Key Insights

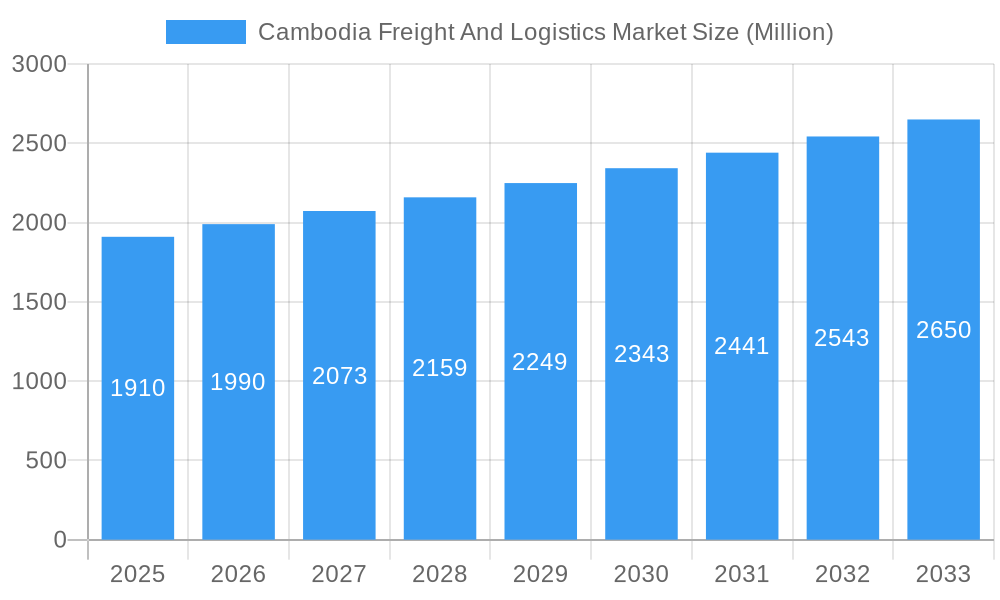

The Cambodian freight and logistics market, valued at $1.91 billion in 2025, is poised for robust growth, driven by a Compound Annual Growth Rate (CAGR) of 3.95% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Cambodia's burgeoning manufacturing and construction sectors, particularly in garments, footwear, and tourism-related infrastructure, are creating significant demand for efficient transportation and warehousing solutions. The increasing adoption of e-commerce further stimulates the logistics sector, requiring enhanced delivery networks and supply chain management. Secondly, government initiatives to improve infrastructure, such as port upgrades and road development, are streamlining logistics operations and reducing transportation costs. Finally, foreign direct investment (FDI) continues to flow into Cambodia, supporting industrial growth and fueling the need for sophisticated logistics services. However, challenges remain. Limited skilled labor in the logistics sector, inadequate transportation infrastructure in certain regions, and regulatory hurdles can hinder market expansion. Overcoming these challenges is crucial for realizing the full potential of this growing market.

Cambodia Freight And Logistics Market Market Size (In Billion)

Despite the challenges, the market segmentation reveals opportunities across various sectors. The rail freight forwarding segment will likely witness significant growth due to increasing volumes of goods transported to and from Cambodia's ports. The warehousing segment benefits from the growing demand for storage and distribution services, especially within the manufacturing and e-commerce sectors. Value-added services, encompassing activities like packaging, labeling, and customs clearance, are becoming increasingly important as supply chains become more complex. The end-user segments, such as manufacturing and automotive, continue to drive demand, but growth in the agriculture and construction sectors also contributes to overall market expansion. Key players like Phnom Penh Autonomous Port, Nippon Express, and ZTO Co Ltd are strategically positioned to benefit from this growth, but smaller, local logistics companies also play a critical role in serving niche markets. Continued investment in technological advancements, such as tracking systems and optimized route planning, will be essential for companies to maintain competitiveness within this dynamic market.

Cambodia Freight And Logistics Market Company Market Share

Cambodia Freight and Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Cambodia freight and logistics market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market dynamics, growth trends, dominant segments, and key players shaping the future of Cambodia's logistics landscape. The report leverages extensive data analysis to project future market size and growth potential.

Cambodia Freight and Logistics Market Market Dynamics & Structure

This section analyzes the Cambodian freight and logistics market's structure, identifying key trends impacting its evolution. The market is characterized by a mix of large multinational corporations and smaller domestic players, leading to a moderately fragmented landscape. Technological innovation, particularly in digital logistics and supply chain management, is a significant driver of growth. However, limited infrastructure development and regulatory complexities pose ongoing challenges. Government regulations and policies focusing on infrastructure improvement and trade facilitation are key determinants of market evolution. Substitutes for traditional freight transportation such as rail and road, are limited, but the potential for greater integration with regional logistics networks represents both an opportunity and a challenge. The increasing adoption of e-commerce fuels growth in last-mile delivery services. The M&A activity in the global logistics sector, illustrated by recent acquisitions like Kuehne+Nagel’s purchase of Morgan Cargo, indicates a trend towards consolidation, which may also impact the Cambodian market.

- Market Concentration: Moderately fragmented, with a mix of multinational and domestic players. xx% market share held by top 5 players (estimated).

- Technological Innovation: Driving efficiency gains and improved supply chain visibility; challenges include digital literacy and infrastructure limitations.

- Regulatory Framework: Influences market access and operational costs; ongoing improvements are needed to foster greater efficiency.

- Competitive Product Substitutes: Limited direct substitutes, but potential for modal shift and increased use of regional logistics networks.

- End-User Demographics: Dominated by manufacturing, agriculture, and distributive trade, with growing contribution from other sectors.

- M&A Trends: Global consolidation trends are expected to eventually influence the Cambodian market, leading to potential mergers and acquisitions.

Cambodia Freight and Logistics Market Growth Trends & Insights

The Cambodian freight and logistics market exhibits robust growth, driven by economic expansion, rising e-commerce adoption, and increasing foreign investment. The market size is projected to reach xx Million units by 2025 and xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by improved infrastructure, expanding manufacturing sector, and growth in intra-regional trade. Technological advancements like real-time tracking, automated warehousing, and blockchain technology are transforming operational efficiencies. Consumer behavior shifts toward faster delivery expectations are pressuring companies to optimize their logistics operations.

Dominant Regions, Countries, or Segments in Cambodia Freight and Logistics Market

The Phnom Penh and Sihanoukville regions are dominant due to their port facilities and proximity to key economic centers. The manufacturing and automotive, and distributive trade (including FMCG) segments show the most significant growth potential due to rising domestic production and consumption. Freight forwarding remains a key segment, with warehousing and value-added services gaining traction. Infrastructure development, particularly road and rail networks, plays a crucial role in shaping regional dominance. Government policies supporting industrial zones and logistics hubs further influence regional growth.

Key Drivers:

- Economic Growth: Rising GDP and increasing industrial activity boost freight volumes.

- Infrastructure Development: Improvements in ports, roads, and railways enhance connectivity.

- Government Policies: Initiatives to improve the business environment and attract foreign investment.

- E-commerce Boom: Growth in online shopping drives demand for last-mile delivery services.

Dominant Segments:

- By Region: Phnom Penh and Sihanoukville.

- By End-User: Manufacturing and Automotive, Distributive Trade (FMCG included).

- By Function: Freight Forwarding, Warehousing

Cambodia Freight and Logistics Market Product Landscape

The Cambodian freight and logistics market features a diverse range of services, including freight forwarding, warehousing, customs brokerage, and value-added services like packaging and labeling. Technological innovations are leading to the adoption of sophisticated supply chain management solutions, real-time tracking systems, and integrated logistics platforms. This allows for greater visibility, efficiency, and optimization across the entire supply chain. These technological advancements are enhancing service quality and competitiveness while reducing costs for businesses.

Key Drivers, Barriers & Challenges in Cambodia Freight And Logistics Market

Key Drivers:

- Government Investments: Infrastructure improvements and trade facilitation initiatives.

- Economic Growth: Expanding manufacturing and agricultural sectors driving demand.

- Rising E-commerce: Increased demand for last-mile delivery services.

Key Barriers and Challenges:

- Infrastructure Gaps: Inadequate road and rail networks in some regions.

- Regulatory Hurdles: Complex customs procedures and bureaucratic processes.

- Limited Skilled Labor: Shortage of skilled logistics professionals.

- Competition: Presence of established international players.

Emerging Opportunities in Cambodia Freight And Logistics Market

The Cambodian freight and logistics market presents significant opportunities for businesses focusing on specialized logistics services, technological advancements, and sustainable practices. E-commerce growth presents opportunities in last-mile delivery and fulfillment solutions, while the development of industrial parks and special economic zones will create demand for warehousing and logistics solutions catering to specific industrial needs. Companies leveraging technology such as AI-powered route optimization and automated warehousing solutions will gain a competitive edge.

Growth Accelerators in the Cambodia Freight And Logistics Market Industry

Long-term growth in the Cambodian freight and logistics market is driven by ongoing infrastructure development, particularly in transportation networks and logistics hubs. Strategic partnerships between domestic and international logistics providers will foster the adoption of advanced technologies and improve service quality. Government policies promoting ease of doing business and attracting foreign investment will further contribute to market expansion.

Key Players Shaping the Cambodia Freight and Logistics Market Market

- Phnom Penh Autonomous Port

- Nippon Express

- ZTO Co Ltd

- Sihanoukville Autonomous Port

- WBJ Logistics Co Ltd

- NHL Import Export Co Ltd

- CBG Logistics

- Shipco Transport Co Ltd

- Union Import Export & Transport Company Limited

- Damco Ltd

- Soon Soon Import Export Co Ltd

- QM Express Co Ltd

Notable Milestones in Cambodia Freight and Logistics Market Sector

- June 2023: Kuehne+Nagel's acquisition of Morgan Cargo expands its perishable goods logistics capabilities and enhances connectivity to and from Africa and the UK.

- March 2023: Yusen Logistics' acquisition of Taylored Services strengthens its U.S. fulfillment network and expands its e-commerce fulfillment capabilities.

In-Depth Cambodia Freight and Logistics Market Market Outlook

The Cambodian freight and logistics market is poised for continued robust growth, driven by sustained economic expansion, infrastructure investments, and technological advancements. Strategic partnerships, adoption of innovative logistics solutions, and focus on sustainable practices will be key factors in determining market leadership. The growing integration with regional logistics networks also presents opportunities for expansion and market consolidation. The long-term outlook is positive, with significant potential for growth and innovation within the sector.

Cambodia Freight And Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Others

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

Cambodia Freight And Logistics Market Segmentation By Geography

- 1. Cambodia

Cambodia Freight And Logistics Market Regional Market Share

Geographic Coverage of Cambodia Freight And Logistics Market

Cambodia Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in trade activities boosting the market; Increase in infrastructure development and increasing foreign investments

- 3.3. Market Restrains

- 3.3.1. Inadequate transportation infrastructure affecting the market; Regulatory challenges affecting the market

- 3.4. Market Trends

- 3.4.1. Surge in import and exports boosting the logistics market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cambodia Freight And Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Others

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Cambodia

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Phnom Penh Autonomous Port

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nippon Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZTO Co Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sihanoukville Autonomous Port

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 WBJ Logistics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NHL Import Export Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CBG Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shipco Transport Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Union Import Export & Transport Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Damco Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Soon Soon Import Export Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 QM Express Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Phnom Penh Autonomous Port

List of Figures

- Figure 1: Cambodia Freight And Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Cambodia Freight And Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Cambodia Freight And Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Cambodia Freight And Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Cambodia Freight And Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Cambodia Freight And Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Cambodia Freight And Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Cambodia Freight And Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cambodia Freight And Logistics Market?

The projected CAGR is approximately 3.95%.

2. Which companies are prominent players in the Cambodia Freight And Logistics Market?

Key companies in the market include Phnom Penh Autonomous Port, Nippon Express, ZTO Co Ltd*List Not Exhaustive, Sihanoukville Autonomous Port, WBJ Logistics Co Ltd, NHL Import Export Co Ltd, CBG Logistics, Shipco Transport Co Ltd, Union Import Export & Transport Company Limited, Damco Ltd, Soon Soon Import Export Co Ltd, QM Express Co Ltd.

3. What are the main segments of the Cambodia Freight And Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in trade activities boosting the market; Increase in infrastructure development and increasing foreign investments.

6. What are the notable trends driving market growth?

Surge in import and exports boosting the logistics market.

7. Are there any restraints impacting market growth?

Inadequate transportation infrastructure affecting the market; Regulatory challenges affecting the market.

8. Can you provide examples of recent developments in the market?

June 2023: Kuehne+Nagel signed an agreement to acquire Morgan Cargo, a leading South African, UK, and Kenyan freight forwarder specializing in the transport and handling of perishable goods. During 2022, the company handled more than 40,000 tonnes of air freight and more than 20,000 TEU of sea freight globally, managed by approximately 450 logistics experts. The acquisition of Morgan Cargo ideally complements Kuehne+Nagel's perishables logistics service offering while improving connectivity for customers to and from South Africa, the UK, and Kenya, which includes state-of-the-art cold chain facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cambodia Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cambodia Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cambodia Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Cambodia Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence