Key Insights

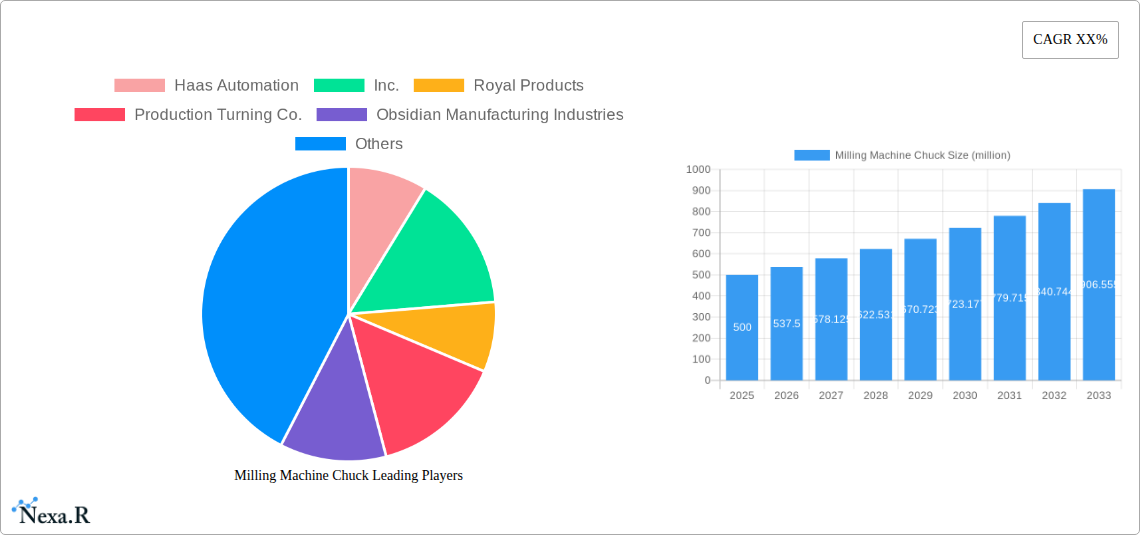

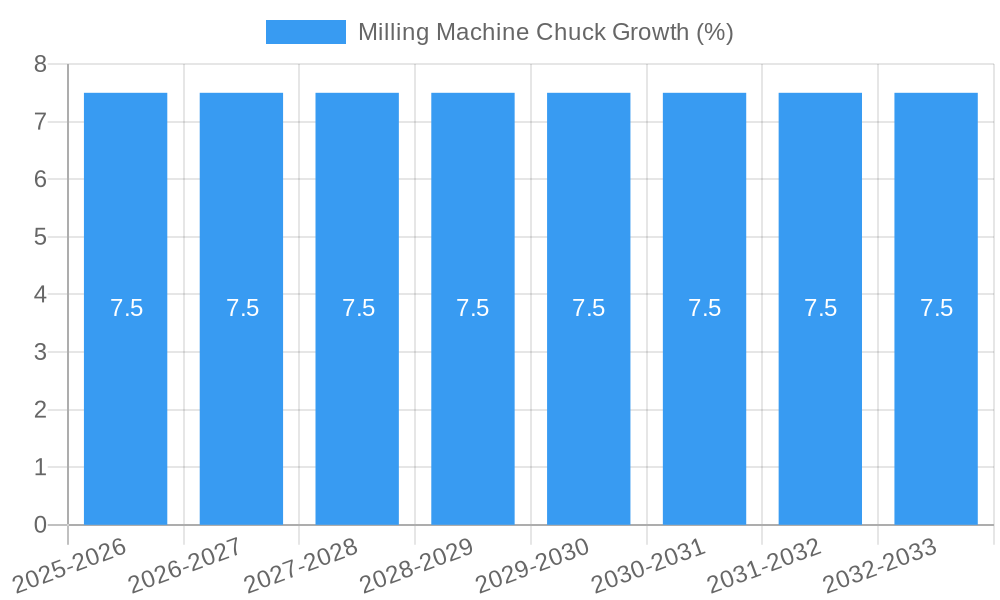

The global Milling Machine Chuck market is poised for significant expansion, projected to reach a substantial market size of approximately $500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.5% expected throughout the forecast period of 2025-2033. This upward trajectory is primarily fueled by the escalating demand for precision machining across diverse industries such as automotive, aerospace, and general manufacturing. The increasing adoption of advanced manufacturing technologies, coupled with a global surge in industrial automation, directly translates to a heightened need for reliable and high-performance chucks to ensure accurate workpiece holding during complex milling operations. Furthermore, the growing emphasis on enhancing manufacturing efficiency and reducing production costs is driving innovation in chuck technology, leading to the development of more sophisticated and versatile solutions.

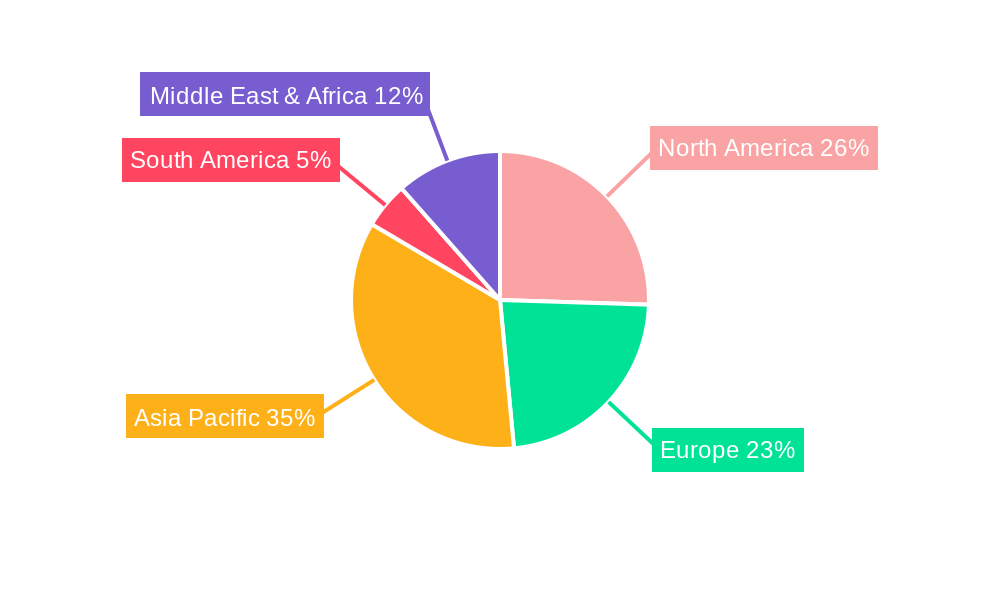

The market is segmented into key applications including Mold Manufacturing and Machine Tool Processing, with the latter expected to dominate due to the sheer volume of milling operations in industrial settings. In terms of types, Pneumatic and Hydraulic Chucks are anticipated to witness strong demand owing to their precision and power, respectively, while Electric Chucks are gaining traction with advancements in automation. Key players like Haas Automation, Inc., NIKKEN KOSAKUSHO WORKS, LTD., and Sandvik Coromant are actively investing in research and development to introduce smart and adaptable chuck solutions. However, the market faces restraints such as the high initial investment costs for advanced chuck systems and the skilled labor requirement for their operation and maintenance. Geographically, Asia Pacific is emerging as a dominant region, driven by the burgeoning manufacturing sector in China and India, followed by North America and Europe, which continue to be significant markets due to established industrial bases and technological advancements.

This comprehensive report delves into the intricate dynamics of the global Milling Machine Chuck market, offering an in-depth analysis of its current state and future trajectory. Spanning the historical period of 2019–2024, with a base year of 2025 and a forecast period extending to 2033, this research provides critical insights for industry stakeholders. We meticulously examine market segmentation by Application (Mold Manufacturing, Machine Tool Processing, Others) and Type (Manual Chuck, Pneumatic Chuck, Hydraulic Chuck, Electric Chuck, Mechanical Chuck). The report incorporates granular data on market size evolution, CAGR, and penetration rates, alongside a detailed examination of key players, notable milestones, and emerging opportunities. With a focus on providing actionable intelligence, this report is designed to empower strategic decision-making in the dynamic milling machine chuck industry.

Milling Machine Chuck Market Dynamics & Structure

The global Milling Machine Chuck market exhibits a moderately concentrated structure, with a blend of established global manufacturers and specialized regional players. Technological innovation acts as a primary driver, pushing advancements in precision, gripping force, and automation capabilities. Regulatory frameworks primarily focus on safety standards and electromagnetic compatibility, influencing product design and manufacturing processes. Competitive product substitutes, such as advanced fixturing systems and specialized workholding solutions, present ongoing challenges. End-user demographics are increasingly dominated by sectors demanding high precision and automation, including automotive, aerospace, and electronics manufacturing. Merger and acquisition (M&A) trends are observable, with larger entities acquiring innovative startups to expand their technological portfolios and market reach. For instance, an estimated 5 M&A deals were recorded in the historical period, indicating a consolidation trend. The market's growth is underpinned by the continuous demand for enhanced productivity and efficiency in machining operations, necessitating sophisticated workholding solutions.

- Market Concentration: Moderately concentrated, with key players holding significant shares but ample room for specialized and regional manufacturers.

- Technological Innovation Drivers: Increased demand for precision machining, automation integration, and higher throughput in manufacturing processes.

- Regulatory Frameworks: Stringent safety standards (e.g., CE marking) and growing emphasis on environmental compliance.

- Competitive Product Substitutes: Advanced fixturing, modular workholding, and robotic end-effectors.

- End-User Demographics: Growing influence of the automotive (35% of demand), aerospace (25% of demand), and electronics (15% of demand) sectors.

- M&A Trends: Strategic acquisitions by larger players to gain market share and access innovative technologies. An estimated 5 significant M&A transactions occurred between 2019 and 2024.

Milling Machine Chuck Growth Trends & Insights

The Milling Machine Chuck market is poised for robust growth, driven by the relentless pursuit of enhanced manufacturing efficiency and precision across diverse industrial sectors. Over the forecast period (2025–2033), the global market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5%, reaching an estimated USD 2,500 million by 2033. This expansion is fueled by the increasing adoption of advanced machining technologies, including CNC machines equipped with sophisticated workholding solutions. The shift towards Industry 4.0 principles, emphasizing automation, connectivity, and intelligent manufacturing, further necessitates the use of high-performance milling machine chucks that can integrate seamlessly into automated workflows.

Consumer behavior is also evolving, with a discernible preference for chucks that offer greater versatility, quicker setup times, and enhanced gripping accuracy. Manufacturers are responding by developing chucks with modular designs, integrated sensor technology for real-time monitoring, and superior resistance to wear and tear. Technological disruptions, such as advancements in material science leading to lighter yet stronger chucks and the integration of smart features, are reshaping the product landscape. For instance, the penetration of electric chucks, offering precise control over gripping force and speed, is expected to witness a significant uptick.

The Mold Manufacturing segment, a critical component of the manufacturing ecosystem, is projected to remain a dominant application, accounting for an estimated 40% of the market share in 2025. This is attributed to the intricate designs and high precision required in mold production. Similarly, Machine Tool Processing, encompassing a wide array of machining operations, will continue to be a substantial market, representing an estimated 45% of the market share. The "Others" segment, including specialized applications in medical device manufacturing and aerospace component production, is also anticipated to grow at a healthy pace.

The adoption rates of advanced chuck technologies are accelerating, driven by the desire for reduced cycle times and improved part quality. Market penetration of hydraulic and electric chucks, in particular, is expected to rise significantly as their benefits in terms of precision and automation become more widely recognized and economically viable. The inherent advantages of these chuck types, such as consistent gripping force and reduced operator fatigue, align perfectly with the evolving demands of modern manufacturing environments. The overall market evolution reflects a continuous drive towards greater automation, higher precision, and increased operational efficiency, with milling machine chucks playing a pivotal role in achieving these objectives.

Dominant Regions, Countries, or Segments in Milling Machine Chuck

The global Milling Machine Chuck market’s growth trajectory is significantly influenced by regional economic policies, industrial infrastructure, and the concentration of key manufacturing industries. North America, particularly the United States, is a dominant region, driven by a strong presence of advanced manufacturing sectors like automotive, aerospace, and medical devices. In 2025, North America is estimated to hold a significant market share, approximately 30% of the global market, due to its robust demand for precision machining and high-tech industrial equipment.

Within North America, the United States leads in terms of market penetration for advanced chuck types such as hydraulic and electric chucks. This dominance is attributed to substantial investments in automation and Industry 4.0 initiatives across its manufacturing base. Key drivers include government incentives for advanced manufacturing, a highly skilled workforce, and the presence of major machine tool manufacturers and end-users. The country’s extensive infrastructure further supports the efficient distribution and servicing of milling machine chucks.

Examining the segments, the Machine Tool Processing application is a key growth driver, projected to account for an estimated 45% of the global market share in 2025. This broad category encompasses a wide spectrum of machining activities, from general production to highly specialized tasks, all of which rely heavily on precise and reliable workholding solutions. The demand for increased productivity, reduced setup times, and improved part quality in machine tool processing directly translates to a higher demand for advanced milling machine chucks.

Among the types of milling machine chucks, Hydraulic Chucks are expected to exhibit strong growth, holding an estimated 25% of the market share in 2025. Their ability to provide high and consistent gripping forces with fine adjustment makes them indispensable for applications requiring exceptional precision and stability. The increasing adoption of high-speed machining and complex part manufacturing in industries like automotive and aerospace directly fuels the demand for hydraulic chucks.

Conversely, Electric Chucks, though currently holding a smaller market share (estimated at 10% in 2025), are anticipated to witness the highest CAGR in the forecast period due to their advanced control capabilities and integration potential with smart manufacturing systems. This segment's growth is closely tied to the broader trend of automation and the implementation of Industry 4.0 technologies, offering precise grip force control and remote monitoring.

The Mold Manufacturing application also remains a substantial contributor, estimated at 40% of the market share in 2025. The intricate and often delicate nature of mold components necessitates chucks that can provide secure yet gentle gripping to prevent damage, making specialized chuck designs crucial in this segment. The continued global demand for intricate plastic and metal components across various industries ensures sustained growth in mold manufacturing.

Milling Machine Chuck Product Landscape

The milling machine chuck product landscape is characterized by a continuous evolution towards enhanced precision, automation integration, and improved durability. Manufacturers are innovating with advanced materials and designs to offer chucks with superior gripping force, accuracy, and resistance to thermal expansion. Key product innovations include self-centering chucks with enhanced runout compensation, quick-change systems that minimize setup times, and smart chucks equipped with sensors for real-time monitoring of gripping force and tool wear. Applications are expanding beyond traditional machining to specialized areas like aerospace component manufacturing and medical implant production, demanding extremely high levels of accuracy and surface finish. The unique selling propositions of leading products often lie in their proprietary gripping mechanisms, advanced control systems for pneumatic and hydraulic chucks, and robust construction for demanding environments.

Key Drivers, Barriers & Challenges in Milling Machine Chuck

The Milling Machine Chuck market is propelled by several key drivers, including the growing demand for automation in manufacturing, the increasing complexity of machined parts, and the continuous need for improved precision and efficiency. Technological advancements in CNC machining and the rise of Industry 4.0 principles are also significant catalysts.

- Technological Advancements: Integration of smart features, improved gripping mechanisms, and use of advanced materials.

- Automation Demand: Need for workholding solutions that integrate seamlessly with automated manufacturing lines.

- Precision Requirements: Growing demand for high-accuracy components in sectors like aerospace and medical.

- Efficiency Gains: Reduced setup times and increased throughput offered by advanced chucks.

Conversely, the market faces several challenges and restraints. High initial investment costs for advanced chucks can be a barrier for smaller enterprises. Supply chain disruptions, particularly for specialized components and raw materials, can impact production and lead times. Stringent quality control requirements and the need for skilled operators to manage and maintain sophisticated chuck systems also pose challenges. Competitive pressure from alternative workholding solutions and the long lifespan of existing chucks can also moderate growth.

- High Initial Investment: Advanced chucks can be costly, posing a barrier for SMEs.

- Supply Chain Volatility: Disruptions in the availability of key materials and components.

- Skilled Workforce Requirements: Need for trained personnel for operation and maintenance.

- Long Product Lifecycles: Existing chucks can remain in service for extended periods, limiting replacement demand.

- Intense Competition: Pressure from both established players and emerging manufacturers.

Emerging Opportunities in Milling Machine Chuck

Emerging opportunities in the Milling Machine Chuck market lie in the development of smart and connected workholding solutions. The increasing adoption of the Industrial Internet of Things (IIoT) presents a significant avenue for growth, with opportunities in integrating sensors for real-time monitoring of gripping force, tool condition, and vibration. The demand for customized and application-specific chucks, particularly in niche sectors like medical device manufacturing and additive manufacturing post-processing, offers untapped potential. Furthermore, the expansion of electric chuck technology, offering precise control and energy efficiency, represents a significant growth area as manufacturers strive for more sustainable and intelligent operations. Exploring markets with a growing manufacturing base and increasing investment in automation also presents lucrative expansion opportunities.

Growth Accelerators in the Milling Machine Chuck Industry

Several factors are acting as growth accelerators for the Milling Machine Chuck industry. The rapid advancements in CNC technology, enabling higher spindle speeds and more complex machining operations, directly translate to a greater need for robust and precise workholding solutions. The global push towards automation and smart manufacturing, fueled by the adoption of Industry 4.0 principles, is a major catalyst, driving demand for chucks that can be seamlessly integrated into automated production lines. Strategic partnerships between chuck manufacturers and machine tool builders are also accelerating growth by ensuring compatibility and co-development of integrated solutions. Furthermore, the increasing focus on reducing manufacturing costs through improved efficiency, reduced scrap rates, and faster cycle times highlights the value proposition of advanced milling machine chucks.

Key Players Shaping the Milling Machine Chuck Market

- Haas Automation, Inc.

- Royal Products

- Production Turning Co.

- Obsidian Manufacturing Industries, Inc.

- MicroCentric

- Magnetool, Inc.

- Worldwide Chuck Services, Inc.

- NIKKEN KOSAKUSHO WORKS, LTD.

- Sandvik Coromant

- Muraki co., ltd.

- Epic Tool Inc.

- MST Corporation

- Toolsavings, LLC

- Amtek Tool and Supply, Inc.

Notable Milestones in Milling Machine Chuck Sector

- 2019: Introduction of advanced self-centering chucks with improved runout compensation.

- 2020: Significant advancements in the integration of sensors for real-time monitoring of chuck performance.

- 2021: Increased adoption of quick-change chuck systems, reducing setup times by up to 50%.

- 2022: Launch of new electric chuck models offering precise control over gripping force and speed.

- 2023: Growing emphasis on sustainable manufacturing practices leading to the development of more energy-efficient chuck designs.

- 2024: Increased M&A activity as larger players acquire innovative startups to enhance their technological portfolios.

In-Depth Milling Machine Chuck Market Outlook

- 2019: Introduction of advanced self-centering chucks with improved runout compensation.

- 2020: Significant advancements in the integration of sensors for real-time monitoring of chuck performance.

- 2021: Increased adoption of quick-change chuck systems, reducing setup times by up to 50%.

- 2022: Launch of new electric chuck models offering precise control over gripping force and speed.

- 2023: Growing emphasis on sustainable manufacturing practices leading to the development of more energy-efficient chuck designs.

- 2024: Increased M&A activity as larger players acquire innovative startups to enhance their technological portfolios.

In-Depth Milling Machine Chuck Market Outlook

The future outlook for the Milling Machine Chuck market is exceptionally positive, driven by ongoing technological advancements and the pervasive trend of industrial automation. The increasing demand for high-precision components across critical sectors like automotive, aerospace, and medical devices will continue to fuel market growth. Growth accelerators, such as the widespread adoption of Industry 4.0 technologies and the development of smart, connected workholding solutions, are poised to create significant value. Strategic partnerships and continued innovation in areas like electric chuck technology will further enhance market potential. The market is expected to witness sustained expansion, with opportunities arising from emerging economies and the increasing need for efficient and reliable manufacturing processes globally.

Milling Machine Chuck Segmentation

-

1. Application

- 1.1. Mold Manufacturing

- 1.2. Machine Tool Processing

- 1.3. Others

-

2. Types

- 2.1. Manual Chuck

- 2.2. Pneumatic Chuck

- 2.3. Hydraulic Chuck

- 2.4. Electric Chuck

- 2.5. Mechanical Chuck

Milling Machine Chuck Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Milling Machine Chuck REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Milling Machine Chuck Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Mold Manufacturing

- 5.1.2. Machine Tool Processing

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Manual Chuck

- 5.2.2. Pneumatic Chuck

- 5.2.3. Hydraulic Chuck

- 5.2.4. Electric Chuck

- 5.2.5. Mechanical Chuck

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Milling Machine Chuck Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Mold Manufacturing

- 6.1.2. Machine Tool Processing

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Manual Chuck

- 6.2.2. Pneumatic Chuck

- 6.2.3. Hydraulic Chuck

- 6.2.4. Electric Chuck

- 6.2.5. Mechanical Chuck

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Milling Machine Chuck Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Mold Manufacturing

- 7.1.2. Machine Tool Processing

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Manual Chuck

- 7.2.2. Pneumatic Chuck

- 7.2.3. Hydraulic Chuck

- 7.2.4. Electric Chuck

- 7.2.5. Mechanical Chuck

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Milling Machine Chuck Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Mold Manufacturing

- 8.1.2. Machine Tool Processing

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Manual Chuck

- 8.2.2. Pneumatic Chuck

- 8.2.3. Hydraulic Chuck

- 8.2.4. Electric Chuck

- 8.2.5. Mechanical Chuck

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Milling Machine Chuck Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Mold Manufacturing

- 9.1.2. Machine Tool Processing

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Manual Chuck

- 9.2.2. Pneumatic Chuck

- 9.2.3. Hydraulic Chuck

- 9.2.4. Electric Chuck

- 9.2.5. Mechanical Chuck

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Milling Machine Chuck Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Mold Manufacturing

- 10.1.2. Machine Tool Processing

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Manual Chuck

- 10.2.2. Pneumatic Chuck

- 10.2.3. Hydraulic Chuck

- 10.2.4. Electric Chuck

- 10.2.5. Mechanical Chuck

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Haas Automation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Royal Products

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Production Turning Co.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Obsidian Manufacturing Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MicroCentric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Magnetool

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Worldwide Chuck Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Inc.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NIKKEN KOSAKUSHO WORKS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LTD.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sandvik Coromant

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Muraki co.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ltd.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Epic Tool Inc.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 MST Corporation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Toolsavings

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 LLC

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Amtek Tool and Supply

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Inc.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Haas Automation

List of Figures

- Figure 1: Global Milling Machine Chuck Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Milling Machine Chuck Revenue (million), by Application 2024 & 2032

- Figure 3: North America Milling Machine Chuck Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Milling Machine Chuck Revenue (million), by Types 2024 & 2032

- Figure 5: North America Milling Machine Chuck Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Milling Machine Chuck Revenue (million), by Country 2024 & 2032

- Figure 7: North America Milling Machine Chuck Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Milling Machine Chuck Revenue (million), by Application 2024 & 2032

- Figure 9: South America Milling Machine Chuck Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Milling Machine Chuck Revenue (million), by Types 2024 & 2032

- Figure 11: South America Milling Machine Chuck Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Milling Machine Chuck Revenue (million), by Country 2024 & 2032

- Figure 13: South America Milling Machine Chuck Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Milling Machine Chuck Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Milling Machine Chuck Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Milling Machine Chuck Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Milling Machine Chuck Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Milling Machine Chuck Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Milling Machine Chuck Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Milling Machine Chuck Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Milling Machine Chuck Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Milling Machine Chuck Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Milling Machine Chuck Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Milling Machine Chuck Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Milling Machine Chuck Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Milling Machine Chuck Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Milling Machine Chuck Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Milling Machine Chuck Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Milling Machine Chuck Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Milling Machine Chuck Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Milling Machine Chuck Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Milling Machine Chuck Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Milling Machine Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Milling Machine Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Milling Machine Chuck Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Milling Machine Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Milling Machine Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Milling Machine Chuck Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Milling Machine Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Milling Machine Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Milling Machine Chuck Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Milling Machine Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Milling Machine Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Milling Machine Chuck Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Milling Machine Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Milling Machine Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Milling Machine Chuck Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Milling Machine Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Milling Machine Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Milling Machine Chuck Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Milling Machine Chuck Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Milling Machine Chuck?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Milling Machine Chuck?

Key companies in the market include Haas Automation, Inc., Royal Products, Production Turning Co., Obsidian Manufacturing Industries, Inc., MicroCentric, Magnetool, Inc., Worldwide Chuck Services, Inc., NIKKEN KOSAKUSHO WORKS, LTD., Sandvik Coromant, Muraki co., ltd., Epic Tool Inc., MST Corporation, Toolsavings, LLC, Amtek Tool and Supply, Inc..

3. What are the main segments of the Milling Machine Chuck?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Milling Machine Chuck," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Milling Machine Chuck report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Milling Machine Chuck?

To stay informed about further developments, trends, and reports in the Milling Machine Chuck, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence