Key Insights

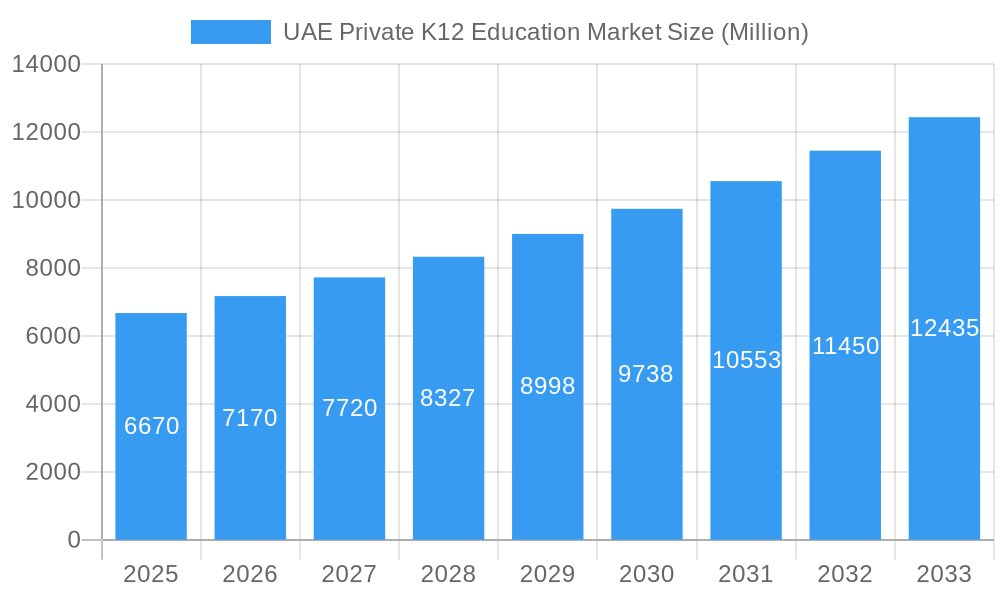

The UAE Private K12 Education market is experiencing robust growth, driven by a burgeoning population, increasing disposable incomes, and a strong emphasis on quality education. The market size in 2025 is estimated at $6.67 billion, exhibiting a Compound Annual Growth Rate (CAGR) of 7.50% from 2019 to 2033. This expansion is fueled by several key factors. Firstly, a significant portion of the UAE's population consists of expatriates, many of whom opt for private international schools that offer curricula aligned with international standards. Secondly, rising parental aspirations for their children's future, coupled with increasing disposable incomes, are driving demand for high-quality private education, leading to premium pricing strategies adopted by many institutions. Thirdly, the UAE government's continuous investments in education infrastructure and supportive policies further stimulate market growth. The sector is highly competitive, with numerous established international school chains and local players vying for market share. Competition fosters innovation in curriculum development, teaching methodologies, and facility upgrades. However, factors like stringent regulatory requirements and increasing operational costs could potentially act as market restraints.

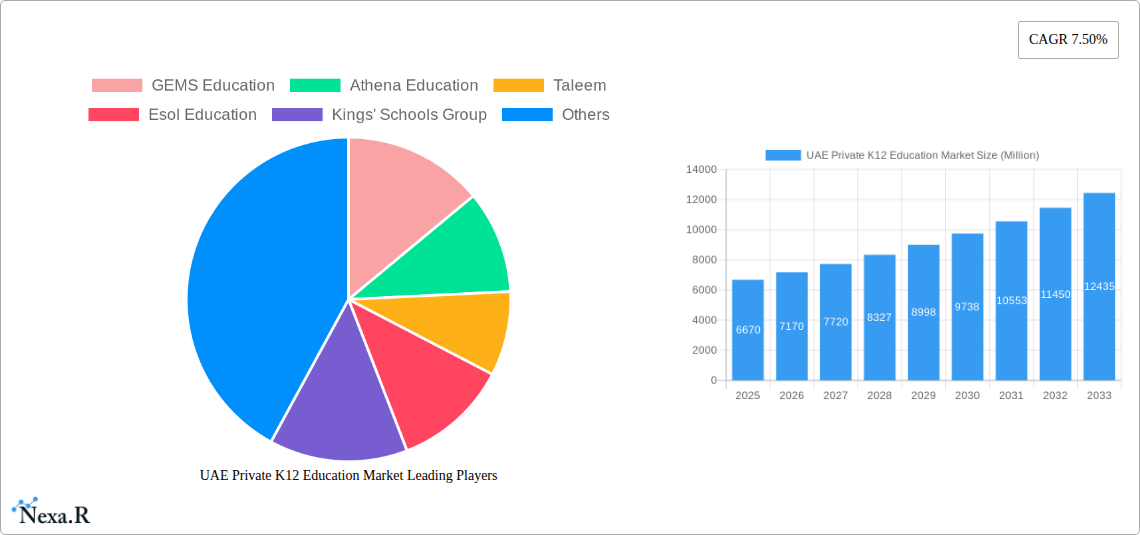

UAE Private K12 Education Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, primarily driven by population growth and sustained economic development. While challenges such as tuition fee affordability might pose some concerns, the overall outlook remains positive. The market segmentation is likely diverse, encompassing various curricula (e.g., British, American, IB), school types (e.g., day schools, boarding schools), and price points. Key players like GEMS Education, Athena Education, and Nord Anglia Education are prominent, contributing significantly to the market's competitive landscape. Future growth will depend on the continued economic stability of the UAE, ongoing government support for the education sector, and the ability of private schools to adapt to evolving educational trends and parental expectations. Strategic partnerships and mergers & acquisitions could also shape the market's evolution during the forecast period.

UAE Private K12 Education Market Company Market Share

UAE Private K12 Education Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE Private K12 Education market, offering invaluable insights for investors, educators, and industry professionals. With a focus on market dynamics, growth trends, key players, and future opportunities, this report covers the historical period (2019-2024), base year (2025), and forecasts until 2033. The report segments the market to provide granular insights, facilitating strategic decision-making. The total market size is projected to reach xx Million by 2033.

UAE Private K12 Education Market Dynamics & Structure

This section analyzes the UAE's private K12 education landscape, examining market concentration, technological advancements, regulatory influences, competitive dynamics, and demographic trends. The market is characterized by a mix of large international players and smaller local institutions.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players controlling a significant share. GEMS Education and Nord Anglia Education hold substantial market share. However, the sector also includes a considerable number of smaller, niche players catering to specific educational philosophies or demographics.

- Technological Innovation: The adoption of EdTech is a key driver, with increasing investment in online learning platforms, interactive educational tools, and data analytics for personalized learning. However, implementation can be constrained by the cost and lack of teacher training.

- Regulatory Framework: The UAE's Ministry of Education sets the standards and regulations for private schools, focusing on curriculum, teacher qualifications, and infrastructure requirements. These regulations significantly impact market entry and operations.

- Competitive Landscape: Competition is intense, driven by factors like curriculum offerings, facilities, teacher quality, and brand reputation. The market is witnessing increased consolidation through mergers and acquisitions (M&A). The number of M&A deals in the last five years stood at xx.

- End-User Demographics: The student population is diverse, comprising Emirati nationals and a large expatriate community, influencing the demand for various curricula (e.g., British, American, IB). Growing affluence fuels the demand for premium private education.

- M&A Activity: The past five years have seen xx M&A deals, indicating a trend towards consolidation in the market.

UAE Private K12 Education Market Growth Trends & Insights

The UAE's private K12 education market has experienced significant growth over the past years. The market size in 2024 was estimated at xx Million and is projected to reach xx Million by 2025 and xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Several factors contribute to this growth including increased government spending on education, rising disposable incomes, increasing demand for quality international education, and technological advancements in the sector. The market penetration rate is currently at xx% with an anticipated increase to xx% by 2033.

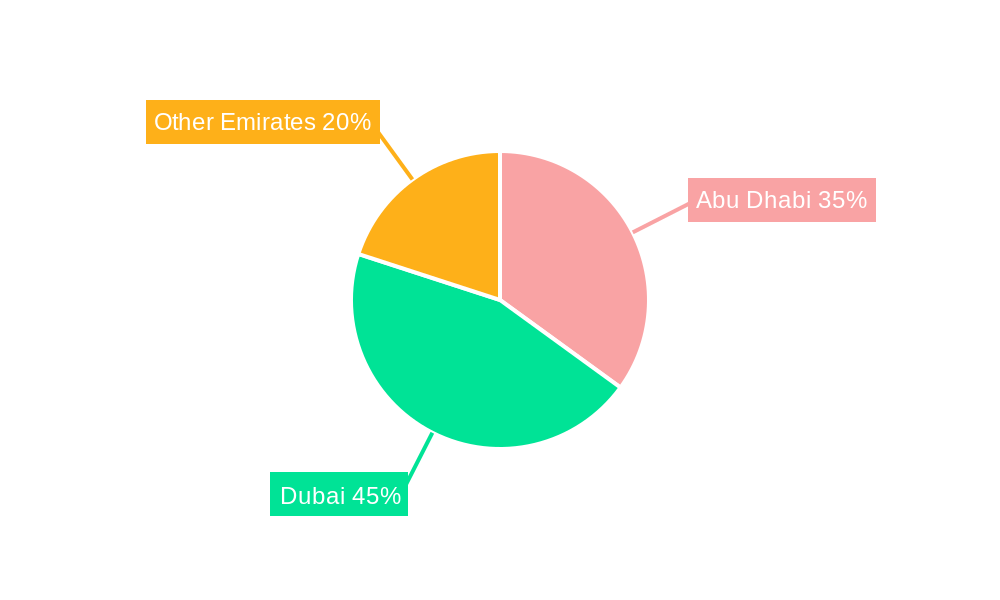

Dominant Regions, Countries, or Segments in UAE Private K12 Education Market

Dubai and Abu Dhabi are the dominant regions for private K12 education in the UAE. Their established infrastructure, high concentration of expatriates, and robust economies fuel demand for high-quality international schools.

Key Drivers in Dubai and Abu Dhabi:

- High disposable incomes: Fuel demand for premium educational offerings.

- Large expatriate population: Creates a diverse market with a high demand for international curricula.

- Government support: Investments in education infrastructure and policies supporting private sector involvement.

- Well-established infrastructure: Provides conducive environment for private schools.

Market Share and Growth Potential: Dubai holds a larger market share compared to Abu Dhabi due to its larger population and higher concentration of international schools. However, Abu Dhabi is witnessing significant growth driven by government initiatives aimed at enhancing its educational ecosystem. Both regions have substantial growth potential over the next decade.

UAE Private K12 Education Market Product Landscape

The product landscape comprises diverse educational offerings, encompassing traditional classroom settings to specialized programs focused on STEM, arts, and sports. International curricula (e.g., British, American, IB) are prevalent, catering to the diverse student population. Innovative pedagogical approaches, incorporating technology and personalized learning, are gaining traction. Key differentiators include curriculum offerings, facilities, teacher quality, extracurricular activities, and brand reputation.

Key Drivers, Barriers & Challenges in UAE Private K12 Education Market

Key Drivers:

- Rising disposable incomes among expatriate and Emirati families.

- Government initiatives promoting quality education.

- Demand for international curricula and diverse educational experiences.

- Technological advancements driving innovative teaching methods.

Challenges & Restraints:

- High operating costs and fees can create affordability barriers for some families.

- Intense competition among private schools necessitates continuous improvement.

- Regulatory compliance and stringent standards can pose challenges for new entrants.

- Maintaining teacher quality and retention is a persistent issue in the market. Teacher turnover impacts the consistent quality of education.

Emerging Opportunities in UAE Private K12 Education Market

Untapped opportunities include:

- Expansion of online and blended learning models.

- Growth in specialized programs (STEM, arts, vocational).

- Increased focus on personalized learning and customized educational pathways.

- Development of early childhood education (ECE) facilities.

Growth Accelerators in the UAE Private K12 Education Market Industry

Long-term growth will be fueled by technological innovation, strategic partnerships (e.g., between schools and EdTech companies), market expansion into underserved regions, and an increasing focus on personalized learning experiences. The continued support of the UAE government in promoting quality education will remain a crucial factor.

Key Players Shaping the UAE Private K12 Education Market Market

- GEMS Education

- Athena Education

- Taleem

- Esol Education

- Kings’ Schools Group

- SABIS Education Services

- British International School

- Al-Mizhar American Academy

- Nord Anglia Education

- Dubai American Academy

- Glendale International School

- Deira International School

List Not Exhaustive

Notable Milestones in UAE Private K12 Education Market Sector

- May 2023: Glendale International School opens in Dubai, expanding capacity by 3000 students.

- March 2023: Kings’ Education partners with Leap, enhancing study abroad options for students.

In-Depth UAE Private K12 Education Market Market Outlook

The UAE private K12 education market is poised for continued growth, driven by increasing demand, technological innovation, and supportive government policies. Strategic partnerships, expansion into niche markets, and an emphasis on personalized learning experiences will shape the future of the sector. The market will see significant consolidation as larger players acquire smaller ones, leading to increased efficiency and better resource allocation. A focus on STEM education and vocational training will gain importance as the UAE continues its economic diversification.

UAE Private K12 Education Market Segmentation

-

1. Source of Revenue

- 1.1. Kindergarten

- 1.2. Primary

- 1.3. Intermediary

- 1.4. Secondary

-

2. Curriculum

- 2.1. American

- 2.2. British

- 2.3. Arabic/UAE

- 2.4. Indian

- 2.5. Other Curricula

UAE Private K12 Education Market Segmentation By Geography

- 1. North Region

- 2. West Region

- 3. South Region

- 4. East Region

UAE Private K12 Education Market Regional Market Share

Geographic Coverage of UAE Private K12 Education Market

UAE Private K12 Education Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market

- 3.4. Market Trends

- 3.4.1 Increased Rate of Population Growth

- 3.4.2 including Expatriates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.1.1. Kindergarten

- 5.1.2. Primary

- 5.1.3. Intermediary

- 5.1.4. Secondary

- 5.2. Market Analysis, Insights and Forecast - by Curriculum

- 5.2.1. American

- 5.2.2. British

- 5.2.3. Arabic/UAE

- 5.2.4. Indian

- 5.2.5. Other Curricula

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North Region

- 5.3.2. West Region

- 5.3.3. South Region

- 5.3.4. East Region

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6. North Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.1.1. Kindergarten

- 6.1.2. Primary

- 6.1.3. Intermediary

- 6.1.4. Secondary

- 6.2. Market Analysis, Insights and Forecast - by Curriculum

- 6.2.1. American

- 6.2.2. British

- 6.2.3. Arabic/UAE

- 6.2.4. Indian

- 6.2.5. Other Curricula

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7. West Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.1.1. Kindergarten

- 7.1.2. Primary

- 7.1.3. Intermediary

- 7.1.4. Secondary

- 7.2. Market Analysis, Insights and Forecast - by Curriculum

- 7.2.1. American

- 7.2.2. British

- 7.2.3. Arabic/UAE

- 7.2.4. Indian

- 7.2.5. Other Curricula

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8. South Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.1.1. Kindergarten

- 8.1.2. Primary

- 8.1.3. Intermediary

- 8.1.4. Secondary

- 8.2. Market Analysis, Insights and Forecast - by Curriculum

- 8.2.1. American

- 8.2.2. British

- 8.2.3. Arabic/UAE

- 8.2.4. Indian

- 8.2.5. Other Curricula

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9. East Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.1.1. Kindergarten

- 9.1.2. Primary

- 9.1.3. Intermediary

- 9.1.4. Secondary

- 9.2. Market Analysis, Insights and Forecast - by Curriculum

- 9.2.1. American

- 9.2.2. British

- 9.2.3. Arabic/UAE

- 9.2.4. Indian

- 9.2.5. Other Curricula

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 GEMS Education

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Athena Education

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Taleem

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Esol Education

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kings' Schools Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SABIS Education Services

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 British International School

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Al-Mizhar American Academy

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nord Anglia Education

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dubai American Academy

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Glendale International School

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Deira International School**List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 GEMS Education

List of Figures

- Figure 1: Global UAE Private K12 Education Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UAE Private K12 Education Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 4: North Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 5: North Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 6: North Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 7: North Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 8: North Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 9: North Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 10: North Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 11: North Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 15: West Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 16: West Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 17: West Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 18: West Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 19: West Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 20: West Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 21: West Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 22: West Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 23: West Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 24: West Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 25: West Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: West Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 28: South Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 29: South Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 30: South Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 31: South Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 32: South Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 33: South Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 34: South Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 35: South Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 36: South Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 37: South Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: South Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 39: East Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 40: East Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 41: East Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 42: East Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 43: East Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 44: East Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 45: East Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 46: East Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 47: East Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 48: East Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 49: East Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: East Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 2: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 3: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 4: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 5: Global UAE Private K12 Education Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global UAE Private K12 Education Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 8: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 9: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 10: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 11: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 14: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 15: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 16: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 17: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 20: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 21: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 22: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 23: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 26: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 27: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 28: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 29: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Private K12 Education Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the UAE Private K12 Education Market?

Key companies in the market include GEMS Education, Athena Education, Taleem, Esol Education, Kings' Schools Group, SABIS Education Services, British International School, Al-Mizhar American Academy, Nord Anglia Education, Dubai American Academy, Glendale International School, Deira International School**List Not Exhaustive.

3. What are the main segments of the UAE Private K12 Education Market?

The market segments include Source of Revenue, Curriculum.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market.

6. What are the notable trends driving market growth?

Increased Rate of Population Growth. including Expatriates.

7. Are there any restraints impacting market growth?

Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Glendale International School opened its doors to students aged 3 to 11 in Dubai. Singapore-based Global Schools Foundation announced the launch. Sprawling over 20,000 square meters, the new premises can accommodate 3000 students.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Private K12 Education Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Private K12 Education Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Private K12 Education Market?

To stay informed about further developments, trends, and reports in the UAE Private K12 Education Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence