Key Insights

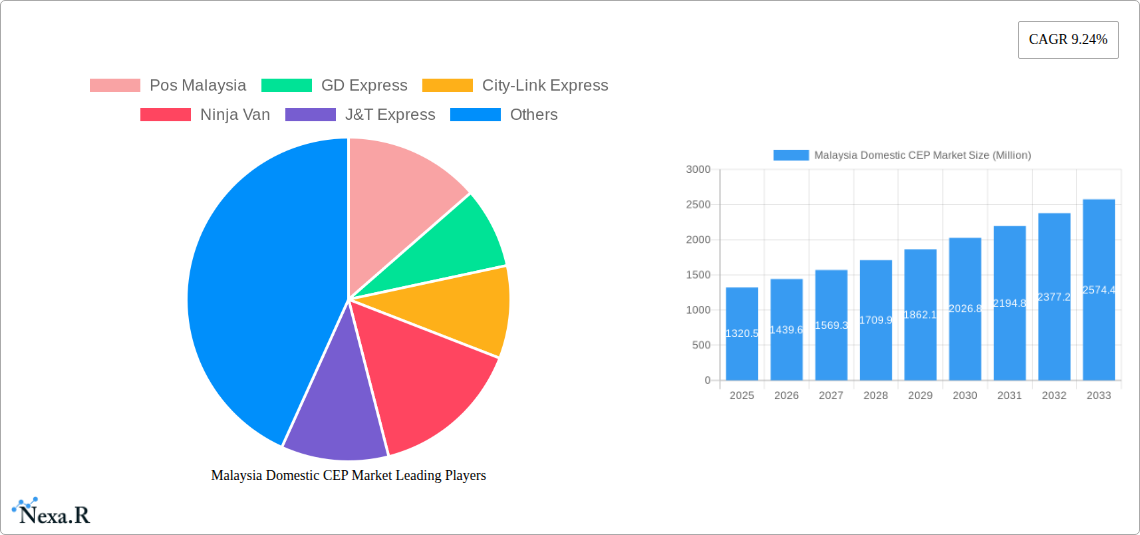

The Malaysia Domestic Courier, Express, and Parcel (CEP) market is poised for significant expansion, driven by robust e-commerce growth and evolving consumer demands. With a current market size of approximately USD 1.28 billion, the sector is projected to witness a healthy Compound Annual Growth Rate (CAGR) of 9.24% over the forecast period of 2025-2033. This sustained growth trajectory underscores the increasing reliance on efficient and reliable delivery services for both businesses and individuals. Key drivers fueling this expansion include the burgeoning e-commerce landscape, which continues to attract new online shoppers and expand the variety of goods available for domestic delivery. Furthermore, the increasing adoption of digital payment methods and the growing preference for convenient doorstep delivery are also playing a pivotal role. The market's diverse segments, encompassing Business-to-Business (B2B), Customer-to-Customer (C2C), and Business-to-Consumer (B2C) models, highlight its broad appeal and adaptability to various operational needs. The dominance of e-commerce as a delivery type is expected to continue, supported by a growing infrastructure and increasingly sophisticated logistics solutions.

Malaysia Domestic CEP Market Market Size (In Billion)

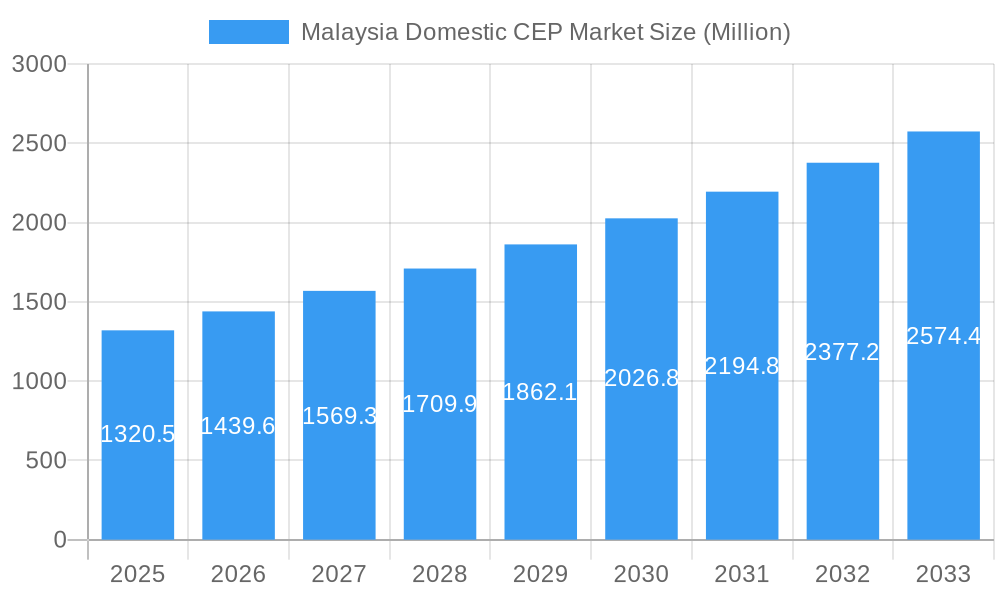

The Malaysia Domestic CEP market is characterized by a dynamic competitive environment with established players like Pos Malaysia, GD Express, and City-Link Express, alongside aggressive newcomers such as Ninja Van and J&T Express, all vying for market share. The healthcare, wholesale and retail, and industrial manufacturing sectors are identified as significant end-users, reflecting the broad applicability of CEP services across the Malaysian economy. While the overall outlook is highly positive, potential restraints such as rising operational costs, including fuel prices and labor, as well as the need for continuous technological investment to maintain service quality and efficiency, could pose challenges. However, the ongoing advancements in logistics technology, including automation and data analytics, are expected to mitigate some of these restraints and further optimize delivery networks, paving the way for enhanced customer experiences and operational excellence within the Malaysian Domestic CEP market.

Malaysia Domestic CEP Market Company Market Share

Here is a compelling, SEO-optimized report description for the Malaysia Domestic CEP Market, integrating high-traffic keywords and structuring the content as requested.

This comprehensive report delivers an in-depth analysis of the Malaysia Domestic Courier, Express, and Parcel (CEP) market, providing actionable insights for stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study meticulously examines market dynamics, growth drivers, competitive landscapes, and emerging opportunities. With a focus on both parent and child market segments, this report is an essential resource for understanding the evolving needs of e-commerce, wholesale, retail, and industrial sectors in Malaysia. All values are presented in Million units for clear quantitative analysis.

Malaysia Domestic CEP Market Market Dynamics & Structure

The Malaysia Domestic CEP market exhibits a moderate to high concentration, with key players like Pos Malaysia, GD Express, and Ninja Van holding significant market shares. Technological innovation is a primary driver, with advancements in automation, route optimization software, and AI-powered sorting systems continuously enhancing operational efficiency. The regulatory framework remains stable, primarily governed by postal service regulations and e-commerce guidelines, fostering a predictable business environment. Competitive product substitutes, such as localized delivery services and in-house logistics solutions from large retailers, exist but face challenges in matching the scale and efficiency of established CEP providers. End-user demographics are increasingly influenced by the digital economy, with a rising demand for faster, more flexible, and trackable delivery services. Merger and acquisition (M&A) trends are observed as companies seek to expand their network reach, consolidate operations, and acquire new technological capabilities. For instance, recent M&A activity has focused on strengthening last-mile delivery capabilities.

- Market Concentration: Dominated by a few major players, with increasing competition from agile new entrants.

- Technological Innovation: Driven by automation, AI, and data analytics for improved efficiency and customer experience.

- Regulatory Framework: Stable, with adherence to postal and e-commerce regulations.

- Competitive Substitutes: Localized services and in-house logistics pose niche competition.

- End-User Demographics: Shifting towards digital-first, demanding speed, visibility, and flexibility.

- M&A Trends: Focus on network expansion, technology acquisition, and service diversification.

Malaysia Domestic CEP Market Growth Trends & Insights

The Malaysia Domestic CEP market has witnessed robust growth, propelled by the burgeoning e-commerce sector and a significant shift in consumer purchasing habits. The market size evolution indicates a consistent upward trajectory, with projections pointing to sustained expansion driven by increased internet penetration and mobile commerce adoption. Adoption rates for express delivery services are soaring, particularly for time-sensitive shipments and last-mile logistics. Technological disruptions, including the integration of IoT for real-time tracking, drone delivery feasibility studies, and advanced warehouse management systems, are reshaping operational models. Consumer behavior shifts are characterized by higher expectations for same-day or next-day delivery, competitive pricing, and seamless returns processes. This has necessitated a greater focus on customer-centric solutions and flexible delivery options.

The market penetration of CEP services across various end-user segments continues to deepen. The CAGR for the forecast period is projected to be substantial, reflecting the ongoing digital transformation and the increasing reliance on online platforms for goods and services. The historical period (2019-2024) has laid the groundwork for this accelerated growth, with investments in infrastructure and technology laying the foundation for future expansion. The rise of the "gig economy" has also influenced delivery models, with platforms leveraging independent contractors for last-mile fulfillment, enhancing speed and cost-effectiveness for certain segments. The e-commerce segment remains the primary growth engine, contributing a significant portion of the overall volume. However, non-e-commerce segments, such as business-to-business (B2B) document delivery and industrial parts distribution, also show steady growth due to the increasing complexity of supply chains. The shift towards a data-driven approach in logistics management is enabling companies to optimize routes, predict demand, and enhance customer service, further fueling market growth.

Dominant Regions, Countries, or Segments in Malaysia Domestic CEP Market

The e-commerce segment is unequivocally the dominant force driving growth within the Malaysia Domestic CEP Market. This segment's ascendancy is underpinned by the widespread adoption of online shopping across B2C, C2C, and increasingly, B2B transactions. The proliferation of e-commerce platforms, coupled with the convenience and accessibility of online retail, has created an unprecedented demand for reliable and efficient parcel delivery services. This surge directly translates into higher volumes for CEP providers, making e-commerce the primary revenue generator and growth catalyst for the industry.

- E-commerce Dominance: The sheer volume of online orders, fueled by a digitally connected population and a growing middle class, makes this the leading segment.

- Market Share: E-commerce constitutes over 60% of the total CEP volume.

- Growth Potential: Expected to maintain a double-digit CAGR over the forecast period.

- Business-to-Consumer (B2C) Sub-segment: This is the largest sub-segment within e-commerce, driven by individual consumer purchases.

- Drivers: Increased disposable income, wider product availability online, and attractive pricing.

- Customer-to-Customer (C2C) Sub-segment: Growing with the popularity of online marketplaces for second-hand goods and peer-to-peer sales.

- Impact: Contributes to parcel volumes and requires specialized handling for diverse items.

- Business-to-Business (B2B) Segment: While smaller than e-commerce, B2B logistics, including supply chain management and inter-branch transfers, remains a stable contributor.

- Key Sectors: Wholesale and Retail, and Industrial Manufacturing rely heavily on efficient B2B CEP services.

The Wholesale and Retail end-user segment also plays a crucial role, as traditional retailers increasingly integrate online sales channels and require efficient logistics for inventory management and fulfillment. The Service sector, encompassing document delivery and specialized item transport, contributes a steady flow of business, though at lower volumes compared to e-commerce. The Healthcare segment is emerging as a growth area, with increasing demand for temperature-controlled and secure delivery of pharmaceuticals and medical supplies. Industrial Manufacturing relies on timely delivery of components and finished goods, making efficient B2B CEP services vital for their operations.

Malaysia Domestic CEP Market Product Landscape

The Malaysia Domestic CEP market is characterized by a range of innovative product offerings designed to meet diverse customer needs. Leading companies are enhancing their express parcel delivery services with features like real-time tracking, flexible delivery windows, and multiple pickup/drop-off options. Beyond traditional parcel services, there's a growing emphasis on specialty logistics, including temperature-controlled solutions for perishable goods and pharmaceuticals, and secure delivery for high-value items. Technology integration is a key differentiator, with advanced tracking and tracing systems, e-commerce fulfillment solutions, and customizable reporting tools providing value-added services. Performance metrics focus on speed, reliability, cost-effectiveness, and customer satisfaction, with companies investing in infrastructure and technology to achieve industry-leading benchmarks.

Key Drivers, Barriers & Challenges in Malaysia Domestic CEP Market

Key Drivers:

- E-commerce Growth: The relentless expansion of online retail is the primary engine, demanding efficient and scalable delivery solutions.

- Digital Adoption: Increasing internet and smartphone penetration among consumers fuels online purchasing.

- Urbanization & Convenience: Growing urban populations seek convenient and timely delivery options for everyday needs.

- Government Support for Digital Economy: Initiatives promoting e-commerce and digital infrastructure enhance the CEP ecosystem.

- Technological Advancements: Automation, AI, and route optimization software improve efficiency and reduce costs.

Barriers & Challenges:

- Logistical Infrastructure Gaps: While improving, some rural areas may still face connectivity and accessibility challenges.

- Rising Operational Costs: Fuel prices, labor costs, and investment in technology can impact profitability.

- Intense Competition: A crowded market leads to price sensitivity and necessitates continuous service innovation.

- Regulatory Compliance: Evolving regulations regarding data privacy and environmental standards require adaptation.

- Last-Mile Delivery Efficiency: Optimizing the final leg of delivery in congested urban environments remains a persistent challenge.

- Returns Management: Efficiently handling product returns, a significant aspect of e-commerce, poses logistical complexities.

Emerging Opportunities in Malaysia Domestic CEP Market

Emerging opportunities in the Malaysia Domestic CEP market are abundant, particularly in the specialized logistics sector. The growing demand for cold chain logistics for food and pharmaceuticals presents a significant untapped market. Furthermore, the increasing adoption of same-day and instant delivery services, especially in urban centers, offers lucrative avenues for growth. The cross-border e-commerce fulfillment segment also holds substantial potential as Malaysian businesses expand their reach internationally. Leveraging innovative delivery technologies, such as electric vehicles for last-mile delivery to promote sustainability, and exploring partnerships for integrated logistics solutions, will be key to capturing these opportunities. The rise of the circular economy also presents opportunities for reverse logistics and efficient product return management.

Growth Accelerators in the Malaysia Domestic CEP Market Industry

Several catalysts are propelling the long-term growth of the Malaysia Domestic CEP Market. Strategic partnerships between logistics providers, e-commerce platforms, and technology companies are fostering synergistic growth and expanding service offerings. Investments in advanced sorting and warehousing technologies, including automated systems and AI-driven analytics, are significantly boosting operational efficiency and capacity. The government's continuous focus on developing robust digital infrastructure and logistics networks provides a fertile ground for expansion. Furthermore, a growing emphasis on sustainable logistics practices, including the adoption of eco-friendly delivery vehicles and optimized routing, is not only meeting regulatory demands but also appealing to environmentally conscious consumers, acting as a significant growth accelerator.

Key Players Shaping the Malaysia Domestic CEP Market Market

- Pos Malaysia

- GD Express

- City-Link Express

- Ninja Van

- J&T Express

- DHL E-commerce

- Skynet

- ABX Express

- Nationwide Express

- Ta-Q-Bin

- DTDC

Notable Milestones in Malaysia Domestic CEP Market Sector

- April 2024: Ninja Van broadened its services to transport perishable items, such as fresh fruit and sashimi, alongside its traditional parcel and online order deliveries, expanding its niche in specialized logistics.

- January 2024: DTDC announced its foray into the Malaysian market through its subsidiary, DTDC Global Express PTE Ltd, inaugurating an office in Kuala Lumpur to focus on advanced trans-shipment services in Southeast Asia and the Australian peninsula.

In-Depth Malaysia Domestic CEP Market Market Outlook

The Malaysia Domestic CEP Market is poised for continued robust growth, driven by a confluence of factors including the unwavering expansion of e-commerce, increasing digital adoption, and evolving consumer demands for speed and convenience. Strategic investments in technological innovation, such as AI-powered logistics and advanced automation, will further enhance operational efficiencies and service quality. Opportunities in specialized logistics, including cold chain solutions and same-day deliveries, are expected to expand significantly. The market outlook is further strengthened by government initiatives supporting digital infrastructure and sustainable practices. Companies that can effectively navigate the competitive landscape by offering value-added services, optimizing last-mile delivery, and embracing eco-friendly solutions will be best positioned for sustained success. The integration of advanced analytics and a customer-centric approach will be paramount in capturing future market potential.

Malaysia Domestic CEP Market Segmentation

-

1. Business Model

- 1.1. Business-to-business (B2B)

- 1.2. Customer-to-customer (C2C)

- 1.3. Business-to-consumer(B2C)

-

2. Type

- 2.1. E-commerce

- 2.2. Non-e-commerce

-

3. End User

- 3.1. Service

- 3.2. Wholesale and Retail

- 3.3. Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End Users

Malaysia Domestic CEP Market Segmentation By Geography

- 1. Malaysia

Malaysia Domestic CEP Market Regional Market Share

Geographic Coverage of Malaysia Domestic CEP Market

Malaysia Domestic CEP Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce

- 3.4. Market Trends

- 3.4.1. Booming Smartphone Sales in E-Commerce Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Domestic CEP Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 5.1.1. Business-to-business (B2B)

- 5.1.2. Customer-to-customer (C2C)

- 5.1.3. Business-to-consumer(B2C)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. E-commerce

- 5.2.2. Non-e-commerce

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Service

- 5.3.2. Wholesale and Retail

- 5.3.3. Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pos Malaysia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GD Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 City-Link Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ninja Van

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J&T Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL E-commerce

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skynet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ABX Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nationwide Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ta-Q-Bin**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pos Malaysia

List of Figures

- Figure 1: Malaysia Domestic CEP Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Domestic CEP Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Domestic CEP Market Revenue Million Forecast, by Business Model 2020 & 2033

- Table 2: Malaysia Domestic CEP Market Volume Billion Forecast, by Business Model 2020 & 2033

- Table 3: Malaysia Domestic CEP Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Malaysia Domestic CEP Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Malaysia Domestic CEP Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Malaysia Domestic CEP Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Malaysia Domestic CEP Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Malaysia Domestic CEP Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Malaysia Domestic CEP Market Revenue Million Forecast, by Business Model 2020 & 2033

- Table 10: Malaysia Domestic CEP Market Volume Billion Forecast, by Business Model 2020 & 2033

- Table 11: Malaysia Domestic CEP Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Malaysia Domestic CEP Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Malaysia Domestic CEP Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Malaysia Domestic CEP Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Malaysia Domestic CEP Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Malaysia Domestic CEP Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Domestic CEP Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Malaysia Domestic CEP Market?

Key companies in the market include Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, DHL E-commerce, Skynet, ABX Express, Nationwide Express, Ta-Q-Bin**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Malaysia Domestic CEP Market?

The market segments include Business Model, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.28 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce.

6. What are the notable trends driving market growth?

Booming Smartphone Sales in E-Commerce Segment.

7. Are there any restraints impacting market growth?

4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce.

8. Can you provide examples of recent developments in the market?

April 2024: Ninja Van, a local express logistics company, broadened its services to transport perishable items, such as fresh fruit and sashimi, alongside its traditional parcel and online order deliveries.January 2024: DTDC, an express logistics company, announced its foray into the Malaysian market. This move was facilitated by its subsidiary, DTDC Global Express PTE Ltd, which inaugurated an office in Kuala Lumpur. The newly minted office, bolstering DTDC's presence in Southeast Asia, will primarily focus on providing advanced trans-shipment services to clients in Southeast Asia and the Australian peninsula, as per DTDC's official statement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Domestic CEP Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Domestic CEP Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Domestic CEP Market?

To stay informed about further developments, trends, and reports in the Malaysia Domestic CEP Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence