Key Insights

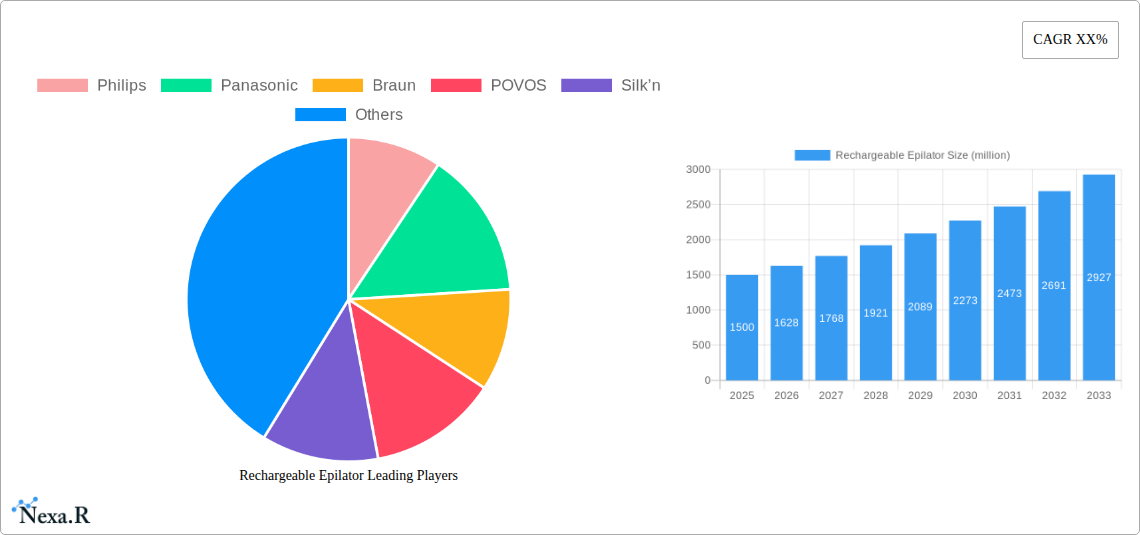

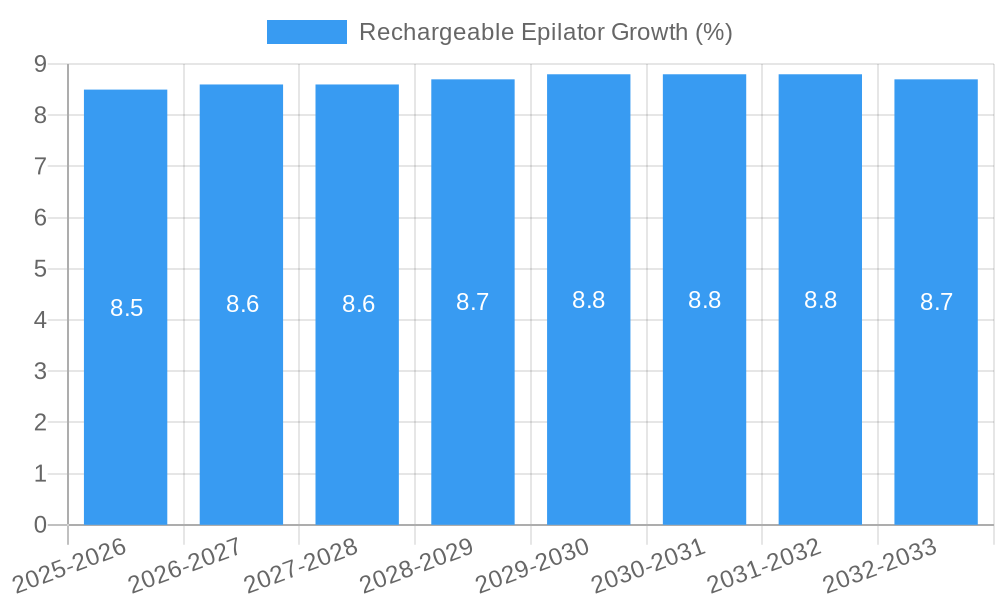

The global Rechargeable Epilator market is poised for substantial growth, estimated to be valued at approximately $1,500 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This robust expansion is primarily fueled by an increasing consumer preference for at-home hair removal solutions that offer convenience, long-term results, and a more cost-effective alternative to salon treatments. The rising disposable incomes in emerging economies, coupled with a growing awareness of personal grooming and aesthetic appeal, are significant drivers. Furthermore, technological advancements in rechargeable epilators, leading to improved efficiency, reduced pain, and enhanced user experience (such as wet and dry functionality, built-in lights, and multiple speed settings), are attracting a wider consumer base. The market is also benefiting from the growing influence of social media and beauty influencers who are actively promoting these devices and their benefits, further stimulating demand.

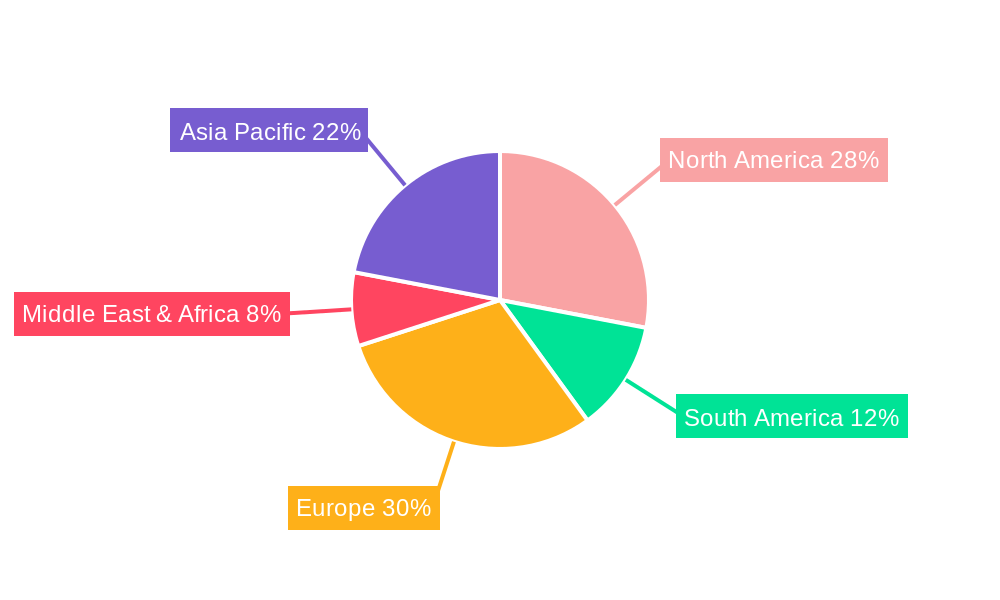

The market is segmented by application into Online Sales and Offline Sales, with online channels exhibiting a higher growth trajectory due to the convenience of e-commerce platforms and wider product availability. Within types, both Facial Epilators and Body Epilators cater to specific consumer needs, with the body epilator segment holding a larger market share owing to its broader application. Geographically, the Asia Pacific region is expected to witness the fastest growth, driven by a burgeoning middle class in countries like China and India, alongside increasing adoption of personal care devices. North America and Europe currently represent mature yet significant markets, characterized by high consumer spending and established brand presence. Restraints such as the initial cost of high-end devices and consumer reliance on traditional hair removal methods are present, but the long-term cost savings and superior results offered by rechargeable epilators are expected to overcome these challenges. Key players like Philips, Panasonic, and Braun are actively investing in research and development to launch innovative products, further shaping the market landscape.

Rechargeable Epilator Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers a strategic analysis of the global rechargeable epilator market, a rapidly expanding segment within the personal grooming industry. Driven by increasing consumer demand for convenient, long-lasting hair removal solutions, the market presents significant opportunities for both established players and emerging innovators. Our comprehensive study, spanning the historical period of 2019-2024 and a forecast period of 2025-2033, with a base and estimated year of 2025, provides granular insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, growth accelerators, key players, and notable milestones. Leveraging high-traffic keywords like "rechargeable epilator," "hair removal technology," "cordless epilator," "home hair removal," "personal care devices," and "beauty gadgets," this report is optimized for maximum search engine visibility, targeting industry professionals, manufacturers, distributors, investors, and market researchers.

Rechargeable Epilator Market Dynamics & Structure

The rechargeable epilator market is characterized by a moderate to high level of concentration, with key global players like Philips, Panasonic, and Braun holding significant market shares. Technological innovation is a primary driver, with continuous advancements in tweezer technology, ergonomic design, and added features such as integrated LED lights and wet/dry functionality enhancing user experience and product efficacy. Regulatory frameworks, primarily focused on product safety and electrical standards, are generally supportive, though compliance remains a crucial aspect for manufacturers. Competitive product substitutes, including shaving, waxing, and laser hair removal, pose an ongoing challenge, necessitating continuous product differentiation and value proposition enhancement. End-user demographics are diverse, encompassing a broad range of age groups and genders increasingly prioritizing convenience and effectiveness in their grooming routines. Mergers and acquisitions (M&A) trends are present, albeit at a moderate pace, as companies seek to expand their product portfolios and geographical reach.

- Market Concentration: Moderate to High, with established brands holding substantial share.

- Technological Innovation Drivers: Advanced tweezer mechanisms, improved battery life, ergonomic designs, smart features (e.g., app connectivity), and enhanced skin comfort technologies.

- Regulatory Frameworks: Primarily focused on product safety (CE, FDA) and electrical certifications; relatively stable.

- Competitive Product Substitutes: Shaving, waxing (both professional and at-home), depilatory creams, professional laser/IPL treatments.

- End-User Demographics: Broad appeal across age groups (18-65+), with increasing adoption by younger consumers and men.

- M&A Trends: Moderate activity, focused on consolidating market share or acquiring innovative technologies.

Rechargeable Epilator Growth Trends & Insights

The global rechargeable epilator market is projected to experience robust growth, driven by evolving consumer preferences towards sophisticated and efficient home hair removal solutions. This market's evolution is intrinsically linked to the broader personal care and beauty device industry, where innovation and convenience are paramount. The increasing disposable income across various economies, coupled with a growing emphasis on personal grooming and aesthetics, fuels the demand for advanced hair removal technologies. Rechargeable epilators, offering a cord-free experience and long-term hair reduction benefits compared to traditional methods like shaving, are at the forefront of this shift. The market's penetration is steadily increasing as awareness of these benefits grows, particularly among younger demographics who are more receptive to adopting new technologies.

Technological disruptions are a constant feature, with manufacturers investing heavily in research and development to introduce epilators with enhanced comfort features, faster hair removal capabilities, and more durable battery performance. The integration of smart technology, such as app connectivity for personalized treatment plans and progress tracking, represents a significant innovation that further appeals to tech-savvy consumers. Consumer behavior has shifted significantly, with a greater willingness to invest in durable, multi-functional beauty gadgets that offer salon-like results at home. This trend is amplified by social media influence and the availability of extensive product reviews and tutorials online, empowering consumers to make informed purchasing decisions. The convenience of cordless operation, combined with the cost-effectiveness over time compared to professional salon treatments, makes rechargeable epilators an attractive long-term investment for a large consumer base. The global market size is anticipated to reach $6.5 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period of 2025-2033. This growth trajectory is supported by a steady increase in market penetration, estimated to reach 45% by 2033, up from 30% in 2024.

Dominant Regions, Countries, or Segments in Rechargeable Epilator

The rechargeable epilator market exhibits distinct regional dominance and segment preferences, with North America and Europe currently leading in terms of market size and adoption rates. These regions benefit from a higher per capita disposable income, a well-established culture of personal grooming, and a strong consumer appetite for advanced beauty technologies. The robust retail infrastructure, encompassing both extensive online sales channels and a significant presence of physical stores, further facilitates market penetration. In North America, the United States stands out as the primary growth engine, driven by a large, affluent population and a high awareness of personal care trends. European markets, particularly Germany, the UK, and France, also contribute significantly due to similar economic conditions and a strong emphasis on product quality and innovation.

Within the application segment, Online Sales are increasingly becoming the dominant channel. This is attributed to the convenience of e-commerce platforms, wider product selection, competitive pricing, and the ability of consumers to access detailed product information and reviews. Online sales are projected to account for approximately 60% of the total market revenue by 2025. Conversely, Offline Sales through department stores, specialty beauty retailers, and electronics stores, while still significant, are experiencing slower growth, catering to consumers who prefer a tactile experience before purchasing.

In terms of product types, the Body Epilator segment holds a larger market share, accounting for an estimated 70% of the market revenue in 2025. This dominance is driven by the larger surface area requiring hair removal and the growing demand for long-term hair reduction solutions for legs, arms, and underarms. The Facial Epilator segment, while smaller, is experiencing a higher growth rate. This is fueled by the increasing demand for precise and gentle facial hair removal, the rising popularity of at-home skincare routines, and product innovations specifically designed for sensitive facial skin. The market value for the Body Epilator segment is estimated at $4.55 billion in 2025, while the Facial Epilator segment is valued at $1.95 billion. Key drivers for regional dominance include strong economic policies supporting consumer spending on personal care, well-developed distribution networks, and a high level of consumer awareness regarding the benefits of rechargeable epilators.

Rechargeable Epilator Product Landscape

The rechargeable epilator product landscape is dynamic, marked by continuous innovation aimed at enhancing user experience and efficacy. Manufacturers are focusing on developing devices with advanced tweezer systems, such as ceramic or micro-grip technology, for more efficient hair removal and reduced skin irritation. Ergonomic designs with comfortable grips and maneuverability are crucial for ease of use across various body parts. Innovations include integrated smart features like app connectivity for personalized treatment plans, variable speed settings, and sensitive area caps. The inclusion of wet and dry functionality is a popular feature, allowing for epilation in or out of the shower, further enhancing convenience and comfort. Performance metrics are increasingly defined by battery life (aiming for over 60 minutes of cordless use), the number of tweezers, and the precision of hair removal.

Key Drivers, Barriers & Challenges in Rechargeable Epilator

The rechargeable epilator market is propelled by several key drivers. The increasing consumer demand for convenient and long-term hair removal solutions that offer a cost-effective alternative to salon treatments is paramount. Technological advancements in tweezer technology, battery life, and ergonomic design continuously improve product performance and user satisfaction. The growing emphasis on personal grooming and aesthetics, amplified by social media trends, further fuels adoption.

However, the market faces significant barriers and challenges. The higher initial cost compared to disposable razors can be a deterrent for price-sensitive consumers. Competition from alternative hair removal methods, including shaving, waxing, and professional laser treatments, remains intense. Supply chain disruptions, particularly for electronic components, can impact production volumes and lead times. Regulatory hurdles related to product safety and certifications, though generally manageable, require diligent adherence.

Emerging Opportunities in Rechargeable Epilator

Emerging opportunities in the rechargeable epilator market lie in untapped markets, particularly in developing economies where disposable incomes are rising and awareness of advanced personal care solutions is growing. Innovative product applications, such as specialized epilators for men's grooming or devices with integrated skincare benefits, present new avenues. Evolving consumer preferences for sustainable and eco-friendly personal care products could also drive the development of devices with longer lifespans and reduced waste. The integration of AI and smart features for personalized hair removal experiences and skin health monitoring offers significant potential.

Growth Accelerators in the Rechargeable Epilator Industry

Several catalysts are accelerating growth in the rechargeable epilator industry. Continuous technological breakthroughs, such as improved motor efficiency for faster epilation and gentler tweezer mechanisms, are enhancing product appeal. Strategic partnerships between manufacturers and beauty influencers or e-commerce platforms can significantly expand market reach and consumer engagement. Market expansion strategies targeting emerging economies with tailored product offerings and localized marketing campaigns are proving effective. The growing trend of "at-home beauty" and the desire for salon-quality results without the associated cost and time commitment are major growth accelerators.

Key Players Shaping the Rechargeable Epilator Market

- Philips

- Panasonic

- Braun

- POVOS

- Silk’n

- Epilady

- Emjoi

Notable Milestones in Rechargeable Epilator Sector

- 2019: Launch of Philips Lumea Prestige IPL devices with advanced app integration, expanding the scope of home hair removal technologies.

- 2020: Panasonic introduces its ES-WH90 Series with improved IPL technology and ergonomic design for enhanced user comfort.

- 2021: Braun expands its Silk-épil range with SmartSkinsensor technology for optimal pressure application.

- 2022: Silk'n introduces new generations of home-use IPL devices with enhanced safety features and longer treatment intervals.

- 2023: Emjoi launches a series of cordlessly rechargeable epilators with advanced micro-grip technology for precision hair removal.

- 2024: Growing consumer demand for multi-functional devices leads to the introduction of epilators with integrated exfoliating brushes and massage elements.

In-Depth Rechargeable Epilator Market Outlook

The outlook for the rechargeable epilator market remains exceptionally positive, driven by sustained consumer demand for effective, convenient, and cost-efficient hair removal solutions. Growth accelerators such as ongoing technological innovation, particularly in areas like comfort and personalization, alongside strategic market expansion into emerging economies, will continue to fuel market expansion. The increasing adoption of online sales channels and the growing influence of digital marketing further enhance accessibility and consumer engagement. Strategic partnerships and a focus on sustainability are poised to shape the future landscape, offering significant opportunities for market players to capture market share and drive long-term value. The market is on track for substantial growth, projected to reach approximately $7.2 billion by 2030.

Rechargeable Epilator Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Facial Epilator

- 2.2. Body Epilator

Rechargeable Epilator Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Rechargeable Epilator REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rechargeable Epilator Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Facial Epilator

- 5.2.2. Body Epilator

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Rechargeable Epilator Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Facial Epilator

- 6.2.2. Body Epilator

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Rechargeable Epilator Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Facial Epilator

- 7.2.2. Body Epilator

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Rechargeable Epilator Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Facial Epilator

- 8.2.2. Body Epilator

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Rechargeable Epilator Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Facial Epilator

- 9.2.2. Body Epilator

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Rechargeable Epilator Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Facial Epilator

- 10.2.2. Body Epilator

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Philips

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Panasonic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Braun

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 POVOS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Silk’n

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Epilady

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Emjoi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Philips

List of Figures

- Figure 1: Global Rechargeable Epilator Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Rechargeable Epilator Revenue (million), by Application 2024 & 2032

- Figure 3: North America Rechargeable Epilator Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Rechargeable Epilator Revenue (million), by Types 2024 & 2032

- Figure 5: North America Rechargeable Epilator Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Rechargeable Epilator Revenue (million), by Country 2024 & 2032

- Figure 7: North America Rechargeable Epilator Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Rechargeable Epilator Revenue (million), by Application 2024 & 2032

- Figure 9: South America Rechargeable Epilator Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Rechargeable Epilator Revenue (million), by Types 2024 & 2032

- Figure 11: South America Rechargeable Epilator Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Rechargeable Epilator Revenue (million), by Country 2024 & 2032

- Figure 13: South America Rechargeable Epilator Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Rechargeable Epilator Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Rechargeable Epilator Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Rechargeable Epilator Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Rechargeable Epilator Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Rechargeable Epilator Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Rechargeable Epilator Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Rechargeable Epilator Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Rechargeable Epilator Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Rechargeable Epilator Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Rechargeable Epilator Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Rechargeable Epilator Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Rechargeable Epilator Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Rechargeable Epilator Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Rechargeable Epilator Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Rechargeable Epilator Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Rechargeable Epilator Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Rechargeable Epilator Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Rechargeable Epilator Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rechargeable Epilator Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Rechargeable Epilator Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Rechargeable Epilator Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Rechargeable Epilator Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Rechargeable Epilator Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Rechargeable Epilator Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Rechargeable Epilator Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Rechargeable Epilator Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Rechargeable Epilator Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Rechargeable Epilator Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Rechargeable Epilator Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Rechargeable Epilator Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Rechargeable Epilator Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Rechargeable Epilator Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Rechargeable Epilator Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Rechargeable Epilator Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Rechargeable Epilator Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Rechargeable Epilator Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Rechargeable Epilator Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Rechargeable Epilator Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rechargeable Epilator?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Rechargeable Epilator?

Key companies in the market include Philips, Panasonic, Braun, POVOS, Silk’n, Epilady, Emjoi.

3. What are the main segments of the Rechargeable Epilator?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rechargeable Epilator," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rechargeable Epilator report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rechargeable Epilator?

To stay informed about further developments, trends, and reports in the Rechargeable Epilator, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence