Key Insights

The Asia-Pacific postal services market is projected for substantial expansion, with an estimated market size of $172.37 billion in the base year 2025. The market is expected to grow at a compelling CAGR of 7.7%, driven by dynamic regional economic trends and evolving consumer behavior. Key growth catalysts include the exponential rise of e-commerce, necessitating increased demand for express and parcel delivery services. Growing urbanization and rising disposable incomes across the region are further contributing to higher shipment volumes. Technological innovations, such as advanced sorting systems and real-time tracking, are enhancing operational efficiency and customer experience. Additionally, government-led infrastructure development initiatives in key markets are fostering a supportive environment for postal service providers. However, the market navigates challenges such as intense competition from private couriers, volatile fuel costs affecting operational expenses, and the need for harmonized regulatory frameworks across diverse national postal systems. The market is segmented by service type (express, standard), item type (letters, parcels), destination (domestic, international), and key geographies including India, China, Japan, Singapore, South Korea, Australia, and New Zealand.

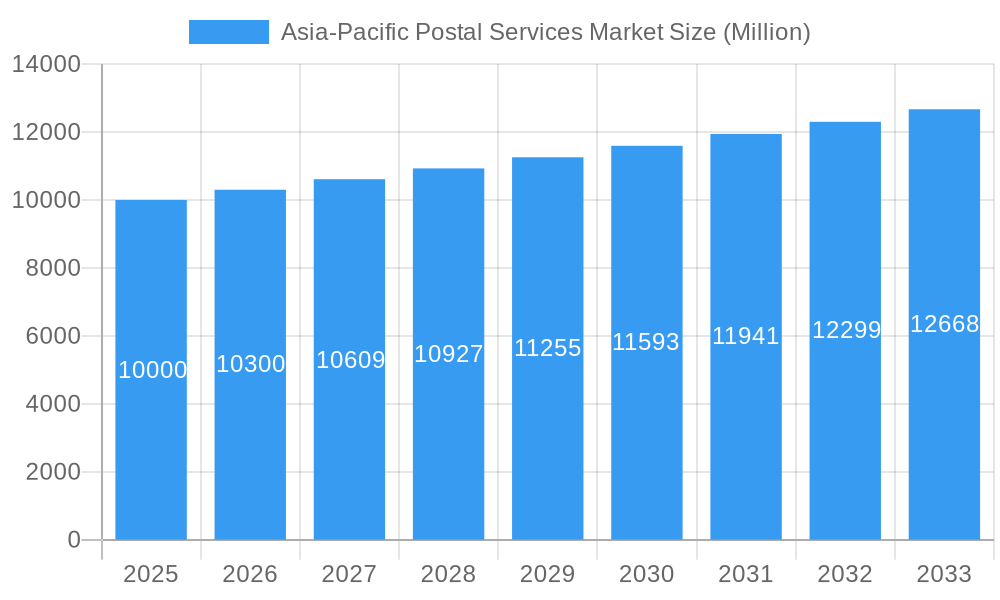

Asia-Pacific Postal Services Market Market Size (In Billion)

The forecast period, 2025-2033, indicates sustained market growth, driven primarily by the persistent influence of e-commerce on delivery demand. Efficient and reliable last-mile delivery will remain critical for success. Government policies supporting digital trade, investments in logistics technology, and the adaptation to consumer demands for faster delivery options will shape future expansion. Market participants must address cost management and competitive pressures through strategic innovation and operational agility. Growth trajectories within sub-segments will be influenced by country-specific economic conditions and regulatory environments.

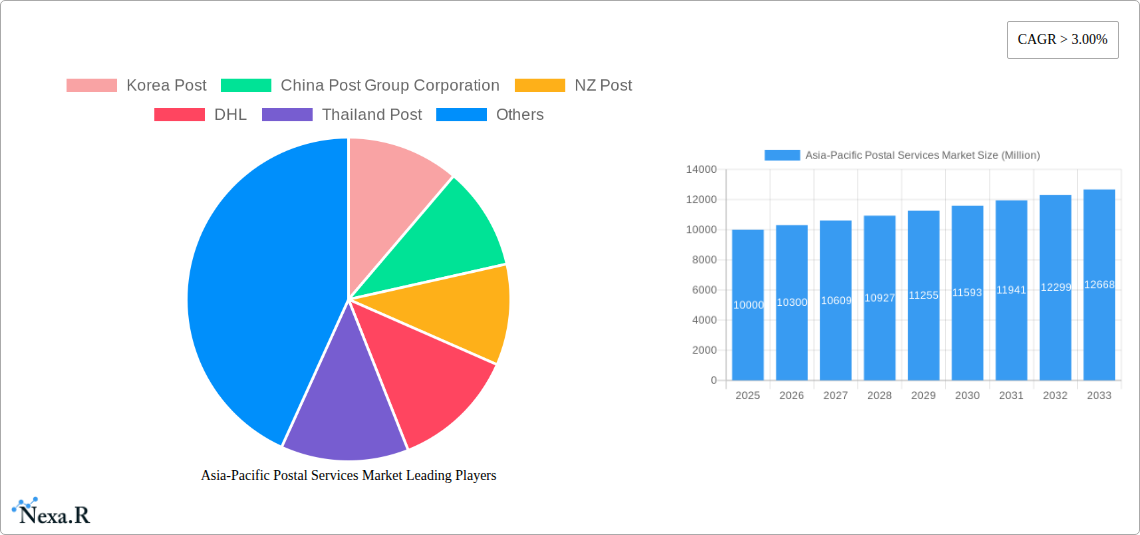

Asia-Pacific Postal Services Market Company Market Share

Asia-Pacific Postal Services Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Postal Services Market, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report utilizes data from 2019-2024 (Historical Period), with the base year set at 2025 (Estimated Year) and forecasts extending to 2033 (Forecast Period). The market is segmented by Type (Express Postal Services, Standard Postal Services), Item (Letter, Parcel), Destination (Domestic, International), and Country (India, China, Japan, Singapore, South Korea, Australia, New Zealand, Rest of Asia-Pacific). Key players analyzed include Korea Post, China Post Group Corporation, NZ Post, DHL, Thailand Post, Australian Postal Corporation, Hongkong Post, FedEx, India Post, Singapore Post Limited, Japan Post Co Ltd, DTDC EXPRESS LTD, Pos Malaysia Berhad, and Pos Indonesia.

Asia-Pacific Postal Services Market Dynamics & Structure

The Asia-Pacific postal services market exhibits a complex interplay of factors shaping its structure and growth trajectory. Market concentration varies significantly across countries, with dominant state-owned enterprises in some nations and a more fragmented landscape in others. Technological innovation, primarily driven by e-commerce growth and the increasing demand for faster, more reliable delivery, is a key driver. Regulatory frameworks, differing across nations, significantly influence market access and operational efficiency. Competitive pressures from private express couriers like FedEx and DHL are substantial, particularly in the express postal services segment. The end-user demographic is broad, encompassing individuals, businesses (SMEs and large enterprises), and government agencies, each with varying needs and service preferences. M&A activity has been relatively limited in recent years (xx deals in the past 5 years, representing a xx% market share shift), though strategic partnerships and collaborations are becoming increasingly common, particularly in cross-border delivery solutions.

- High Market Concentration: Dominance of state-owned enterprises in several countries.

- Technological Disruption: Automation, AI, and digitalization are transforming postal operations.

- Evolving Regulatory Landscape: Differing regulations across countries impact market entry and competition.

- Intense Competition: Private couriers exert pressure on market share.

- Diverse End-User Base: Individual consumers, businesses, and government entities create varied demand.

- Limited M&A Activity: Strategic alliances are emerging as a key growth strategy.

Asia-Pacific Postal Services Market Growth Trends & Insights

The Asia-Pacific postal services market is experiencing robust growth, driven by the booming e-commerce sector and the increasing reliance on online shopping across the region. Market size expanded from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. This growth is projected to continue, with an anticipated CAGR of xx% between 2025 and 2033, reaching xx million units by 2033. Adoption rates for express postal services are particularly high in urban areas and among younger demographics, reflecting a preference for faster and more convenient delivery options. Technological disruptions, including the widespread adoption of automated sorting systems and digital tracking technologies, are enhancing efficiency and improving customer satisfaction. Consumer behavior shifts towards online transactions and heightened expectations for delivery speed are further accelerating market growth. The rise of cross-border e-commerce presents a significant opportunity, pushing for greater innovation in international postal services. However, challenges remain regarding last-mile delivery in remote areas and maintaining competitive pricing in the face of intensified competition.

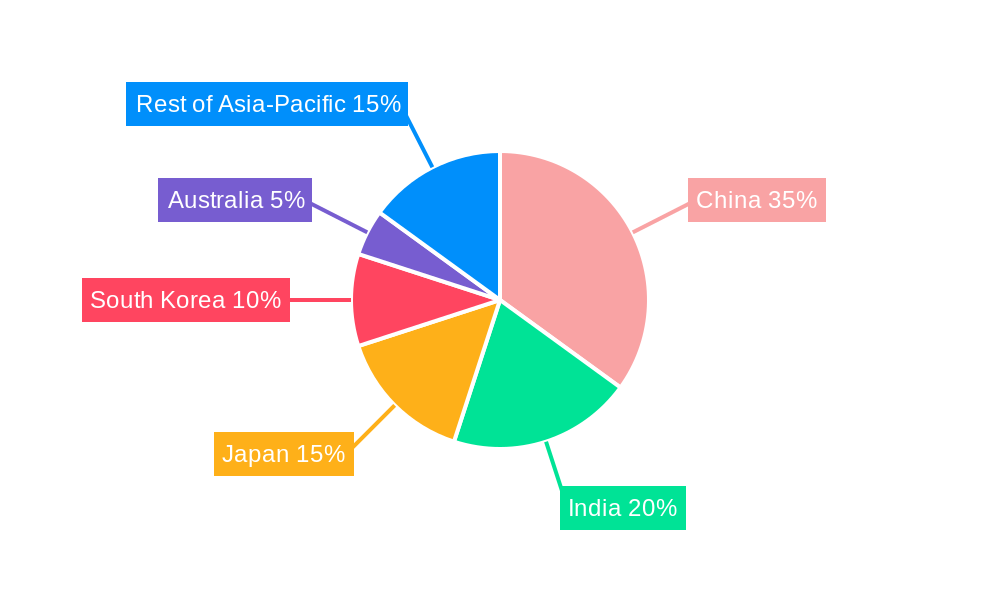

Dominant Regions, Countries, or Segments in Asia-Pacific Postal Services Market

China and India stand as the dominant markets in the Asia-Pacific region, driven by their massive populations and rapid economic growth. These countries exhibit high volumes in both domestic and international mail segments, particularly parcels, fueled by booming e-commerce activities. The express postal services segment is experiencing accelerated growth across the region, with a significant increase in demand for faster delivery times. Japan and South Korea, while smaller in terms of overall volume, display high per capita usage and advanced postal infrastructure, driving efficient and technologically advanced services. Australia and New Zealand, although geographically isolated, benefit from robust domestic markets and serve as crucial hubs for international mail flow within the Pacific region.

- China & India: Largest markets driven by population size and e-commerce boom.

- Japan & South Korea: High per capita usage & advanced postal infrastructure.

- Australia & New Zealand: Strong domestic markets and key international transit points.

- Express Postal Services: Fastest-growing segment, reflecting demand for speed and convenience.

- Parcel Delivery: Dominant item category due to e-commerce growth.

Asia-Pacific Postal Services Market Product Landscape

The Asia-Pacific postal services market offers a diverse range of products and services, catering to varied customer needs. These range from traditional letter mail and standard parcel delivery to specialized express services, offering enhanced speed and tracking capabilities. Product innovations are focused on improving delivery speed, enhancing tracking accuracy, and providing greater security and reliability. Technological advancements, such as the use of drones and autonomous vehicles for last-mile delivery, are expected to further transform the product landscape in the coming years. Unique selling propositions increasingly revolve around enhanced customer experience, including real-time tracking, flexible delivery options, and integrated e-commerce solutions.

Key Drivers, Barriers & Challenges in Asia-Pacific Postal Services Market

Key Drivers: The rapid expansion of e-commerce is a primary driver, increasing demand for efficient and reliable postal services. Government initiatives to improve infrastructure and streamline logistics also play a critical role. Technological advancements, particularly in automation and tracking systems, enhance efficiency and customer experience.

Key Challenges: Competition from private couriers, particularly in the express segment, poses a significant challenge. Supply chain disruptions and infrastructure limitations in remote areas can hinder efficient delivery. Varying regulatory landscapes across countries can create operational complexities.

Emerging Opportunities in Asia-Pacific Postal Services Market

Emerging opportunities lie in the expansion of cross-border e-commerce, requiring innovative solutions for international shipping and customs clearance. The development of specialized services catering to niche markets, such as temperature-sensitive goods or high-value items, presents further opportunities. Leveraging technological advancements, such as drone delivery in remote areas or AI-powered sorting systems, can enhance efficiency and reduce operational costs.

Growth Accelerators in the Asia-Pacific Postal Services Market Industry

Technological breakthroughs in logistics and automation are key growth accelerators. Strategic partnerships between postal services and e-commerce platforms enhance delivery efficiency and customer experience. Expansion into untapped markets and the development of innovative delivery solutions, such as micro-fulfillment centers, will drive future growth.

Key Players Shaping the Asia-Pacific Postal Services Market Market

- Korea Post

- China Post Group Corporation

- NZ Post

- DHL

- Thailand Post

- Australian Postal Corporation

- Hongkong Post

- FedEx

- India Post

- Singapore Post Limited

- Japan Post Co Ltd

- DTDC EXPRESS LTD

- Pos Malaysia Berhad

- Pos Indonesia

Notable Milestones in Asia-Pacific Postal Services Market Sector

- Sept 2022: The Australian Government and Australia Post launched a Pacific Postal Development Partnership, securing a USD 450,000 contribution to upgrade postal systems in the Pacific region. This signifies a commitment to improving regional connectivity and efficiency.

- Jul 2022: China's postal sector announced a significant green transformation initiative, aiming to recycle 700 million corrugated boxes and utilize 10 million recyclable packaging boxes annually. This highlights a growing focus on sustainability within the industry.

In-Depth Asia-Pacific Postal Services Market Market Outlook

The Asia-Pacific postal services market is poised for continued robust growth, driven by sustained e-commerce expansion and technological advancements. Opportunities exist in expanding last-mile delivery solutions, particularly in rural and remote areas. Strategic partnerships and investments in automation and digitalization will be crucial for maintaining competitiveness and improving service efficiency. The focus on sustainability and the adoption of eco-friendly practices will also shape the future of the industry.

Asia-Pacific Postal Services Market Segmentation

-

1. Type

- 1.1. Express Postal Services

- 1.2. Standard Postal Services

-

2. Item

- 2.1. Letter

- 2.2. Parcel

-

3. Destination

- 3.1. Domestic

- 3.2. International

Asia-Pacific Postal Services Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Postal Services Market Regional Market Share

Geographic Coverage of Asia-Pacific Postal Services Market

Asia-Pacific Postal Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In eCommerce; Rise In Urbanization

- 3.3. Market Restrains

- 3.3.1. The Risk of Package Theft or Damage; Cost Efficiency

- 3.4. Market Trends

- 3.4.1. Liberalization Affecting the Market Share of Designated Operators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Express Postal Services

- 5.1.2. Standard Postal Services

- 5.2. Market Analysis, Insights and Forecast - by Item

- 5.2.1. Letter

- 5.2.2. Parcel

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Korea Post

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Post Group Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NZ Post

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thailand Post

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Australian Postal Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hongkong Post**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 India Post

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Singapore Post Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Japan Post Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DTDC EXPRESS LTD

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Pos Malaysia Berhad

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Pos Indonesia

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Korea Post

List of Figures

- Figure 1: Asia-Pacific Postal Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Postal Services Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 3: Asia-Pacific Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Asia-Pacific Postal Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 7: Asia-Pacific Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 8: Asia-Pacific Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Postal Services Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Asia-Pacific Postal Services Market?

Key companies in the market include Korea Post, China Post Group Corporation, NZ Post, DHL, Thailand Post, Australian Postal Corporation, Hongkong Post**List Not Exhaustive, FedEx, India Post, Singapore Post Limited, Japan Post Co Ltd, DTDC EXPRESS LTD, Pos Malaysia Berhad, Pos Indonesia.

3. What are the main segments of the Asia-Pacific Postal Services Market?

The market segments include Type, Item, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise In eCommerce; Rise In Urbanization.

6. What are the notable trends driving market growth?

Liberalization Affecting the Market Share of Designated Operators.

7. Are there any restraints impacting market growth?

The Risk of Package Theft or Damage; Cost Efficiency.

8. Can you provide examples of recent developments in the market?

Sept 2022: The Australian Government and Australia Post announced a new Pacific Postal Development Partnership to strengthen postal services in the Pacific by signing a joint declaration with the Universal Postal Union (UPU) and Asian-Pacific Postal Union (APPU) to improve the efficiency and security of postal services between Australia and Pacific island countries, benefiting consumers and businesses. To support the three-year partnership, the government has provided Australia Post with a USD 450,000 contribution to target improvements to postal systems, processes, technology, and training in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Postal Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Postal Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Postal Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Postal Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence