Key Insights

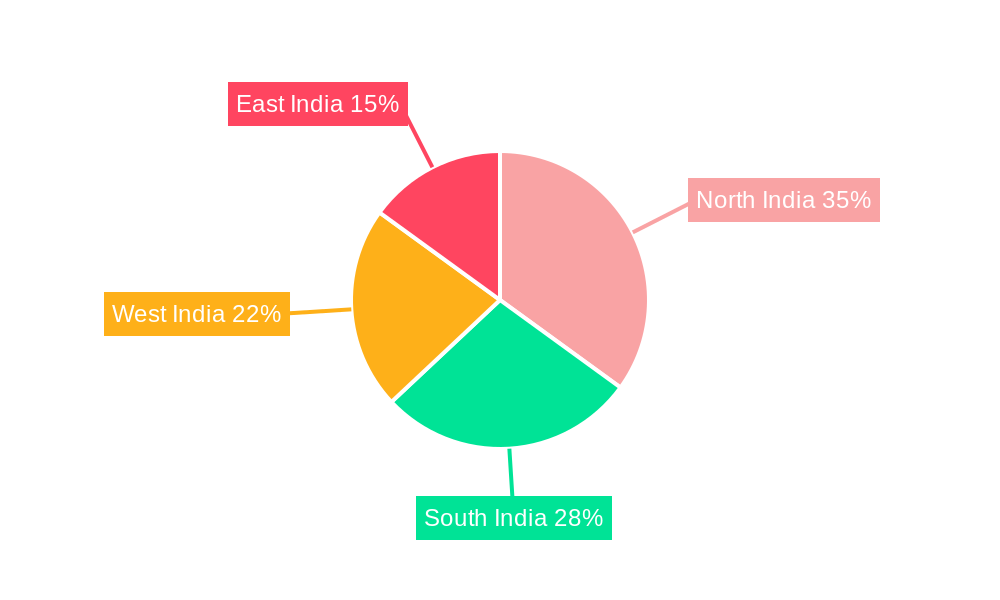

India's Direct-to-Consumer (D2C) logistics solutions market is poised for significant expansion, propelled by robust e-commerce growth and increasing consumer preference for D2C brands. The market is projected to grow at a CAGR of 25%, reaching an estimated market size of $14 billion by 2033, with a base year estimate of $14 billion for 2025. Key growth catalysts include widespread internet and smartphone adoption, a youthful and digitally adept demographic, and the expanding presence of D2C brands across diverse sectors such as fashion, electronics, beauty, and home furnishings. Geographically, the market is segmented across North, South, East, and West India, with growth varying based on infrastructure development, digital literacy, and consumer spending power. Leading logistics providers are actively investing in technology and infrastructure to address the escalating demand for efficient and dependable logistics services.

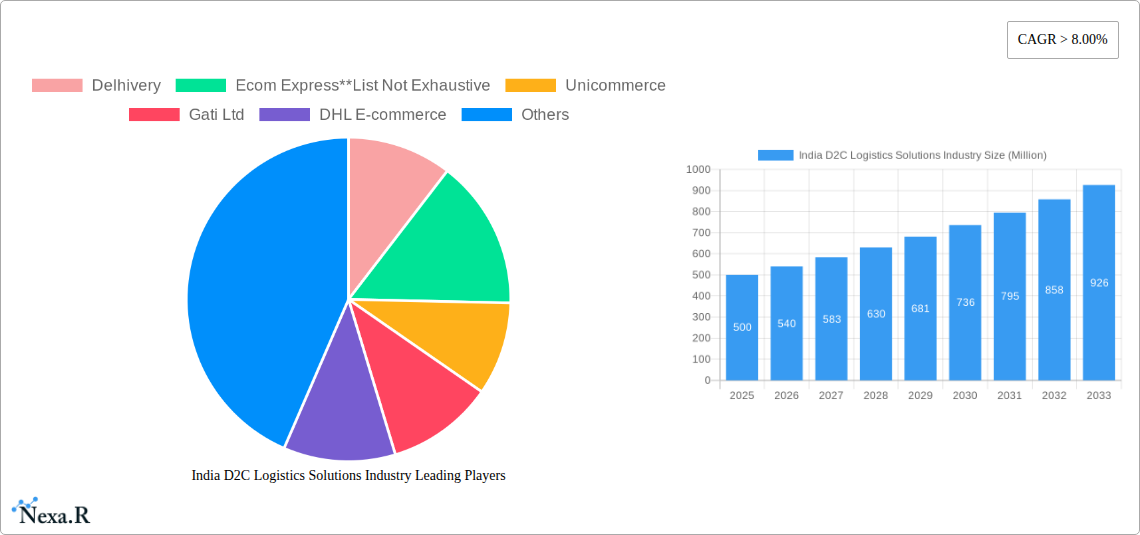

India D2C Logistics Solutions Industry Market Size (In Billion)

The sustained expansion of e-commerce, coupled with advancements in logistics technologies like automation and AI-driven route optimization, will continue to drive market growth through 2033. Evolving consumer expectations for faster and more convenient deliveries will also play a crucial role. Future market developments are expected to focus on enhanced supply chain visibility, the adoption of sustainable logistics practices, and catering to the unique needs of various D2C businesses. Companies are exploring strategies such as developing hyperlocal delivery networks and forming strategic partnerships to effectively serve India's vast and geographically diverse consumer base. The competitive environment remains dynamic, demanding continuous innovation and adaptation from both established players and emerging startups.

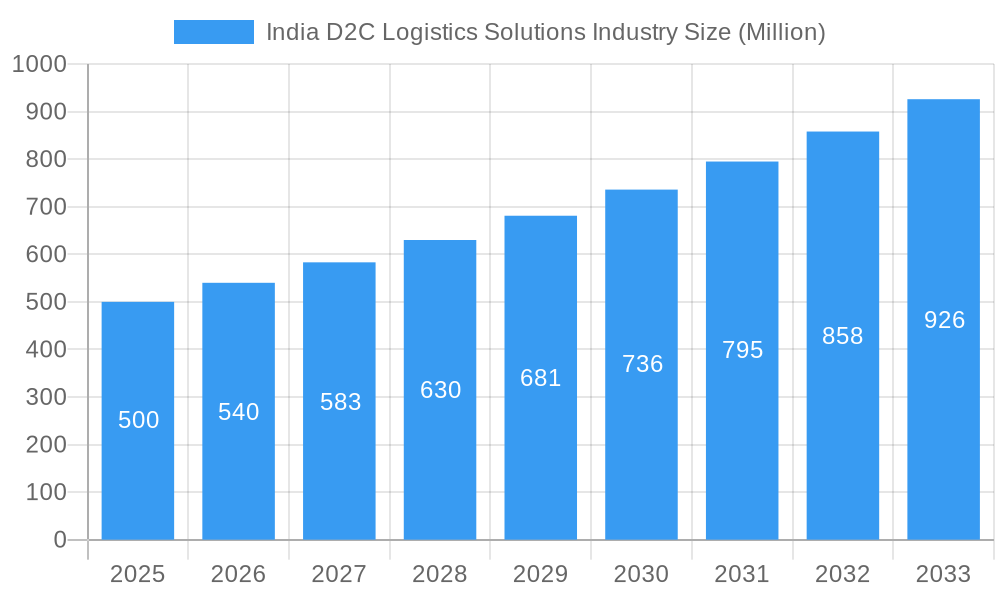

India D2C Logistics Solutions Industry Company Market Share

India D2C Logistics Solutions Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India D2C Logistics Solutions Industry, offering invaluable insights for industry professionals, investors, and strategists. We delve into market dynamics, growth trends, key players, and future opportunities, covering the period from 2019 to 2033, with a focus on 2025. The report utilizes robust data analysis and expert insights to provide a clear, actionable understanding of this rapidly evolving sector. Parent markets include the broader Indian e-commerce and logistics industries, while child markets focus specifically on D2C fulfillment and delivery solutions.

India D2C Logistics Solutions Industry Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, and regulatory influences shaping the India D2C logistics solutions industry. We explore market concentration, highlighting the market share held by key players like Delhivery (xx%), Ecom Express (xx%), and others. The analysis also covers technological innovations, such as AI-powered route optimization and automated warehousing, and their impact on efficiency and cost reduction. Furthermore, we examine the regulatory framework impacting the industry, including government policies related to e-commerce and logistics. The impact of competitive substitutes, such as in-house logistics solutions, is also assessed. Finally, we analyze merger and acquisition (M&A) activity, providing insights into deal volumes (xx deals in 2024) and their implications for market consolidation.

- Market Concentration: Highly fragmented, with top players holding xx% of the market.

- Technological Innovation: Focus on AI, automation, and data analytics for enhanced efficiency.

- Regulatory Framework: Government policies on e-commerce and infrastructure development.

- Competitive Substitutes: Growing adoption of in-house logistics solutions poses a challenge.

- M&A Trends: Consolidation through acquisitions, reflecting industry maturity.

India D2C Logistics Solutions Industry Growth Trends & Insights

The Indian D2C logistics solutions market is experiencing robust growth, driven by the expansion of the e-commerce sector and increasing consumer demand for faster and more reliable delivery services. The market size has grown from xx million in 2019 to xx million in 2024, exhibiting a CAGR of xx%. This growth is further fueled by the rising adoption of technology and changing consumer behavior, with a preference for convenient and personalized delivery options. We project continued market expansion, reaching xx million by 2025 and xx million by 2033, driven by technological advancements and increasing D2C penetration. Market penetration in 2025 is estimated at xx%. The report analyzes these trends in detail, providing granular insights into regional variations and segment-specific growth patterns.

Dominant Regions, Countries, or Segments in India D2C Logistics Solutions Industry

The fashion segment is the leading end-user segment in the Indian D2C logistics solutions market, accounting for xx% of the total market share in 2024. This dominance is driven by the rapidly growing online fashion industry and the increasing preference for online shopping among Indian consumers. Other significant segments include consumer electronics (xx%), beauty and personal care (xx%), and home decor (xx%). The growth of these segments is fueled by factors such as rising disposable incomes, improving internet penetration, and the proliferation of e-commerce platforms. Certain regions, particularly metropolitan areas and densely populated states, exhibit faster growth due to higher internet penetration, advanced infrastructure, and a larger consumer base.

- Key Drivers for Fashion Segment Dominance: High online penetration, diverse fashion offerings, and favorable consumer preferences.

- Growth Potential in Other Segments: Consumer electronics and beauty & personal care are poised for significant growth.

- Regional Variations: Metropolitan areas and major cities exhibit higher growth due to better infrastructure and higher demand.

India D2C Logistics Solutions Industry Product Landscape

The product landscape is characterized by a wide range of services, including last-mile delivery, warehousing, reverse logistics, and value-added services like packaging and returns management. Innovations focus on technology integration – such as real-time tracking, predictive analytics, and AI-powered route optimization – to enhance efficiency and customer experience. These solutions offer unique selling propositions like faster delivery times, reduced costs, and improved visibility across the supply chain. Performance metrics are increasingly focused on delivery speed, cost-effectiveness, and customer satisfaction.

Key Drivers, Barriers & Challenges in India D2C Logistics Solutions Industry

Key Drivers: The explosive growth of e-commerce, increasing smartphone penetration, government initiatives promoting digitalization, and the rise of D2C brands are key drivers. Technological advancements such as AI-powered route optimization and drone delivery also contribute significantly.

Key Challenges: Infrastructure limitations in certain regions, high fuel costs, stringent regulatory requirements, and intense competition pose major challenges. These factors can lead to increased operational costs and potentially impact delivery timelines and customer satisfaction. For example, inadequate warehousing capacity in certain areas restricts efficient storage and distribution, impacting overall market efficiency and potentially increasing costs by xx%.

Emerging Opportunities in India D2C Logistics Solutions Industry

Emerging opportunities lie in leveraging technology to enhance delivery efficiency, expanding into underserved markets, and catering to niche customer segments. The adoption of sustainable logistics practices, such as electric vehicles and eco-friendly packaging, presents a significant opportunity. Furthermore, integrating advanced technologies like AI and blockchain can offer enhanced transparency, traceability, and security. Finally, providing value-added services such as personalized delivery options and enhanced customer support can help companies differentiate themselves and attract more customers.

Growth Accelerators in the India D2C Logistics Solutions Industry

Long-term growth will be propelled by technological advancements, strategic partnerships between logistics providers and e-commerce platforms, and government policies supporting infrastructure development and digitalization. Expansion into rural markets, where online shopping is rapidly gaining traction, will unlock substantial growth potential. Focusing on improving the overall customer experience through faster and more reliable deliveries will be critical.

Key Players Shaping the India D2C Logistics Solutions Industry Market

- Delhivery

- Ecom Express

- Unicommerce

- Gati Ltd

- DHL E-commerce

- Shipyaari

- Shiprocket

- Shipway

- Shadowfax

- Pickrr

Notable Milestones in India D2C Logistics Solutions Industry Sector

- May 2023: Delhivery invests Rs 25 crore in Vinculum to strengthen D2C offerings. This strategic investment signifies a commitment to enhancing technology and software capabilities within the D2C logistics space.

- July 2023: Myntra's D2C program accelerates growth for 200 Indian fashion and lifestyle brands. This initiative boosts the D2C ecosystem significantly by providing support and resources for a large number of emerging brands.

- August 2023: CEVA Logistics acquires a 96% stake in Stellar Value Chain Solutions. This acquisition expands CEVA's footprint in the Indian market and strengthens its position in the D2C logistics sector.

In-Depth India D2C Logistics Solutions Industry Market Outlook

The Indian D2C logistics solutions market is poised for sustained growth over the forecast period, driven by the increasing adoption of e-commerce, technological advancements, and favorable government policies. Strategic partnerships and investments in technology will be crucial for companies to maintain a competitive edge. The focus on customer experience, sustainable practices, and expansion into underserved markets will further shape the industry's future landscape. Opportunities abound for companies that can effectively adapt to the evolving needs of D2C brands and consumers.

India D2C Logistics Solutions Industry Segmentation

-

1. End user

- 1.1. Fashion

- 1.2. Consumer electronic

- 1.3. Beauty and Personal Care

- 1.4. Home decor

- 1.5. Other end users

India D2C Logistics Solutions Industry Segmentation By Geography

- 1. India

India D2C Logistics Solutions Industry Regional Market Share

Geographic Coverage of India D2C Logistics Solutions Industry

India D2C Logistics Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of digital infrastructure and rise in the number of millennials; Higher internet penetration

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Competition from established brands

- 3.4. Market Trends

- 3.4.1. Festive Season and Mega Sales Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India D2C Logistics Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End user

- 5.1.1. Fashion

- 5.1.2. Consumer electronic

- 5.1.3. Beauty and Personal Care

- 5.1.4. Home decor

- 5.1.5. Other end users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by End user

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delhivery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ecom Express**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unicommerce

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gati Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL E-commerce

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shipyaari

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shiprocket

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shipway

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shadowfax

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pickrr

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Delhivery

List of Figures

- Figure 1: India D2C Logistics Solutions Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India D2C Logistics Solutions Industry Share (%) by Company 2025

List of Tables

- Table 1: India D2C Logistics Solutions Industry Revenue billion Forecast, by End user 2020 & 2033

- Table 2: India D2C Logistics Solutions Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India D2C Logistics Solutions Industry Revenue billion Forecast, by End user 2020 & 2033

- Table 4: India D2C Logistics Solutions Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India D2C Logistics Solutions Industry?

The projected CAGR is approximately 25%.

2. Which companies are prominent players in the India D2C Logistics Solutions Industry?

Key companies in the market include Delhivery, Ecom Express**List Not Exhaustive, Unicommerce, Gati Ltd, DHL E-commerce, Shipyaari, Shiprocket, Shipway, Shadowfax, Pickrr.

3. What are the main segments of the India D2C Logistics Solutions Industry?

The market segments include End user.

4. Can you provide details about the market size?

The market size is estimated to be USD 14 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of digital infrastructure and rise in the number of millennials; Higher internet penetration.

6. What are the notable trends driving market growth?

Festive Season and Mega Sales Driving the Market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Competition from established brands.

8. Can you provide examples of recent developments in the market?

May 2023: Delhivery India's largest fully integrated logistics services provider, will invest around Rs 25 crore in Vinculum, a global software leader enabling omnichannel retailing for D2C enterprises, brands, brand distributors, and quick commerce companies, to strengthen its D2C offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India D2C Logistics Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India D2C Logistics Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India D2C Logistics Solutions Industry?

To stay informed about further developments, trends, and reports in the India D2C Logistics Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence