Key Insights

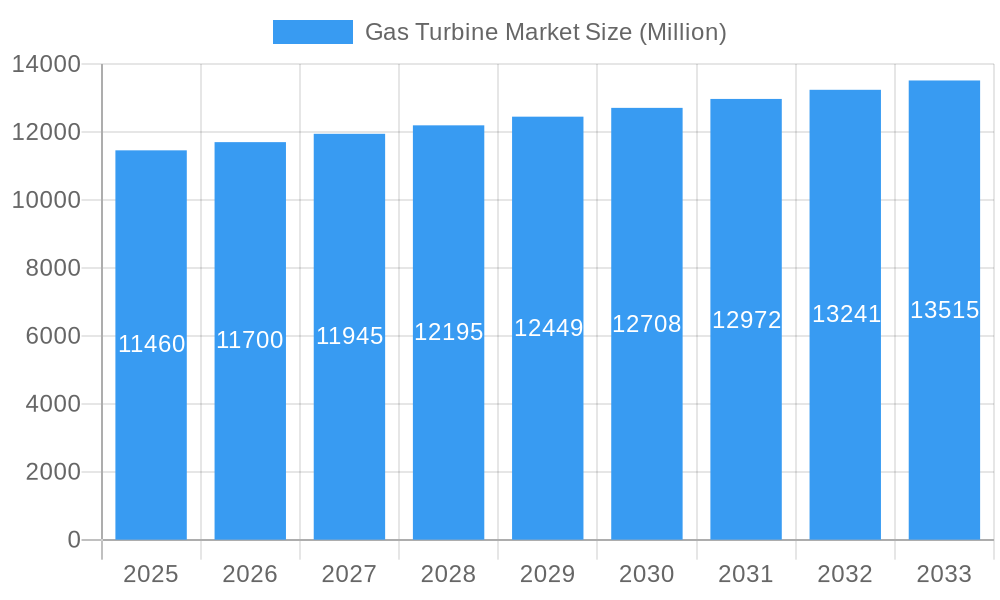

The global Gas Turbine Market is poised for steady expansion, projecting a market size of $11.46 billion in 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 2.1% throughout the forecast period of 2025-2033. A key driver for this market is the increasing demand for efficient and reliable power generation solutions across various industries. The ongoing need to upgrade existing power infrastructure and the development of new energy projects, particularly in emerging economies, are significant contributors to this upward trend. Furthermore, the oil and gas sector continues to rely heavily on gas turbines for both exploration and production operations, as well as for powering refineries and petrochemical plants. Innovations in turbine technology, focusing on improved fuel efficiency, reduced emissions, and enhanced operational flexibility, are also playing a crucial role in stimulating market growth and ensuring the sustained relevance of gas turbine technology in a rapidly evolving energy landscape.

Gas Turbine Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape shaped by varying technological capacities and end-user demands. Within the capacity segments, turbines of Above 120 MW are likely to dominate due to their suitability for large-scale power generation facilities. In terms of types, Combined Cycle turbines are expected to hold a significant market share owing to their superior efficiency in converting fuel to electricity. The Power industry remains the largest end-user, a trend anticipated to persist throughout the forecast period. However, the Oil and Gas sector is also a substantial consumer, with its demand closely tied to global energy prices and exploration activities. While the market benefits from strong demand drivers, potential restraints such as the increasing adoption of renewable energy sources and stringent environmental regulations could pose challenges. Nevertheless, the continued importance of reliable baseload power and the long operational lifespan of gas turbines suggest a resilient market trajectory.

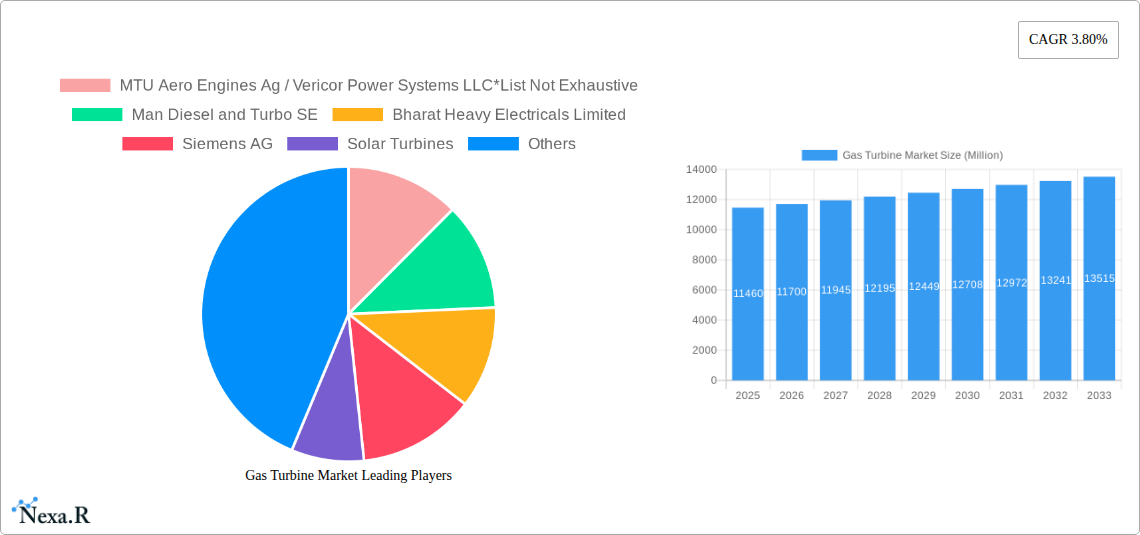

Gas Turbine Market Company Market Share

This comprehensive report delivers an in-depth analysis of the global Gas Turbine Market, a critical component of power generation, oil & gas operations, and various industrial applications. With an estimated market size of $XX billion in 2025, this market is poised for significant expansion throughout the forecast period, driven by increasing energy demands, technological advancements, and a global shift towards more efficient and cleaner power solutions. We explore the intricate dynamics of this evolving industry, from its segmented structure to the key players shaping its future.

Gas Turbine Market Market Dynamics & Structure

The Gas Turbine Market is characterized by a moderate level of concentration, with a few key players holding substantial market share, yet providing ample space for specialized manufacturers and emerging technologies. Technological innovation is a primary driver, fueled by the relentless pursuit of higher efficiency, lower emissions, and enhanced reliability. The development of advanced materials, digital twin technology for predictive maintenance, and hybrid-cycle designs are transforming the landscape. Regulatory frameworks, particularly those concerning emissions standards and environmental impact, play a crucial role in dictating product development and adoption rates. Competitive product substitutes, such as advancements in renewable energy storage and more efficient internal combustion engines, necessitate continuous innovation within the gas turbine sector. End-user demographics are shifting, with a growing demand for decentralized power generation solutions and robust power for industrial processes. Mergers and acquisitions (M&A) trends reflect a strategic consolidation, aiming to leverage complementary technologies, expand geographic reach, and enhance competitive positioning. For instance, the past few years have witnessed X number of significant M&A deals, collectively valued at approximately $XX billion, aimed at acquiring innovative startups or consolidating market leadership.

- Market Concentration: Dominated by a few global leaders, but with significant opportunities for niche players.

- Technological Innovation Drivers: Focus on fuel flexibility, hydrogen combustion readiness, and digital integration for O&M.

- Regulatory Frameworks: Stringent emissions regulations (e.g., CO2, NOx) are shaping design and fuel choices.

- Competitive Product Substitutes: Emerging energy storage solutions and advancements in other power generation technologies.

- End-User Demographics: Growing demand for flexible, reliable power in industrial and developing regions.

- M&A Trends: Strategic acquisitions to enhance technological portfolios and market access.

Gas Turbine Market Growth Trends & Insights

The Gas Turbine Market is experiencing a robust growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately X.X% from 2025 to 2033. This expansion is underpinned by escalating global energy needs, particularly in developing economies, and the imperative for reliable, dispatchable power sources to complement intermittent renewables. The market size, estimated at $XX billion in 2025, is anticipated to reach $XX billion by 2033. Adoption rates are being propelled by the increasing integration of gas turbines in combined cycle power plants, offering superior efficiency and reduced emissions compared to older technologies. Technological disruptions are a constant feature, with advancements in aeroderivatives for faster start-up times and greater load following capabilities, and the exploration of alternative fuels like hydrogen and ammonia, positioning gas turbines as a transitional technology towards a decarbonized future. Consumer behavior shifts, particularly in the industrial sector, are emphasizing operational efficiency, reduced maintenance costs, and a lower carbon footprint, all areas where modern gas turbines excel. Market penetration of advanced gas turbine technologies, such as those designed for peaking power and distributed generation, is steadily increasing. The ongoing development of advanced control systems and artificial intelligence for performance optimization further enhances their appeal.

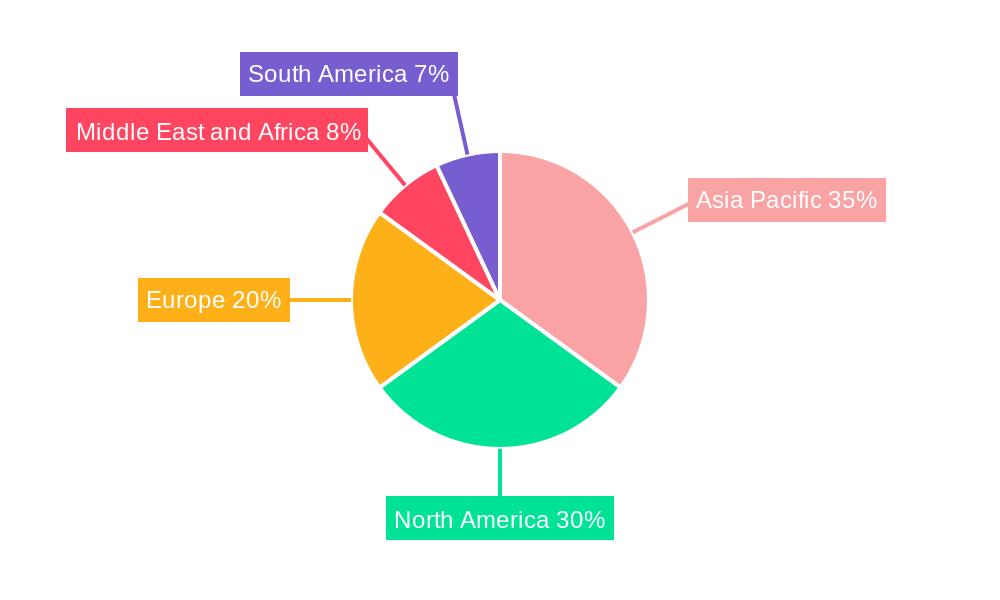

Dominant Regions, Countries, or Segments in Gas Turbine Market

The Power segment, specifically within the Combined Cycle type and Above 120 MW capacity, currently dominates the global Gas Turbine Market. This dominance is driven by several interconnected factors.

- Power Segment Dominance: The burgeoning global demand for electricity, fueled by population growth, industrialization, and increased electrification across various sectors, makes power generation the primary application for gas turbines. These turbines are crucial for meeting base load, intermediate load, and peaking power requirements, offering a balance of efficiency, flexibility, and environmental performance.

- Combined Cycle Advantage: Combined cycle power plants, which utilize waste heat from the gas turbine to drive a steam turbine, achieve significantly higher thermal efficiencies (often exceeding 60%) compared to open cycle configurations. This enhanced efficiency translates into lower fuel consumption and reduced operating costs, making them highly attractive for large-scale power generation. The ability to generate more power from the same amount of fuel is a key economic and environmental driver.

- Above 120 MW Capacity: Larger capacity turbines are favored for utility-scale power generation due to economies of scale. These high-power output units are essential for building large, efficient power plants that can meet the demands of entire cities or industrial complexes. The cost per megawatt decreases with increasing turbine size, making them the most economically viable option for significant power output.

Key Drivers for Dominance:

- Economic Policies: Government initiatives promoting energy security, grid modernization, and the transition away from higher-emission fossil fuels are indirectly supporting the adoption of advanced gas turbine technologies. Incentives for cleaner energy production and the need for reliable power infrastructure are critical.

- Infrastructure Development: Significant investments in new power plant construction and the upgrade of existing grids in developing economies, particularly in Asia-Pacific and the Middle East, are creating substantial demand for large-capacity gas turbines.

- Technological Advancements: Continuous improvements in efficiency, emissions control, and fuel flexibility for large-scale gas turbines make them a compelling choice for power producers. The development of hydrogen-ready turbines further solidifies their position in the long term.

- Market Share: The Power segment, particularly for Combined Cycle and Above 120 MW capacities, accounts for an estimated XX% of the total gas turbine market revenue. This segment is expected to maintain its leading position due to ongoing new power plant constructions and upgrades.

- Growth Potential: While mature markets may see slower growth, emerging economies offer significant untapped potential for large-scale power generation projects requiring these high-capacity turbines.

Gas Turbine Market Product Landscape

The Gas Turbine Market is witnessing a surge in product innovations focused on enhancing efficiency, reducing emissions, and expanding operational flexibility. Advanced aerodynamic designs, improved material science for higher operating temperatures, and sophisticated control systems are enabling turbines to achieve unprecedented performance levels. Applications are diversifying beyond traditional power generation, with a growing presence in the oil & gas sector for mechanical drives in upstream and midstream operations, and in industrial applications like chemical processing and district heating. Performance metrics are being redefined by lower heat rates, reduced NOx emissions, and extended operational lifespans. Unique selling propositions include hydrogen-ready combustion technologies, modular designs for faster deployment, and digital solutions for predictive maintenance and remote diagnostics, all contributing to lower total cost of ownership.

Key Drivers, Barriers & Challenges in Gas Turbine Market

Key Drivers:

- Growing Global Energy Demand: The continuous need for electricity and industrial power, especially in emerging economies, is a primary growth catalyst.

- Transition to Cleaner Energy: Gas turbines offer a more efficient and lower-emission alternative to coal, serving as a crucial bridge to renewable energy sources.

- Technological Advancements: Innovations in efficiency, fuel flexibility (including hydrogen readiness), and digital integration are making gas turbines more competitive and attractive.

- Reliability and Dispatchability: Gas turbines provide essential baseload, intermediate, and peaking power, ensuring grid stability even with the rise of intermittent renewables.

Key Barriers & Challenges:

- Environmental Regulations: Increasingly stringent emissions standards, particularly for CO2 and NOx, necessitate significant R&D investment and can impact operational costs.

- High Capital Investment: The initial cost of purchasing and installing gas turbine systems is substantial, which can be a barrier for some projects.

- Competition from Renewables: The declining cost of solar and wind power, coupled with advancements in energy storage, presents a growing competitive challenge.

- Supply Chain Volatility: Geopolitical factors and global events can impact the availability and cost of raw materials and components, affecting production timelines and costs. The XX% increase in raw material costs over the past two years exemplifies this challenge.

Emerging Opportunities in Gas Turbine Market

Emerging opportunities within the Gas Turbine Market are largely driven by the global energy transition and the need for flexible, low-carbon power solutions. The development and adoption of hydrogen-fueled and ammonia-fueled gas turbines represent a significant growth avenue, positioning them as critical components for decarbonizing the power sector and heavy industry. Furthermore, the demand for decentralized power generation and microgrids, particularly in regions with unreliable grid infrastructure, presents a market for smaller, more adaptable gas turbine units. Opportunities also exist in the retrofitting and upgrade of existing gas turbine fleets to enhance efficiency and meet evolving environmental regulations, thereby extending their operational life and reducing their carbon footprint. The integration of advanced digital solutions for remote monitoring, predictive maintenance, and performance optimization continues to unlock value for operators.

Growth Accelerators in the Gas Turbine Market Industry

Several factors are acting as significant growth accelerators for the Gas Turbine Market. Technological breakthroughs in areas such as advanced combustion technologies, including those supporting hydrogen and synthetic fuels, are crucial. The increasing strategic partnerships between turbine manufacturers, energy companies, and technology providers are fostering innovation and facilitating market penetration. Market expansion strategies, particularly in rapidly industrializing regions and emerging economies, are creating new demand centers. The growing emphasis on energy security and grid reliability is also a key accelerator, as gas turbines offer a dependable power source that can complement intermittent renewable energy. Investments in research and development for higher efficiency and lower emission solutions are also driving the adoption of new, more advanced turbine models.

Key Players Shaping the Gas Turbine Market Market

- General Electric Company

- Siemens AG

- Mitsubishi Heavy Industries Ltd

- Man Diesel and Turbo SE

- Solar Turbines

- Kawasaki Heavy Industries Ltd

- Bharat Heavy Electricals Limited

- Ansaldo Energia SpA

- Harbin Electric International Company Limited

- MTU Aero Engines Ag

- Vericor Power Systems LLC

Notable Milestones in Gas Turbine Market Sector

- 2021: Siemens Energy launched its first hydrogen-ready gas turbine, marking a significant step towards decarbonizing power generation.

- 2022: General Electric announced advancements in its H-class gas turbine technology, achieving higher efficiency levels and reduced emissions.

- 2023: Mitsubishi Heavy Industries and MAN Energy Solutions announced a strategic collaboration to develop advanced gas turbine solutions for future energy needs.

- 2024: Ansaldo Energia successfully demonstrated sustained operation of a gas turbine on a high percentage of hydrogen fuel, paving the way for wider adoption.

- Q1 2024: The global installed capacity of gas turbines surpassed XX GW, underscoring its continued importance in the energy mix.

In-Depth Gas Turbine Market Market Outlook

The outlook for the Gas Turbine Market remains positive, driven by the ongoing need for flexible, efficient, and increasingly cleaner power generation solutions. Growth accelerators such as technological advancements in hydrogen and synthetic fuel combustion, strategic industry collaborations, and expansion into emerging markets will continue to fuel market expansion. The increasing focus on energy security and grid reliability further solidifies the role of gas turbines as a vital component of the global energy infrastructure. While challenges related to environmental regulations and competition from renewables persist, ongoing innovation and the development of low-carbon solutions position the gas turbine industry for sustained growth and a critical role in the global energy transition, with an estimated market size of $XX billion by 2033.

Gas Turbine Market Segmentation

-

1. Capacity

- 1.1. Less than 30 MW

- 1.2. 31-120 MW

- 1.3. Above 120 MW

-

2. Types

- 2.1. Combined Cycle

- 2.2. Open Cycle

-

3. End-User Industry

- 3.1. Power

- 3.2. Oil and Gas

- 3.3. Others

Gas Turbine Market Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Europe

- 4. South America

- 5. Middle East and Africa

Gas Turbine Market Regional Market Share

Geographic Coverage of Gas Turbine Market

Gas Turbine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Smart Technology in Power Grid Infrastructure4.; Aging of Transmission and Distribution (T&D) Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Low Accessibility to Electricity in Underdeveloped Nations

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Turbine for Power Generation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Turbine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Less than 30 MW

- 5.1.2. 31-120 MW

- 5.1.3. Above 120 MW

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Combined Cycle

- 5.2.2. Open Cycle

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Power

- 5.3.2. Oil and Gas

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. Asia Pacific Gas Turbine Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. Less than 30 MW

- 6.1.2. 31-120 MW

- 6.1.3. Above 120 MW

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Combined Cycle

- 6.2.2. Open Cycle

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Power

- 6.3.2. Oil and Gas

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. North America Gas Turbine Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. Less than 30 MW

- 7.1.2. 31-120 MW

- 7.1.3. Above 120 MW

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Combined Cycle

- 7.2.2. Open Cycle

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Power

- 7.3.2. Oil and Gas

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. Europe Gas Turbine Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. Less than 30 MW

- 8.1.2. 31-120 MW

- 8.1.3. Above 120 MW

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Combined Cycle

- 8.2.2. Open Cycle

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Power

- 8.3.2. Oil and Gas

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. South America Gas Turbine Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. Less than 30 MW

- 9.1.2. 31-120 MW

- 9.1.3. Above 120 MW

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Combined Cycle

- 9.2.2. Open Cycle

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Power

- 9.3.2. Oil and Gas

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. Middle East and Africa Gas Turbine Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 10.1.1. Less than 30 MW

- 10.1.2. 31-120 MW

- 10.1.3. Above 120 MW

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Combined Cycle

- 10.2.2. Open Cycle

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Power

- 10.3.2. Oil and Gas

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MTU Aero Engines Ag / Vericor Power Systems LLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Man Diesel and Turbo SE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bharat Heavy Electricals Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Solar Turbines

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ansaldo Energia SpA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kawasaki Heavy Industries Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Harbin Electric International Company Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 MTU Aero Engines Ag / Vericor Power Systems LLC*List Not Exhaustive

List of Figures

- Figure 1: Global Gas Turbine Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Gas Turbine Market Revenue (undefined), by Capacity 2025 & 2033

- Figure 3: Asia Pacific Gas Turbine Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 4: Asia Pacific Gas Turbine Market Revenue (undefined), by Types 2025 & 2033

- Figure 5: Asia Pacific Gas Turbine Market Revenue Share (%), by Types 2025 & 2033

- Figure 6: Asia Pacific Gas Turbine Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 7: Asia Pacific Gas Turbine Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: Asia Pacific Gas Turbine Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Asia Pacific Gas Turbine Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Gas Turbine Market Revenue (undefined), by Capacity 2025 & 2033

- Figure 11: North America Gas Turbine Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 12: North America Gas Turbine Market Revenue (undefined), by Types 2025 & 2033

- Figure 13: North America Gas Turbine Market Revenue Share (%), by Types 2025 & 2033

- Figure 14: North America Gas Turbine Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 15: North America Gas Turbine Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: North America Gas Turbine Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: North America Gas Turbine Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Gas Turbine Market Revenue (undefined), by Capacity 2025 & 2033

- Figure 19: Europe Gas Turbine Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 20: Europe Gas Turbine Market Revenue (undefined), by Types 2025 & 2033

- Figure 21: Europe Gas Turbine Market Revenue Share (%), by Types 2025 & 2033

- Figure 22: Europe Gas Turbine Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 23: Europe Gas Turbine Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Europe Gas Turbine Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Gas Turbine Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Gas Turbine Market Revenue (undefined), by Capacity 2025 & 2033

- Figure 27: South America Gas Turbine Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 28: South America Gas Turbine Market Revenue (undefined), by Types 2025 & 2033

- Figure 29: South America Gas Turbine Market Revenue Share (%), by Types 2025 & 2033

- Figure 30: South America Gas Turbine Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 31: South America Gas Turbine Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: South America Gas Turbine Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Gas Turbine Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Gas Turbine Market Revenue (undefined), by Capacity 2025 & 2033

- Figure 35: Middle East and Africa Gas Turbine Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 36: Middle East and Africa Gas Turbine Market Revenue (undefined), by Types 2025 & 2033

- Figure 37: Middle East and Africa Gas Turbine Market Revenue Share (%), by Types 2025 & 2033

- Figure 38: Middle East and Africa Gas Turbine Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 39: Middle East and Africa Gas Turbine Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East and Africa Gas Turbine Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Gas Turbine Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gas Turbine Market Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 2: Global Gas Turbine Market Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Gas Turbine Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Gas Turbine Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Gas Turbine Market Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 6: Global Gas Turbine Market Revenue undefined Forecast, by Types 2020 & 2033

- Table 7: Global Gas Turbine Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Gas Turbine Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Gas Turbine Market Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 10: Global Gas Turbine Market Revenue undefined Forecast, by Types 2020 & 2033

- Table 11: Global Gas Turbine Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Gas Turbine Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Gas Turbine Market Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 14: Global Gas Turbine Market Revenue undefined Forecast, by Types 2020 & 2033

- Table 15: Global Gas Turbine Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Gas Turbine Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Gas Turbine Market Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 18: Global Gas Turbine Market Revenue undefined Forecast, by Types 2020 & 2033

- Table 19: Global Gas Turbine Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Gas Turbine Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Gas Turbine Market Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 22: Global Gas Turbine Market Revenue undefined Forecast, by Types 2020 & 2033

- Table 23: Global Gas Turbine Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 24: Global Gas Turbine Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Turbine Market?

The projected CAGR is approximately 2.1%.

2. Which companies are prominent players in the Gas Turbine Market?

Key companies in the market include MTU Aero Engines Ag / Vericor Power Systems LLC*List Not Exhaustive, Man Diesel and Turbo SE, Bharat Heavy Electricals Limited, Siemens AG, Solar Turbines, Ansaldo Energia SpA, General Electric Company, Kawasaki Heavy Industries Ltd, Harbin Electric International Company Limited, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Gas Turbine Market?

The market segments include Capacity, Types, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Smart Technology in Power Grid Infrastructure4.; Aging of Transmission and Distribution (T&D) Infrastructure.

6. What are the notable trends driving market growth?

Increasing Demand for Turbine for Power Generation.

7. Are there any restraints impacting market growth?

4.; Low Accessibility to Electricity in Underdeveloped Nations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Turbine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Turbine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Turbine Market?

To stay informed about further developments, trends, and reports in the Gas Turbine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence