Key Insights

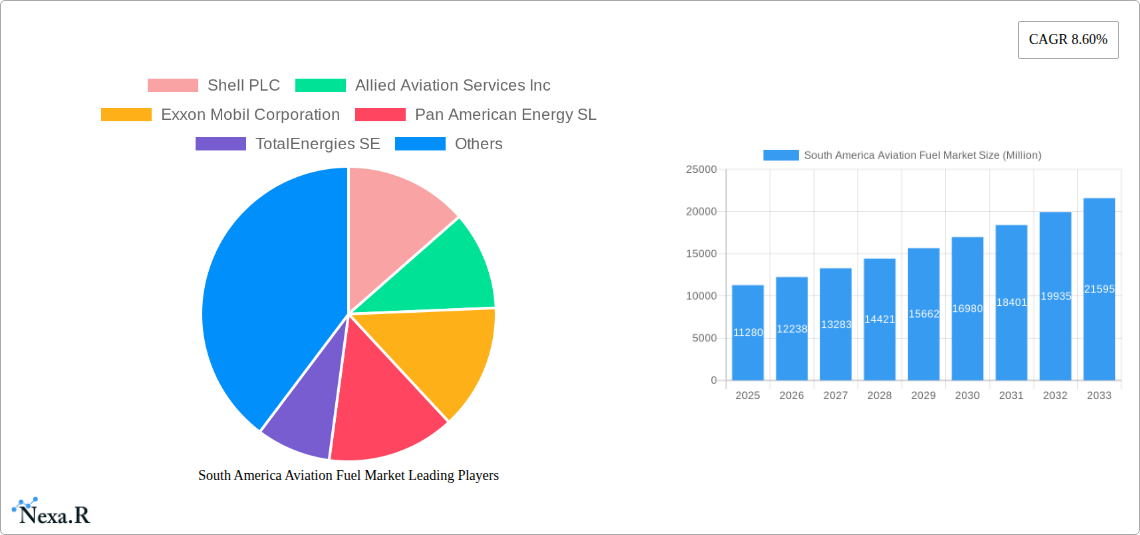

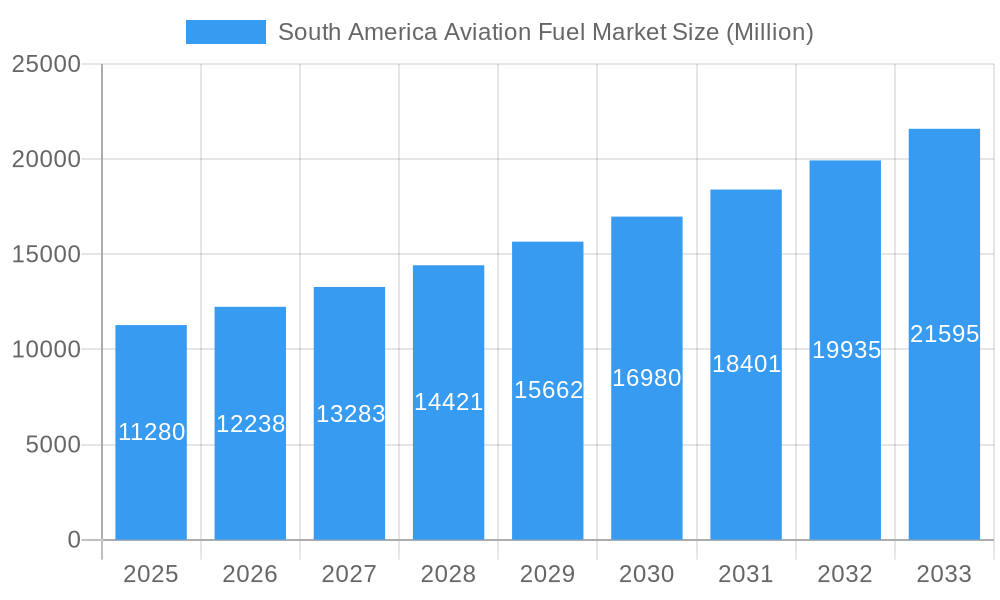

The South American aviation fuel market, valued at $11.28 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 8.60% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning tourism sector across South America is significantly increasing air travel demand, necessitating a higher volume of aviation fuel. Secondly, the region's economic growth, particularly in Brazil and Argentina, is stimulating both passenger and cargo air traffic, further fueling market expansion. The increasing adoption of more fuel-efficient aircraft technologies also contributes to moderate growth, offsetting some price pressures. However, market growth may be tempered by fluctuating global oil prices and potential environmental regulations aimed at reducing carbon emissions from air travel. While specific data on individual fuel types (ATF, Aviation Biofuel, AVGAS) and application segments (Commercial, Defense, General Aviation) within the South American context isn't provided, we can assume that commercial aviation will likely dominate given the overall market dynamics. Growth within the aviation biofuel segment is expected to be particularly strong in coming years due to growing environmental concerns and governmental incentives to reduce the carbon footprint of the aviation industry. Major players such as Shell, ExxonMobil, and TotalEnergies are well-positioned to capitalize on these trends due to their established infrastructure and distribution networks.

South America Aviation Fuel Market Market Size (In Billion)

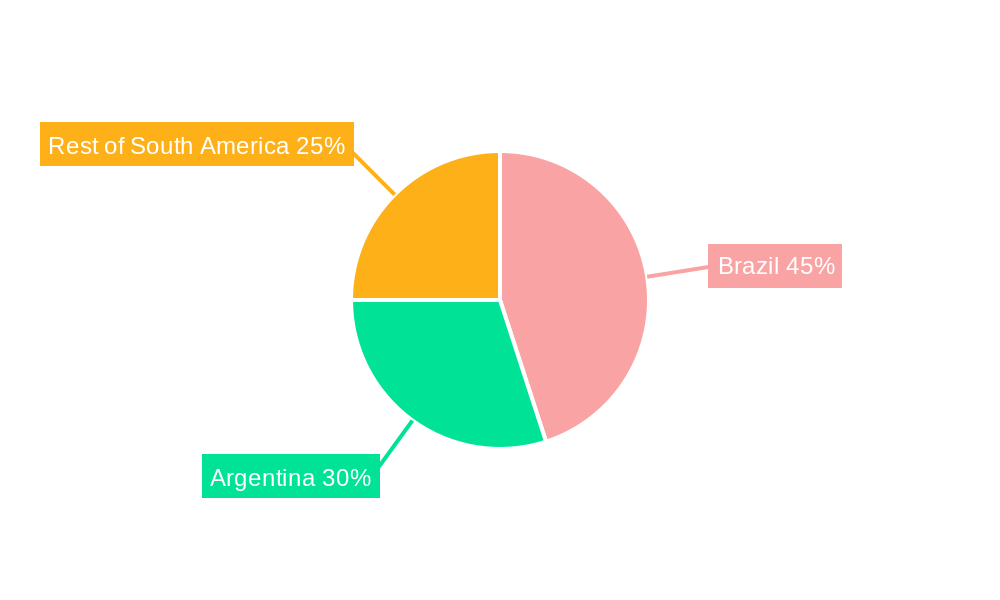

Brazil and Argentina are the leading markets within South America, reflecting their larger economies and higher levels of air travel activity. The remaining South American countries contribute to market growth, but their individual contributions are smaller due to variations in economic development and air travel infrastructure. Growth will continue to be influenced by government policies, infrastructure investments in airports, and fluctuations in international fuel prices. Looking ahead, the successful integration of sustainable aviation fuels and proactive measures to address environmental concerns will likely shape the future trajectory of this dynamic market.

South America Aviation Fuel Market Company Market Share

South America Aviation Fuel Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South America Aviation Fuel Market, covering the period 2019-2033. It delves into market dynamics, growth trends, key players, and future opportunities, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by fuel type (Air Turbine Fuel (ATF), Aviation Biofuel, AVGAS) and application (Commercial, Defense, General Aviation), providing a granular understanding of market size and growth across various segments. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033.

South America Aviation Fuel Market Dynamics & Structure

This section analyzes the South American aviation fuel market's competitive landscape, technological advancements, regulatory environment, and market trends. The market is moderately concentrated, with key players like Shell PLC, Exxon Mobil Corporation, and TotalEnergies SE holding significant market share. However, the emergence of biofuels and smaller, regional players is increasing competition.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players accounting for approximately xx% of the total market share in 2024.

- Technological Innovation: Ongoing research and development in sustainable aviation fuels (SAFs) are driving innovation, pushing for lower-carbon alternatives to traditional ATF. However, high initial investment costs and scalability challenges act as barriers.

- Regulatory Framework: Government regulations concerning emissions and sustainable practices are shaping the market, influencing the adoption of biofuels and incentivizing technological advancements.

- Competitive Product Substitutes: The growing availability of biofuels presents a strong substitute for traditional ATF, particularly as environmental concerns gain prominence.

- End-User Demographics: The increasing air travel demand, driven by both commercial and general aviation segments, contributes significantly to market expansion.

- M&A Trends: The acquisition of Chacraservicios by Bunge and Chevron's Renewable Energy Group in July 2023 exemplifies the strategic consolidation and expansion efforts within the biofuel segment. The number of M&A deals in the historical period (2019-2024) totaled approximately xx, with xx million in total deal value.

South America Aviation Fuel Market Growth Trends & Insights

The South American aviation fuel market witnessed significant growth during the historical period (2019-2024), driven by an increase in air passenger traffic and cargo movements. The market size was valued at xx million in 2024 and is projected to reach xx million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is further fueled by infrastructure development at airports across South America and the expanding middle class driving increased travel demand. Technological disruptions, particularly in SAF production and distribution, will further influence market growth and adoption rates. Consumer preference shifts towards sustainable travel options also create a significant opportunity for biofuels. The market penetration of SAFs is currently low but is expected to grow rapidly due to increasing environmental regulations and corporate sustainability initiatives.

Dominant Regions, Countries, or Segments in South America Aviation Fuel Market

Brazil and Argentina are the dominant markets in South America, accounting for the majority of aviation fuel consumption. The commercial aviation segment holds the largest market share due to the high volume of passenger and cargo flights. Air Turbine Fuel (ATF) remains the dominant fuel type, although the Aviation Biofuel segment is projected to experience significant growth owing to increasing environmental regulations and the availability of sustainable feedstocks.

- Brazil: Strong economic growth and robust air travel infrastructure drive high demand for aviation fuel.

- Argentina: Expanding tourism and increasing domestic air travel contribute to market growth in Argentina.

- Commercial Aviation: This segment dominates due to its considerable scale and passenger volume.

- Air Turbine Fuel (ATF): The largest segment by fuel type due to its widespread use in commercial and defense aviation.

South America Aviation Fuel Market Product Landscape

The aviation fuel market offers a range of products catering to different needs and aircraft types. Innovations focus on improving fuel efficiency, reducing emissions, and enhancing performance. The development and adoption of sustainable aviation fuels (SAFs) represent a key product innovation, offering lower-carbon alternatives to traditional jet fuel. Key performance indicators include energy density, emission levels, and cost-effectiveness. These products are differentiated based on their blend composition, sustainability certifications, and performance characteristics.

Key Drivers, Barriers & Challenges in South America Aviation Fuel Market

Key Drivers: Increased air travel demand, economic growth in certain regions, and government initiatives promoting infrastructure development. Investment in sustainable aviation fuels is also a significant driver due to its positive environmental impact.

Challenges: High initial investment costs for SAF production and infrastructure limit widespread adoption. Volatility in crude oil prices and geopolitical instability also impact supply chains and fuel pricing. Moreover, stringent regulatory compliance can increase operational complexities.

Emerging Opportunities in South America Aviation Fuel Market

The growing demand for sustainable aviation fuels (SAFs) presents a significant opportunity for market expansion. Further development of SAF infrastructure and the exploration of alternative feedstocks are crucial. The untapped potential of the general aviation sector in certain South American countries also represents a growth opportunity.

Growth Accelerators in the South America Aviation Fuel Market Industry

Technological advancements in biofuel production and distribution will significantly accelerate market growth. Strategic partnerships between oil companies and biofuel producers, along with government support for SAF initiatives, will further catalyze market expansion.

Key Players Shaping the South America Aviation Fuel Market Market

- Shell PLC

- Allied Aviation Services Inc

- Exxon Mobil Corporation

- Pan American Energy SL

- TotalEnergies SE

- BP PLC

- Petroleo Brasileiro SA

- Repsol SA

Notable Milestones in South America Aviation Fuel Market Sector

- January 2024: Emirates announces a fifth weekly flight from Dubai to Rio de Janeiro, increasing demand for aviation fuel.

- July 2023: Bunge and Chevron's Renewable Energy Group acquire Chacraservicios, boosting biofuel production.

In-Depth South America Aviation Fuel Market Market Outlook

The South American aviation fuel market is poised for robust growth, driven by rising air travel demand and the increasing adoption of sustainable aviation fuels. Strategic investments in SAF infrastructure, coupled with supportive government policies, will unlock significant market potential. The focus on sustainable practices and operational efficiencies will be key factors shaping the market's future trajectory.

South America Aviation Fuel Market Segmentation

-

1. Fuel Type

- 1.1. Air Turbine Fuel (ATF)

- 1.2. Aviation Biofuel

- 1.3. AVGAS

-

2. Application

- 2.1. Commercial

- 2.2. Defense

- 2.3. General Aviation

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Rest of South America

South America Aviation Fuel Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Aviation Fuel Market Regional Market Share

Geographic Coverage of South America Aviation Fuel Market

South America Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Recovering Number of Air Passengers

- 3.2.2 on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries

- 3.4. Market Trends

- 3.4.1. The Commercial Sector to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Air Turbine Fuel (ATF)

- 5.1.2. Aviation Biofuel

- 5.1.3. AVGAS

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Defense

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Brazil South America Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Air Turbine Fuel (ATF)

- 6.1.2. Aviation Biofuel

- 6.1.3. AVGAS

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Defense

- 6.2.3. General Aviation

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Argentina South America Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Air Turbine Fuel (ATF)

- 7.1.2. Aviation Biofuel

- 7.1.3. AVGAS

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Defense

- 7.2.3. General Aviation

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Colombia South America Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Air Turbine Fuel (ATF)

- 8.1.2. Aviation Biofuel

- 8.1.3. AVGAS

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Defense

- 8.2.3. General Aviation

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Rest of South America South America Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Air Turbine Fuel (ATF)

- 9.1.2. Aviation Biofuel

- 9.1.3. AVGAS

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial

- 9.2.2. Defense

- 9.2.3. General Aviation

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Shell PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Allied Aviation Services Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Exxon Mobil Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Pan American Energy SL

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 TotalEnergies SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BP PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Petroleo Brasileiro SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Repsol SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Shell PLC

List of Figures

- Figure 1: South America Aviation Fuel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Aviation Fuel Market Share (%) by Company 2025

List of Tables

- Table 1: South America Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 2: South America Aviation Fuel Market Volume litres Forecast, by Fuel Type 2020 & 2033

- Table 3: South America Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: South America Aviation Fuel Market Volume litres Forecast, by Application 2020 & 2033

- Table 5: South America Aviation Fuel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South America Aviation Fuel Market Volume litres Forecast, by Geography 2020 & 2033

- Table 7: South America Aviation Fuel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: South America Aviation Fuel Market Volume litres Forecast, by Region 2020 & 2033

- Table 9: South America Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 10: South America Aviation Fuel Market Volume litres Forecast, by Fuel Type 2020 & 2033

- Table 11: South America Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: South America Aviation Fuel Market Volume litres Forecast, by Application 2020 & 2033

- Table 13: South America Aviation Fuel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: South America Aviation Fuel Market Volume litres Forecast, by Geography 2020 & 2033

- Table 15: South America Aviation Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: South America Aviation Fuel Market Volume litres Forecast, by Country 2020 & 2033

- Table 17: South America Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 18: South America Aviation Fuel Market Volume litres Forecast, by Fuel Type 2020 & 2033

- Table 19: South America Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: South America Aviation Fuel Market Volume litres Forecast, by Application 2020 & 2033

- Table 21: South America Aviation Fuel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: South America Aviation Fuel Market Volume litres Forecast, by Geography 2020 & 2033

- Table 23: South America Aviation Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: South America Aviation Fuel Market Volume litres Forecast, by Country 2020 & 2033

- Table 25: South America Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 26: South America Aviation Fuel Market Volume litres Forecast, by Fuel Type 2020 & 2033

- Table 27: South America Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: South America Aviation Fuel Market Volume litres Forecast, by Application 2020 & 2033

- Table 29: South America Aviation Fuel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: South America Aviation Fuel Market Volume litres Forecast, by Geography 2020 & 2033

- Table 31: South America Aviation Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: South America Aviation Fuel Market Volume litres Forecast, by Country 2020 & 2033

- Table 33: South America Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 34: South America Aviation Fuel Market Volume litres Forecast, by Fuel Type 2020 & 2033

- Table 35: South America Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: South America Aviation Fuel Market Volume litres Forecast, by Application 2020 & 2033

- Table 37: South America Aviation Fuel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: South America Aviation Fuel Market Volume litres Forecast, by Geography 2020 & 2033

- Table 39: South America Aviation Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: South America Aviation Fuel Market Volume litres Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Aviation Fuel Market?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the South America Aviation Fuel Market?

Key companies in the market include Shell PLC, Allied Aviation Services Inc, Exxon Mobil Corporation, Pan American Energy SL, TotalEnergies SE, BP PLC, Petroleo Brasileiro SA, Repsol SA.

3. What are the main segments of the South America Aviation Fuel Market?

The market segments include Fuel Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.28 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Recovering Number of Air Passengers. on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population.

6. What are the notable trends driving market growth?

The Commercial Sector to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries.

8. Can you provide examples of recent developments in the market?

January 2024: Emirates has announced the addition of a fifth weekly flight to its Dubai to Rio de Janeiro route, set to commence on December 7, 2024. This supplementary Saturday flight is introduced to bolster the airline's overall capacity to service Rio de Janeiro, catering to the increasing travel demand along this route. Moreover, the integrated service provides passengers the convenience to seamlessly extend their journey to Buenos Aires, the capital of Argentina. This expansion is expected to contribute to the heightened demand for aviation fuels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in litres.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the South America Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence