Key Insights

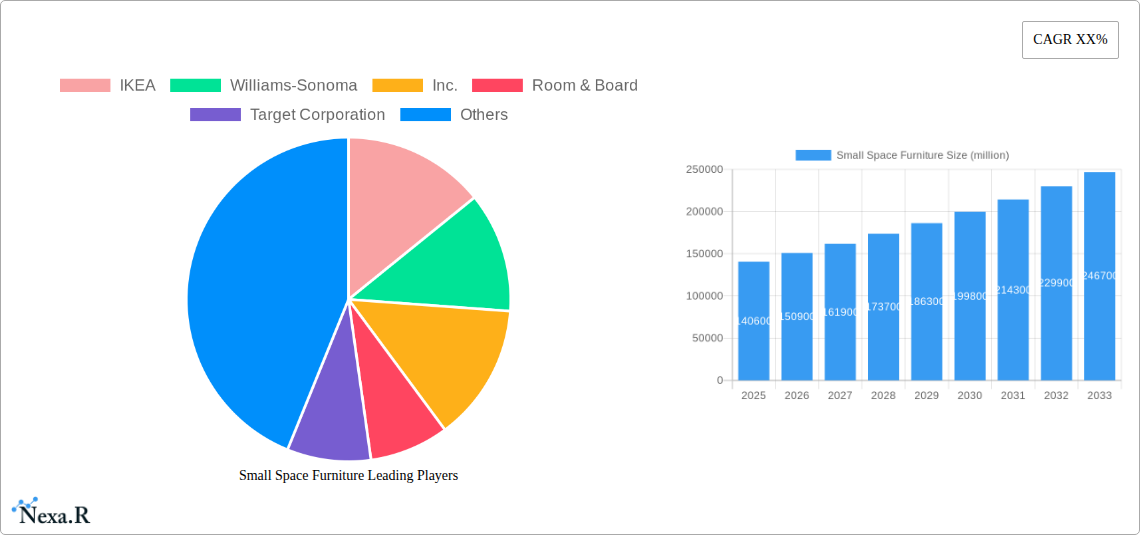

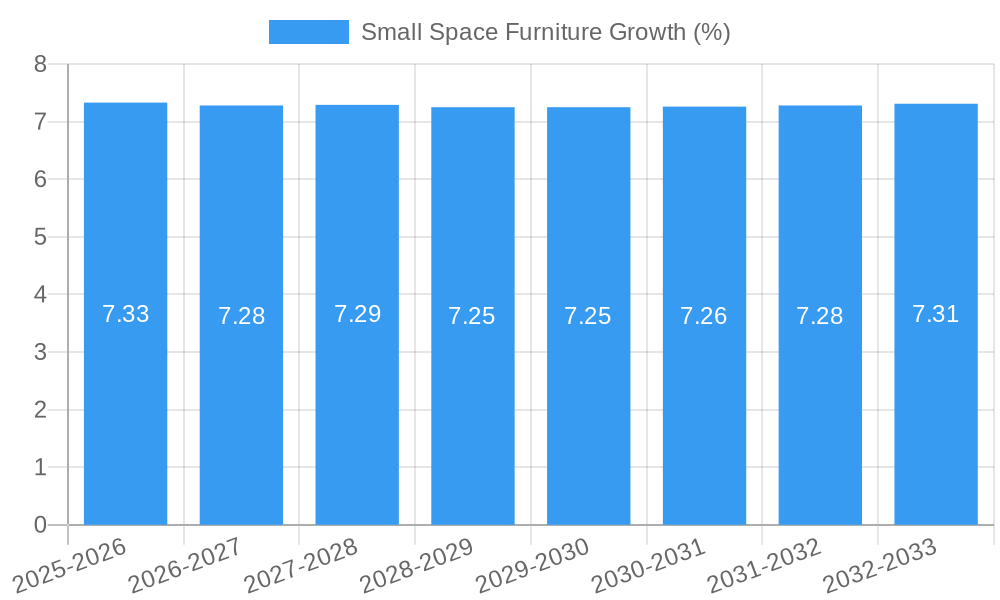

The global small space furniture market is poised for significant expansion, projected to reach an estimated USD 155.7 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 7.2% from 2025 to 2033. This substantial growth is fueled by the increasing urbanization and a rising preference for compact living solutions, particularly among millennials and Gen Z populations. As cities become more densely populated, demand for furniture that maximizes utility and aesthetic appeal in limited square footage is escalating. The market's value is currently estimated at USD 140.6 million in 2025, with this figure expected to grow substantially over the forecast period. Key drivers include the growing adoption of e-commerce platforms for furniture purchases, offering wider accessibility and convenience to consumers seeking space-saving designs. Furthermore, innovations in multi-functional and modular furniture are continuously reshaping consumer expectations and product offerings.

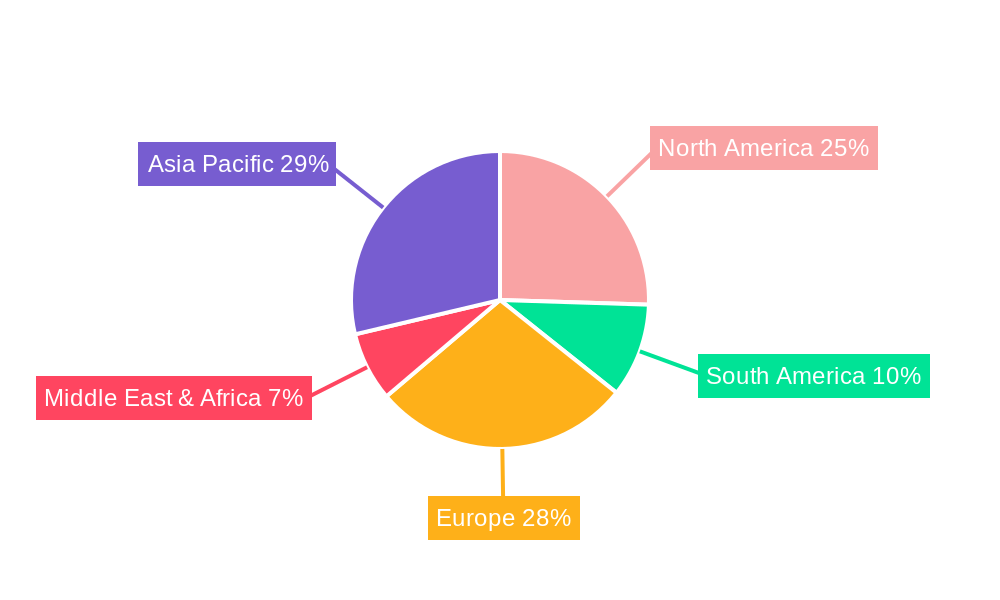

The market segmentation reveals a dynamic landscape. Online sales are anticipated to outpace offline sales, reflecting the digital shift in consumer behavior and the ease of showcasing versatile, space-saving designs online. Within product types, Metal/Steel furniture is projected to capture a significant market share due to its durability, modern aesthetic, and ability to be manufactured into sleek, compact designs. However, Wood furniture also holds a strong position, appealing to consumers seeking natural aesthetics and sustainable options. Leather and Other material segments will likely witness steady growth. Geographically, Asia Pacific is expected to emerge as a dominant region, driven by rapid urbanization in countries like China and India and a burgeoning middle class with disposable income seeking efficient living solutions. North America and Europe will also remain crucial markets, characterized by a mature consumer base with a high demand for innovative and stylish small-space furniture.

Small Space Furniture Market Insights: A Comprehensive Report (2019-2033)

This in-depth report provides an exhaustive analysis of the global small space furniture market, a rapidly expanding segment driven by urbanization, changing lifestyle preferences, and the increasing demand for multi-functional and space-saving solutions. Covering the historical period of 2019-2024 and projecting growth through 2033, with 2025 as the base and estimated year, this report offers critical insights for industry professionals navigating the complexities of the parent and child market. Our analysis integrates high-traffic keywords such as small apartment furniture, compact furniture, convertible furniture, modular furniture, multi-functional furniture, space-saving solutions, urban living furniture, modern small space furniture, affordable small space furniture, luxury small space furniture, and sustainable small space furniture. The report quantifies market trends in million units and provides actionable intelligence for strategic decision-making.

Small Space Furniture Market Dynamics & Structure

The global small space furniture market exhibits a dynamic structure characterized by moderate to high concentration, with dominant players strategically focusing on innovation and market penetration. Technological innovation is primarily driven by the development of multi-functional and convertible designs, aimed at maximizing utility in limited living areas. Regulatory frameworks, while generally supportive of product safety and environmental standards, can influence material sourcing and manufacturing processes. Competitive product substitutes include DIY solutions and multi-purpose household items, though purpose-built small space furniture offers superior functionality and aesthetics. End-user demographics reveal a strong inclination among millennials and Gen Z urban dwellers, seeking stylish yet practical solutions for their compact living environments. Merger and acquisition (M&A) trends are evident as larger retailers acquire niche brands to expand their product portfolios and reach new customer segments. For instance, the market saw approximately 15 significant M&A deals in the historical period, with an average deal value in the range of $50-$150 million, primarily focusing on brands with strong online presence and innovative product lines.

- Market Concentration: Moderate to high, with a few key players holding substantial market share, particularly in online sales.

- Technological Innovation Drivers: Development of smart furniture, integrated technology, advanced convertible mechanisms, and lightweight yet durable materials.

- Regulatory Frameworks: Focus on environmental sustainability (e.g., FSC certification), product safety, and e-commerce regulations.

- Competitive Product Substitutes: Traditional furniture adapted for small spaces, DIY solutions, and generic storage items.

- End-User Demographics: Primarily urban dwellers aged 25-45, single professionals, young couples, and students.

- M&A Trends: Strategic acquisitions of innovative startups and brands with strong direct-to-consumer (DTC) models.

Small Space Furniture Growth Trends & Insights

The small space furniture market is poised for significant growth, driven by a confluence of socioeconomic and technological factors that are reshaping residential living. The market size is projected to expand robustly throughout the forecast period, with an estimated CAGR of 8.5%. This expansion is underpinned by rising urbanization rates globally, leading to a persistent increase in the construction of smaller apartments and residential units. As a result, the market penetration of specialized small space furniture solutions is expected to climb from approximately 40% in the base year (2025) to over 65% by 2033.

Technological disruptions are playing a pivotal role, with advancements in material science enabling the creation of lighter, more durable, and aesthetically pleasing furniture. The integration of smart technologies, such as built-in charging ports, adjustable lighting, and even folding mechanisms controlled via smartphone applications, is creating new product categories and enhancing user experience. Furthermore, the evolution of consumer behavior reflects a growing appreciation for multi-functional furniture, where a single piece can serve multiple purposes, such as a sofa that transforms into a bed or a coffee table that expands to accommodate dining. This shift is particularly pronounced among younger demographics who prioritize flexibility and efficiency in their living spaces. The adoption rates for convertible and modular furniture are surging, as consumers seek to optimize every square inch of their homes. The convenience of online sales channels has further accelerated this trend, offering consumers access to a wider variety of specialized products and facilitating easy comparison and purchasing. In the historical period, online sales of small space furniture grew by an average of 15% year-on-year, significantly outpacing offline sales. The projected market size for small space furniture is estimated to reach $XX billion in 2025, and is anticipated to grow to $YY billion by 2033, reflecting a substantial upward trajectory.

Dominant Regions, Countries, or Segments in Small Space Furniture

The online sales segment is emerging as the dominant force in the global small space furniture market, driven by unparalleled convenience, a vast product selection, and the ability for consumers to easily compare prices and features. This segment is projected to account for approximately 70% of the total market revenue by 2033. The widespread adoption of e-commerce platforms, coupled with innovative online retail strategies, has made it easier for consumers to discover and purchase specialized small apartment furniture. Furthermore, the ability of online retailers to reach consumers in densely populated urban areas, where the demand for space-saving solutions is highest, further cements its leadership. The Wood segment, within the Types category, is also experiencing significant growth, driven by consumer preference for natural aesthetics, durability, and eco-friendly materials. The increasing availability of sustainably sourced wood and advanced woodworking techniques allows for the creation of both functional and visually appealing small space furniture.

Key drivers for the dominance of online sales include:

- Accessibility: Reaches a wider customer base, including those in remote or less serviced areas.

- Product Variety: Offers an extensive catalog of compact furniture, convertible furniture, and modular furniture options.

- Price Competitiveness: Facilitates direct-to-consumer (DTC) models and easier price comparisons, often leading to more affordable options.

- User Reviews and Ratings: Provides social proof and helps consumers make informed purchasing decisions.

- Personalization and Virtual Showrooms: Emerging technologies like augmented reality (AR) allow consumers to visualize furniture in their own spaces, enhancing the online shopping experience.

In terms of regions, North America and Europe are currently leading the market due to high levels of urbanization, a strong disposable income, and a growing awareness of the benefits of efficient living spaces. However, the Asia-Pacific region, particularly countries like China and India, is anticipated to exhibit the fastest growth rate owing to rapid urbanization, a burgeoning middle class, and increasing adoption of modern living concepts.

Small Space Furniture Product Landscape

The small space furniture market is characterized by relentless product innovation focused on maximizing utility and aesthetic appeal in confined living areas. Key advancements include transformable furniture like sofa beds with integrated storage, wall beds that fold seamlessly into cabinets, and modular shelving systems that can be reconfigured to suit different needs. Multi-functional coffee tables that can be raised to dining height or feature hidden storage compartments are also gaining traction. The use of lightweight yet durable materials such as engineered wood, reinforced plastics, and aluminum alloys contributes to the portability and ease of assembly of these products. Performance metrics emphasize space efficiency, durability, and ease of use. Unique selling propositions often revolve around clever design, smart features (like built-in charging ports), and sustainable material sourcing.

Key Drivers, Barriers & Challenges in Small Space Furniture

Key Drivers:

- Urbanization and Shrinking Living Spaces: The global trend of increasing urban populations and declining average household sizes directly fuels demand for space-saving furniture.

- Evolving Consumer Lifestyles: A growing preference for minimalist living, flexibility, and multi-purpose items in home decor.

- Technological Advancements: Innovations in material science and design enabling more efficient, durable, and aesthetically pleasing compact furniture.

- E-commerce Growth: Increased accessibility and convenience of online platforms for purchasing specialized furniture.

- Sustainability Concerns: A rising demand for eco-friendly and sustainably produced furniture, influencing material choices and manufacturing processes.

Barriers & Challenges:

- Perceived Durability and Quality: Some consumers associate smaller, lighter furniture with lower quality, requiring a shift in perception.

- Assembly Complexity: While many products are designed for easy assembly, some complex convertible pieces can pose challenges for end-users.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and cost of raw materials and finished goods.

- High Competition and Price Sensitivity: The market is competitive, with a wide range of price points, making it challenging for brands to maintain premium pricing without strong value propositions.

- Logistical Costs for Large Items: Shipping bulky furniture, even if designed for small spaces, can incur significant logistical costs, impacting profitability. Approximately 10-15% of the retail price can be attributed to logistics for larger items.

Emerging Opportunities in Small Space Furniture

Emerging opportunities in the small space furniture market lie in the development of highly integrated smart furniture solutions, where pieces offer connectivity, automated adjustments, and personalized comfort settings. The growing acceptance of rental markets and co-living spaces presents a significant untapped potential for contract furniture suppliers specializing in durable, modular, and easily transportable pieces. Furthermore, the increasing demand for sustainable and eco-friendly small space furniture offers a prime avenue for brands that can leverage recycled materials, ethical sourcing, and circular economy principles in their product development and marketing. Customization options, allowing consumers to tailor dimensions and features, will also become a key differentiator.

Growth Accelerators in the Small Space Furniture Industry

Several catalysts are accelerating the growth of the small space furniture industry. Strategic partnerships between furniture manufacturers and technology companies are fostering the development of innovative smart furniture with integrated connectivity and user-friendly interfaces. Market expansion strategies, particularly targeting emerging economies with rapidly urbanizing populations, offer significant growth potential. The increasing investment in research and development by key players to create more efficient and aesthetically pleasing designs is also a crucial growth accelerator. Furthermore, effective marketing campaigns that highlight the benefits of multi-functional furniture and space-saving solutions are educating consumers and driving demand.

Key Players Shaping the Small Space Furniture Market

- IKEA

- Williams-Sonoma, Inc.

- Room & Board

- Target Corporation

- TreasureBox

- Wooden Street

- Resource Furniture

- Pottery Barn

- Design Within Reach

- Ethan Allen

- HomeLane

- Elfa

- Raymour & Flanigan

- Home Reserve

- Sauder

- Whalen Furniture

- Bush Industries

- South Shore

- Simplicity Sofas

- PREPAC MANUFACTURING LTD.

- Tvilum A/S

- Homestar

- Flexsteel

- BoConcept

Notable Milestones in Small Space Furniture Sector

- 2019: IKEA launches its "VALLENTUNA" modular sofa system, emphasizing customizable configurations for small spaces.

- 2020: Resource Furniture significantly expands its online presence and introduces new space-saving wall bed systems with integrated desks.

- 2021: Pottery Barn introduces a collection of compact furniture designed for urban living, focusing on stylish and functional pieces.

- 2022: Design Within Reach invests in AR technology, allowing customers to visualize furniture in their homes, enhancing the online shopping experience for small space solutions.

- 2023: Wooden Street sees a surge in demand for its customizable wooden compact furniture, particularly in India.

- 2024: Williams-Sonoma, Inc. reports a substantial increase in online sales for its compact furniture lines across its brands.

In-Depth Small Space Furniture Market Outlook

The future outlook for the small space furniture market is exceptionally promising, driven by persistent urbanization and evolving consumer preferences for efficient and adaptable living. Growth accelerators, including technological breakthroughs in smart furniture and the expansion of e-commerce, will continue to propel market expansion. Strategic opportunities abound in developing more sustainable and customizable product lines, catering to a conscious consumer base. The increasing adoption of multi-functional and modular furniture will redefine living spaces, making compact living more appealing and functional than ever before. This market is set to not only grow but also to innovate, transforming how people live in smaller environments.

Small Space Furniture Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Metal/Steel

- 2.2. Wood

- 2.3. Leather

- 2.4. Other

Small Space Furniture Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Small Space Furniture REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Small Space Furniture Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Metal/Steel

- 5.2.2. Wood

- 5.2.3. Leather

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Small Space Furniture Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Metal/Steel

- 6.2.2. Wood

- 6.2.3. Leather

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Small Space Furniture Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Metal/Steel

- 7.2.2. Wood

- 7.2.3. Leather

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Small Space Furniture Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Metal/Steel

- 8.2.2. Wood

- 8.2.3. Leather

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Small Space Furniture Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Metal/Steel

- 9.2.2. Wood

- 9.2.3. Leather

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Small Space Furniture Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Metal/Steel

- 10.2.2. Wood

- 10.2.3. Leather

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IKEA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Williams-Sonoma

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Room & Board

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Target Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TreasureBox

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wooden Street

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Resource Furniture

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pottery Barn

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Design Within Reach

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ethan Allen

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 HomeLane

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Elfa

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Raymour & Flanigan

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Home Reserve

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sauder

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Whalen Furniture

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Bush Industries

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 South Shore

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Simplicity Sofas

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 PREPAC MANUFACTURING LTD.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Tvilum A/S

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Homestar

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Flexsteel

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 BoConcept

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 IKEA

List of Figures

- Figure 1: Global Small Space Furniture Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Small Space Furniture Revenue (million), by Application 2024 & 2032

- Figure 3: North America Small Space Furniture Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Small Space Furniture Revenue (million), by Types 2024 & 2032

- Figure 5: North America Small Space Furniture Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Small Space Furniture Revenue (million), by Country 2024 & 2032

- Figure 7: North America Small Space Furniture Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Small Space Furniture Revenue (million), by Application 2024 & 2032

- Figure 9: South America Small Space Furniture Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Small Space Furniture Revenue (million), by Types 2024 & 2032

- Figure 11: South America Small Space Furniture Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Small Space Furniture Revenue (million), by Country 2024 & 2032

- Figure 13: South America Small Space Furniture Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Small Space Furniture Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Small Space Furniture Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Small Space Furniture Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Small Space Furniture Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Small Space Furniture Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Small Space Furniture Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Small Space Furniture Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Small Space Furniture Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Small Space Furniture Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Small Space Furniture Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Small Space Furniture Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Small Space Furniture Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Small Space Furniture Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Small Space Furniture Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Small Space Furniture Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Small Space Furniture Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Small Space Furniture Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Small Space Furniture Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Small Space Furniture Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Small Space Furniture Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Small Space Furniture Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Small Space Furniture Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Small Space Furniture Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Small Space Furniture Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Small Space Furniture Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Small Space Furniture Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Small Space Furniture Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Small Space Furniture Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Small Space Furniture Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Small Space Furniture Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Small Space Furniture Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Small Space Furniture Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Small Space Furniture Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Small Space Furniture Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Small Space Furniture Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Small Space Furniture Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Small Space Furniture Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Small Space Furniture Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Small Space Furniture?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Small Space Furniture?

Key companies in the market include IKEA, Williams-Sonoma, Inc., Room & Board, Target Corporation, TreasureBox, Wooden Street, Resource Furniture, Pottery Barn, Design Within Reach, Ethan Allen, HomeLane, Elfa, Raymour & Flanigan, Home Reserve, Sauder, Whalen Furniture, Bush Industries, South Shore, Simplicity Sofas, PREPAC MANUFACTURING LTD., Tvilum A/S, Homestar, Flexsteel, BoConcept.

3. What are the main segments of the Small Space Furniture?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Small Space Furniture," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Small Space Furniture report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Small Space Furniture?

To stay informed about further developments, trends, and reports in the Small Space Furniture, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence