Key Insights

The Omani third-party logistics (3PL) market, valued at 51.34 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.6% from 2025 to 2033. This expansion is propelled by the burgeoning e-commerce sector, requiring efficient warehousing and last-mile delivery. Growth in manufacturing, automotive, and oil & gas industries further necessitates specialized 3PL services. Oman's strategic geographic position as a regional gateway enhances its appeal for international transportation management. While regulatory and infrastructure considerations exist, the market outlook is positive.

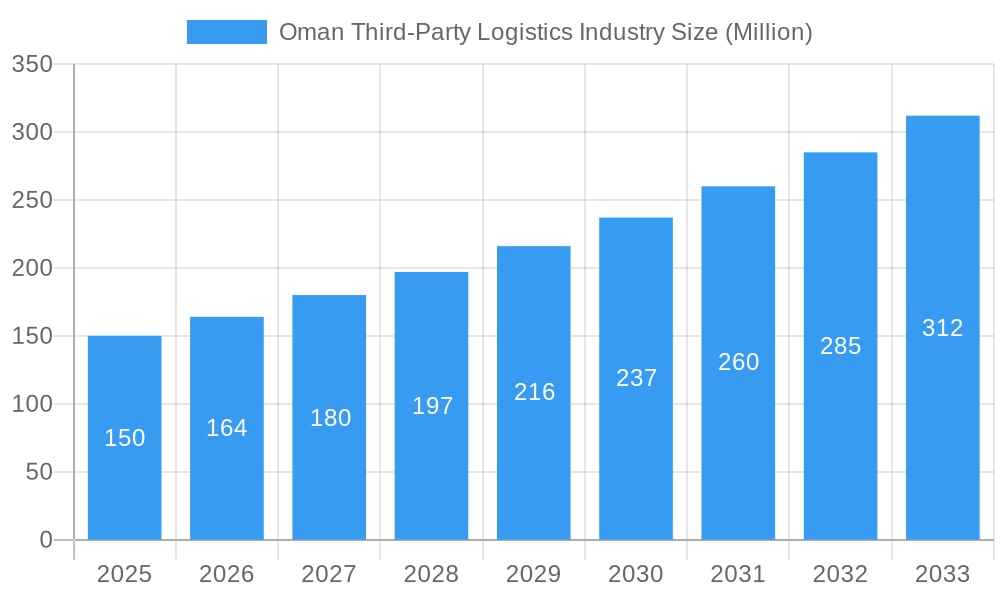

Oman Third-Party Logistics Industry Market Size (In Billion)

Market segmentation highlights domestic transportation as a dominant segment, with international transportation poised for significant growth driven by global trade. Value-added warehousing and distribution services are also in demand for supply chain optimization. Key end-user industries include manufacturing & automotive, oil & gas and chemicals, and distributive trade, notably the expanding e-commerce sector. Pharma & healthcare, construction, and other segments contribute to market dynamics. Leading players such as Premier Logistics Muscat, Marafi Asyad Company, and DHL Supply Chains are shaping service offerings and competitive strategies. The forecast period anticipates sustained growth, supported by infrastructure improvements, foreign investment, and government initiatives to enhance logistics efficiency.

Oman Third-Party Logistics Industry Company Market Share

Oman Third-Party Logistics (3PL) Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Oman 3PL industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on both the parent market (Oman Logistics) and child markets (Domestic & International Transportation, Warehousing & Distribution, specific end-user sectors), this report is essential for industry professionals, investors, and strategic planners. The study period spans 2019-2033, with 2025 as the base and estimated year.

Study Period: 2019-2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025-2033 | Historical Period: 2019-2024

Oman Third-Party Logistics Industry Market Dynamics & Structure

The Omani 3PL market is experiencing moderate consolidation, with larger players like Asyad Group and Aramex Muscat increasing their market share. Technological innovation, driven by the adoption of automation and digitalization, is a key growth driver, albeit facing challenges related to infrastructure limitations and skilled labor scarcity. The regulatory framework, while supportive of logistics development, requires ongoing refinement for optimal efficiency. Competitive substitutes, primarily in the form of in-house logistics operations, are present but are gradually being replaced by specialized 3PL providers offering economies of scale and expertise.

- Market Concentration: Moderately consolidated, with a few dominant players and numerous smaller firms. (Market share data will be provided in the full report - xx% for top 3 players).

- Technological Innovation: Automation (warehouse robots), digitalization (e-commerce logistics), and data analytics are key drivers, hindered by infrastructure limitations and skill gaps.

- Regulatory Framework: Supportive, but improvements needed in streamlining licensing and customs procedures.

- Competitive Substitutes: In-house logistics operations pose some competition, but outsourcing to 3PLs is increasingly prevalent.

- End-User Demographics: Diverse, with significant contributions from Manufacturing & Automotive, Oil & Gas, and Distributive Trade.

- M&A Trends: Moderate M&A activity, with larger players pursuing acquisitions to expand service offerings and geographical reach. (xx M&A deals in the last 5 years).

Oman Third-Party Logistics Industry Growth Trends & Insights

The Omani 3PL market exhibits a steady growth trajectory, fueled by increasing e-commerce penetration, infrastructure development, and government initiatives promoting diversification of the economy. The adoption rate of advanced technologies, such as AI-powered route optimization and predictive analytics, is gradually increasing, further enhancing operational efficiency and cost-effectiveness. Consumer behavior shifts towards online shopping are driving demand for efficient last-mile delivery solutions. The report will provide a detailed analysis of the market size evolution, including the Compound Annual Growth Rate (CAGR) and market penetration rates for various segments. (Expected CAGR for 2025-2033: xx%).

Dominant Regions, Countries, or Segments in Oman Third-Party Logistics Industry

The Muscat region continues to be the epicenter of the Omani 3PL market, benefiting from a high concentration of businesses and robust, well-developed infrastructure including key ports, extensive road networks, and international airports. Within service offerings, International Transportation Management and Value-added Warehousing & Distribution are experiencing significant expansion. This growth is fueled by increasing import and export volumes, the ongoing expansion of e-commerce, and a growing demand for sophisticated supply chain solutions. In terms of end-user industries, Distributive Trade (Wholesale & Retail, encompassing the rapidly growing e-commerce sector) stands as a primary driver. This is closely followed by the vital Oil & Gas and Chemicals sectors, reflecting Oman's substantial hydrocarbon industry and its associated logistics requirements.

- Key Drivers (Muscat Region): Centralized business hub, superior multimodal infrastructure (ports, roads, airports), proximity to major industrial and commercial zones, and a skilled workforce.

- Key Drivers (International Transportation): Increasing global trade, growing demand for efficient cross-border logistics, and the strategic importance of Oman's geographic location for regional and international trade routes.

- Key Drivers (Value-added Warehousing & Distribution): The e-commerce boom necessitates advanced fulfillment and last-mile delivery solutions, alongside a rising demand for specialized warehousing such as temperature-controlled environments, kitting, and custom packaging.

- Key Drivers (Distributive Trade): Continued expansion of e-commerce platforms, rising consumer purchasing power, and the diversification and growth of both traditional retail and online sales channels.

Oman Third-Party Logistics Industry Product Landscape

The Omani 3PL market offers a range of services, from basic transportation to complex supply chain management solutions. Recent innovations include the adoption of advanced technologies like blockchain for enhanced supply chain transparency and IoT sensors for real-time asset tracking. Unique selling propositions often focus on specialized expertise in specific sectors (e.g., handling of hazardous materials in the Oil & Gas industry) and tailored solutions to meet specific customer needs.

Key Drivers, Barriers & Challenges in Oman Third-Party Logistics Industry

Key Drivers: Government initiatives promoting logistics development, growth of e-commerce, and increasing foreign investment in the Omani economy. Technological advancements are also boosting efficiency and reducing costs.

Key Challenges: Infrastructure limitations in some regions, competition from smaller, less regulated operators, and a shortage of skilled workforce. These factors can lead to increased operational costs and delivery delays, impacting overall market growth. (Estimated impact of infrastructure limitations on operational costs: xx%).

Emerging Opportunities in Oman Third-Party Logistics Industry

The burgeoning e-commerce sector presents a substantial and dynamic opportunity for 3PL providers. There is a significant and growing demand for specialized services focused on efficient last-mile delivery and comprehensive fulfillment solutions. Beyond e-commerce, the development and provision of specialized logistics services for sectors such as pharmaceuticals and healthcare are emerging as key growth areas. These industries require stringent adherence to regulations and specialized capabilities, including sophisticated temperature-controlled transportation and storage solutions. Furthermore, significant untapped market potential exists in the smaller cities and regions outside of Muscat, offering prime opportunities for market expansion and the establishment of new logistics hubs.

Growth Accelerators in the Oman Third-Party Logistics Industry Industry

Fostering strategic partnerships between 3PL providers and cutting-edge technology firms is a critical growth accelerator, enabling enhanced service offerings, increased operational efficiency, and the development of innovative solutions. Significant investment in technological advancements is paramount for sustained growth. This includes the adoption of AI-powered tools for route optimization, advanced warehouse automation, real-time tracking, and data analytics to drive supply chain visibility and predictability. Strategic expansion into underserved regional markets, coupled with the diversification into specialized niche sectors requiring bespoke logistics capabilities, will further fuel the market's robust growth trajectory.

Key Players Shaping the Oman Third-Party Logistics Industry Market

- Premier Logistics Muscat

- Marafi Asyad Company

- Kunooz Logistics Global

- Global Logistics (Oman) Llc

- Maersk Shipping Services & Company LLC

- Al Madina Logistics Company

- Al Wattaar Trading

- Khimji Ramdas - Shipping & Services Group

- Aramex Muscat

- DHL Supply Chains

- United Shipping & Trading Agency

- Sultan Bin Soud Ahmed Al

Notable Milestones in Oman Third-Party Logistics Industry Sector

- November 2022: Asyad Group signed an MoU with Tanzania Post to explore a multimodal logistics business park and e-commerce hub. This signifies Oman's growing interest in regional logistics expansion.

- February 2023: Aramex successfully tested drone and roadside bot deliveries in Dubai, showcasing innovation in last-mile delivery and potentially influencing future Omani logistics strategies.

In-Depth Oman Third-Party Logistics Industry Market Outlook

The Omani 3PL market is on a strong trajectory for continued and sustained growth. This upward trend is underpinned by ongoing infrastructure development initiatives, proactive government support and favorable regulatory frameworks, and the accelerating adoption of technological advancements across the supply chain. Success and leadership within the market will increasingly be determined by the formation of strategic alliances and substantial investments in innovative technologies. Significant opportunities lie in the development and delivery of specialized logistics services tailored to specific industry needs, the strategic expansion into emerging regional markets, and the adept leveraging of technology to build more efficient, agile, and sustainable supply chains. The future dynamism of the market will hinge on its capacity to nimbly adapt to evolving consumer demands, embrace digital transformations, and proactively address emerging technological disruptions.

Oman Third-Party Logistics Industry Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Manufacturing & Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End-Users

Oman Third-Party Logistics Industry Segmentation By Geography

- 1. Oman

Oman Third-Party Logistics Industry Regional Market Share

Geographic Coverage of Oman Third-Party Logistics Industry

Oman Third-Party Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market

- 3.4. Market Trends

- 3.4.1 Investments on infrastructure and latest technology for upgrading ports

- 3.4.2 airport facilities

- 3.4.3 new road links

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Third-Party Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Premier Logistics Muscat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marafi Asyad Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kunooz Logistics Global

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Global Logistics (Oman) Llc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maersk Shipping Services & Company LLC**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al Madina Logistics Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al Wattaar Trading

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Khimji Ramdas - Shipping & Services Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Aramex Muscat

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DHL Supply Chains

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 United Shipping & Trading Agency

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sultan Bin Soud Ahmed Al

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Premier Logistics Muscat

List of Figures

- Figure 1: Oman Third-Party Logistics Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Oman Third-Party Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Oman Third-Party Logistics Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 2: Oman Third-Party Logistics Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Oman Third-Party Logistics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Oman Third-Party Logistics Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 5: Oman Third-Party Logistics Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Oman Third-Party Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Third-Party Logistics Industry?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Oman Third-Party Logistics Industry?

Key companies in the market include Premier Logistics Muscat, Marafi Asyad Company, Kunooz Logistics Global, Global Logistics (Oman) Llc, Maersk Shipping Services & Company LLC**List Not Exhaustive, Al Madina Logistics Company, Al Wattaar Trading, Khimji Ramdas - Shipping & Services Group, Aramex Muscat, DHL Supply Chains, United Shipping & Trading Agency, Sultan Bin Soud Ahmed Al.

3. What are the main segments of the Oman Third-Party Logistics Industry?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.34 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market.

6. What are the notable trends driving market growth?

Investments on infrastructure and latest technology for upgrading ports. airport facilities. new road links.

7. Are there any restraints impacting market growth?

4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market.

8. Can you provide examples of recent developments in the market?

February 2023: Aramex (DFM: ARMX), a global provider of comprehensive logistics and transportation solutions, announced the successful testing of its drone and roadside bot deliveries in Dubai. This is part of the company's "Future Delivery Program," aimed at enhancing last-mile logistics using smart shipping solutions to enable quicker, more sustainable, and cost-effective deliveries. Aramex becomes a pioneer in the GCC to fulfill deliveries using a combination of bots and drone technology in last-mile deliveries. In partnership with BARQ EV and Kiwibot, the testing in Dubai involves a multi-modal approach using both drones and autonomous bots.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Third-Party Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Third-Party Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Third-Party Logistics Industry?

To stay informed about further developments, trends, and reports in the Oman Third-Party Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence