Key Insights

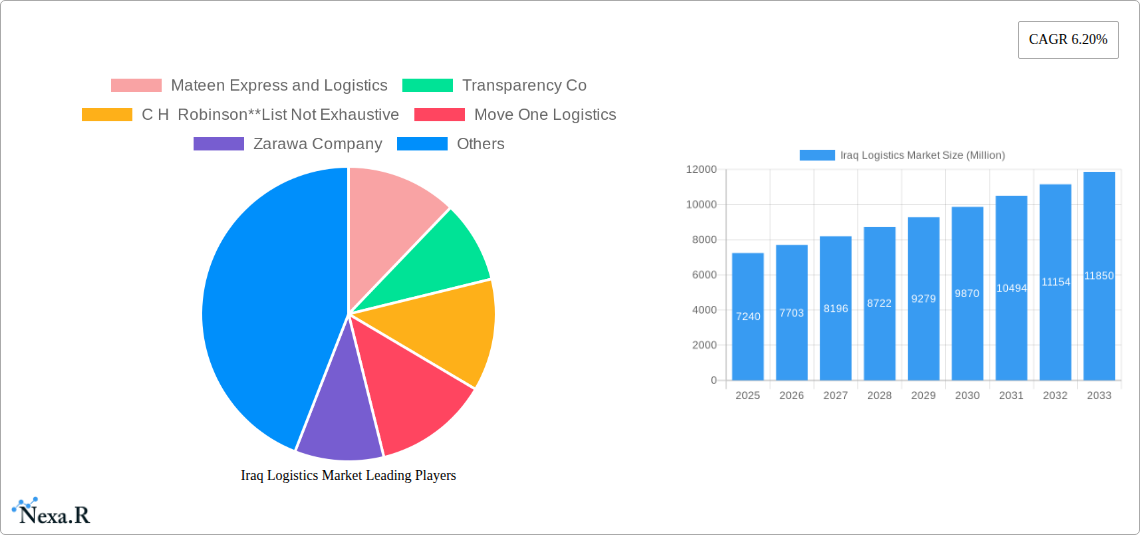

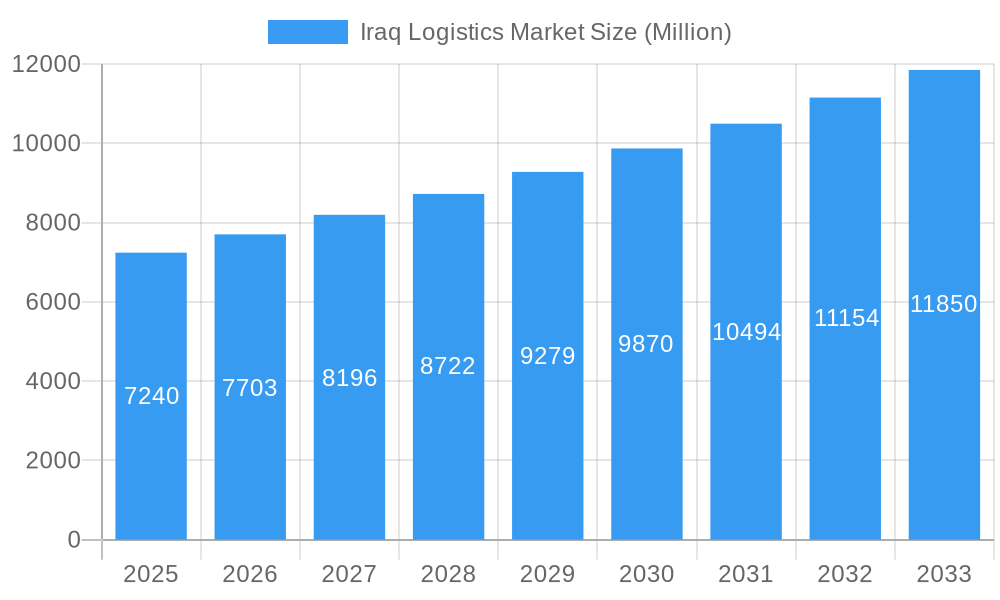

The Iraqi logistics market, valued at $7.24 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.20% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Iraq's reconstruction efforts following years of conflict are stimulating significant infrastructure development, particularly in transportation networks, leading to increased efficiency in goods movement. Secondly, the burgeoning oil and gas sector, a cornerstone of the Iraqi economy, necessitates robust logistics solutions for the transportation of raw materials and finished products. The growing manufacturing and automotive sectors also contribute significantly to market demand. Furthermore, the expansion of e-commerce and a rising consumer class are increasing the need for efficient last-mile delivery services. Key players like DHL, Maersk, and numerous local logistics providers are capitalizing on these opportunities, while others are entering to meet growing demand. Segmentation by function reveals strong growth in freight forwarding, warehousing, and value-added services, reflecting the increasing complexity of supply chains. The end-user segment dominated by manufacturing, automotive, and oil & gas further underpins this growth, though the distributive trade (FMCG included), agriculture, and construction sectors also play significant roles.

Iraq Logistics Market Market Size (In Billion)

However, the market faces certain challenges. Political instability and security concerns remain key restraints, impacting infrastructure investment and operational efficiency. Bureaucratic hurdles and regulatory complexities can also hinder market development. Furthermore, the scarcity of skilled labor and a lack of advanced technological adoption present limitations for some logistics operators. Despite these challenges, the long-term outlook for the Iraqi logistics market remains positive, driven by sustained economic growth and increasing investment in infrastructure modernization. The market's growth trajectory is poised to attract further investment and competition, leading to enhanced service offerings and greater efficiency in the years to come.

Iraq Logistics Market Company Market Share

This in-depth report provides a comprehensive analysis of the Iraq logistics market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by function (Freight Transport, Rail Freight Forwarding, Warehousing, Value-added Services, and Others) and end-user (Manufacturing & Automotive, Oil & Gas, Mining & Quarrying, Agriculture, Fishing & Forestry, Construction, Distributive Trade, and Other End Users). Market size is presented in Million units.

Iraq Logistics Market Market Dynamics & Structure

This section analyzes the Iraqi logistics market's competitive landscape, driven by technological advancements, regulatory changes, and evolving end-user demands. The market concentration is moderately high, with a few large players and numerous smaller, regional operators competing. Technological innovation, while present, faces barriers such as infrastructure limitations and security concerns. The regulatory framework is constantly evolving, impacting operational costs and efficiency. The report analyzes M&A activities, estimating xx deals in the historical period (2019-2024) and predicting xx deals for the forecast period (2025-2033).

- Market Concentration: Moderately high, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Driven by increasing demand for efficiency and tracking capabilities, but hampered by infrastructure limitations and security risks.

- Regulatory Framework: Undergoing continuous evolution, influencing operational costs and compliance.

- Competitive Product Substitutes: Limited, with the main competition stemming from varying service levels and pricing strategies among logistics providers.

- End-User Demographics: Shifting towards increased demand from the manufacturing and distributive trade sectors.

- M&A Trends: Consolidation expected to continue, driven by economies of scale and expansion into new markets.

Iraq Logistics Market Growth Trends & Insights

The Iraqi logistics market is experiencing significant growth, driven by post-conflict reconstruction, economic diversification efforts, and increasing trade activity. The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period. Technological disruptions, such as the adoption of advanced tracking systems and automated warehousing solutions, are accelerating efficiency gains. Consumer behavior shifts reflect a preference for reliable and secure logistics services.

- Market Size Evolution: Steady growth fueled by economic recovery and infrastructure development.

- Adoption Rates: Increasing adoption of technological solutions for enhanced efficiency and transparency.

- Technological Disruptions: Implementation of advanced tracking, fleet management, and warehouse automation solutions.

- Consumer Behavior Shifts: Demand for reliable, secure, and transparent logistics services is rising.

Dominant Regions, Countries, or Segments in Iraq Logistics Market

The Baghdad region dominates the Iraqi logistics market, owing to its concentration of industrial activity, population, and transportation infrastructure. The Manufacturing and Automotive and Oil & Gas sectors are the leading end-users, accounting for approximately xx% and xx% of market share respectively in 2025. Freight Transport remains the largest segment by function, with xx million units in 2025. Growth is fueled by increasing domestic and international trade, along with government investments in infrastructure development.

- Key Drivers: Government investments in infrastructure, rising manufacturing and oil & gas production, and increasing international trade.

- Baghdad Region Dominance: Central location, population density, and infrastructure concentration.

- Manufacturing & Automotive Sector Leadership: Significant contribution to GDP and reliance on logistics for supply chain management.

- Oil & Gas Sector Importance: High volume and specialized requirements drive market growth.

- Freight Transport Market Share: Largest functional segment due to high goods movement volume.

Iraq Logistics Market Product Landscape

The Iraqi logistics market is characterized by a diverse range of services, including freight transport, warehousing, and value-added services. Recent product innovations include the implementation of GPS tracking systems, sophisticated warehouse management systems (WMS), and advanced supply chain management platforms. These innovations aim to improve efficiency, enhance visibility, and strengthen security across logistics operations. Companies are increasingly focusing on providing customized solutions and value-added services to meet the specific needs of their clients.

Key Drivers, Barriers & Challenges in Iraq Logistics Market

Key Drivers:

- Increasing government investment in infrastructure development.

- Growth in the manufacturing, oil & gas, and construction sectors.

- Rising e-commerce adoption driving demand for last-mile delivery solutions.

Key Barriers & Challenges:

- Security concerns and political instability impacting operational efficiency.

- Limited infrastructure in certain regions hindering logistics operations.

- Regulatory hurdles and bureaucratic processes increasing operational costs.

Emerging Opportunities in Iraq Logistics Market

- Expansion of e-commerce creating new opportunities in last-mile delivery.

- Development of specialized logistics solutions for the oil & gas sector.

- Growth in cold chain logistics driven by increasing demand for temperature-sensitive goods.

Growth Accelerators in the Iraq Logistics Market Industry

Technological advancements, such as AI and IoT-based solutions, are poised to revolutionize logistics operations in Iraq. Strategic partnerships between local and international logistics providers are creating synergy and expanding market access. Government initiatives focused on infrastructure improvements and regulatory reforms are creating a more favorable environment for industry growth.

Key Players Shaping the Iraq Logistics Market Market

- Mateen Express and Logistics

- Transparency Co

- C H Robinson

- Move One Logistics

- Zarawa Company

- Sheraz Co

- Arch Star Logistics

- Nippon Express Co Ltd

- DHL Global Forwarding

- The Maersk Group

- Al-Rashed United Shipping Services

- DSV Global Transport and Logistics

- Guangzhou International

- Crown Logistics LTD

Notable Milestones in Iraq Logistics Market Sector

- 2020: Introduction of new warehousing facilities in Baghdad.

- 2022: Implementation of advanced tracking systems by major logistics providers.

- 2023: Government initiatives to improve border crossing procedures.

In-Depth Iraq Logistics Market Market Outlook

The Iraqi logistics market is expected to experience sustained growth over the forecast period, driven by factors such as infrastructure improvements, economic diversification, and increasing trade activity. Strategic opportunities exist in developing specialized logistics solutions, leveraging technology for efficiency gains, and expanding into underserved regions. The market's future success hinges on addressing security concerns, improving infrastructure, and fostering a more favorable regulatory environment.

Iraq Logistics Market Segmentation

- 1. Market Overview

-

2. Market Dynamics

- 2.1. Drivers

- 2.2. Restraints

- 2.3. Opportunities

- 3. Value Chain/Supply Chain Analysis

-

4. Porter's Five Force Analysis

- 4.1. Threat of New Entrants

- 4.2. Bargaining Power of Consumers

- 4.3. Bargaining Power of Suppliers

- 4.4. Threat of Substitute Products

- 4.5. Intensity of Competitive Rivalry

- 5. Technological Advancements in Freight Forwarding

- 6. Overview of Global Freight Forwarding Market

- 7. Market segmentation of Freight Forwarding

- 8. Digitalisation of Freight Forwarding Market

- 9. Pricing

- 10. Assessment of the Impact of COVID-19 on the Market

-

11. Function

-

11.1. Freight Transport

- 11.1.1. Road

- 11.1.2. Shipping

- 11.1.3. Air

- 11.1.4. Rail

- 11.2. Freight Forwarding

- 11.3. Warehousing

- 11.4. Value-added Services and Others

-

11.1. Freight Transport

-

12. End User

- 12.1. Manufacturing and Automotive

- 12.2. Oil and Gas, Mining, and Quarrying

- 12.3. Agriculture, Fishing, and Forestry

- 12.4. Construction

- 12.5. Distribu

- 12.6. Other En

Iraq Logistics Market Segmentation By Geography

- 1. Iraq

Iraq Logistics Market Regional Market Share

Geographic Coverage of Iraq Logistics Market

Iraq Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. UAE'S strategic location serving has an advantage for the market'; Morder infrastructure boosting the market

- 3.3. Market Restrains

- 3.3.1. Regulations and customs affecting the market; Lack of skilled workforce affecting the market

- 3.4. Market Trends

- 3.4.1. Expanding e-commerce industry drives logistics market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iraq Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Market Overview

- 5.2. Market Analysis, Insights and Forecast - by Market Dynamics

- 5.2.1. Drivers

- 5.2.2. Restraints

- 5.2.3. Opportunities

- 5.3. Market Analysis, Insights and Forecast - by Value Chain/Supply Chain Analysis

- 5.4. Market Analysis, Insights and Forecast - by Porter's Five Force Analysis

- 5.4.1. Threat of New Entrants

- 5.4.2. Bargaining Power of Consumers

- 5.4.3. Bargaining Power of Suppliers

- 5.4.4. Threat of Substitute Products

- 5.4.5. Intensity of Competitive Rivalry

- 5.5. Market Analysis, Insights and Forecast - by Technological Advancements in Freight Forwarding

- 5.6. Market Analysis, Insights and Forecast - by Overview of Global Freight Forwarding Market

- 5.7. Market Analysis, Insights and Forecast - by Market segmentation of Freight Forwarding

- 5.8. Market Analysis, Insights and Forecast - by Digitalisation of Freight Forwarding Market

- 5.9. Market Analysis, Insights and Forecast - by Pricing

- 5.10. Market Analysis, Insights and Forecast - by Assessment of the Impact of COVID-19 on the Market

- 5.11. Market Analysis, Insights and Forecast - by Function

- 5.11.1. Freight Transport

- 5.11.1.1. Road

- 5.11.1.2. Shipping

- 5.11.1.3. Air

- 5.11.1.4. Rail

- 5.11.2. Freight Forwarding

- 5.11.3. Warehousing

- 5.11.4. Value-added Services and Others

- 5.11.1. Freight Transport

- 5.12. Market Analysis, Insights and Forecast - by End User

- 5.12.1. Manufacturing and Automotive

- 5.12.2. Oil and Gas, Mining, and Quarrying

- 5.12.3. Agriculture, Fishing, and Forestry

- 5.12.4. Construction

- 5.12.5. Distribu

- 5.12.6. Other En

- 5.13. Market Analysis, Insights and Forecast - by Region

- 5.13.1. Iraq

- 5.1. Market Analysis, Insights and Forecast - by Market Overview

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mateen Express and Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Transparency Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 C H Robinson**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Move One Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zarawa Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sheraz Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Arch Star Logisitcs

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nippon Express Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DHL Global Forwarding

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Maersk Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Al-Rashed United Shipping Services

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dsv Global Transports and Logistics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Guangzhou International

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Crown Logistics LTD

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Mateen Express and Logistics

List of Figures

- Figure 1: Iraq Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Iraq Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Iraq Logistics Market Revenue Million Forecast, by Market Overview 2020 & 2033

- Table 2: Iraq Logistics Market Revenue Million Forecast, by Market Dynamics 2020 & 2033

- Table 3: Iraq Logistics Market Revenue Million Forecast, by Value Chain/Supply Chain Analysis 2020 & 2033

- Table 4: Iraq Logistics Market Revenue Million Forecast, by Porter's Five Force Analysis 2020 & 2033

- Table 5: Iraq Logistics Market Revenue Million Forecast, by Technological Advancements in Freight Forwarding 2020 & 2033

- Table 6: Iraq Logistics Market Revenue Million Forecast, by Overview of Global Freight Forwarding Market 2020 & 2033

- Table 7: Iraq Logistics Market Revenue Million Forecast, by Market segmentation of Freight Forwarding 2020 & 2033

- Table 8: Iraq Logistics Market Revenue Million Forecast, by Digitalisation of Freight Forwarding Market 2020 & 2033

- Table 9: Iraq Logistics Market Revenue Million Forecast, by Pricing 2020 & 2033

- Table 10: Iraq Logistics Market Revenue Million Forecast, by Assessment of the Impact of COVID-19 on the Market 2020 & 2033

- Table 11: Iraq Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 12: Iraq Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Iraq Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 14: Iraq Logistics Market Revenue Million Forecast, by Market Overview 2020 & 2033

- Table 15: Iraq Logistics Market Revenue Million Forecast, by Market Dynamics 2020 & 2033

- Table 16: Iraq Logistics Market Revenue Million Forecast, by Value Chain/Supply Chain Analysis 2020 & 2033

- Table 17: Iraq Logistics Market Revenue Million Forecast, by Porter's Five Force Analysis 2020 & 2033

- Table 18: Iraq Logistics Market Revenue Million Forecast, by Technological Advancements in Freight Forwarding 2020 & 2033

- Table 19: Iraq Logistics Market Revenue Million Forecast, by Overview of Global Freight Forwarding Market 2020 & 2033

- Table 20: Iraq Logistics Market Revenue Million Forecast, by Market segmentation of Freight Forwarding 2020 & 2033

- Table 21: Iraq Logistics Market Revenue Million Forecast, by Digitalisation of Freight Forwarding Market 2020 & 2033

- Table 22: Iraq Logistics Market Revenue Million Forecast, by Pricing 2020 & 2033

- Table 23: Iraq Logistics Market Revenue Million Forecast, by Assessment of the Impact of COVID-19 on the Market 2020 & 2033

- Table 24: Iraq Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 25: Iraq Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Iraq Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iraq Logistics Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Iraq Logistics Market?

Key companies in the market include Mateen Express and Logistics, Transparency Co, C H Robinson**List Not Exhaustive, Move One Logistics, Zarawa Company, Sheraz Co, Arch Star Logisitcs, Nippon Express Co Ltd, DHL Global Forwarding, The Maersk Group, Al-Rashed United Shipping Services, Dsv Global Transports and Logistics, Guangzhou International, Crown Logistics LTD.

3. What are the main segments of the Iraq Logistics Market?

The market segments include Market Overview, Market Dynamics, Value Chain/Supply Chain Analysis, Porter's Five Force Analysis, Technological Advancements in Freight Forwarding, Overview of Global Freight Forwarding Market, Market segmentation of Freight Forwarding, Digitalisation of Freight Forwarding Market, Pricing , Assessment of the Impact of COVID-19 on the Market, Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.24 Million as of 2022.

5. What are some drivers contributing to market growth?

UAE'S strategic location serving has an advantage for the market'; Morder infrastructure boosting the market.

6. What are the notable trends driving market growth?

Expanding e-commerce industry drives logistics market.

7. Are there any restraints impacting market growth?

Regulations and customs affecting the market; Lack of skilled workforce affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iraq Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iraq Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iraq Logistics Market?

To stay informed about further developments, trends, and reports in the Iraq Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence