Key Insights

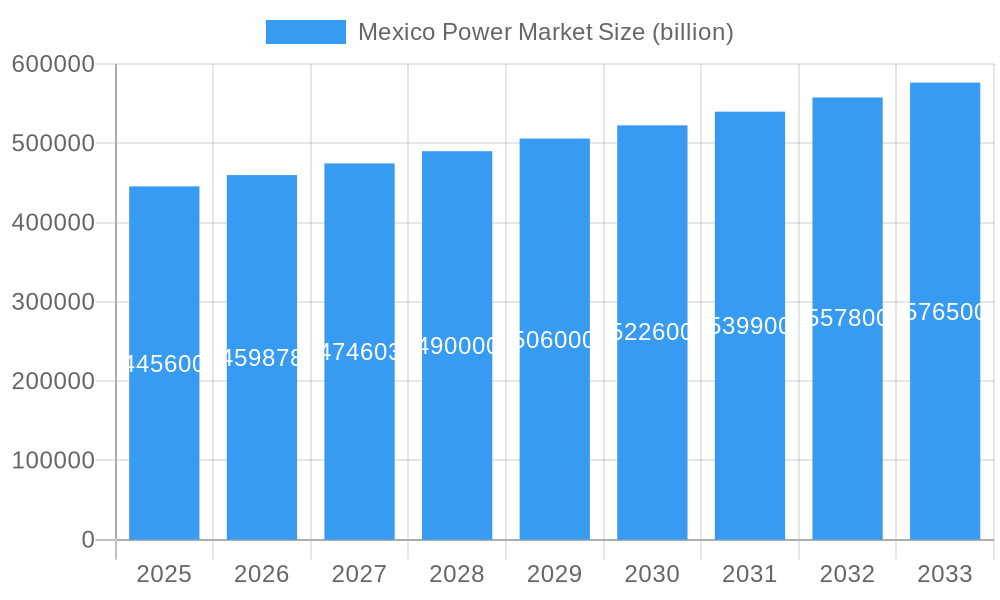

The Mexico power market is poised for robust expansion, projected to reach a substantial market size of USD 445.6 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.26% anticipated through 2033. This growth is primarily fueled by an increasing demand for electricity, driven by industrial development, a growing population, and the nation's commitment to modernizing its energy infrastructure. The "drivers" for this upward trajectory likely include significant investments in renewable energy sources, the ongoing need for grid modernization and expansion to meet demand, and government initiatives aimed at enhancing energy security and sustainability. Power generation, a critical component of this market, is characterized by a diverse mix, with Thermal power holding a significant share, complemented by growing contributions from Hydropower, Nuclear, and increasingly, Non-hydro Renewables such as solar and wind energy.

Mexico Power Market Market Size (In Billion)

The market's evolution is further shaped by key "trends" that include a strong push towards integrating renewable energy into the national grid, advancements in smart grid technologies for improved efficiency and reliability, and a growing focus on energy storage solutions. However, challenges in the form of "restrains" may include regulatory hurdles, the need for substantial capital investment in infrastructure upgrades, and potential price volatility of fossil fuels for thermal power generation. The "segments" within the power market are broadly categorized into Power Generation from various sources (Thermal, Hydropower, Nuclear, Non-hydro Renewables) and Power Transmission and Distribution (T&D). Leading companies such as Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, and Acciona SA are actively participating, alongside local players, in shaping the market landscape through innovation and project development across the Mexico region.

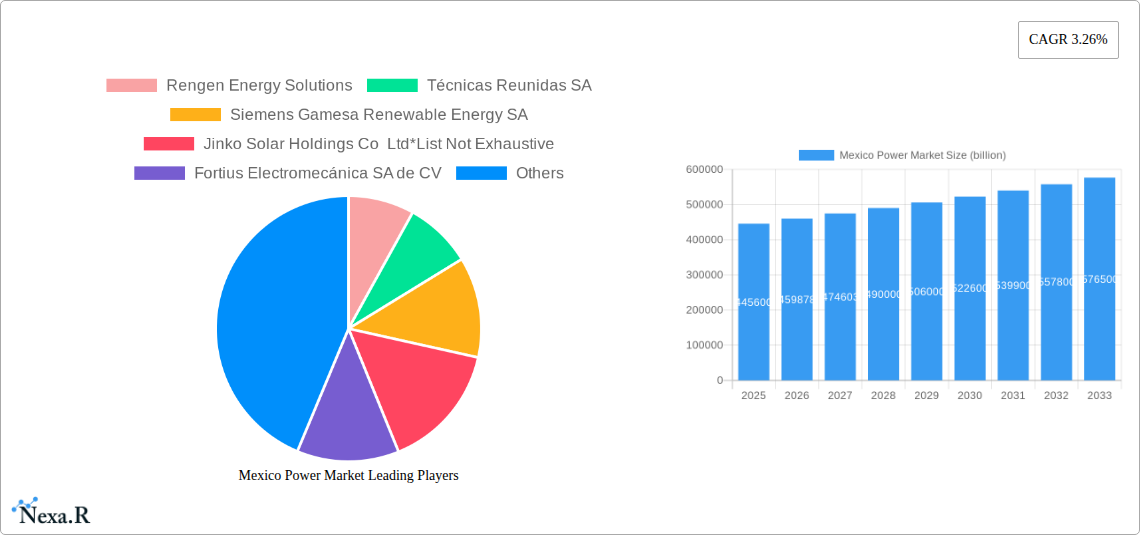

Mexico Power Market Company Market Share

Mexico Power Market: Comprehensive Outlook and Growth Strategies (2019-2033)

**Unlock the potential of Mexico's burgeoning power sector with this definitive report. Covering the period from 2019 to 2033, with a detailed base year analysis of 2025, this report offers an in-depth examination of market dynamics, growth trends, key players, and emerging opportunities within Mexico's electricity generation and transmission infrastructure. Essential for strategists, investors, and industry leaders, this analysis navigates the evolving landscape of *Mexican energy*, *power generation Mexico*, *renewable energy Mexico*, and *transmission and distribution Mexico*. Discover critical insights into the *Mexico power market size*, its parent and child market dynamics, and the factors shaping its future trajectory. This report is your indispensable guide to understanding and capitalizing on the vast opportunities within the **Mexico power industry.

Mexico Power Market Market Dynamics & Structure

The Mexico power market is characterized by a dynamic interplay of regulatory frameworks, technological advancements, and evolving end-user demographics. Market concentration, while historically influenced by the state-owned utility CFE, is gradually diversifying with increasing private sector participation, particularly in renewable energy. Technological innovation is a significant driver, with a growing emphasis on sustainable solutions and grid modernization. Competitive product substitutes are emerging, primarily from advancements in solar and wind technologies offering cost-effective alternatives to traditional thermal power Mexico. End-user demographics are shifting, with industrial and commercial sectors demanding more reliable and cleaner energy sources, while residential consumers are increasingly exploring distributed generation options. Mergers and acquisitions (M&A) trends indicate consolidation and strategic partnerships aimed at expanding market reach and technological capabilities. Barriers to innovation include policy uncertainties and the need for significant infrastructure investment. The market size is projected to reach approximately USD 75 billion by 2025, with a compound annual growth rate (CAGR) of xx% during the forecast period.

- Market Concentration: Shifting from a dominant state-owned utility to a more diversified landscape with private players in Mexico renewable energy projects.

- Technological Innovation Drivers: Advancements in solar PV efficiency, wind turbine technology, and smart grid solutions are propelling adoption.

- Regulatory Frameworks: Evolving policies influence investment decisions and market access for various energy sources.

- Competitive Product Substitutes: Solar and wind power are increasingly competitive alternatives to Mexican thermal power plants.

- End-User Demographics: Growing demand for clean energy from industrial, commercial, and residential sectors.

- M&A Trends: Strategic alliances and acquisitions to enhance market presence and technological expertise.

Mexico Power Market Growth Trends & Insights

The Mexico power market is poised for substantial growth, driven by a confluence of factors including increased energy demand, government initiatives promoting renewable energy, and ongoing infrastructure development. The market size is expected to witness a significant expansion from approximately USD 68 billion in 2019 to an estimated USD 75 billion in 2025. This growth trajectory is further projected to continue through the forecast period, exhibiting a robust CAGR of xx% between 2025 and 2033. Adoption rates for non-hydro renewables, particularly solar and wind power, are accelerating due to declining technology costs and supportive policies. Technological disruptions are evident with the integration of advanced grid management systems and the increasing penetration of distributed energy resources. Consumer behavior is shifting towards a preference for cleaner and more sustainable energy sources, influenced by environmental awareness and the pursuit of cost savings. The Mexico electricity market is witnessing a transformation, moving towards a more diversified and resilient energy mix. Market penetration of renewable energy sources is expected to rise significantly, contributing to a greener energy future for the nation. The overall market value is projected to reach an estimated USD 85 billion by the end of the forecast period in 2033.

Dominant Regions, Countries, or Segments in Mexico Power Market

The Mexico power market's growth is predominantly fueled by the Non-hydro Renewables segment, which has emerged as a leading driver of market expansion. This dominance is attributable to a combination of favorable government policies, increasing investor confidence, and the inherent advantages of solar and wind energy in many regions of Mexico. Economic policies that incentivize renewable energy deployment, coupled with the vast solar and wind potential across the country, are key contributors to this segment's ascendance. Market share within the non-hydro renewables segment is steadily increasing, projected to constitute a significant portion of the overall Mexican power generation.

Key Drivers:

- Favorable Government Policies: Incentives and targets for renewable energy integration.

- Abundant Natural Resources: High solar irradiance and consistent wind speeds in various regions.

- Declining Technology Costs: Reduced capital expenditure for solar panels and wind turbines.

- International Commitments: Mexico's participation in global climate agreements.

- Corporate Power Purchase Agreements (PPAs): Growing demand from the private sector for clean energy.

Dominance Factors:

- Market Share Growth: Non-hydro renewables are capturing an increasing share of the total installed capacity.

- Investment Inflows: Significant foreign and domestic investments are directed towards renewable energy projects.

- Project Pipeline: A robust pipeline of solar and wind projects under development and planned.

- Cost Competitiveness: Increasingly competitive with conventional power sources.

- Grid Integration: Ongoing efforts to enhance grid infrastructure to accommodate higher shares of intermittent renewables.

The Power Transmission and Distribution (T&D) segment also plays a crucial role, acting as a critical enabler for the integration of new generation capacity, particularly from non-hydro renewables. Investments in T&D infrastructure are essential to ensure grid stability and reliability as the energy mix diversifies. Regions with high renewable energy potential, such as the northern and central states, are experiencing significant investment in transmission and distribution networks to evacuate power efficiently.

Mexico Power Market Product Landscape

The Mexico power market product landscape is characterized by a continuous evolution of generation technologies and energy management solutions. Innovations in solar photovoltaic (PV) modules, including higher efficiency panels and bifacial designs, are enhancing energy yield. Wind turbine technology is advancing with larger rotor diameters and improved aerodynamic designs, leading to increased power output even in lower wind speed conditions. Smart grid technologies, such as advanced metering infrastructure (AMI) and grid automation systems, are crucial for managing the intermittent nature of renewables and improving overall grid efficiency. The integration of energy storage solutions, particularly battery energy storage systems (BESS), is becoming increasingly important for grid stability and reliability. These technological advancements offer unique selling propositions by reducing operational costs, enhancing grid resilience, and enabling a more sustainable energy future for Mexico.

Key Drivers, Barriers & Challenges in Mexico Power Market

Key Drivers:

- Government Mandates and Renewable Energy Targets: Policies supporting the growth of solar power Mexico and wind power Mexico.

- Declining Cost of Renewable Technologies: Making solar and wind energy increasingly competitive with traditional sources.

- Growing Demand for Electricity: Driven by industrial expansion and population growth.

- Energy Independence and Security: Reducing reliance on imported fossil fuels.

- Environmental Concerns and Climate Change Commitments: Pushing for cleaner energy alternatives.

Barriers & Challenges:

- Regulatory Uncertainty and Policy Changes: Affecting long-term investment decisions.

- Grid Infrastructure Limitations: The need for significant upgrades to accommodate increased renewable energy.

- Financing Challenges: Securing adequate capital for large-scale Mexico power projects.

- Supply Chain Disruptions: Potential for delays in equipment delivery and increased costs.

- Intermittency of Renewable Sources: Requiring robust grid management and storage solutions.

Emerging Opportunities in Mexico Power Market

Emerging opportunities in the Mexico power market lie in the expansion of distributed generation, particularly rooftop solar for residential and commercial consumers, driven by decreasing costs and increasing environmental awareness. The development of energy storage solutions, including utility-scale battery systems, presents a significant opportunity to enhance grid stability and integrate higher percentages of renewables. Furthermore, investments in modernizing and expanding the Mexico power transmission and distribution network are crucial, creating opportunities for infrastructure development and technology deployment. The growing demand for electric vehicles (EVs) also signals an opportunity for developing charging infrastructure and smart grid solutions to support increased electricity demand.

Growth Accelerators in the Mexico Power Market Industry

Several catalysts are accelerating long-term growth within the Mexico power market industry. Technological breakthroughs in energy storage, such as more efficient and cost-effective battery chemistries, will be pivotal. Strategic partnerships between international technology providers and local Mexican companies will foster knowledge transfer and accelerate the adoption of advanced solutions. Market expansion strategies focused on underserved regions and the development of microgrids in remote areas will unlock new growth potential. Furthermore, the increasing commitment to decarbonization targets at both national and sub-national levels will continue to drive investment in green energy Mexico.

Key Players Shaping the Mexico Power Market Market

- Rengen Energy Solutions

- Técnicas Reunidas SA

- Siemens Gamesa Renewable Energy SA

- Jinko Solar Holdings Co Ltd

- Fortius Electromecánica SA de CV

- Arendal S de RL de CV

- SENER Engineering Group

- Vestas Wind Systems AS

- Acciona SA

Notable Milestones in Mexico Power Market Sector

- July 2021: Mexico confirms the development plan for the Sonora solar project to supply cheap electricity to the Baja California Peninsula, co-owned by CFE and the state of Sonora, with a USD 100 million outlay. Commissioning expected by 2023.

- 2021: The Veracruz II-Tamarindo II double-circuit line, a 36 km transmission project in Veracruz involving upgradation, is added to the country's key planned power projects list. Expected to enter service by 2025.

- March 2022: The Government of Mexico City announces the second phase call for the Central Market solar project, estimated to be the largest urban solar installation (36,000 modules generating 25GWh annually). Contract signing was anticipated in May 2022.

In-Depth Mexico Power Market Market Outlook

The Mexico power market presents a robust outlook for continued growth, propelled by an increasing embrace of renewable energy sources and strategic investments in grid modernization. The commitment to decarbonization and energy security will act as significant growth accelerators. Opportunities abound in distributed generation, energy storage solutions, and the expansion of transmission and distribution infrastructure. The market's future potential is intrinsically linked to favorable policy environments, sustained technological innovation, and the ability to attract significant capital investment. Strategic collaborations and market expansion into new geographical areas will be crucial for maximizing future growth and solidifying Mexico's position as a key player in the global energy transition.

Mexico Power Market Segmentation

-

1. Power Generation from Sources

- 1.1. Thermal

- 1.2. Hydropower

- 1.3. Nuclear

- 1.4. Non-hydro Renewables

- 2. Power Transmission and Distribution (T&D)

Mexico Power Market Segmentation By Geography

- 1. Mexico

Mexico Power Market Regional Market Share

Geographic Coverage of Mexico Power Market

Mexico Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Cleaner Energy4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Underdeveloped Power Grid

- 3.4. Market Trends

- 3.4.1. Thermal Power Generation Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Generation from Sources

- 5.1.1. Thermal

- 5.1.2. Hydropower

- 5.1.3. Nuclear

- 5.1.4. Non-hydro Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Power Generation from Sources

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rengen Energy Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Técnicas Reunidas SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Gamesa Renewable Energy SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jinko Solar Holdings Co Ltd*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fortius Electromecánica SA de CV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arendal S de RL de CV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SENER Engineering Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vestas Wind Systems AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Acciona SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Rengen Energy Solutions

List of Figures

- Figure 1: Mexico Power Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Power Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Power Market Revenue billion Forecast, by Power Generation from Sources 2020 & 2033

- Table 2: Mexico Power Market Revenue billion Forecast, by Power Transmission and Distribution (T&D) 2020 & 2033

- Table 3: Mexico Power Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Power Market Revenue billion Forecast, by Power Generation from Sources 2020 & 2033

- Table 5: Mexico Power Market Revenue billion Forecast, by Power Transmission and Distribution (T&D) 2020 & 2033

- Table 6: Mexico Power Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Power Market?

The projected CAGR is approximately 3.26%.

2. Which companies are prominent players in the Mexico Power Market?

Key companies in the market include Rengen Energy Solutions, Técnicas Reunidas SA, Siemens Gamesa Renewable Energy SA, Jinko Solar Holdings Co Ltd*List Not Exhaustive, Fortius Electromecánica SA de CV, Arendal S de RL de CV, SENER Engineering Group, Vestas Wind Systems AS, Acciona SA.

3. What are the main segments of the Mexico Power Market?

The market segments include Power Generation from Sources, Power Transmission and Distribution (T&D).

4. Can you provide details about the market size?

The market size is estimated to be USD 445.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Cleaner Energy4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Thermal Power Generation Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Underdeveloped Power Grid.

8. Can you provide examples of recent developments in the market?

In July 2021, Mexico confirmed its plan to develop the Sonora solar project to provide cheap electricity to the Baja California Peninsula. The project will be co-owned by CFE, the state-owned utility, and the state of Sonora will include an outlay of USD 100 million. The project is expected to be commissioned by 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Power Market?

To stay informed about further developments, trends, and reports in the Mexico Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence