Key Insights

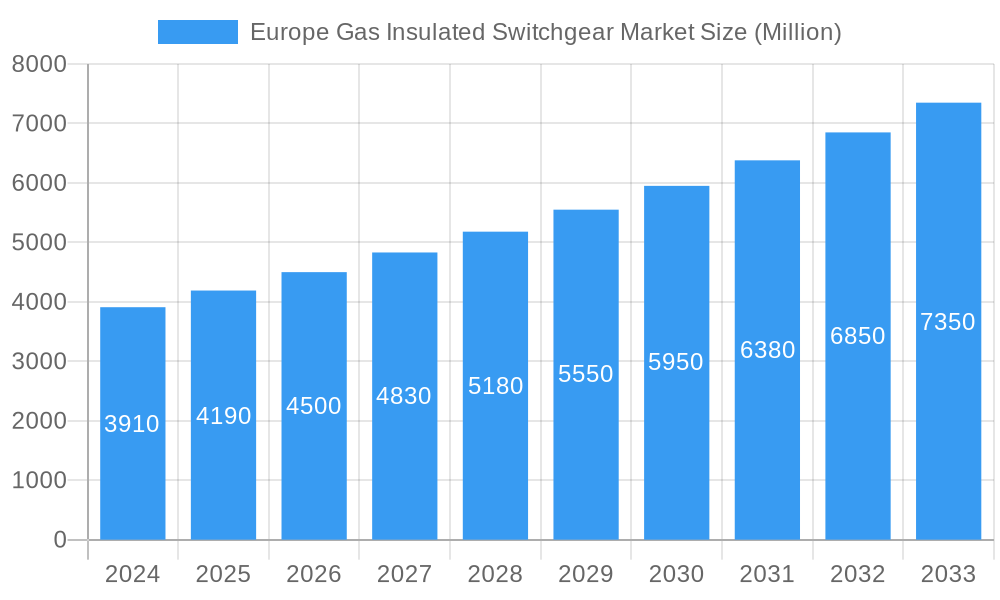

The Europe Gas Insulated Switchgear Market is poised for significant expansion, projected to reach an estimated $4.19 billion by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 7.62% through 2033. This upward trajectory is primarily fueled by the increasing demand for reliable and efficient power distribution infrastructure across the continent. Key drivers include the ongoing modernization of aging power grids, the burgeoning integration of renewable energy sources that necessitate advanced grid management solutions, and stringent environmental regulations promoting the use of SF6-free or low-GWP (Global Warming Potential) alternatives in switchgear technology. The market is also benefiting from substantial investments in smart grid technologies and the growing need for compact, space-saving switchgear solutions in urbanized areas, particularly for commercial and residential applications.

Europe Gas Insulated Switchgear Market Market Size (In Billion)

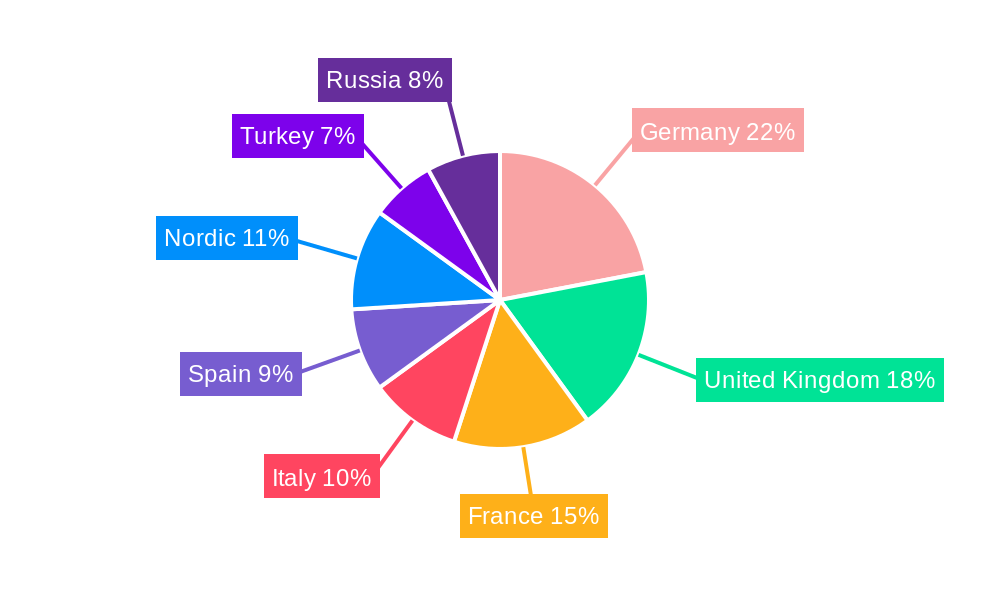

The market segmentation by voltage level highlights a strong demand across low, medium, and high voltage applications, reflecting the diverse needs of power utilities, industrial sectors, and the commercial & residential segments. Geographically, key European markets like Germany, France, the United Kingdom, and Italy are leading the charge due to their proactive approach to energy transition and grid upgrades. While the market benefits from these strong growth drivers, it also faces certain restraints. These include the high initial cost of Gas Insulated Switchgear (GIS) systems compared to traditional air-insulated counterparts and the evolving regulatory landscape surrounding SF6 gas emissions, which, while driving innovation, also presents a transitional challenge for some manufacturers and end-users. Nevertheless, the overarching trend towards a more sustainable and resilient energy future in Europe is expected to consistently propel the demand for advanced GIS solutions.

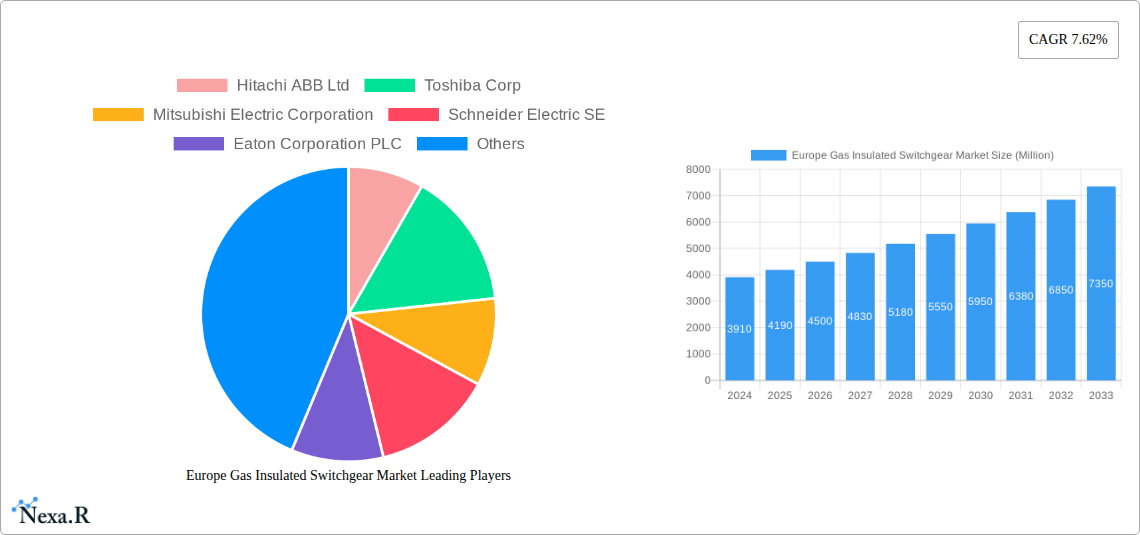

Europe Gas Insulated Switchgear Market Company Market Share

Europe Gas Insulated Switchgear Market: Comprehensive Analysis and Future Outlook (2019-2033)

Report Description:

Dive deep into the expansive Europe Gas Insulated Switchgear (GIS) Market with this definitive report. Covering the study period of 2019–2033, with a base year of 2025, this analysis provides unparalleled insights into market dynamics, growth trends, and future projections. Discover the intricate workings of the parent market and its crucial child markets, segmented by voltage level (Low Voltage, Medium Voltage, High Voltage) and end-user industry (Commercial & Residential, Power Utilities, Industrial Sector). We meticulously examine key countries including Germany, France, United Kingdom, Spain, Italy, NORDIC, Turkey, and Russia, alongside the Rest of Europe. This report is an indispensable resource for industry professionals seeking to understand market concentration, technological innovation drivers, regulatory frameworks, competitive landscapes, and emerging opportunities. Gain a competitive edge by leveraging data on market size evolution, adoption rates, CAGR, and market penetration.

Europe Gas Insulated Switchgear Market Market Dynamics & Structure

The Europe Gas Insulated Switchgear (GIS) market exhibits a moderately concentrated structure, characterized by the presence of established global players and a growing number of regional specialists. Technological innovation is a paramount driver, with a continuous push towards more environmentally friendly alternatives to SF6 gas and enhanced digital integration for smart grid functionalities. Regulatory frameworks, particularly those focused on environmental protection and grid modernization, significantly shape market dynamics, influencing product development and adoption rates. Competitive product substitutes, such as air-insulated switchgear, offer alternatives, but GIS maintains its dominance in specific high-demand applications due to its compact design and superior performance. End-user demographics are evolving, with a growing demand from the industrial sector for increased reliability and from power utilities for grid resilience and expansion. Mergers and acquisitions (M&A) trends, though not hyperactive, are strategically focused on consolidating market share and acquiring innovative technologies, particularly in the realm of eco-friendly GIS solutions.

- Market Concentration: Dominated by a few key global players, with increasing fragmentation in specialized segments.

- Technological Innovation Drivers: Focus on SF6-free alternatives, digitalization, and compact designs.

- Regulatory Frameworks: Stringent environmental regulations (e.g., F-gas regulations) and grid modernization initiatives are key influences.

- Competitive Product Substitutes: Air-insulated switchgear (AIS) and solid-insulated switchgear (SIS) present alternatives but GIS holds advantages in space-constrained and high-voltage applications.

- End-User Demographics: Strong demand from power utilities for grid upgrades and industrial sectors for reliable power distribution.

- M&A Trends: Strategic acquisitions to enhance product portfolios and gain access to new technologies, particularly in eco-friendly GIS.

Europe Gas Insulated Switchgear Market Growth Trends & Insights

The Europe Gas Insulated Switchgear (GIS) market is on a robust growth trajectory, fueled by a confluence of factors including the imperative for grid modernization, increasing demand for renewable energy integration, and stringent environmental regulations. The market size is projected to witness a significant expansion, with CAGR of xx% expected between 2025 and 2033. Adoption rates for GIS technology are steadily rising, particularly for Medium Voltage (MV) and High Voltage (HV) applications where its space-saving and enhanced safety features are highly valued. Technological disruptions are a constant theme, with the industry actively seeking and implementing alternatives to SF6 gas, a potent greenhouse gas. Innovations are geared towards developing SF6-free GIS solutions that offer comparable or superior performance, driving significant R&D investments. Consumer behavior shifts are also playing a crucial role, with end-users prioritizing reliability, operational efficiency, and environmental sustainability in their switchgear choices. The increasing complexity of power grids, driven by the decentralization of energy sources and the growth of electric vehicles, necessitates the deployment of advanced switchgear solutions like GIS. Market penetration is expected to deepen across all voltage segments, with a particular surge in demand for smart GIS that offer enhanced monitoring, diagnostics, and control capabilities, facilitating the development of resilient and efficient energy networks. The focus on energy transition and the retirement of aging infrastructure further bolster the demand for new GIS installations.

Dominant Regions, Countries, or Segments in Europe Gas Insulated Switchgear Market

The Power Utilities end-user segment stands out as the dominant force driving growth within the Europe Gas Insulated Switchgear (GIS) Market. This is primarily attributed to the continuous need for grid modernization, expansion, and the integration of renewable energy sources across the continent. Power utilities are at the forefront of investing in robust and reliable infrastructure to ensure uninterrupted power supply and to manage the intermittent nature of renewable energy generation. Germany emerges as a leading country within the European GIS market, propelled by its strong industrial base, commitment to energy transition (Energiewende), and substantial investments in grid infrastructure upgrades. The country's stringent environmental policies also favor the adoption of advanced and eco-friendly switchgear solutions.

- Dominant End-User Segment: Power Utilities are the primary market driver due to grid modernization, renewable energy integration, and reliability demands.

- Leading Country: Germany commands a significant market share owing to its robust industrial sector, energy transition initiatives, and proactive environmental regulations.

- Dominant Voltage Segment: High Voltage (HV) and Medium Voltage (MV) segments are experiencing the most substantial growth. HV GIS is critical for transmission networks and large substations, while MV GIS is essential for distribution networks and industrial applications.

- Key Drivers in Dominant Segments:

- Power Utilities: Aging infrastructure requiring replacement, need for enhanced grid stability, integration of smart grid technologies, and capacity expansion for renewable energy.

- Germany: Ambitious renewable energy targets, significant investments in transmission and distribution networks, and a strong manufacturing sector.

- High Voltage & Medium Voltage: Superior performance characteristics, compact footprint, enhanced safety, and longer lifespan compared to traditional switchgear, making them ideal for critical infrastructure.

- Growth Potential: The ongoing digital transformation of power grids and the increasing adoption of decentralized energy systems will continue to fuel demand across all segments, with a particular focus on intelligent and eco-friendly GIS solutions. The "Rest of Europe" also represents a significant and growing market due to ongoing infrastructure development and the increasing focus on energy security.

Europe Gas Insulated Switchgear Market Product Landscape

The Europe Gas Insulated Switchgear (GIS) product landscape is characterized by a relentless pursuit of innovation focused on enhanced performance, safety, and environmental sustainability. Leading manufacturers are investing heavily in the development of SF6-free GIS, utilizing vacuum interrupters and alternative gases like C4-FN or a mixture of N2 and CO2. These advancements address growing environmental concerns while maintaining or improving the dielectric and arc-quenching properties of the switchgear. Product innovations also include modular designs for easier installation and maintenance, increased digitalization for remote monitoring and control, and improved sealing technologies to prevent gas leakage. Performance metrics are continually being pushed, with a focus on reducing partial discharge, enhancing operational lifetime, and minimizing footprint. The application scope of GIS is expanding from traditional substation applications to include integration within industrial facilities and smart city infrastructure.

Key Drivers, Barriers & Challenges in Europe Gas Insulated Switchgear Market

Key Drivers:

- Grid Modernization & Expansion: The aging European grid infrastructure requires substantial upgrades, driving demand for reliable and advanced GIS.

- Renewable Energy Integration: The increasing penetration of renewable energy sources necessitates robust grid management and expansion, where GIS plays a vital role.

- Environmental Regulations: Stringent regulations regarding SF6 emissions are a significant catalyst for the adoption of SF6-free and low-GWP alternatives.

- Technological Advancements: Innovations in SF6-free technologies, digitalization, and smart grid capabilities are enhancing GIS performance and attractiveness.

- Demand for Reliability & Safety: GIS offers superior reliability, safety, and compact design, making it ideal for critical infrastructure and space-constrained environments.

Barriers & Challenges:

- High Initial Cost: The upfront investment for GIS is generally higher compared to traditional air-insulated switchgear, posing a barrier for some utilities.

- SF6 Handling & Disposal: While SF6-free alternatives are emerging, managing existing SF6 gas, its handling, and disposal remain complex regulatory and operational challenges.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of critical components and raw materials, leading to price fluctuations and delivery delays.

- Skilled Workforce Requirements: The installation, maintenance, and operation of advanced GIS systems require specialized knowledge and a skilled workforce, which can be a bottleneck in some regions.

- Market Penetration of Alternatives: The increasing availability and improvement of alternative switchgear technologies, such as Solid Insulated Switchgear (SIS), present competitive pressure.

Emerging Opportunities in Europe Gas Insulated Switchgear Market

The Europe Gas Insulated Switchgear (GIS) market presents significant emerging opportunities driven by the ongoing energy transition and digitalization trends. The development and widespread adoption of SF6-free GIS solutions represent a substantial growth avenue as environmental regulations tighten. Furthermore, the expansion of smart grids and the increasing demand for digital substations are creating opportunities for GIS with integrated monitoring, control, and diagnostic capabilities. The growth of decentralized energy systems, including microgrids and distributed generation, requires flexible and adaptable switchgear solutions, which GIS can increasingly provide. Emerging opportunities also lie in the refurbishment and upgrade of existing substations across Europe, particularly in regions with aging infrastructure. The increasing electrification of transportation and the burgeoning demand for charging infrastructure also present new application areas for GIS in power distribution.

Growth Accelerators in the Europe Gas Insulated Switchgear Market Industry

Several key catalysts are accelerating the growth of the Europe Gas Insulated Switchgear (GIS) market. The European Green Deal and its associated policies are significantly pushing for decarbonization and the adoption of sustainable technologies, directly benefiting SF6-free GIS solutions. Continued investment in renewable energy infrastructure, including wind and solar farms, requires robust and reliable switchgear for grid connection and power distribution. The digitalization of the energy sector, leading to the development of smart grids and IoT-enabled substations, is another major accelerator, as GIS with advanced communication and control features becomes increasingly vital. Strategic partnerships between GIS manufacturers and technology providers focusing on digitalization and alternative gas technologies are fostering innovation and market penetration. Furthermore, government incentives and funding programs aimed at grid modernization and renewable energy integration are providing a substantial boost to market expansion.

Key Players Shaping the Europe Gas Insulated Switchgear Market Market

- Hitachi ABB Ltd

- Toshiba Corp

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Eaton Corporation PLC

- Siemens Energy AG

- Nuventura GmbH

- General Electric Company

Notable Milestones in Europe Gas Insulated Switchgear Market Sector

- October 2023: Nuventura and Iberapa announced a strategic partnership to integrate Nuventura's SF6-free MV GIS into Iberapa's MV substation offerings, signaling a strong move towards eco-friendly solutions.

- March 2023: Siemens Energy announced a USD 32.5 million investment in expanding its gas-insulated medium voltage switchgear manufacturing plant in Frankfurt-Fechenheim, Germany, to meet rising order volumes and increase production capacity with a new assembly line.

In-Depth Europe Gas Insulated Switchgear Market Market Outlook

The future outlook for the Europe Gas Insulated Switchgear (GIS) market is exceptionally promising, driven by a potent combination of regulatory mandates, technological advancements, and growing infrastructure demands. The imperative to decarbonize and reduce greenhouse gas emissions will continue to propel the adoption of SF6-free GIS, presenting substantial growth opportunities for manufacturers innovating in this space. The ongoing digital transformation of power grids will further enhance the value proposition of GIS by enabling smart functionalities, predictive maintenance, and seamless grid integration. Investments in renewable energy, grid modernization initiatives, and the electrification of various sectors will ensure a sustained demand for reliable and high-performance switchgear. Strategic collaborations and acquisitions will likely continue to shape the competitive landscape, fostering innovation and market consolidation. The market is poised for significant expansion, driven by a commitment to building a more sustainable, resilient, and intelligent energy future across Europe.

Europe Gas Insulated Switchgear Market Segmentation

-

1. Voltage Level

- 1.1. Low Voltage

- 1.2. Medium Voltage

- 1.3. High Voltage

-

2. End-User

- 2.1. Commercial & Residential

- 2.2. Power utilities

- 2.3. Industrial sector

-

3. Countries

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Spain

- 3.5. Italy

- 3.6. NORDIC

- 3.7. Turkery

- 3.8. Russia

- 3.9. Rest of Europe

Europe Gas Insulated Switchgear Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Gas Insulated Switchgear Market Regional Market Share

Geographic Coverage of Europe Gas Insulated Switchgear Market

Europe Gas Insulated Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Transmission and Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; The restriction on SF6 gas usage

- 3.4. Market Trends

- 3.4.1. High Voltage Level Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Gas Insulated Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage Level

- 5.1.1. Low Voltage

- 5.1.2. Medium Voltage

- 5.1.3. High Voltage

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial & Residential

- 5.2.2. Power utilities

- 5.2.3. Industrial sector

- 5.3. Market Analysis, Insights and Forecast - by Countries

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Spain

- 5.3.5. Italy

- 5.3.6. NORDIC

- 5.3.7. Turkery

- 5.3.8. Russia

- 5.3.9. Rest of Europe

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Voltage Level

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Electric Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eaton Corporation PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Energy AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nuventura GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Hitachi ABB Ltd

List of Figures

- Figure 1: Europe Gas Insulated Switchgear Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Gas Insulated Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Gas Insulated Switchgear Market Revenue Million Forecast, by Voltage Level 2020 & 2033

- Table 2: Europe Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Voltage Level 2020 & 2033

- Table 3: Europe Gas Insulated Switchgear Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Europe Gas Insulated Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 5: Europe Gas Insulated Switchgear Market Revenue Million Forecast, by Countries 2020 & 2033

- Table 6: Europe Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Countries 2020 & 2033

- Table 7: Europe Gas Insulated Switchgear Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 9: Europe Gas Insulated Switchgear Market Revenue Million Forecast, by Voltage Level 2020 & 2033

- Table 10: Europe Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Voltage Level 2020 & 2033

- Table 11: Europe Gas Insulated Switchgear Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Europe Gas Insulated Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 13: Europe Gas Insulated Switchgear Market Revenue Million Forecast, by Countries 2020 & 2033

- Table 14: Europe Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Countries 2020 & 2033

- Table 15: Europe Gas Insulated Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 21: France Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Gas Insulated Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Gas Insulated Switchgear Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Gas Insulated Switchgear Market?

The projected CAGR is approximately 7.62%.

2. Which companies are prominent players in the Europe Gas Insulated Switchgear Market?

Key companies in the market include Hitachi ABB Ltd, Toshiba Corp, Mitsubishi Electric Corporation, Schneider Electric SE, Eaton Corporation PLC, Siemens Energy AG, Nuventura GmbH, General Electric Company.

3. What are the main segments of the Europe Gas Insulated Switchgear Market?

The market segments include Voltage Level, End-User, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.19 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Transmission and Distribution Infrastructure.

6. What are the notable trends driving market growth?

High Voltage Level Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The restriction on SF6 gas usage.

8. Can you provide examples of recent developments in the market?

October 2023: Nuventura and Iberapa, a Spanish manufacturer of high-voltage (HV) and medium-voltage (MV) substations have announced the signing of a strategic partnership agreement. This exciting collaboration will enable Iberapa to incorporate Nuventura's cutting-edge SF6-free MV GIS into their MV substation offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Gas Insulated Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Gas Insulated Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Gas Insulated Switchgear Market?

To stay informed about further developments, trends, and reports in the Europe Gas Insulated Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence