Key Insights

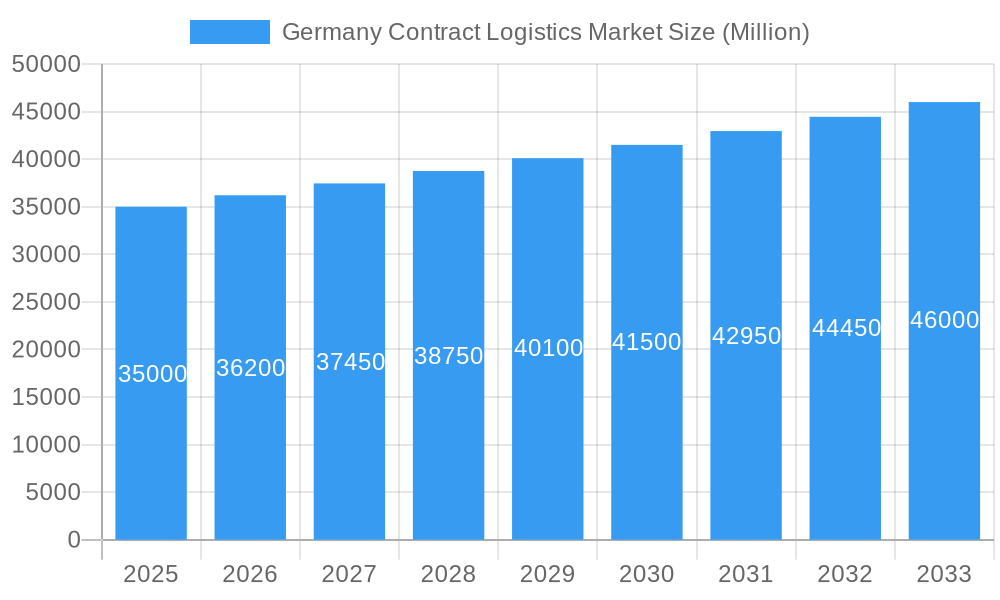

Germany's contract logistics market is projected for significant expansion, reaching an estimated market size of 30.43 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.18% from 2025 to 2033. This growth is propelled by several key factors. Increasing global supply chain complexity, alongside a strong business imperative for operational efficiency and cost reduction, is driving outsourcing of logistics functions. The robust growth of e-commerce in Germany, marked by rising online retail and heightened customer demands for rapid, reliable deliveries, is a major catalyst for contract logistics providers to enhance and expand their services. Furthermore, the ongoing digital transformation of the logistics sector, including the integration of Artificial Intelligence (AI), Internet of Things (IoT), and automation, is improving service delivery and increasing demand for advanced contract logistics solutions.

Germany Contract Logistics Market Market Size (In Billion)

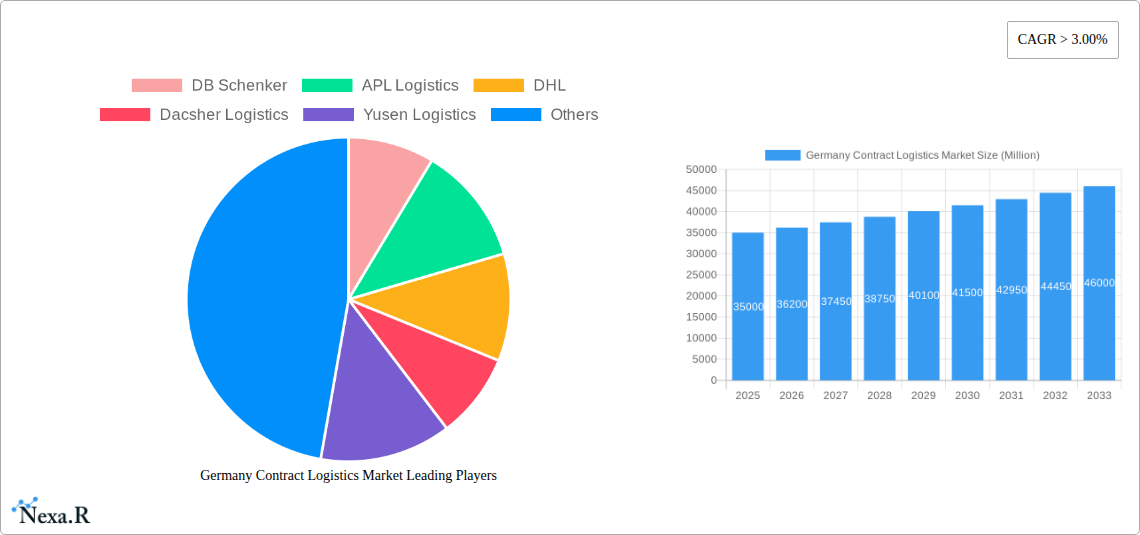

There is a clear trend towards outsourced contract logistics, as businesses acknowledge the advantages of utilizing specialized expertise and infrastructure. The automotive sector continues to be a significant contributor, driven by stringent just-in-time and just-in-sequence delivery requirements. Simultaneously, the consumer and retail sector is experiencing substantial expansion due to the persistent growth of e-commerce and the demand for adaptable fulfillment solutions. The energy sector is also contributing to market growth, influenced by the logistical complexities of renewable energy projects and the necessity for specialized material handling. Key market players in Germany, including DB Schenker, DHL, and Dachser Logistics, are making substantial investments in technological innovation and service portfolio expansion to meet evolving client needs. Sustainability and green logistics are also emerging as critical trends, shaping service offerings and operational strategies.

Germany Contract Logistics Market Company Market Share

Germany Contract Logistics Market Report Description

This comprehensive report provides an in-depth analysis of the Germany Contract Logistics Market, a critical component of the European supply chain. We delve into market dynamics, growth trends, regional dominance, product innovations, and the competitive landscape, offering actionable insights for industry stakeholders. Our analysis spans the historical period of 2019-2024, with a base year of 2025 and a robust forecast period extending to 2033. This report is essential for understanding the evolving needs of sectors such as Automotive, Consumer & Retail, Healthcare, and Industrial & Aerospace within the German market.

Germany Contract Logistics Market Market Dynamics & Structure

The Germany Contract Logistics Market is characterized by a moderate level of market concentration, with a few key players holding significant market share, estimated at XX% collectively for the top 5 companies in 2025. Technological innovation is a primary driver, fueled by investments in automation, Artificial Intelligence (AI) for route optimization, and Internet of Things (IoT) for real-time tracking, projected to contribute to an annual innovation investment of approximately €1.5 billion. Regulatory frameworks, particularly those concerning environmental sustainability and labor laws, are increasingly shaping operational strategies. Competitive product substitutes, such as in-house logistics solutions, are continuously being challenged by the efficiency and cost-effectiveness of outsourced contract logistics. End-user demographics are shifting towards greater demand for customized, flexible, and sustainable logistics solutions, with the e-commerce sector's expansion significantly influencing these preferences. Mergers and Acquisitions (M&A) remain a significant strategic tool, with an estimated XX number of deals valued at over €500 million annually in the historical period, driven by the pursuit of market consolidation and enhanced service offerings.

- Market Concentration: Top 5 players estimated to hold XX% market share in 2025.

- Technological Innovation: AI and IoT adoption rates for supply chain visibility are projected to reach XX% by 2028.

- Regulatory Impact: Increased focus on CO2 emission reduction targets impacting fleet management and warehouse operations.

- End-User Demographics: Growing demand for temperature-controlled logistics in the Healthcare sector.

- M&A Trends: XX M&A deals exceeding €50 million recorded in the past three years.

Germany Contract Logistics Market Growth Trends & Insights

The Germany Contract Logistics Market is poised for substantial growth, driven by the increasing complexity of supply chains and the continuous pursuit of operational efficiencies by businesses across various sectors. The market size, estimated at €XX billion in the base year 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This growth is underpinned by the rising adoption rates of outsourced contract logistics services, which are predicted to increase from XX% in 2025 to XX% by 2033, as companies focus on their core competencies. Technological disruptions, including the integration of advanced Warehouse Management Systems (WMS), Transportation Management Systems (TMS), and predictive analytics, are transforming the landscape, enabling greater agility and responsiveness. Consumer behavior shifts, particularly the surge in e-commerce and the demand for faster, more personalized deliveries, are compelling logistics providers to innovate and expand their service portfolios. Furthermore, the "Industry 4.0" initiative in Germany is fostering an environment conducive to the adoption of smart logistics solutions, including autonomous vehicles and robotic warehousing. The growing emphasis on sustainable logistics practices, driven by both consumer demand and regulatory pressures, is also a significant growth accelerator. The transition from traditional, linear supply chains to more resilient, networked models further amplifies the need for sophisticated contract logistics capabilities. The increasing globalization of businesses necessitates robust international logistics networks, which contract logistics providers are well-equipped to offer. The digitalization of trade documentation and customs procedures is streamlining cross-border operations, making outsourced logistics even more attractive. The focus on supply chain visibility and risk management, amplified by recent global disruptions, is also driving the demand for specialized contract logistics expertise. The development of urban logistics hubs and micro-fulfillment centers is another key trend, catering to the evolving delivery requirements of densely populated areas. The report will meticulously analyze these trends, providing specific metrics such as market penetration rates, historical CAGR figures (2019-2024), and future growth projections.

Dominant Regions, Countries, or Segments in Germany Contract Logistics Market

The Automotive end-user segment is a dominant force within the Germany Contract Logistics Market, projected to account for approximately XX% of the total market value in 2025. This dominance stems from the sheer volume and complexity of automotive supply chains, which require specialized handling, just-in-time (JIT) delivery, and sophisticated inventory management. The robust German automotive manufacturing base, with its global reach, necessitates highly efficient and integrated contract logistics solutions for parts, components, and finished vehicles. The Outsourced segment is also a significant growth driver, expected to capture XX% of the market by 2025. Businesses are increasingly recognizing the strategic advantage of outsourcing non-core logistics functions to specialized providers, allowing them to focus on innovation and core business operations. This trend is particularly pronounced in the Industrial & Aerospace sector, where intricate supply chains and stringent quality control requirements demand expert logistics management. The leading region for contract logistics in Germany is undoubtedly North Rhine-Westphalia, driven by its dense industrial landscape, major transportation hubs, and significant manufacturing output, particularly in the automotive and industrial sectors. Its strategic location at the heart of Europe further bolsters its importance.

- Dominant End-User: Automotive sector, representing XX% of market share in 2025.

- Key Drivers: Just-in-time (JIT) delivery requirements, high volume of parts and finished goods, global manufacturing presence.

- Growth Potential: Continued investment in electric vehicle (EV) production and associated battery logistics.

- Dominant Segment (Type): Outsourced contract logistics, estimated at XX% market share in 2025.

- Key Drivers: Focus on core competencies, cost optimization, access to specialized expertise and technology.

- Growth Potential: Increasing demand for flexible and scalable logistics solutions from SMEs and startups.

- Dominant Region: North Rhine-Westphalia.

- Key Drivers: High concentration of industrial companies, extensive transportation infrastructure (road, rail, waterways), proximity to key European markets.

- Market Share: Estimated to contribute XX% to the national contract logistics market in 2025.

Germany Contract Logistics Market Product Landscape

The Germany Contract Logistics Market is defined by a landscape of innovative and performance-driven services. Companies are increasingly offering integrated solutions encompassing warehousing, transportation management, freight forwarding, and value-added services like kitting, assembly, and reverse logistics. Performance metrics are centered on delivery speed, accuracy, cost-efficiency, and enhanced supply chain visibility. Unique selling propositions include the deployment of advanced Warehouse Management Systems (WMS) for optimized inventory control and robotic automation for increased picking efficiency, achieving throughput rates of XX units per hour. Furthermore, the integration of IoT devices for real-time shipment tracking and condition monitoring provides customers with unprecedented transparency. Technological advancements in route optimization software are reducing transit times and fuel consumption, contributing to sustainability goals.

Key Drivers, Barriers & Challenges in Germany Contract Logistics Market

Key Drivers:

- Technological Advancements: Adoption of AI, IoT, and automation for enhanced efficiency and visibility.

- E-commerce Growth: Surging online retail demands faster, more flexible delivery solutions.

- Globalization: Increasing need for complex international supply chain management.

- Focus on Core Competencies: Businesses outsourcing logistics to concentrate on their primary operations.

- Sustainability Initiatives: Growing demand for eco-friendly logistics solutions.

Barriers & Challenges:

- Labor Shortages: Difficulty in finding skilled warehouse and transport personnel, impacting operational capacity.

- Rising Operating Costs: Increased fuel prices, energy costs, and labor expenses.

- Regulatory Compliance: Navigating complex environmental, safety, and labor regulations.

- Infrastructure Congestion: Traffic bottlenecks and limited capacity at key transportation nodes.

- Cybersecurity Risks: Protecting sensitive customer data and operational systems from cyber threats.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and unforeseen global issues.

Emerging Opportunities in Germany Contract Logistics Market

Emerging opportunities within the Germany Contract Logistics Market lie in specialized niche services and advanced technological integrations. The burgeoning demand for cold chain logistics, particularly for pharmaceuticals and temperature-sensitive food products, presents a significant avenue for growth, with an estimated market expansion of XX% by 2030. The increasing adoption of electric vehicles (EVs) is creating a need for specialized logistics solutions for battery manufacturing, charging infrastructure maintenance, and the end-of-life management of EV components. Furthermore, the development of urban consolidation centers and last-mile delivery solutions powered by AI-driven route optimization and autonomous delivery technologies offers substantial potential to address urban congestion and enhance delivery speed. The circular economy is also fostering opportunities in reverse logistics, repair, and refurbishment services.

Growth Accelerators in the Germany Contract Logistics Market Industry

Long-term growth in the Germany Contract Logistics Market will be propelled by strategic technological breakthroughs and proactive market expansion strategies. The continued integration of AI and machine learning for predictive analytics, demand forecasting, and dynamic network optimization will be a critical catalyst. Strategic partnerships between logistics providers and technology companies, as well as with manufacturers and retailers, will foster collaborative innovation and create integrated supply chain ecosystems. The ongoing digitalization of trade processes and the development of digital freight platforms will streamline operations and enhance market accessibility. Furthermore, investments in sustainable logistics infrastructure, including green warehousing solutions and alternative fuel fleets, will align with evolving market demands and regulatory pressures, acting as significant growth accelerators.

Key Players Shaping the Germany Contract Logistics Market Market

- DB Schenker

- APL Logistics

- DHL

- Dachser Logistics

- Yusen Logistics

- Hellmann Worldwide Logistics

- CEVA Logistics

- BLG Logistics

- Feige

- Agility Logistics

Notable Milestones in Germany Contract Logistics Market Sector

- 2020/Q1: DHL launches a new automated parcel sorting facility in Leipzig, increasing processing capacity by XX%.

- 2021/Q2: DB Schenker invests heavily in its digital freight forwarding platform, expanding its online service offerings.

- 2022/Q4: CEVA Logistics acquires a specialized healthcare logistics provider, strengthening its cold chain capabilities.

- 2023/Q1: Dachser Logistics announces significant expansion of its intermodal transport network, focusing on sustainable solutions.

- 2023/Q3: Yusen Logistics invests in robotic automation for its warehousing operations, enhancing efficiency by XX%.

In-Depth Germany Contract Logistics Market Market Outlook

The future outlook for the Germany Contract Logistics Market is exceptionally strong, driven by a confluence of accelerating factors. The continued embrace of Industry 4.0 principles will foster an environment of hyper-connected and data-driven supply chains. Strategic alliances and consolidations are expected to streamline the market, leading to more integrated and comprehensive service offerings. The increasing global focus on supply chain resilience, amplified by recent geopolitical events, will further elevate the importance of robust and adaptable contract logistics solutions. Emerging technologies such as blockchain for enhanced transparency and autonomous vehicles for last-mile delivery will revolutionize operational capabilities. The commitment to sustainability will not only remain a key differentiator but also a significant driver for innovation and investment in green logistics. This dynamic landscape presents substantial growth potential for players who can effectively leverage technology, adapt to evolving customer needs, and navigate regulatory complexities.

Germany Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End-User

- 2.1. Automotive

- 2.2. Consumer & Retail

- 2.3. Energy

- 2.4. Healthcare

- 2.5. Industrial & Aerospace

- 2.6. Technology

- 2.7. Other End Users

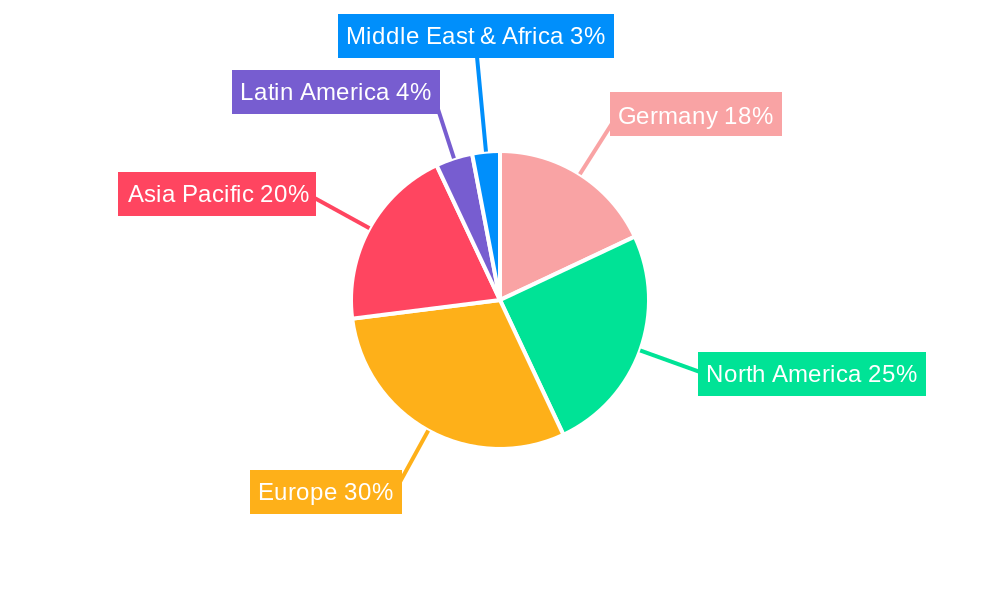

Germany Contract Logistics Market Segmentation By Geography

- 1. Germany

Germany Contract Logistics Market Regional Market Share

Geographic Coverage of Germany Contract Logistics Market

Germany Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trade Activities

- 3.3. Market Restrains

- 3.3.1. Truck Drivers Protest

- 3.4. Market Trends

- 3.4.1. Climate Protection and Green Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Consumer & Retail

- 5.2.3. Energy

- 5.2.4. Healthcare

- 5.2.5. Industrial & Aerospace

- 5.2.6. Technology

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 APL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dacsher Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yusen Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hellman Worldwide Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BLG Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Feige

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agility Logistics*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Germany Contract Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Contract Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Contract Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Germany Contract Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Germany Contract Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Contract Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Germany Contract Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Germany Contract Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Contract Logistics Market?

The projected CAGR is approximately 2.18%.

2. Which companies are prominent players in the Germany Contract Logistics Market?

Key companies in the market include DB Schenker, APL Logistics, DHL, Dacsher Logistics, Yusen Logistics, Hellman Worldwide Logistics, CEVA Logistics, BLG Logistics, Feige, Agility Logistics*List Not Exhaustive.

3. What are the main segments of the Germany Contract Logistics Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.43 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Trade Activities.

6. What are the notable trends driving market growth?

Climate Protection and Green Logistics.

7. Are there any restraints impacting market growth?

Truck Drivers Protest.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Contract Logistics Market?

To stay informed about further developments, trends, and reports in the Germany Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence