Key Insights

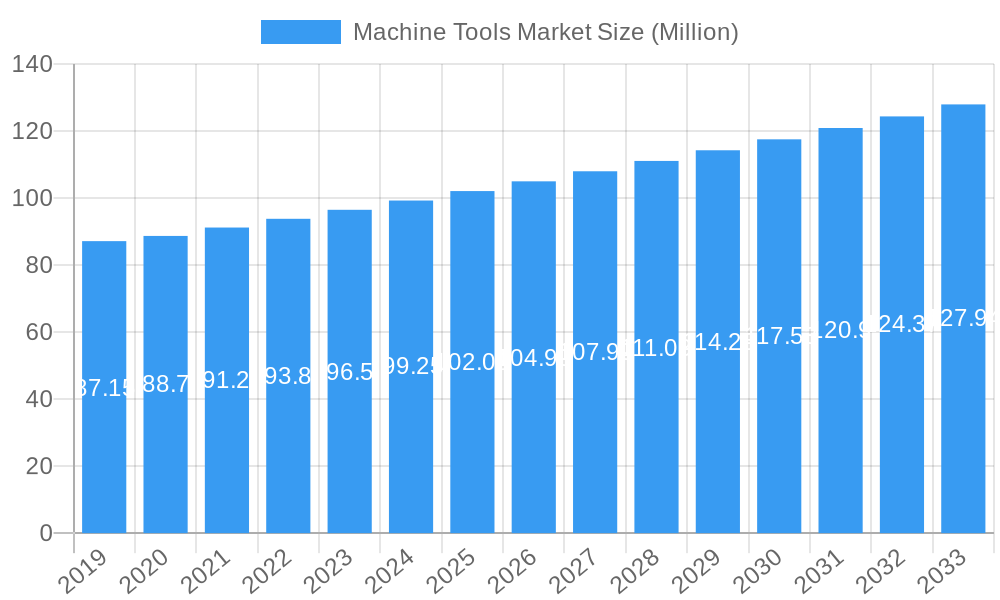

The global Machine Tools Market is poised for steady expansion, projected to reach $103.57 million with a Compound Annual Growth Rate (CAGR) of 2.92% during the forecast period of 2019-2033. This growth is primarily fueled by increasing investments in advanced manufacturing technologies across key industries. The automotive sector, in particular, is a significant driver, demanding sophisticated machine tools for the production of lightweight and complex components. Fabrication and industrial machinery manufacturing also contributes substantially, driven by the need for precision and efficiency in producing a wide array of industrial equipment. Furthermore, the aerospace and defense sector's stringent requirements for high-precision components and the growing demand for advanced materials are expected to bolster market growth. The precision engineering segment also plays a crucial role, necessitating the adoption of cutting-edge machine tools for intricate designs and tight tolerances.

Machine Tools Market Market Size (In Million)

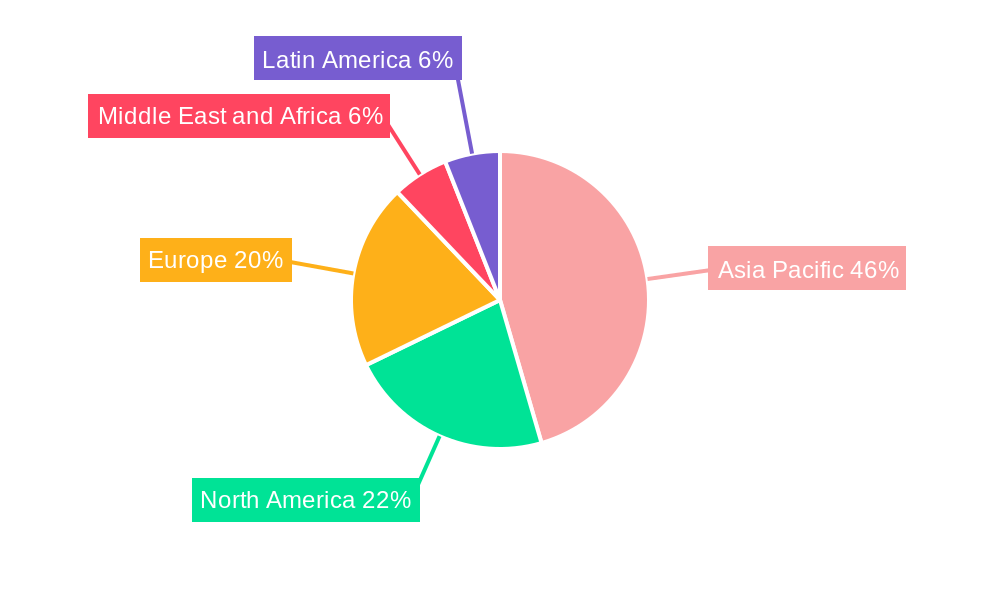

Emerging trends such as the integration of Industry 4.0 technologies, including automation, AI, and IoT, are reshaping the machine tools landscape, enabling smarter and more connected manufacturing processes. The adoption of additive manufacturing alongside traditional subtractive methods is also gaining traction, offering new possibilities for component design and production. Geographically, the Asia Pacific region is anticipated to lead the market, driven by rapid industrialization and a strong manufacturing base. North America and Europe are also expected to witness significant growth, supported by technological advancements and a focus on reshoring manufacturing activities. While the market benefits from these drivers and trends, challenges such as high initial investment costs for advanced machinery and the need for skilled labor to operate and maintain these sophisticated systems could present some constraints. Nonetheless, the overall outlook for the machine tools market remains robust, with continuous innovation and evolving industry demands shaping its trajectory.

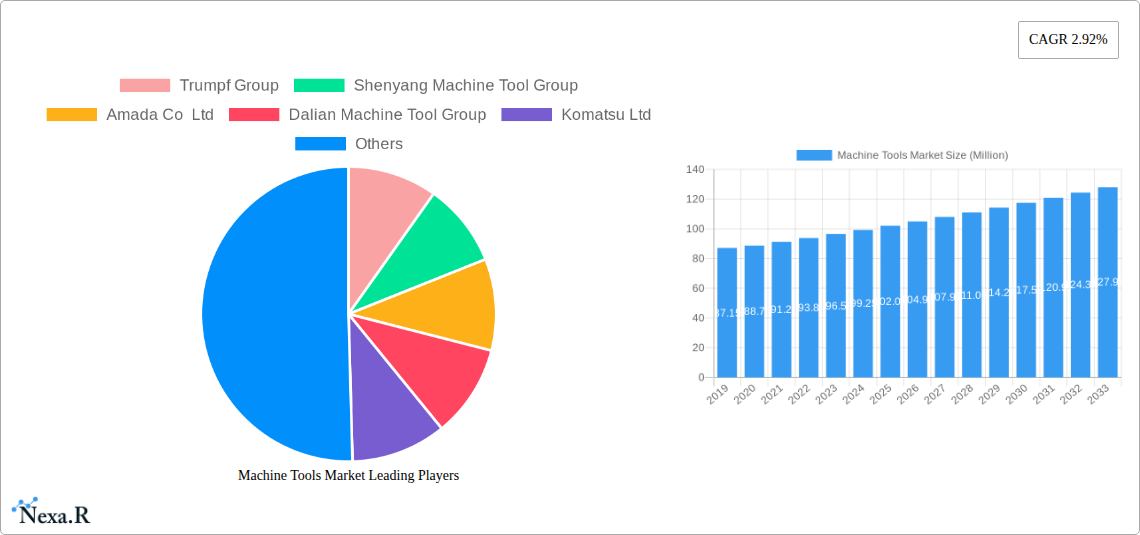

Machine Tools Market Company Market Share

Machine Tools Market: A Comprehensive Analysis of Global Trends, Innovations, and Growth Prospects (2019–2033)

This report offers an in-depth analysis of the global Machine Tools Market, providing critical insights into its dynamics, growth trajectory, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this study meticulously examines key market segments, regional dominance, and the competitive landscape. For industry professionals seeking to understand the evolving metal cutting machines market, metal forming machines market, and the broader industrial machinery market, this report is an indispensable resource. We delve into the intricate interplay of technological advancements, end-user demands, and strategic industry developments shaping the future of CNC machine tools, 5-axis machining centers, and advanced manufacturing technologies.

Machine Tools Market Market Dynamics & Structure

The Machine Tools Market is characterized by a moderately concentrated structure, with a blend of large multinational corporations and specialized regional players. Technological innovation remains a primary driver, fueled by increasing demand for precision, automation, and efficiency in manufacturing processes. Key innovations include the advancement of multi-axis machining, additive manufacturing integration, and intelligent control systems. Regulatory frameworks, particularly those focused on environmental sustainability and industrial safety, are increasingly influencing product development and market entry. Competitive product substitutes, such as advanced robotics and alternative manufacturing processes, pose a growing challenge, necessitating continuous innovation from traditional machine tool manufacturers. End-user demographics are shifting, with a rising demand for customized solutions and integrated manufacturing ecosystems. Mergers and acquisitions (M&A) trends indicate a strategic consolidation to enhance market share, expand technological capabilities, and gain access to new geographical markets. For instance, the drive towards Industry 4.0 and smart factories is a significant M&A catalyst.

- Market Concentration: Moderate, with key players holding substantial market share.

- Technological Drivers: Automation, Industry 4.0 integration, advanced materials processing, 5-axis machining.

- Regulatory Impact: Environmental standards (e.g., energy efficiency), safety compliance.

- Competitive Substitutes: Advanced robotics, additive manufacturing, alternative fabrication methods.

- End-User Demographics: Growing demand for bespoke solutions, integrated systems, and high-precision output.

- M&A Trends: Strategic acquisitions to bolster portfolios, expand global reach, and acquire advanced technologies.

Machine Tools Market Growth Trends & Insights

The global Machine Tools Market is poised for robust growth, driven by the relentless pursuit of manufacturing efficiency and the proliferation of advanced technologies across various industries. The market size is projected to expand significantly, fueled by increasing adoption rates of sophisticated CNC machines and automation solutions. Technological disruptions, such as the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into machine tool operations, are revolutionizing manufacturing processes, leading to enhanced productivity, reduced downtime, and improved quality control. Consumer behavior shifts are also playing a crucial role, with end-users demanding more integrated, data-driven, and sustainable manufacturing solutions. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). This growth is underpinned by the increasing automation in sectors like automotive manufacturing, aerospace and defense, and precision engineering. The penetration of advanced milling machines, turning machines, and grinding machines is on an upward trajectory as industries strive to optimize production workflows and maintain competitive edge. The demand for highly specialized electrical discharge machines (EDM) for intricate component manufacturing is also a significant contributor to market expansion.

Dominant Regions, Countries, or Segments in Machine Tools Market

Asia Pacific currently dominates the Machine Tools Market, largely driven by manufacturing prowess and substantial investments in industrial infrastructure by countries like China and Japan. The region's dominance is a confluence of several factors. China, in particular, has emerged as the largest manufacturer and consumer of machine tools globally, benefiting from a vast domestic market, supportive government policies, and a highly developed supply chain for metal cutting and forming machinery. Japan, with its strong legacy in precision engineering and technological innovation, continues to be a leading exporter of high-end machine tools, particularly advanced CNC milling machines and lathes.

Within the segments, Milling Machines and Turning Machines consistently hold the largest market share, owing to their foundational role in a wide array of manufacturing processes across industries. The Automotive sector remains a primary end-user, driving demand for high-volume production of engine components, chassis parts, and other critical elements. Similarly, Fabrication and Industrial Machinery Manufacturing are significant consumers, requiring versatile machines for diverse applications. The Marine and Aerospace & Defense sectors, with their stringent precision and quality requirements, also contribute substantially to the market's growth, especially for sophisticated multi-axis machining and specialized EDM machines. The increasing focus on advanced manufacturing and automation is further solidifying the market position of these dominant segments and regions.

- Dominant Region: Asia Pacific, led by China and Japan.

- Key Segment Drivers (Type): Milling Machines, Turning Machines, Grinding Machines, Electrical Discharge Machines.

- Key Segment Drivers (End User): Automotive, Fabrication and Industrial Machinery Manufacturing, Marine and Aerospace & Defense.

- Dominance Factors:

- Economic Policies: Government initiatives promoting industrialization and manufacturing upgrades.

- Infrastructure: Well-developed industrial ecosystems and supply chains.

- Technological Adoption: High uptake of advanced CNC technology and automation.

- Market Size: Large domestic demand from key end-user industries.

Machine Tools Market Product Landscape

The Machine Tools Market product landscape is characterized by continuous innovation focused on enhancing precision, speed, and automation. Manufacturers are increasingly integrating smart technologies, such as AI-powered diagnostics and predictive maintenance, into their offerings. Advanced 5-axis machining centers are becoming more prevalent, enabling complex part geometries to be manufactured in a single setup. The development of hybrid machines, combining additive and subtractive manufacturing capabilities, is opening new application frontiers. Performance metrics like cutting speed, accuracy, and energy efficiency are key differentiators. Product applications span across diverse industries, from intricate aerospace components to high-volume automotive parts and specialized medical devices. Unique selling propositions often lie in the sophisticated control systems, integrated automation solutions, and the ability to handle a wide range of materials.

Key Drivers, Barriers & Challenges in Machine Tools Market

Key Drivers:

- Technological Advancements: The relentless pursuit of automation, Industry 4.0 integration, and the development of smart manufacturing solutions are primary growth accelerators. The adoption of AI, IoT, and advanced robotics in machine tool operations significantly boosts efficiency and productivity.

- Growing Demand for Precision and Efficiency: Industries such as automotive, aerospace, and precision engineering are continuously demanding higher precision, faster cycle times, and more complex part geometries, driving the need for advanced CNC machines.

- Industrial Growth and Infrastructure Development: Emerging economies are investing heavily in industrial infrastructure, creating substantial demand for new machine tools to support manufacturing expansion.

- Government Initiatives and Subsidies: Favorable government policies, tax incentives, and subsidies for manufacturing upgrades and technological adoption in various regions stimulate market growth.

Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of sophisticated industrial machinery and metal fabrication equipment, especially advanced multi-axis machining centers, can be a significant barrier for small and medium-sized enterprises (SMEs).

- Skilled Labor Shortage: A lack of skilled operators, programmers, and maintenance technicians for advanced CNC equipment and automated systems poses a challenge to widespread adoption and efficient operation.

- Supply Chain Disruptions: Global supply chain volatility, impacting the availability of raw materials and components, can lead to production delays and increased costs for machine tool manufacturers.

- Rapid Technological Obsolescence: The fast pace of technological development necessitates frequent upgrades, leading to concerns about the longevity and resale value of existing equipment.

Emerging Opportunities in Machine Tools Market

Emerging opportunities in the Machine Tools Market are primarily concentrated around the integration of digital technologies and the expansion into niche applications. The increasing adoption of additive manufacturing alongside traditional subtractive methods presents a significant avenue for growth, leading to the development of hybrid 3D printing and CNC machines. The demand for customized and flexible manufacturing solutions is creating opportunities for modular machine designs and adaptable automation systems. Furthermore, the growing emphasis on sustainable manufacturing practices is driving demand for energy-efficient machine tools and technologies that minimize waste. Untapped markets in developing economies with burgeoning industrial sectors offer substantial potential for market expansion. The rise of the digital twin concept in manufacturing also presents an opportunity for machine tool providers to offer integrated simulation and optimization services.

Growth Accelerators in the Machine Tools Market Industry

Long-term growth in the Machine Tools Market is being significantly accelerated by several key catalysts. Technological breakthroughs, particularly in areas like artificial intelligence for process optimization and machine learning for predictive maintenance, are transforming the capabilities and efficiency of machine tools. Strategic partnerships between machine tool manufacturers, software providers, and automation specialists are fostering the development of comprehensive, integrated manufacturing solutions. Market expansion strategies, including geographical diversification into emerging economies and the development of specialized product lines for high-growth sectors like medical devices and electric vehicles, are further fueling growth. The increasing global focus on reshoring manufacturing activities also presents a considerable growth opportunity for domestic machine tool industries.

Key Players Shaping the Machine Tools Market Market

- Trumpf Group

- Shenyang Machine Tool Group

- Amada Co Ltd

- Dalian Machine Tool Group

- Komatsu Ltd

- Dmg Mori Seiki Co Ltd

- Schuler AG

- Jtekt Corporation

- Okuma Corporation

- Mag

- Makino Milling Machine Co Ltd

Notable Milestones in Machine Tools Market Sector

- March 2023: Phillips Machine Tools announced a strategic partnership with JFY International to broaden its solution portfolio for metal processing customers. JFY International, a member of the TRUMPF Group, is a full-service provider of sheet metal processing solutions, offering CNC bending, punching, shearing, 2D laser cutting machines, and even automation, from a single machine to a fully automated line. Through its partners, JFY International guarantees professional consulting, quick responses, and excellent on-time services.

- December 2022: EIT Manufacturing, the largest innovation community in the industry in Europe, and AMT - Advanced Machine Tools, the new biennial event with the latest innovations in machine tools, machinery deformation, cutting and forming, instruments, components, and accessories, and its auxiliary industry, join forces to foster innovation and digital transformation in the metal industry. By signing this collaboration agreement, EIT Manufacturing, and AMT give industrial manufacturing specialists in Europe access to a world of opportunities.

- September 2022: HELLER Machine Tools announced a strategic partnership with TITANS of CNC, Inc. The key points of the agreement include cooperation in machining technology, process, and practical application. TITANS of CNC agreed to install two 5-axis machining centers into their Texas facility: the HF 5500 with the fifth axis in the workpiece and the CP 6000 with the fifth axis in the tool - and a Round Pallet Storage System.

In-Depth Machine Tools Market Market Outlook

The Machine Tools Market outlook remains exceptionally positive, driven by sustained investment in advanced manufacturing and the global push towards Industry 4.0. Growth accelerators such as the ongoing integration of AI and IoT into machine operations, the development of hybrid manufacturing technologies, and the increasing demand for high-precision components in sectors like aerospace and medical devices will continue to propel market expansion. Strategic collaborations between technology providers and manufacturers, coupled with proactive government initiatives supporting industrial modernization, will further solidify this growth trajectory. Emerging economies present significant untapped potential, offering substantial opportunities for market penetration. The market is set to witness a surge in demand for intelligent, connected, and sustainable industrial machinery, marking a transformative era for global manufacturing.

Machine Tools Market Segmentation

-

1. Type

- 1.1. Milling Machines

- 1.2. Drilling Machines

- 1.3. Turning Machines

- 1.4. Grinding Machines

- 1.5. Electrical Discharge Machines

- 1.6. Others

-

2. End User

- 2.1. Automotive

- 2.2. Fabrication and Industrial Machinery Manufacturing

- 2.3. Marine and Aerospace & Defense

- 2.4. Precision Engineering

- 2.5. Other End Users

Machine Tools Market Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Europe

- 4. Middle East and Africa

- 5. Latin America

Machine Tools Market Regional Market Share

Geographic Coverage of Machine Tools Market

Machine Tools Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of the Automotive industry is driving the Machine Tool Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Machine Tools Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Milling Machines

- 5.1.2. Drilling Machines

- 5.1.3. Turning Machines

- 5.1.4. Grinding Machines

- 5.1.5. Electrical Discharge Machines

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Fabrication and Industrial Machinery Manufacturing

- 5.2.3. Marine and Aerospace & Defense

- 5.2.4. Precision Engineering

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Machine Tools Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Milling Machines

- 6.1.2. Drilling Machines

- 6.1.3. Turning Machines

- 6.1.4. Grinding Machines

- 6.1.5. Electrical Discharge Machines

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Automotive

- 6.2.2. Fabrication and Industrial Machinery Manufacturing

- 6.2.3. Marine and Aerospace & Defense

- 6.2.4. Precision Engineering

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Machine Tools Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Milling Machines

- 7.1.2. Drilling Machines

- 7.1.3. Turning Machines

- 7.1.4. Grinding Machines

- 7.1.5. Electrical Discharge Machines

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Automotive

- 7.2.2. Fabrication and Industrial Machinery Manufacturing

- 7.2.3. Marine and Aerospace & Defense

- 7.2.4. Precision Engineering

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Machine Tools Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Milling Machines

- 8.1.2. Drilling Machines

- 8.1.3. Turning Machines

- 8.1.4. Grinding Machines

- 8.1.5. Electrical Discharge Machines

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Automotive

- 8.2.2. Fabrication and Industrial Machinery Manufacturing

- 8.2.3. Marine and Aerospace & Defense

- 8.2.4. Precision Engineering

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Machine Tools Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Milling Machines

- 9.1.2. Drilling Machines

- 9.1.3. Turning Machines

- 9.1.4. Grinding Machines

- 9.1.5. Electrical Discharge Machines

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Automotive

- 9.2.2. Fabrication and Industrial Machinery Manufacturing

- 9.2.3. Marine and Aerospace & Defense

- 9.2.4. Precision Engineering

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Machine Tools Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Milling Machines

- 10.1.2. Drilling Machines

- 10.1.3. Turning Machines

- 10.1.4. Grinding Machines

- 10.1.5. Electrical Discharge Machines

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Automotive

- 10.2.2. Fabrication and Industrial Machinery Manufacturing

- 10.2.3. Marine and Aerospace & Defense

- 10.2.4. Precision Engineering

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Trumpf Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shenyang Machine Tool Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amada Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dalian Machine Tool Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Komatsu Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dmg Mori Seiki Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schuler AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jtekt Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Okuma Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mag

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Makino Milling Machine Co Ltd**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Trumpf Group

List of Figures

- Figure 1: Global Machine Tools Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Machine Tools Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Machine Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 4: Asia Pacific Machine Tools Market Volume (Billion), by Type 2025 & 2033

- Figure 5: Asia Pacific Machine Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Machine Tools Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Machine Tools Market Revenue (Million), by End User 2025 & 2033

- Figure 8: Asia Pacific Machine Tools Market Volume (Billion), by End User 2025 & 2033

- Figure 9: Asia Pacific Machine Tools Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: Asia Pacific Machine Tools Market Volume Share (%), by End User 2025 & 2033

- Figure 11: Asia Pacific Machine Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Machine Tools Market Volume (Billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Machine Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Machine Tools Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Machine Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Machine Tools Market Volume (Billion), by Type 2025 & 2033

- Figure 17: North America Machine Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Machine Tools Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Machine Tools Market Revenue (Million), by End User 2025 & 2033

- Figure 20: North America Machine Tools Market Volume (Billion), by End User 2025 & 2033

- Figure 21: North America Machine Tools Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: North America Machine Tools Market Volume Share (%), by End User 2025 & 2033

- Figure 23: North America Machine Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Machine Tools Market Volume (Billion), by Country 2025 & 2033

- Figure 25: North America Machine Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Machine Tools Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Machine Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Machine Tools Market Volume (Billion), by Type 2025 & 2033

- Figure 29: Europe Machine Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Machine Tools Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Machine Tools Market Revenue (Million), by End User 2025 & 2033

- Figure 32: Europe Machine Tools Market Volume (Billion), by End User 2025 & 2033

- Figure 33: Europe Machine Tools Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: Europe Machine Tools Market Volume Share (%), by End User 2025 & 2033

- Figure 35: Europe Machine Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Machine Tools Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Machine Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Machine Tools Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Machine Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Middle East and Africa Machine Tools Market Volume (Billion), by Type 2025 & 2033

- Figure 41: Middle East and Africa Machine Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East and Africa Machine Tools Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East and Africa Machine Tools Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Middle East and Africa Machine Tools Market Volume (Billion), by End User 2025 & 2033

- Figure 45: Middle East and Africa Machine Tools Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East and Africa Machine Tools Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East and Africa Machine Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Machine Tools Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East and Africa Machine Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Machine Tools Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Machine Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Latin America Machine Tools Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Latin America Machine Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Latin America Machine Tools Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Latin America Machine Tools Market Revenue (Million), by End User 2025 & 2033

- Figure 56: Latin America Machine Tools Market Volume (Billion), by End User 2025 & 2033

- Figure 57: Latin America Machine Tools Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: Latin America Machine Tools Market Volume Share (%), by End User 2025 & 2033

- Figure 59: Latin America Machine Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Machine Tools Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Latin America Machine Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Machine Tools Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Machine Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Machine Tools Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Machine Tools Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Machine Tools Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Global Machine Tools Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Machine Tools Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Machine Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Machine Tools Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global Machine Tools Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Machine Tools Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Global Machine Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Machine Tools Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Machine Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Machine Tools Market Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Global Machine Tools Market Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Machine Tools Market Volume Billion Forecast, by End User 2020 & 2033

- Table 17: Global Machine Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Machine Tools Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Machine Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Machine Tools Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global Machine Tools Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Machine Tools Market Volume Billion Forecast, by End User 2020 & 2033

- Table 23: Global Machine Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Machine Tools Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Machine Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Machine Tools Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global Machine Tools Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Machine Tools Market Volume Billion Forecast, by End User 2020 & 2033

- Table 29: Global Machine Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Machine Tools Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Machine Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Machine Tools Market Volume Billion Forecast, by Type 2020 & 2033

- Table 33: Global Machine Tools Market Revenue Million Forecast, by End User 2020 & 2033

- Table 34: Global Machine Tools Market Volume Billion Forecast, by End User 2020 & 2033

- Table 35: Global Machine Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Machine Tools Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Machine Tools Market?

The projected CAGR is approximately 2.92%.

2. Which companies are prominent players in the Machine Tools Market?

Key companies in the market include Trumpf Group, Shenyang Machine Tool Group, Amada Co Ltd, Dalian Machine Tool Group, Komatsu Ltd, Dmg Mori Seiki Co Ltd, Schuler AG, Jtekt Corporation, Okuma Corporation, Mag, Makino Milling Machine Co Ltd**List Not Exhaustive.

3. What are the main segments of the Machine Tools Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 103.57 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of the Automotive industry is driving the Machine Tool Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Phillips Machine Tools announced a strategic partnership with JFY International to broaden its solution portfolio for metal processing customers. JFY International, a member of the TRUMPF Group, is a full-service provider of sheet metal processing solutions, offering CNC bending, punching, shearing, 2D laser cutting machines, and even automation, from a single machine to a fully automated line. Through its partners, JFY International guarantees professional consulting, quick responses, and excellent on-time services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Machine Tools Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Machine Tools Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Machine Tools Market?

To stay informed about further developments, trends, and reports in the Machine Tools Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence