Key Insights

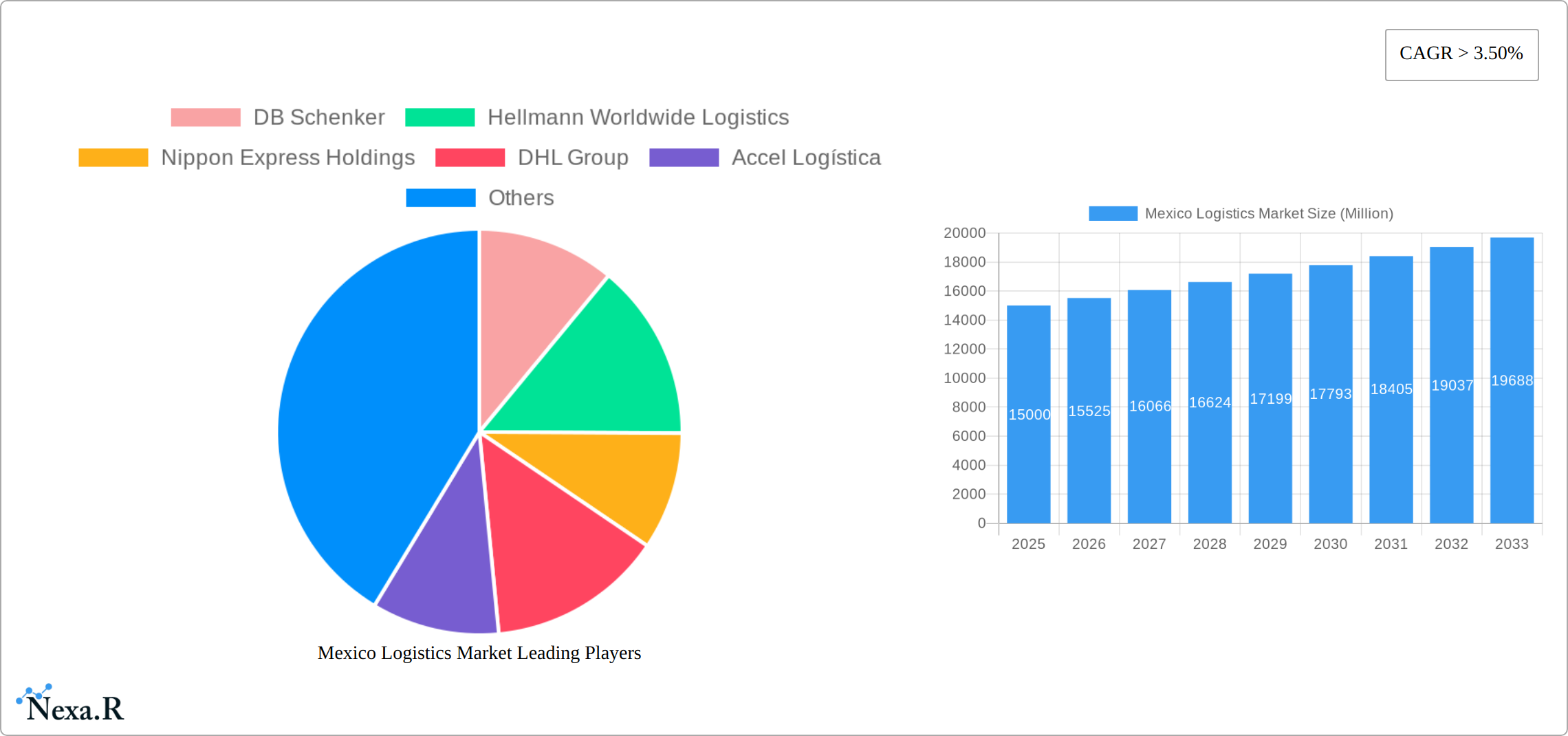

The Mexico logistics market, valued at approximately $XX million in 2025 (assuming a logical estimate based on the provided CAGR and study period), is experiencing robust growth, projected to expand at a CAGR exceeding 3.50% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector in Mexico is significantly boosting demand for efficient and reliable delivery services, particularly within the Courier, Express, and Parcel (CEP) segment. Furthermore, the growth of manufacturing and industrial activities, especially in sectors like automotive and food processing, necessitates sophisticated logistics solutions for both domestic and international trade. Increased cross-border trade with the United States and Canada also contributes to market growth. The temperature-controlled segment is experiencing notable growth driven by the increasing demand for the transportation of perishable goods, particularly within the agriculture, fishing, and food processing sectors. However, the market faces challenges including infrastructure limitations, particularly in rural areas, and regulatory complexities. Despite these constraints, the overall outlook remains positive, given the country's strategic geographic location, expanding economy, and ongoing investments in infrastructure development.

The market segmentation reveals significant opportunities across various end-user industries. The Agriculture, Fishing, and Forestry sector, alongside Manufacturing and Construction, are major contributors to logistics demand. While the Oil and Gas and Mining and Quarrying sectors also require specialized logistics solutions, the Wholesale and Retail Trade sector's growth directly correlates with the expansion of the CEP segment. Considering the competitive landscape, established players like DHL Group, FedEx, and Kuehne + Nagel are major forces. However, the market also features a significant number of regional and national logistics providers, indicating substantial competition and opportunities for both large multinational corporations and smaller, specialized firms. Future growth will likely be shaped by investments in technology, such as improved tracking and delivery systems, and the adoption of sustainable practices to meet growing environmental concerns.

Mexico Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico Logistics Market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. It offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. Parent markets include the broader Latin American logistics sector and the global supply chain management industry. Child markets analyzed include specific logistics functions and end-user industries within Mexico.

Mexico Logistics Market Dynamics & Structure

The Mexican logistics market is characterized by a moderately concentrated landscape, with both multinational giants and domestic players competing for market share. The market size in 2025 is estimated at XXX Million. Technological innovation, driven by increasing e-commerce penetration and the need for efficiency gains, is a significant driver of market growth. However, regulatory hurdles, including customs procedures and infrastructure limitations, present challenges. The competitive landscape is further shaped by the presence of substitute services and changing end-user demographics. M&A activity has been moderate, with xx deals recorded in the last five years, reflecting strategic consolidation within the sector.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on automation, digitalization, and sustainable solutions. Barriers include high initial investment costs and limited digital literacy.

- Regulatory Framework: Complex customs procedures and infrastructure limitations impact operational efficiency.

- Competitive Substitutes: Alternative transportation modes and third-party logistics providers create competition.

- End-User Demographics: Growing e-commerce and manufacturing sectors drive demand.

- M&A Trends: Moderate activity driven by strategic consolidation and expansion into new segments.

Mexico Logistics Market Growth Trends & Insights

The Mexico logistics market is experiencing robust growth, fueled by several key factors. The surge in e-commerce adoption is significantly impacting demand, alongside increased cross-border trade, primarily with the United States, and the robust growth of Mexico's manufacturing and industrial sectors, particularly in automotive and aerospace. Market projections indicate substantial expansion, with estimates suggesting a market size of [Insert Projected Market Size in USD Million] by 2033, representing a Compound Annual Growth Rate (CAGR) of [Insert CAGR Percentage]% during the forecast period (2025-2033). This growth trajectory is further accelerated by technological advancements. The integration of blockchain technology enhances supply chain transparency and traceability, while AI-powered solutions optimize logistics operations, improve route planning, and predict potential disruptions. Simultaneously, evolving consumer expectations—demanding faster delivery speeds and increased transparency—are driving logistics providers to innovate and adapt their service offerings to meet these heightened expectations. This includes the rise of last-mile delivery solutions tailored to the unique challenges of the Mexican market.

Dominant Regions, Countries, or Segments in Mexico Logistics Market

Within the Mexican logistics landscape, several key segments and regions stand out. The manufacturing sector, notably automotive and aerospace, constitutes a substantial portion of the market, holding an estimated [Insert Market Share Percentage]% market share in 2025. Mexico's northern region exhibits particularly strong growth potential, driven by its geographical proximity to the United States, well-established industrial clusters, and significant foreign direct investment (FDI). Government initiatives focused on infrastructure development further bolster this region's prominence. The Courier, Express, and Parcel (CEP) segment also demonstrates robust growth, directly mirroring the expansion of the e-commerce sector and the associated need for efficient and rapid delivery services. This segment is poised for continued expansion as e-commerce penetration deepens across Mexico.

- Key Drivers for Manufacturing: Increased foreign direct investment (FDI), proximity to the US market, robust government incentives supporting industrial growth, and a skilled workforce.

- Key Drivers for Northern Region: Established industrial clusters, strategic location near US markets, ongoing infrastructure improvements (roads, rail, ports), and a favorable business environment.

- Key Drivers for CEP Segment: Explosive growth of e-commerce, rising consumer demand for faster delivery options, and continuous technological advancements in logistics services (e.g., improved tracking, automated sorting).

Mexico Logistics Market Product Landscape

The Mexican logistics market showcases a dynamic product landscape, characterized by a growing emphasis on integrated logistics solutions. This trend reflects the demand for comprehensive, end-to-end services that streamline the entire supply chain. Technological advancements are reshaping the market, with a strong focus on real-time tracking and tracing capabilities, enhancing visibility and control. Specialized services, such as temperature-controlled transportation for pharmaceuticals and perishable goods, are also gaining traction. Key innovations include AI-powered route optimization, significantly reducing transportation costs and delivery times; blockchain technology, enhancing supply chain transparency and security; and the exploration of autonomous vehicles, though still in the nascent stages for widespread adoption in Mexico. These innovations are collectively aimed at increasing efficiency, lowering operational costs, and improving overall service quality. Successful logistics providers are differentiating themselves through unique selling propositions (USPs) that emphasize speed, reliability, and customized solutions tailored to the specific needs of individual clients.

Key Drivers, Barriers & Challenges in Mexico Logistics Market

Key Drivers: Growing e-commerce, increasing manufacturing activity, government infrastructure investments, and the ongoing shift towards just-in-time manufacturing all contribute to market expansion. Furthermore, the increasing adoption of advanced technologies offers significant potential for increased efficiency and reduced costs.

Key Challenges: Inadequate infrastructure, particularly in certain regions, remains a significant constraint. Furthermore, regulatory complexities, cross-border logistics challenges, and security concerns pose obstacles to growth. The high cost of fuel and labor also adds to operating costs. Increased competition among logistics providers further intensifies the challenge. These challenges reduce operational efficiency, adding approximately xx Million in additional costs annually.

Emerging Opportunities in Mexico Logistics Market

Untapped opportunities exist within the last-mile delivery segment, specifically in rural and underserved areas. The growth of e-commerce presents significant potential for expanding logistics services to reach new customer segments. Further opportunities exist in the development of specialized logistics solutions such as cold chain logistics for perishable goods. The rising demand for sustainable and environmentally friendly logistics practices offers potential for businesses offering green solutions.

Growth Accelerators in the Mexico Logistics Market Industry

Technological advancements, particularly in automation and data analytics, will continue to be a key driver of growth. Strategic partnerships between logistics providers and technology companies can foster innovation and improve efficiency. Furthermore, expansion into new markets and segments will play a crucial role. Government initiatives to improve infrastructure and streamline regulations will support market development.

Key Players Shaping the Mexico Logistics Market Market

- DB Schenker

- Hellmann Worldwide Logistics

- Nippon Express Holdings

- DHL Group

- Accel Logística

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Trayecto GTM- Larmex

- Transportes Marva

- Penske Logistics

- FedEx

- Estafeta Mexicana S A de C V

- Kuehne + Nagel

- Grupo SID

- Transportes Lar-Mex

- Fomento Económico Mexicano S A B de C V (Solistica)

- Agility Public Warehousing Company K S C P

- SEKO Bansard

- Grupo TMM

- C H Robinson

- TIBA Group

- Traxion

- Grupo Mexico

- Tresguerra

- Ryder System Inc

- Aeromexico Cargo

- Grupo FH

Notable Milestones in Mexico Logistics Market Sector

- November 2023: DB Schenker partnered with American Airlines Cargo to launch an API connection for streamlined airfreight booking.

- January 2024: Kuehne + Nagel announced its Book & Claim insetting solution for electric vehicles to enhance decarbonization efforts.

- February 2024: C.H. Robinson introduced new AI-powered technology for optimized freight shipping appointment scheduling.

In-Depth Mexico Logistics Market Market Outlook

The Mexico Logistics Market is poised for continued expansion, driven by strong economic growth, increasing e-commerce penetration, and ongoing investments in infrastructure development. Strategic opportunities exist for logistics providers focusing on technology adoption, sustainable practices, and expansion into underserved markets. The market's future potential is significant, with further growth expected in the coming years, particularly within the specialized logistics segments and the digitalization of the overall supply chain.

Mexico Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Mexico Logistics Market Segmentation By Geography

- 1. Mexico

Mexico Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellmann Worldwide Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nippon Express Holdings

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accel Logística

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trayecto GTM- Larmex

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Transportes Marva

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Penske Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 FedEx

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Estafeta Mexicana S A de C V

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kuehne + Nagel

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Grupo SID

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Transportes Lar-Mex

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Fomento Económico Mexicano S A B de C V (Solistica)

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Agility Public Warehousing Company K S C P

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 SEKO Bansard

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Grupo TMM

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 C H Robinson

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 TIBA Group

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Traxion

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Grupo Mexico

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Tresguerra

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Ryder System Inc

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.25 Aeromexico Cargo

- 6.2.25.1. Overview

- 6.2.25.2. Products

- 6.2.25.3. SWOT Analysis

- 6.2.25.4. Recent Developments

- 6.2.25.5. Financials (Based on Availability)

- 6.2.26 Grupo FH

- 6.2.26.1. Overview

- 6.2.26.2. Products

- 6.2.26.3. SWOT Analysis

- 6.2.26.4. Recent Developments

- 6.2.26.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Mexico Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Mexico Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Mexico Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexico Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 7: Mexico Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 8: Mexico Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Logistics Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Mexico Logistics Market?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistics, Nippon Express Holdings, DHL Group, Accel Logística, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Trayecto GTM- Larmex, Transportes Marva, Penske Logistics, FedEx, Estafeta Mexicana S A de C V, Kuehne + Nagel, Grupo SID, Transportes Lar-Mex, Fomento Económico Mexicano S A B de C V (Solistica), Agility Public Warehousing Company K S C P, SEKO Bansard, Grupo TMM, C H Robinson, TIBA Group, Traxion, Grupo Mexico, Tresguerra, Ryder System Inc, Aeromexico Cargo, Grupo FH.

3. What are the main segments of the Mexico Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.November 2023: DB Schenker, in partnership with American Airlines Cargo, announces an advancement in airfreight operations. The introduction of an API (Application Programming Interface) connection, introduced on November 14th, 2023, marks the next step in digitalizing and streamlining airfreight booking processes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Logistics Market?

To stay informed about further developments, trends, and reports in the Mexico Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence