Key Insights

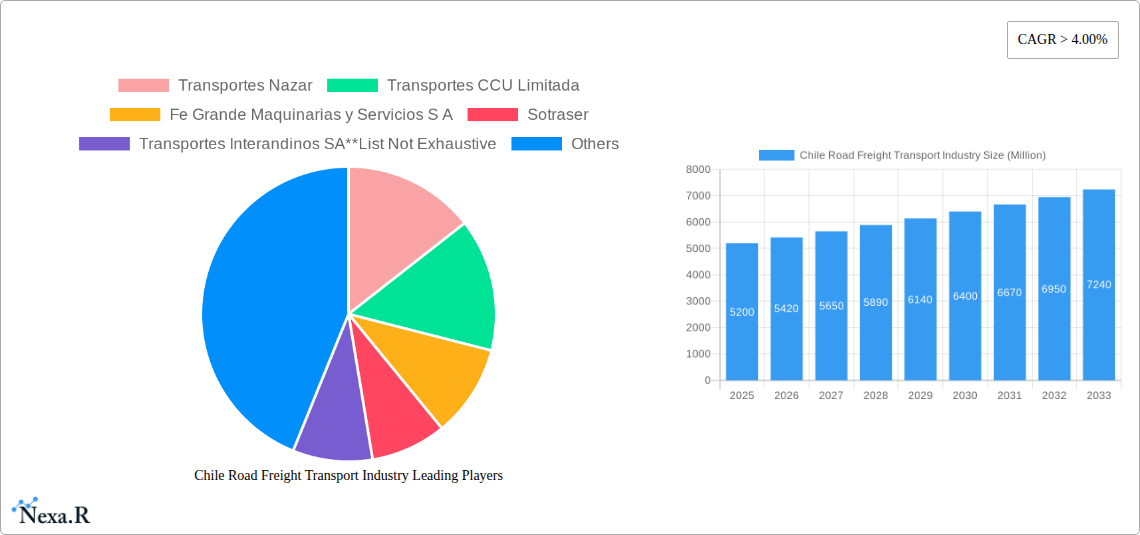

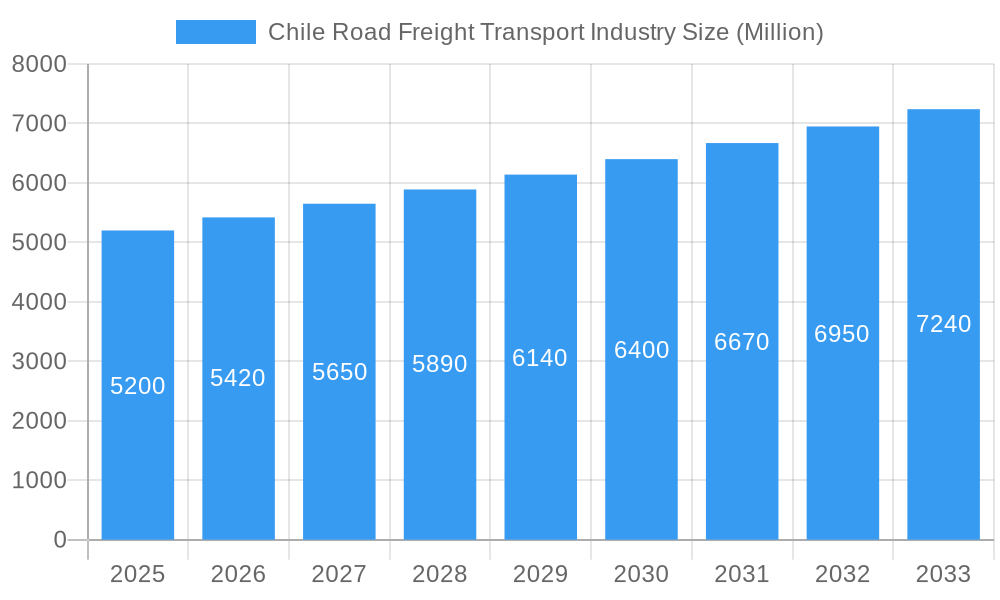

The Chilean Road Freight Transport Industry is projected to experience significant expansion, with an anticipated Compound Annual Growth Rate (CAGR) of 4.1%. The market size is estimated at $1.14 billion in the base year 2025. Key growth drivers include escalating demand from manufacturing and automotive sectors, alongside the essential needs of the oil and gas, mining, and quarrying industries. The agricultural, fishing, and forestry sectors also contribute substantially through the transport of raw materials and finished products, demonstrating the industry's vital role in Chile's economy. Ongoing construction projects and an expanding distributive trade network, facilitating consumer goods movement, further bolster this growth trajectory. Emerging trends such as the adoption of advanced logistics technologies, a focus on supply chain optimization, and a growing emphasis on sustainable transport solutions are shaping the industry's future, fostering innovation and enhancing network efficiency.

Chile Road Freight Transport Industry Market Size (In Billion)

Despite positive growth prospects, the industry faces potential challenges. These include infrastructure development and maintenance requirements, particularly in remote or developing regions, which could affect transit times and operational expenses. Fuel price volatility and evolving regulatory frameworks also present ongoing considerations. The market is segmented by destination, encompassing both domestic and international freight. Major end-user industries are diverse, reflecting a broad economic dependence on efficient road transport. Leading companies such as Transportes Nazar, Transportes CCU Limitada, and Andes Logistics de Chile S.A. are key participants, contributing to market competitiveness and service enhancement. The Chilean market, with a study period from 2019 to 2033, is characterized by consistent demand for dependable and scalable road freight solutions to support economic activities.

Chile Road Freight Transport Industry Company Market Share

Comprehensive Report: Chile Road Freight Transport Industry Market Analysis & Forecast (2019-2033)

This in-depth report offers a definitive analysis of the Chile Road Freight Transport Industry, a critical sector fueling the nation's economic growth. We meticulously examine market dynamics, growth trends, dominant segments, and competitive landscapes, providing actionable insights for stakeholders. The study spans the historical period (2019-2024), base year (2025), and extends to a comprehensive forecast period (2025-2033), ensuring a robust understanding of both present conditions and future trajectories. Our analysis integrates high-traffic keywords such as "Chile logistics," "road freight Chile," "transportation services Chile," and "supply chain Chile" to maximize visibility and reach industry professionals. This report delves into parent and child market segments, providing a granular view of market penetration and opportunities within the Chilean transport sector.

Chile Road Freight Transport Industry Market Dynamics & Structure

The Chilean road freight transport market exhibits a moderately consolidated structure, with key players investing in technological advancements and operational efficiencies to secure market share. Regulatory frameworks, including those governing vehicle emissions and driver hours, significantly influence operational strategies. Technological innovation is driven by the need for enhanced tracking, route optimization, and fleet management solutions, aiming to improve efficiency and reduce costs. Competitive product substitutes, such as rail and maritime transport for specific routes, necessitate a focus on the unique advantages of road freight, including flexibility and last-mile delivery capabilities. End-user demographics are diverse, with significant reliance on the mining industry, manufacturing and automotive, and distributive trade sectors. Mergers and acquisitions (M&A) are observed as companies seek to expand their service offerings, geographic reach, and consolidate their market positions.

- Market Concentration: Moderately consolidated, with a few dominant players and a significant number of smaller operators.

- Technological Innovation Drivers: Demand for real-time tracking, route optimization software, fuel efficiency technologies, and digitalization of logistics processes.

- Regulatory Frameworks: Focus on sustainability, safety standards, and international trade agreements impacting cross-border operations.

- Competitive Product Substitutes: Rail freight for long-haul bulk cargo, and maritime transport for international imports/exports where feasible.

- End-User Demographics: Strong demand from mining, manufacturing, agriculture, and retail sectors.

- M&A Trends: Strategic acquisitions aimed at expanding service portfolios and market reach, particularly in specialized logistics.

Chile Road Freight Transport Industry Growth Trends & Insights

The Chilean road freight transport market is poised for steady growth, driven by robust economic activity and increasing demand across various end-user industries. The market size evolution is anticipated to reflect the nation's industrial output and trade volumes. Adoption rates for advanced logistics technologies, such as IoT-enabled tracking and AI-powered route planning, are increasing, contributing to improved operational efficiency and service delivery. Technological disruptions, including the potential integration of autonomous vehicles in the long term and the adoption of greener fleet technologies, are shaping the industry's future. Consumer behavior shifts, particularly the rise of e-commerce, are creating new demands for agile and efficient last-mile delivery solutions. The Chile road transport forecast indicates a positive trajectory, with key performance indicators like CAGR (Compound Annual Growth Rate) expected to show consistent upward movement. Market penetration for specialized logistics services, such as cold chain and hazardous materials transport, is also projected to expand.

Dominant Regions, Countries, or Segments in Chile Road Freight Transport Industry

Within the Chilean road freight transport industry, the Domestic destination segment is a dominant driver of market growth, supported by extensive internal trade networks and the widespread distribution of goods across the country's diverse geography. The Mining and Quarrying end-user sector consistently contributes significantly to freight volumes, owing to Chile's rich mineral resources and the logistical demands of extraction and processing. Furthermore, the Distributive Trade segment plays a pivotal role, fueled by an expanding retail sector and the growing consumption patterns of the Chilean population. Economic policies promoting industrial development and infrastructure investments, particularly in improving road networks and logistics hubs, further bolster the dominance of these segments. Market share within these dominant areas is influenced by the efficiency of logistics providers, the cost-effectiveness of transport solutions, and the ability to cater to specific industry requirements.

- Dominant Destination: Domestic transportation, characterized by high-volume intra-country movement of goods.

- Dominant End-Users:

- Mining and Quarrying: Continuous demand for heavy-duty transport of raw materials and equipment.

- Distributive Trade: Essential for the supply chain of retail goods, including food, electronics, and consumer products.

- Manufacturing and Automotive: Supporting the movement of raw materials and finished products within and out of manufacturing facilities.

- Key Drivers of Dominance:

- Economic Policies: Government initiatives supporting domestic trade and industrial growth.

- Infrastructure Development: Investments in roads, bridges, and logistics centers enhancing connectivity.

- Resource Rich Economy: The sustained importance of the mining sector for national GDP.

- Consumer Demand: Growing middle class and e-commerce driving retail distribution.

- Growth Potential: Continued urbanization and the expansion of retail chains are expected to fuel further growth in the distributive trade and domestic segments.

Chile Road Freight Transport Industry Product Landscape

The Chilean road freight transport industry is characterized by a diverse range of services catering to various cargo types and delivery needs. Innovations focus on enhancing fleet efficiency, safety, and environmental sustainability. This includes the adoption of advanced fleet management systems for real-time monitoring and optimization, specialized vehicles for temperature-sensitive goods (cold chain logistics), and robust solutions for the secure transportation of hazardous materials. Performance metrics are increasingly evaluated based on delivery timelines, cargo integrity, fuel efficiency, and adherence to safety regulations. Unique selling propositions often lie in specialized handling capabilities, customized logistics solutions, and the integration of technology to provide transparency and reliability throughout the supply chain. Technological advancements are aimed at minimizing transit times and reducing the carbon footprint of freight operations.

Key Drivers, Barriers & Challenges in Chile Road Freight Transport Industry

The Chile road freight transport market is propelled by several key drivers, including the country's significant natural resources, robust export-oriented economy, and increasing domestic consumption. Technological advancements in fleet management and route optimization are further enhancing efficiency and competitiveness.

- Key Drivers:

- Strong Export Economy: Reliance on road freight for internal distribution of export goods.

- Growing Domestic Demand: Increased consumption and e-commerce driving last-mile logistics.

- Technological Adoption: Implementation of digital solutions for enhanced efficiency.

- Infrastructure Investment: Government focus on improving transport networks.

Key barriers and challenges include the country's geographical constraints, with long distances and varied terrain impacting transit times and operational costs. Intense competition among a large number of transport providers can lead to price pressures.

- Key Barriers & Challenges:

- Geographical Constraints: Long distances, mountainous terrain, and varied climate conditions.

- Fuel Price Volatility: Fluctuations in global oil prices directly impacting operating costs.

- Infrastructure Gaps: While improving, some areas may still face connectivity challenges.

- Regulatory Compliance: Adherence to evolving safety and environmental standards.

- Labor Shortages: Potential difficulties in recruiting and retaining qualified drivers.

Emerging Opportunities in Chile Road Freight Transport Industry

Emerging opportunities in the Chile road freight transport sector lie in the expansion of specialized logistics services, driven by evolving industry needs. The increasing focus on sustainability presents opportunities for the adoption of electric and alternative fuel vehicles, aligning with global environmental trends and potentially offering long-term cost savings. The growth of e-commerce continues to create demand for efficient and agile last-mile delivery solutions, particularly in urban centers. Furthermore, the development of cross-border logistics with neighboring countries, facilitated by trade agreements and improved infrastructure, offers significant potential for market expansion.

Growth Accelerators in the Chile Road Freight Transport Industry Industry

Long-term growth in the Chilean road freight transport industry will be significantly accelerated by continued technological innovation, strategic partnerships, and market expansion strategies. The integration of advanced technologies, such as artificial intelligence for predictive maintenance and dynamic route optimization, will enhance operational efficiency and reduce costs. Strategic alliances between logistics providers and end-user industries can create integrated supply chain solutions, fostering loyalty and driving volume. Market expansion can occur through the development of new service offerings, such as temperature-controlled logistics for the growing pharmaceutical and food sectors, and by capitalizing on increased trade flows with emerging markets.

Key Players Shaping the Chile Road Freight Transport Industry Market

- Transportes Nazar

- Transportes CCU Limitada

- Fe Grande Maquinarias y Servicios S A

- Sotraser

- Transportes Interandinos SA

- Andes Logistics de Chile S A

- Transportes Tamarugal Limitada

- Agunsa

- Transportes Casablanca

- Logistica Linsa S A

Notable Milestones in Chile Road Freight Transport Industry Sector

- February 2023: Agunsa's chartering area in China and Chile successfully coordinated the shipment of 400 electric buses in five bulk ships due to a lack of RoRo ship availability, showcasing their problem-solving capabilities and supporting electromobility in public transport.

- November 2022: Agunsa received a USD 70 million loan linked to sustainability from the International Finance Corporation (IFC), a World Bank Group member. This financing is tied to achieving goals in water consumption reduction and gender equality, highlighting the growing importance of ESG factors in the logistics sector.

In-Depth Chile Road Freight Transport Industry Market Outlook

The Chile road freight transport market outlook is exceptionally positive, driven by sustained economic development and evolving logistical demands. Growth accelerators such as the strategic adoption of sustainable transport solutions, including electric fleets, will not only align with global environmental objectives but also present significant operational cost benefits in the long term. The continuous expansion of e-commerce and the robust performance of key sectors like mining and agriculture will ensure a consistent demand for efficient freight services. Furthermore, ongoing investments in infrastructure and technology promise to enhance connectivity and operational capabilities, creating a fertile ground for innovation and market growth. Strategic partnerships and the development of specialized logistics services are poised to further capitalize on emerging market niches, solidifying Chile's position as a key logistics hub in the region.

Chile Road Freight Transport Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. End-User

- 2.1. Manufacturing and Automotive)

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distributive Trade

- 2.6. Pharmaceutical and Healthcare

- 2.7. Other End-Users

Chile Road Freight Transport Industry Segmentation By Geography

- 1. Chile

Chile Road Freight Transport Industry Regional Market Share

Geographic Coverage of Chile Road Freight Transport Industry

Chile Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. Growth in the E-commerce Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive)

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distributive Trade

- 5.2.6. Pharmaceutical and Healthcare

- 5.2.7. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Transportes Nazar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Transportes CCU Limitada

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fe Grande Maquinarias y Servicios S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sotraser

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Transportes Interandinos SA**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Andes Logistics de Chile S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Transportes Tamarugal Limitada

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agunsa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Transportes Casablanca

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Logistica Linsa S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Transportes Nazar

List of Figures

- Figure 1: Chile Road Freight Transport Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Chile Road Freight Transport Industry Share (%) by Company 2025

List of Tables

- Table 1: Chile Road Freight Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Chile Road Freight Transport Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Chile Road Freight Transport Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Chile Road Freight Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 5: Chile Road Freight Transport Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Chile Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Road Freight Transport Industry?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Chile Road Freight Transport Industry?

Key companies in the market include Transportes Nazar, Transportes CCU Limitada, Fe Grande Maquinarias y Servicios S A, Sotraser, Transportes Interandinos SA**List Not Exhaustive, Andes Logistics de Chile S A, Transportes Tamarugal Limitada, Agunsa, Transportes Casablanca, Logistica Linsa S A.

3. What are the main segments of the Chile Road Freight Transport Industry?

The market segments include Destination, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.14 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

Growth in the E-commerce Sector is Driving the Market.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

February 2023: Due to the lack of available spaces for RoRo ships, Agunsa's chartering area in China and Chile accepted the challenge and developed a comprehensive solution to ship 400 electric buses in five bulk ships on time through their POS subsidiary. For AGUNSA, this project is highly relevant since, in addition to providing a comprehensive solution to the client, it allows them to contribute to the electromobility process of the public transport system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the Chile Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence