Key Insights

The United States e-cigarette market, a significant segment of the global industry, is experiencing robust growth, fueled by evolving consumer preferences and technological advancements. With a global market size of $34.49 billion in 2025 and a Compound Annual Growth Rate (CAGR) of 13.72%, the US market, being a major consumer, is projected to represent a substantial portion of this figure. The market is segmented by product type (completely disposable models, rechargeable but disposable cartomizers, and personalized vaporizers), battery mode (automatic and manual e-cigarettes), and distribution channel (offline and online retail). The popularity of disposable e-cigarettes, driven by convenience and affordability, is a significant growth driver. Simultaneously, increasing health concerns regarding vaping, particularly amongst young adults, and stringent regulatory measures represent key market restraints. However, the emergence of innovative product features, including improved flavor profiles and advanced battery technology, are counterbalancing these challenges and stimulating market expansion. Leading players like Juul Labs, NJOY, and major tobacco companies such as British American Tobacco and Philip Morris International are actively shaping market dynamics through product innovation, aggressive marketing strategies, and strategic acquisitions.

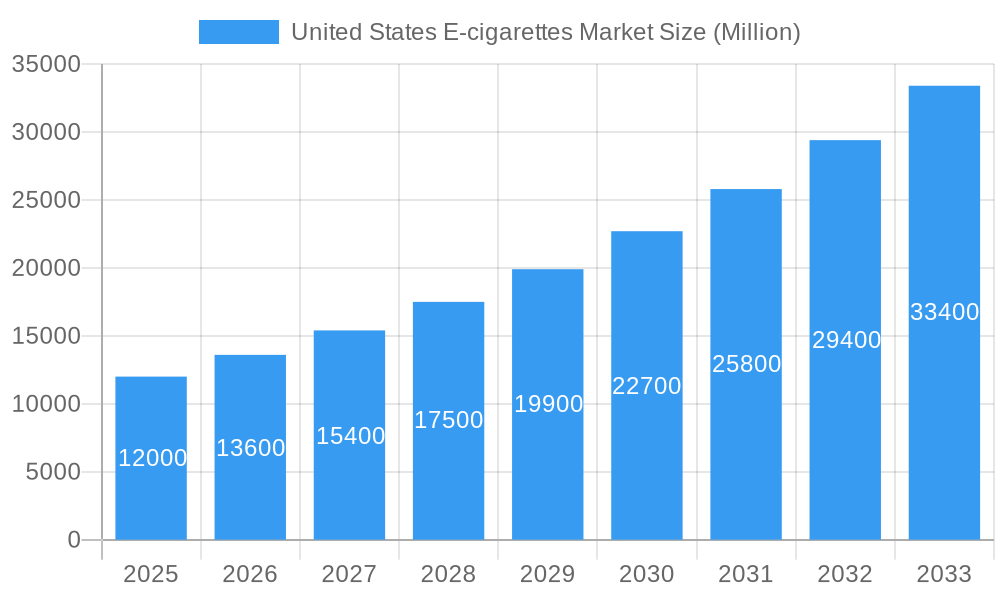

United States E-cigarettes Market Market Size (In Billion)

The competitive landscape is marked by both established players and emerging startups vying for market share. The online retail channel contributes significantly to overall sales, driven by ease of access and broader product availability. The forecast period (2025-2033) anticipates continued growth, though the pace may moderate due to ongoing regulatory scrutiny and evolving public perception. Specific growth rates within the US market will depend on the evolution of consumer preferences, governmental policies regarding vaping products, and the success of new product launches. The market is also anticipated to see a shift towards more sophisticated and personalized devices, catering to the growing demand for customized vaping experiences. This includes innovations in both hardware and e-liquids. A successful strategy within the US e-cigarette market requires careful navigation of regulatory frameworks, targeted marketing campaigns that address consumer concerns, and a commitment to responsible product innovation.

United States E-cigarettes Market Company Market Share

United States E-cigarettes Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States e-cigarettes market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report segments the market by product type (Completely Disposable Model, Rechargeable but Disposable Cartomizer, Personalized Vaporizer), battery mode (Automatic E-cigarettes, Manual E-cigarettes), and distribution channel (Offline Retail, Online Retail). Key players analyzed include BOTS Inc, JWEI Group, British American Tobacco PLC, Philip Morris International Inc, Intelligent Cigarettes, Nicoventures Trading Limited, Japan Tobacco Inc, NJOY Inc, Imperial Brands PLC, and Juul Labs Inc. This report is an invaluable resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this dynamic market. The total market size in 2025 is estimated at xx Million units.

United States E-cigarettes Market Dynamics & Structure

The US e-cigarette market is characterized by intense competition, rapid technological innovation, and evolving regulatory landscapes. Market concentration is moderate, with several major players holding significant shares, but a sizable number of smaller companies also vying for market position. Technological advancements, particularly in battery technology, flavor delivery systems, and device design, are key drivers of market growth. However, stringent regulations, including those related to nicotine content, marketing, and sales to minors, pose significant challenges. The market also faces competition from traditional cigarettes and other nicotine delivery systems.

- Market Concentration: Moderate, with top 5 players holding approximately xx% of market share in 2025.

- Technological Innovation: Focus on improved battery life, flavor customization, and discreet device designs.

- Regulatory Framework: Stringent regulations impacting marketing, sales, and product composition.

- Competitive Substitutes: Traditional cigarettes, nicotine pouches, and other smokeless tobacco products.

- End-User Demographics: Primarily young adults and adult smokers seeking alternatives to traditional cigarettes.

- M&A Trends: Significant M&A activity observed, driven by expansion strategies and consolidation efforts (e.g., Philip Morris' acquisition of Swedish Match). xx M&A deals were recorded in the historical period.

United States E-cigarettes Market Growth Trends & Insights

The US e-cigarette market demonstrated significant growth from 2019 to 2024, achieving a Compound Annual Growth Rate (CAGR) of [Insert Precise CAGR Percentage]%. This expansion was fueled by rising awareness of potential health advantages over traditional cigarettes, evolving consumer preferences, and the introduction of innovative product designs. However, recent growth has moderated due to intensified regulatory scrutiny and ongoing concerns regarding the long-term health effects of vaping. Market penetration reached an estimated [Insert Precise Percentage]% in 2025, indicating substantial untapped potential across various segments and geographic regions. The market landscape has been significantly reshaped by technological advancements, particularly the rise of disposable vape devices, impacting consumer behavior and preferences towards convenient and discreet vaping options. The projected CAGR for 2025-2033 is [Insert Precise CAGR Percentage]%, driven by sustained e-cigarette adoption, the emergence of novel product categories, and market expansion into underserved demographics. This growth will be influenced by factors such as evolving consumer preferences, technological innovations, and the regulatory environment.

Dominant Regions, Countries, or Segments in United States E-cigarettes Market

The US e-cigarette market is geographically diverse, with significant variations in growth rates and adoption across different states. California and New York, due to their large populations and established retail networks, are currently the leading states. However, growth is also strong in other states with less stringent regulations. Among the product segments, the Completely Disposable Model currently holds the largest market share (xx% in 2025), driven by its convenience and affordability. Online retail channels are also experiencing rapid growth, exceeding offline channels in some areas.

- Leading Regions: California, New York, and Texas exhibit the highest market growth and penetration.

- Dominant Product Type: Completely Disposable Models lead due to convenience and low price point.

- Fastest Growing Segment: Online Retail is experiencing rapid growth driven by convenience and accessibility.

- Key Growth Drivers: Rising disposable incomes in certain areas and increasing awareness of e-cigarettes as harm reduction tools.

United States E-cigarettes Market Product Landscape

The e-cigarette market is characterized by a diverse range of products, each distinguished by unique designs, functionalities, and flavor profiles. Key advancements include refined battery technology enhancing longevity and portability, sophisticated flavor delivery systems providing more nuanced taste experiences, and innovative device designs prioritizing user experience and discretion. Manufacturers are increasingly focusing on unique selling propositions (USPs) that offer customized vaping experiences tailored to individual preferences, emphasizing enhanced user convenience and discretion. Performance metrics continue to be crucial, with manufacturers focusing on improvements in battery life, vapor production, and flavor consistency. The market is seeing a trend toward smaller, more discreet devices, as well as a greater variety of flavors and nicotine strengths.

Key Drivers, Barriers & Challenges in United States E-cigarettes Market

Key Drivers: Increasing consumer awareness of e-cigarettes as a potentially less harmful alternative to traditional smoking, technological innovations leading to improved product features, and expanding distribution networks.

Challenges: Stringent regulations concerning nicotine content, marketing restrictions, taxation, and concerns over the potential long-term health impacts of vaping are major obstacles. Supply chain disruptions, including delays in the procurement of components and manufacturing capacity constraints, have had a noticeable impact on product availability and pricing. These issues have contributed to market volatility and have hindered the growth projections by approximately xx Million units.

Emerging Opportunities in United States E-cigarettes Market

Significant untapped opportunities exist in expanding into underserved demographics, developing and marketing nicotine-free alternatives incorporating health-promoting components (such as vitamins or herbal extracts), and creating personalized vaping experiences through AI-powered devices and data-driven customization. The exploration of innovative applications, including the potential use of e-cigarettes for targeted drug delivery or as advanced nicotine cessation aids, presents promising new market avenues. The increasing consumer demand for sustainable and environmentally friendly products presents a key opportunity for manufacturers to develop and promote eco-conscious vaping devices and packaging.

Growth Accelerators in the United States E-cigarettes Market Industry

Technological breakthroughs, strategic collaborations (especially between e-cigarette companies and pharmaceutical firms for cessation programs), and market expansion into international territories are anticipated to be key catalysts for sustained growth. Efforts to improve public perception and address health concerns are also crucial growth drivers.

Key Players Shaping the United States E-cigarettes Market Market

- British American Tobacco PLC

- Philip Morris International Inc

- Japan Tobacco Inc

- Imperial Brands PLC

- BOTS Inc

- JWEI Group

- Intelligent Cigarettes

- Nicoventures Trading Limited

- NJOY Inc

- Juul Labs Inc

Notable Milestones in United States E-cigarettes Market Sector

- November 2022: R.J. Reynolds Tobacco Company patents composite tobacco-containing materials for "smokeless" consumption, signaling ongoing innovation in alternative tobacco products.

- November 2022: Philip Morris's acquisition of 93% of Swedish Match positions them to significantly expand within the US reduced-risk products market and compete more effectively.

- June 2022: Japan Tobacco Inc.'s patent application for a flavor inhaler smoking system highlights the continued development of novel e-cigarette technology and designs.

- [Add another significant milestone here, with date and brief description]

In-Depth United States E-cigarettes Market Market Outlook

The future of the US e-cigarette market holds significant potential. Continued technological advancements, strategic partnerships, and a more nuanced regulatory environment will shape market growth. The focus on harm reduction and the development of innovative product categories will drive market expansion, with significant opportunities for companies that can effectively adapt to evolving consumer preferences and regulatory landscapes. The predicted market size by 2033 will be xx Million units.

United States E-cigarettes Market Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-cigarettes

- 2.2. Manual E-cigarettes

-

3. Distribution Channel

- 3.1. Offline Retail

- 3.2. Online Retail

United States E-cigarettes Market Segmentation By Geography

- 1. United States

United States E-cigarettes Market Regional Market Share

Geographic Coverage of United States E-cigarettes Market

United States E-cigarettes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism

- 3.3. Market Restrains

- 3.3.1. Presence of counterfeit products

- 3.4. Market Trends

- 3.4.1. Increasing Health Concern Among Smoking Population Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States E-cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-cigarettes

- 5.2.2. Manual E-cigarettes

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail

- 5.3.2. Online Retail

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BOTS Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JWEI Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 British American Tobacco PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Philip Morris International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Intelligent Cigarettes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nicoventures Trading Limited*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Japan Tobacco Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NJOY Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Imperial Brands PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Juul Labs Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BOTS Inc

List of Figures

- Figure 1: United States E-cigarettes Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States E-cigarettes Market Share (%) by Company 2025

List of Tables

- Table 1: United States E-cigarettes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States E-cigarettes Market Revenue Million Forecast, by Battery Mode 2020 & 2033

- Table 3: United States E-cigarettes Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States E-cigarettes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States E-cigarettes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: United States E-cigarettes Market Revenue Million Forecast, by Battery Mode 2020 & 2033

- Table 7: United States E-cigarettes Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: United States E-cigarettes Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States E-cigarettes Market?

The projected CAGR is approximately 13.72%.

2. Which companies are prominent players in the United States E-cigarettes Market?

Key companies in the market include BOTS Inc, JWEI Group, British American Tobacco PLC, Philip Morris International Inc, Intelligent Cigarettes, Nicoventures Trading Limited*List Not Exhaustive, Japan Tobacco Inc, NJOY Inc, Imperial Brands PLC, Juul Labs Inc.

3. What are the main segments of the United States E-cigarettes Market?

The market segments include Product Type, Battery Mode, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism.

6. What are the notable trends driving market growth?

Increasing Health Concern Among Smoking Population Drives the Market.

7. Are there any restraints impacting market growth?

Presence of counterfeit products.

8. Can you provide examples of recent developments in the market?

November 2022: A patent for composite tobacco-containing materials from R.J. Reynolds Tobacco Company shows that tobacco can be consumed in a reportedly "smokeless" form. The use of smokeless tobacco products often involves placing processed tobacco or a formulation containing tobacco in the user's mouth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States E-cigarettes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States E-cigarettes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States E-cigarettes Market?

To stay informed about further developments, trends, and reports in the United States E-cigarettes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence