Key Insights

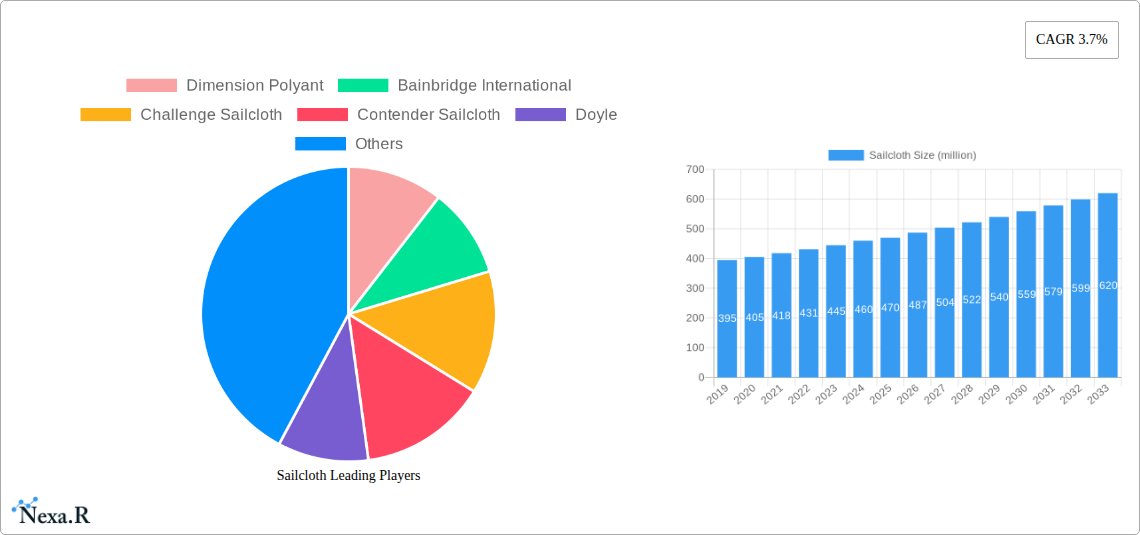

The global sailcloth market is projected to reach a substantial valuation of approximately $470 million by 2025, with a steady Compound Annual Growth Rate (CAGR) of 3.7% expected to propel it forward through 2033. This robust growth is underpinned by several key drivers, including the increasing popularity of recreational sailing and a resurgent interest in competitive yacht racing. Advancements in material technology are also playing a significant role, with innovations in laminate sailcloth offering enhanced durability, reduced weight, and improved aerodynamic performance, catering to the demands of both leisure and professional sailors. The market's expansion is further fueled by a growing global middle class with disposable income for leisure activities, leading to increased participation in sailing as a recreational pursuit. Furthermore, the development of eco-friendly and sustainable sailcloth options is emerging as a significant trend, aligning with broader environmental consciousness and regulatory shifts.

The market is segmented across various applications, with cruising sails and racing sails representing the dominant segments, reflecting the dual nature of sailcloth utilization. Other applications, though smaller, contribute to the overall market diversity. In terms of material types, laminate sailcloth is expected to witness significant adoption due to its superior properties, followed by traditional polyester and nylon sailcloth, which continue to cater to specific market needs and price points. Key industry players, including Dimension Polyant, Bainbridge International, and Challenge Sailcloth, are actively investing in research and development to innovate and capture market share. Geographically, North America and Europe are anticipated to remain major markets due to established sailing cultures and robust marine infrastructure. However, the Asia Pacific region, particularly China and India, presents a significant growth opportunity driven by expanding economies and increasing adoption of water sports. Challenges for the market include the high initial cost of advanced sailcloth materials and the cyclical nature of the marine industry, which can be influenced by global economic conditions.

Here is a compelling, SEO-optimized report description for the Sailcloth market, designed to maximize visibility and engage industry professionals.

Sailcloth Market Dynamics & Structure

The global sailcloth market is characterized by a moderately concentrated landscape, with leading players like Dimension Polyant, Bainbridge International, Challenge Sailcloth, Contender Sailcloth, and Doyle holding significant influence. Technological innovation is a primary driver, with advancements in material science leading to the development of lighter, stronger, and more durable sailcloth, particularly in the laminate sailcloth segment. Regulatory frameworks, while not overly restrictive, focus on environmental sustainability and material safety, influencing product development and sourcing. Competitive product substitutes, such as advanced composites and alternative sail materials, pose a nascent threat, pushing sailcloth manufacturers to continually enhance their offerings. End-user demographics are shifting, with an increasing interest in recreational sailing and a growing demand for high-performance materials in racing sails. Mergers and acquisitions (M&A) activity has been moderate, reflecting consolidation efforts and strategic expansions by key companies seeking to broaden their product portfolios and market reach. The market is projected to see a CAGR of XX% from 2025 to 2033, indicating a steady growth trajectory. The estimated market size in 2025 is $XXX million units, with projections reaching $XXX million units by 2033.

- Market Concentration: Moderate, with key players dominating a substantial share of the market.

- Technological Innovation: Focus on enhancing material strength, weight reduction, UV resistance, and aerodynamic properties, especially in laminate sailcloth.

- Regulatory Frameworks: Evolving focus on sustainability, material recyclability, and compliance with maritime safety standards.

- Competitive Product Substitutes: Emerging use of advanced composites and alternative sail materials, driving innovation in traditional sailcloth.

- End-User Demographics: Growing participation in recreational sailing, demand for offshore cruising sails, and continued emphasis on performance in racing.

- M&A Trends: Strategic acquisitions aimed at market expansion, diversification of product lines, and integration of supply chains.

Sailcloth Growth Trends & Insights

The global sailcloth market is poised for robust expansion, driven by escalating demand across both the parent market (recreational and competitive sailing) and child markets (specialty applications and industrial uses). The market size is projected to grow from approximately $XXX million units in 2024 to an estimated $XXX million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth is underpinned by several critical trends. Firstly, the resurgence of interest in outdoor recreational activities, including sailing, post-pandemic, has significantly boosted demand for cruising sails and associated equipment. Secondly, technological disruptions are continuously reshaping the sailcloth landscape. The development and widespread adoption of advanced laminate sailcloth, offering superior strength-to-weight ratios and reduced stretch, are key differentiators. These materials are becoming standard for high-performance racing sails and are increasingly influencing the design of cruising sails. Consumer behavior shifts are also evident, with sailors prioritizing durability, longevity, and performance, leading them to invest in premium sailcloth. Furthermore, sustainability concerns are influencing purchasing decisions, prompting manufacturers to explore eco-friendly materials and production processes. The increasing popularity of offshore cruising and the growing competitive sailing circuit, including events like the America's Cup and Vendée Globe, are significant growth engines. The "Others" application segment, encompassing kitesurfing, windsurfing, and even specialized industrial applications like architectural fabrics and awnings, is also contributing to market diversification and growth, exhibiting an estimated CAGR of XX%. Adoption rates for laminate sailcloth are particularly high, currently standing at an estimated XX% of the total market, a figure expected to rise to XX% by 2033. Nylon and polyester sailcloth continue to hold significant market share, especially in the more traditional and cost-sensitive segments, but are facing increased competition from innovative laminate structures. The penetration of advanced sailcloth technologies in the recreational segment is estimated at XX% in 2025, with a projected increase to XX% by 2033. The market is also experiencing a ripple effect from the booming marine leisure industry, directly impacting sail production and, consequently, sailcloth demand. The average lifespan of a modern sailcloth is increasing due to material advancements, leading to a replacement cycle that, while longer, ensures a consistent demand for high-quality materials. The estimated market size for racing sails alone is projected to reach $XXX million units by 2033, while cruising sails are expected to contribute $XXX million units to the market. The "Others" segment, encompassing a diverse range of applications, is anticipated to grow at XX%, reaching $XXX million units by 2033.

Dominant Regions, Countries, or Segments in Sailcloth

The global sailcloth market's dominance is multifaceted, with distinct regions, countries, and product segments playing pivotal roles in shaping its trajectory. Europe emerges as a dominant region, driven by its rich maritime heritage, extensive coastline, significant number of sailing enthusiasts, and a well-established marine industry. Countries within Europe, particularly France, the United Kingdom, and Italy, are major contributors to sailcloth demand, fueled by a strong culture of competitive sailing and a thriving leisure boating sector. These nations boast a high concentration of sailing schools, yacht clubs, and professional sailmakers, creating a consistent and robust market for high-performance sailcloth. Economic policies in these regions often support marine tourism and recreational activities, indirectly bolstering the sailcloth industry. Infrastructure, such as advanced marinas and competitive sailing event venues, further enhances market activity.

Within the product segments, Laminate Sailcloth is the most dominant type, showcasing exceptional growth potential and market penetration. Its superiority in terms of strength-to-weight ratio, reduced stretch, and durability makes it the preferred choice for both professional racing sails and high-performance cruising sails. The estimated market share of laminate sailcloth in 2025 is XX%, a figure projected to escalate to XX% by 2033. This dominance is a testament to continuous technological innovation by companies like Dimension Polyant and Challenge Sailcloth, which are at the forefront of developing advanced laminate technologies.

Among the applications, Racing Sails represent a significant growth driver and a segment where premium sailcloth finds its most demanding use. The relentless pursuit of speed and performance in competitive sailing necessitates cutting-edge materials, making racing sails a lucrative niche. The estimated market size for racing sails is projected to reach $XXX million units by 2033, driven by a CAGR of XX%. This segment is particularly strong in regions with a vibrant professional sailing circuit and numerous regattas.

Conversely, Cruising Sails represent the largest volume segment, catering to the substantial global population of recreational sailors. While perhaps not demanding the absolute pinnacle of performance found in racing, cruising sails require durability, UV resistance, and ease of handling, areas where modern sailcloth technologies also excel. The market for cruising sails is expected to reach $XXX million units by 2033, with a steady CAGR of XX%. The "Others" application segment, including kitesurfing, windsurfing, and other niche uses, is also exhibiting strong growth, albeit from a smaller base, with a projected CAGR of XX%.

The dominance of these segments and regions is further amplified by key drivers:

- Technological Advancements: Leading to lighter, stronger, and more durable sailcloth.

- Growing Marine Leisure Industry: Increasing number of boat owners and sailing enthusiasts.

- Competitive Sailing Events: Driving demand for high-performance materials.

- Consumer Preferences: Prioritization of quality, durability, and performance.

- Supportive Economic Policies: Encouraging recreational activities and marine tourism.

Sailcloth Product Landscape

The sailcloth product landscape is characterized by continuous innovation focused on enhancing performance and durability. Laminate sailcloth, a leading segment, offers advanced composite structures that minimize stretch and optimize sail shape for superior aerodynamic efficiency. These include materials like Spectra/Dyneema and Vectran fibers embedded within advanced films and scrims. Developments are geared towards lighter, stronger, and more UV-resistant sailcloth, crucial for both racing and offshore cruising. Innovations in polyester and nylon sailcloth continue, focusing on improved weave density, resin treatments for enhanced water repellency, and increased abrasion resistance. The unique selling proposition of advanced sailcloth lies in its ability to translate into tangible performance gains for sailors, offering better upwind performance, improved speed, and longer sail life.

Key Drivers, Barriers & Challenges in Sailcloth

Key Drivers: The sailcloth market is propelled by the enduring appeal of sailing as a recreational activity and a competitive sport, leading to consistent demand for high-quality sails. Technological advancements in material science, particularly in laminate sailcloth, are creating new performance benchmarks and driving innovation. The growing global marine leisure industry, coupled with increasing disposable incomes, fuels the demand for new boats and sail replacements. Furthermore, the expansion of competitive sailing events worldwide, from local regattas to professional ocean races, consistently pushes the boundaries of sailcloth technology.

Barriers & Challenges: The primary challenge facing the sailcloth industry is the inherent cost associated with advanced materials and manufacturing processes, which can limit adoption among budget-conscious consumers. Supply chain disruptions, particularly for specialized fibers and resins, can lead to price volatility and production delays. Regulatory pressures concerning environmental sustainability and the use of certain chemicals in material production require ongoing adaptation and investment in eco-friendly alternatives. Intense competition, both from established players and emerging material technologies, necessitates continuous product development and competitive pricing strategies. The long lifespan of modern sailcloth, while a testament to quality, can also lead to extended replacement cycles, impacting revenue growth.

Emerging Opportunities in Sailcloth

Emerging opportunities in the sailcloth market lie in the development of sustainable and recycled sailcloth materials, appealing to an increasingly environmentally conscious consumer base. The expansion of the sailcloth market into niche applications, such as high-performance kitesurfing sails, windsurfing sails, and even advanced architectural fabrics, presents untapped potential. Furthermore, the increasing demand for lightweight and durable materials in other industries, like aerospace and performance textiles, could open avenues for diversification. Customization and personalization of sailcloth for specific sailing disciplines and boat types also represent a growing trend, allowing for value-added offerings.

Growth Accelerators in the Sailcloth Industry

Several growth accelerators are poised to significantly propel the sailcloth industry forward. Technological breakthroughs in fiber science, leading to even lighter and stronger materials with enhanced UV resistance and reduced environmental impact, will be critical. Strategic partnerships between sailcloth manufacturers, sailmakers, and boat builders can foster innovation and streamline product development cycles. The expanding reach of offshore and ocean racing events, coupled with the growing participation in long-distance cruising, provides a sustained demand for high-performance and durable sailcloth. Furthermore, market expansion into emerging economies with a growing middle class and increasing interest in marine leisure activities will unlock new revenue streams.

Key Players Shaping the Sailcloth Market

- Dimension Polyant

- Bainbridge International

- Challenge Sailcloth

- Contender Sailcloth

- Doyle

- British Millerain

- Hood

- Aztec Tents

- Powerplast

- North Sails

- IYU Sailcloth

- Mazu Sailcloth

- Quantum Sails

- Sailmaker International

Notable Milestones in Sailcloth Sector

- 2019: Introduction of advanced 3Di™ molded sail technology by North Sails, revolutionizing sail construction.

- 2020: Dimension Polyant launches Polyspin, a new recycled polyester yarn for sailcloth, underscoring sustainability efforts.

- 2021: Challenge Sailcloth expands its UV-resistant sailcloth offerings, enhancing durability for cruising applications.

- 2022: Bainbridge International introduces a new range of high-strength laminate sailcloth for offshore racing.

- 2023: Contender Sailcloth develops innovative sailcloth coatings for improved water repellency and reduced friction.

- 2024: Doyle Sailmakers announces a strategic partnership to enhance composite sail development and integration.

- 2025 (Projected): Expected advancements in biodegradable sailcloth materials and increased adoption of computational fluid dynamics (CFD) in sail design, influencing sailcloth requirements.

In-Depth Sailcloth Market Outlook

The future of the sailcloth market is exceptionally promising, driven by an interplay of sustained recreational sailing growth and relentless technological innovation. Accelerators such as the development of bio-based and recycled sailcloth materials will not only meet increasing environmental demands but also unlock new premium market segments. Strategic alliances between material suppliers and leading sailmakers are set to expedite the adoption of next-generation sailcloth, integrating advanced computational design with cutting-edge material properties. The expanding global participation in ocean racing and expedition cruising further solidifies the demand for high-performance, ultra-durable sailcloth, positioning it as a critical enabler of extreme sailing endeavors. This confluence of factors indicates a dynamic market poised for significant value creation and expanded applications in the coming years.

Sailcloth Segmentation

-

1. Application

- 1.1. Cruising sails

- 1.2. Racing sails

- 1.3. Others

-

2. Types

- 2.1. Laminate Sailcloth

- 2.2. Nylon Sailcloth

- 2.3. Polyester Sailcloth

- 2.4. Others

Sailcloth Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sailcloth REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sailcloth Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cruising sails

- 5.1.2. Racing sails

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Laminate Sailcloth

- 5.2.2. Nylon Sailcloth

- 5.2.3. Polyester Sailcloth

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sailcloth Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cruising sails

- 6.1.2. Racing sails

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Laminate Sailcloth

- 6.2.2. Nylon Sailcloth

- 6.2.3. Polyester Sailcloth

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sailcloth Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cruising sails

- 7.1.2. Racing sails

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Laminate Sailcloth

- 7.2.2. Nylon Sailcloth

- 7.2.3. Polyester Sailcloth

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sailcloth Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cruising sails

- 8.1.2. Racing sails

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Laminate Sailcloth

- 8.2.2. Nylon Sailcloth

- 8.2.3. Polyester Sailcloth

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sailcloth Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cruising sails

- 9.1.2. Racing sails

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Laminate Sailcloth

- 9.2.2. Nylon Sailcloth

- 9.2.3. Polyester Sailcloth

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sailcloth Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cruising sails

- 10.1.2. Racing sails

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Laminate Sailcloth

- 10.2.2. Nylon Sailcloth

- 10.2.3. Polyester Sailcloth

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dimension Polyant

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bainbridge International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Challenge Sailcloth

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Contender Sailcloth

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Doyle

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 British Millerain

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hood

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aztec Tents

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Powerplast

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 North Sails

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IYU Sailcloth

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mazu Sailcloth

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Quantum Sails

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sailmaker International

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Dimension Polyant

List of Figures

- Figure 1: Global Sailcloth Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Sailcloth Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Sailcloth Revenue (million), by Application 2024 & 2032

- Figure 4: North America Sailcloth Volume (K), by Application 2024 & 2032

- Figure 5: North America Sailcloth Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Sailcloth Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Sailcloth Revenue (million), by Types 2024 & 2032

- Figure 8: North America Sailcloth Volume (K), by Types 2024 & 2032

- Figure 9: North America Sailcloth Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Sailcloth Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Sailcloth Revenue (million), by Country 2024 & 2032

- Figure 12: North America Sailcloth Volume (K), by Country 2024 & 2032

- Figure 13: North America Sailcloth Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Sailcloth Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Sailcloth Revenue (million), by Application 2024 & 2032

- Figure 16: South America Sailcloth Volume (K), by Application 2024 & 2032

- Figure 17: South America Sailcloth Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Sailcloth Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Sailcloth Revenue (million), by Types 2024 & 2032

- Figure 20: South America Sailcloth Volume (K), by Types 2024 & 2032

- Figure 21: South America Sailcloth Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Sailcloth Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Sailcloth Revenue (million), by Country 2024 & 2032

- Figure 24: South America Sailcloth Volume (K), by Country 2024 & 2032

- Figure 25: South America Sailcloth Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Sailcloth Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Sailcloth Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Sailcloth Volume (K), by Application 2024 & 2032

- Figure 29: Europe Sailcloth Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Sailcloth Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Sailcloth Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Sailcloth Volume (K), by Types 2024 & 2032

- Figure 33: Europe Sailcloth Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Sailcloth Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Sailcloth Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Sailcloth Volume (K), by Country 2024 & 2032

- Figure 37: Europe Sailcloth Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Sailcloth Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Sailcloth Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Sailcloth Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Sailcloth Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Sailcloth Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Sailcloth Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Sailcloth Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Sailcloth Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Sailcloth Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Sailcloth Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Sailcloth Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Sailcloth Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Sailcloth Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Sailcloth Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Sailcloth Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Sailcloth Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Sailcloth Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Sailcloth Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Sailcloth Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Sailcloth Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Sailcloth Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Sailcloth Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Sailcloth Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Sailcloth Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Sailcloth Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sailcloth Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Sailcloth Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Sailcloth Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Sailcloth Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Sailcloth Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Sailcloth Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Sailcloth Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Sailcloth Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Sailcloth Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Sailcloth Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Sailcloth Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Sailcloth Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Sailcloth Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Sailcloth Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Sailcloth Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Sailcloth Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Sailcloth Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Sailcloth Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Sailcloth Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Sailcloth Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Sailcloth Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Sailcloth Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Sailcloth Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Sailcloth Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Sailcloth Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Sailcloth Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Sailcloth Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Sailcloth Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Sailcloth Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Sailcloth Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Sailcloth Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Sailcloth Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Sailcloth Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Sailcloth Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Sailcloth Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Sailcloth Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Sailcloth Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Sailcloth Volume K Forecast, by Country 2019 & 2032

- Table 81: China Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Sailcloth Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Sailcloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Sailcloth Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sailcloth?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Sailcloth?

Key companies in the market include Dimension Polyant, Bainbridge International, Challenge Sailcloth, Contender Sailcloth, Doyle, British Millerain, Hood, Aztec Tents, Powerplast, North Sails, IYU Sailcloth, Mazu Sailcloth, Quantum Sails, Sailmaker International.

3. What are the main segments of the Sailcloth?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 470 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sailcloth," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sailcloth report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sailcloth?

To stay informed about further developments, trends, and reports in the Sailcloth, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence