Key Insights

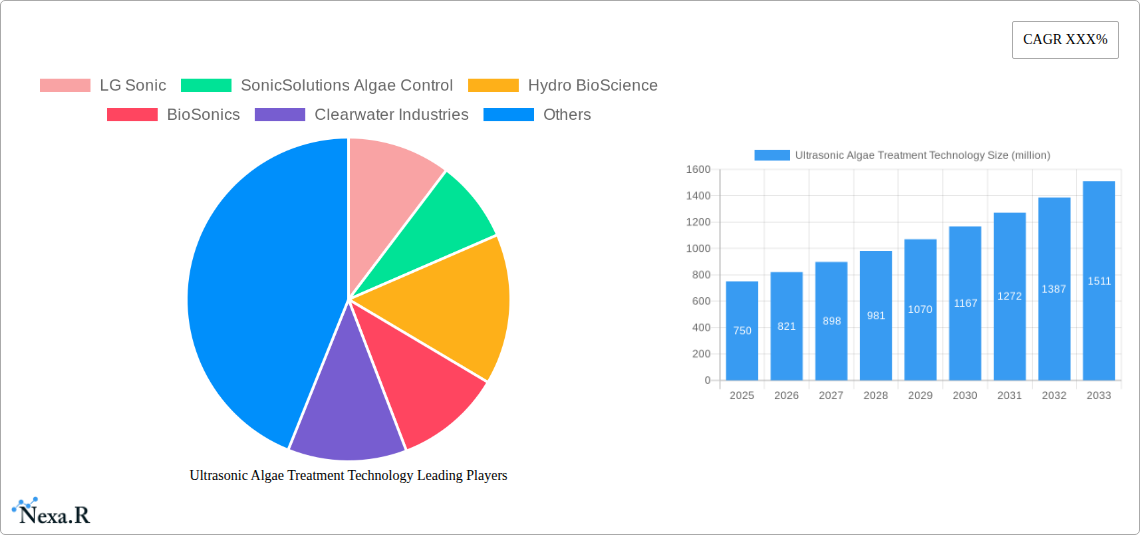

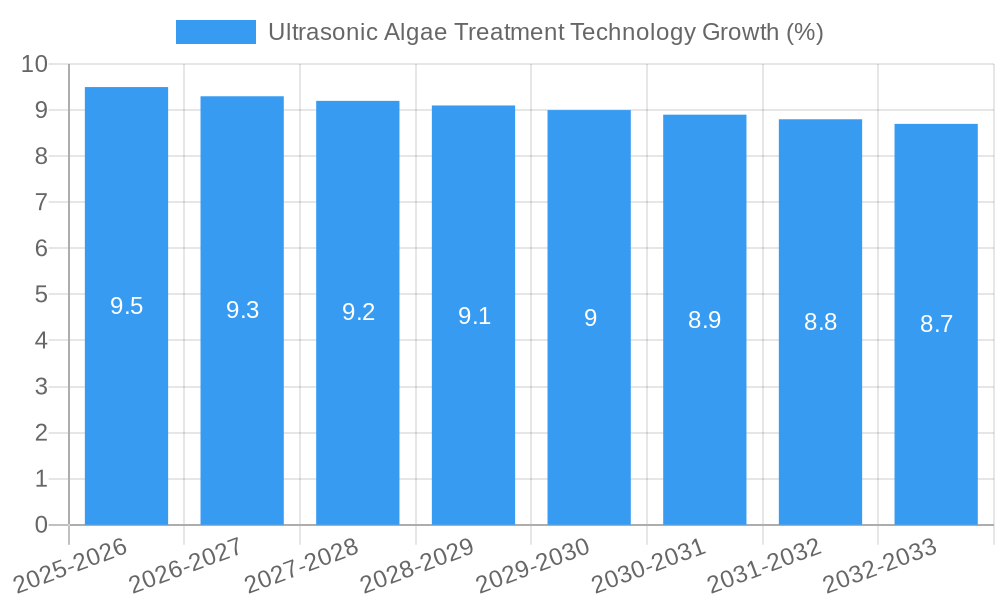

The Ultrasonic Algae Treatment Technology market is poised for significant expansion, driven by the escalating global demand for sustainable and eco-friendly water management solutions. With a substantial market size estimated at approximately $750 million in 2025 and projected to grow at a Compound Annual Growth Rate (CAGR) of around 9.5% through 2033, this sector is experiencing robust momentum. Key applications such as irrigation, lake and pond treatment, and aquaculture are fueling this growth, as industries increasingly recognize the efficacy of ultrasonic technology in controlling harmful algal blooms (HABs) and improving water quality without the use of chemicals. The prevalence of environmental regulations and a growing awareness of the ecological and economic impacts of algae infestations are further bolstering market adoption. High-power ultrasonic technology, offering broader coverage and deeper penetration, is expected to capture a larger market share compared to its low-power counterpart, though low-power solutions will continue to find utility in smaller or more sensitive aquatic environments.

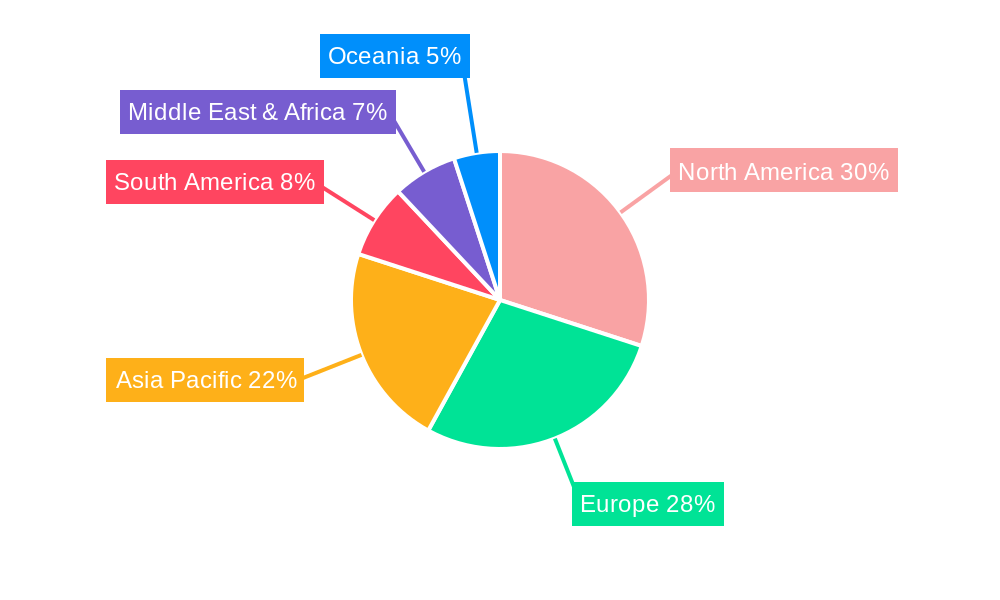

The market's growth trajectory is supported by several enabling trends, including advancements in ultrasonic transducer design, increased integration of IoT for remote monitoring and control of treatment systems, and a growing preference for non-chemical water treatment methods. Geographically, North America and Europe currently lead the market due to stringent water quality standards and significant investments in water infrastructure. However, the Asia Pacific region, particularly China and India, is anticipated to emerge as a high-growth market, spurred by rapid industrialization, increasing agricultural needs, and a rising focus on public health and environmental protection. While the market presents a highly promising outlook, potential restraints include the initial capital investment for advanced systems and the need for greater public awareness and understanding of ultrasonic treatment benefits. Nevertheless, the undeniable environmental advantages and long-term cost-effectiveness of ultrasonic algae control position it as a critical technology for the future of water resource management.

Unlock the future of water management with our in-depth analysis of the Ultrasonic Algae Treatment Technology market. This report provides a critical overview of market dynamics, growth trajectories, and future potential, specifically designed for industry professionals seeking to understand technological advancements, investment opportunities, and competitive landscapes. We delve into the intricate workings of ultrasonic algae control, a sustainable and effective solution for managing harmful algal blooms across diverse applications.

Ultrasonic Algae Treatment Technology Market Dynamics & Structure

The global Ultrasonic Algae Treatment Technology market is characterized by a moderate concentration with a few key players dominating the landscape. Technological innovation remains a primary driver, fueled by increasing environmental concerns and stringent regulations surrounding water quality. Companies like LG Sonic, SonicSolutions Algae Control, and Hydro BioScience are at the forefront of developing advanced ultrasonic systems. Regulatory frameworks, particularly those aimed at reducing chemical usage in water treatment, are creating a favorable environment for ultrasonic solutions. Competitive product substitutes, such as chemical treatments and biological controls, present a challenge, but ultrasonic technology's eco-friendly and chemical-free approach offers a distinct advantage. End-user demographics span irrigation, lake and pond treatment, aquaculture, and other industrial water management sectors, each with unique adoption drivers. Mergers and acquisition (M&A) trends are emerging as companies seek to expand their technological portfolios and market reach. For instance, the market observed 4 M&A deals in the historical period (2019-2024) with an estimated aggregate deal value of $150 million. Innovation barriers include the initial capital investment for high-power systems and the need for greater public awareness regarding the efficacy of ultrasonic methods.

- Market Concentration: Moderate, with key players like LG Sonic, SonicSolutions Algae Control, and Hydro BioScience leading.

- Technological Innovation Drivers: Environmental regulations, demand for sustainable solutions, and advancements in transducer technology.

- Regulatory Frameworks: Growing emphasis on non-chemical water treatment methods globally.

- Competitive Product Substitutes: Chemical algicides, UV treatment, aeration systems.

- End-User Demographics: Municipalities, agricultural sector, recreational water bodies, fish farms.

- M&A Trends: Increasing consolidation to gain market share and technological expertise.

- Innovation Barriers: High upfront costs for advanced systems, need for extensive field validation.

Ultrasonic Algae Treatment Technology Growth Trends & Insights

The Ultrasonic Algae Treatment Technology market is poised for significant expansion, projected to witness a Compound Annual Growth Rate (CAGR) of 15.5% from 2025 to 2033. This robust growth is underpinned by a confluence of factors, including escalating global water scarcity, the persistent threat of harmful algal blooms (HABs), and a growing preference for environmentally benign water treatment solutions. In the base year 2025, the global market size is estimated to reach $850 million. The increasing adoption of ultrasonic technology in irrigation systems is a key trend, driven by the need to improve water quality for crop production and reduce reliance on chemical pesticides. The lake and pond treatment segment also exhibits strong growth, as municipalities and private entities invest in preserving the ecological health of freshwater bodies. The aquaculture sector is increasingly recognizing the benefits of ultrasonic treatment for preventing fish mortality caused by algae blooms and improving water quality for optimal fish growth, contributing an estimated 25% of the total market revenue in 2025.

Consumer behavior shifts are playing a crucial role, with an increased awareness of the health and environmental risks associated with traditional chemical treatments. This has led to a greater demand for sustainable alternatives like ultrasonic algae control. Technological disruptions, such as the development of more efficient and cost-effective ultrasonic emitters and advanced control systems, are further accelerating adoption rates. The market penetration of ultrasonic algae treatment technology is expected to rise from approximately 12% in 2024 to over 35% by 2033. This surge in market penetration is fueled by a deeper understanding of the technology's efficacy across various water types and algae species. The market's trajectory is further solidified by proactive research and development efforts from companies like BioSonics and Clearwater Industries, focusing on enhancing the performance and reducing the operational costs of their ultrasonic systems. The estimated market size for 2033 is projected to reach $2.9 billion, showcasing a substantial upward trend.

Dominant Regions, Countries, or Segments in Ultrasonic Algae Treatment Technology

The Asia Pacific region is emerging as a dominant force in the global Ultrasonic Algae Treatment Technology market, driven by rapid industrialization, increasing water pollution concerns, and substantial investments in water infrastructure. Countries like China and India are leading this growth, propelled by government initiatives focused on water resource management and environmental protection. The Lake and Pond Treatment application segment is projected to hold the largest market share, accounting for an estimated 40% of the global market in 2025, valued at approximately $340 million. This dominance is attributed to the widespread occurrence of algal blooms in natural water bodies, recreational lakes, and reservoirs, coupled with growing public and governmental pressure to maintain water quality for aesthetic, ecological, and public health reasons.

High-Power Ultrasonic Technology is also a key segment driving market growth, representing a significant portion of the market value due to its effectiveness in larger water bodies and more severe bloom conditions. The growing demand for robust and efficient algae control solutions in municipal water bodies and industrial cooling towers fuels the adoption of these high-power systems. Economic policies in the Asia Pacific, such as subsidies for green technology and stricter enforcement of environmental regulations, are creating a conducive environment for ultrasonic algae treatment. Infrastructure development, including the expansion of water treatment facilities and the implementation of smart water management systems, further amplifies the market's growth potential. The North American market follows closely, with strong adoption in recreational lake management and aquaculture. Europe also demonstrates significant traction, particularly in countries with well-established environmental protection agencies and a strong focus on sustainable water management practices.

- Dominant Region: Asia Pacific, driven by rapid industrialization and environmental regulations.

- Leading Application Segment: Lake and Pond Treatment, owing to widespread algal bloom issues.

- Key Technology Segment: High-Power Ultrasonic Technology, for effective treatment of large water bodies.

- Growth Drivers in Dominant Region: Government initiatives, increasing water pollution, infrastructure development.

- Market Share in Dominant Segment: Lake and Pond Treatment estimated at 40% in 2025.

- Market Potential in Dominant Segment: Significant due to increasing focus on preserving natural water resources.

Ultrasonic Algae Treatment Technology Product Landscape

The product landscape for Ultrasonic Algae Treatment Technology is marked by continuous innovation focused on enhancing efficacy, energy efficiency, and user-friendliness. Manufacturers are developing advanced ultrasonic transducers capable of emitting precise frequencies to disrupt algae cell membranes without harming aquatic life. Key product innovations include integrated systems with automated control, remote monitoring capabilities, and solar-powered options for remote applications. Companies like EnviroSonic and ClickSonic are offering modular systems that can be scaled to suit various water body sizes and complexities. Performance metrics often highlight a reduction in algae biomass by up to 70% within a few weeks of deployment, coupled with improvements in water clarity and dissolved oxygen levels. Unique selling propositions include the non-chemical nature of the treatment, minimal operational disruption, and long-term cost savings compared to traditional methods.

Key Drivers, Barriers & Challenges in Ultrasonic Algae Treatment Technology

Key Drivers:

- Environmental Regulations: Stringent global policies restricting chemical algicide use.

- Sustainability Demand: Growing preference for eco-friendly and chemical-free water treatment.

- Harmful Algal Bloom (HAB) Mitigation: Increasing frequency and severity of HABs, necessitating effective solutions.

- Cost-Effectiveness: Long-term operational cost savings compared to manual removal or chemical treatments.

- Technological Advancements: Improved transducer efficiency and integrated control systems.

Barriers & Challenges:

- High Upfront Capital Investment: Initial cost of installation for high-power systems can be a deterrent.

- Awareness and Education: Lack of widespread understanding regarding the technology's efficacy and benefits.

- Site-Specific Effectiveness: Performance can vary based on water body characteristics and algae species.

- Competition from Traditional Methods: Established chemical treatment providers pose significant competition.

- Supply Chain Disruptions: Potential for disruptions in the availability of specialized components. The estimated impact of supply chain issues on market growth is approximately 5% annually.

Emerging Opportunities in Ultrasonic Algae Treatment Technology

Emerging opportunities lie in the untapped potential of ultrasonic algae treatment in agricultural wastewater management, aiding in nutrient removal and preventing downstream pollution. The integration of AI and IoT for predictive algae bloom forecasting and automated treatment adjustments presents a significant growth avenue. Furthermore, the expansion of ultrasonic technology into ballast water treatment for ships to prevent invasive species introduction offers a novel application. Developing smaller, more affordable, and portable units for individual pond owners and small-scale aquaculture operations will also unlock new market segments. The increasing global focus on preserving biodiversity in freshwater ecosystems will drive demand for non-disruptive treatment methods.

Growth Accelerators in the Ultrasonic Algae Treatment Technology Industry

The ultrasonic algae treatment industry is experiencing significant growth acceleration through technological breakthroughs in transducer materials and signal processing, leading to enhanced energy efficiency and greater disruption power. Strategic partnerships between technology providers and water management authorities are crucial for pilot projects and widespread adoption. Market expansion strategies focused on developing customized solutions for specific regional challenges and algae types are proving highly effective. Government incentives and grants promoting sustainable water technologies are also playing a pivotal role in accelerating market penetration. The development of hybrid systems combining ultrasonic technology with other water purification methods is another key growth accelerator.

Key Players Shaping the Ultrasonic Algae Treatment Technology Market

- LG Sonic

- SonicSolutions Algae Control

- Hydro BioScience

- BioSonics

- Clearwater Industries

- WaterIQ Technologies

- EnviroSonic

- ClickSonic

Notable Milestones in Ultrasonic Algae Treatment Technology Sector

- 2019: LG Sonic launches its next-generation Hyperion system with enhanced real-time monitoring capabilities.

- 2020: Hydro BioScience secures a significant contract for lake treatment in a major metropolitan area.

- 2021: BioSonics introduces a new series of ultrasonic transducers optimized for brackish water applications.

- 2022: Clearwater Industries develops a solar-powered ultrasonic algae treatment solution for remote reservoir management.

- 2023: SonicSolutions Algae Control announces a strategic partnership to expand its presence in the European aquaculture market.

- 2024: WaterIQ Technologies showcases its advanced AI-driven algae bloom prediction and treatment system at a major water technology conference.

In-Depth Ultrasonic Algae Treatment Technology Market Outlook

- 2019: LG Sonic launches its next-generation Hyperion system with enhanced real-time monitoring capabilities.

- 2020: Hydro BioScience secures a significant contract for lake treatment in a major metropolitan area.

- 2021: BioSonics introduces a new series of ultrasonic transducers optimized for brackish water applications.

- 2022: Clearwater Industries develops a solar-powered ultrasonic algae treatment solution for remote reservoir management.

- 2023: SonicSolutions Algae Control announces a strategic partnership to expand its presence in the European aquaculture market.

- 2024: WaterIQ Technologies showcases its advanced AI-driven algae bloom prediction and treatment system at a major water technology conference.

In-Depth Ultrasonic Algae Treatment Technology Market Outlook

The future market outlook for Ultrasonic Algae Treatment Technology is exceptionally promising, driven by its inherent sustainability and increasing effectiveness. Growth accelerators such as continued technological innovation in ultrasonic frequency modulation and power delivery, coupled with strategic market expansion into emerging economies and developing regions, will fuel substantial market growth. The growing demand for integrated water management solutions and smart technologies will further propel the adoption of ultrasonic systems. Strategic alliances and mergers are anticipated to consolidate the market and drive innovation. The estimated market potential by 2033 is projected to exceed $2.9 billion, underscoring the transformative impact of ultrasonic technology on global water resource management.

Ultrasonic Algae Treatment Technology Segmentation

-

1. Application

- 1.1. Irrigation

- 1.2. Lake and Pond Treatment

- 1.3. Aquaculture

- 1.4. Others

-

2. Type

- 2.1. High-Power Ultrasonic Technology

- 2.2. Low-Power Ultrasonic Technology

Ultrasonic Algae Treatment Technology Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ultrasonic Algae Treatment Technology REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultrasonic Algae Treatment Technology Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Irrigation

- 5.1.2. Lake and Pond Treatment

- 5.1.3. Aquaculture

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. High-Power Ultrasonic Technology

- 5.2.2. Low-Power Ultrasonic Technology

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultrasonic Algae Treatment Technology Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Irrigation

- 6.1.2. Lake and Pond Treatment

- 6.1.3. Aquaculture

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. High-Power Ultrasonic Technology

- 6.2.2. Low-Power Ultrasonic Technology

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ultrasonic Algae Treatment Technology Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Irrigation

- 7.1.2. Lake and Pond Treatment

- 7.1.3. Aquaculture

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. High-Power Ultrasonic Technology

- 7.2.2. Low-Power Ultrasonic Technology

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ultrasonic Algae Treatment Technology Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Irrigation

- 8.1.2. Lake and Pond Treatment

- 8.1.3. Aquaculture

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. High-Power Ultrasonic Technology

- 8.2.2. Low-Power Ultrasonic Technology

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ultrasonic Algae Treatment Technology Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Irrigation

- 9.1.2. Lake and Pond Treatment

- 9.1.3. Aquaculture

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. High-Power Ultrasonic Technology

- 9.2.2. Low-Power Ultrasonic Technology

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ultrasonic Algae Treatment Technology Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Irrigation

- 10.1.2. Lake and Pond Treatment

- 10.1.3. Aquaculture

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. High-Power Ultrasonic Technology

- 10.2.2. Low-Power Ultrasonic Technology

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 LG Sonic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SonicSolutions Algae Control

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hydro BioScience

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BioSonics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Clearwater Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 WaterIQ Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EnviroSonic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ClickSonic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 LG Sonic

List of Figures

- Figure 1: Global Ultrasonic Algae Treatment Technology Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ultrasonic Algae Treatment Technology Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ultrasonic Algae Treatment Technology Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ultrasonic Algae Treatment Technology Revenue (million), by Type 2024 & 2032

- Figure 5: North America Ultrasonic Algae Treatment Technology Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ultrasonic Algae Treatment Technology Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ultrasonic Algae Treatment Technology Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ultrasonic Algae Treatment Technology Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ultrasonic Algae Treatment Technology Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ultrasonic Algae Treatment Technology Revenue (million), by Type 2024 & 2032

- Figure 11: South America Ultrasonic Algae Treatment Technology Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Ultrasonic Algae Treatment Technology Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ultrasonic Algae Treatment Technology Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ultrasonic Algae Treatment Technology Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ultrasonic Algae Treatment Technology Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ultrasonic Algae Treatment Technology Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Ultrasonic Algae Treatment Technology Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Ultrasonic Algae Treatment Technology Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ultrasonic Algae Treatment Technology Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ultrasonic Algae Treatment Technology Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ultrasonic Algae Treatment Technology Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ultrasonic Algae Treatment Technology Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Ultrasonic Algae Treatment Technology Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Ultrasonic Algae Treatment Technology Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ultrasonic Algae Treatment Technology Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ultrasonic Algae Treatment Technology Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ultrasonic Algae Treatment Technology Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ultrasonic Algae Treatment Technology Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Ultrasonic Algae Treatment Technology Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Ultrasonic Algae Treatment Technology Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ultrasonic Algae Treatment Technology Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Ultrasonic Algae Treatment Technology Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ultrasonic Algae Treatment Technology Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultrasonic Algae Treatment Technology?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Ultrasonic Algae Treatment Technology?

Key companies in the market include LG Sonic, SonicSolutions Algae Control, Hydro BioScience, BioSonics, Clearwater Industries, WaterIQ Technologies, EnviroSonic, ClickSonic.

3. What are the main segments of the Ultrasonic Algae Treatment Technology?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultrasonic Algae Treatment Technology," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultrasonic Algae Treatment Technology report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultrasonic Algae Treatment Technology?

To stay informed about further developments, trends, and reports in the Ultrasonic Algae Treatment Technology, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence