Key Insights

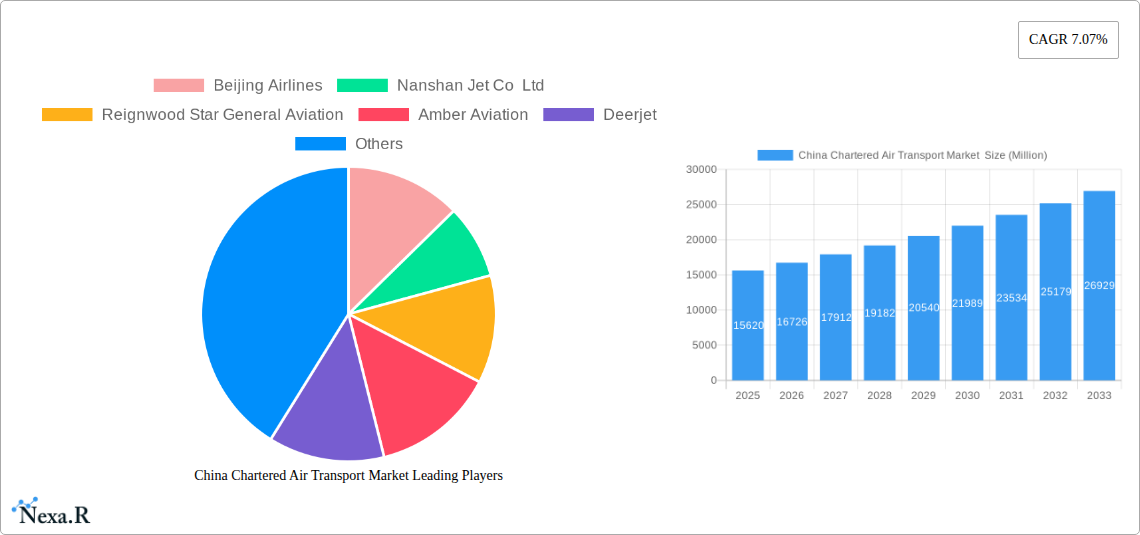

The China chartered air transport market is experiencing robust growth, projected to reach a market size of $15.62 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.07% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector necessitates faster and more reliable delivery solutions, driving demand for time-sensitive cargo transportation. Simultaneously, the increasing affluence of the Chinese population fuels a rise in luxury travel and specialized transportation needs like animal transportation, further boosting market growth. Government initiatives aimed at improving infrastructure and streamlining regulations within the aviation sector also contribute positively. Competition amongst established players like Beijing Airlines, China Southern Airlines General Aviation, and Sino Jet, alongside emerging companies, is intensifying, leading to innovation in service offerings and pricing strategies. While potential restraints like fluctuating fuel prices and regulatory changes exist, the overall market outlook remains positive due to the strong underlying growth drivers.

China Chartered Air Transport Market Market Size (In Billion)

The segmentation of the market reveals diverse opportunities. Time-critical cargo, encompassing express deliveries and high-value goods, forms a significant segment, while the heavy and oversized cargo segment is growing due to increasing industrial activity and infrastructure projects. The growing awareness of animal welfare is also positively impacting the animal transportation segment. The ‘Other Cargo Types’ segment likely encompasses specialized goods requiring specific handling and transportation conditions, reflecting the market’s ability to adapt to diverse needs. Regional data, currently limited to China, indicates a substantial and concentrated market within the country. However, future expansion into neighboring regions is likely, given the country's growing economic influence and cross-border trade activities. The historical period (2019-2024) likely showcased a foundation for this impressive projected growth, reflecting consistent market development before the accelerated growth predicted for the forecast period.

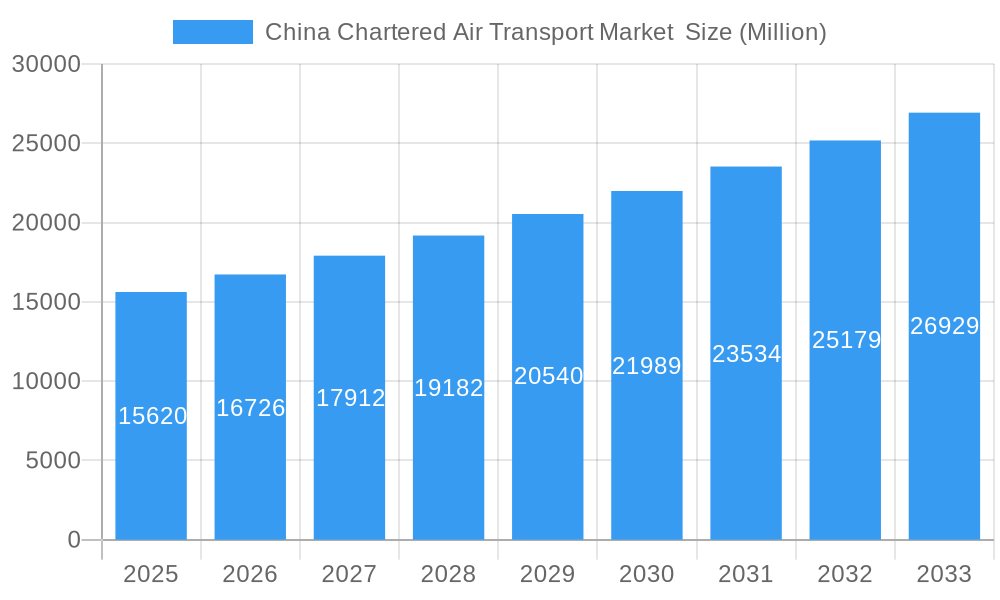

China Chartered Air Transport Market Company Market Share

China Chartered Air Transport Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China chartered air transport market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both the parent market (Air Freight) and child market (Chartered Air Transport), this report is an essential resource for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The market size is presented in million units.

China Chartered Air Transport Market Market Dynamics & Structure

This section delves into the intricate structure of China's chartered air transport market, analyzing market concentration, technological advancements, regulatory landscapes, competitive dynamics, and M&A activities. The market exhibits a moderately concentrated structure, with key players holding significant market share, though the presence of numerous smaller operators fosters competition. Technological innovations, such as advanced flight scheduling software and enhanced tracking systems, are driving efficiency and operational improvements. However, stringent regulatory frameworks and hurdles related to airspace management remain a challenge. The market experiences competition from alternative modes of transport, including rail and road freight, which necessitate continuous improvements in service offerings and cost-effectiveness. M&A activity within the sector has been relatively moderate in recent years, with an estimated xx deals in 2024, reflecting consolidation and growth strategies among larger operators.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation Drivers: Advanced flight scheduling software, improved tracking systems, and drone technology integration.

- Regulatory Framework: Stringent regulations impacting airspace access and operational approvals.

- Competitive Product Substitutes: Rail freight, road freight, and sea freight.

- End-User Demographics: Diverse, including businesses across various sectors (e.g., manufacturing, e-commerce, pharmaceuticals).

- M&A Trends: Moderate M&A activity, with an estimated xx deals completed in 2024, indicating ongoing consolidation.

China Chartered Air Transport Market Growth Trends & Insights

The China chartered air transport market experienced significant growth during the historical period (2019-2024), fueled by expanding e-commerce activities, rising demand for time-sensitive goods, and the increasing need for specialized cargo transport. The market size reached xx million units in 2024, exhibiting a CAGR of xx% during the period. Adoption rates are expected to increase further, driven by sustained economic growth and infrastructural development across China. Technological disruptions, such as the increasing utilization of digital platforms for booking and managing charters, and the adoption of advanced data analytics for optimizing logistics, are enhancing efficiency and transparency. Shifting consumer behavior towards premium and specialized cargo solutions is bolstering market growth. The forecast period (2025-2033) is projected to witness a continued expansion, with a projected CAGR of xx%, resulting in a market size of xx million units by 2033. Market penetration is expected to increase significantly in less-developed regions of China, due to infrastructure development initiatives.

Dominant Regions, Countries, or Segments in China Chartered Air Transport Market

The coastal regions of eastern China, particularly Shanghai, Guangdong, and Jiangsu provinces, represent the dominant segments within the chartered air transport market, driven by high economic activity, developed infrastructure, and robust industrial sectors. The Time Critical Cargo segment holds a significant market share due to the growing demand for swift and reliable delivery of high-value goods. This is further propelled by increased e-commerce penetration and expansion of global supply chains, demanding faster turnaround times.

Key Drivers for Coastal Regions: Concentrated economic activity, well-developed airports and infrastructure, access to global trade routes.

Key Drivers for Time Critical Cargo Segment: E-commerce boom, increasing demand for fast and efficient supply chains, growth of specialized industries requiring fast transportation (pharmaceuticals, high-tech goods).

Growth Potential: Significant growth potential remains in less-developed regions as infrastructure improvements continue and economic activity expands.

Market Share Breakdown by Segment (2024):

- Time Critical Cargo: xx%

- Heavy and Oversized Cargo: xx%

- Dangerous Cargo: xx%

- Animal Transportation: xx%

- Other Cargo Types: xx%

China Chartered Air Transport Market Product Landscape

The China chartered air transport market offers a diverse range of services tailored to specific cargo needs. Services include specialized temperature-controlled transport for pharmaceuticals and perishable goods, heavy-lift capabilities for oversized machinery, and secure handling for dangerous materials. Technological advancements are continuously improving the efficiency, safety, and tracking capabilities of these services. The focus on delivering secure, reliable, and timely transportation continues to be a primary selling point, driving customer loyalty and market expansion.

Key Drivers, Barriers & Challenges in China Chartered Air Transport Market

Key Drivers:

- E-commerce growth: Fuels demand for expedited delivery of goods.

- Industrial expansion: Increases the need for specialized cargo transportation.

- Government infrastructure investments: Improves connectivity and accessibility.

Key Challenges and Restraints:

- Regulatory complexities: Obtaining necessary permits and approvals can be time-consuming.

- High operational costs: Fuel prices and airport charges impact profitability.

- Competition from other transport modes: Rail and road freight offer lower costs for some types of cargo. The impact of these challenges is estimated to reduce the market growth by approximately xx% over the next 5 years.

Emerging Opportunities in China Chartered Air Transport Market

Untapped markets in less developed regions, expansion of e-commerce to smaller cities, and a growing demand for specialized solutions like cold chain logistics and high-value item transportation present significant opportunities. Furthermore, the increasing adoption of technology, such as real-time tracking and data analytics, offers opportunities for enhanced service offerings and efficiency gains. The adoption of sustainable aviation fuels presents a major long-term growth opportunity.

Growth Accelerators in the China Chartered Air Transport Market Industry

Technological advancements in aircraft design, optimization of logistics through AI and machine learning, and strategic partnerships between charter operators and logistics providers will drive significant growth in the long term. Expansion into new regions, particularly through strategic airport investments and regional connectivity improvements, will also play a vital role. Government support for the development of air cargo infrastructure and incentives for green technologies will further fuel market expansion.

Key Players Shaping the China Chartered Air Transport Market Market

- Beijing Airlines

- Nanshan Jet Co Ltd

- Reignwood Star General Aviation

- Amber Aviation

- Deerjet

- ZYB Lily Jet Ltd

- China Southern Airlines General Aviation

- Sino Jet

- Baa Jet Management Ltd

- Donghai Jet Co Ltd

- Jiangsu Jet

Notable Milestones in China Chartered Air Transport Market Sector

- October 2023: Air Charter Services expands its presence in Shanghai and surrounding provinces.

- July 2023: Jayud launches new air charter services, strengthening its Southeast Asian presence.

In-Depth China Chartered Air Transport Market Market Outlook

The China chartered air transport market is poised for robust growth over the forecast period (2025-2033), driven by continued economic expansion, infrastructure development, and technological advancements. Strategic partnerships, innovative service offerings, and effective utilization of data analytics will enable players to capture significant market share. Focus on sustainability and adoption of green technologies will be key to long-term success. The market is expected to benefit from increasing demand for specialized cargo handling, resulting in a significant expansion of market size and value in the coming years.

China Chartered Air Transport Market Segmentation

-

1. type

- 1.1. Time Critical Cargo

- 1.2. Heavy and Oversized Cargo

- 1.3. Dangerous Cargo

- 1.4. Animal Transportation

- 1.5. Other Cargo Types

China Chartered Air Transport Market Segmentation By Geography

- 1. China

China Chartered Air Transport Market Regional Market Share

Geographic Coverage of China Chartered Air Transport Market

China Chartered Air Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for businesses; Increasing disposable income

- 3.3. Market Restrains

- 3.3.1. Regulatory challenges; Infrastructure limitations

- 3.4. Market Trends

- 3.4.1. Booming Chartered Freight Transport Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Chartered Air Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by type

- 5.1.1. Time Critical Cargo

- 5.1.2. Heavy and Oversized Cargo

- 5.1.3. Dangerous Cargo

- 5.1.4. Animal Transportation

- 5.1.5. Other Cargo Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Beijing Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nanshan Jet Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reignwood Star General Aviation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amber Aviation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deerjet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ZYB Lily Jet Ltd *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Southern Airlines General Aviation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sino Jet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baa Jet Management Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Donghai Jet Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jiangsu Jet

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Beijing Airlines

List of Figures

- Figure 1: China Chartered Air Transport Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Chartered Air Transport Market Share (%) by Company 2025

List of Tables

- Table 1: China Chartered Air Transport Market Revenue Million Forecast, by type 2020 & 2033

- Table 2: China Chartered Air Transport Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: China Chartered Air Transport Market Revenue Million Forecast, by type 2020 & 2033

- Table 4: China Chartered Air Transport Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Chartered Air Transport Market ?

The projected CAGR is approximately 7.07%.

2. Which companies are prominent players in the China Chartered Air Transport Market ?

Key companies in the market include Beijing Airlines, Nanshan Jet Co Ltd, Reignwood Star General Aviation, Amber Aviation, Deerjet, ZYB Lily Jet Ltd *List Not Exhaustive, China Southern Airlines General Aviation, Sino Jet, Baa Jet Management Ltd, Donghai Jet Co Ltd, Jiangsu Jet.

3. What are the main segments of the China Chartered Air Transport Market ?

The market segments include type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for businesses; Increasing disposable income.

6. What are the notable trends driving market growth?

Booming Chartered Freight Transport Segment.

7. Are there any restraints impacting market growth?

Regulatory challenges; Infrastructure limitations.

8. Can you provide examples of recent developments in the market?

October 2023: Air Charter Services, the aircraft charter broker, has increased its efforts to concentrate on Shanghai and the surrounding provinces, including Zhejiang and Jiangsu, by relocating its office in Shanghai to bigger premises.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Chartered Air Transport Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Chartered Air Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Chartered Air Transport Market ?

To stay informed about further developments, trends, and reports in the China Chartered Air Transport Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence