Key Insights

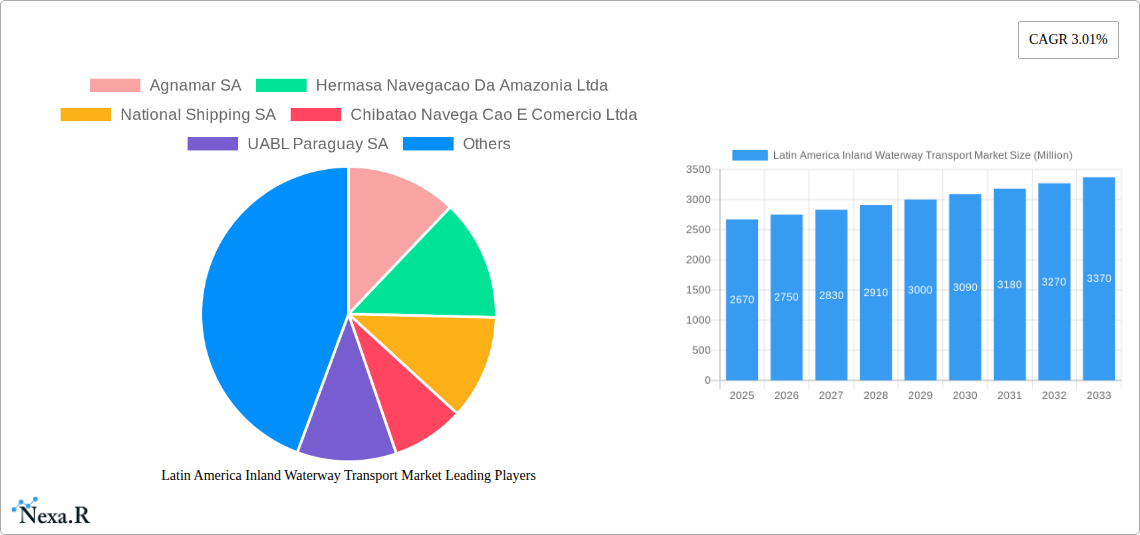

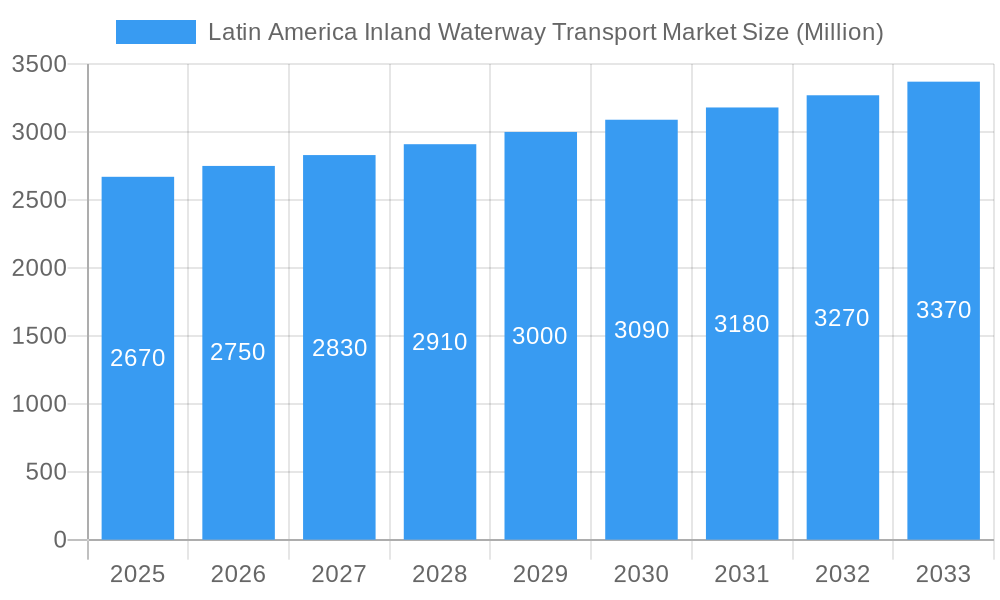

The Latin America Inland Waterway Transport Market, valued at $2.67 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.01% from 2025 to 2033. This growth is fueled by several key factors. Increased investment in infrastructure development, particularly the modernization and expansion of inland waterways and port facilities across the region, is significantly enhancing transport efficiency and capacity. Furthermore, the rising demand for cost-effective and environmentally friendly transportation solutions is driving the adoption of inland waterway transport, especially for bulk commodities like agricultural goods and raw materials. Government initiatives promoting sustainable transportation and regional trade integration further contribute to market expansion. While challenges such as fluctuating water levels, inconsistent regulatory frameworks, and security concerns in certain areas exist, the overall market outlook remains positive, driven by the long-term benefits of waterway transport.

Latin America Inland Waterway Transport Market Market Size (In Billion)

The market is characterized by a diverse range of players, including both large multinational shipping companies like Maersk Line, MSC Mediterranean Shipping Company, and CMA CGM, and smaller regional operators such as Agnamar SA and Hermasa Navegacao Da Amazonia Ltda. Competition is expected to intensify as companies strive to optimize their operations and expand their market share. Future growth will likely be influenced by advancements in technology, such as the adoption of digital logistics platforms and the implementation of more efficient vessel designs. The strategic partnerships between shipping companies and government agencies to improve infrastructure and logistics will also play a crucial role in shaping the market's trajectory over the forecast period. Increased focus on sustainable practices, including the use of cleaner fuels and environmentally friendly vessel operations, is also likely to become a significant competitive differentiator.

Latin America Inland Waterway Transport Market Company Market Share

Latin America Inland Waterway Transport Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Latin America Inland Waterway Transport Market, encompassing market dynamics, growth trends, key players, and future prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This in-depth analysis serves as an invaluable resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this dynamic market. The parent market is the Latin American Transportation market, and the child market is Inland Waterway Transport. The market size is expected to reach XX Million by 2033.

Latin America Inland Waterway Transport Market Market Dynamics & Structure

The Latin America Inland Waterway Transport market is characterized by a moderate level of concentration, with a few large players such as Hamburg Sud, CMA CGM, and Maersk Line alongside numerous smaller regional operators like Agnamar SA and Hermasa Navegacao Da Amazonia Ltda. The market is influenced by several key factors:

- Market Concentration: The top 10 players hold an estimated xx% market share, leaving xx% to smaller players.

- Technological Innovation: Adoption of GPS tracking, optimized routing software, and improved vessel design are driving efficiency gains. However, high initial investment costs represent a barrier to entry for smaller companies.

- Regulatory Frameworks: Varying regulations across countries impact operational costs and efficiency. Harmonization efforts are underway but progress is slow.

- Competitive Product Substitutes: Road and rail transport pose significant competition, especially for shorter distances. The cost-effectiveness of inland waterways depends significantly on infrastructure development.

- End-User Demographics: The key end-users include agricultural product exporters, mining companies, and manufacturers of various goods. Their geographic distribution and transportation needs shape market demand.

- M&A Trends: The past five years witnessed xx M&A deals in the sector, driven primarily by a need for expansion and consolidation among existing players. This trend is expected to continue at a rate of xx deals annually.

Latin America Inland Waterway Transport Market Growth Trends & Insights

The Latin American Inland Waterway Transport market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is projected to continue, with a projected CAGR of xx% during the forecast period (2025-2033). Several factors contribute to this positive outlook:

Increased investments in infrastructure development, particularly in Brazil and the Amazon basin, are expected to unlock new transportation routes and reduce operational costs. Growing e-commerce and the rising demand for faster and more efficient logistics solutions are also bolstering the market. Further, government initiatives promoting sustainable transportation solutions and reducing reliance on road transport are positive catalysts for growth. The market penetration rate of technologically advanced vessels is gradually increasing, currently at around xx% and expected to grow to xx% by 2033. However, challenges remain, including infrastructure limitations in certain regions, seasonal variations in water levels, and security concerns.

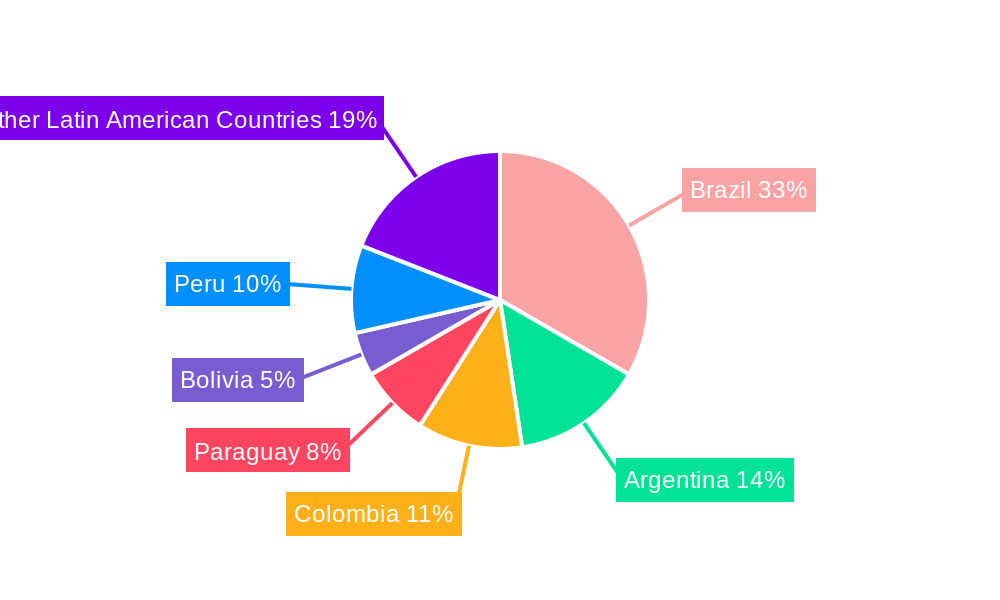

Dominant Regions, Countries, or Segments in Latin America Inland Waterway Transport Market

Brazil dominates the Latin American inland waterway transport market, accounting for approximately xx% of total market volume. This dominance stems from its extensive river network, particularly the Amazon River system, coupled with substantial agricultural and industrial activity. Key growth drivers for Brazil include:

- Extensive River Network: Provides cost-effective transportation options.

- Government Initiatives: Supporting infrastructure development and modernization.

- Agricultural Exports: High volume of agricultural goods requiring efficient transportation.

Other important markets include:

- Argentina: Parana-Paraguay waterway transportation is growing.

- Colombia: Increased focus on river-based logistics.

- Paraguay: Investments in improving port infrastructure and river navigation.

The market is segmented by cargo type (bulk cargo, containerized cargo, etc.), vessel type (barges, tugboats, etc.), and route. Bulk cargo currently dominates with xx% of market share and is expected to increase to xx% by 2033.

Latin America Inland Waterway Transport Market Product Landscape

The market sees ongoing development in vessel design, incorporating fuel-efficient technologies and enhanced cargo handling capabilities. Innovations in navigation systems and cargo tracking technologies are improving efficiency and safety. There is increasing adoption of containerization for inland waterway transport to streamline logistics and reduce handling times. Key competitive advantages include efficient vessel operations, reliable service delivery, and cost-effective solutions tailored to specific customer needs.

Key Drivers, Barriers & Challenges in Latin America Inland Waterway Transport Market

Key Drivers:

- Government investment in infrastructure: Expansion and modernization of ports and waterways.

- Growing agricultural and industrial output: Increasing demand for efficient transportation.

- E-commerce expansion: Growing reliance on efficient delivery networks.

Challenges:

- Inadequate infrastructure in certain regions: Limited access to certain areas.

- Seasonal variations in water levels: Affecting operational efficiency.

- Security concerns: Issues of piracy and theft impacting trade.

- Bureaucratic hurdles: Complex regulations and licensing procedures.

Emerging Opportunities in Latin America Inland Waterway Transport Market

- Untapped potential in smaller waterways: Expansion beyond major river systems.

- Growing demand for sustainable transportation: Investment in eco-friendly vessels.

- Integration of technology: Automation and digitalization of logistics operations.

Growth Accelerators in the Latin America Inland Waterway Transport Market Industry

Long-term growth is fueled by strategic partnerships between logistics companies and infrastructure developers, enabling coordinated investment in new routes and facilities. Technological advancements, such as automated navigation systems and improved vessel designs, will increase efficiency and sustainability. Government policies promoting inland waterway transportation and reducing reliance on road transport will continue to support market growth.

Key Players Shaping the Latin America Inland Waterway Transport Market Market

- Agnamar SA

- Hermasa Navegacao Da Amazonia Ltda

- National Shipping SA

- Chibatao Navega Cao E Comercio Ltda

- UABL Paraguay SA

- Hamburg Sud

- CMA CGM

- Maersk Line

- MSC Mediterranean Shipping Company

- Grimaldi Group

- 63 Other Companies

Notable Milestones in Latin America Inland Waterway Transport Market Sector

- September 2023: Blue Water opens Santiago office, expanding its presence in Latin America to meet growing project logistics demand.

- April 2024: Unifeeder Group establishes a regional office in Panama City, signifying commitment to expanded LATAM trade routes.

In-Depth Latin America Inland Waterway Transport Market Market Outlook

The future of the Latin America Inland Waterway Transport market looks promising. Continued infrastructure investments, coupled with technological advancements and supportive government policies, will drive significant growth over the next decade. Strategic partnerships between key players will be crucial for unlocking the full potential of this sector. The focus on sustainable and efficient transportation solutions presents significant opportunities for investors and businesses seeking to capitalize on this expanding market.

Latin America Inland Waterway Transport Market Segmentation

-

1. Type of Carrgo

-

1.1. Bulk

- 1.1.1. Liquid Bulk Transportation

- 1.1.2. Dry Bulk Transportation

- 1.2. Container

-

1.1. Bulk

-

2. Geography

- 2.1. Mexico

- 2.2. Brazil

- 2.3. Chile

- 2.4. Colombia

- 2.5. Rest of Latin America

Latin America Inland Waterway Transport Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Chile

- 4. Colombia

- 5. Rest of Latin America

Latin America Inland Waterway Transport Market Regional Market Share

Geographic Coverage of Latin America Inland Waterway Transport Market

Latin America Inland Waterway Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Enhanced connectivity and intermodal integration4.; Economic growth and trade driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Enhanced connectivity and intermodal integration4.; Economic growth and trade driving the market

- 3.4. Market Trends

- 3.4.1. Rise in container throughput driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 5.1.1. Bulk

- 5.1.1.1. Liquid Bulk Transportation

- 5.1.1.2. Dry Bulk Transportation

- 5.1.2. Container

- 5.1.1. Bulk

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Mexico

- 5.2.2. Brazil

- 5.2.3. Chile

- 5.2.4. Colombia

- 5.2.5. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Chile

- 5.3.4. Colombia

- 5.3.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 6. Mexico Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 6.1.1. Bulk

- 6.1.1.1. Liquid Bulk Transportation

- 6.1.1.2. Dry Bulk Transportation

- 6.1.2. Container

- 6.1.1. Bulk

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Mexico

- 6.2.2. Brazil

- 6.2.3. Chile

- 6.2.4. Colombia

- 6.2.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 7. Brazil Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 7.1.1. Bulk

- 7.1.1.1. Liquid Bulk Transportation

- 7.1.1.2. Dry Bulk Transportation

- 7.1.2. Container

- 7.1.1. Bulk

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Mexico

- 7.2.2. Brazil

- 7.2.3. Chile

- 7.2.4. Colombia

- 7.2.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 8. Chile Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 8.1.1. Bulk

- 8.1.1.1. Liquid Bulk Transportation

- 8.1.1.2. Dry Bulk Transportation

- 8.1.2. Container

- 8.1.1. Bulk

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Mexico

- 8.2.2. Brazil

- 8.2.3. Chile

- 8.2.4. Colombia

- 8.2.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 9. Colombia Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 9.1.1. Bulk

- 9.1.1.1. Liquid Bulk Transportation

- 9.1.1.2. Dry Bulk Transportation

- 9.1.2. Container

- 9.1.1. Bulk

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Mexico

- 9.2.2. Brazil

- 9.2.3. Chile

- 9.2.4. Colombia

- 9.2.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 10. Rest of Latin America Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 10.1.1. Bulk

- 10.1.1.1. Liquid Bulk Transportation

- 10.1.1.2. Dry Bulk Transportation

- 10.1.2. Container

- 10.1.1. Bulk

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Mexico

- 10.2.2. Brazil

- 10.2.3. Chile

- 10.2.4. Colombia

- 10.2.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Agnamar SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hermasa Navegacao Da Amazonia Ltda

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 National Shipping SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Chibatao Navega Cao E Comercio Ltda

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UABL Paraguay SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hamburg Sud

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CMA CGM

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maersk Line

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MSC Mediterranean Shipping Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Grimaldi Group*6 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Agnamar SA

List of Figures

- Figure 1: Latin America Inland Waterway Transport Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Inland Waterway Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2020 & 2033

- Table 2: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2020 & 2033

- Table 3: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 5: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2020 & 2033

- Table 8: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2020 & 2033

- Table 9: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 11: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2020 & 2033

- Table 14: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2020 & 2033

- Table 15: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 17: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2020 & 2033

- Table 20: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2020 & 2033

- Table 21: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2020 & 2033

- Table 26: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2020 & 2033

- Table 27: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 29: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2020 & 2033

- Table 32: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2020 & 2033

- Table 33: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 35: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Inland Waterway Transport Market?

The projected CAGR is approximately 3.01%.

2. Which companies are prominent players in the Latin America Inland Waterway Transport Market?

Key companies in the market include Agnamar SA, Hermasa Navegacao Da Amazonia Ltda, National Shipping SA, Chibatao Navega Cao E Comercio Ltda, UABL Paraguay SA, Hamburg Sud, CMA CGM, Maersk Line, MSC Mediterranean Shipping Company, Grimaldi Group*6 3 Other Companie.

3. What are the main segments of the Latin America Inland Waterway Transport Market?

The market segments include Type of Carrgo, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.67 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Enhanced connectivity and intermodal integration4.; Economic growth and trade driving the market.

6. What are the notable trends driving market growth?

Rise in container throughput driving the market.

7. Are there any restraints impacting market growth?

4.; Enhanced connectivity and intermodal integration4.; Economic growth and trade driving the market.

8. Can you provide examples of recent developments in the market?

April 2024: In its push to bolster trade and economic growth in Latin America (LATAM), Unifeeder Group inaugurated its inaugural regional office in Panama City. This move followed the company's establishment of new trade routes across LATAM.September 2023: Blue Water strategically positioned itself in the Latin American market with the inauguration of its Santiago office. Complementing its existing presence in Brazil, this move equipped the global transport and logistics giant to cater to the rising demand for project logistics in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Inland Waterway Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Inland Waterway Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Inland Waterway Transport Market?

To stay informed about further developments, trends, and reports in the Latin America Inland Waterway Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence