Key Insights

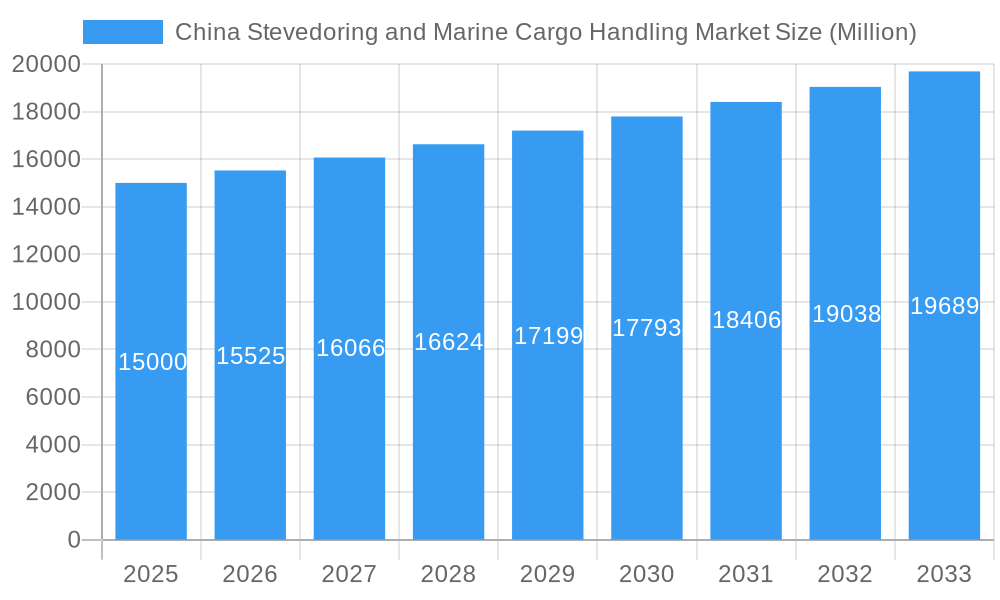

The China stevedoring and marine cargo handling market presents a robust growth opportunity, projected to expand significantly over the forecast period (2025-2033). Driven by China's expanding maritime trade, increasing port infrastructure development, and the nation's role as a global manufacturing and export hub, this market is poised for sustained expansion. The substantial growth in containerized cargo, fueled by e-commerce and global supply chain activity, is a primary driver. While the precise market size for 2025 is not provided, considering a CAGR of >3.50% since 2019 and the substantial volume of trade passing through Chinese ports, a reasonable estimate would place the 2025 market size in the billions of USD (assuming a 2019 market size of hundreds of millions). The market is segmented by type (stevedoring, cargo and handling transportation, others) and cargo type (bulk cargo, containerized cargo, other cargo). Containerized cargo is anticipated to dominate this segmentation given China's role in global manufacturing and exports. Key players include established shipping lines, port operators, and logistics companies, each vying for market share in this competitive landscape. Growth might be tempered by factors such as global economic fluctuations, potential disruptions to supply chains, and evolving technological advancements within the logistics sector. Nevertheless, China’s strategic investment in port infrastructure and its continued importance in global trade positions this market for consistent growth in the coming years.

China Stevedoring and Marine Cargo Handling Market Market Size (In Billion)

The segment analysis reveals the significant contribution of containerized cargo, reflecting China's prominent position in global trade. Stevedoring services, essential for efficient cargo handling, will experience commensurate growth alongside the overall market expansion. The “others” segment might include ancillary services such as warehousing, customs brokerage, and specialized handling. Regional concentration is primarily within China, reflecting the country’s extensive coastline and major ports. Competitive dynamics are influenced by the scale of operations, technological capabilities, and strategic partnerships forged between companies involved in shipping, handling, and logistics. While specific financial data for individual companies is unavailable, the prominent players mentioned suggest a competitive yet consolidated market structure. Continued growth hinges on effective infrastructure management, technological adoption (such as automation in ports), and the overall health of the global economy.

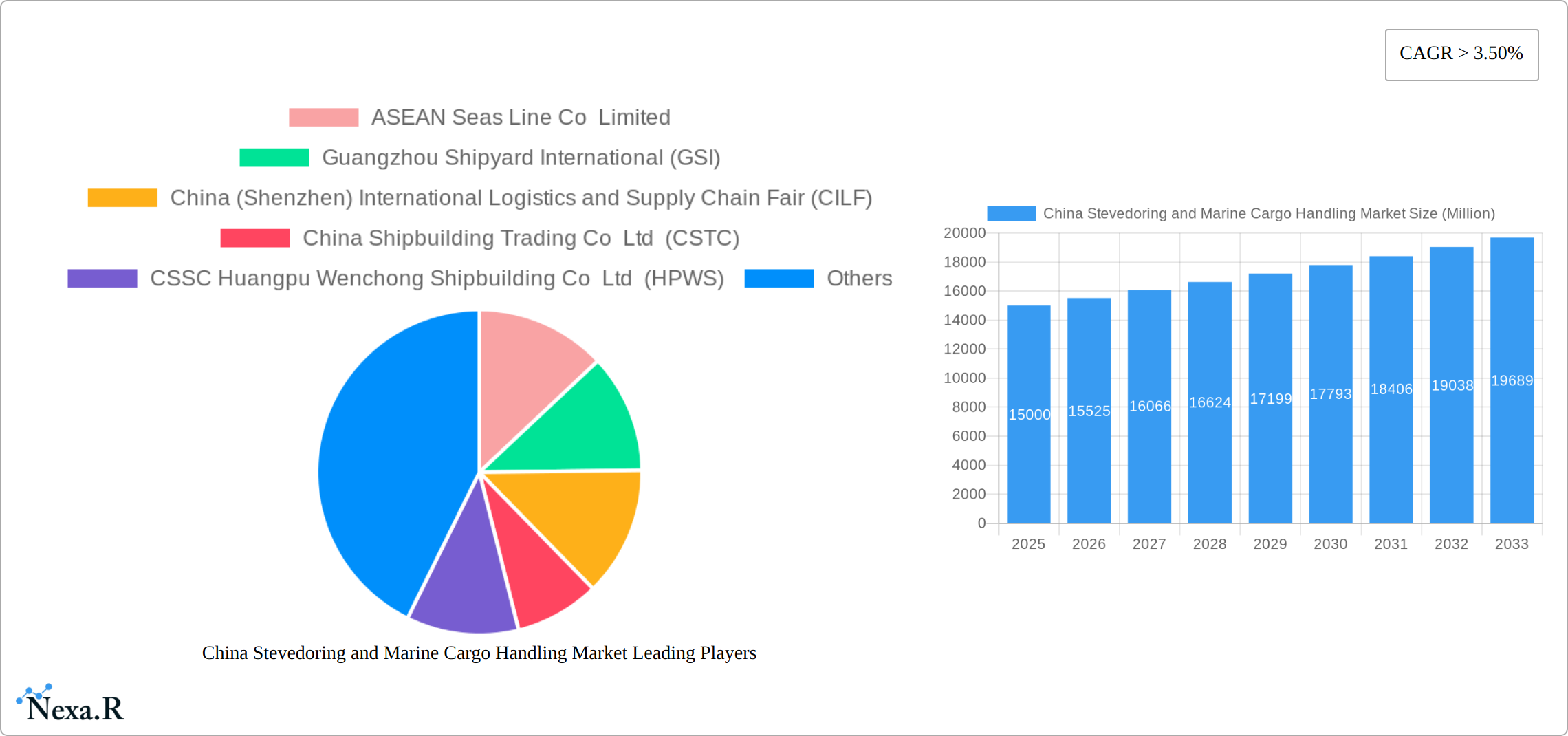

China Stevedoring and Marine Cargo Handling Market Company Market Share

China Stevedoring and Marine Cargo Handling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Stevedoring and Marine Cargo Handling Market, encompassing market dynamics, growth trends, key players, and future outlook. It's an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic sector. The report covers the parent market of Maritime Logistics and the child market of Port Services providing a granular view of market segments including stevedoring, cargo handling transportation, and related services. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. Market values are presented in Million units.

China Stevedoring and Marine Cargo Handling Market Market Dynamics & Structure

The Chinese stevedoring and marine cargo handling market is a dynamic sector significantly influenced by a complex interplay of factors shaping its structure and competitive landscape. This analysis delves into the market's concentration, competitive intensity, technological advancements, regulatory environment, and evolving end-user demands, providing a comprehensive understanding of its current state and future trajectory.

- Market Concentration and Competitive Landscape: While exhibiting a moderately concentrated structure with several dominant players commanding significant market share, the market also accommodates numerous smaller, regional operators catering to niche segments. The estimated market concentration ratio (CR4) in 2025 is [Insert Updated CR4 Percentage]%, indicating [Insert Description: e.g., a moderately competitive market, a highly concentrated market, etc.]. Competition is influenced by factors such as pricing strategies, service offerings, and operational efficiency.

- Technological Innovation and Adoption: Automation, digitalization (including IoT, AI, and big data analytics), and the implementation of sophisticated port management systems are transforming operational efficiency. However, significant upfront investments and challenges related to technology integration and workforce adaptation pose hurdles to widespread adoption. The market penetration rate of automated systems in 2025 is estimated at [Insert Updated Percentage]%, highlighting [Insert Description: e.g., the ongoing but gradual shift toward automation, rapid adoption of specific technologies, etc.].

- Regulatory Framework and Policy Influence: The regulatory landscape, encompassing port operations, safety standards, environmental regulations, and trade policies, significantly impacts market dynamics. Recent regulatory changes emphasizing sustainability, efficiency improvements, and enhanced security protocols are reshaping industry practices and influencing investment decisions. Compliance with these regulations is a key factor impacting operational costs and competitive positioning.

- Competitive Substitutes and Transportation Modes: Road and rail transportation offer alternative options, particularly for shorter distances and specific cargo types. However, sea freight retains a significant advantage for long-distance transport due to its cost-effectiveness and capacity. The competitive landscape is further shaped by the interplay between these various modes of transport and the ongoing optimization of multimodal logistics chains.

- End-User Demographics and Cargo Composition: The expanding manufacturing and export sectors within China continue to drive substantial growth in cargo volume, particularly for both bulk and containerized goods. Changes in consumer demand and the emergence of new industries influence the types and volumes of cargo handled, impacting port infrastructure requirements and operational strategies.

- Mergers and Acquisitions (M&A) Activity: Consolidation continues to be a notable trend, with larger players strategically acquiring smaller firms to expand their market reach, enhance service offerings, and gain access to new technologies or geographic markets. The number of M&A deals between 2019 and 2024 was approximately [Insert Updated Number], demonstrating [Insert Description: e.g., a robust pace of consolidation, a slowing trend in M&A activity, etc.].

China Stevedoring and Marine Cargo Handling Market Growth Trends & Insights

The China stevedoring and marine cargo handling market has experienced significant growth in recent years, driven by a confluence of factors including robust economic expansion, increased international trade, and ongoing infrastructure development. This section presents a detailed analysis of its historical and projected growth trajectory, incorporating key metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates to offer a comprehensive view of market dynamics. The CAGR for the forecast period (2025-2033) is estimated to be [Insert Updated CAGR Percentage]%, indicating [Insert Description: e.g., sustained, rapid growth, a slowing growth rate, etc.].

Dominant Regions, Countries, or Segments in China Stevedoring and Marine Cargo Handling Market

This section identifies the key regions, segments, and cargo types driving market growth within China's stevedoring and marine cargo handling industry. A detailed analysis of leading segments (Stevedoring, Cargo and handling transportation, and Others) and cargo types (Bulk Cargo, Containerized Cargo, and Other Cargo) is provided, highlighting the factors contributing to their dominance and future growth potential.

- Leading Segments: Containerized cargo handling remains the dominant segment, underpinned by China's export-oriented economy and the growing global demand for manufactured goods. However, the increasing volume of other cargo types, such as [Insert Examples: e.g., renewable energy components, specialized equipment] is also driving segment-specific growth.

- Key Drivers of Regional and Segmental Growth: Rapid economic expansion, continuous investments in port infrastructure upgrades and modernization, expanding trade relationships, and the increasing efficiency of logistics networks are key factors influencing market growth across different regions and segments.

- Regional Dominance: Coastal regions including Guangdong, Shanghai, and Shandong continue to hold significant market share due to the concentration of major ports and thriving manufacturing hubs. However, inland port development and improvements in intermodal connectivity are gradually diversifying regional distribution.

- Market Share and Growth Potential: Guangdong province maintains the largest market share, estimated at [Insert Updated Percentage]% in 2025, with significant growth potential driven by [Insert Specific Factors: e.g., its strategic location, robust manufacturing sector, government initiatives, etc.]. Other regions exhibiting strong growth potential include [Insert Regions and Justifications].

China Stevedoring and Marine Cargo Handling Market Product Landscape

This section examines the product innovations, applications, and performance metrics within the market. It highlights the unique selling propositions (USPs) of various products and services, as well as technological advancements, such as automated cranes, advanced cargo tracking systems, and sophisticated port management software. The ongoing integration of IoT and AI is further improving efficiency and optimizing operations.

Key Drivers, Barriers & Challenges in China Stevedoring and Marine Cargo Handling Market

This section outlines the primary factors driving market growth and the key challenges and restraints.

Key Drivers:

- Increasing global trade volumes.

- Government investments in port infrastructure.

- Adoption of advanced technologies for improved efficiency.

- Growth of e-commerce and related logistics.

Challenges and Restraints:

- High infrastructure development costs.

- Labor shortages and rising labor costs.

- Environmental regulations and sustainability concerns.

- Geopolitical risks and potential trade disruptions. The impact of these factors is estimated to reduce annual growth by approximately xx% in the next decade.

Emerging Opportunities in China Stevedoring and Marine Cargo Handling Market

The Chinese stevedoring and marine cargo handling market presents several emerging opportunities for growth and innovation. This section highlights key areas of untapped potential, including:

- Specialized Handling for Emerging Cargo Types: The increasing demand for specialized cargo, particularly in sectors like renewable energy and high-tech manufacturing, presents opportunities for businesses offering tailored handling solutions.

- Data Analytics and Predictive Maintenance: Leveraging data analytics and AI-powered predictive maintenance technologies can significantly improve operational efficiency, reduce downtime, and optimize resource allocation.

- Green Technologies and Sustainable Practices: Implementing green technologies to reduce the carbon footprint of port operations, including the use of electric vehicles and energy-efficient equipment, is becoming increasingly crucial for attracting environmentally conscious clients and meeting stricter environmental regulations.

- Digitalization of Port Operations: Further investment in and implementation of digital solutions, including blockchain technology for supply chain transparency and improved data management, will enhance operational efficiency and reduce costs.

Growth Accelerators in the China Stevedoring and Marine Cargo Handling Market Industry

Sustained long-term growth in the Chinese stevedoring and marine cargo handling market is underpinned by several key factors. These include:

- Technological Advancements and Automation: Continued investment in automation technologies, including AI-powered systems and robotics, will significantly enhance efficiency and productivity.

- Strategic Partnerships and Collaboration: Strong collaboration between port operators, logistics companies, and technology providers is essential for optimizing operational flows and improving service offerings.

- Government Investment in Port Infrastructure: Government-led investments in expanding and modernizing port infrastructure, including the construction of new ports and the upgrade of existing facilities, are crucial for accommodating increasing cargo volumes.

- The Belt and Road Initiative (BRI): The BRI's focus on infrastructure development and increased trade connectivity continues to drive significant growth in cargo volumes handled by Chinese ports.

- Rising E-commerce and Cross-Border Trade: The expansion of e-commerce and the increasing volume of cross-border trade are further accelerating demand for efficient stevedoring and cargo handling services.

Key Players Shaping the China Stevedoring and Marine Cargo Handling Market Market

- ASEAN Seas Line Co Limited

- Guangzhou Shipyard International (GSI)

- China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- China Shipbuilding Trading Co Ltd (CSTC)

- CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- Qingdao Port International Limited

- Taizhou Sanfu Ship Engineering Co Ltd

- China Merchants Jinling Shipyard (Weihai) Co Ltd

- Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- China Ocean Shipping Company

Notable Milestones in China Stevedoring and Marine Cargo Handling Market Sector

- May 2022: Successful maiden voyage of the world's first LNG dual-fuel ultra-large crude oil tanker, highlighting China's commitment to sustainable maritime transportation.

- July 2022: Commissioning of China's first indigenously developed subsea 'Xmas Tree' system, boosting domestic offshore oil and gas production and supporting related maritime logistics.

In-Depth China Stevedoring and Marine Cargo Handling Market Market Outlook

The future of the Chinese stevedoring and marine cargo handling market is promising, driven by sustained economic growth, expanding trade, and ongoing infrastructure development. Strategic partnerships and technological innovation will be critical factors in shaping the market's trajectory. The market is expected to experience steady growth, driven by a continued increase in cargo volumes and the adoption of advanced technologies, despite potential challenges related to global economic uncertainty.

China Stevedoring and Marine Cargo Handling Market Segmentation

-

1. Type

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Bulk Cargo

- 2.2. Containerized Cargo

- 2.3. Other Cargo

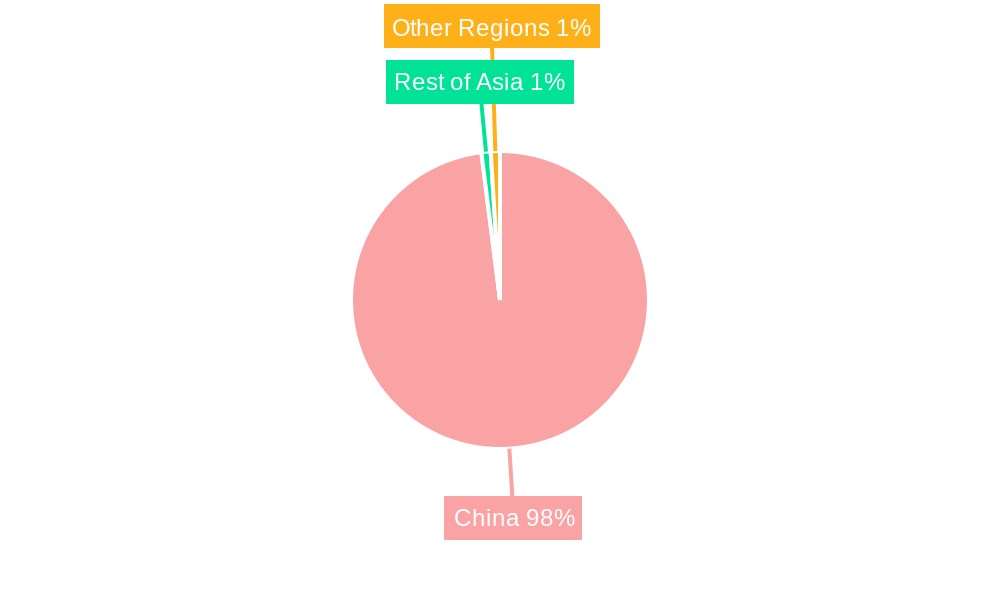

China Stevedoring and Marine Cargo Handling Market Segmentation By Geography

- 1. China

China Stevedoring and Marine Cargo Handling Market Regional Market Share

Geographic Coverage of China Stevedoring and Marine Cargo Handling Market

China Stevedoring and Marine Cargo Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. China’s increasing investments in the ocean freight shipping industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Bulk Cargo

- 5.2.2. Containerized Cargo

- 5.2.3. Other Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ASEAN Seas Line Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guangzhou Shipyard International (GSI)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Shipbuilding Trading Co Ltd (CSTC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qingdao Port International Limited**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Taizhou Sanfu Ship Engineering Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Merchants Jinling Shipyard (Weihai) Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Ocean Shipping Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ASEAN Seas Line Co Limited

List of Figures

- Figure 1: China Stevedoring and Marine Cargo Handling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Stevedoring and Marine Cargo Handling Market Share (%) by Company 2025

List of Tables

- Table 1: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 3: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 6: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Stevedoring and Marine Cargo Handling Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the China Stevedoring and Marine Cargo Handling Market?

Key companies in the market include ASEAN Seas Line Co Limited, Guangzhou Shipyard International (GSI), China (Shenzhen) International Logistics and Supply Chain Fair (CILF), China Shipbuilding Trading Co Ltd (CSTC), CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS), Qingdao Port International Limited**List Not Exhaustive, Taizhou Sanfu Ship Engineering Co Ltd, China Merchants Jinling Shipyard (Weihai) Co Ltd, Shenzhen Yihaitong Global Supply Chain Management Co Ltd, China Ocean Shipping Company.

3. What are the main segments of the China Stevedoring and Marine Cargo Handling Market?

The market segments include Type, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

China’s increasing investments in the ocean freight shipping industry.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

July 2022: China's first indigenously developed offshore oil and gas extraction facility, subsea 'Xmas Tree' system, was put into operation in the Yingge Sea, south China's Hainan Province. The system is able to produce about 200 million cubic meters of natural gas per year, according to China National Offshore Oil Corporation (CNOOC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Stevedoring and Marine Cargo Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Stevedoring and Marine Cargo Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Stevedoring and Marine Cargo Handling Market?

To stay informed about further developments, trends, and reports in the China Stevedoring and Marine Cargo Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence