Key Insights

The North America container terminal operations market is experiencing robust expansion, propelled by surging global trade, particularly e-commerce growth, and the imperative for efficient port infrastructure to accommodate larger vessels. A projected compound annual growth rate (CAGR) of 4.5% from 2025 to 2033 indicates substantial market evolution. Key growth drivers include crude oil and dry cargo handling, with stevedoring and cargo transportation services demonstrating peak demand. Market expansion is further stimulated by ongoing investments in port modernization and automation, focusing on enhanced operational efficiency and reduced turnaround times. Leading entities such as Ports America Inc., SSA Marine, and Mediterranean Shipping Company are instrumental in shaping the market through strategic alliances, expansions, and technological advancements. The United States, leveraging its extensive coastline and key ports, commands the majority of the North American market, followed by Canada and Mexico. Nevertheless, potential market restraints include regulatory complexities, labor dynamics, and supply chain vulnerabilities. Sustained infrastructure development, adoption of advanced technologies like AI and automation, and adept management of logistical challenges will be critical for future market prosperity.

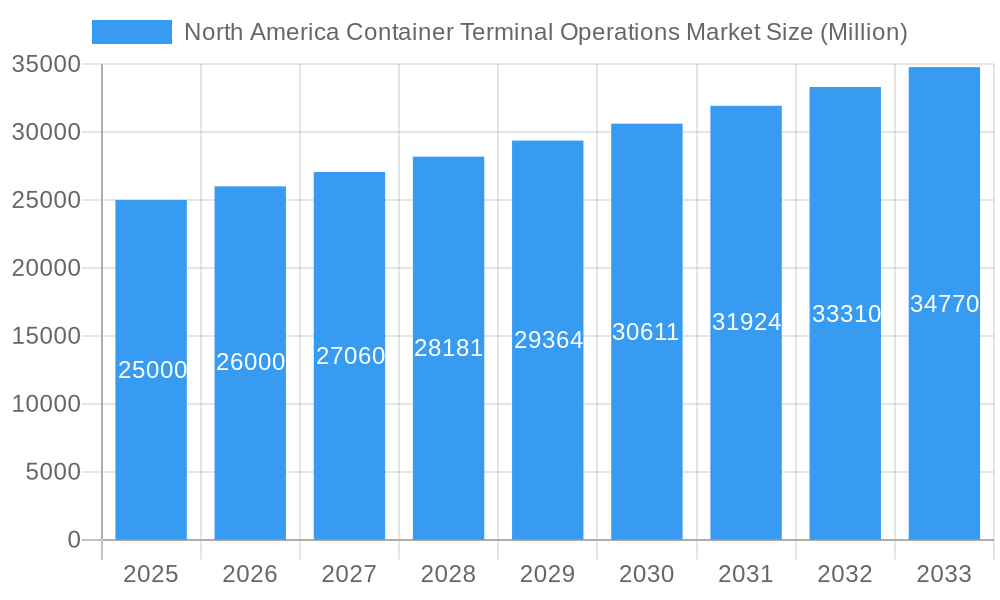

North America Container Terminal Operations Market Market Size (In Billion)

While specific market size figures for the base year are still being refined, projections suggest the North American container terminal operations market will reach approximately $213.38 billion by 2025. This forecast considers the significant influence of major market participants and the considerable volume of cargo processed. Continued expansion is anticipated through 2033, driven by ongoing investments in port capacity and the sustained growth of e-commerce, which will necessitate increased shipping and handling activities across major ports. The growing emphasis on sustainable and eco-friendly port operations will also shape market dynamics, potentially spurring investment in alternative energy and green technologies. This presents opportunities for forward-thinking companies that can effectively integrate sustainability into their operational strategies.

North America Container Terminal Operations Market Company Market Share

North America Container Terminal Operations Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Container Terminal Operations Market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, key players, and future projections, offering valuable insights for industry professionals, investors, and stakeholders. The parent market is the broader North American logistics and transportation sector, while the child market specifically focuses on container terminal operations within this landscape. The market size is projected to reach xx Million by 2033.

North America Container Terminal Operations Market Dynamics & Structure

This section analyzes the competitive landscape of the North American container terminal operations market, examining market concentration, technological advancements, regulatory influences, and the role of mergers and acquisitions (M&A). The market is characterized by a moderately concentrated structure, with key players holding significant market share. However, the presence of several smaller, regional operators fosters competition.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the North American container terminal operations market is estimated at xx, indicating a moderately concentrated market. The top 5 players hold an estimated xx% market share.

Technological Innovation: Automation, digitization (e.g., blockchain technology for supply chain transparency), and the implementation of sophisticated port management systems are driving efficiency and productivity improvements. However, high initial investment costs and integration challenges act as barriers to wider adoption.

Regulatory Frameworks: Government regulations regarding port security, environmental protection, and labor practices significantly influence market operations. Compliance costs and evolving regulations represent ongoing challenges.

Competitive Product Substitutes: While direct substitutes are limited, the increasing efficiency of intermodal transportation (rail and truck) presents indirect competition.

End-User Demographics: The primary end-users are importers, exporters, shipping lines, and freight forwarders. Their needs and preferences regarding terminal services (speed, efficiency, reliability) significantly shape market demand.

M&A Trends: The past five years have witnessed xx M&A deals in the North American container terminal operations market, driven by a desire to expand capacity, optimize operations, and gain access to new markets.

North America Container Terminal Operations Market Growth Trends & Insights

The North American container terminal operations market has experienced consistent growth over the historical period (2019-2024). This growth is primarily fueled by increasing global trade volumes, expanding e-commerce activities, and the steady growth of containerized cargo. However, global economic uncertainties and supply chain disruptions have impacted growth rates in recent years.

- Market Size Evolution: The market size grew from xx Million in 2019 to xx Million in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%.

- Adoption Rates: The adoption of automation and digital technologies within container terminals is increasing, albeit at a moderate pace.

- Technological Disruptions: The implementation of AI-powered systems for cargo optimization and predictive maintenance is enhancing operational efficiency.

- Consumer Behavior Shifts: Increased demand for faster transit times and improved supply chain visibility are shaping customer expectations.

- Forecast: The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033.

Dominant Regions, Countries, or Segments in North America Container Terminal Operations Market

The West Coast ports (particularly California) and the East Coast ports (New York/New Jersey, Savannah) dominate the North American container terminal operations market. These regions benefit from established infrastructure, proximity to major consumer markets, and high cargo volumes.

By Cargo Type: The Dry Cargo segment holds the largest market share, followed by Other Liquid Cargo and Crude Oil.

- Dry Cargo: High import/export volumes of manufactured goods and consumer products drive growth in this segment.

- Other Liquid Cargo: This segment's growth is tied to the transportation of chemicals and other liquid commodities.

- Crude Oil: This segment's growth depends on energy demand and trade patterns.

By Service: The Stevedoring segment commands the largest market share, reflecting the crucial role of loading and unloading cargo in container terminal operations. Cargo and handling transportation and other services support this core function.

North America Container Terminal Operations Market Product Landscape

Technological advancements are reshaping the product landscape, focusing on enhanced efficiency, automation, and data-driven decision-making. Automated guided vehicles (AGVs), automated stacking cranes, and real-time cargo tracking systems are key examples of product innovations. These technologies offer improvements in speed, safety, and cost-effectiveness. Unique selling propositions are centered on improving throughput, reducing labor costs, and enhancing supply chain visibility.

Key Drivers, Barriers & Challenges in North America Container Terminal Operations Market

Key Drivers: Increasing global trade, growing e-commerce, and investments in port infrastructure are key market drivers. Government initiatives to improve port efficiency and support trade also contribute.

Key Challenges: Congestion at major ports, labor shortages, and the increasing cost of complying with environmental regulations represent significant challenges. Supply chain disruptions and geopolitical instability further add to market uncertainties. These factors can impact operational efficiency and profitability.

Emerging Opportunities in North America Container Terminal Operations Market

Emerging opportunities lie in the adoption of advanced technologies like AI and IoT to enhance automation, optimize operations, and improve supply chain visibility. The growing demand for sustainable and environmentally friendly port operations presents further opportunities for green technology investments. Expansion into inland ports and improved intermodal connectivity can also unlock significant growth potential.

Growth Accelerators in the North America Container Terminal Operations Market Industry

Technological advancements, strategic partnerships between terminal operators and logistics providers, and expansion into new markets (e.g., inland ports) are expected to drive long-term growth. Investments in infrastructure upgrades and capacity expansion in key port regions will also contribute significantly.

Key Players Shaping the North America Container Terminal Operations Market Market

- Ports America Inc

- Bayliner

- SSA Marine

- Rhenus Group

- Husky Terminal and Stevedoring LLC

- Viking Line

- Indiana Port Commission

- MEYER WERFT GmbH & Co KG

- Mississippi State Port Authority at Gulfport

- Mediterranean Shipping Company S A

Notable Milestones in North America Container Terminal Operations Market Sector

- 2021: Implementation of new port security protocols at several major ports.

- 2022: Launch of several automated container handling systems at key terminals.

- 2023: Increased investment in port infrastructure modernization projects.

In-Depth North America Container Terminal Operations Market Market Outlook

The North American container terminal operations market is poised for continued growth, driven by the factors discussed above. Strategic investments in automation, digitalization, and infrastructure upgrades will be crucial for maintaining competitiveness and meeting increasing demand. The focus on sustainability and resilient supply chains will shape future market developments. Opportunities exist for companies to leverage emerging technologies and strategic partnerships to capture market share and drive profitability.

North America Container Terminal Operations Market Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Crude Oil

- 2.2. Dry Cargo

- 2.3. Other Liquid Cargo

- 3. US

- 4. Canada

North America Container Terminal Operations Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Container Terminal Operations Market Regional Market Share

Geographic Coverage of North America Container Terminal Operations Market

North America Container Terminal Operations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Initiatives towards Greener Industrial Port Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Crude Oil

- 5.2.2. Dry Cargo

- 5.2.3. Other Liquid Cargo

- 5.3. Market Analysis, Insights and Forecast - by US

- 5.4. Market Analysis, Insights and Forecast - by Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ports America Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayliner

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SSA Marine

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rhenus Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Husky Terminal and Stevedoring LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Viking Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indiana Port Commission

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MEYER WERFT GmbH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mississippi State Port Authority at Gulfport**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mediterranean Shipping Company S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ports America Inc

List of Figures

- Figure 1: North America Container Terminal Operations Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Container Terminal Operations Market Share (%) by Company 2025

List of Tables

- Table 1: North America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: North America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 3: North America Container Terminal Operations Market Revenue billion Forecast, by US 2020 & 2033

- Table 4: North America Container Terminal Operations Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 5: North America Container Terminal Operations Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 7: North America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 8: North America Container Terminal Operations Market Revenue billion Forecast, by US 2020 & 2033

- Table 9: North America Container Terminal Operations Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 10: North America Container Terminal Operations Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Container Terminal Operations Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Container Terminal Operations Market?

Key companies in the market include Ports America Inc, Bayliner, SSA Marine, Rhenus Group, Husky Terminal and Stevedoring LLC, Viking Line, Indiana Port Commission, MEYER WERFT GmbH & Co KG, Mississippi State Port Authority at Gulfport**List Not Exhaustive, Mediterranean Shipping Company S A.

3. What are the main segments of the North America Container Terminal Operations Market?

The market segments include Service, Cargo Type, US, Canada.

4. Can you provide details about the market size?

The market size is estimated to be USD 213.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Initiatives towards Greener Industrial Port Activities.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Container Terminal Operations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Container Terminal Operations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Container Terminal Operations Market?

To stay informed about further developments, trends, and reports in the North America Container Terminal Operations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence