Key Insights

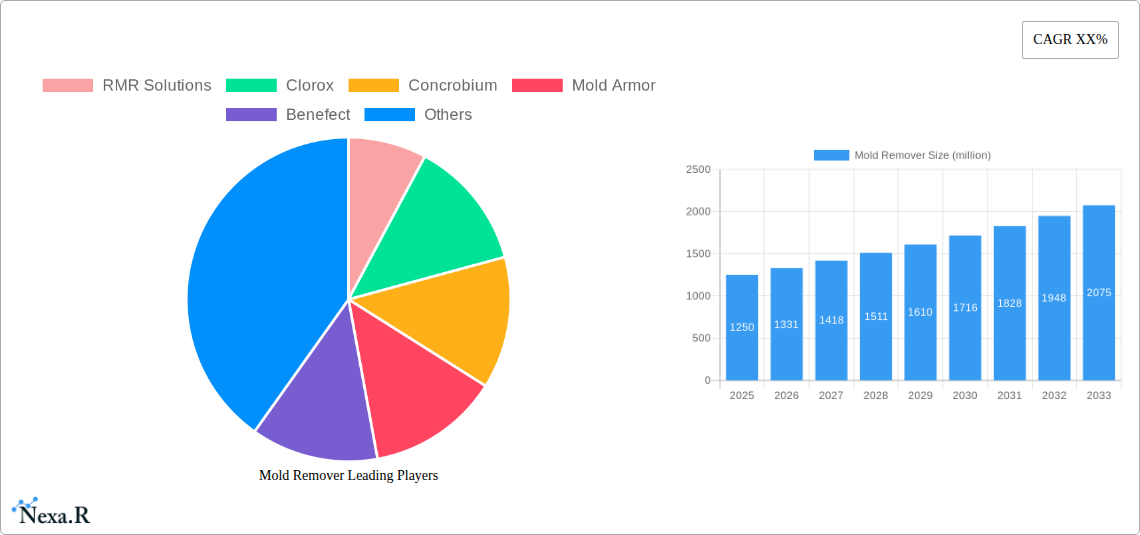

The global mold remover market is projected for robust growth, estimated at a market size of USD 1,250 million in 2025 and expected to expand at a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This expansion is primarily driven by increasing consumer awareness regarding the health hazards associated with mold infestation, coupled with rising disposable incomes that enable greater investment in home maintenance and improvement. The growing concern for indoor air quality, especially in residential settings, fuels demand for effective mold removal solutions. Furthermore, the commercial sector, encompassing healthcare facilities, hospitality, and food processing industries, also contributes significantly to market growth due to stringent hygiene regulations and the need to maintain a safe and compliant environment. The market is segmented into family use and commercial use applications, with the family use segment currently holding a dominant share due to a heightened focus on health and well-being within households.

Emerging trends like the development of eco-friendly and non-toxic mold removers are shaping the market landscape, catering to environmentally conscious consumers. Technological advancements are also leading to more potent and faster-acting formulations. However, the market faces restraints such as the perceived high cost of specialized mold removal products and the availability of DIY alternatives, which can hinder widespread adoption. The forecast period is expected to witness substantial growth across all regions, with Asia Pacific emerging as a key growth engine due to rapid urbanization and increasing disposable incomes, leading to greater spending on home care. North America and Europe are anticipated to maintain significant market shares, driven by mature markets with established awareness and regulatory frameworks. The competitive landscape is characterized by the presence of both global giants and specialized regional players, all vying for market dominance through product innovation and strategic partnerships.

Comprehensive Report on the Global Mold Remover Market: Dynamics, Trends, and Future Outlook (2019-2033)

This report offers an in-depth analysis of the global mold remover market, a critical segment within the broader household and commercial cleaning industries. It provides actionable insights into market dynamics, growth trajectories, regional dominance, product innovation, and key player strategies, catering to industry professionals, manufacturers, distributors, and investors. The study encompasses a detailed examination of the market from 2019 to 2033, with a base year of 2025, offering a robust historical perspective and a comprehensive forecast.

Mold Remover Market Dynamics & Structure

The global mold remover market exhibits a moderately concentrated structure, with a mix of large multinational corporations and smaller specialized manufacturers. Key players like Clorox, SC Johnson, and Microban hold significant market shares due to their established brand recognition and extensive distribution networks. Technological innovation is a primary driver, with ongoing research focused on developing eco-friendly, faster-acting, and more effective formulations that minimize collateral damage to surfaces. Regulatory frameworks, particularly concerning chemical safety and environmental impact, play a crucial role in shaping product development and market access. Competitive product substitutes include natural remedies and DIY solutions, though professional-grade mold removers often offer superior efficacy. End-user demographics span both residential homeowners seeking to maintain healthy living environments and commercial entities in sectors like healthcare, hospitality, and construction addressing significant mold issues. Merger and acquisition (M&A) trends are observed as companies seek to expand their product portfolios, gain access to new technologies, or consolidate market presence. For instance, the historical period saw an estimated 15 M&A deals valued at over $50 million in aggregate, reflecting the industry's consolidation drive. Innovation barriers include the high cost of research and development for novel active ingredients and the stringent testing required to meet safety and efficacy standards.

- Market Concentration: Moderately concentrated with a blend of large corporations and niche players.

- Technological Innovation Drivers: Demand for eco-friendly, high-performance, and surface-safe formulations.

- Regulatory Frameworks: Emphasis on chemical safety, environmental sustainability, and product labeling standards.

- Competitive Product Substitutes: Natural alternatives, DIY solutions, and preventative measures.

- End-User Demographics: Household consumers, property managers, healthcare facilities, construction companies.

- M&A Trends: Consolidation to expand market reach and technological capabilities, with an estimated 15 deals exceeding $50 million in the historical period.

- Innovation Barriers: R&D costs, regulatory approval processes, and market education for novel solutions.

Mold Remover Growth Trends & Insights

The global mold remover market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% between 2025 and 2033. This robust expansion is fueled by increasing consumer awareness regarding the health risks associated with mold exposure, leading to a higher demand for effective cleaning solutions. The market size, estimated at around $1.8 billion in 2025, is expected to reach approximately $2.8 billion by 2033. Adoption rates for specialized mold removers are steadily increasing, driven by urbanization, aging infrastructure in developed nations, and the growing prevalence of moisture-related building issues in humid climates. Technological disruptions are contributing to this growth through the development of advanced formulations, including enzyme-based cleaners, low-VOC (Volatile Organic Compound) products, and antimicrobial treatments that offer long-term protection. Consumer behavior shifts are also playing a pivotal role, with a growing preference for convenient, ready-to-use products and a heightened concern for indoor air quality. The family use segment, driven by concerns over child health and well-being, is witnessing a substantial surge in demand for safe and effective mold removal solutions. Similarly, the commercial use segment, encompassing sectors like healthcare, hospitality, and food processing, is increasingly investing in professional-grade mold remediation to comply with health regulations and maintain operational integrity. Market penetration is anticipated to rise as more households and businesses recognize the necessity of proactive mold management, moving beyond reactive cleaning to preventative measures.

Dominant Regions, Countries, or Segments in Mold Remover

The North America region currently dominates the global mold remover market, with the United States being the primary growth engine. This dominance is attributed to a confluence of factors including high consumer disposable income, a strong emphasis on home maintenance and health, and a well-established infrastructure for cleaning product distribution. The estimated market share for North America stands at approximately 35% of the global market. Within North America, the Family Use segment, particularly for Inside Mold Removers, is the most significant contributor to market growth. This is driven by heightened awareness of the health implications of indoor mold, especially concerning respiratory issues and allergies, which disproportionately affect families with children and the elderly.

- Regional Dominance: North America, led by the United States.

- Key Drivers in North America:

- High disposable income and consumer spending on home improvement and health.

- Strong awareness of health risks associated with mold exposure.

- Well-developed retail and e-commerce distribution channels.

- Prevalence of older housing stock requiring remediation.

- Favorable regulatory environment for cleaning products.

- Dominant Segment: Family Use, specifically Inside Mold Removers.

- Factors Driving Family Use Segment Growth:

- Increased focus on indoor air quality and healthy living environments.

- Concern for vulnerable populations, including children and individuals with respiratory conditions.

- Availability of user-friendly, readily available consumer-grade products.

- The growth of the DIY home maintenance culture.

- Market Share within North America: Family Use segment accounts for an estimated 60% of the regional market for mold removers.

- Growth Potential: While mature, North America continues to show steady growth, with emerging opportunities in specialized formulations for sensitive surfaces and allergen reduction.

Other regions like Europe also represent significant markets, with countries like Germany and the UK showing strong demand due to aging infrastructure and stringent building codes promoting healthy indoor environments. The Asia-Pacific region is emerging as a high-growth market, driven by rapid urbanization, increasing disposable incomes, and rising awareness of health and hygiene standards. The Commercial Use segment, while smaller in current market share (estimated at 30%), is projected to witness higher growth rates due to increased investment in industrial mold remediation, particularly in sectors like food and beverage, pharmaceuticals, and data centers.

Mold Remover Product Landscape

The mold remover product landscape is characterized by innovation aimed at enhancing efficacy, safety, and user convenience. Current offerings include a variety of formulations such as sprays, gels, wipes, and concentrates, catering to diverse application needs. Key innovations involve the incorporation of natural active ingredients, such as vinegar and essential oils, appealing to environmentally conscious consumers. Advanced chemical formulations now feature low-VOC content, bleach-free options, and quick-drying properties to minimize disruption. Performance metrics focus on rapid killing of mold and mildew spores, effective stain removal, and long-term prevention of regrowth. Unique selling propositions often revolve around specific application targets, like bathroom mold, shower mold, or outdoor mildew, and the compatibility with various surfaces, including delicate materials. Technological advancements are also leading to the development of smart mold detection and removal kits that integrate with home automation systems.

Key Drivers, Barriers & Challenges in Mold Remover

Key Drivers:

- Growing Health and Wellness Awareness: Increased understanding of mold's detrimental effects on health, particularly respiratory issues and allergies, is a primary market propellant.

- Urbanization and Aging Infrastructure: Densely populated urban areas and older buildings are more susceptible to moisture issues and mold growth.

- Demand for Eco-Friendly and Safe Products: A strong consumer preference for sustainable, non-toxic, and biodegradable cleaning solutions.

- Technological Advancements: Development of more effective, faster-acting, and surface-friendly formulations.

- Government Regulations and Building Codes: Stricter regulations for healthy indoor environments are driving demand for effective mold remediation.

Barriers & Challenges:

- Perception of DIY vs. Professional Solutions: Some consumers still rely on less effective DIY methods, creating a barrier to adoption of specialized products.

- Cost of Advanced Formulations: The research and development of novel, eco-friendly ingredients can lead to higher product costs.

- Consumer Education on Mold Prevention: A need for greater consumer education on proactive mold prevention strategies rather than just reactive removal.

- Supply Chain Disruptions: Global supply chain volatility can impact raw material availability and product distribution.

- Intense Competition: The market faces competition from established brands and an increasing number of new entrants, putting pressure on pricing. Quantifiable impacts include potential price wars leading to a 5-8% reduction in profit margins for smaller players and a projected 10% increase in marketing expenditure to differentiate products.

Emerging Opportunities in Mold Remover

Emerging opportunities in the mold remover market lie in the development of advanced preventative solutions that go beyond immediate eradication. This includes the creation of coatings and treatments that actively inhibit mold growth for extended periods, particularly for high-risk areas like basements, bathrooms, and kitchens. Untapped markets exist in regions with rapidly developing economies and increasing awareness of indoor environmental quality. Innovative applications in smart home technology, where mold sensors trigger automated cleaning responses, present a future growth avenue. Evolving consumer preferences are leaning towards multi-functional products that offer mold removal, disinfection, and deodorizing capabilities in a single solution. The commercial sector presents a substantial opportunity with specialized, heavy-duty mold removers for industrial applications and healthcare facilities.

Growth Accelerators in the Mold Remover Industry

Several catalysts are accelerating growth in the mold remover industry. Technological breakthroughs in biotechnology are leading to the development of enzyme-based mold removers that are highly effective and environmentally benign. Strategic partnerships between chemical manufacturers and consumer goods companies are facilitating broader market penetration and the co-development of innovative product lines. The increasing global focus on sustainability and green chemistry is pushing the industry towards biodegradable and low-impact formulations, creating a competitive advantage for early adopters. Furthermore, market expansion strategies targeting emerging economies, coupled with increased investment in marketing and consumer education campaigns highlighting the health benefits of mold-free environments, are significantly boosting industry growth. The estimated CAGR for the forecast period is driven by these factors.

Key Players Shaping the Mold Remover Market

- RMR Solutions

- Clorox

- Concrobium

- Mold Armor

- Benefect

- Wet & Forget

- Microban

- 30 Seconds

- Clr

- Goo Gone

- Damprid

- Home Armor

- Humydry

- Kurd Kutter

- Miracle Brands

- KAO

- Asahipen

- Lvsan

- Mootaa

- SC Johnson

Notable Milestones in Mold Remover Sector

- 2019: Launch of bio-based, eco-friendly mold removers by several niche manufacturers, responding to growing consumer demand for sustainable products.

- 2020 (Early): Increased demand for household cleaning products, including mold removers, due to heightened awareness of hygiene during the global pandemic.

- 2021: Introduction of spray-and-seal formulations that not only remove mold but also offer preventative protection, gaining significant traction.

- 2022 (Mid): Acquisition of smaller, innovative mold remediation companies by larger corporations to expand product portfolios and technological capabilities.

- 2023: Growing emphasis on low-VOC and bleach-free mold remover options due to increasing regulatory scrutiny and consumer health concerns.

In-Depth Mold Remover Market Outlook

The mold remover market is set for sustained and robust growth, driven by an unwavering focus on indoor air quality and public health. The convergence of technological innovation, particularly in eco-friendly and highly effective formulations, with evolving consumer preferences for safer and more sustainable products, will continue to shape the market's trajectory. Strategic investments in research and development, coupled with aggressive market expansion into underserved regions and commercial sectors, are expected to be key growth accelerators. Companies that can successfully navigate regulatory landscapes, address supply chain complexities, and effectively educate consumers on both mold removal and prevention will be well-positioned to capture significant market share and capitalize on the vast future potential of this essential industry. The outlook remains highly positive, with continued innovation promising to deliver enhanced solutions for a healthier living and working environment.

Mold Remover Segmentation

-

1. Application

- 1.1. Family Use

- 1.2. Commercial Use

-

2. Types

- 2.1. Inside Mold Remover

- 2.2. Outside Mold Remover

Mold Remover Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mold Remover REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mold Remover Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Family Use

- 5.1.2. Commercial Use

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Inside Mold Remover

- 5.2.2. Outside Mold Remover

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Mold Remover Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Family Use

- 6.1.2. Commercial Use

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Inside Mold Remover

- 6.2.2. Outside Mold Remover

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Mold Remover Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Family Use

- 7.1.2. Commercial Use

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Inside Mold Remover

- 7.2.2. Outside Mold Remover

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Mold Remover Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Family Use

- 8.1.2. Commercial Use

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Inside Mold Remover

- 8.2.2. Outside Mold Remover

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Mold Remover Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Family Use

- 9.1.2. Commercial Use

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Inside Mold Remover

- 9.2.2. Outside Mold Remover

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Mold Remover Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Family Use

- 10.1.2. Commercial Use

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Inside Mold Remover

- 10.2.2. Outside Mold Remover

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 RMR Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clorox

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Concrobium

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mold Armor

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Benefect

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wet & Forget

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microban

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 30 Seconds

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Clr

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Goo Gone

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Damprid

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Home Armor

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Humydry

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kurd Kutter

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Miracle Brands

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 KAO

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Asahipen

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Lvsan

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Mootaa

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 SC Johnson

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 RMR Solutions

List of Figures

- Figure 1: Global Mold Remover Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Mold Remover Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Mold Remover Revenue (million), by Application 2024 & 2032

- Figure 4: North America Mold Remover Volume (K), by Application 2024 & 2032

- Figure 5: North America Mold Remover Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Mold Remover Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Mold Remover Revenue (million), by Types 2024 & 2032

- Figure 8: North America Mold Remover Volume (K), by Types 2024 & 2032

- Figure 9: North America Mold Remover Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Mold Remover Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Mold Remover Revenue (million), by Country 2024 & 2032

- Figure 12: North America Mold Remover Volume (K), by Country 2024 & 2032

- Figure 13: North America Mold Remover Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Mold Remover Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Mold Remover Revenue (million), by Application 2024 & 2032

- Figure 16: South America Mold Remover Volume (K), by Application 2024 & 2032

- Figure 17: South America Mold Remover Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Mold Remover Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Mold Remover Revenue (million), by Types 2024 & 2032

- Figure 20: South America Mold Remover Volume (K), by Types 2024 & 2032

- Figure 21: South America Mold Remover Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Mold Remover Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Mold Remover Revenue (million), by Country 2024 & 2032

- Figure 24: South America Mold Remover Volume (K), by Country 2024 & 2032

- Figure 25: South America Mold Remover Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Mold Remover Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Mold Remover Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Mold Remover Volume (K), by Application 2024 & 2032

- Figure 29: Europe Mold Remover Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Mold Remover Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Mold Remover Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Mold Remover Volume (K), by Types 2024 & 2032

- Figure 33: Europe Mold Remover Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Mold Remover Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Mold Remover Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Mold Remover Volume (K), by Country 2024 & 2032

- Figure 37: Europe Mold Remover Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Mold Remover Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Mold Remover Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Mold Remover Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Mold Remover Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Mold Remover Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Mold Remover Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Mold Remover Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Mold Remover Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Mold Remover Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Mold Remover Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Mold Remover Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Mold Remover Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Mold Remover Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Mold Remover Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Mold Remover Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Mold Remover Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Mold Remover Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Mold Remover Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Mold Remover Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Mold Remover Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Mold Remover Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Mold Remover Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Mold Remover Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Mold Remover Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Mold Remover Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mold Remover Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Mold Remover Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Mold Remover Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Mold Remover Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Mold Remover Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Mold Remover Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Mold Remover Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Mold Remover Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Mold Remover Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Mold Remover Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Mold Remover Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Mold Remover Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Mold Remover Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Mold Remover Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Mold Remover Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Mold Remover Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Mold Remover Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Mold Remover Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Mold Remover Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Mold Remover Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Mold Remover Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Mold Remover Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Mold Remover Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Mold Remover Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Mold Remover Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Mold Remover Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Mold Remover Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Mold Remover Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Mold Remover Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Mold Remover Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Mold Remover Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Mold Remover Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Mold Remover Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Mold Remover Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Mold Remover Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Mold Remover Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Mold Remover Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Mold Remover Volume K Forecast, by Country 2019 & 2032

- Table 81: China Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Mold Remover Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Mold Remover Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Mold Remover Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mold Remover?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Mold Remover?

Key companies in the market include RMR Solutions, Clorox, Concrobium, Mold Armor, Benefect, Wet & Forget, Microban, 30 Seconds, Clr, Goo Gone, Damprid, Home Armor, Humydry, Kurd Kutter, Miracle Brands, KAO, Asahipen, Lvsan, Mootaa, SC Johnson.

3. What are the main segments of the Mold Remover?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mold Remover," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mold Remover report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mold Remover?

To stay informed about further developments, trends, and reports in the Mold Remover, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence