Key Insights

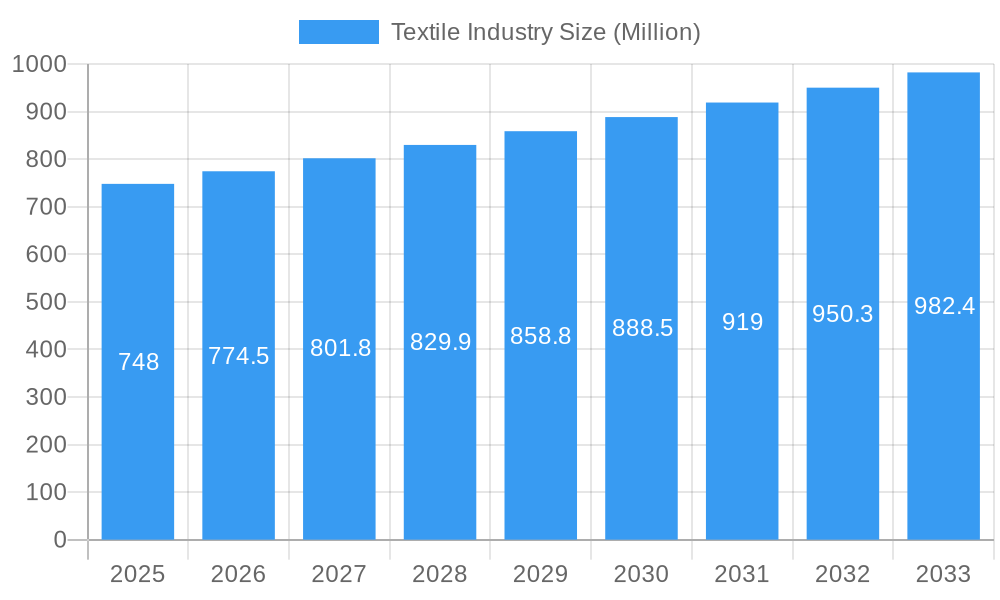

The global Textile Industry is poised for significant growth, with a projected market size of approximately $748.00 million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.52% through 2033. This robust expansion is fueled by a confluence of evolving consumer demands and advancements in manufacturing processes. Key drivers underpinning this growth include the increasing global population, a rising disposable income in emerging economies, and a heightened consumer preference for sustainable and ethically produced textiles. Furthermore, technological innovations in textile manufacturing, such as the development of smart fabrics and advanced dyeing techniques, are creating new avenues for market penetration and product differentiation. The industry is witnessing a strong trend towards eco-friendly materials like organic cotton and recycled synthetics, driven by growing environmental consciousness among consumers and stringent regulatory frameworks. This shift is not only reshaping product portfolios but also influencing supply chain dynamics, promoting circular economy principles.

Textile Industry Market Size (In Million)

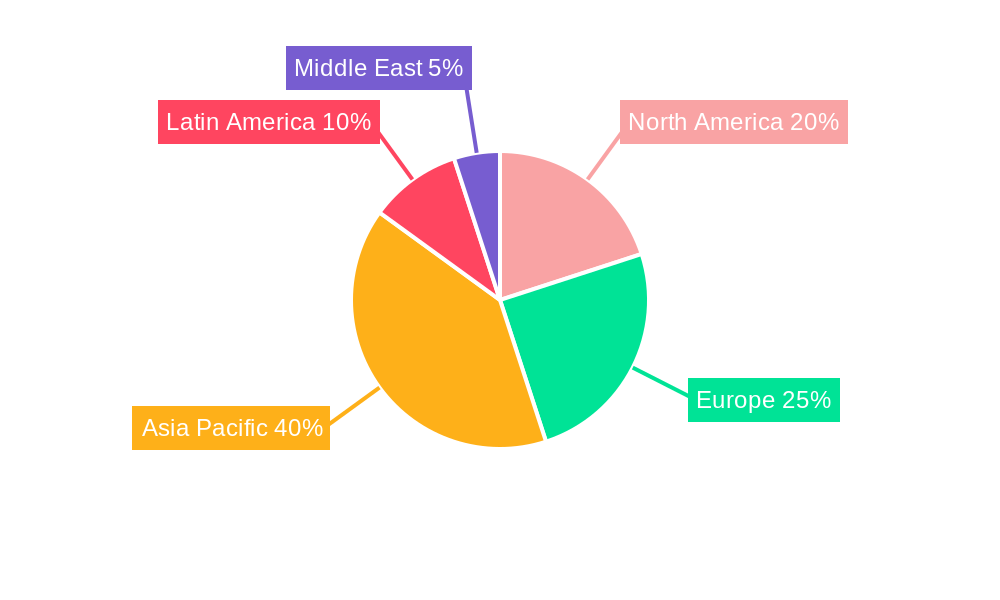

The textile market is segmented across diverse applications, with Clothing Application holding a substantial share due to continuous fashion cycles and demand for athleisure wear. Industrial/Technical Applications are also exhibiting steady growth, driven by sectors like automotive, healthcare, and construction, which increasingly utilize specialized textiles for their unique properties. Household applications, while mature, continue to contribute to market stability through demand for home furnishings and decor. The material segment is dominated by synthetics, offering versatility and cost-effectiveness, but natural fibers like cotton and jute are gaining traction due to sustainability mandates. In terms of processing, woven fabrics remain prevalent, while the non-woven segment is experiencing rapid growth, particularly in hygiene and medical applications. Geographically, the Asia Pacific region is expected to lead market expansion, owing to its robust manufacturing base and a large consumer market. However, North America and Europe remain significant markets, with a strong emphasis on innovation and premium, sustainable products. The industry faces restraints such as fluctuating raw material prices and intense competition, necessitating strategic investments in efficiency and differentiation to maintain profitability.

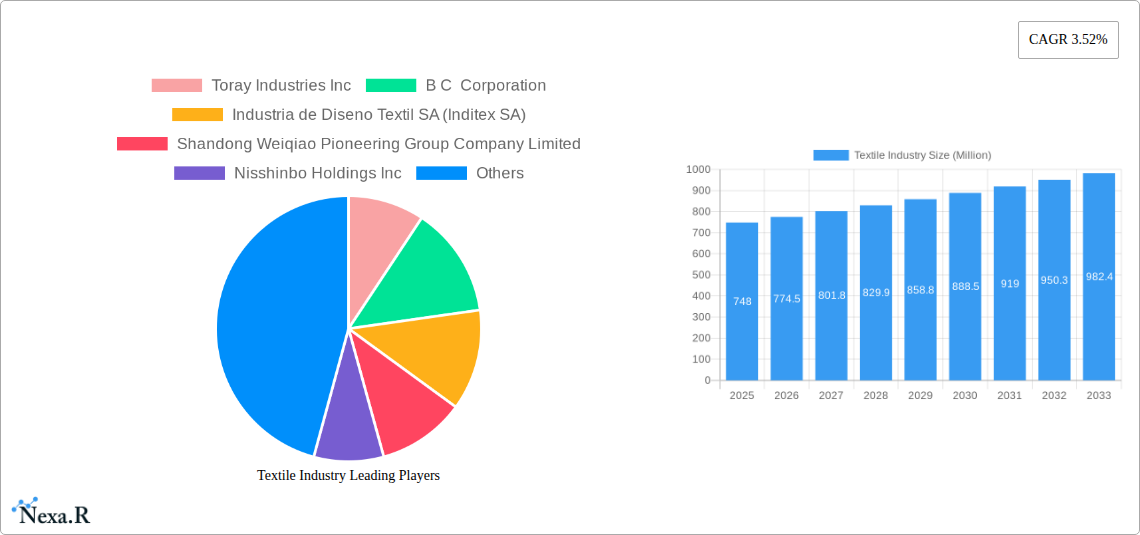

Textile Industry Company Market Share

Textile Industry Market Outlook: Comprehensive Analysis and Growth Strategies (2019-2033)

This comprehensive report provides an in-depth analysis of the global textile industry, forecasting market evolution from 2019 to 2033, with a detailed focus on the base and estimated year of 2025 and the forecast period of 2025-2033. Leveraging extensive data and expert insights, this report explores market dynamics, growth trends, dominant segments, product landscape, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and the influential key players shaping the future of the global textile market. Our analysis encompasses textile applications like clothing, industrial/technical, and household textiles, and delves into crucial textile materials such as cotton, jute, silk, synthetics, and wool, as well as textile processes including woven and non-woven manufacturing. This report is meticulously designed for industry professionals seeking to understand the intricate workings of the textile sector, identify strategic advantages, and navigate the evolving textile manufacturing landscape.

Textile Industry Market Dynamics & Structure

The global textile industry exhibits a dynamic and evolving structure, characterized by moderate to high market concentration in specific segments, driven by significant capital investment and technological advancements. Innovation in textile technology, particularly in sustainable materials, smart textiles, and advanced manufacturing processes, acts as a key differentiator, while the availability of competitive product substitutes from both traditional and emerging markets influences market share. Regulatory frameworks, encompassing environmental standards, labor laws, and trade policies, play a crucial role in shaping market entry and operational efficiency. End-user demographics, with their changing preferences towards sustainable and performance-driven textiles, are increasingly influencing product development and marketing strategies. Mergers and acquisitions (M&A) trends are prevalent as larger players seek to consolidate market share, acquire innovative technologies, and expand their geographical footprint.

- Market Concentration: Dominated by a few large integrated players in specific high-value segments like performance synthetics and technical textiles.

- Technological Innovation Drivers: Focus on sustainability (biodegradable fibers, recycled materials), smart textiles (wearable tech integration), and automation in manufacturing.

- Regulatory Frameworks: Evolving environmental regulations (e.g., REACH, OEKO-TEX) and trade agreements impacting global sourcing and production.

- Competitive Product Substitutes: Increasing availability of bio-based alternatives to synthetic fibers and advancements in performance characteristics of existing materials.

- End-User Demographics: Growing demand for ethically sourced, sustainable, and personalized textile products across all applications.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios, gaining access to new markets, and acquiring intellectual property in cutting-edge textile technologies.

Textile Industry Growth Trends & Insights

The textile industry's market size is projected to witness robust growth, propelled by evolving consumer preferences, technological advancements, and increasing demand across diverse applications. The CAGR of the textile market is expected to be significant, reflecting the sector's resilience and adaptability. Adoption rates for sustainable and eco-friendly textile materials are escalating, driven by heightened environmental awareness and supportive government policies. Technological disruptions, such as the integration of artificial intelligence in design and production, 3D printing for textiles, and the development of advanced finishing techniques, are reshaping manufacturing processes and product capabilities. Consumer behavior shifts are evident, with a growing emphasis on transparency in supply chains, ethical production practices, and a demand for functional and durable textile products. The textile market forecast indicates sustained expansion driven by innovation and evolving consumer needs.

- Market Size Evolution: Continuous expansion driven by population growth, rising disposable incomes, and diversification of applications.

- Adoption Rates: Accelerated adoption of sustainable textile manufacturing practices and materials, alongside the increasing integration of smart textile technologies.

- Technological Disruptions: Impact of AI, IoT, and advanced automation on design, production efficiency, and product innovation.

- Consumer Behavior Shifts: Increased demand for traceability, ethical sourcing, and personalized textile solutions.

- Market Penetration: Deepening penetration in emerging economies and expansion into new niche markets requiring specialized textile solutions.

Dominant Regions, Countries, or Segments in Textile Industry

Asia Pacific, particularly China and India, is expected to continue its dominance in the global textile market due to its vast manufacturing capabilities, skilled labor force, and supportive government initiatives. The clothing application segment will remain the largest contributor to market growth, fueled by a growing global population and rising fashion trends. Within textile materials, synthetics will continue to lead due to their versatility, durability, and cost-effectiveness, while demand for sustainable alternatives like recycled polyester and bio-based fibers is rapidly increasing. Woven textiles will maintain their stronghold, though the non-woven textile market is experiencing significant growth in technical and hygiene applications.

- Dominant Region: Asia Pacific (China, India) leading in production volume and export of various textile products.

- Key Drivers: Lower production costs, extensive supply chain networks, government incentives for textile exports, and a massive domestic consumer base.

- Market Share: Estimated to hold over 60% of the global textile manufacturing output.

- Growth Potential: Continued expansion driven by increasing domestic consumption and evolving manufacturing technologies.

- Dominant Country (within the region): China, with its massive production scale and technological advancements.

- Key Drivers: Significant investment in R&D, advanced manufacturing infrastructure, and strong export-oriented policies.

- Market Share: A leading exporter of apparel, home textiles, and technical textiles.

- Dominant Segment (Application): Clothing Application, driven by fast fashion, athleisure, and the demand for functional apparel.

- Market Share: Accounts for over 50% of the global textile market value.

- Growth Potential: Sustained growth due to evolving fashion trends, population increase, and increasing disposable incomes worldwide.

- Dominant Material: Synthetics (Polyester, Nylon), offering durability, versatility, and cost-effectiveness across various applications.

- Market Share: A significant portion of the textile material market.

- Growth Potential: Continued demand, with increasing focus on recycled and sustainable synthetic options.

- Dominant Process: Woven textiles, a foundational process for apparel and many industrial applications.

- Market Share: A substantial segment within the textile processing industry.

- Growth Potential: Stable growth, with innovations in weave structures for enhanced performance.

Textile Industry Product Landscape

The textile industry is witnessing a surge in innovative products designed for enhanced performance, sustainability, and functionality. Innovations range from advanced technical textiles for automotive and aerospace applications to bio-based and recycled fibers for eco-conscious apparel. Performance metrics are increasingly focusing on durability, breathability, water repellency, and antimicrobial properties. Unique selling propositions often revolve around sustainable sourcing, circular economy principles, and the integration of smart technologies. Technological advancements are enabling the creation of textiles with self-cleaning capabilities, temperature regulation, and integrated sensors, expanding the scope of textile applications beyond traditional uses.

Key Drivers, Barriers & Challenges in Textile Industry

The textile industry is propelled by several key drivers including increasing global population, rising disposable incomes, and a growing demand for functional and sustainable textile products. Technological innovations in materials science and manufacturing processes also act as significant growth accelerators. Economic factors, such as favorable trade agreements and government incentives for textile manufacturing, further boost market expansion.

However, the industry faces notable barriers and challenges. Supply chain disruptions, volatility in raw material prices, and increasing competition from low-cost production regions pose significant restraints. Stringent environmental regulations, particularly concerning wastewater treatment and chemical usage, require substantial investment in compliance. Furthermore, the evolving landscape of consumer preferences towards ethical sourcing and sustainability necessitates a proactive approach to supply chain transparency and responsible manufacturing.

Emerging Opportunities in Textile Industry

Emerging opportunities in the textile industry lie in the burgeoning demand for sustainable and recycled textile materials, driven by a global shift towards environmental consciousness. The development of smart textiles with integrated functionalities for healthcare, sports, and wearable technology presents a significant untapped market. Furthermore, the expansion of e-commerce platforms is creating new avenues for direct-to-consumer sales and niche market penetration. The increasing focus on the circular economy, promoting textile recycling and upcycling, offers substantial opportunities for innovative business models and waste reduction.

Growth Accelerators in the Textile Industry Industry

Long-term growth in the textile industry is being significantly accelerated by breakthroughs in sustainable material science, leading to the development of biodegradable and compostable fibers. Strategic partnerships between technology providers and textile manufacturers are fostering the adoption of Industry 4.0 principles, enhancing automation and efficiency. Market expansion into emerging economies with rapidly growing middle classes and increasing demand for quality apparel and home textiles also acts as a major growth catalyst. The continued focus on research and development to create high-performance and specialized textile solutions for niche applications is also a key accelerator.

Key Players Shaping the Textile Industry Market

- Toray Industries Inc

- B C Corporation

- Industria de Diseno Textil SA (Inditex SA)

- Shandong Weiqiao Pioneering Group Company Limited

- Nisshinbo Holdings Inc

- Chori Co Ltd

- Texhong Textile Group Ltd

- Aditya Birla Nuvo Ltd

- Hyosung TNC Corp

- PVH Corp

- Far Eastern New Century Corp

- Arvind Ltd

Notable Milestones in Textile Industry Sector

- Feb 2021: The Indian Government announced the setting up of seven mega textile parks within the next three years, aiming to boost domestic manufacturing and exports.

- Feb 2021: The Indian Government decided to rationalize duties on raw material inputs to manmade textiles, reducing the customs duty on caprolactam, nylon chips, and nylon fiber and yarn to 5%, positively impacting the synthetic textile market.

- Feb 2021: Paraguay's Ministry of Industry and Commerce announced an investment of USD 1.1 million in the manufacturing sector, with significant benefits allocated to the clothing and textile industries, among other assembly operations.

In-Depth Textile Industry Market Outlook

The textile industry is poised for sustained growth, driven by a confluence of factors including escalating global demand, continuous technological innovation, and a strong pivot towards sustainability. The forecast period from 2025 to 2033 anticipates significant expansion in technical textiles, sustainable apparel, and smart textile applications. Strategic opportunities lie in leveraging advanced manufacturing technologies, embracing circular economy principles, and catering to the evolving conscious consumer. Companies that invest in R&D for eco-friendly materials and efficient production processes will be well-positioned to capture market share and drive the future of the global textile market.

Textile Industry Segmentation

-

1. Application

- 1.1. Clothing Application

- 1.2. Industrial/Technical Application

- 1.3. Household Application

-

2. Material

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Synthetics

- 2.5. Wool

-

3. Process

- 3.1. Woven

- 3.2. Non-woven

Textile Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Textile Industry Regional Market Share

Geographic Coverage of Textile Industry

Textile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Natural Fibers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Textile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing Application

- 5.1.2. Industrial/Technical Application

- 5.1.3. Household Application

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Synthetics

- 5.2.5. Wool

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Woven

- 5.3.2. Non-woven

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Textile Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Clothing Application

- 6.1.2. Industrial/Technical Application

- 6.1.3. Household Application

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Cotton

- 6.2.2. Jute

- 6.2.3. Silk

- 6.2.4. Synthetics

- 6.2.5. Wool

- 6.3. Market Analysis, Insights and Forecast - by Process

- 6.3.1. Woven

- 6.3.2. Non-woven

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Textile Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Clothing Application

- 7.1.2. Industrial/Technical Application

- 7.1.3. Household Application

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Cotton

- 7.2.2. Jute

- 7.2.3. Silk

- 7.2.4. Synthetics

- 7.2.5. Wool

- 7.3. Market Analysis, Insights and Forecast - by Process

- 7.3.1. Woven

- 7.3.2. Non-woven

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Textile Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Clothing Application

- 8.1.2. Industrial/Technical Application

- 8.1.3. Household Application

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Cotton

- 8.2.2. Jute

- 8.2.3. Silk

- 8.2.4. Synthetics

- 8.2.5. Wool

- 8.3. Market Analysis, Insights and Forecast - by Process

- 8.3.1. Woven

- 8.3.2. Non-woven

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Textile Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Clothing Application

- 9.1.2. Industrial/Technical Application

- 9.1.3. Household Application

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Cotton

- 9.2.2. Jute

- 9.2.3. Silk

- 9.2.4. Synthetics

- 9.2.5. Wool

- 9.3. Market Analysis, Insights and Forecast - by Process

- 9.3.1. Woven

- 9.3.2. Non-woven

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Textile Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Clothing Application

- 10.1.2. Industrial/Technical Application

- 10.1.3. Household Application

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Cotton

- 10.2.2. Jute

- 10.2.3. Silk

- 10.2.4. Synthetics

- 10.2.5. Wool

- 10.3. Market Analysis, Insights and Forecast - by Process

- 10.3.1. Woven

- 10.3.2. Non-woven

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Toray Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 B C Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Industria de Diseno Textil SA (Inditex SA)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shandong Weiqiao Pioneering Group Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nisshinbo Holdings Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chori Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Texhong Textile Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aditya Birla Nuvo Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hyosung TNC Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PVH Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Far Eastern New Century Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Arvind Ltd**List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Toray Industries Inc

List of Figures

- Figure 1: Global Textile Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Textile Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Textile Industry Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America Textile Industry Volume (Billion), by Application 2025 & 2033

- Figure 5: North America Textile Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Textile Industry Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Textile Industry Revenue (undefined), by Material 2025 & 2033

- Figure 8: North America Textile Industry Volume (Billion), by Material 2025 & 2033

- Figure 9: North America Textile Industry Revenue Share (%), by Material 2025 & 2033

- Figure 10: North America Textile Industry Volume Share (%), by Material 2025 & 2033

- Figure 11: North America Textile Industry Revenue (undefined), by Process 2025 & 2033

- Figure 12: North America Textile Industry Volume (Billion), by Process 2025 & 2033

- Figure 13: North America Textile Industry Revenue Share (%), by Process 2025 & 2033

- Figure 14: North America Textile Industry Volume Share (%), by Process 2025 & 2033

- Figure 15: North America Textile Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Textile Industry Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Textile Industry Revenue (undefined), by Application 2025 & 2033

- Figure 20: Europe Textile Industry Volume (Billion), by Application 2025 & 2033

- Figure 21: Europe Textile Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Textile Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Textile Industry Revenue (undefined), by Material 2025 & 2033

- Figure 24: Europe Textile Industry Volume (Billion), by Material 2025 & 2033

- Figure 25: Europe Textile Industry Revenue Share (%), by Material 2025 & 2033

- Figure 26: Europe Textile Industry Volume Share (%), by Material 2025 & 2033

- Figure 27: Europe Textile Industry Revenue (undefined), by Process 2025 & 2033

- Figure 28: Europe Textile Industry Volume (Billion), by Process 2025 & 2033

- Figure 29: Europe Textile Industry Revenue Share (%), by Process 2025 & 2033

- Figure 30: Europe Textile Industry Volume Share (%), by Process 2025 & 2033

- Figure 31: Europe Textile Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Textile Industry Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Textile Industry Revenue (undefined), by Application 2025 & 2033

- Figure 36: Asia Pacific Textile Industry Volume (Billion), by Application 2025 & 2033

- Figure 37: Asia Pacific Textile Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific Textile Industry Volume Share (%), by Application 2025 & 2033

- Figure 39: Asia Pacific Textile Industry Revenue (undefined), by Material 2025 & 2033

- Figure 40: Asia Pacific Textile Industry Volume (Billion), by Material 2025 & 2033

- Figure 41: Asia Pacific Textile Industry Revenue Share (%), by Material 2025 & 2033

- Figure 42: Asia Pacific Textile Industry Volume Share (%), by Material 2025 & 2033

- Figure 43: Asia Pacific Textile Industry Revenue (undefined), by Process 2025 & 2033

- Figure 44: Asia Pacific Textile Industry Volume (Billion), by Process 2025 & 2033

- Figure 45: Asia Pacific Textile Industry Revenue Share (%), by Process 2025 & 2033

- Figure 46: Asia Pacific Textile Industry Volume Share (%), by Process 2025 & 2033

- Figure 47: Asia Pacific Textile Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pacific Textile Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Textile Industry Revenue (undefined), by Application 2025 & 2033

- Figure 52: Latin America Textile Industry Volume (Billion), by Application 2025 & 2033

- Figure 53: Latin America Textile Industry Revenue Share (%), by Application 2025 & 2033

- Figure 54: Latin America Textile Industry Volume Share (%), by Application 2025 & 2033

- Figure 55: Latin America Textile Industry Revenue (undefined), by Material 2025 & 2033

- Figure 56: Latin America Textile Industry Volume (Billion), by Material 2025 & 2033

- Figure 57: Latin America Textile Industry Revenue Share (%), by Material 2025 & 2033

- Figure 58: Latin America Textile Industry Volume Share (%), by Material 2025 & 2033

- Figure 59: Latin America Textile Industry Revenue (undefined), by Process 2025 & 2033

- Figure 60: Latin America Textile Industry Volume (Billion), by Process 2025 & 2033

- Figure 61: Latin America Textile Industry Revenue Share (%), by Process 2025 & 2033

- Figure 62: Latin America Textile Industry Volume Share (%), by Process 2025 & 2033

- Figure 63: Latin America Textile Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: Latin America Textile Industry Volume (Billion), by Country 2025 & 2033

- Figure 65: Latin America Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East Textile Industry Revenue (undefined), by Application 2025 & 2033

- Figure 68: Middle East Textile Industry Volume (Billion), by Application 2025 & 2033

- Figure 69: Middle East Textile Industry Revenue Share (%), by Application 2025 & 2033

- Figure 70: Middle East Textile Industry Volume Share (%), by Application 2025 & 2033

- Figure 71: Middle East Textile Industry Revenue (undefined), by Material 2025 & 2033

- Figure 72: Middle East Textile Industry Volume (Billion), by Material 2025 & 2033

- Figure 73: Middle East Textile Industry Revenue Share (%), by Material 2025 & 2033

- Figure 74: Middle East Textile Industry Volume Share (%), by Material 2025 & 2033

- Figure 75: Middle East Textile Industry Revenue (undefined), by Process 2025 & 2033

- Figure 76: Middle East Textile Industry Volume (Billion), by Process 2025 & 2033

- Figure 77: Middle East Textile Industry Revenue Share (%), by Process 2025 & 2033

- Figure 78: Middle East Textile Industry Volume Share (%), by Process 2025 & 2033

- Figure 79: Middle East Textile Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: Middle East Textile Industry Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East Textile Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Textile Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 3: Global Textile Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 4: Global Textile Industry Volume Billion Forecast, by Material 2020 & 2033

- Table 5: Global Textile Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 6: Global Textile Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 7: Global Textile Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Textile Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Textile Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Textile Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 12: Global Textile Industry Volume Billion Forecast, by Material 2020 & 2033

- Table 13: Global Textile Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 14: Global Textile Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 15: Global Textile Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Textile Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Textile Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 19: Global Textile Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 20: Global Textile Industry Volume Billion Forecast, by Material 2020 & 2033

- Table 21: Global Textile Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 22: Global Textile Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 23: Global Textile Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Textile Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Textile Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 26: Global Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 27: Global Textile Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 28: Global Textile Industry Volume Billion Forecast, by Material 2020 & 2033

- Table 29: Global Textile Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 30: Global Textile Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 31: Global Textile Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global Textile Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Textile Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 35: Global Textile Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 36: Global Textile Industry Volume Billion Forecast, by Material 2020 & 2033

- Table 37: Global Textile Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 38: Global Textile Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 39: Global Textile Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global Textile Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global Textile Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 42: Global Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 43: Global Textile Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 44: Global Textile Industry Volume Billion Forecast, by Material 2020 & 2033

- Table 45: Global Textile Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 46: Global Textile Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 47: Global Textile Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Global Textile Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Textile Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Textile Industry?

Key companies in the market include Toray Industries Inc, B C Corporation, Industria de Diseno Textil SA (Inditex SA), Shandong Weiqiao Pioneering Group Company Limited, Nisshinbo Holdings Inc, Chori Co Ltd, Texhong Textile Group Ltd, Aditya Birla Nuvo Ltd, Hyosung TNC Corp, PVH Corp, Far Eastern New Century Corp, Arvind Ltd**List Not Exhaustive.

3. What are the main segments of the Textile Industry?

The market segments include Application , Material , Process .

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand for Natural Fibers.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In Feb 2021, The Indian Government has announced the setting up of seven mega textile parks in the next three years. The government has also decided to rationalize the duties on raw material inputs to manmade textiles by reducing the customs duty rate on caprolactam, nylon chips, and nylon fiber and yarn to 5 %.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Textile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Textile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Textile Industry?

To stay informed about further developments, trends, and reports in the Textile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence