Key Insights

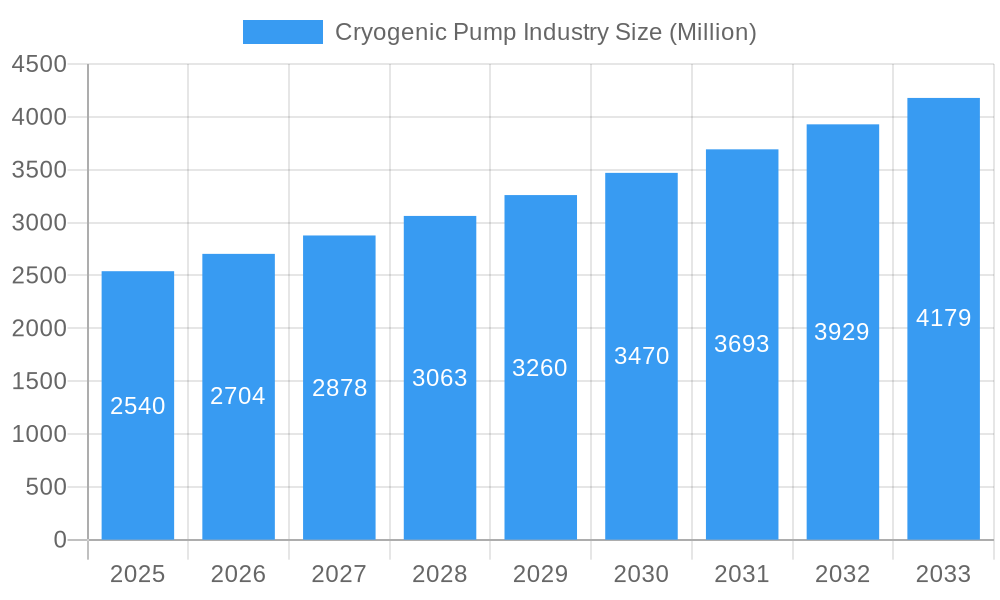

The global Cryogenic Pump market is poised for significant expansion, projected to reach $2.54 billion in 2025. This robust growth is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 6.4% over the forecast period of 2025-2033. A primary driver for this upward trajectory is the increasing demand for liquefied gases, particularly nitrogen, oxygen, and argon, across a multitude of industries. The power generation sector, with its growing reliance on advanced cooling systems and energy storage solutions, is a major consumer of cryogenic pumps. Similarly, the chemicals industry leverages these pumps for efficient liquefaction and transportation of various gases essential for chemical processes. The healthcare sector's need for cryopreservation and medical gas supply further contributes to this demand. Emerging applications in areas like space exploration and advanced manufacturing also present promising growth avenues for cryogenic pump manufacturers.

Cryogenic Pump Industry Market Size (In Billion)

Despite the positive outlook, certain factors could temper the market's expansion. High initial investment costs associated with cryogenic pump technology and the complex infrastructure required for handling liquefied gases represent significant restraints. Furthermore, the availability of alternative technologies and the stringent safety regulations surrounding cryogenic applications can pose challenges. However, ongoing technological advancements, including improvements in pump efficiency, reliability, and cost-effectiveness, are expected to mitigate these restraints. The market is segmented by pump type, with both Dynamic Pumps and Positive Displacement Pumps playing crucial roles, catering to different application needs. The diverse range of gases handled, from common industrial gases to specialized LNG, and the broad spectrum of end-user industries underscore the market's versatility and resilience.

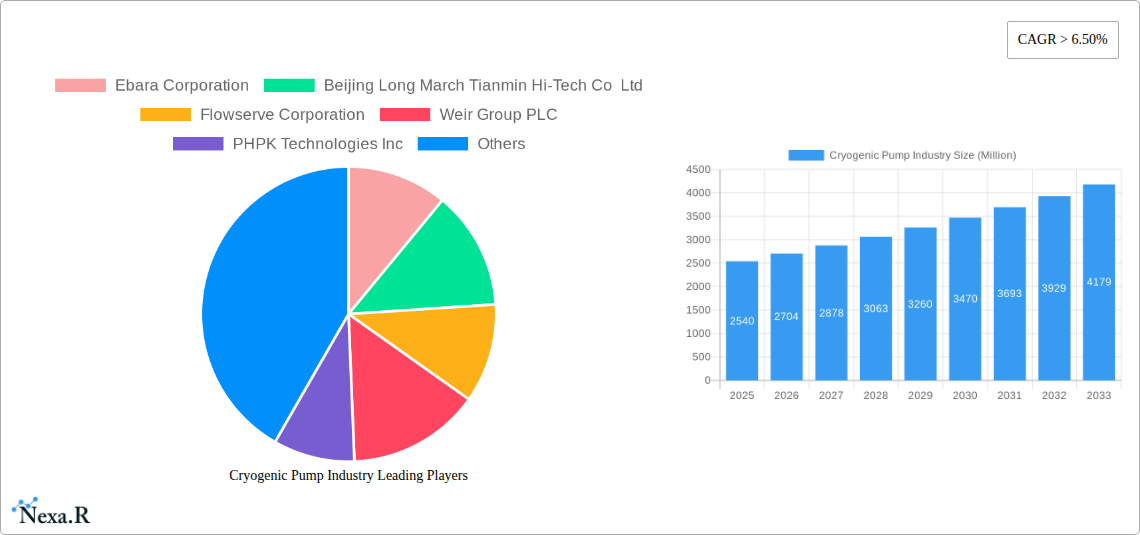

Cryogenic Pump Industry Company Market Share

Unlocking Global Markets: The Definitive Cryogenic Pump Industry Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Cryogenic Pump Industry, forecasting market evolution from $15.8 billion in 2025 to an anticipated $25.2 billion by 2033, exhibiting a robust CAGR of 5.9%. Spanning the Study Period: 2019–2033, with a Base Year: 2025 and Forecast Period: 2025–2033, this research delves into critical market dynamics, growth trends, regional dominance, product landscape, key players, and emerging opportunities. We meticulously analyze the Parent Market (Industrial Pumps) and Child Markets (specific cryogenic pump applications) to offer unparalleled insights for stakeholders, including manufacturers, suppliers, investors, and end-users.

Cryogenic Pump Industry Market Dynamics & Structure

The global cryogenic pump market is characterized by a moderately consolidated structure, with leading players like Ebara Corporation, Flowserve Corporation, and Sumitomo Heavy Industries Ltd. holding significant market shares. Technological innovation remains a primary driver, fueled by increasing demand for energy efficiency and specialized applications in sectors such as LNG handling and healthcare. Robust regulatory frameworks governing safety and environmental standards also influence product development and market entry. Competitive product substitutes, while present, often lack the specific performance capabilities required for cryogenic temperatures. End-user demographics are shifting, with a growing emphasis on reliable and high-performance solutions for liquefied gases. Mergers and acquisitions (M&A) activity, though not consistently high, plays a crucial role in market consolidation and geographical expansion.

- Market Concentration: Moderately consolidated with a focus on specialized manufacturers.

- Technological Innovation Drivers: Energy efficiency, miniaturization, and advanced materials for extreme temperature resistance.

- Regulatory Frameworks: Stringent safety and environmental regulations, particularly for LNG and industrial gas applications.

- Competitive Product Substitutes: Limited direct substitutes for high-performance cryogenic pumping applications.

- End-User Demographics: Growing demand from LNG infrastructure, advanced manufacturing, and biomedical research.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios and market reach.

Cryogenic Pump Industry Growth Trends & Insights

The cryogenic pump industry is poised for substantial growth, driven by the escalating global demand for liquefied natural gas (LNG), advancements in scientific research, and the expanding healthcare sector. The market is projected to grow from $15.8 billion in 2025 to $25.2 billion by 2033, representing a compound annual growth rate (CAGR) of 5.9%. This expansion is underpinned by increasing investments in LNG liquefaction terminals and regasification plants worldwide, creating a significant demand for reliable cryogenic pumps for storage and transportation. Furthermore, the burgeoning field of superconductivity and its applications in power transmission and high-energy physics necessitate specialized cryogenic pumping solutions. The healthcare industry's reliance on cryopreservation for biological samples and the development of advanced medical imaging techniques also contribute to market penetration.

Technological disruptions are playing a pivotal role, with manufacturers focusing on developing more energy-efficient, compact, and durable cryogenic pumps. Innovations in materials science have led to the creation of pumps capable of withstanding extreme temperature fluctuations with enhanced reliability. Consumer behavior shifts are evident in the increasing preference for integrated pumping systems that offer greater automation and remote monitoring capabilities. The adoption rates for advanced cryogenic pumping technologies are steadily rising, particularly in regions with developing LNG infrastructure and significant industrial gas consumption. Market penetration is also influenced by the decreasing cost of advanced materials and manufacturing processes, making these sophisticated pumps more accessible across various applications.

The historical performance from 2019 to 2024 indicated a steady upward trajectory, with market participants navigating challenges related to supply chain disruptions and raw material price volatility. However, the inherent demand from core industries and ongoing technological advancements have ensured sustained growth. The Estimated Year: 2025 sees the market at $15.8 billion, setting the stage for accelerated growth through the Forecast Period: 2025–2033. Key metrics such as market size evolution, adoption rates of new technologies, and the impact of digitalization on operational efficiency are critical indicators of the sector's robust future. The increasing complexity of industrial processes and the need for precise temperature control in specialized applications will continue to drive the demand for advanced cryogenic pumping solutions, solidifying the industry's growth trajectory.

Dominant Regions, Countries, or Segments in Cryogenic Pump Industry

The Cryogenic Pump Industry is experiencing robust growth across various segments, with distinct regional strengths driving its global expansion. Among the Types, Dynamic Pumps, including centrifugal and axial variants, are currently dominating the market, accounting for an estimated 65% market share in 2025. Their efficiency and suitability for high-volume fluid transfer, particularly in LNG applications, position them as the leading choice. The Positive Displacement Pump segment, encompassing screw and piston designs, is also experiencing significant growth, driven by its precision and ability to handle viscous fluids, particularly in specialized chemical and scientific applications.

In terms of Gas handled, LNG (Liquefied Natural Gas) continues to be the most significant driver of demand. The global push for cleaner energy sources and the expansion of LNG infrastructure worldwide contribute to an estimated 45% market share for LNG-related cryogenic pumping solutions in 2025. Nitrogen and Oxygen represent the next major segments, driven by their widespread use in industrial processes, healthcare, and advanced manufacturing, collectively holding an estimated 35% market share. Argon and Other Gases constitute the remaining share, with niche but growing applications in specialized fields.

The End User segment of Power Generation is a primary contributor to cryogenic pump demand, particularly from the burgeoning LNG sector for fueling power plants. This segment accounts for an estimated 30% market share in 2025. The Chemicals industry, with its diverse applications requiring precise temperature control for reactions and storage, follows closely, representing an estimated 25% market share. The Healthcare sector, driven by cryopreservation and medical research, is a rapidly growing segment, expected to capture an estimated 15% market share.

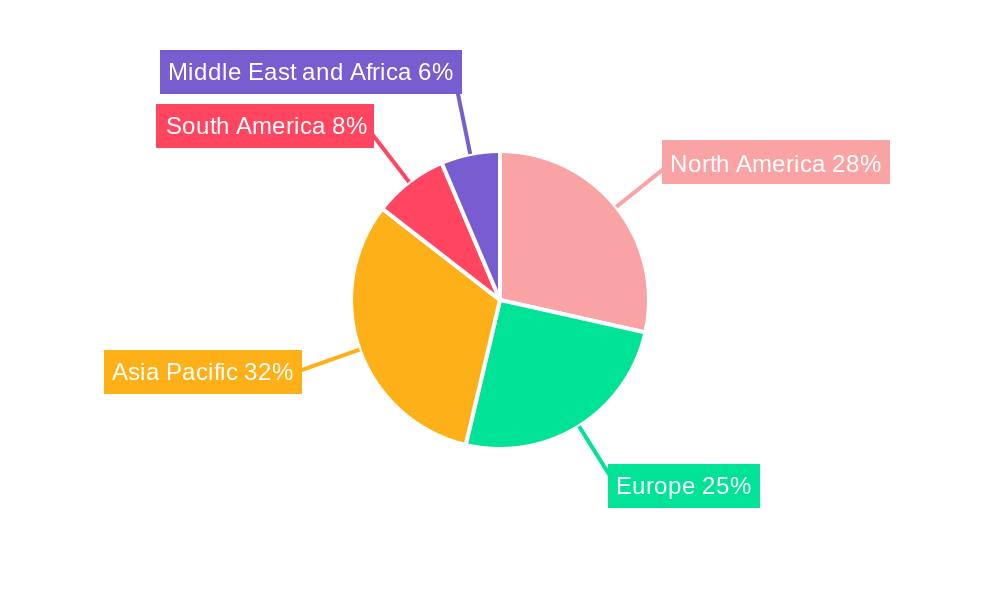

Geographically, Asia-Pacific is emerging as the dominant region, driven by rapid industrialization, significant investments in LNG infrastructure in countries like China and India, and expanding manufacturing capabilities. North America, particularly the United States with its extensive shale gas reserves and LNG export capacity, remains a stronghold. Europe's strong industrial base and commitment to cleaner energy further solidify its position. Key drivers for regional dominance include supportive government policies, substantial infrastructure development projects, and a growing emphasis on technological adoption. The market share within these regions is influenced by the presence of major end-users and the strategic investments made by leading cryogenic pump manufacturers.

Cryogenic Pump Industry Product Landscape

The cryogenic pump product landscape is defined by continuous innovation focused on enhanced efficiency, reliability, and miniaturization for extreme temperature applications. Key product developments include advanced materials such as specialized alloys and composites that offer superior thermal insulation and resistance to cryogenic embrittlement. Innovations in impeller and housing designs for dynamic pumps optimize fluid dynamics, leading to reduced energy consumption and improved pumping performance for gases like nitrogen, oxygen, and LNG. Positive displacement pumps are seeing advancements in sealing technologies and precision manufacturing to ensure leak-free operation and accurate flow control in sensitive applications within the healthcare and research sectors. Unique selling propositions revolve around extended Mean Time Between Failures (MTBF), modular designs for easier maintenance, and integrated intelligent monitoring systems for predictive diagnostics. Technological advancements are enabling pumps to operate efficiently across a wider range of pressures and flow rates, catering to diverse industrial and scientific needs.

Key Drivers, Barriers & Challenges in Cryogenic Pump Industry

Key Drivers:

- Global Energy Demand: The increasing reliance on Liquefied Natural Gas (LNG) as a cleaner energy alternative is a paramount driver, necessitating robust cryogenic pumping infrastructure for liquefaction, storage, and transportation.

- Technological Advancements: Continuous improvements in materials science, pump design, and manufacturing techniques are enhancing efficiency, reliability, and reducing the operational costs of cryogenic pumps.

- Growth in Industrial Gases: Expanding applications for industrial gases like nitrogen and oxygen in sectors such as manufacturing, healthcare, and electronics fuel demand.

- R&D and Scientific Exploration: Advancements in research requiring super-cooled environments, such as in particle accelerators and space exploration, create niche but critical demand.

Barriers & Challenges:

- High Initial Investment: The sophisticated engineering and specialized materials required for cryogenic pumps result in high upfront costs, potentially limiting adoption for smaller enterprises.

- Supply Chain Volatility: Reliance on specialized raw materials and complex manufacturing processes can lead to supply chain disruptions and price fluctuations, impacting production timelines and costs.

- Technical Expertise Requirement: The operation and maintenance of cryogenic pumps demand a high level of technical expertise, which can be a barrier to widespread adoption and efficient utilization.

- Stringent Safety and Regulatory Standards: Compliance with rigorous safety and environmental regulations for handling extremely cold and potentially hazardous substances adds complexity and cost to product development and deployment.

- Competition from Alternatives: While specialized, alternative fluid transfer methods or less efficient pumping technologies can pose a competitive threat in certain less demanding applications.

Emerging Opportunities in Cryogenic Pump Industry

Emerging opportunities in the cryogenic pump industry lie in the burgeoning green hydrogen economy, where cryogenic liquefaction is a key for efficient storage and transportation of hydrogen fuel. The increasing adoption of superconducting technologies in power grids and advanced scientific instruments, such as MRI machines and particle accelerators, presents a growing demand for specialized cryogenic pumps. Furthermore, the expansion of space exploration initiatives and the commercialization of space tourism will require robust and reliable cryogenic pumping systems for propellants. The food and beverage industry's growing interest in cryogenics for preservation and processing also offers untapped potential. Advancements in IoT and AI integration for predictive maintenance and remote monitoring of cryogenic pump systems represent a significant opportunity to enhance operational efficiency and customer service.

Growth Accelerators in the Cryogenic Pump Industry Industry

Several key catalysts are accelerating growth in the cryogenic pump industry. The accelerating global transition towards cleaner energy sources, with LNG at the forefront, is a primary growth accelerator, driving massive investments in liquefaction plants and associated infrastructure. Technological breakthroughs in materials science, leading to more durable, efficient, and cost-effective components, are further propelling market expansion. Strategic partnerships between pump manufacturers and end-users, focusing on developing tailored solutions for specific applications, are crucial for market penetration. The increasing demand for cryogenic freezing and preservation technologies in the pharmaceutical and biotechnology sectors, especially for vaccines and cell therapies, represents a significant growth avenue. Furthermore, government initiatives promoting the development of hydrogen energy infrastructure are creating substantial long-term demand for cryogenic pumps for hydrogen liquefaction and distribution.

Key Players Shaping the Cryogenic Pump Industry Market

- Ebara Corporation

- Beijing Long March Tianmin Hi-Tech Co Ltd

- Flowserve Corporation

- Weir Group PLC

- PHPK Technologies Inc

- Fives Group

- Nikkiso Co Ltd

- KSB SE & Co KGaA

- Cryostar SAS

- Sumitomo Heavy Industries Ltd

Notable Milestones in Cryogenic Pump Industry Sector

- 2019: Launch of advanced, energy-efficient centrifugal cryogenic pumps by Ebara Corporation for large-scale LNG applications.

- 2020: Flowserve Corporation expands its cryogenic pump portfolio with enhanced sealing technologies for increased reliability in harsh environments.

- 2021: Nikkiso Co Ltd introduces a new line of compact, high-performance positive displacement cryogenic pumps for specialized industrial gas applications.

- 2022: Sumitomo Heavy Industries Ltd announces significant advancements in cryogenic pump materials, enhancing operational lifespan and reducing maintenance requirements.

- 2023: Cryostar SAS secures a major contract for supplying cryogenic pumps to a new LNG terminal development in Europe.

- 2024 (Ongoing): Increased focus on developing cryogenic pumps for green hydrogen liquefaction and transportation from key industry players.

In-Depth Cryogenic Pump Industry Market Outlook

The outlook for the cryogenic pump industry remains exceptionally bright, driven by the dual forces of global energy transition and technological innovation. The anticipated growth accelerators—namely the expanding LNG market, the nascent but rapidly growing green hydrogen sector, and the continuous evolution of superconducting technologies—are set to create sustained demand. Strategic partnerships and the development of specialized solutions for emerging applications, such as advanced medical cryopreservation and space exploration, will further diversify revenue streams. As manufacturers continue to invest in R&D, leading to more efficient, compact, and intelligent pumping systems, market penetration will deepen across existing and new end-user segments. The industry is well-positioned for significant expansion, with opportunities for both established players and new entrants to capitalize on the evolving global industrial landscape.

Cryogenic Pump Industry Segmentation

-

1. Type

- 1.1. Dynamic Pump

- 1.2. Positive Displacement Pump

-

2. Gas

- 2.1. Nitrogen

- 2.2. Oxygen

- 2.3. Argon

- 2.4. LNG

- 2.5. Other Gases

-

3. End User

- 3.1. Power Generation

- 3.2. Chemicals

- 3.3. Healthcare

- 3.4. Other End Users

Cryogenic Pump Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Cryogenic Pump Industry Regional Market Share

Geographic Coverage of Cryogenic Pump Industry

Cryogenic Pump Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Demand for Increaing Refinening Capacity4.; Increasing Investment in Downstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuating Price of Crude Oil May Impede the Development of the Downstream Sector

- 3.4. Market Trends

- 3.4.1. Positive Displacement Cryogenic Pump Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cryogenic Pump Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dynamic Pump

- 5.1.2. Positive Displacement Pump

- 5.2. Market Analysis, Insights and Forecast - by Gas

- 5.2.1. Nitrogen

- 5.2.2. Oxygen

- 5.2.3. Argon

- 5.2.4. LNG

- 5.2.5. Other Gases

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Power Generation

- 5.3.2. Chemicals

- 5.3.3. Healthcare

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cryogenic Pump Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Dynamic Pump

- 6.1.2. Positive Displacement Pump

- 6.2. Market Analysis, Insights and Forecast - by Gas

- 6.2.1. Nitrogen

- 6.2.2. Oxygen

- 6.2.3. Argon

- 6.2.4. LNG

- 6.2.5. Other Gases

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Power Generation

- 6.3.2. Chemicals

- 6.3.3. Healthcare

- 6.3.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Cryogenic Pump Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Dynamic Pump

- 7.1.2. Positive Displacement Pump

- 7.2. Market Analysis, Insights and Forecast - by Gas

- 7.2.1. Nitrogen

- 7.2.2. Oxygen

- 7.2.3. Argon

- 7.2.4. LNG

- 7.2.5. Other Gases

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Power Generation

- 7.3.2. Chemicals

- 7.3.3. Healthcare

- 7.3.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Cryogenic Pump Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Dynamic Pump

- 8.1.2. Positive Displacement Pump

- 8.2. Market Analysis, Insights and Forecast - by Gas

- 8.2.1. Nitrogen

- 8.2.2. Oxygen

- 8.2.3. Argon

- 8.2.4. LNG

- 8.2.5. Other Gases

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Power Generation

- 8.3.2. Chemicals

- 8.3.3. Healthcare

- 8.3.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Cryogenic Pump Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Dynamic Pump

- 9.1.2. Positive Displacement Pump

- 9.2. Market Analysis, Insights and Forecast - by Gas

- 9.2.1. Nitrogen

- 9.2.2. Oxygen

- 9.2.3. Argon

- 9.2.4. LNG

- 9.2.5. Other Gases

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Power Generation

- 9.3.2. Chemicals

- 9.3.3. Healthcare

- 9.3.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Cryogenic Pump Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Dynamic Pump

- 10.1.2. Positive Displacement Pump

- 10.2. Market Analysis, Insights and Forecast - by Gas

- 10.2.1. Nitrogen

- 10.2.2. Oxygen

- 10.2.3. Argon

- 10.2.4. LNG

- 10.2.5. Other Gases

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Power Generation

- 10.3.2. Chemicals

- 10.3.3. Healthcare

- 10.3.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ebara Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Beijing Long March Tianmin Hi-Tech Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Flowserve Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Weir Group PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PHPK Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fives Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nikkiso Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KSB SE & Co KGaA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cryostar SAS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sumitomo Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ebara Corporation

List of Figures

- Figure 1: Global Cryogenic Pump Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Cryogenic Pump Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cryogenic Pump Industry Revenue (undefined), by Type 2025 & 2033

- Figure 4: North America Cryogenic Pump Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Cryogenic Pump Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Cryogenic Pump Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Cryogenic Pump Industry Revenue (undefined), by Gas 2025 & 2033

- Figure 8: North America Cryogenic Pump Industry Volume (K Unit), by Gas 2025 & 2033

- Figure 9: North America Cryogenic Pump Industry Revenue Share (%), by Gas 2025 & 2033

- Figure 10: North America Cryogenic Pump Industry Volume Share (%), by Gas 2025 & 2033

- Figure 11: North America Cryogenic Pump Industry Revenue (undefined), by End User 2025 & 2033

- Figure 12: North America Cryogenic Pump Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Cryogenic Pump Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Cryogenic Pump Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Cryogenic Pump Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Cryogenic Pump Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Cryogenic Pump Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Cryogenic Pump Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Cryogenic Pump Industry Revenue (undefined), by Type 2025 & 2033

- Figure 20: Europe Cryogenic Pump Industry Volume (K Unit), by Type 2025 & 2033

- Figure 21: Europe Cryogenic Pump Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Cryogenic Pump Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Cryogenic Pump Industry Revenue (undefined), by Gas 2025 & 2033

- Figure 24: Europe Cryogenic Pump Industry Volume (K Unit), by Gas 2025 & 2033

- Figure 25: Europe Cryogenic Pump Industry Revenue Share (%), by Gas 2025 & 2033

- Figure 26: Europe Cryogenic Pump Industry Volume Share (%), by Gas 2025 & 2033

- Figure 27: Europe Cryogenic Pump Industry Revenue (undefined), by End User 2025 & 2033

- Figure 28: Europe Cryogenic Pump Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Cryogenic Pump Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Cryogenic Pump Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Cryogenic Pump Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Cryogenic Pump Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Cryogenic Pump Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Cryogenic Pump Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Cryogenic Pump Industry Revenue (undefined), by Type 2025 & 2033

- Figure 36: Asia Pacific Cryogenic Pump Industry Volume (K Unit), by Type 2025 & 2033

- Figure 37: Asia Pacific Cryogenic Pump Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Cryogenic Pump Industry Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Cryogenic Pump Industry Revenue (undefined), by Gas 2025 & 2033

- Figure 40: Asia Pacific Cryogenic Pump Industry Volume (K Unit), by Gas 2025 & 2033

- Figure 41: Asia Pacific Cryogenic Pump Industry Revenue Share (%), by Gas 2025 & 2033

- Figure 42: Asia Pacific Cryogenic Pump Industry Volume Share (%), by Gas 2025 & 2033

- Figure 43: Asia Pacific Cryogenic Pump Industry Revenue (undefined), by End User 2025 & 2033

- Figure 44: Asia Pacific Cryogenic Pump Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Cryogenic Pump Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Cryogenic Pump Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Cryogenic Pump Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pacific Cryogenic Pump Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Cryogenic Pump Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Cryogenic Pump Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Cryogenic Pump Industry Revenue (undefined), by Type 2025 & 2033

- Figure 52: South America Cryogenic Pump Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: South America Cryogenic Pump Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: South America Cryogenic Pump Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: South America Cryogenic Pump Industry Revenue (undefined), by Gas 2025 & 2033

- Figure 56: South America Cryogenic Pump Industry Volume (K Unit), by Gas 2025 & 2033

- Figure 57: South America Cryogenic Pump Industry Revenue Share (%), by Gas 2025 & 2033

- Figure 58: South America Cryogenic Pump Industry Volume Share (%), by Gas 2025 & 2033

- Figure 59: South America Cryogenic Pump Industry Revenue (undefined), by End User 2025 & 2033

- Figure 60: South America Cryogenic Pump Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: South America Cryogenic Pump Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: South America Cryogenic Pump Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: South America Cryogenic Pump Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: South America Cryogenic Pump Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: South America Cryogenic Pump Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Cryogenic Pump Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Cryogenic Pump Industry Revenue (undefined), by Type 2025 & 2033

- Figure 68: Middle East and Africa Cryogenic Pump Industry Volume (K Unit), by Type 2025 & 2033

- Figure 69: Middle East and Africa Cryogenic Pump Industry Revenue Share (%), by Type 2025 & 2033

- Figure 70: Middle East and Africa Cryogenic Pump Industry Volume Share (%), by Type 2025 & 2033

- Figure 71: Middle East and Africa Cryogenic Pump Industry Revenue (undefined), by Gas 2025 & 2033

- Figure 72: Middle East and Africa Cryogenic Pump Industry Volume (K Unit), by Gas 2025 & 2033

- Figure 73: Middle East and Africa Cryogenic Pump Industry Revenue Share (%), by Gas 2025 & 2033

- Figure 74: Middle East and Africa Cryogenic Pump Industry Volume Share (%), by Gas 2025 & 2033

- Figure 75: Middle East and Africa Cryogenic Pump Industry Revenue (undefined), by End User 2025 & 2033

- Figure 76: Middle East and Africa Cryogenic Pump Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: Middle East and Africa Cryogenic Pump Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: Middle East and Africa Cryogenic Pump Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: Middle East and Africa Cryogenic Pump Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: Middle East and Africa Cryogenic Pump Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Cryogenic Pump Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Cryogenic Pump Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cryogenic Pump Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Cryogenic Pump Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Cryogenic Pump Industry Revenue undefined Forecast, by Gas 2020 & 2033

- Table 4: Global Cryogenic Pump Industry Volume K Unit Forecast, by Gas 2020 & 2033

- Table 5: Global Cryogenic Pump Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Cryogenic Pump Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Cryogenic Pump Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Cryogenic Pump Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Cryogenic Pump Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Cryogenic Pump Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Cryogenic Pump Industry Revenue undefined Forecast, by Gas 2020 & 2033

- Table 12: Global Cryogenic Pump Industry Volume K Unit Forecast, by Gas 2020 & 2033

- Table 13: Global Cryogenic Pump Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 14: Global Cryogenic Pump Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Cryogenic Pump Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Cryogenic Pump Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Cryogenic Pump Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Cryogenic Pump Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Global Cryogenic Pump Industry Revenue undefined Forecast, by Gas 2020 & 2033

- Table 20: Global Cryogenic Pump Industry Volume K Unit Forecast, by Gas 2020 & 2033

- Table 21: Global Cryogenic Pump Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 22: Global Cryogenic Pump Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Cryogenic Pump Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Cryogenic Pump Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Cryogenic Pump Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Cryogenic Pump Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Cryogenic Pump Industry Revenue undefined Forecast, by Gas 2020 & 2033

- Table 28: Global Cryogenic Pump Industry Volume K Unit Forecast, by Gas 2020 & 2033

- Table 29: Global Cryogenic Pump Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Global Cryogenic Pump Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 31: Global Cryogenic Pump Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global Cryogenic Pump Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Cryogenic Pump Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global Cryogenic Pump Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 35: Global Cryogenic Pump Industry Revenue undefined Forecast, by Gas 2020 & 2033

- Table 36: Global Cryogenic Pump Industry Volume K Unit Forecast, by Gas 2020 & 2033

- Table 37: Global Cryogenic Pump Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 38: Global Cryogenic Pump Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 39: Global Cryogenic Pump Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global Cryogenic Pump Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Cryogenic Pump Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 42: Global Cryogenic Pump Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 43: Global Cryogenic Pump Industry Revenue undefined Forecast, by Gas 2020 & 2033

- Table 44: Global Cryogenic Pump Industry Volume K Unit Forecast, by Gas 2020 & 2033

- Table 45: Global Cryogenic Pump Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 46: Global Cryogenic Pump Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 47: Global Cryogenic Pump Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Global Cryogenic Pump Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cryogenic Pump Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Cryogenic Pump Industry?

Key companies in the market include Ebara Corporation, Beijing Long March Tianmin Hi-Tech Co Ltd, Flowserve Corporation, Weir Group PLC, PHPK Technologies Inc, Fives Group, Nikkiso Co Ltd, KSB SE & Co KGaA, Cryostar SAS, Sumitomo Heavy Industries Ltd.

3. What are the main segments of the Cryogenic Pump Industry?

The market segments include Type, Gas, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Demand for Increaing Refinening Capacity4.; Increasing Investment in Downstream Sector.

6. What are the notable trends driving market growth?

Positive Displacement Cryogenic Pump Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Fluctuating Price of Crude Oil May Impede the Development of the Downstream Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cryogenic Pump Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cryogenic Pump Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cryogenic Pump Industry?

To stay informed about further developments, trends, and reports in the Cryogenic Pump Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence