Key Insights

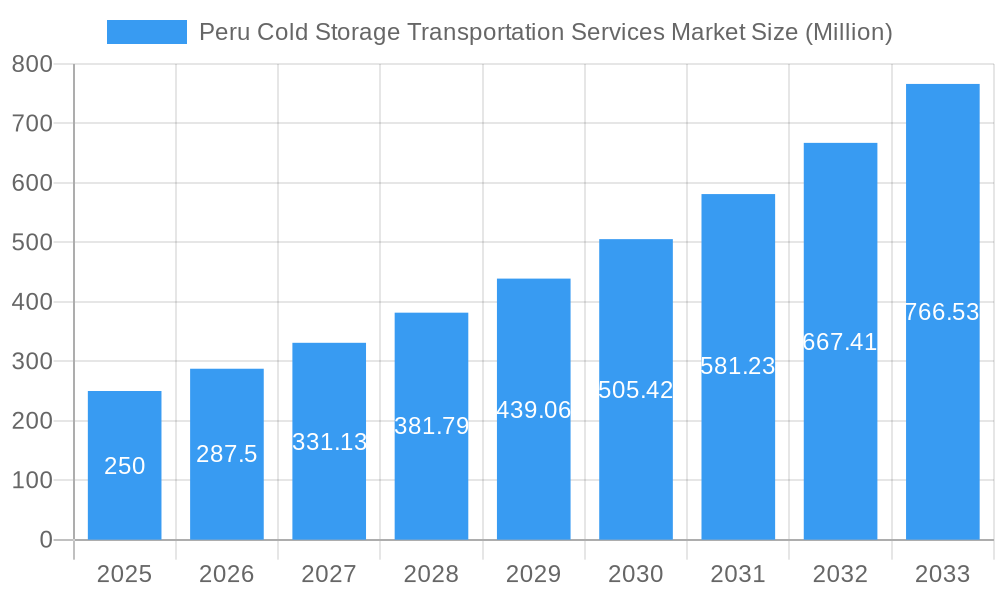

The Peruvian cold storage and transportation services market is experiencing robust growth, fueled by a burgeoning food and beverage sector and increasing demand for temperature-sensitive pharmaceuticals. With a Compound Annual Growth Rate (CAGR) of 15.16% from 2019-2024, the market is projected to maintain significant expansion through 2033. Key drivers include rising consumer incomes leading to increased demand for perishable goods, improved infrastructure facilitating efficient cold chain logistics, and the growing adoption of value-added services like blast freezing and inventory management. The market is segmented by temperature type (chilled and frozen), end-user (fruits & vegetables, dairy, seafood, processed foods, pharmaceuticals, and others), and service type (warehousing, transportation, and value-added services). The dominance of specific segments will depend on the evolving consumption patterns and infrastructural developments within Peru. While data limitations prevent precise quantification of segment sizes, the observed CAGR suggests a substantial market expansion across all segments. Frozen storage and transportation likely holds a larger share given the climatic conditions in Peru and the nature of many agricultural exports. The increasing adoption of sophisticated cold chain technologies and the entrance of larger logistics companies like Lineage Logistics signals a shift toward greater efficiency and reliability within the industry.

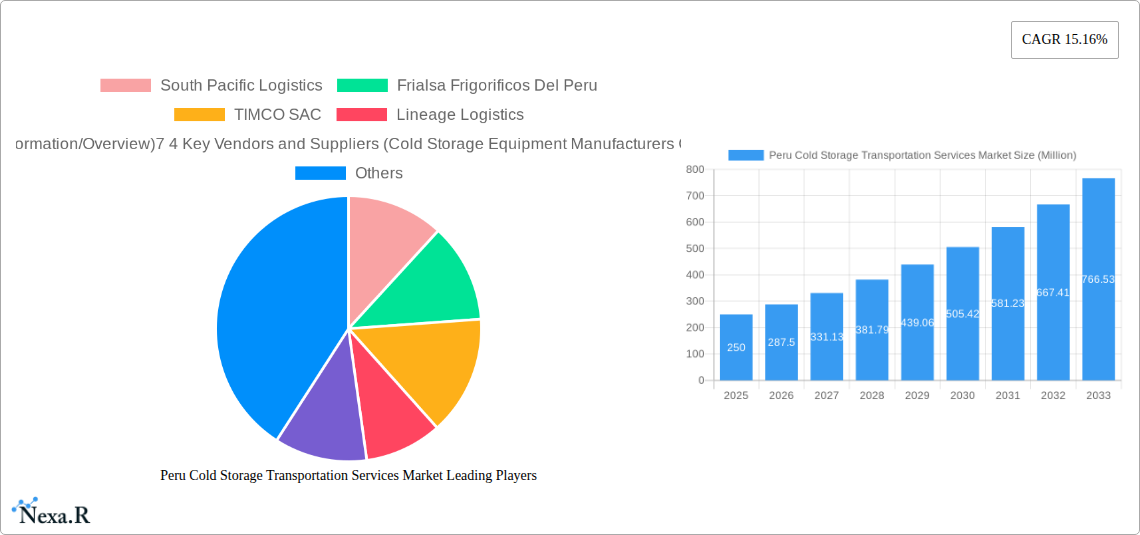

Peru Cold Storage Transportation Services Market Market Size (In Million)

Competition within the Peruvian cold storage and transportation services market is fairly dynamic, with both established local players like Frialsa Frigorificos Del Peru and TIMCO SAC and international players like Lineage Logistics vying for market share. Smaller companies focusing on specialized services or niche segments will likely continue to play a significant role. The supply chain's efficiency will be heavily reliant on the availability of robust cold storage equipment and suitable transportation infrastructure, including refrigerated trucks and intermodal solutions. The continued growth will be dependent upon further investment in infrastructure and technology, governmental support for cold chain development, and the ability of companies to effectively meet the evolving demands of various industries reliant on temperature-controlled logistics. Future growth is expected to be further shaped by investments in technology, enhancing traceability and efficiency in cold chain management, a trend already observed in the increased adoption of value-added services.

Peru Cold Storage Transportation Services Market Company Market Share

Peru Cold Storage Transportation Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Peru cold storage transportation services market, covering market size, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for industry professionals, investors, and anyone seeking to understand this dynamic market. The report segments the market by temperature type (chilled, frozen), end-user (fruits & vegetables, dairy, fish & seafood, processed food, pharmaceuticals, bakery & confectionery, other), and service type (cold storage, refrigerated transportation, value-added services).

Peru Cold Storage Transportation Services Market Dynamics & Structure

The Peruvian cold storage transportation services market is experiencing significant growth driven by a burgeoning food and beverage sector, increasing pharmaceutical production, and expanding e-commerce activities. Market concentration is moderate, with several key players holding substantial market share, but also room for smaller players to thrive. Technological advancements, particularly in temperature monitoring and tracking, are transforming efficiency and safety. The regulatory environment is evolving to improve food safety standards, which presents both opportunities and challenges. Competition comes from substitute transportation methods, but the need for temperature-controlled handling maintains a high barrier to entry. M&A activity is moderate, with larger players consolidating their presence through acquisitions, as shown by recent activity like Ransa's expansion.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Driven by IoT sensors, real-time tracking systems, and improved refrigeration technologies.

- Regulatory Framework: Stringent regulations on food safety and transportation are promoting market standardization but also adding compliance costs.

- Competitive Substitutes: Limited, due to the specialized nature of temperature-sensitive goods handling.

- M&A Trends: Moderate consolidation activity, with larger players acquiring smaller companies to expand their reach and service offerings. Example: Ransa’s 2020 acquisition significantly boosted their market position.

- End-User Demographics: Growing middle class and increasing urbanization are driving demand for higher-quality, temperature-sensitive food products.

Peru Cold Storage Transportation Services Market Growth Trends & Insights

The Peruvian cold storage transportation services market is projected to experience substantial growth during the forecast period (2025-2033). Driven by rising consumer demand for fresh produce, processed foods, and pharmaceuticals, the market is expected to achieve a CAGR of xx% from 2025 to 2033, reaching a market size of xx Million by 2033. Market penetration of sophisticated cold chain solutions is steadily increasing, further facilitated by technological advancements in temperature monitoring and logistics management. E-commerce growth plays a crucial role in fueling demand for reliable and efficient cold chain solutions. Changes in consumer behavior, such as a preference for convenience and ready-to-eat meals, are directly influencing market demand. Adoption rates of value-added services like blast freezing and inventory management are increasing as businesses seek greater efficiency and enhanced product quality. Technological disruptions, like the integration of AI and blockchain in the cold chain, further improve transparency and traceability.

(Note: This section requires data to populate the xx placeholders with accurate CAGR and market size predictions. Detailed market research and data analysis are necessary to provide specific numbers here.)

Dominant Regions, Countries, or Segments in Peru Cold Storage Transportation Services Market

The Lima Metropolitan Area dominates the Peru cold storage transportation services market due to its high population density, extensive industrial activity, and concentration of major ports. Within the market segmentation, the frozen segment exhibits faster growth compared to the chilled segment due to the rising demand for frozen food products. The fruits and vegetables end-user segment holds a significant market share, while pharmaceuticals and processed foods are showing rapid growth potential, owing to increasing health awareness and demand for convenience foods. Cold storage/refrigerated warehousing is the largest service segment, with refrigerated transportation and value-added services experiencing increased demand. Key growth drivers include:

- Economic Growth: Peru's ongoing economic growth fuels demand for higher-quality food and pharmaceutical products.

- Infrastructure Development: Investments in port infrastructure and transportation networks enhance the efficiency of the cold chain.

- Government Policies: Policies focused on food safety and supply chain efficiency are indirectly boosting market expansion.

(Note: This section needs quantitative data to quantify market share and growth potential of different segments and regions. For example, the exact percentage of the Lima market share or the comparative growth rates of chilled vs. frozen products are needed to complete this section.)

Peru Cold Storage Transportation Services Market Product Landscape

Technological advancements are driving significant product innovations in the Peru cold storage transportation services market. These innovations focus on enhancing efficiency, optimizing temperature control, and improving traceability. Modern cold storage facilities incorporate advanced refrigeration systems, automated inventory management systems, and real-time temperature monitoring capabilities. Refrigerated transportation vehicles employ GPS tracking and telematics for improved route optimization and real-time shipment monitoring. Value-added services are increasingly incorporating automation and advanced data analytics to improve efficiency and reduce waste. These improvements lead to superior product quality, reduced spoilage rates, and increased overall efficiency.

Key Drivers, Barriers & Challenges in Peru Cold Storage Transportation Services Market

Key Drivers: Rising disposable incomes, growing population, increased demand for fresh and processed food, and growing pharmaceutical industry are all driving market growth. Technological advancements in refrigeration and logistics management improve efficiency and reduce costs. Government regulations promoting food safety and supply chain integrity are also significant drivers.

Challenges: Infrastructure limitations in certain regions, particularly outside of Lima, can hamper efficient transportation and storage. Fluctuations in energy prices can impact operational costs. Competition from unorganized players offering lower prices and potentially compromising quality can create challenges. The high capital investment required for new cold storage facilities can serve as a barrier to entry.

Emerging Opportunities in Peru Cold Storage Transportation Services Market

Untapped opportunities exist in expanding cold chain infrastructure in smaller cities and rural areas to reach underserved markets. There is significant potential for growth in value-added services such as customized packaging, labeling, and specialized handling for pharmaceuticals and other temperature-sensitive goods. The adoption of innovative technologies such as blockchain for enhanced traceability and transparency offers significant growth opportunities. Expanding into e-commerce logistics and last-mile delivery solutions for temperature-sensitive goods creates a large untapped market.

Growth Accelerators in the Peru Cold Storage Transportation Services Market Industry

Strategic partnerships between cold storage providers and food processors or pharmaceutical companies can foster vertical integration and improve supply chain efficiency. Technological innovations, such as smart containers and IoT-enabled temperature monitoring systems, are expected to streamline operations and reduce waste. Government support and investment in cold chain infrastructure through public-private partnerships will help improve logistics and reduce bottlenecks. Expanding market access through international trade agreements could boost exports of Peruvian produce and processed goods.

Key Players Shaping the Peru Cold Storage Transportation Services Market Market

- South Pacific Logistics

- Frialsa Frigorificos Del Peru

- TIMCO SAC

- Lineage Logistics

- Husky SAC

- 7 3 Other Companies (Key Information/Overview) (Information needed to populate this point)

- 7 4 Key Vendors and Suppliers (Cold Storage Equipment Manufacturers Carrier Manufacturers Technology Providers for the Cold Chain Industry,Depsa,Transporte Campos,San Louis J&C,G&R Frigotrans,Absolute Zero)

Notable Milestones in Peru Cold Storage Transportation Services Market Sector

- Dec 2019: Frialsa Peru opened a new storage and distribution center with a capacity of over 10,000 metric tons, significantly increasing storage capacity for frozen and refrigerated products.

- Jan 2020: Ransa's integration of foreign trade services with temporary storage and empty container management expanded its infrastructure and forecasted an 18% sales growth, demonstrating aggressive expansion in the market.

In-Depth Peru Cold Storage Transportation Services Market Market Outlook

The Peru cold storage transportation services market is poised for continued growth, driven by sustained economic expansion, increasing demand for temperature-sensitive goods, and technological advancements. Strategic investments in infrastructure, coupled with the adoption of innovative cold chain solutions, will further unlock market potential. The increasing focus on food safety and supply chain efficiency, both by the government and private sector, will continue to drive demand. Opportunities for consolidation and expansion through mergers and acquisitions remain, paving the way for larger players to dominate the market. Focus on value-added services and technological integration will lead to superior market positions and profitability.

Peru Cold Storage Transportation Services Market Segmentation

-

1. Service

- 1.1. Cold Storage/Refrigerated Warehousing

- 1.2. Refrigerated Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. End User

- 3.1. Fruits and Vegetables

- 3.2. Dairy Pr

- 3.3. Fish, Meat, and Seafood

- 3.4. Processed Food

- 3.5. Pharmaceutical (Includes Biopharma)

- 3.6. Bakery and Confectionery

- 3.7. Other End Users (Chemicals, etc.)

Peru Cold Storage Transportation Services Market Segmentation By Geography

- 1. Peru

Peru Cold Storage Transportation Services Market Regional Market Share

Geographic Coverage of Peru Cold Storage Transportation Services Market

Peru Cold Storage Transportation Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS

- 3.3. Market Restrains

- 3.3.1. 4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES

- 3.4. Market Trends

- 3.4.1. Pharmaceutical sector growth driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Peru Cold Storage Transportation Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Cold Storage/Refrigerated Warehousing

- 5.1.2. Refrigerated Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Fruits and Vegetables

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat, and Seafood

- 5.3.4. Processed Food

- 5.3.5. Pharmaceutical (Includes Biopharma)

- 5.3.6. Bakery and Confectionery

- 5.3.7. Other End Users (Chemicals, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Peru

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 South Pacific Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Frialsa Frigorificos Del Peru

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TIMCO SAC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lineage Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Husky SAC**List Not Exhaustive 7 3 Other Companies (Key Information/Overview)7 4 Key Vendors and Suppliers (Cold Storage Equipment Manufacturers Carrier Manufacturers Technology Providers for the Cold Chain Industry

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Depsa

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Transporte Campos

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 San Louis J&C

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 G&R Frigotrans

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Absolute Zero

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 South Pacific Logistics

List of Figures

- Figure 1: Peru Cold Storage Transportation Services Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Peru Cold Storage Transportation Services Market Share (%) by Company 2025

List of Tables

- Table 1: Peru Cold Storage Transportation Services Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 2: Peru Cold Storage Transportation Services Market Revenue undefined Forecast, by Temperature Type 2020 & 2033

- Table 3: Peru Cold Storage Transportation Services Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Peru Cold Storage Transportation Services Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Peru Cold Storage Transportation Services Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Peru Cold Storage Transportation Services Market Revenue undefined Forecast, by Temperature Type 2020 & 2033

- Table 7: Peru Cold Storage Transportation Services Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Peru Cold Storage Transportation Services Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Peru Cold Storage Transportation Services Market?

The projected CAGR is approximately 4.13%.

2. Which companies are prominent players in the Peru Cold Storage Transportation Services Market?

Key companies in the market include South Pacific Logistics, Frialsa Frigorificos Del Peru, TIMCO SAC, Lineage Logistics, Husky SAC**List Not Exhaustive 7 3 Other Companies (Key Information/Overview)7 4 Key Vendors and Suppliers (Cold Storage Equipment Manufacturers Carrier Manufacturers Technology Providers for the Cold Chain Industry, Depsa, Transporte Campos, San Louis J&C, G&R Frigotrans, Absolute Zero.

3. What are the main segments of the Peru Cold Storage Transportation Services Market?

The market segments include Service, Temperature Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS.

6. What are the notable trends driving market growth?

Pharmaceutical sector growth driving the market.

7. Are there any restraints impacting market growth?

4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES.

8. Can you provide examples of recent developments in the market?

Jan 2020: Ransa, the Romero Group's logistics operator, combined its foreign trade services with the temporary storage business and the empty container business of the port operator Tramarsa . Thus, Ransa will increase its infrastructure and foresees an 18% growth in sales of its business in Peru.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Peru Cold Storage Transportation Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Peru Cold Storage Transportation Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Peru Cold Storage Transportation Services Market?

To stay informed about further developments, trends, and reports in the Peru Cold Storage Transportation Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence