Key Insights

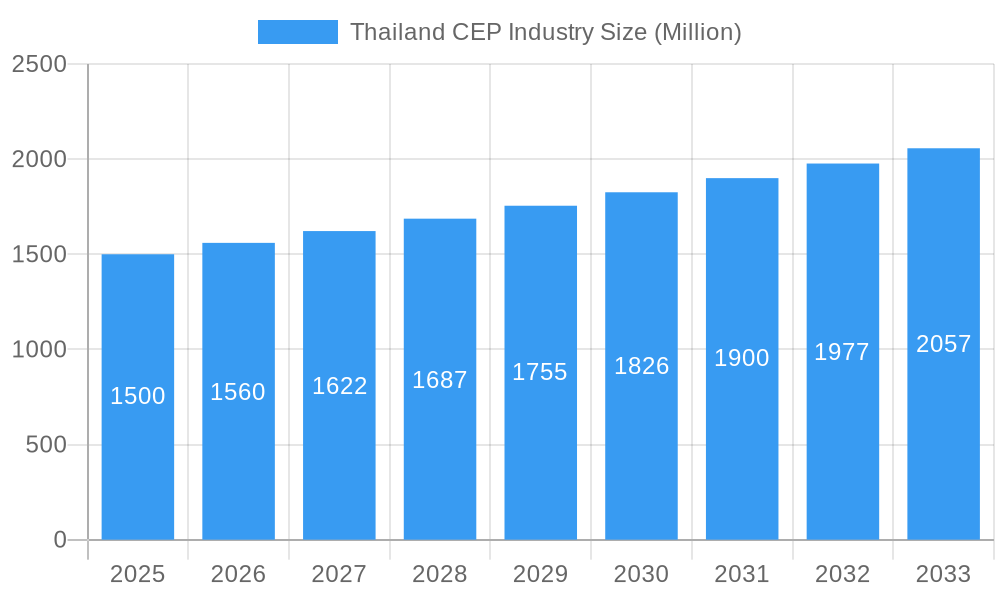

The Thailand Courier, Express, and Parcel (CEP) industry is projected for substantial growth, anticipating a Compound Annual Growth Rate (CAGR) of

Thailand CEP Industry Market Size (In Billion)

Despite challenges including fluctuating fuel prices and infrastructure constraints, government initiatives focused on logistics modernization and digital connectivity are mitigating these impacts. Thailand's robust economic outlook, strategic geographic positioning, and expanding middle-class consumer base ensure sustained growth for the CEP sector. Market segmentation allows for tailored service offerings, enhancing adaptability and competitiveness. Continuous investment in technology and network expansion by industry participants positions the Thailand CEP market for further advancement through innovation and strategic alliances.

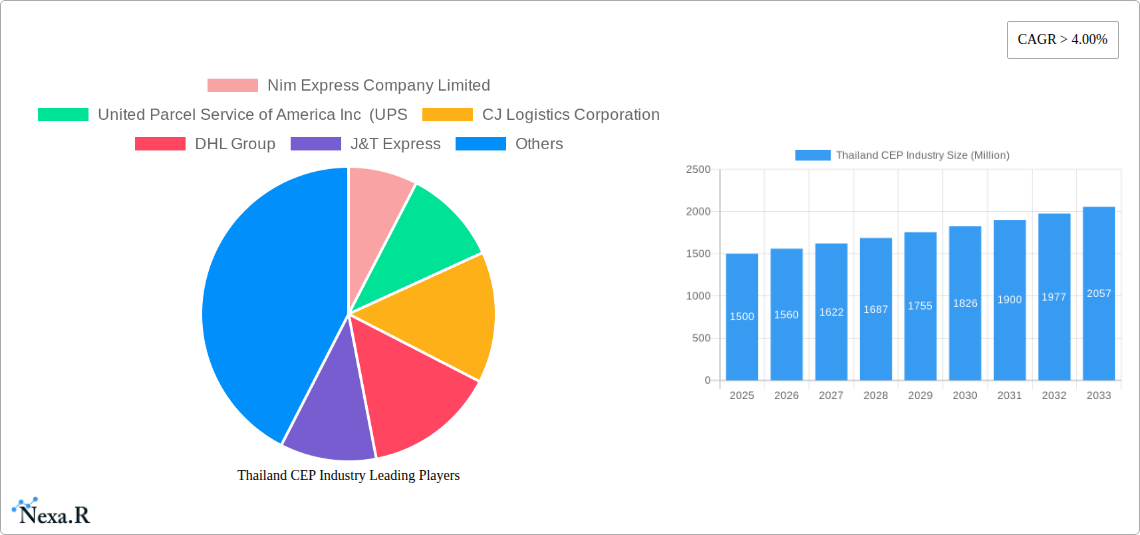

Thailand CEP Industry Company Market Share

Thailand CEP Industry Market Analysis: 2025-2033

This report offers an in-depth analysis of the Thailand CEP industry, detailing market dynamics, growth forecasts, and key participants. The analysis covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. This research is vital for industry stakeholders, investors, and businesses seeking to leverage opportunities in this dynamic market. The market is segmented by: mode of transport (air, road, others), end-user industry (e-commerce, BFSI, healthcare, manufacturing, primary industry, wholesale & retail trade, others), destination (domestic, international), speed of delivery (express, non-express), business model (B2B, B2C, C2C), and shipment weight (light, medium, heavy). Key market players analyzed include Nim Express Company Limited, UPS, CJ Logistics Corporation, DHL Group, J&T Express, Thailand Post, FedEx, SF Express (KEX-SF), Best Inc, Aqua Corporation (including Thai Parcel Public Company Limited), Flash Express, and JWD Group. The estimated market size in 2025 is $2.82 billion.

Thailand CEP Industry Market Dynamics & Structure

The Thai CEP industry is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is moderate, with a few major players dominating alongside numerous smaller, specialized businesses. Technological innovation, particularly in tracking, automation, and last-mile delivery solutions, is a key driver. The regulatory framework, while generally supportive of industry growth, presents certain compliance challenges. Competitive product substitutes, such as postal services and specialized delivery networks, exert influence. The expanding e-commerce sector significantly impacts end-user demographics, driving demand for faster and more reliable delivery services. Mergers and acquisitions (M&A) activity has been observed, albeit at a moderate pace, suggesting consolidation trends.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025).

- Technological Innovation: Significant investment in automation, route optimization software, and delivery tracking systems.

- Regulatory Framework: Generally supportive, but compliance requirements present challenges for smaller firms.

- Competitive Substitutes: Postal services and specialized delivery networks offer competition.

- End-User Demographics: Shift toward younger, digitally savvy consumers fuels demand for express delivery.

- M&A Activity: Moderate level of consolidation through strategic acquisitions (xx deals in the last 5 years).

Thailand CEP Industry Growth Trends & Insights

The Thai CEP industry exhibits robust growth driven by the burgeoning e-commerce sector and increasing consumer preference for fast and convenient delivery. Market size experienced a CAGR of xx% during 2019-2024, and is projected to reach xx Million units by 2025, with a forecast CAGR of xx% during 2025-2033. This growth is fueled by several factors, including rising disposable incomes, improved logistics infrastructure, and technological advancements. Market penetration rates for express delivery services are increasing, particularly in urban areas. The rise of mobile commerce is impacting consumer behavior, with a preference for same-day and next-day delivery gaining traction. Disruptive technologies, such as drone delivery and autonomous vehicles, are emerging, although widespread adoption is still limited due to regulatory factors and infrastructure limitations.

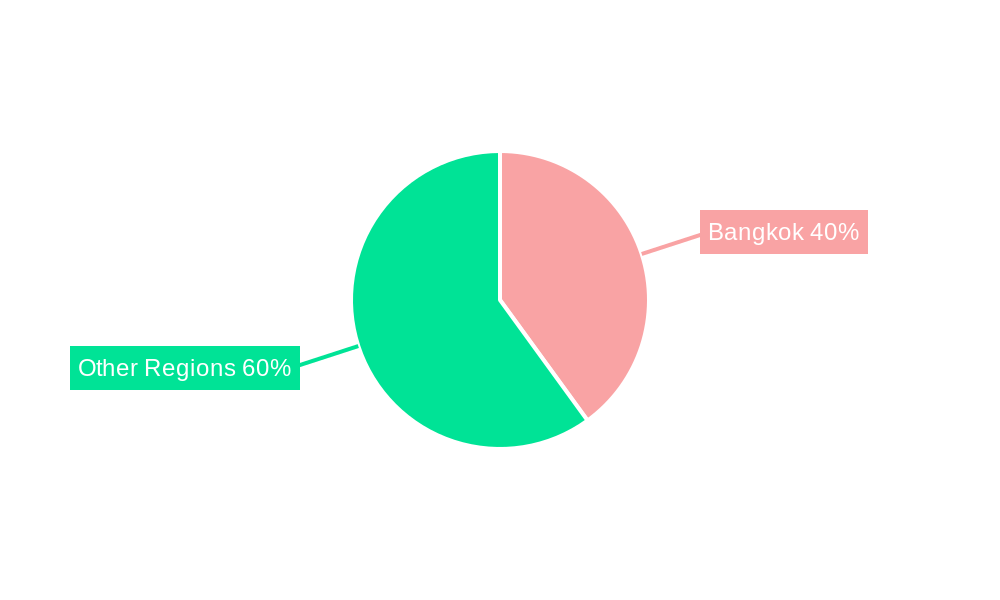

Dominant Regions, Countries, or Segments in Thailand CEP Industry

The Bangkok metropolitan area and other major urban centers dominate the Thailand CEP market, accounting for xx% of the total volume. The e-commerce segment is the largest end-user industry, with a market share of approximately xx% in 2025, followed by the wholesale and retail trade (offline) sector and BFSI. Domestic deliveries comprise the largest share of the market (xx%), driven by the booming e-commerce sector. Express delivery services hold the dominant position, accounting for xx% of the total volume, owing to consumer preference for faster delivery times. The B2C model constitutes the largest portion of the market (xx%), reflecting the substantial growth of online retail. Medium weight shipments represent the highest volume (xx%), indicating a balance between smaller and larger parcels.

- Key Growth Drivers:

- Rapid expansion of the e-commerce industry.

- Rising disposable incomes and increased consumer spending.

- Government initiatives to improve logistics infrastructure.

- Technological advancements in delivery management systems.

- Dominance Factors:

- Bangkok and major urban centers account for the majority of CEP volume.

- E-commerce and domestic deliveries dominate the market.

- Preference for express delivery drives segment dominance.

Thailand CEP Industry Product Landscape

The Thai CEP industry showcases a range of services, from standard express delivery to specialized options like temperature-controlled transportation for pharmaceuticals and oversized goods. Innovation is evident in real-time tracking capabilities, advanced routing algorithms, and integration with e-commerce platforms. Unique selling propositions include customizable delivery options, flexible pricing models, and robust customer support. The ongoing development of technologically advanced solutions is enhancing efficiency and customer experience within the industry.

Key Drivers, Barriers & Challenges in Thailand CEP Industry

Key Drivers: The burgeoning e-commerce sector, rising consumer spending, improving logistics infrastructure, and government support for the industry are key drivers of growth. Technological advancements in tracking, delivery management systems, and automated sorting facilities also significantly contribute.

Key Challenges & Restraints: High transportation costs due to fuel price volatility, traffic congestion in urban areas, and the need for last-mile delivery optimization pose challenges. Competition from established players and new entrants puts pressure on pricing and profitability. Regulatory changes and compliance requirements also impact the industry’s operating environment. For example, xx% of businesses faced delays due to regulatory compliance in 2024.

Emerging Opportunities in Thailand CEP Industry

Untapped markets in rural areas present significant expansion opportunities. The growing demand for specialized services like refrigerated transportation for the healthcare sector offers potential for innovation. Evolving consumer preferences towards sustainable and eco-friendly delivery options represent an avenue for differentiation and growth. The adoption of technologies like drones and autonomous vehicles offers further opportunities to improve efficiency and reduce delivery times, despite potential regulatory barriers.

Growth Accelerators in the Thailand CEP Industry

Technological breakthroughs in automation, AI-powered route optimization, and delivery management systems are crucial accelerators. Strategic partnerships between CEP providers and e-commerce platforms enhance reach and market share. Market expansion strategies, focusing on underserved regions and the development of specialized services, offer significant growth potential. The ongoing investment in logistics infrastructure by the government also boosts the industry's ability to expand its reach and capacity.

Key Players Shaping the Thailand CEP Industry Market

- Nim Express Company Limited

- United Parcel Service of America Inc (UPS)

- CJ Logistics Corporation

- DHL Group

- J&T Express

- Thailand Post

- FedEx

- SF Express (KEX-SF)

- Best Inc

- Aqua Corporation (including Thai Parcel Public Company Limited)

- Flash Express

- JWD Group

Notable Milestones in Thailand CEP Industry Sector

- November 2023: J&T Home partnered with SABUY SPEED, expanding its delivery network to over 22,000 branches nationwide.

- August 2023: Thailand Post partnered with The Transport Company Limited, increasing delivery capacity and reach.

- July 2023: J&T Express launched the "J&T HOME" project, expanding its parcel pick-up points throughout Thailand.

In-Depth Thailand CEP Industry Market Outlook

The Thai CEP industry is poised for sustained growth, driven by e-commerce expansion and technological advancements. Strategic partnerships, infrastructure development, and innovative service offerings will shape the future market landscape. The increasing adoption of technology, particularly in last-mile delivery solutions and automated systems, will enhance efficiency and reduce costs. Opportunities abound for companies that can adapt to evolving consumer preferences and leverage data-driven insights to optimize their operations. The market is expected to maintain a healthy growth trajectory throughout the forecast period (2025-2033).

Thailand CEP Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

Thailand CEP Industry Segmentation By Geography

- 1. Thailand

Thailand CEP Industry Regional Market Share

Geographic Coverage of Thailand CEP Industry

Thailand CEP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand CEP Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nim Express Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service of America Inc (UPS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CJ Logistics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J&T Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thailand Post

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FedEx

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SF Express (KEX-SF)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Best Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aqua Corporation (including Thai Parcel Public Company Limited)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Flash Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 JWD Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nim Express Company Limited

List of Figures

- Figure 1: Thailand CEP Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Thailand CEP Industry Share (%) by Company 2025

List of Tables

- Table 1: Thailand CEP Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Thailand CEP Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Thailand CEP Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 4: Thailand CEP Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: Thailand CEP Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Thailand CEP Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Thailand CEP Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Thailand CEP Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Thailand CEP Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Thailand CEP Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 11: Thailand CEP Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: Thailand CEP Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Thailand CEP Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Thailand CEP Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand CEP Industry?

The projected CAGR is approximately 7.16%.

2. Which companies are prominent players in the Thailand CEP Industry?

Key companies in the market include Nim Express Company Limited, United Parcel Service of America Inc (UPS, CJ Logistics Corporation, DHL Group, J&T Express, Thailand Post, FedEx, SF Express (KEX-SF), Best Inc, Aqua Corporation (including Thai Parcel Public Company Limited), Flash Express, JWD Group.

3. What are the main segments of the Thailand CEP Industry?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

November 2023: J&T Home has partnered with SABUY SPEED, a subsidiary of Sabai Technology Public Company Limited, to accept and deliver parcels throughout Thailand 365 days, excluding public holidays at affiliated stores including Shipsmile, Plus Express, The Letter Post, Point Express, Speedy, Payspost and Paypoint, more than 22,000 branches nationwide.August 2023: Thailand Post Company Limited partnered with The Transport Company Limited (Bor Kor Sor) to provide delivery and parcel delivery services. The amount of consignment and delivery continued to increase steadily due to expertise in routes, vehicles, technology, and information, including service points.July 2023: J&T Express is expanding its parcel pick-up point agents through the "J&T HOME" project. To expand the J&T Express service network to cover all areas throughout Thailand they are converting existing vacant space into a parcel pick-up service point and would provide parcel transportation services with the highest quality and potential. It also creates convenience for J&T Express users at branches near their homes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand CEP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand CEP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand CEP Industry?

To stay informed about further developments, trends, and reports in the Thailand CEP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence