Key Insights

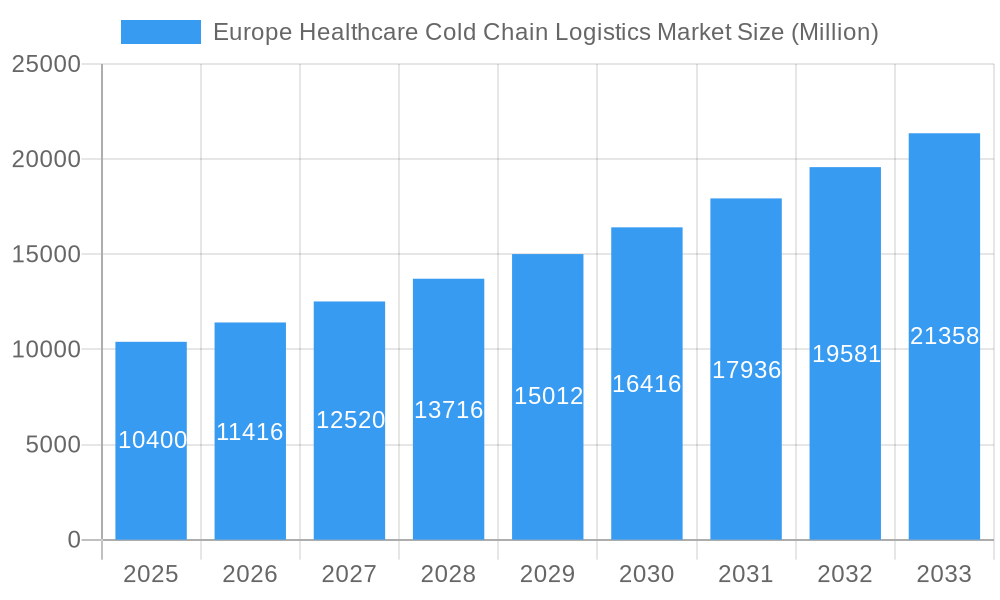

The European healthcare cold chain logistics market is experiencing robust growth, projected to reach €10.40 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.69% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of temperature-sensitive pharmaceuticals, including biologics, vaccines, and clinical trial materials, necessitates sophisticated cold chain solutions for their safe and efficient transportation and storage. Furthermore, stringent regulatory requirements regarding product integrity and patient safety are pushing the market toward advanced technologies and robust quality control measures. The rise in outsourcing of logistics functions by pharmaceutical companies and a growing emphasis on efficient supply chain management also contribute significantly to market growth. Germany, France, and Spain represent major markets within Europe, driven by their strong pharmaceutical industries and advanced healthcare infrastructure. The market is segmented by services (transportation, storage, value-added services like packaging and labeling), product type, and end-user, indicating diverse growth opportunities across various segments. Competition is relatively high, with established players like DB Schenker, DHL, and Kuehne + Nagel alongside specialized cold chain logistics providers like Marken and Biocair vying for market share. Ongoing technological advancements in temperature-controlled containers, monitoring systems, and data analytics are expected to further optimize the efficiency and reliability of the cold chain, supporting the sustained market growth throughout the forecast period.

Europe Healthcare Cold Chain Logistics Market Market Size (In Billion)

The market's growth trajectory reflects the growing demand for specialized services, particularly value-added services. Increased investments in infrastructure and technology, including investments in sustainable cold chain solutions, are anticipated to enhance operational efficiency and reduce environmental impact. The expansion of e-commerce within the healthcare sector, albeit still developing in comparison to other sectors, represents a potential avenue for future market growth, though it requires further attention to the specific challenges in transporting highly sensitive medical products directly to consumers. The continued focus on patient safety and regulatory compliance will remain paramount, shaping market dynamics and driving technological innovation within the European healthcare cold chain logistics sector in the coming years.

Europe Healthcare Cold Chain Logistics Market Company Market Share

Europe Healthcare Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Healthcare Cold Chain Logistics Market, encompassing market dynamics, growth trends, dominant segments, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) to project future market trends and opportunities. The market is segmented by country (Germany, France, Spain, Rest of Europe), product (Biopharmaceuticals, Vaccines, Clinical Trial Materials), services (Transportation, Storage, Value Added Services – Packaging and Labeling), and end-user (Hospitals, Clinics, Pharmaceuticals, Biopharmaceutical, Biotechnology companies). The market size is presented in Million units.

Europe Healthcare Cold Chain Logistics Market Dynamics & Structure

The European healthcare cold chain logistics market is characterized by moderate concentration, with key players like DB Schenker, DHL, Marken Ltd, and Kuehne + Nagel holding significant market share (estimated xx%). However, the market also accommodates numerous smaller, specialized players. Technological innovation, particularly in temperature-controlled packaging and monitoring technologies, is a key driver. Stringent regulatory frameworks, including GDP (Good Distribution Practice) guidelines, shape operational practices and necessitate significant investment in compliance. Competitive pressure arises from substitute technologies and services, while the market also faces challenges from potential supply chain disruptions, exemplified by the recent global events. Mergers and acquisitions (M&A) activity is relatively frequent, with xx deals recorded in the past five years, indicating consolidation trends within the sector. End-user demographics, primarily driven by an aging population and increasing prevalence of chronic diseases, fuel market demand.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Technological Innovation: Focus on real-time monitoring, advanced packaging, and automation.

- Regulatory Framework: Stringent GDP guidelines and evolving regulations influencing market dynamics.

- Competitive Substitutes: Emergence of alternative transportation and storage solutions.

- End-User Demographics: Aging population and rise in chronic diseases driving demand.

- M&A Trends: xx M&A deals in the past five years, signaling industry consolidation.

Europe Healthcare Cold Chain Logistics Market Growth Trends & Insights

The European healthcare cold chain logistics market exhibited a CAGR of xx% during 2019-2024, reaching a market size of xx Million units in 2024. This growth is propelled by factors such as increasing demand for temperature-sensitive pharmaceuticals, rising investments in healthcare infrastructure, and advancements in cold chain technologies. Adoption rates for advanced tracking and monitoring systems are increasing steadily, driven by the need for enhanced product security and regulatory compliance. Technological disruptions, such as the introduction of IoT-enabled sensors and AI-powered predictive maintenance, are transforming market dynamics and improving operational efficiency. Consumer behavior shifts, with a growing preference for personalized medicine and specialized therapies requiring enhanced cold chain solutions, further fuel market growth. The forecast period (2025-2033) projects a CAGR of xx%, indicating continued market expansion.

Dominant Regions, Countries, or Segments in Europe Healthcare Cold Chain Logistics Market

Germany, France, and Spain constitute the largest national markets within the European healthcare cold chain logistics sector, collectively commanding a significant portion of the overall market value. Germany's robust pharmaceutical industry, coupled with its advanced logistics infrastructure, contributes substantially to its market leadership. France's commitment to innovation and its stringent regulatory environment further fuels market expansion. While Spain's growth may be comparatively slower than Germany and France, it presents substantial untapped potential. Analyzing the product segment reveals that biopharmaceuticals represent the most significant share, followed by vaccines and clinical trial materials. The transportation service segment holds the largest market share, driven by Europe's extensive geographical expanse and complex, multi-modal distribution networks. Hospitals and pharmaceutical companies remain the primary end-users of these services.

- Key Drivers (Germany): Strong pharmaceutical manufacturing base, sophisticated logistics infrastructure, high regulatory standards.

- Key Drivers (France): High R&D investment in pharmaceutical and biotechnological advancements, stringent regulatory compliance, significant government support for the sector.

- Key Drivers (Spain): A growing pharmaceutical sector, increasing demand driven by medical tourism, and a developing network of specialized cold chain logistics providers.

- Key Drivers (Biopharmaceuticals): High product value, stringent temperature-sensitive requirements necessitating specialized handling and transportation.

- Key Drivers (Transportation): Extensive and complex distribution networks across diverse geographical terrains, the urgent need for efficient and reliable delivery systems across diverse geographical terrains and varying climates.

- Key Drivers (Hospitals): Large-scale storage and distribution needs, increasing demand for efficient inventory management and timely delivery of temperature-sensitive medications and biological samples.

Europe Healthcare Cold Chain Logistics Market Product Landscape

The product landscape is marked by continuous innovation in temperature-controlled packaging, incorporating passive and active solutions. Passive containers rely on insulation materials to maintain temperature stability, while active systems utilize refrigeration units or phase-change materials. Advanced monitoring systems, employing GPS trackers and temperature sensors, are integrated into packaging solutions to ensure product integrity and compliance. Unique selling propositions frequently involve superior insulation capabilities, enhanced data logging features, or specialized solutions for specific products (e.g., vaccines requiring ultra-low temperatures).

Key Drivers, Barriers & Challenges in Europe Healthcare Cold Chain Logistics Market

Key Drivers: Rising demand for temperature-sensitive pharmaceuticals, stringent regulatory compliance requirements, and advancements in cold chain technologies are driving market growth. Growing investments in healthcare infrastructure, particularly in emerging markets across Europe, support the expansion of cold chain logistics. Government initiatives and incentives promoting pharmaceutical innovation further propel the market.

Key Challenges: Maintaining consistent temperature control throughout the supply chain poses a significant challenge. Regulatory hurdles and compliance costs can be substantial. Competition is intense, with numerous players vying for market share. Supply chain disruptions, as seen recently with geopolitical events, can cause delays and impact product integrity.

Emerging Opportunities in Europe Healthcare Cold Chain Logistics Market

Significant untapped market potential exists within smaller European countries, representing a substantial opportunity for growth and expansion. The market is further shaped by specialized cold chain solutions tailored to emerging therapies, such as cell and gene therapies, which require exceptionally stringent temperature control and handling protocols. The integration of blockchain technology offers a promising avenue for enhanced traceability and security of pharmaceutical products throughout the cold chain, increasing transparency and reducing the risk of counterfeiting. The growing trend toward personalized medicine creates additional demand for specialized, patient-centric cold chain services.

Growth Accelerators in the Europe Healthcare Cold Chain Logistics Market Industry

Technological advancements, such as the Internet of Things (IoT) and artificial intelligence (AI), are acting as crucial growth catalysts. These technologies enable real-time monitoring of temperature and other critical parameters, predictive maintenance of cold chain equipment, and enhanced overall efficiency. Strategic alliances and partnerships between logistics providers and pharmaceutical companies are fostering innovation and facilitating the optimization of supply chain operations. Market expansion into underserved regions and countries across Europe continues to open new avenues for growth and diversification of the market.

Key Players Shaping the Europe Healthcare Cold Chain Logistics Market Market

- DB Schenker

- DHL

- Marken Ltd

- Cavalier Logistics

- Alloga

- Kuehne + Nagel

- Envirotainer

- Carrier Transicold

- Primafrio

- Biocair

- And 73 other companies

Notable Milestones in Europe Healthcare Cold Chain Logistics Market Sector

- 2021: Marken Ltd. introduced innovative temperature-controlled packaging solutions enhancing product protection and efficiency.

- 2022: DHL invested significantly in expanding its cold chain infrastructure across Europe, strengthening its network and capacity.

- 2023: The market witnessed several mergers and acquisitions, leading to increased market consolidation and reshaping the competitive landscape. (Further details on specific transactions require additional research).

In-Depth Europe Healthcare Cold Chain Logistics Market Market Outlook

The future of the European healthcare cold chain logistics market appears bright, driven by technological advancements, increasing demand for temperature-sensitive pharmaceuticals, and expanding healthcare infrastructure. Strategic partnerships and investments in innovative solutions will be crucial for sustained growth. The market is poised for further consolidation through M&A activities. The continued focus on enhancing supply chain resilience and addressing the challenges posed by climate change will shape future market dynamics. The forecast projects continued expansion, reaching a market size of xx Million units by 2033.

Europe Healthcare Cold Chain Logistics Market Segmentation

-

1. Product

- 1.1. Biopharmaceuticals

- 1.2. Vaccines

- 1.3. Clinical Trial Materials

-

2. Services

- 2.1. Transportation

- 2.2. Storage

- 2.3. Value Added Services (Packaging and Labeling)

-

3. End User

- 3.1. Hospitals, Clinics and Pharmaceuticals

- 3.2. Biopharmaceutical

- 3.3. Biotechnology

Europe Healthcare Cold Chain Logistics Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Healthcare Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Europe Healthcare Cold Chain Logistics Market

Europe Healthcare Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Vaccine Distribution; Growing Pharmaceutical and Biotechnology Industries

- 3.3. Market Restrains

- 3.3.1. High Initial Capital Investment; Risk of Temperature Excursions

- 3.4. Market Trends

- 3.4.1. The OTC Pharmaceuticals Consumption is Projected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Healthcare Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Biopharmaceuticals

- 5.1.2. Vaccines

- 5.1.3. Clinical Trial Materials

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Transportation

- 5.2.2. Storage

- 5.2.3. Value Added Services (Packaging and Labeling)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals, Clinics and Pharmaceuticals

- 5.3.2. Biopharmaceutical

- 5.3.3. Biotechnology

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marken Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cavalier Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alloga

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Envirotainer**List Not Exhaustive 7 3 Other Companie

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Carrier Transicold

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Primafrio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Biocair

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe Healthcare Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Healthcare Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 3: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 7: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Healthcare Cold Chain Logistics Market?

The projected CAGR is approximately 9.69%.

2. Which companies are prominent players in the Europe Healthcare Cold Chain Logistics Market?

Key companies in the market include DB Schenker, DHL, Marken Ltd, Cavalier Logistics, Alloga, Kuehne + Nagel, Envirotainer**List Not Exhaustive 7 3 Other Companie, Carrier Transicold, Primafrio, Biocair.

3. What are the main segments of the Europe Healthcare Cold Chain Logistics Market?

The market segments include Product, Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Vaccine Distribution; Growing Pharmaceutical and Biotechnology Industries.

6. What are the notable trends driving market growth?

The OTC Pharmaceuticals Consumption is Projected to Grow Significantly.

7. Are there any restraints impacting market growth?

High Initial Capital Investment; Risk of Temperature Excursions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Healthcare Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Healthcare Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Healthcare Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Europe Healthcare Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence