Key Insights

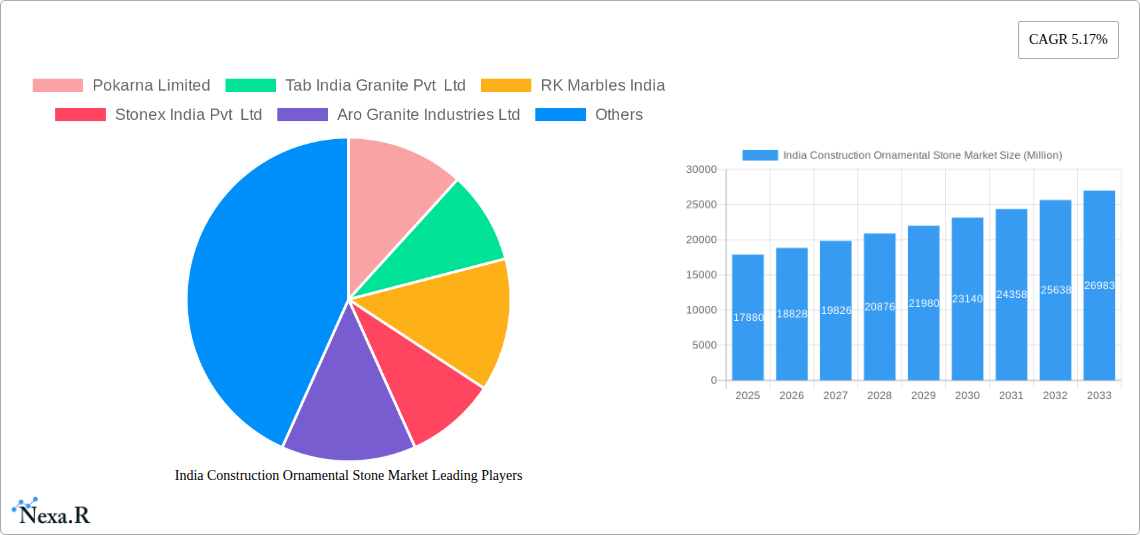

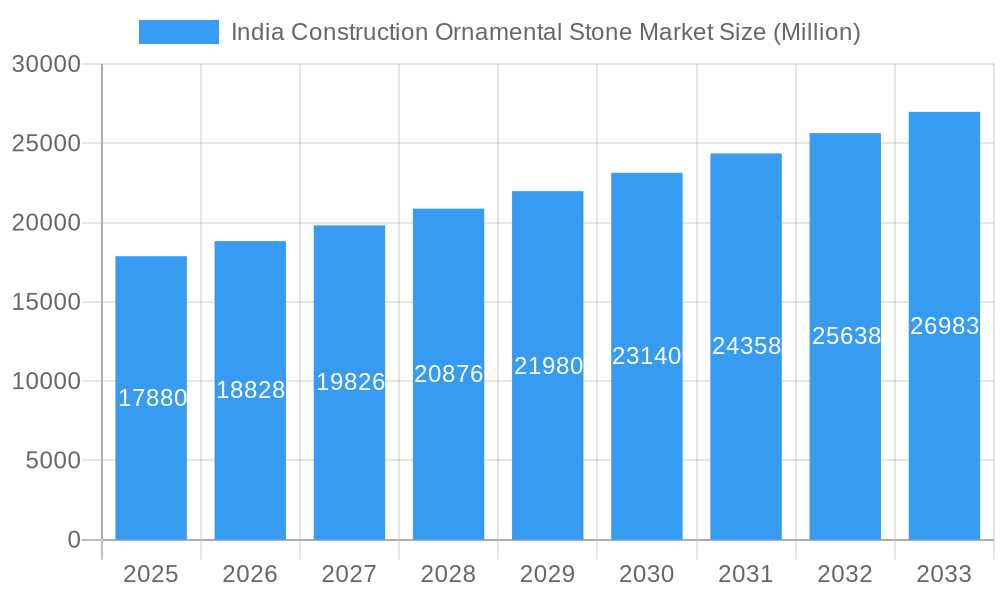

The India Construction Ornamental Stone Market is experiencing robust growth, projected to reach a market size of $17.88 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.17% from 2019 to 2033. This expansion is fueled by several key drivers. The burgeoning construction sector, particularly in residential and commercial real estate, is a significant contributor. Increased disposable incomes and a rising middle class are driving demand for aesthetically pleasing and high-quality building materials, making ornamental stone a preferred choice. Furthermore, government initiatives promoting infrastructure development and smart cities are creating lucrative opportunities for the market. Growing urbanization and a shift towards modern architectural designs further enhance the market's potential. While the market faces some restraints, such as fluctuations in raw material prices and concerns about environmental sustainability, these are being addressed by companies through efficient sourcing strategies and the adoption of eco-friendly production practices. Key players like Pokarna Limited, Tab India Granite Pvt Ltd, and others are actively innovating, offering a diverse range of products, and expanding their distribution networks to maintain a competitive edge. The market is segmented based on stone type (marble, granite, sandstone, etc.), application (flooring, cladding, countertops, etc.), and region (North, South, East, West). The forecast period (2025-2033) anticipates consistent growth, driven by continued economic development and urbanization across the country.

India Construction Ornamental Stone Market Market Size (In Billion)

The competitive landscape is characterized by a mix of large established players and smaller regional companies. The presence of numerous players indicates a dynamic and competitive market. These companies are focusing on strategies like product diversification, strategic partnerships, and mergers and acquisitions to maintain their market share and expand their reach. Given the growth trajectory and the diverse applications of ornamental stone, the Indian market presents significant opportunities for both established players and new entrants. However, success will hinge on adapting to changing consumer preferences, managing operational costs, and ensuring sustainable practices. The market's future trajectory will be influenced by factors like government regulations, technological advancements, and fluctuating global economic conditions.

India Construction Ornamental Stone Market Company Market Share

This comprehensive report provides an in-depth analysis of the India construction ornamental stone market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the historical period (2019-2024), the base year (2025), and forecasts the market's trajectory until 2033. This study is crucial for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic market valued at xx Million in 2025. The parent market is the broader Indian construction materials market, while the child market focuses specifically on ornamental stones used in construction.

India Construction Ornamental Stone Market Dynamics & Structure

This section delves into the intricate structure of the Indian construction ornamental stone market. We analyze market concentration, revealing the market share held by key players such as Pokarna Limited, Tab India Granite Pvt Ltd, and others. Technological innovations, including advancements in stone processing and surface treatments, are examined, along with the influence of regulatory frameworks on market growth. We assess the competitive landscape, considering substitute materials like engineered stone and their impact on market share. End-user demographics, including residential, commercial, and infrastructural projects, are explored to understand demand patterns. Finally, the report details M&A activities within the sector, providing quantitative data on deal volumes and qualitative insights into their strategic implications.

- Market Concentration: xx% dominated by top 5 players in 2025.

- Technological Innovation: Focus on sustainable sourcing and advanced processing techniques.

- Regulatory Framework: Impact of environmental regulations and building codes.

- Competitive Substitutes: Increasing competition from engineered stone and other materials.

- End-User Demographics: Residential sector accounts for xx% of market share in 2025.

- M&A Trends: xx M&A deals recorded between 2019-2024, indicating consolidation in the market.

India Construction Ornamental Stone Market Growth Trends & Insights

This section presents a detailed analysis of the India construction ornamental stone market's growth trajectory using robust data analysis techniques (XXX). We examine market size evolution from 2019 to 2024, highlighting the compound annual growth rate (CAGR) and projecting growth until 2033. The report investigates adoption rates across various end-user segments and analyzes the impact of technological disruptions, such as the introduction of new stone types and processing methods. Further analysis covers evolving consumer preferences and their influence on market demand for specific types of ornamental stones.

- Market Size (2025): xx Million

- CAGR (2025-2033): xx%

- Market Penetration: xx% in major metropolitan areas in 2025.

- Technological Disruptions: Impact of digital design tools and automated cutting technologies.

- Consumer Behavior Shifts: Increasing preference for sustainable and ethically sourced materials.

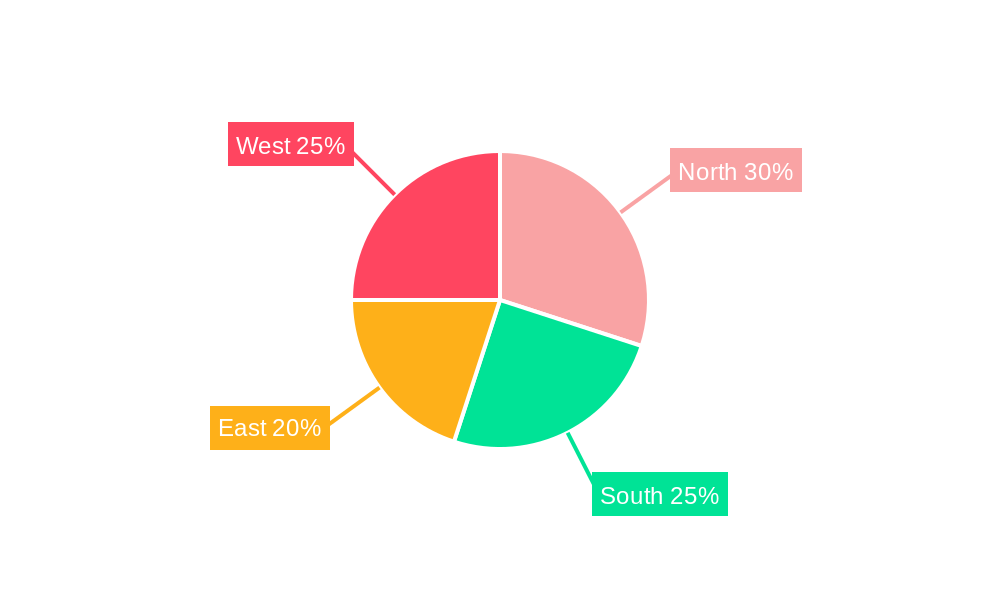

Dominant Regions, Countries, or Segments in India Construction Ornamental Stone Market

This section identifies the leading regions and segments driving market growth within India. We analyze factors contributing to dominance, including economic policies promoting infrastructure development, favorable government regulations, and regional preferences for specific stone types. The analysis incorporates market share data and growth potential projections for each region and segment, providing a granular understanding of market dynamics across different geographical areas.

- Leading Region: xx (driven by xx% of market share in 2025)

- Key Drivers: Robust infrastructure development, increased government spending on construction projects, and rising disposable incomes.

- Market Share: Regional breakdown of market share for 2025.

- Growth Potential: Analysis of future growth potential based on regional economic forecasts and construction activity projections.

India Construction Ornamental Stone Market Product Landscape

This section provides an overview of the product landscape, encompassing product innovations, applications, and performance metrics. We discuss the unique selling propositions of various ornamental stone types and highlight technological advancements in processing and finishing techniques, including the integration of new technologies and materials.

The market offers a diverse range of products, from classic marbles and granites to more contemporary options like engineered stones and quartz. Innovations focus on improving durability, enhancing aesthetics, and offering sustainable solutions. Performance metrics include strength, stain resistance, and ease of maintenance.

Key Drivers, Barriers & Challenges in India Construction Ornamental Stone Market

This section outlines the primary drivers and challenges influencing market growth. Drivers include increasing construction activity, rising disposable incomes, and government initiatives promoting infrastructure development. Challenges include supply chain disruptions, fluctuating raw material prices, and competition from substitute materials. We quantify the impact of these factors on market growth using available data.

Key Drivers:

- Rising disposable incomes driving demand for premium building materials.

- Government infrastructure projects stimulating market growth.

- Increasing urbanization fueling demand for residential and commercial construction.

Key Challenges:

- Supply chain vulnerabilities leading to price volatility.

- Competition from cheaper substitutes like engineered stone.

- Environmental regulations impacting the sourcing of raw materials.

Emerging Opportunities in India Construction Ornamental Stone Market

This section highlights emerging opportunities for growth. These include exploring untapped markets in tier 2 and tier 3 cities, developing innovative applications for ornamental stone in interior design and landscaping, and catering to evolving consumer preferences for sustainable and ethically sourced materials. Further opportunities include the adoption of advanced technologies to optimize efficiency in manufacturing and distribution.

Growth Accelerators in the India Construction Ornamental Stone Market Industry

Long-term growth will be propelled by several key factors, including technological advancements such as improved cutting and polishing techniques enhancing the efficiency of the production process and resulting in cost-effective solutions, strategic partnerships between stone producers and construction companies to reduce risks and facilitate smoother transactions, and expanding into new markets both domestically and internationally by focusing on regions with high growth potential.

Key Players Shaping the India Construction Ornamental Stone Market Market

- Pokarna Limited

- Tab India Granite Pvt Ltd

- RK Marbles India

- Stonex India Pvt Ltd

- Aro Granite Industries Ltd

- A-Class Marble India Pvt Ltd

- Inani Marbles and Industries Ltd

- Asian Granito India Ltd

- Bhandari Marble Group

- Marble City Company

List Not Exhaustive

Notable Milestones in India Construction Ornamental Stone Market Sector

- February 2024: The India Design 2024 event showcased innovative marble collections, highlighting design trends and market demand.

- February 2024: AGL's partnership with Ogilvy India signifies a strategic shift in brand building and market penetration within the home décor segment.

In-Depth India Construction Ornamental Stone Market Market Outlook

The India construction ornamental stone market exhibits strong growth potential driven by robust infrastructure development, increasing urbanization, and rising consumer spending. Strategic opportunities lie in adopting sustainable practices, embracing technological innovation, and focusing on value-added products and services to cater to evolving consumer preferences. The market is poised for continued expansion, attracting investment and driving innovation in the coming years.

India Construction Ornamental Stone Market Segmentation

-

1. Type

- 1.1. Marble

- 1.2. Granite

- 1.3. Sandstone

- 1.4. Onyx

- 1.5. Quartzite

- 1.6. Slate

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Application

- 3.1. Flooring

- 3.2. Cladding

-

4. Distribution Channel

- 4.1. Direct Sales

- 4.2. Retail Stores

- 4.3. Online Retail

India Construction Ornamental Stone Market Segmentation By Geography

- 1. India

India Construction Ornamental Stone Market Regional Market Share

Geographic Coverage of India Construction Ornamental Stone Market

India Construction Ornamental Stone Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization Leads to Increased Demand; Rapid Growth in the Real Estate Industry

- 3.3. Market Restrains

- 3.3.1. Rapid Urbanization Leads to Increased Demand; Rapid Growth in the Real Estate Industry

- 3.4. Market Trends

- 3.4.1. Indian Residential Real Estate is Driving the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Construction Ornamental Stone Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Marble

- 5.1.2. Granite

- 5.1.3. Sandstone

- 5.1.4. Onyx

- 5.1.5. Quartzite

- 5.1.6. Slate

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Flooring

- 5.3.2. Cladding

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Direct Sales

- 5.4.2. Retail Stores

- 5.4.3. Online Retail

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pokarna Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tab India Granite Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RK Marbles India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stonex India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aro Granite Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 A-Class Marble India Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Inani Marbles and Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Asian Granito India Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bhandari Marble Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Marble City Company**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pokarna Limited

List of Figures

- Figure 1: India Construction Ornamental Stone Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Construction Ornamental Stone Market Share (%) by Company 2025

List of Tables

- Table 1: India Construction Ornamental Stone Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Construction Ornamental Stone Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: India Construction Ornamental Stone Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: India Construction Ornamental Stone Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: India Construction Ornamental Stone Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: India Construction Ornamental Stone Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: India Construction Ornamental Stone Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: India Construction Ornamental Stone Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: India Construction Ornamental Stone Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: India Construction Ornamental Stone Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: India Construction Ornamental Stone Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: India Construction Ornamental Stone Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: India Construction Ornamental Stone Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: India Construction Ornamental Stone Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: India Construction Ornamental Stone Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: India Construction Ornamental Stone Market Volume Billion Forecast, by Application 2020 & 2033

- Table 17: India Construction Ornamental Stone Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: India Construction Ornamental Stone Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: India Construction Ornamental Stone Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Construction Ornamental Stone Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Construction Ornamental Stone Market?

The projected CAGR is approximately 5.17%.

2. Which companies are prominent players in the India Construction Ornamental Stone Market?

Key companies in the market include Pokarna Limited, Tab India Granite Pvt Ltd, RK Marbles India, Stonex India Pvt Ltd, Aro Granite Industries Ltd, A-Class Marble India Pvt Ltd, Inani Marbles and Industries Ltd, Asian Granito India Ltd, Bhandari Marble Group, Marble City Company**List Not Exhaustive.

3. What are the main segments of the India Construction Ornamental Stone Market?

The market segments include Type, End User, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization Leads to Increased Demand; Rapid Growth in the Real Estate Industry.

6. What are the notable trends driving market growth?

Indian Residential Real Estate is Driving the Market Studied.

7. Are there any restraints impacting market growth?

Rapid Urbanization Leads to Increased Demand; Rapid Growth in the Real Estate Industry.

8. Can you provide examples of recent developments in the market?

February 2024: The prestigious India Design 2024 event featured a marble brand showcasing collections themed 'Harmony in Duality,' blending Yin-Yang concepts with Amazonian elements using pastel Brazilian coastal marble and lush green quartz from the rainforestFebruary 2024: AGL, a prominent player in the Indian tiles, engineered marble, quartz, and bathware industry, announced its partnership with Ogilvy India for a dynamic brand campaign. Through this collaboration, AGL seeks to reshape narratives in the constantly evolving home decor landscape. It aims to penetrate the home decor market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Construction Ornamental Stone Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Construction Ornamental Stone Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Construction Ornamental Stone Market?

To stay informed about further developments, trends, and reports in the India Construction Ornamental Stone Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence