Key Insights

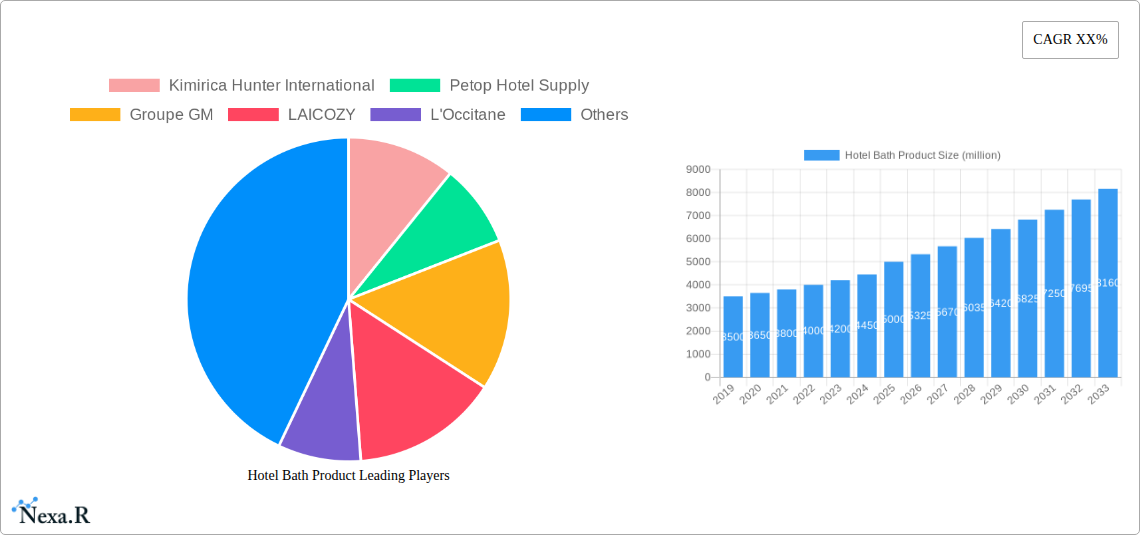

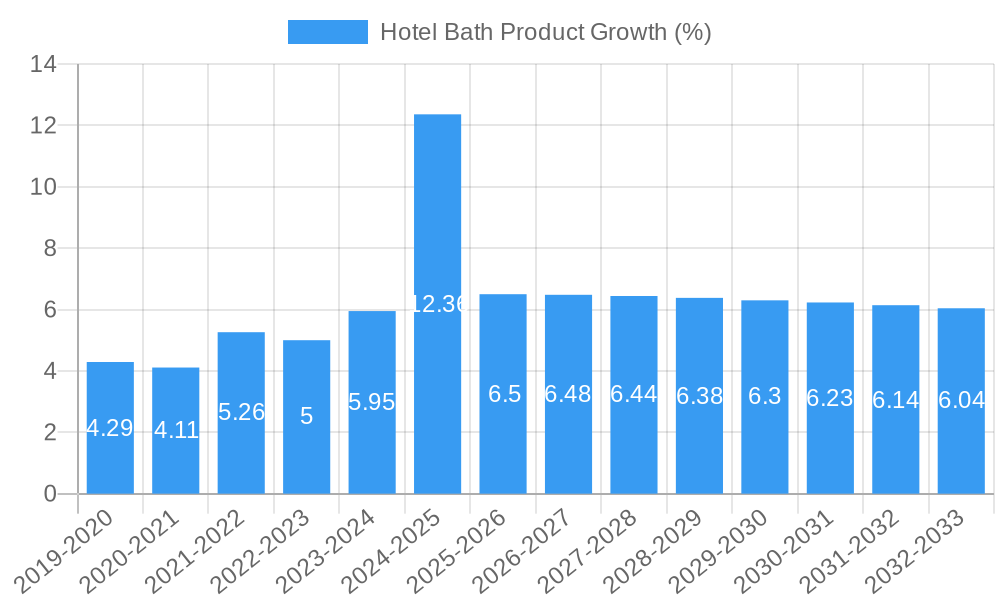

The global Hotel Bath Product market is poised for significant expansion, projected to reach an estimated market size of $5,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% expected throughout the forecast period of 2025-2033. This growth is primarily propelled by the escalating demand for premium and personalized guest experiences in the hospitality sector. As travelers increasingly seek comfort and luxury, hotels are investing heavily in high-quality, branded, and often eco-friendly bath amenities. The rise of boutique hotels and the growing emphasis on sustainable and natural ingredients are further fueling this trend, encouraging manufacturers to innovate with organic, paraben-free, and cruelty-free product lines. Furthermore, the expanding global tourism industry, particularly in emerging economies, is creating new avenues for market penetration and revenue generation. The COVID-19 pandemic, while initially disruptive, has also underscored the importance of hygiene and guest well-being, leading to increased attention on the quality and presentation of in-room amenities.

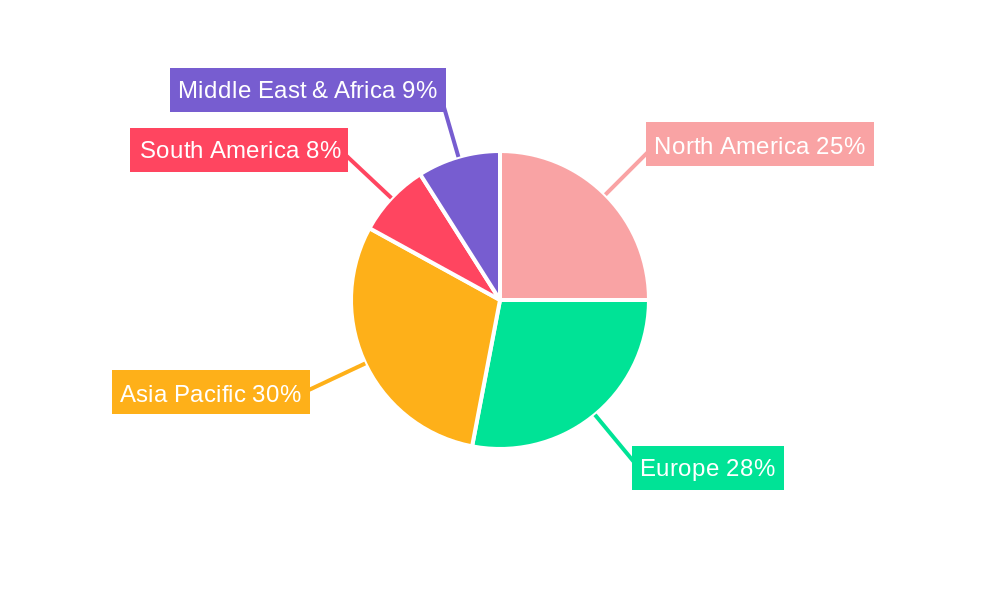

The market is characterized by diverse product offerings, catering to a wide spectrum of hospitality segments, from budget-friendly hostels to ultra-luxury hotels. Key applications include family rooms, hostels, hotels, and other accommodation types, with a prominent demand for shampoos, conditioners, and shower gels. The competitive landscape is populated by a mix of established global players and emerging regional brands, each vying for market share through product differentiation, strategic partnerships, and a focus on sustainability. Restraints, such as the fluctuating raw material costs and intense price competition, are present, but the overarching drive towards enhanced guest satisfaction and the growing consciousness around personal care and environmental impact are expected to outweigh these challenges. The Asia Pacific region, driven by rapid economic development and a burgeoning tourism sector, is anticipated to be a key growth engine, alongside established markets in North America and Europe, which continue to innovate in product formulation and packaging.

This comprehensive report provides an in-depth analysis of the global hotel bath product market, offering crucial insights for industry stakeholders. The study covers the historical period from 2019 to 2024, with the base year at 2025 and a detailed forecast for 2025–2033. We explore market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, opportunities, and the pivotal roles of leading companies.

Hotel Bath Product Market Dynamics & Structure

The global hotel bath product market is characterized by a moderately concentrated structure, with a mix of large, established players and numerous smaller, niche manufacturers. Technological innovation plays a significant role, particularly in the development of eco-friendly packaging, natural ingredients, and personalized guest experiences. Regulatory frameworks, focusing on product safety, ingredient disclosure, and sustainability, are increasingly influencing product formulations and supply chains. Competitive product substitutes include bulk dispensers, which offer cost savings but can compromise guest perception, and in-room amenities provided by guests themselves. End-user demographics are shifting, with a growing demand for premium, sustainable, and health-conscious bath products from millennial and Gen Z travelers. Mergers and acquisitions (M&A) activity is expected to continue, driven by the pursuit of market expansion, access to new technologies, and economies of scale. For instance, the acquisition of smaller sustainable brands by larger conglomerates can significantly alter market share dynamics. Key innovation drivers include the demand for sustainable packaging, leading to a projected 2.5% CAGR in the adoption of biodegradable materials. Barriers to innovation often stem from stringent product testing requirements and the need for cost-effective scaling of novel formulations.

- Market Concentration: Moderate, with a blend of global and regional players.

- Technological Innovation: Focus on sustainability (biodegradable packaging, natural ingredients), smart dispensing, and luxury formulations.

- Regulatory Frameworks: Emphasis on product safety, ingredient transparency (e.g., REACH compliance), and environmental standards.

- Competitive Substitutes: Bulk dispensers, guest-provided amenities, and multi-functional personal care products.

- End-User Demographics: Increasing demand from younger demographics for premium, sustainable, and allergen-free options.

- M&A Trends: Driven by market consolidation, diversification, and the acquisition of innovative smaller firms.

Hotel Bath Product Growth Trends & Insights

The global hotel bath product market is poised for significant growth, projected to reach an estimated value of $18.7 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period of 2025–2033. This expansion is fueled by a resurgence in global travel and a heightened focus on guest experience within the hospitality sector. The adoption rate of premium and eco-friendly bath amenities is steadily increasing, driven by consumer awareness and hotel chains' commitment to sustainability. Technological disruptions, such as the integration of smart dispensing systems and the use of advanced natural ingredient extraction techniques, are further enhancing product offerings and operational efficiency. Consumer behavior shifts are evident, with a growing preference for personalized, high-quality, and ethically sourced bath products. Travelers are increasingly willing to pay a premium for amenities that align with their values, such as vegan, cruelty-free, and organic formulations. The market penetration of specialized bath products, catering to specific needs like sensitive skin or aromatherapy benefits, is also on the rise. The average consumer now spends an estimated $35 per room night on in-room amenities, a figure expected to climb by 7% annually. This trend is particularly pronounced in the luxury and boutique hotel segments, where branded and customized amenities are becoming a key differentiator. The rise of wellness tourism is also contributing to the demand for bath products infused with essential oils and therapeutic properties. Furthermore, the increasing emphasis on hygiene and cleanliness post-pandemic has reinforced the importance of well-appointed and high-quality in-room bath amenities. The market is also witnessing a trend towards smaller, more sustainable packaging formats, with refillable options gaining traction. This shift is not only driven by environmental concerns but also by a desire to reduce waste and enhance the aesthetic appeal of guest bathrooms. The overall market size is projected to reach $29.5 billion by 2033.

Dominant Regions, Countries, or Segments in Hotel Bath Product

The Hotel segment, within the Application category, is the primary driver of growth in the global hotel bath product market. This segment is projected to account for a significant 65% of the total market share by 2025, driven by the sheer volume of hotel establishments worldwide and the continuous demand for in-room amenities. The Asia Pacific region is emerging as the fastest-growing geographical market, expected to witness a CAGR of 7.2% during the forecast period. This growth is attributed to rapid infrastructure development in the hospitality sector, increasing tourist arrivals, and a rising middle class with a greater propensity to travel and demand premium hotel services. Countries like China, India, and Southeast Asian nations are leading this expansion, fueled by government initiatives promoting tourism and foreign investment.

- Dominant Application Segment: Hotel (estimated 65% market share in 2025).

- Key Drivers: High occupancy rates, brand differentiation through amenities, demand for premium guest experiences.

- Growth Potential: Continual expansion of hotel chains and independent hotels globally.

- Dominant Type Segment: Shower Gel (projected 30% market share in 2025), followed closely by Shampoo (28%) and Conditioner (25%).

- Key Drivers: High usage frequency, broad consumer appeal, established product formulations.

- Growth Potential: Innovation in formulations (e.g., sulfate-free, natural ingredients) and sustainable packaging.

- Fastest Growing Region: Asia Pacific (estimated CAGR of 7.2%).

- Key Drivers: Robust tourism growth, significant investment in hotel infrastructure, increasing disposable incomes, and a growing middle class.

- Market Share (Asia Pacific): Projected to grow from 22% in 2025 to 28% by 2033.

- Key Countries in Asia Pacific: China, India, Thailand, Vietnam.

- Factors: Government support for tourism, development of new hotel brands, and increasing adoption of international hospitality standards.

- North America & Europe: Remain mature but stable markets with a strong emphasis on luxury and sustainable offerings.

- Key Drivers: High per capita spending on travel, strong brand loyalty, and established eco-conscious consumer bases.

Hotel Bath Product Product Landscape

The hotel bath product landscape is continually evolving with a strong emphasis on premiumization and sustainability. Innovations are centered around natural and organic ingredients, offering benefits such as enhanced skin conditioning and aromatherapy. Brands are increasingly adopting cruelty-free and vegan formulations, aligning with ethical consumer preferences. Unique selling propositions often lie in the distinct scent profiles, luxurious textures, and the use of rare or regionally sourced ingredients. For example, the introduction of solid shampoo bars and refillable dispenser systems represents a significant technological advancement in reducing plastic waste by an estimated 30%. Performance metrics are being redefined to include not only efficacy but also environmental impact and guest satisfaction scores, with specialized formulations targeting sensitive skin or offering therapeutic properties.

Key Drivers, Barriers & Challenges in Hotel Bath Product

Key Drivers:

- Resurgent Global Tourism: Increased travel is directly correlating with higher demand for in-room amenities.

- Focus on Guest Experience: Hotels are leveraging high-quality bath products as a differentiator to enhance guest satisfaction and loyalty.

- Growing Demand for Sustainable Products: A significant shift towards eco-friendly packaging, natural ingredients, and ethical sourcing is driving innovation.

- Rise of Wellness Tourism: Increased interest in products offering aromatherapy, relaxation, and natural healing properties.

- Technological Advancements: Innovations in formulations, dispensing systems, and sustainable packaging are creating new market opportunities.

Barriers & Challenges:

- Cost Sensitivity: Hotels, especially budget segments, often prioritize cost-effectiveness, which can limit the adoption of premium or niche products. The average cost increase for sustainable packaging can be 15%, impacting overall amenity budgets.

- Supply Chain Volatility: Global supply chain disruptions can affect the availability and pricing of raw materials, impacting production and delivery.

- Regulatory Compliance: Meeting diverse international regulations for product ingredients, labeling, and safety can be complex and costly.

- Intense Competition: A crowded market with numerous players vying for hotel contracts leads to price pressures and the need for continuous differentiation.

- Consumer Perceptions of Bulk Dispensers: While cost-effective, bulk dispensers can sometimes be perceived as less hygienic or luxurious by guests, posing a challenge for their widespread adoption in higher-tier hotels.

Emerging Opportunities in Hotel Bath Product

Emerging opportunities lie in the continued expansion of personalized amenity offerings, catering to specific guest needs and preferences through customized formulations and scent options. The growing demand for travel-sized and miniature luxury bath products presents a significant untapped market within hotel gift shops and direct-to-consumer channels. Furthermore, the development of smart hotel rooms, integrating automated amenity replenishment systems and personalized product recommendations based on guest profiles, offers a unique avenue for growth. The focus on "clean beauty" and "wellness" within bath products, featuring plant-based ingredients, essential oils, and minimal chemical formulations, is a rapidly expanding niche that hotels can leverage to attract health-conscious travelers. The potential for partnerships between hotel chains and niche, high-end cosmetic brands for exclusive amenity lines is also a promising avenue.

Growth Accelerators in the Hotel Bath Product Industry

Long-term growth in the hotel bath product industry is being significantly accelerated by strategic partnerships between hotel groups and established or emerging cosmetic brands, creating exclusive co-branded amenity lines that enhance brand value and guest appeal. Technological breakthroughs in sustainable ingredient sourcing and production, such as upcycling byproducts from other industries, are not only reducing environmental impact but also offering cost efficiencies. Furthermore, market expansion strategies focused on emerging economies with rapidly growing tourism sectors, coupled with a rising middle class, are crucial growth accelerators. The increasing adoption of direct-to-consumer (DTC) models by some hotel amenity suppliers, allowing them to tap into individual consumer markets and gather valuable feedback, also fuels innovation and growth.

Key Players Shaping the Hotel Bath Product Market

- Kimirica Hunter International

- Petop Hotel Supply

- Groupe GM

- LAICOZY

- L'Occitane

- VOSHON International Company

- Ecoway

- ADA Cosmetics International

- Dolphin Enterprise

- Shanti Enterprises

- LMZ (Jiangsu) Industrial

- Guest Supply

- La Bottega

- Vanity Group

- Ming Fai

- Kracie

- POLA

- Asprey

- Aromatherapy Associates

- Aveda

- C.O. Bigelow

- June Jacobs

- MALIN+GOETZ

- Pharmacopia

Notable Milestones in Hotel Bath Product Sector

- 2019: Increased adoption of plant-based and organic ingredients in hotel amenities, driven by consumer demand for natural products.

- 2020: Surge in demand for individually packaged, high-hygiene amenities due to the global pandemic.

- 2021: Greater emphasis on sustainable packaging solutions, including refillable dispensers and biodegradable materials, gaining traction among eco-conscious hotel brands.

- 2022: Introduction of smart dispensing systems in select luxury hotels, offering personalized product selection and usage tracking.

- 2023: Expansion of niche amenity offerings, such as aromatherapy-focused products and allergen-free options, to cater to specific wellness needs.

- 2024: Growing number of M&A activities as larger hospitality suppliers acquire smaller, innovative eco-friendly amenity brands.

In-Depth Hotel Bath Product Market Outlook

- 2019: Increased adoption of plant-based and organic ingredients in hotel amenities, driven by consumer demand for natural products.

- 2020: Surge in demand for individually packaged, high-hygiene amenities due to the global pandemic.

- 2021: Greater emphasis on sustainable packaging solutions, including refillable dispensers and biodegradable materials, gaining traction among eco-conscious hotel brands.

- 2022: Introduction of smart dispensing systems in select luxury hotels, offering personalized product selection and usage tracking.

- 2023: Expansion of niche amenity offerings, such as aromatherapy-focused products and allergen-free options, to cater to specific wellness needs.

- 2024: Growing number of M&A activities as larger hospitality suppliers acquire smaller, innovative eco-friendly amenity brands.

In-Depth Hotel Bath Product Market Outlook

The future of the hotel bath product market is exceptionally bright, driven by a confluence of factors including sustained global travel recovery and an unwavering focus on enhancing the guest experience. Growth accelerators such as innovative sustainable packaging solutions, like the projected 20% increase in refillable dispenser adoption by 2028, and the continued integration of natural and ethically sourced ingredients will be paramount. Strategic alliances between hotel chains and premium cosmetic brands will further solidify brand loyalty and introduce novel product lines. The market is poised for significant expansion in emerging economies, where increasing disposable incomes and a burgeoning middle class are fueling demand for elevated hospitality services. Future opportunities lie in harnessing data analytics for hyper-personalized amenity offerings and leveraging smart technology for efficient inventory management and guest engagement. The industry is on track to not only meet but exceed current growth projections, presenting lucrative prospects for stakeholders committed to innovation and sustainability.

Hotel Bath Product Segmentation

-

1. Application

- 1.1. Family

- 1.2. Hostel

- 1.3. Hotel

- 1.4. Others

-

2. Types

- 2.1. Shampoo

- 2.2. Conditioner

- 2.3. Shower Gel

- 2.4. Others

Hotel Bath Product Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hotel Bath Product REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hotel Bath Product Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Family

- 5.1.2. Hostel

- 5.1.3. Hotel

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Shampoo

- 5.2.2. Conditioner

- 5.2.3. Shower Gel

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Hotel Bath Product Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Family

- 6.1.2. Hostel

- 6.1.3. Hotel

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Shampoo

- 6.2.2. Conditioner

- 6.2.3. Shower Gel

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Hotel Bath Product Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Family

- 7.1.2. Hostel

- 7.1.3. Hotel

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Shampoo

- 7.2.2. Conditioner

- 7.2.3. Shower Gel

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Hotel Bath Product Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Family

- 8.1.2. Hostel

- 8.1.3. Hotel

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Shampoo

- 8.2.2. Conditioner

- 8.2.3. Shower Gel

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Hotel Bath Product Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Family

- 9.1.2. Hostel

- 9.1.3. Hotel

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Shampoo

- 9.2.2. Conditioner

- 9.2.3. Shower Gel

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Hotel Bath Product Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Family

- 10.1.2. Hostel

- 10.1.3. Hotel

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Shampoo

- 10.2.2. Conditioner

- 10.2.3. Shower Gel

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Kimirica Hunter International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Petop Hotel Supply

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Groupe GM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LAICOZY

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 L'Occitane

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VOSHON International Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ecoway

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ADA Cosmetics International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dolphin Enterprise

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shanti Enterprises

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LMZ (Jiangsu) Industrial

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Guest Supply

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 La Bottega

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Vanity Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ming Fai

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Kracie

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 POLA

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Asprey

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Aromatherapy Associates

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Aveda

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 C.O. Bigelow

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 June Jacobs

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 MALIN+GOETZ

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Pharmacopia

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 Kimirica Hunter International

List of Figures

- Figure 1: Global Hotel Bath Product Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Hotel Bath Product Revenue (million), by Application 2024 & 2032

- Figure 3: North America Hotel Bath Product Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Hotel Bath Product Revenue (million), by Types 2024 & 2032

- Figure 5: North America Hotel Bath Product Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Hotel Bath Product Revenue (million), by Country 2024 & 2032

- Figure 7: North America Hotel Bath Product Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Hotel Bath Product Revenue (million), by Application 2024 & 2032

- Figure 9: South America Hotel Bath Product Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Hotel Bath Product Revenue (million), by Types 2024 & 2032

- Figure 11: South America Hotel Bath Product Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Hotel Bath Product Revenue (million), by Country 2024 & 2032

- Figure 13: South America Hotel Bath Product Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Hotel Bath Product Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Hotel Bath Product Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Hotel Bath Product Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Hotel Bath Product Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Hotel Bath Product Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Hotel Bath Product Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Hotel Bath Product Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Hotel Bath Product Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Hotel Bath Product Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Hotel Bath Product Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Hotel Bath Product Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Hotel Bath Product Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Hotel Bath Product Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Hotel Bath Product Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Hotel Bath Product Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Hotel Bath Product Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Hotel Bath Product Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Hotel Bath Product Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hotel Bath Product Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Hotel Bath Product Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Hotel Bath Product Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Hotel Bath Product Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Hotel Bath Product Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Hotel Bath Product Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Hotel Bath Product Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Hotel Bath Product Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Hotel Bath Product Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Hotel Bath Product Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Hotel Bath Product Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Hotel Bath Product Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Hotel Bath Product Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Hotel Bath Product Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Hotel Bath Product Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Hotel Bath Product Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Hotel Bath Product Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Hotel Bath Product Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Hotel Bath Product Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Hotel Bath Product Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hotel Bath Product?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Hotel Bath Product?

Key companies in the market include Kimirica Hunter International, Petop Hotel Supply, Groupe GM, LAICOZY, L'Occitane, VOSHON International Company, Ecoway, ADA Cosmetics International, Dolphin Enterprise, Shanti Enterprises, LMZ (Jiangsu) Industrial, Guest Supply, La Bottega, Vanity Group, Ming Fai, Kracie, POLA, Asprey, Aromatherapy Associates, Aveda, C.O. Bigelow, June Jacobs, MALIN+GOETZ, Pharmacopia.

3. What are the main segments of the Hotel Bath Product?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hotel Bath Product," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hotel Bath Product report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hotel Bath Product?

To stay informed about further developments, trends, and reports in the Hotel Bath Product, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence