Key Insights

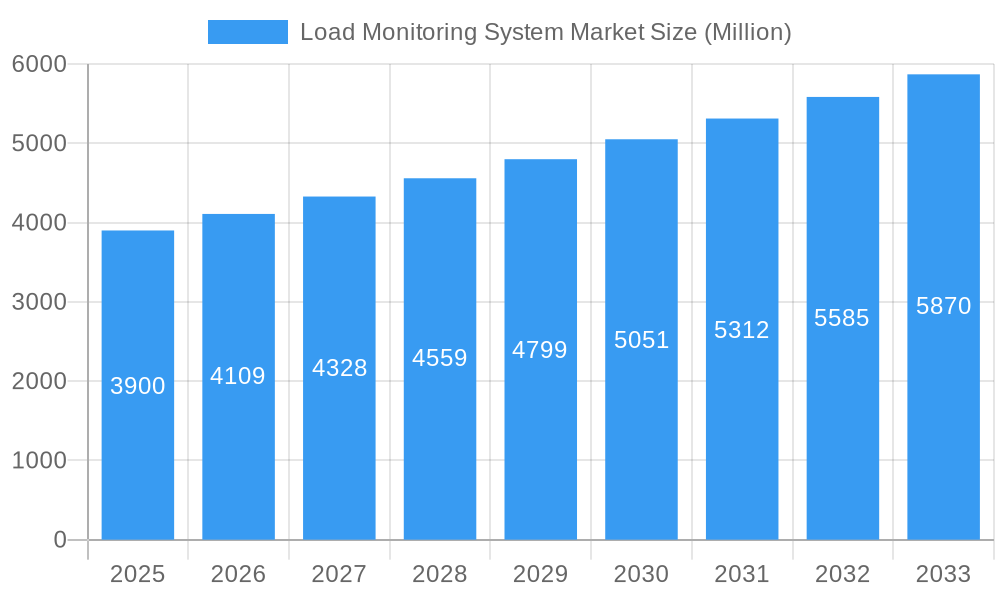

The global Load Monitoring System Market is poised for significant expansion, currently valued at $3.9 billion in 2025 and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 5.3% through 2033. This dynamic market is driven by an increasing demand for enhanced safety, efficiency, and accuracy in critical industrial applications. The automotive sector, with its stringent safety regulations and the rise of advanced driver-assistance systems, is a key driver. Similarly, the construction industry's perpetual need for precise structural integrity monitoring and the healthcare sector's reliance on accurate weighing and patient monitoring solutions are fueling market growth. Emerging trends such as the integration of IoT and AI for predictive maintenance and real-time data analysis are further shaping the landscape, offering sophisticated solutions that optimize operational performance and minimize risks.

Load Monitoring System Market Market Size (In Billion)

While the market demonstrates strong growth potential, certain restraints need to be addressed. High initial investment costs for advanced load monitoring systems and the need for skilled personnel for installation and maintenance can pose challenges for widespread adoption, particularly in smaller enterprises. However, the continuous innovation in sensor technology, miniaturization of components, and the development of cloud-based data management platforms are steadily mitigating these barriers. The market is segmented across various product types including Load Cells, Indicators and Controllers, and Data Logging Software, with both Analog and Digital technologies catering to diverse application needs. Leading companies like Mettler Toledo and Vishay Precision Group are at the forefront, driving innovation and market penetration across key regions like North America and Asia Pacific.

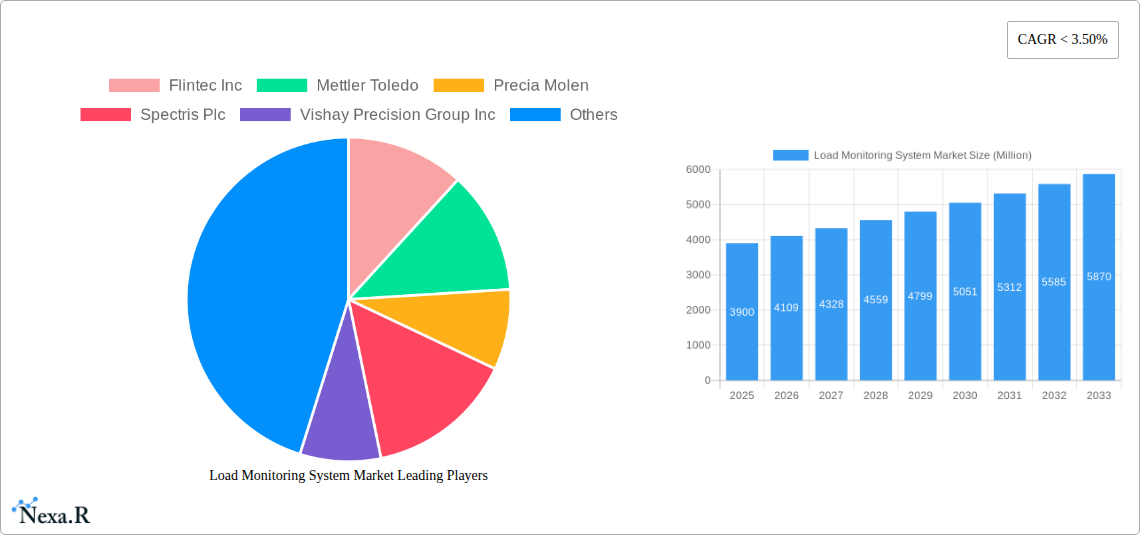

Load Monitoring System Market Company Market Share

The global Load Monitoring System Market is poised for significant expansion, driven by increasing industrial automation, stringent safety regulations, and the growing demand for real-time data analytics across diverse sectors. This report offers an in-depth analysis of market dynamics, growth trends, competitive landscape, and future opportunities, presenting a definitive guide for stakeholders in the load monitoring solutions industry.

Key Report Highlights:

- Market Size: The global Load Monitoring System Market was valued at approximately \$2.5 billion in 2024 and is projected to reach \$4.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period (2025-2033).

- Dominant Segments: Load Cells are expected to hold the largest market share, followed by Indicator and Controller solutions. The Digital technology segment is anticipated to witness the fastest growth.

- Regional Leadership: North America currently leads the market, with Asia Pacific projected to emerge as the fastest-growing region.

- Key Players: The market is characterized by the presence of established players such as Flintec Inc, Mettler Toledo, Spectris Plc, and Vishay Precision Group Inc, alongside emerging innovators.

Load Monitoring System Market Dynamics & Structure

The Load Monitoring System Market is characterized by a moderate to high level of competition, with a mix of global conglomerates and specialized manufacturers vying for market share. Technological innovation is a primary driver, with advancements in sensor accuracy, wireless connectivity, and data analytics software continually enhancing product capabilities. Regulatory frameworks, particularly in sectors like construction and healthcare, mandate the use of reliable load monitoring to ensure safety and compliance, thereby fueling market growth. Competitive product substitutes exist in the form of manual inspection and less sophisticated measurement tools, but their limitations in accuracy and real-time data provision make them less appealing for critical applications. End-user demographics are diversifying, with an increasing adoption by small and medium-sized enterprises (SMEs) alongside large industrial players. Mergers and acquisitions (M&A) are a notable trend, as companies seek to expand their product portfolios, geographic reach, and technological expertise.

- Market Concentration: Moderately consolidated with key players holding significant shares, but with room for niche players and new entrants.

- Technological Innovation Drivers: Miniaturization of sensors, IoT integration for remote monitoring, AI-powered analytics for predictive maintenance, and improved data security.

- Regulatory Frameworks: ISO standards, OSHA regulations, and industry-specific safety compliance requirements significantly influence product development and adoption.

- Competitive Product Substitutes: Basic weighing scales, manual inspection protocols, and non-integrated measurement devices.

- End-User Demographics: Spans heavy industries, manufacturing, logistics, transportation, medical devices, and research institutions.

- M&A Trends: Strategic acquisitions to gain market share, acquire innovative technologies, and expand service offerings. For instance, the acquisition of 'Load Moving Systems Ltd' and 'AeroGo UK Ltd by LMS in September 2022 signifies a consolidation strategy within the intelligent lifting equipment sector.

Load Monitoring System Market Growth Trends & Insights

The Load Monitoring System Market is on a robust growth trajectory, underpinned by a confluence of economic, technological, and regulatory factors. The increasing mechanization and automation across industries such as manufacturing, construction, and logistics necessitate precise and reliable load measurement for operational efficiency, safety, and quality control. The global market size, estimated at \$2.5 billion in 2024, is projected to expand to \$4.8 billion by 2033, demonstrating a compelling CAGR of 6.2% over the forecast period (2025-2033). This growth is further amplified by the growing adoption of Industry 4.0 principles, where the integration of load monitoring systems with IoT devices and cloud platforms enables real-time data collection, analysis, and remote management.

Technological advancements play a pivotal role in shaping market adoption rates. The shift from analog to digital load monitoring systems is a significant trend, offering enhanced accuracy, greater resolution, and improved noise immunity. Furthermore, the development of wireless load cells and data logging software is revolutionizing how data is collected and utilized, reducing installation costs and improving flexibility. Consumer behavior is also shifting, with a greater emphasis on data-driven decision-making and proactive risk management. This translates into a higher demand for sophisticated load monitoring solutions that provide comprehensive insights into operational performance and potential failure points. The increasing emphasis on workplace safety and the reduction of accidents related to overloading or improper weight distribution in industries like construction and marine further bolster demand.

- Market Size Evolution: From an estimated \$2.5 billion in 2024 to a projected \$4.8 billion by 2033.

- CAGR: 6.2% from 2025 to 2033.

- Adoption Rates: Steadily increasing across all key application segments, particularly in construction and automotive for safety and quality control.

- Technological Disruptions: Rise of IoT-enabled load cells, AI for predictive maintenance insights, and advanced data analytics platforms.

- Consumer Behavior Shifts: Increasing demand for real-time, accessible data for operational optimization and risk mitigation.

- Market Penetration: Growing penetration in emerging economies due to industrialization and infrastructure development.

- Impact of Automation: Direct correlation between automation levels in industries and the adoption of advanced load monitoring systems.

Dominant Regions, Countries, or Segments in Load Monitoring System Market

The global Load Monitoring System Market is segmented by product, technology, and application, with each segment exhibiting unique growth dynamics and regional dominance. Among the product segments, Load Cells are anticipated to maintain their leading position, driven by their fundamental role in converting mechanical force into an electrical signal for measurement. The increasing sophistication and miniaturization of load cells, coupled with their widespread application across various industries, solidify their market supremacy. Following closely are Indicator and Controller solutions, which are essential for interpreting and acting upon the data provided by load cells. Data Logging Software is emerging as a critical segment, as industries increasingly focus on historical data analysis for process optimization and compliance.

In terms of technology, the Digital segment is outpacing its Analog counterpart. Digital load monitoring systems offer superior accuracy, resolution, noise immunity, and integration capabilities with modern digital platforms, aligning perfectly with the demands of Industry 4.0. This technological shift is a significant growth catalyst.

The Application segments reveal diverse adoption patterns. The Construction industry, with its inherent safety risks and heavy machinery operations, represents a substantial market for load monitoring systems, ensuring structural integrity and preventing accidents. The Automotive sector utilizes load cells for quality control, vehicle testing, and powertrain applications. The Healthcare industry employs these systems in medical devices and weighing solutions for accurate patient care and diagnostics. The Marine sector relies on them for critical lifting operations and cargo management.

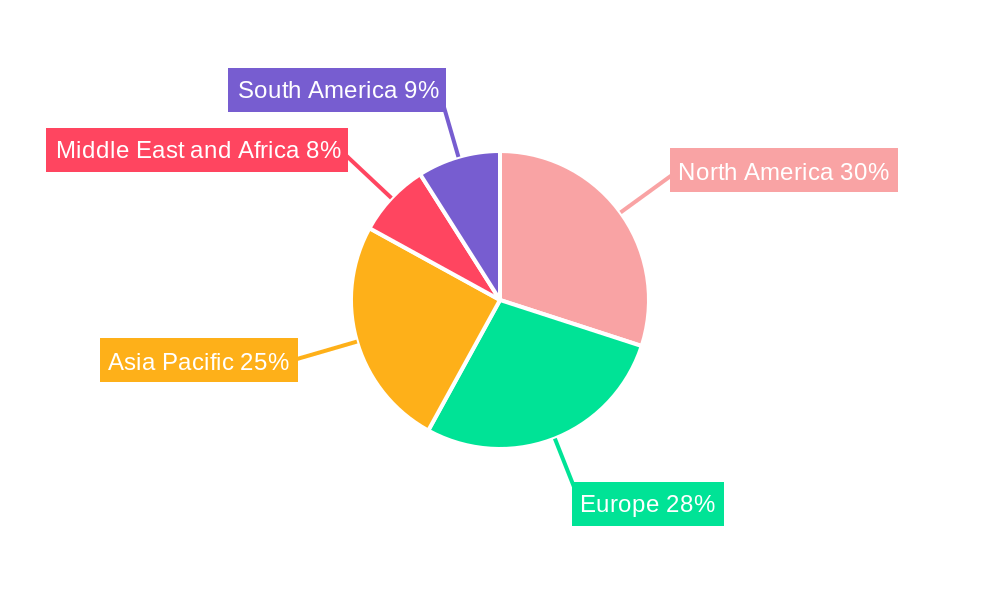

North America currently holds the dominant position in the Load Monitoring System Market, propelled by a strong industrial base, advanced technological adoption, and stringent safety regulations. The region's well-established construction, automotive, and manufacturing sectors drive consistent demand for sophisticated load monitoring solutions. The presence of leading market players and a robust research and development ecosystem further contribute to its leadership.

However, the Asia Pacific region is poised to emerge as the fastest-growing market. Rapid industrialization, massive infrastructure development projects, and the increasing adoption of automation in countries like China, India, and Southeast Asian nations are creating unprecedented demand. Government initiatives promoting manufacturing and technological advancement, coupled with a growing awareness of safety standards, are accelerating market penetration in this region.

- Dominant Product Segment: Load Cell, driven by its foundational role and broad applicability.

- Fastest Growing Product Segment: Data Logging Software, due to the increasing emphasis on data analytics.

- Dominant Technology Segment: Digital, offering superior performance and integration capabilities.

- Key Application Drivers: Construction for safety and structural integrity; Automotive for quality control and testing.

- Leading Region: North America, due to established industries and advanced technology adoption.

- Fastest Growing Region: Asia Pacific, fueled by industrialization and infrastructure projects.

- Market Share (Estimated 2025): Load Cells: 45%, Indicator and Controller: 30%, Data Logging Software: 25%.

- CAGR by Application (2025-2033): Construction: 6.8%, Automotive: 6.5%, Healthcare: 5.9%, Marine: 5.5%, Other Applications: 6.2%.

Load Monitoring System Market Product Landscape

The product landscape of the Load Monitoring System Market is characterized by continuous innovation, focusing on enhanced accuracy, durability, and connectivity. Load cells, the core components, are evolving with advancements in strain gauge technology, MEMS (Micro-Electro-Mechanical Systems), and piezoelectric principles, leading to more compact, robust, and sensitive devices. Indicator and controller units are becoming smarter, integrating advanced signal processing, digital displays, and communication protocols like Modbus and Ethernet for seamless integration into larger control systems. Data logging software is at the forefront of value addition, offering cloud-based solutions, predictive analytics, and user-friendly interfaces for real-time monitoring, historical data analysis, and compliance reporting. Wireless load monitoring solutions, including Bluetooth and Wi-Fi enabled load cells, are gaining significant traction due to their ease of installation and flexibility in challenging environments.

Key Drivers, Barriers & Challenges in Load Monitoring System Market

Key Drivers:

- Increasing Automation & Industrialization: The global push towards automated processes in manufacturing, logistics, and construction necessitates precise load measurement for efficiency and safety.

- Stringent Safety Regulations: Mandates for workplace safety and equipment integrity in various industries, particularly construction and heavy lifting, drive the adoption of load monitoring systems to prevent accidents and ensure compliance.

- Demand for Real-time Data & Analytics: The growing reliance on data-driven decision-making for process optimization, predictive maintenance, and quality control fuels the demand for sophisticated monitoring solutions.

- Advancements in Sensor Technology: Miniaturization, improved accuracy, and wireless capabilities of load cells and sensors are expanding their application scope and appeal.

- Growth in Emerging Economies: Rapid industrial development and infrastructure projects in regions like Asia Pacific are creating significant market opportunities.

Key Barriers & Challenges:

- High Initial Investment: The cost of advanced load monitoring systems can be a deterrent for small and medium-sized enterprises (SMEs).

- Integration Complexities: Integrating new systems with existing legacy infrastructure can be technically challenging and time-consuming.

- Data Security Concerns: The transmission and storage of sensitive operational data through connected systems raise concerns about cybersecurity.

- Skilled Workforce Requirements: Operating and maintaining advanced load monitoring systems often requires specialized technical expertise, which may be scarce in certain regions.

- Standardization Issues: A lack of universal standards across different regions and industries can sometimes hinder interoperability and widespread adoption.

Emerging Opportunities in Load Monitoring System Market

Emerging opportunities in the Load Monitoring System Market lie in the burgeoning fields of the Internet of Things (IoT) and Artificial Intelligence (AI). The integration of load monitoring systems with IoT platforms opens up vast possibilities for remote monitoring, predictive maintenance, and fleet management across various applications. AI-powered analytics can transform raw load data into actionable insights, enabling proactive identification of potential equipment failures and optimization of operational parameters. The growing demand for sustainable practices also presents an opportunity, as accurate load monitoring can contribute to fuel efficiency and reduced wear and tear on machinery. Furthermore, the expansion of smart cities initiatives and the increasing complexity of infrastructure projects will necessitate highly reliable and integrated load monitoring solutions.

Growth Accelerators in the Load Monitoring System Market Industry

The long-term growth of the Load Monitoring System Market is being accelerated by several key catalysts. Technological breakthroughs, such as the development of novel sensing materials and advanced wireless communication protocols, are continuously enhancing system capabilities and reducing costs. Strategic partnerships between sensor manufacturers, software developers, and industrial automation companies are fostering the creation of integrated solutions that offer greater value to end-users. Market expansion strategies, including a focus on underserved sectors and emerging economies, are broadening the customer base and driving demand. The increasing emphasis on asset management and operational efficiency across industries is also a significant growth accelerator, as businesses recognize the return on investment provided by robust load monitoring.

Key Players Shaping the Load Monitoring System Market Market

- Flintec Inc

- Mettler Toledo

- Precia Molen

- Spectris Plc

- Vishay Precision Group Inc

- Dynamic Load Monitoring Ltd

- JCM Load Monitoring Ltd

- LCM Systems

- Keli Electric Manufacturing Co Ltd

- Straightpoint

- Wirop Industrial Co Ltd

Notable Milestones in Load Monitoring System Market Sector

- October 2022: Mettler-Toledo launched a new Track & Trace and Checkweighing combination solution, the CT33 system, targeting small and mid-market manufacturers in the pharmaceutical and cosmetics industries, enhancing compliance and supply chain traceability.

- September 2022: LMS (Load Monitoring Systems) acquired 'Load Moving Systems Ltd' and 'AeroGo UK Ltd, strengthening its position in intelligent lifting equipment and expanding its growth opportunities in domestic and overseas markets.

In-Depth Load Monitoring System Market Market Outlook

The future outlook for the Load Monitoring System Market is exceptionally promising, driven by ongoing technological advancements and expanding application horizons. The continued integration of IoT and AI will unlock new levels of operational intelligence, enabling predictive maintenance, process optimization, and enhanced safety protocols across industries. The growing global focus on infrastructure development and the increasing complexity of industrial operations will fuel sustained demand for accurate and reliable load measurement solutions. Strategic collaborations and product innovations aimed at addressing specific industry challenges, coupled with the expansion into emerging markets, are set to be key growth enablers. The market is poised for significant expansion, offering substantial opportunities for stakeholders who can deliver innovative, integrated, and data-driven load monitoring solutions.

Load Monitoring System Market Segmentation

-

1. Product

- 1.1. Load Cell

- 1.2. Indicator and Controller

- 1.3. Data Logging Software

-

2. Technology

- 2.1. Analog

- 2.2. Digital

-

3. Application

- 3.1. Automotive

- 3.2. Construction

- 3.3. Healthcare

- 3.4. Marine

- 3.5. Other Applications

Load Monitoring System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Italy

- 2.4. Spain

- 2.5. Germany

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Southeast Asia

- 3.6. Australia

- 3.7. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Qatar

- 4.4. South Africa

- 4.5. Rest of Middle East and Africa

-

5. South America

- 5.1. Argentina

- 5.2. Brazil

- 5.3. Chile

- 5.4. Rest of South America

Load Monitoring System Market Regional Market Share

Geographic Coverage of Load Monitoring System Market

Load Monitoring System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand in Automotive and Healthcare Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Load Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Load Cell

- 5.1.2. Indicator and Controller

- 5.1.3. Data Logging Software

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Analog

- 5.2.2. Digital

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Automotive

- 5.3.2. Construction

- 5.3.3. Healthcare

- 5.3.4. Marine

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Load Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Load Cell

- 6.1.2. Indicator and Controller

- 6.1.3. Data Logging Software

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Analog

- 6.2.2. Digital

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Automotive

- 6.3.2. Construction

- 6.3.3. Healthcare

- 6.3.4. Marine

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Load Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Load Cell

- 7.1.2. Indicator and Controller

- 7.1.3. Data Logging Software

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Analog

- 7.2.2. Digital

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Automotive

- 7.3.2. Construction

- 7.3.3. Healthcare

- 7.3.4. Marine

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Load Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Load Cell

- 8.1.2. Indicator and Controller

- 8.1.3. Data Logging Software

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Analog

- 8.2.2. Digital

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Automotive

- 8.3.2. Construction

- 8.3.3. Healthcare

- 8.3.4. Marine

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Load Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Load Cell

- 9.1.2. Indicator and Controller

- 9.1.3. Data Logging Software

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Analog

- 9.2.2. Digital

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Automotive

- 9.3.2. Construction

- 9.3.3. Healthcare

- 9.3.4. Marine

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Load Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Load Cell

- 10.1.2. Indicator and Controller

- 10.1.3. Data Logging Software

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Analog

- 10.2.2. Digital

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Automotive

- 10.3.2. Construction

- 10.3.3. Healthcare

- 10.3.4. Marine

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Flintec Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mettler Toledo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Precia Molen

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Spectris Plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vishay Precision Group Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dynamic Load Monitoring Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 JCM Load Monitoring Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LCM Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Keli Electric Manufacturing Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Straightpoint

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Wirop Industrial Co Ltd**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Flintec Inc

List of Figures

- Figure 1: Global Load Monitoring System Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Load Monitoring System Market Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Load Monitoring System Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Load Monitoring System Market Revenue (undefined), by Technology 2025 & 2033

- Figure 5: North America Load Monitoring System Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Load Monitoring System Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Load Monitoring System Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Load Monitoring System Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Load Monitoring System Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Load Monitoring System Market Revenue (undefined), by Product 2025 & 2033

- Figure 11: Europe Load Monitoring System Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Load Monitoring System Market Revenue (undefined), by Technology 2025 & 2033

- Figure 13: Europe Load Monitoring System Market Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Load Monitoring System Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Load Monitoring System Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Load Monitoring System Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Load Monitoring System Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Load Monitoring System Market Revenue (undefined), by Product 2025 & 2033

- Figure 19: Asia Pacific Load Monitoring System Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Load Monitoring System Market Revenue (undefined), by Technology 2025 & 2033

- Figure 21: Asia Pacific Load Monitoring System Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Load Monitoring System Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Asia Pacific Load Monitoring System Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Load Monitoring System Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Load Monitoring System Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Load Monitoring System Market Revenue (undefined), by Product 2025 & 2033

- Figure 27: Middle East and Africa Load Monitoring System Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Load Monitoring System Market Revenue (undefined), by Technology 2025 & 2033

- Figure 29: Middle East and Africa Load Monitoring System Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East and Africa Load Monitoring System Market Revenue (undefined), by Application 2025 & 2033

- Figure 31: Middle East and Africa Load Monitoring System Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Load Monitoring System Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Load Monitoring System Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Load Monitoring System Market Revenue (undefined), by Product 2025 & 2033

- Figure 35: South America Load Monitoring System Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Load Monitoring System Market Revenue (undefined), by Technology 2025 & 2033

- Figure 37: South America Load Monitoring System Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: South America Load Monitoring System Market Revenue (undefined), by Application 2025 & 2033

- Figure 39: South America Load Monitoring System Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Load Monitoring System Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Load Monitoring System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Load Monitoring System Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Load Monitoring System Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: Global Load Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Load Monitoring System Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Load Monitoring System Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 6: Global Load Monitoring System Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 7: Global Load Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Load Monitoring System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Load Monitoring System Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 13: Global Load Monitoring System Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Global Load Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Load Monitoring System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Russia Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Load Monitoring System Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 24: Global Load Monitoring System Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 25: Global Load Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 26: Global Load Monitoring System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: India Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: China Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Japan Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Southeast Asia Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Australia Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Load Monitoring System Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 35: Global Load Monitoring System Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 36: Global Load Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 37: Global Load Monitoring System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Qatar Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: South Africa Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Global Load Monitoring System Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 44: Global Load Monitoring System Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 45: Global Load Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 46: Global Load Monitoring System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 47: Argentina Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Brazil Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: Chile Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Rest of South America Load Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Load Monitoring System Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Load Monitoring System Market?

Key companies in the market include Flintec Inc, Mettler Toledo, Precia Molen, Spectris Plc, Vishay Precision Group Inc, Dynamic Load Monitoring Ltd, JCM Load Monitoring Ltd, LCM Systems, Keli Electric Manufacturing Co Ltd, Straightpoint, Wirop Industrial Co Ltd**List Not Exhaustive.

3. What are the main segments of the Load Monitoring System Market?

The market segments include Product, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand in Automotive and Healthcare Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Mettler-Toledo (a global manufacturer of precision instruments and a service provider) launched a new Track & Trace and Checkweighing combination solution aimed at small and mid-market manufacturers in the pharmaceutical and cosmetics industries. The Mettler-Toledo CT33 system gives operators a deep level of integration between Mark & Verify, serialization, and precision weighing capabilities, helping them to achieve compliance, better brand protection, quality control, and supply chain traceability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Load Monitoring System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Load Monitoring System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Load Monitoring System Market?

To stay informed about further developments, trends, and reports in the Load Monitoring System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence