Key Insights

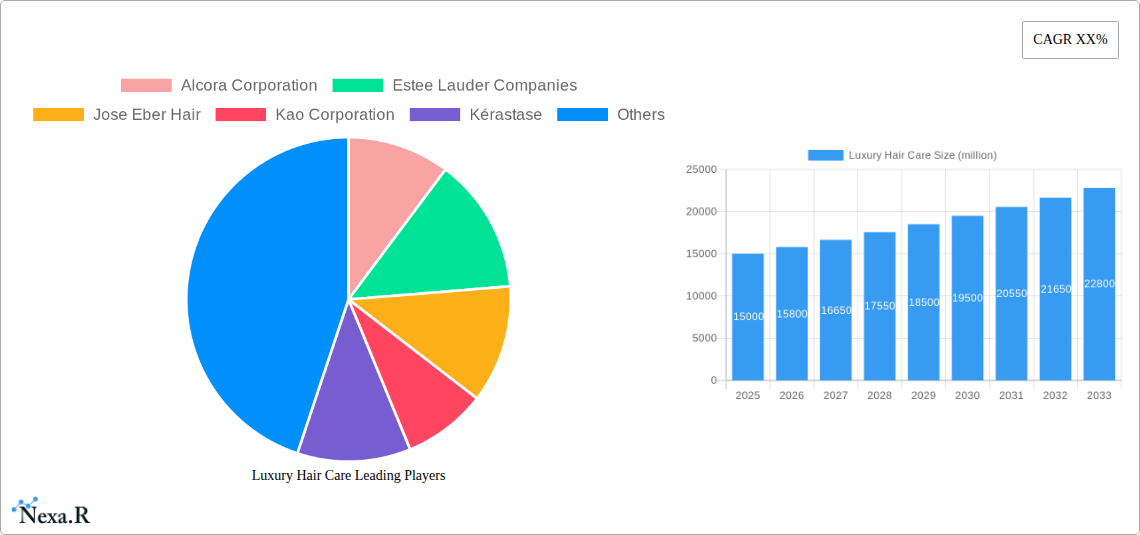

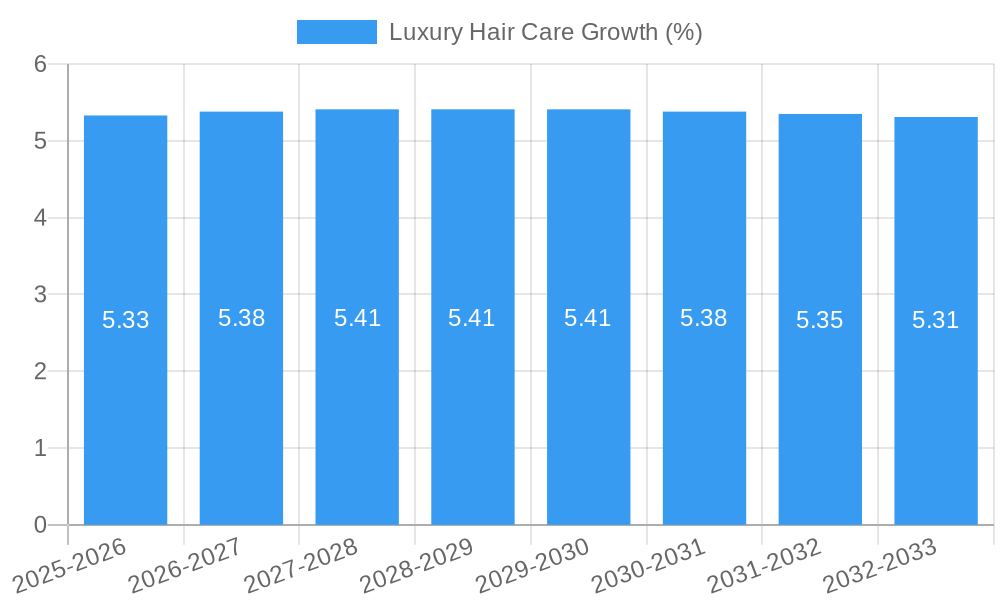

The global luxury hair care market is experiencing robust expansion, projected to reach approximately $15,000 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 5.5% through 2033. This surge is largely propelled by an increasing consumer demand for premium, efficacy-driven products that offer advanced solutions for hair health and styling. Key drivers include a growing affluent consumer base, a heightened awareness of hair as a reflection of personal well-being and status, and the pervasive influence of social media and celebrity endorsements showcasing aspirational hair aesthetics. Consumers are willing to invest more in high-quality ingredients, innovative formulations, and scientifically backed benefits, moving beyond basic cleansing to embrace specialized treatments, anti-aging hair solutions, and personalized regimens. The market is also benefiting from a shift towards omnichannel retail strategies, where online sales platforms offer unparalleled convenience and access to exclusive brands, complementing the experiential aspect of offline luxury retail.

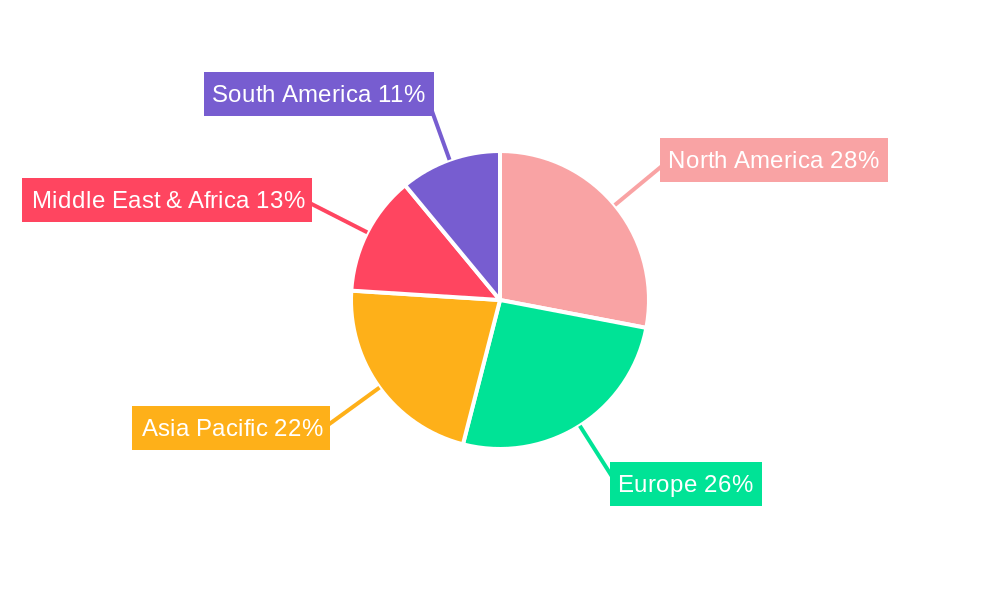

The market's trajectory is further shaped by significant trends such as the rising popularity of "clean beauty" within the luxury segment, emphasizing natural, organic, and ethically sourced ingredients without compromising on performance. Sustainability is also a growing concern, with brands increasingly focusing on eco-friendly packaging and production processes. Conversely, the market faces certain restraints, including the high price points that can limit accessibility for some consumer segments and the potential for market saturation. Intense competition among established luxury brands and the emergence of niche, high-performance indie brands necessitate continuous innovation and strong brand differentiation. Key product segments like Shampoos, Conditioners, and Oil & Serums are expected to lead the market, driven by their daily usage and the growing demand for targeted treatments for issues like hair loss, damage, and scalp health. Geographically, North America and Europe are expected to maintain significant market shares due to their established luxury markets and high disposable incomes, while the Asia Pacific region presents substantial growth opportunities driven by its expanding middle and upper classes.

Luxury Hair Care Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth market research report offers a strategic analysis of the global Luxury Hair Care market, covering the historical period from 2019 to 2024 and projecting growth through 2033. With a base year of 2025, this report provides unparalleled insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities. Designed for industry professionals, investors, and strategists, this report leverages high-traffic SEO keywords to maximize visibility and deliver actionable intelligence.

Luxury Hair Care Market Dynamics & Structure

The global Luxury Hair Care market exhibits a moderately concentrated structure, with a few key players holding significant market share, estimated at 65% in 2025. Technological innovation remains a primary driver, fueled by advancements in ingredient science, formulation techniques, and sustainable packaging solutions. Regulatory frameworks, while generally supportive of product safety, can introduce compliance hurdles, particularly concerning ingredient sourcing and efficacy claims. Competitive product substitutes, ranging from mass-market premium brands to DIY formulations, present a dynamic competitive landscape. End-user demographics are shifting towards affluent millennials and Gen Z consumers who prioritize efficacy, sustainability, and brand ethos. Mergers and acquisitions (M&A) are expected to play a crucial role in market consolidation, with an estimated 15 significant M&A deals anticipated between 2025 and 2033, totaling approximately $1200 million in value.

- Market Concentration: Dominated by established players with strong brand equity.

- Technological Innovation Drivers: Advanced ingredient formulations, bio-technology, and personalized solutions.

- Regulatory Frameworks: Focus on ingredient safety, ethical sourcing, and environmental impact.

- Competitive Product Substitutes: Premium mass-market hair care, salon-exclusive brands, and natural/organic alternatives.

- End-User Demographics: Rising disposable incomes, demand for efficacy, and ethical consumerism.

- M&A Trends: Strategic acquisitions for market expansion and portfolio diversification.

Luxury Hair Care Growth Trends & Insights

The Luxury Hair Care market is poised for substantial growth, projected to expand from an estimated $22,000 million in 2025 to a remarkable $45,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period. This robust expansion is underpinned by several key trends. Increasing consumer awareness regarding hair health and the desire for premium, results-driven products are driving adoption rates. Consumers are increasingly seeking personalized solutions tailored to their specific hair concerns, from anti-aging and scalp health to color protection and hair loss treatment. Technological disruptions, such as the integration of artificial intelligence in product recommendation engines and the development of advanced delivery systems for active ingredients, are further enhancing product efficacy and user experience.

Consumer behavior is also undergoing a significant shift. The rise of e-commerce and direct-to-consumer (DTC) channels has democratized access to luxury hair care, allowing brands to connect directly with their target audience and foster loyalty. Social media influence, particularly from beauty influencers and dermatologists, plays a pivotal role in shaping purchase decisions, driving demand for innovative and scientifically backed formulations. Furthermore, a growing emphasis on sustainability and clean beauty is influencing product development, with consumers actively seeking out brands that utilize ethically sourced ingredients, eco-friendly packaging, and transparent manufacturing processes. This paradigm shift towards conscious consumption is creating a fertile ground for brands that align with these values.

The market penetration of luxury hair care products is also on an upward trajectory, especially in emerging economies where rising disposable incomes and a growing middle class are fueling demand for premium personal care items. Brands are increasingly investing in targeted marketing campaigns and premium retail experiences to capture this burgeoning demographic. The demand for specialized treatments, such as hair growth serums, advanced scalp care solutions, and high-performance styling products, is also a significant growth driver. As consumers become more educated about the benefits of investing in their hair health, the willingness to spend on superior formulations is increasing, further accelerating market growth.

Dominant Regions, Countries, or Segments in Luxury Hair Care

North America, specifically the United States, is projected to be the dominant region in the global Luxury Hair Care market, estimated to hold a market share of approximately 35% in 2025, valued at around $7,700 million. This dominance is driven by a confluence of factors including a high disposable income, a sophisticated consumer base with a strong penchant for premium beauty products, and a robust retail infrastructure that supports both online and offline sales channels. The US market's leadership is further bolstered by significant investments in research and development by leading cosmetic and personal care companies, fostering continuous product innovation and brand differentiation.

Within the application segment, Online Sales are anticipated to witness the fastest growth, projected to capture a CAGR of 11.2% between 2025 and 2033, reaching an estimated value of $10,500 million by the end of the forecast period. This surge is attributed to the convenience, wider product selection, and personalized recommendations offered by e-commerce platforms. The increasing reliance on digital channels for product discovery and purchase among affluent consumers, coupled with effective digital marketing strategies employed by luxury brands, fuels this upward trend.

Analyzing the product Types, Oil & Serums are expected to emerge as a significant growth driver, projected to reach a market size of approximately $4,000 million by 2033, with an estimated CAGR of 10.1%. The growing consumer demand for targeted treatments that address specific concerns like hair damage, frizz, and scalp health, combined with the perceived efficacy and luxurious feel of these products, contributes to their escalating popularity. Advanced formulations incorporating potent active ingredients and botanical extracts are further enhancing their appeal.

- Dominant Region: North America (USA)

- High disposable income and consumer demand for premium products.

- Well-established retail infrastructure supporting diverse distribution channels.

- Significant R&D investment by leading companies.

- Fastest Growing Application: Online Sales

- Convenience and accessibility of e-commerce platforms.

- Effective digital marketing and DTC strategies.

- Increasing preference for online product discovery and purchase.

- Key Product Type Growth Driver: Oil & Serums

- Demand for targeted hair treatments and solutions.

- Perceived efficacy and luxurious user experience.

- Innovative formulations with advanced ingredients.

Luxury Hair Care Product Landscape

The Luxury Hair Care product landscape is characterized by continuous innovation, focusing on scientifically advanced formulations that deliver visible results. Brands are increasingly investing in premium ingredients such as peptides, ceramides, hyaluronic acid, and potent botanical extracts to address specific concerns like hair thinning, scalp health, and age-related damage. The emphasis is on high-performance products with unique selling propositions, often backed by clinical studies and dermatologist recommendations. Innovations in delivery systems, such as encapsulated actives and micro-emulsions, ensure optimal penetration and efficacy. Product applications span from intensive treatment serums and restorative masks to revitalizing shampoos and conditioners designed for a salon-like experience at home.

Key Drivers, Barriers & Challenges in Luxury Hair Care

Key Drivers: The Luxury Hair Care market is propelled by a rising global disposable income, a growing consumer consciousness towards premium and effective hair solutions, and continuous technological advancements in formulation science. The influence of social media and beauty influencers also plays a pivotal role in shaping consumer preferences and driving demand for innovative products. Furthermore, the increasing emphasis on self-care and holistic beauty routines contributes to the sustained growth of this segment.

Key Barriers & Challenges: Supply chain disruptions, particularly in sourcing rare or ethically produced ingredients, can pose significant challenges, impacting production volumes and cost. Stringent regulatory requirements concerning product claims and ingredient safety in different regions can also create hurdles. Intense competition from both established luxury brands and emerging indie labels, coupled with the need for substantial marketing investments to build brand equity, presents a constant competitive pressure. The high price point of luxury hair care can also be a barrier for a broader consumer base, limiting market penetration in price-sensitive economies.

Emerging Opportunities in Luxury Hair Care

Emerging opportunities in the Luxury Hair Care sector lie in the untapped potential of personalized hair care solutions powered by AI and genetic profiling, allowing for hyper-tailored product recommendations and formulations. The growing demand for sustainable and clean beauty ingredients, coupled with innovative eco-friendly packaging, presents a significant avenue for brands committed to ethical practices. Expansion into emerging markets, particularly in Asia-Pacific and Latin America, where a burgeoning affluent consumer base is keen on premium beauty products, offers substantial growth potential. Furthermore, the development of specialized treatments for specific demographic needs, such as products addressing hair loss in women or age-defying scalp treatments, represents a niche yet lucrative opportunity.

Growth Accelerators in the Luxury Hair Care Industry

Technological breakthroughs in biotechnology and ingredient efficacy are key accelerators for the Luxury Hair Care industry. Strategic partnerships between luxury brands and dermatologists or trichologists lend credibility and drive innovation in scientifically formulated products. Market expansion strategies, including entering new geographical regions and strengthening online DTC channels, are crucial for sustained growth. The increasing consumer willingness to invest in preventative and corrective hair treatments, viewing them as essential components of a comprehensive beauty regimen, further fuels market acceleration. The trend towards mindful consumption and the demand for transparency in ingredient sourcing and product efficacy will also drive growth for brands that champion these values.

Key Players Shaping the Luxury Hair Care Market

- Alcora Corporation

- Estee Lauder Companies

- Jose Eber Hair

- Kao Corporation

- Kérastase

- KOSE Corporation

- L’Oreal

- ORIBE

- Rahua

- Seven, LLC.

Notable Milestones in Luxury Hair Care Sector

- 2019: Launch of Kérastase's "Initialiste Scalp & Hair Concentrate," a pioneering serum focusing on scalp health and hair regeneration.

- 2020: L'Oréal's acquisition of an undisclosed luxury clean beauty hair care brand, signaling a strategic move towards sustainable and natural formulations.

- 2021: ORIBE launched its innovative "Serene Scalp" line, incorporating advanced ingredients for soothing and revitalizing scalp treatments, gaining significant traction.

- 2022: Estee Lauder Companies expanded its luxury hair care portfolio with a focus on science-backed solutions for thinning hair and scalp concerns.

- 2023 (Q3): Rahua significantly increased its investment in sustainable sourcing and packaging, resonating with eco-conscious consumers.

- 2024 (Q1): Jose Eber Hair introduced a new range of professional-grade styling tools and complementary hair care products, emphasizing salon-quality results at home.

- 2025 (Q2 - Projected): KAO Corporation is anticipated to unveil a new line of luxury hair color products with enhanced protective and restorative properties.

- 2025 (Q3 - Projected): Seven, LLC. is expected to announce strategic partnerships aimed at expanding its direct-to-consumer (DTC) online sales channels.

In-Depth Luxury Hair Care Market Outlook

The future of the Luxury Hair Care market is exceptionally promising, driven by an anticipated surge in personalized beauty solutions, sustainable product development, and strategic market expansion into emerging economies. Growth accelerators will focus on leveraging advanced biotechnology for ingredient innovation, forging stronger collaborations with scientific experts, and expanding direct-to-consumer e-commerce capabilities. The increasing consumer demand for preventative hair care and treatments for specific concerns like hair loss and scalp health will continue to shape product development. Brands that prioritize transparency, ethical sourcing, and demonstrable efficacy will undoubtedly capture significant market share, solidifying their position as leaders in this dynamic and evolving industry.

Luxury Hair Care Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Retail

-

2. Types

- 2.1. Shampoos

- 2.2. Conditioners

- 2.3. Oil & Serums

- 2.4. Hair Coloring Products

- 2.5. Hair Cream & Gels

- 2.6. Hair Sprays

- 2.7. Others

Luxury Hair Care Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Hair Care REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Hair Care Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Retail

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Shampoos

- 5.2.2. Conditioners

- 5.2.3. Oil & Serums

- 5.2.4. Hair Coloring Products

- 5.2.5. Hair Cream & Gels

- 5.2.6. Hair Sprays

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Luxury Hair Care Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Retail

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Shampoos

- 6.2.2. Conditioners

- 6.2.3. Oil & Serums

- 6.2.4. Hair Coloring Products

- 6.2.5. Hair Cream & Gels

- 6.2.6. Hair Sprays

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Luxury Hair Care Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Retail

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Shampoos

- 7.2.2. Conditioners

- 7.2.3. Oil & Serums

- 7.2.4. Hair Coloring Products

- 7.2.5. Hair Cream & Gels

- 7.2.6. Hair Sprays

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Luxury Hair Care Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Retail

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Shampoos

- 8.2.2. Conditioners

- 8.2.3. Oil & Serums

- 8.2.4. Hair Coloring Products

- 8.2.5. Hair Cream & Gels

- 8.2.6. Hair Sprays

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Luxury Hair Care Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Retail

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Shampoos

- 9.2.2. Conditioners

- 9.2.3. Oil & Serums

- 9.2.4. Hair Coloring Products

- 9.2.5. Hair Cream & Gels

- 9.2.6. Hair Sprays

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Luxury Hair Care Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Retail

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Shampoos

- 10.2.2. Conditioners

- 10.2.3. Oil & Serums

- 10.2.4. Hair Coloring Products

- 10.2.5. Hair Cream & Gels

- 10.2.6. Hair Sprays

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Alcora Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Estee Lauder Companies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jose Eber Hair

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kao Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kérastase

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KOSE Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 L’Oreal

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ORIBE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rahua

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Seven

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LLC.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Alcora Corporation

List of Figures

- Figure 1: Global Luxury Hair Care Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Luxury Hair Care Revenue (million), by Application 2024 & 2032

- Figure 3: North America Luxury Hair Care Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Luxury Hair Care Revenue (million), by Types 2024 & 2032

- Figure 5: North America Luxury Hair Care Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Luxury Hair Care Revenue (million), by Country 2024 & 2032

- Figure 7: North America Luxury Hair Care Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Luxury Hair Care Revenue (million), by Application 2024 & 2032

- Figure 9: South America Luxury Hair Care Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Luxury Hair Care Revenue (million), by Types 2024 & 2032

- Figure 11: South America Luxury Hair Care Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Luxury Hair Care Revenue (million), by Country 2024 & 2032

- Figure 13: South America Luxury Hair Care Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Luxury Hair Care Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Luxury Hair Care Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Luxury Hair Care Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Luxury Hair Care Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Luxury Hair Care Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Luxury Hair Care Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Luxury Hair Care Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Luxury Hair Care Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Luxury Hair Care Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Luxury Hair Care Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Luxury Hair Care Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Luxury Hair Care Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Luxury Hair Care Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Luxury Hair Care Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Luxury Hair Care Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Luxury Hair Care Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Luxury Hair Care Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Luxury Hair Care Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Luxury Hair Care Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Luxury Hair Care Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Luxury Hair Care Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Luxury Hair Care Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Luxury Hair Care Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Luxury Hair Care Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Luxury Hair Care Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Luxury Hair Care Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Luxury Hair Care Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Luxury Hair Care Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Luxury Hair Care Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Luxury Hair Care Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Luxury Hair Care Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Luxury Hair Care Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Luxury Hair Care Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Luxury Hair Care Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Luxury Hair Care Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Luxury Hair Care Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Luxury Hair Care Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Luxury Hair Care Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Hair Care?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Luxury Hair Care?

Key companies in the market include Alcora Corporation, Estee Lauder Companies, Jose Eber Hair, Kao Corporation, Kérastase, KOSE Corporation, L’Oreal, ORIBE, Rahua, Seven, LLC..

3. What are the main segments of the Luxury Hair Care?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Hair Care," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Hair Care report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Hair Care?

To stay informed about further developments, trends, and reports in the Luxury Hair Care, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence