.2.2. Cloud-based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America B2b Buyer Intent Data Tools Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. SMEs

- 7.1.2. Large Companies

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. On-premise

- 7.2.2. Cloud-based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe B2b Buyer Intent Data Tools Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. SMEs

- 8.1.2. Large Companies

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. On-premise

- 8.2.2. Cloud-based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa B2b Buyer Intent Data Tools Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. SMEs

- 9.1.2. Large Companies

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. On-premise

- 9.2.2. Cloud-based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific B2b Buyer Intent Data Tools Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. SMEs

- 10.1.2. Large Companies

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. On-premise

- 10.2.2. Cloud-based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Demandbase

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 6sense

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IT Central Station

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bombora

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EverString

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TechTarget

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LeadSift

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PureB2B

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Idio

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aberdeen

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IntentData

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Demandbase

List of Figures

- Figure 1: Global B2b Buyer Intent Data Tools Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America B2b Buyer Intent Data Tools Revenue (million), by Application 2024 & 2032

- Figure 3: North America B2b Buyer Intent Data Tools Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America B2b Buyer Intent Data Tools Revenue (million), by Type 2024 & 2032

- Figure 5: North America B2b Buyer Intent Data Tools Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America B2b Buyer Intent Data Tools Revenue (million), by Country 2024 & 2032

- Figure 7: North America B2b Buyer Intent Data Tools Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America B2b Buyer Intent Data Tools Revenue (million), by Application 2024 & 2032

- Figure 9: South America B2b Buyer Intent Data Tools Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America B2b Buyer Intent Data Tools Revenue (million), by Type 2024 & 2032

- Figure 11: South America B2b Buyer Intent Data Tools Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America B2b Buyer Intent Data Tools Revenue (million), by Country 2024 & 2032

- Figure 13: South America B2b Buyer Intent Data Tools Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe B2b Buyer Intent Data Tools Revenue (million), by Application 2024 & 2032

- Figure 15: Europe B2b Buyer Intent Data Tools Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe B2b Buyer Intent Data Tools Revenue (million), by Type 2024 & 2032

- Figure 17: Europe B2b Buyer Intent Data Tools Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe B2b Buyer Intent Data Tools Revenue (million), by Country 2024 & 2032

- Figure 19: Europe B2b Buyer Intent Data Tools Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa B2b Buyer Intent Data Tools Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa B2b Buyer Intent Data Tools Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa B2b Buyer Intent Data Tools Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa B2b Buyer Intent Data Tools Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa B2b Buyer Intent Data Tools Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa B2b Buyer Intent Data Tools Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific B2b Buyer Intent Data Tools Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific B2b Buyer Intent Data Tools Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific B2b Buyer Intent Data Tools Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific B2b Buyer Intent Data Tools Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific B2b Buyer Intent Data Tools Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific B2b Buyer Intent Data Tools Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global B2b Buyer Intent Data Tools Revenue million Forecast, by Country 2019 & 2032

- Table 41: China B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific B2b Buyer Intent Data Tools Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the B2b Buyer Intent Data Tools?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the B2b Buyer Intent Data Tools?

Key companies in the market include Demandbase, 6sense, IT Central Station, Bombora, EverString, TechTarget, LeadSift, PureB2B, Idio, Aberdeen, IntentData.

3. What are the main segments of the B2b Buyer Intent Data Tools?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "B2b Buyer Intent Data Tools," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the B2b Buyer Intent Data Tools report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the B2b Buyer Intent Data Tools?

To stay informed about further developments, trends, and reports in the B2b Buyer Intent Data Tools, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence