Key Insights

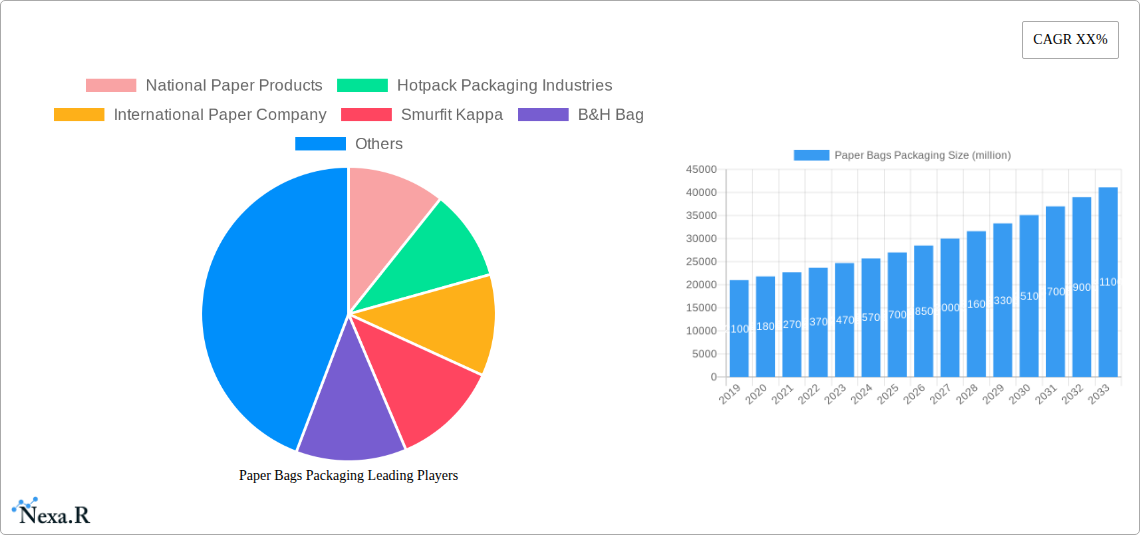

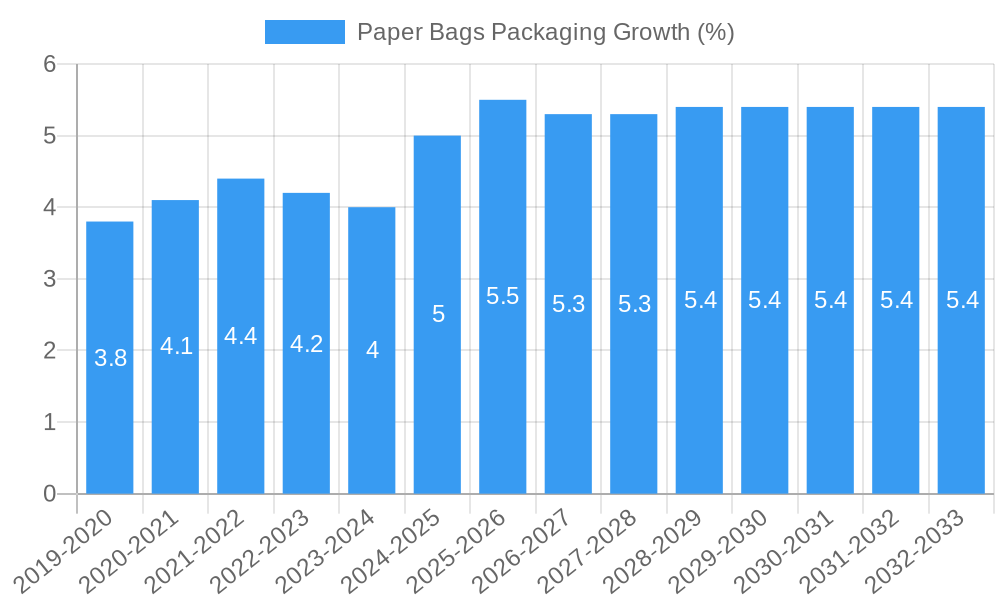

The global paper bags packaging market is poised for substantial growth, projected to reach an estimated $28,500 million by 2025. This upward trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025-2033. A significant driver for this expansion is the increasing consumer preference and regulatory push towards sustainable and eco-friendly packaging solutions. As environmental concerns mount, businesses across various sectors are actively seeking alternatives to single-use plastics, making paper bags a preferred choice. The Food & Beverages and Pharmaceutical industries are leading this adoption, driven by the need for safe, hygienic, and recyclable packaging for their products. Furthermore, the retail sector is witnessing a resurgence in the use of paper bags as a branding and customer experience enhancement tool, particularly for premium and artisanal goods. The growing e-commerce landscape also presents an opportunity, with paper bags being utilized for secure and sustainable shipment of smaller packages.

Several key trends are shaping the paper bags packaging market. The development of innovative paper bag designs, including reinforced handles and specialized coatings, is enhancing their durability and functionality. Multi-wall paper sacks, a significant segment, are experiencing strong demand in industrial applications such as cement, chemicals, and agriculture due to their superior strength and moisture resistance. However, the market also faces certain restraints, primarily the cost volatility of raw materials, particularly pulp, and competition from alternative packaging materials like bioplastics and reusable fabric bags. Despite these challenges, the inherent biodegradability and recyclability of paper bags, coupled with ongoing technological advancements in papermaking and bag manufacturing, are expected to propel the market forward. Key players like International Paper Company, Smurfit Kappa, and WestRock Company are investing in research and development to offer a wider range of customized and high-performance paper bag solutions, catering to the evolving needs of a global clientele.

This in-depth report provides a holistic analysis of the global Paper Bags Packaging market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and a detailed outlook. It offers critical insights for stakeholders within the parent and child markets, leveraging high-traffic keywords for maximum SEO visibility. The study covers the Historical Period (2019–2024), Base Year (2025), Estimated Year (2025), and Forecast Period (2025–2033).

Paper Bags Packaging Market Dynamics & Structure

The global paper bags packaging market exhibits a moderate level of concentration, with leading players like National Paper Products, Hotpack Packaging Industries, International Paper Company, Smurfit Kappa, B&H Bag, Ronpak, DS Smith, WestRock Company, OJI Holding Corporation, Georgia-Pacific, Holmen Group, United Bags, Novolex, Paper Sacks Factory, and Hood Packaging collectively holding a significant share. Technological innovation is a primary driver, fueled by advancements in paper production, printing capabilities, and sustainable manufacturing processes. Regulatory frameworks, particularly those promoting eco-friendly packaging solutions and single-use plastic reduction, are increasingly shaping market demand and product development. Competitive product substitutes, such as plastic bags and biodegradable alternatives, present ongoing challenges, necessitating continuous innovation in terms of functionality and cost-effectiveness. End-user demographics are shifting towards environmentally conscious consumers and businesses seeking sustainable packaging options. Mergers and acquisitions (M&A) activity, while present, is carefully strategic, often focusing on consolidating market share, acquiring new technologies, or expanding geographical reach.

- Market Concentration: Moderate, with a significant share held by top 10-15 players.

- Technological Innovation Drivers: Sustainable material sourcing, advanced printing techniques, enhanced barrier properties, and automated production processes.

- Regulatory Frameworks: Government mandates for plastic reduction, eco-labeling initiatives, and waste management policies.

- Competitive Product Substitutes: Conventional plastic bags, bioplastics, reusable tote bags.

- End-User Demographics: Growing demand from environmentally conscious consumers and businesses in retail, food, and e-commerce.

- M&A Trends: Strategic acquisitions for market expansion, technology integration, and vertical integration.

Paper Bags Packaging Growth Trends & Insights

The paper bags packaging market is projected to experience robust growth throughout the forecast period, driven by an escalating global demand for sustainable and eco-friendly packaging solutions. The market size evolution is marked by a steady increase in adoption rates across diverse industries, propelled by consumer preference and regulatory pressure to reduce plastic waste. Technological disruptions, such as the development of stronger, more moisture-resistant paper materials and sophisticated printing technologies for branding and information, are enhancing the appeal and functionality of paper bags. Consumer behavior shifts are a pivotal factor, with a growing segment of the population actively seeking products packaged in recyclable and biodegradable materials. This trend is particularly pronounced in the Food & Beverages and Retail sectors, where visual appeal and environmental credentials significantly influence purchasing decisions. The market penetration of paper bags is expected to deepen as their cost-competitiveness improves and their perceived value as a sustainable alternative strengthens.

The CAGR for the global paper bags packaging market is estimated to be 5.8% from 2025 to 2033. Market penetration in the Food & Beverages segment is expected to reach 70% by 2033. The adoption of multi-wall paper sacks in the Construction and Chemicals industries is anticipated to grow by 6.2% annually. Consumer willingness to pay a premium for sustainable packaging is increasing, further accelerating market adoption. The e-commerce boom has also significantly boosted demand for durable and branded paper bags for shipping and delivery. Innovations in paper bag design, including integrated handles and customized printing, are contributing to their appeal in the retail sector. The increasing availability of recycled paper pulp and advancements in waste-to-energy initiatives further support the environmental narrative of paper bag packaging. The market size is expected to reach approximately $45,000 million units by 2033, from an estimated $27,000 million units in 2025.

Dominant Regions, Countries, or Segments in Paper Bags Packaging

The Food & Beverages segment, leveraging its extensive application in bakery, fast food, and grocery retail, is emerging as the dominant segment driving global paper bags packaging market growth. This dominance is further amplified by its broad appeal across both developed and developing economies.

- Key Drivers in Food & Beverages:

- Consumer Preference for Sustainability: Growing awareness of environmental issues and a preference for eco-friendly packaging.

- Food Safety and Hygiene: Paper bags offer a hygienic and safe packaging solution for various food items.

- Branding and Marketing: High-quality printing capabilities allow for attractive branding, enhancing product visibility.

- Regulatory Support: Government initiatives promoting sustainable packaging indirectly benefit the food and beverage sector.

- Growth of Fast Food and Takeaway: The booming fast-food and takeaway industry significantly relies on convenient and disposable paper bag packaging.

- Market Share: This segment is estimated to hold 35% of the total paper bags packaging market by 2033.

- Growth Potential: Projected to witness a CAGR of 6.5% during the forecast period.

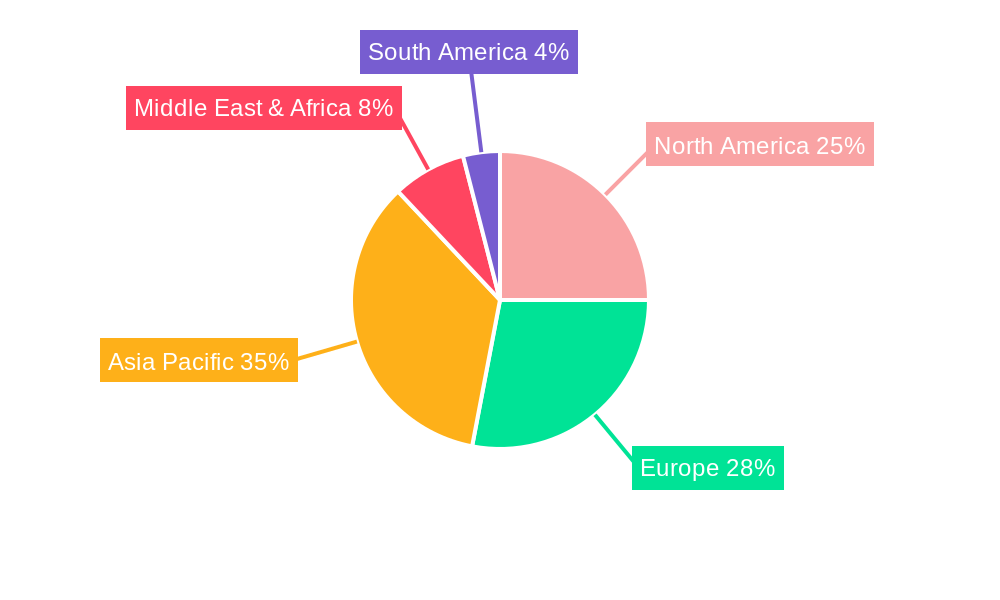

North America, particularly the United States, and Europe, spearheaded by countries like Germany and the United Kingdom, are the leading regions. This dominance is attributed to stringent environmental regulations, high consumer awareness regarding sustainability, and the presence of major players in the paper packaging industry. The economic policies in these regions actively encourage the adoption of sustainable alternatives to plastics. Infrastructure development also plays a crucial role, facilitating efficient production and distribution of paper bags.

- Dominant Regions - North America & Europe:

- Market Share: Collectively estimated to account for 55% of the global market by 2033.

- Growth Potential: Expected to grow at a CAGR of 5.5% during the forecast period.

- Key Drivers: Strict environmental legislation, strong consumer demand for sustainable products, advanced manufacturing capabilities, and a well-established retail and food service infrastructure.

- Country-Specific Factors: The US leads due to its large consumer base and corporate sustainability initiatives, while Europe benefits from strong EU environmental directives and growing public pressure.

Paper Bags Packaging Product Landscape

The product landscape of paper bags packaging is characterized by continuous innovation and diversification. Flat paper bags, often used for lighter items and retail shopping, are seeing advancements in paper strength and print quality. Multi-wall paper sacks, crucial for industrial applications like construction materials and chemicals, are being engineered for enhanced durability, moisture resistance, and load-bearing capacity. Innovations include advanced barrier coatings for improved product protection and the development of paper bags with integrated features like resealable closures and ergonomic handles. Performance metrics are increasingly focused on sustainability, recyclability, and biodegradability, alongside traditional factors like tensile strength and puncture resistance.

Key Drivers, Barriers & Challenges in Paper Bags Packaging

The paper bags packaging market is propelled by a confluence of powerful forces. The overarching driver is the global imperative for environmental sustainability, with governments and consumers alike pushing for the reduction of plastic waste. Technological advancements in paper production, leading to stronger and more versatile paper materials, are also critical. Furthermore, the growing e-commerce sector and the need for attractive, branded packaging for shipped goods contribute significantly to market expansion.

- Key Drivers:

- Environmental Regulations: Stricter policies against single-use plastics.

- Consumer Demand for Sustainability: Growing eco-consciousness influencing purchasing decisions.

- E-commerce Growth: Increased need for durable and branded shipping packaging.

- Technological Advancements: Improved paper strength, barrier properties, and printing capabilities.

Conversely, the market faces several barriers and challenges. The primary challenge remains the cost competitiveness compared to traditional plastic bags, although this gap is narrowing. Fluctuations in raw material prices, particularly pulp, can impact profitability. Supply chain disruptions, exacerbated by global events, can affect production and delivery timelines. Competition from other sustainable packaging alternatives also presents a restraint.

- Key Barriers & Challenges:

- Cost Competitiveness: Higher initial production costs compared to some plastic alternatives.

- Raw Material Price Volatility: Fluctuations in pulp prices.

- Supply Chain Disruptions: Impacting availability and delivery of raw materials and finished goods.

- Competition from Alternatives: Emerging bioplastics and reusable packaging solutions.

- Moisture Sensitivity: Traditional paper bags can be susceptible to moisture damage, requiring specialized coatings.

Emerging Opportunities in Paper Bags Packaging

Emerging opportunities lie in the continued development of advanced, high-performance paper bags that can rival or surpass the functionality of plastic alternatives. The untapped potential in developing economies, where the demand for sustainable packaging is rapidly growing, presents significant expansion avenues. Innovative applications, such as temperature-controlled paper bags for food delivery and specialized packaging for sensitive pharmaceutical products, are also areas of growth. Furthermore, the increasing focus on circular economy principles opens opportunities for closed-loop recycling systems and the development of compostable paper bags.

Growth Accelerators in the Paper Bags Packaging Industry

Several catalysts are accelerating the long-term growth of the paper bags packaging industry. Continuous technological breakthroughs in paper science, leading to the creation of lighter yet stronger materials with superior barrier properties, are a major accelerator. Strategic partnerships between paper manufacturers, packaging converters, and end-users are fostering collaborative innovation and market penetration. Furthermore, aggressive market expansion strategies by key players into emerging economies, coupled with their investment in localized production facilities, are significantly contributing to global growth. The development of bio-based coatings and adhesives further enhances the sustainability profile, attracting environmentally conscious brands.

Key Players Shaping the Paper Bags Packaging Market

- National Paper Products

- Hotpack Packaging Industries

- International Paper Company

- Smurfit Kappa

- B&H Bag

- Ronpak

- DS Smith

- WestRock Company

- OJI Holding Corporation

- Georgia-Pacific

- Holmen Group

- United Bags

- Novolex

- Paper Sacks Factory

- Hood Packaging

Notable Milestones in Paper Bags Packaging Sector

- 2019: Increased adoption of paper bags for e-commerce shipping packaging.

- 2020: Growing consumer demand for reusable and sustainable shopping bags.

- 2021: Introduction of advanced barrier coatings for improved moisture and grease resistance in food service paper bags.

- 2022: Significant investments in R&D for biodegradable and compostable paper bag solutions.

- 2023: Implementation of new government regulations in several countries restricting single-use plastics, boosting paper bag demand.

- 2024: Major players announce ambitious sustainability goals, including increased use of recycled content in paper bags.

In-Depth Paper Bags Packaging Market Outlook

- 2019: Increased adoption of paper bags for e-commerce shipping packaging.

- 2020: Growing consumer demand for reusable and sustainable shopping bags.

- 2021: Introduction of advanced barrier coatings for improved moisture and grease resistance in food service paper bags.

- 2022: Significant investments in R&D for biodegradable and compostable paper bag solutions.

- 2023: Implementation of new government regulations in several countries restricting single-use plastics, boosting paper bag demand.

- 2024: Major players announce ambitious sustainability goals, including increased use of recycled content in paper bags.

In-Depth Paper Bags Packaging Market Outlook

The future of the paper bags packaging market is exceptionally bright, characterized by sustained growth driven by an unwavering global commitment to sustainability and evolving consumer preferences. Growth accelerators such as ongoing technological innovation in material science, the development of high-performance and specialized paper bags, and strategic market expansions into high-potential emerging economies will continue to propel the industry forward. Strategic partnerships and a focus on circular economy principles will further enhance the market's environmental credentials and economic viability, ensuring paper bags remain a dominant and preferred packaging solution for a wide array of applications. The market is poised for significant value creation and continued expansion, offering attractive opportunities for stakeholders across the value chain.

Paper Bags Packaging Segmentation

-

1. Application

- 1.1. Food & Beverages

- 1.2. Pharmaceutical

- 1.3. Retail

- 1.4. Construction

- 1.5. Chemicals

- 1.6. Others

-

2. Types

- 2.1. Flat Paper Bag

- 2.2. Multi-Wall Paper Sacks

Paper Bags Packaging Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Paper Bags Packaging REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Paper Bags Packaging Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food & Beverages

- 5.1.2. Pharmaceutical

- 5.1.3. Retail

- 5.1.4. Construction

- 5.1.5. Chemicals

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Flat Paper Bag

- 5.2.2. Multi-Wall Paper Sacks

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Paper Bags Packaging Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food & Beverages

- 6.1.2. Pharmaceutical

- 6.1.3. Retail

- 6.1.4. Construction

- 6.1.5. Chemicals

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Flat Paper Bag

- 6.2.2. Multi-Wall Paper Sacks

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Paper Bags Packaging Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food & Beverages

- 7.1.2. Pharmaceutical

- 7.1.3. Retail

- 7.1.4. Construction

- 7.1.5. Chemicals

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Flat Paper Bag

- 7.2.2. Multi-Wall Paper Sacks

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Paper Bags Packaging Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food & Beverages

- 8.1.2. Pharmaceutical

- 8.1.3. Retail

- 8.1.4. Construction

- 8.1.5. Chemicals

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Flat Paper Bag

- 8.2.2. Multi-Wall Paper Sacks

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Paper Bags Packaging Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food & Beverages

- 9.1.2. Pharmaceutical

- 9.1.3. Retail

- 9.1.4. Construction

- 9.1.5. Chemicals

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Flat Paper Bag

- 9.2.2. Multi-Wall Paper Sacks

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Paper Bags Packaging Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food & Beverages

- 10.1.2. Pharmaceutical

- 10.1.3. Retail

- 10.1.4. Construction

- 10.1.5. Chemicals

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Flat Paper Bag

- 10.2.2. Multi-Wall Paper Sacks

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 National Paper Products

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hotpack Packaging Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 International Paper Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Smurfit Kappa

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 B&H Bag

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ronpak

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DS Smith

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 WestRock Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 OJI Holding Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Georgia-Pacific

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Holmen Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 United Bags

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Novolex

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Paper Sacks Factory

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hood Packaging

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 National Paper Products

List of Figures

- Figure 1: Global Paper Bags Packaging Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Paper Bags Packaging Revenue (million), by Application 2024 & 2032

- Figure 3: North America Paper Bags Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Paper Bags Packaging Revenue (million), by Types 2024 & 2032

- Figure 5: North America Paper Bags Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Paper Bags Packaging Revenue (million), by Country 2024 & 2032

- Figure 7: North America Paper Bags Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Paper Bags Packaging Revenue (million), by Application 2024 & 2032

- Figure 9: South America Paper Bags Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Paper Bags Packaging Revenue (million), by Types 2024 & 2032

- Figure 11: South America Paper Bags Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Paper Bags Packaging Revenue (million), by Country 2024 & 2032

- Figure 13: South America Paper Bags Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Paper Bags Packaging Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Paper Bags Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Paper Bags Packaging Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Paper Bags Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Paper Bags Packaging Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Paper Bags Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Paper Bags Packaging Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Paper Bags Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Paper Bags Packaging Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Paper Bags Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Paper Bags Packaging Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Paper Bags Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Paper Bags Packaging Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Paper Bags Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Paper Bags Packaging Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Paper Bags Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Paper Bags Packaging Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Paper Bags Packaging Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Paper Bags Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Paper Bags Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Paper Bags Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Paper Bags Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Paper Bags Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Paper Bags Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Paper Bags Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Paper Bags Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Paper Bags Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Paper Bags Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Paper Bags Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Paper Bags Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Paper Bags Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Paper Bags Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Paper Bags Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Paper Bags Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Paper Bags Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Paper Bags Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Paper Bags Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Paper Bags Packaging Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Paper Bags Packaging?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Paper Bags Packaging?

Key companies in the market include National Paper Products, Hotpack Packaging Industries, International Paper Company, Smurfit Kappa, B&H Bag, Ronpak, DS Smith, WestRock Company, OJI Holding Corporation, Georgia-Pacific, Holmen Group, United Bags, Novolex, Paper Sacks Factory, Hood Packaging.

3. What are the main segments of the Paper Bags Packaging?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Paper Bags Packaging," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Paper Bags Packaging report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Paper Bags Packaging?

To stay informed about further developments, trends, and reports in the Paper Bags Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence