Key Insights

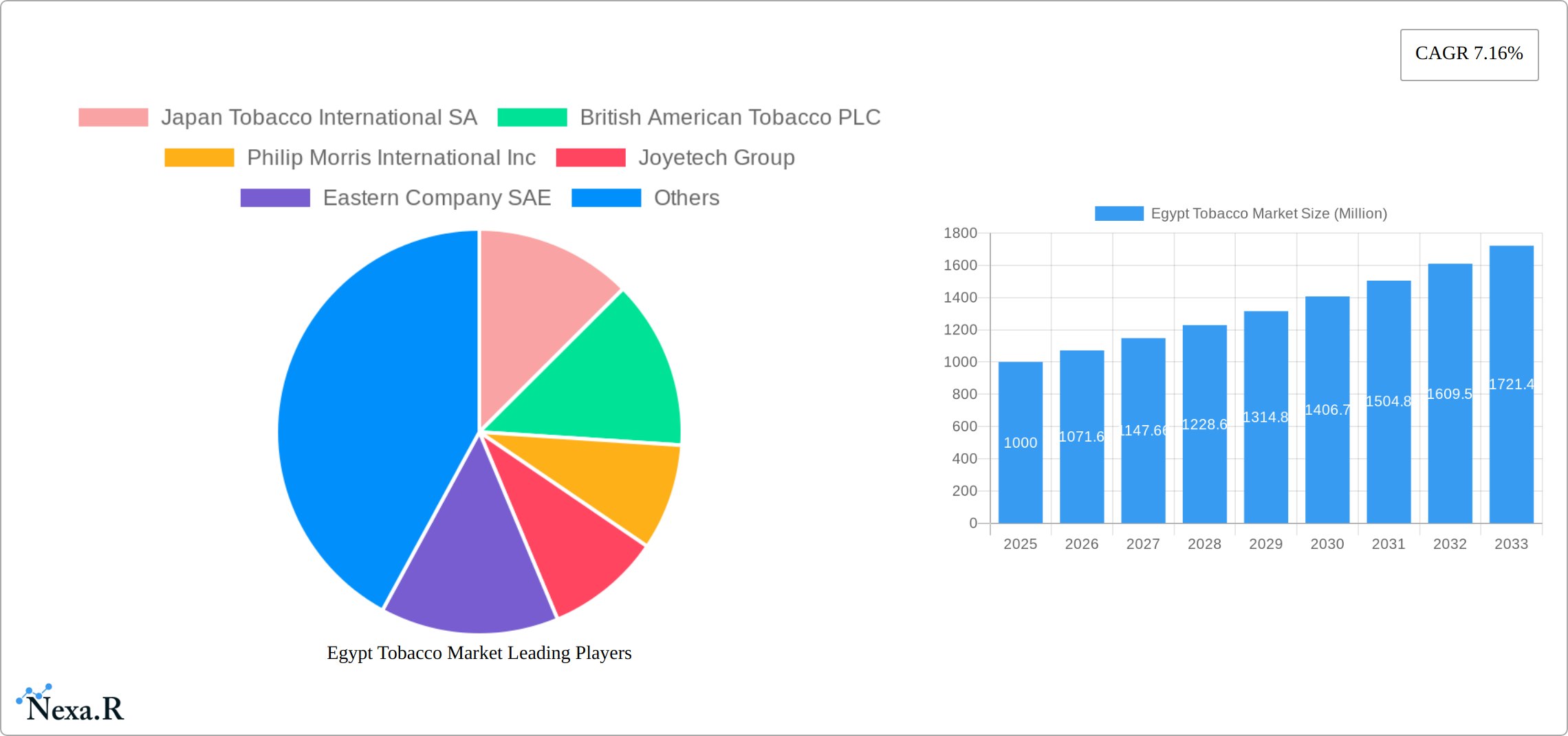

The Egypt tobacco market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.16% from 2025 to 2033. This expansion is fueled by several key drivers. A significant factor is the relatively high smoking prevalence among the adult population, despite public health initiatives aimed at reducing consumption. The market is segmented by product type (cigarettes, cigars, cigarillos, pipes, e-cigarettes/HTPs), end-user demographics (male and female), and distribution channels (supermarkets/hypermarkets, convenience stores, specialty tobacco stores, and others). The dominance of traditional tobacco products like cigarettes is gradually being challenged by the rising popularity of e-cigarettes and heated tobacco products (HTPs), particularly among younger demographics. However, stringent regulations and increasing health consciousness are acting as restraints, potentially slowing down the overall market growth. The competitive landscape features both multinational corporations like Japan Tobacco International, British American Tobacco, and Philip Morris International, as well as local players. Regional variations exist within Egypt itself, with urban areas potentially showing higher consumption than rural regions. The forecast suggests a substantial market expansion by 2033, driven by shifting consumer preferences and the dynamic interplay between regulatory pressures and market innovation.

Egypt Tobacco Market Market Size (In Billion)

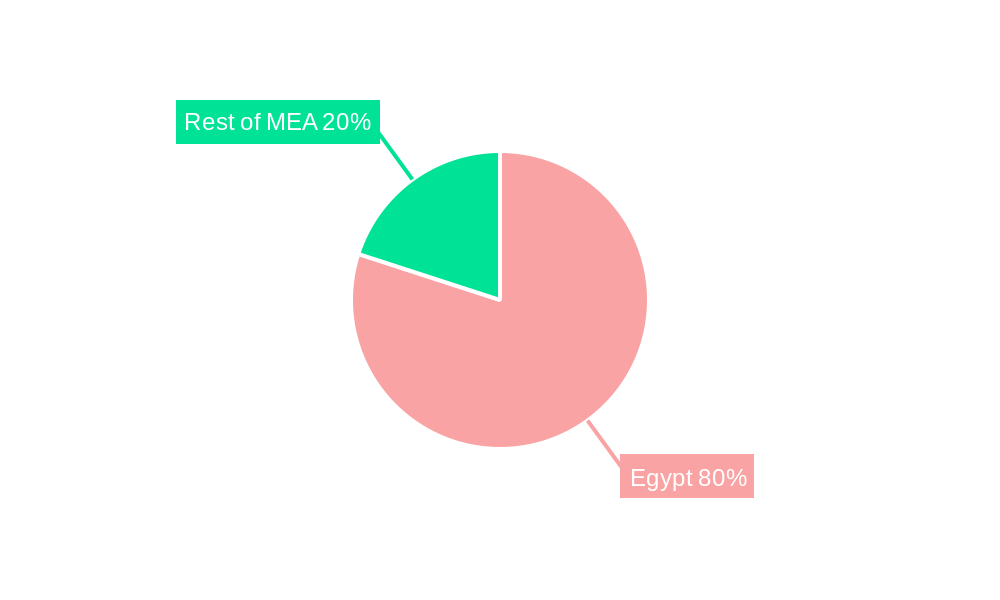

The Middle East and Africa region, including key markets within Egypt like UAE, South Africa, and Saudi Arabia, contribute significantly to the overall growth. The market's future trajectory will be heavily influenced by government policies regarding tobacco taxation and advertising, alongside consumer behavior shifts towards healthier alternatives. The presence of both international giants and local companies creates a dynamic competitive environment, with continuous product innovation and marketing strategies vying for market share. Successful players will need to navigate the balance between satisfying consumer demand, complying with regulations, and addressing growing public health concerns related to tobacco consumption. The ongoing evolution of e-cigarettes and HTPs will further shape the landscape, presenting opportunities and challenges for established and emerging brands alike. Precise market size figures for specific years within the forecast period (2025-2033) can be extrapolated using the provided CAGR and 2025 base value through compound interest calculations.

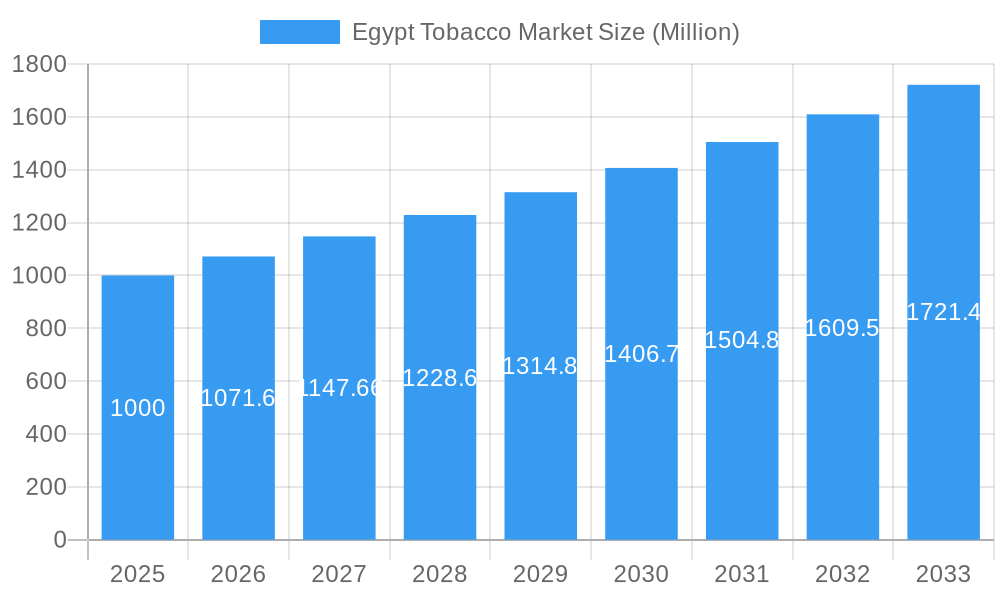

Egypt Tobacco Market Company Market Share

Egypt Tobacco Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Egypt tobacco market, covering the period 2019-2033. It delves into market dynamics, growth trends, key players, and future opportunities within the parent market (Tobacco) and its child markets (Cigarettes, Cigars, Cigarillos, Cigar Pipes, and E-cigarettes/HTPs). The report uses 2025 as its base year and offers valuable insights for industry professionals, investors, and strategic decision-makers. Market values are presented in million units.

Egypt Tobacco Market Dynamics & Structure

The Egyptian tobacco market is characterized by a moderate level of concentration, with key players like Eastern Company SAE, British American Tobacco PLC, and Philip Morris International Inc. holding significant market share. Technological innovation, particularly in e-cigarettes and heated tobacco products (HTPs), is transforming the landscape, but faces barriers including regulatory uncertainty and consumer adoption rates. The regulatory framework, including taxation and advertising restrictions, significantly impacts market dynamics. The market also witnesses competitive pressure from substitute products, such as vaping devices. End-user demographics, predominantly male, are gradually shifting with increased female consumption. The M&A landscape shows recent activity, primarily focused on securing manufacturing licenses and distribution agreements.

- Market Concentration: Eastern Company SAE holds an estimated xx% market share in 2025, followed by British American Tobacco PLC at xx% and Philip Morris International Inc. at xx%.

- Technological Innovation: Adoption of HTPs and e-cigarettes is growing at a CAGR of xx% (2025-2033), though challenges include consumer awareness and regulatory approvals.

- Regulatory Framework: Stringent regulations on advertising and taxation impact pricing and consumer behavior.

- Competitive Substitutes: The rise of vaping poses a significant challenge, estimated to capture xx% of the market by 2033.

- End-User Demographics: The male segment dominates (xx%), with a projected xx% increase in female consumption by 2033.

- M&A Activity: Recent deals, including Philip Morris' USD 450 million investment in 2022, indicate a trend of strategic expansion and market consolidation. The total volume of M&A deals in the period 2019-2024 was estimated at xx deals.

Egypt Tobacco Market Growth Trends & Insights

The Egyptian tobacco market experienced a period of xx% CAGR during the historical period (2019-2024). While overall consumption may be declining slightly due to health concerns and rising prices, the market is witnessing growth in specific segments. The shift towards HTPs and e-cigarettes is driving market evolution, although traditional cigarettes remain the dominant product. Consumer behavior is influenced by factors such as pricing, brand loyalty, and increasing health awareness. Technological disruptions are significantly impacting both production methods and product offerings. Market penetration of e-cigarettes is expected to reach xx% by 2033.

- Market Size: The market size was estimated at xx million units in 2024 and is projected to reach xx million units by 2033.

- CAGR: The projected CAGR for the forecast period (2025-2033) is xx%.

- Adoption Rates: E-cigarette adoption is growing at a faster rate than traditional cigarette consumption.

- Technological Disruptions: Automation in manufacturing and the emergence of HTPs have transformed production and product design.

- Consumer Behavior Shifts: Increased awareness of health risks is driving a segment of consumers towards HTPs and e-cigarettes.

Dominant Regions, Countries, or Segments in Egypt Tobacco Market

The Egyptian tobacco market is predominantly concentrated in urban areas. Cigarettes remain the dominant product type, accounting for approximately xx% of the market in 2025. The male segment represents the largest end-user group. Supermarket/hypermarkets and convenience stores are the primary distribution channels.

- Product Type: Cigarettes (xx%), followed by e-cigarettes/HTPs (xx%).

- End User: Male (xx%) significantly outweighs the female segment (xx%).

- Distribution Channel: Supermarket/Hypermarkets (xx%) and Convenience Stores (xx%) account for the largest share of sales.

- Key Drivers: Population density, disposable income levels, and existing infrastructure influence market dominance.

The growth potential lies primarily in the expansion of e-cigarettes/HTPs, leveraging increasing consumer interest in less harmful alternatives and focusing on rural penetration of distribution networks.

Egypt Tobacco Market Product Landscape

The Egyptian tobacco market offers a variety of cigarette brands, with a growing presence of HTPs and e-cigarettes from international players and local manufacturers. Innovation focuses on flavor profiles, product design, and technological advancements in HTPs to enhance user experience and reduce perceived harm. Key selling propositions include brand recognition, taste, and perceived value for traditional cigarettes and reduced harm claims for alternatives.

Key Drivers, Barriers & Challenges in Egypt Tobacco Market

Key Drivers:

- Rising Disposable Incomes and Urbanization: An increasing segment of the urban population in Egypt is experiencing a rise in disposable incomes, leading to greater purchasing power and a corresponding increase in tobacco consumption, particularly among younger demographics.

- Growth of Heated Tobacco Products (HTPs) and New-Generation Products (NGPs): The market is witnessing a significant surge in the popularity of HTPs and other NGPs. These innovative products offer consumers alternatives to traditional cigarettes and are driving new avenues for market expansion and revenue growth.

- Strategic Alliances and International Collaboration: Collaborations between established international tobacco companies and local Egyptian manufacturers are proving instrumental. These partnerships foster the introduction of new products, enhance distribution networks, and drive innovation within the sector.

Key Barriers & Challenges:

- Evolving Regulatory Landscape and Taxation: The Egyptian government continues to implement and revise stringent regulations concerning tobacco products, including significant increases in taxation. These measures, while aimed at public health, present a considerable challenge to market growth and profitability for legal manufacturers.

- Growing Health Consciousness and Public Health Initiatives: A heightened awareness of the health risks associated with tobacco consumption is leading to a gradual decrease in usage among certain consumer segments. Public health campaigns and a greater emphasis on healthier lifestyles are contributing to this trend.

- Prevalence of Illicit Tobacco Trade: The significant presence of illicit and untaxed tobacco products poses a substantial threat to the legitimate market. It is estimated that illicit tobacco could account for approximately XX% of the market by 2025, directly impacting the revenue streams of legal manufacturers and undermining their market share.

Emerging Opportunities in Egypt Tobacco Market

The dynamic Egyptian tobacco market offers a fertile ground for strategic growth and innovation. Key opportunities include:

- Untapped Consumer Segments for E-cigarettes and HTPs: A substantial opportunity exists in expanding the reach of e-cigarettes and HTPs into underserved or emerging consumer segments, particularly in regions with growing disposable incomes and a propensity for adopting new technologies.

- Localization of HTP Development: Developing HTPs specifically tailored to the unique preferences and cultural nuances of Egyptian consumers presents a significant advantage. This could involve catering to specific flavor profiles, device designs, or price points.

- Expansion of Distribution Channels in Rural Areas: While urban centers are well-served, there is considerable potential for growth by establishing and optimizing distribution networks in rural and semi-urban areas, bringing a wider range of products to previously inaccessible markets.

- Investment in Research and Development for Reduced-Risk Products: As global trends shift towards harm reduction, investing in the research and development of next-generation products with potentially reduced risks compared to traditional cigarettes can position companies for future market leadership.

Growth Accelerators in the Egypt Tobacco Market Industry

The sustained long-term growth of the Egypt tobacco market is anticipated to be propelled by a multifaceted approach. Strategic partnerships will continue to be a cornerstone, fostering synergy and market penetration. A pivotal growth accelerator will be the diversification of product portfolios towards less harmful alternatives, including a significant emphasis on Heated Tobacco Products (HTPs) and e-cigarettes. Expanding into new and emerging consumer segments, particularly those with growing disposable incomes, will unlock further potential. Technological advancements in HTPs and e-cigarettes will not only drive innovation but also create new market categories. Crucially, the effective communication and marketing of harm reduction benefits associated with these newer products will be essential in shaping consumer perception and driving adoption, while navigating the regulatory environment.

Key Players Shaping the Egypt Tobacco Market Market

- Japan Tobacco International SA

- British American Tobacco PLC

- Philip Morris International Inc

- Joyetech Group

- Eastern Company SAE

- Innokin Technology Co Ltd

- J Well France SARL

- Imperial Brands PLC

Notable Milestones in Egypt Tobacco Market Sector

- December 2021: Eastern Company and Al-Mansour International Distribution Company forged a strategic distribution agreement for the novel Davidoff Evolve cigarettes, signaling a commitment to expanding the availability of modern tobacco products.

- June 2022: Philip Morris International made a significant commitment to the Egyptian market by securing a new license to manufacture both traditional and electronic cigarettes, underscoring their long-term investment strategy with a substantial USD 450 million capital injection.

- September 2022: Philip Morris's subsidiary, United Tobacco Company (UTC), commenced local manufacturing operations for the Egyptian market, marking a crucial step in localizing production and further strengthening their presence within the country.

In-Depth Egypt Tobacco Market Market Outlook

The Egyptian tobacco market presents significant long-term growth potential, driven by the increasing adoption of e-cigarettes and HTPs, and strategic investments by major players. The market's future success will hinge on adapting to evolving consumer preferences, navigating the regulatory landscape, and addressing health concerns effectively. Opportunities for innovative product development and expansion into new segments will be key drivers of future market growth.

Egypt Tobacco Market Segmentation

-

1. Product Type

- 1.1. Cigarettes

- 1.2. Cigar, Cigarillos, and Cigar Pipes

- 1.3. E-Cigarette/HTP's

-

2. End User

- 2.1. Male

- 2.2. Female

-

3. Distribution Channel

- 3.1. Supermarket/Hypermarket

- 3.2. Convenience/Small Grocery Stores

- 3.3. Specialty/Tobacco Stores

- 3.4. Other Distribution Channels

Egypt Tobacco Market Segmentation By Geography

- 1. Egypt

Egypt Tobacco Market Regional Market Share

Geographic Coverage of Egypt Tobacco Market

Egypt Tobacco Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Consumption of Cigarettes across the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Tobacco Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cigarettes

- 5.1.2. Cigar, Cigarillos, and Cigar Pipes

- 5.1.3. E-Cigarette/HTP's

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/Hypermarket

- 5.3.2. Convenience/Small Grocery Stores

- 5.3.3. Specialty/Tobacco Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Tobacco International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 British American Tobacco PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philip Morris International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Joyetech Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eastern Company SAE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Innokin Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 J Well France SARL*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Imperial Brands PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Japan Tobacco International SA

List of Figures

- Figure 1: Egypt Tobacco Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Egypt Tobacco Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Tobacco Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Tobacco Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Egypt Tobacco Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Egypt Tobacco Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Egypt Tobacco Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Egypt Tobacco Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 7: Egypt Tobacco Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Egypt Tobacco Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Tobacco Market?

The projected CAGR is approximately 7.16%.

2. Which companies are prominent players in the Egypt Tobacco Market?

Key companies in the market include Japan Tobacco International SA, British American Tobacco PLC, Philip Morris International Inc, Joyetech Group, Eastern Company SAE, Innokin Technology Co Ltd, J Well France SARL*List Not Exhaustive, Imperial Brands PLC.

3. What are the main segments of the Egypt Tobacco Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network.

6. What are the notable trends driving market growth?

Rising Consumption of Cigarettes across the Country.

7. Are there any restraints impacting market growth?

Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Philip Morris announced that its United Tobacco Co. (UTC) subsidiary would begin manufacturing its products for the Egyptian market. Philip Morris' cigarettes will continue to be manufactured by Eastern Co. until its production stock is depleted.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Tobacco Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Tobacco Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Tobacco Market?

To stay informed about further developments, trends, and reports in the Egypt Tobacco Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence