Key Insights

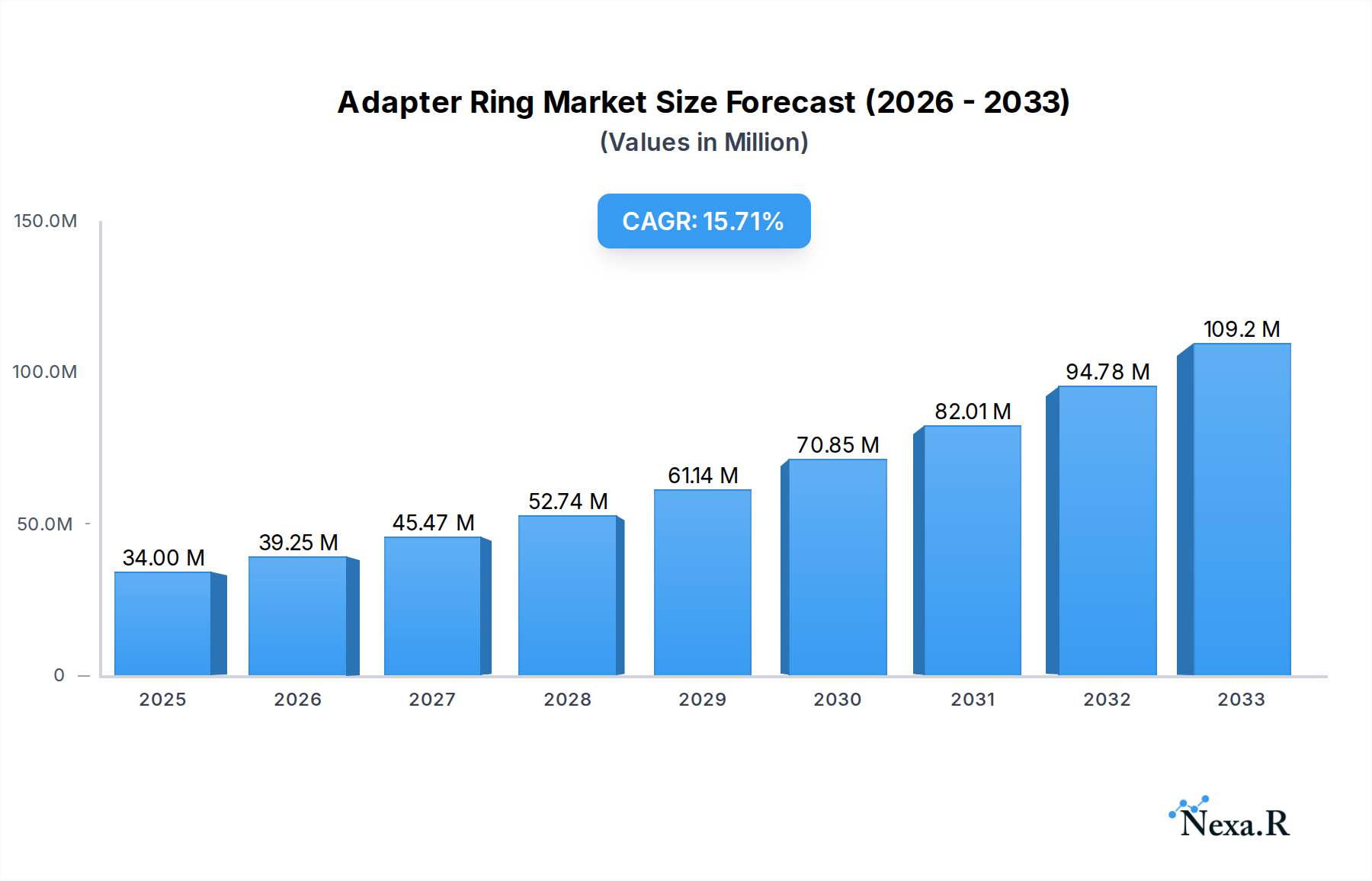

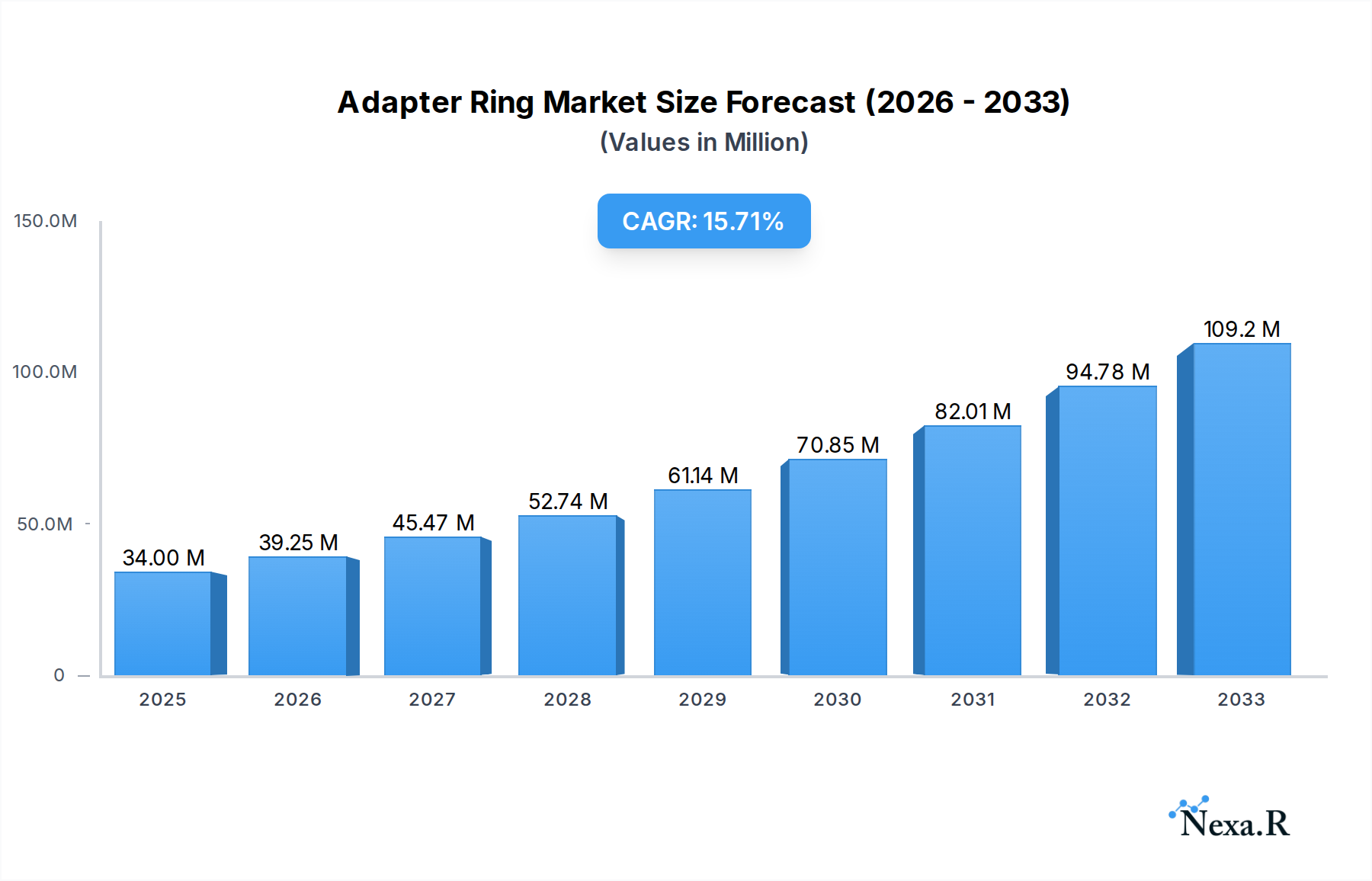

The global adapter ring market is poised for significant expansion, projected to reach $34 million in 2025 and grow at a robust CAGR of 15.6% through 2033. This impressive growth is propelled by several key drivers, including the burgeoning demand for interchangeable lens cameras among both professional photographers and hobbyists seeking greater creative control. The increasing popularity of vlogging, content creation, and professional photography, particularly in the individual and photo studio segments, fuels the need for versatile lens adaptation. Furthermore, advancements in camera technology and the continuous release of new lens systems necessitate adapter rings to ensure backward compatibility and expand lens options. The market is witnessing a surge in demand for both step-up and step-down adapter rings, catering to diverse needs such as fitting larger filters onto smaller lenses or adapting lenses with different thread sizes. This dynamic landscape presents substantial opportunities for market players.

Adapter Ring Market Size (In Million)

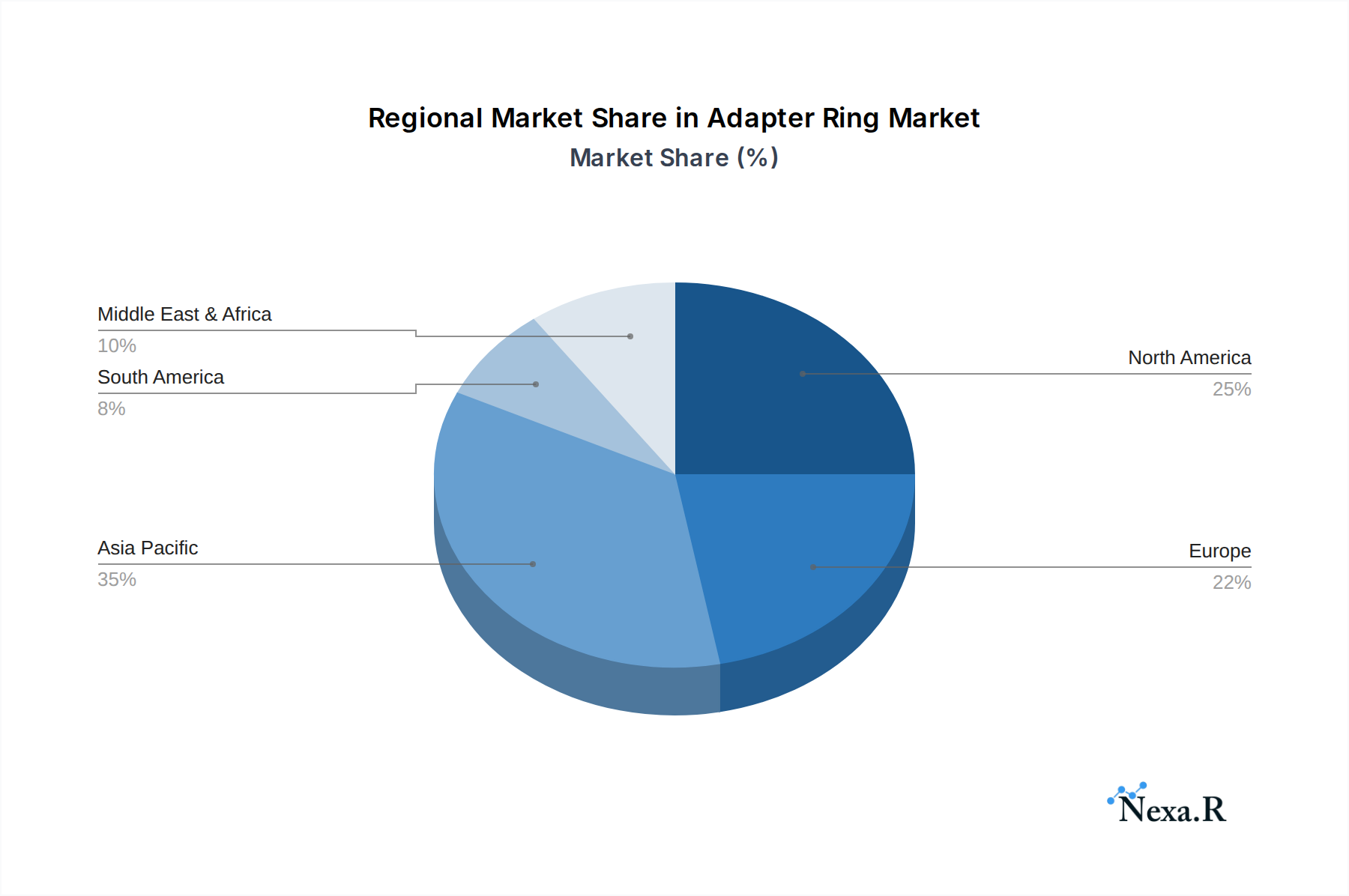

The adapter ring market is characterized by a dynamic ecosystem with a wide array of established and emerging companies, including K and F CONCEPT, Lee Filters, Cokin, and Haida, all actively innovating and competing to capture market share. Key trends include the development of high-quality, durable, and precise adapter rings that minimize light loss and distortion, as well as the integration of smart features and advanced materials. The growing influence of e-commerce platforms has also made these products more accessible to a global audience. While the market exhibits strong growth potential, certain restraints, such as the high cost of some premium adapter rings and the potential for compatibility issues with certain niche lens-camera combinations, need to be addressed. However, the overall outlook remains exceptionally positive, driven by the relentless pursuit of photographic excellence and the ever-expanding creative possibilities offered by adaptable lens systems across diverse geographical regions like Asia Pacific, North America, and Europe.

Adapter Ring Company Market Share

Comprehensive Adapter Ring Market Report: Analysis, Trends, and Future Outlook (2019-2033)

This in-depth report provides a thorough analysis of the global adapter ring market, covering its structure, growth trajectories, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and future outlook. Spanning the historical period of 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, this report offers invaluable insights for industry professionals, manufacturers, and investors navigating the evolving adapter ring ecosystem. We delve into market dynamics, technological innovations, and consumer behavior shifts, presenting quantitative data in millions of units and qualitative factors to shape strategic decision-making.

Adapter Ring Market Dynamics & Structure

The adapter ring market exhibits a moderate to high concentration, with a blend of established global players and emerging niche manufacturers. Technological innovation is a primary driver, fueled by advancements in lens manufacturing, camera sensor technology, and the increasing demand for vintage and specialized lens compatibility. Regulatory frameworks are generally minimal, primarily focused on product safety and material compliance. Competitive product substitutes are limited, with the core function of adapter rings being highly specialized. End-user demographics are diverse, encompassing professional photographers, videographers, hobbyists, and enthusiasts seeking creative flexibility. Mergers and acquisitions (M&A) activity is moderate, driven by companies aiming to expand their product portfolios, gain market share, or integrate complementary technologies. The market is characterized by a continuous drive for precision engineering, material durability, and seamless integration between camera bodies and lenses. Innovations in lightweight yet robust materials, such as high-grade aluminum alloys and advanced plastics, are crucial for performance and user experience. The growing trend of mirrorless cameras has significantly amplified the need for adapter rings to facilitate the use of legacy DSLR lenses, contributing to market expansion.

- Market Concentration: Moderate to High, with key players holding substantial market share.

- Technological Innovation Drivers: Lens Mount Compatibility, Mirrorless Camera Adoption, Advanced Material Science.

- Regulatory Frameworks: Product Safety Standards, Material Composition Guidelines.

- Competitive Product Substitutes: Minimal direct substitutes; focus on quality and functionality.

- End-User Demographics: Professional Photographers, Videographers, Hobbyists, Content Creators.

- M&A Trends: Strategic acquisitions for product line expansion and technology integration.

Adapter Ring Growth Trends & Insights

The adapter ring market is poised for robust growth, driven by a confluence of technological advancements and evolving user preferences. The market size is projected to reach approximately $1,500 million units by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of around 7.5% from the base year of 2025. This expansion is primarily attributed to the burgeoning adoption of mirrorless camera systems globally. As manufacturers continue to introduce new mirrorless camera bodies, the demand for adapter rings to utilize existing DSLR lens collections surges. Furthermore, the resurgence of analog photography and the increasing popularity of vintage lenses among creative professionals and enthusiasts further fuel market penetration. Technological disruptions, such as the development of smart adapter rings with electronic capabilities for autofocus and aperture control, are enhancing user experience and driving adoption. Consumer behavior is shifting towards greater experimentation and customization, with photographers actively seeking ways to expand their lens options and achieve unique visual aesthetics. The increasing accessibility of high-quality imaging equipment, coupled with the affordability of adapter rings compared to purchasing entirely new lens systems, makes them an attractive investment for a wide spectrum of users. The rise of social media platforms has also contributed to this trend, with creators showcasing diverse lens effects achieved through adapter rings, inspiring a wider audience. The continuous innovation in lens mount designs and the interoperability challenges between different camera and lens manufacturers ensure a sustained demand for adapter solutions. The market penetration is expected to reach approximately 65% of active camera users by the end of the forecast period.

Dominant Regions, Countries, or Segments in Adapter Ring

The Individual application segment is currently the dominant force in the global adapter ring market, accounting for an estimated 55% of the total market share by volume in 2025. This dominance is propelled by a confluence of factors including the widespread adoption of mirrorless cameras by amateur photographers and hobbyists, the growing interest in vintage lens experimentation, and the desire for creative flexibility among content creators and social media influencers. North America and Europe represent the leading regional markets for adapter rings, driven by a strong photographic culture, a high disposable income, and a technologically savvy consumer base. In North America, the United States stands out as a key country due to its vast photography enthusiast community and the presence of major camera manufacturers and retailers. Europe's strong tradition in filmmaking and fine art photography also contributes to a consistent demand for specialized lens accessories like adapter rings.

Within the Type segment, Step up Adapter Rings are projected to experience a slightly higher growth rate than Step down Adapter Rings during the forecast period, driven by the increasing trend of using larger, older lenses on smaller sensor mirrorless cameras. This allows photographers to achieve wider effective focal lengths and distinct bokeh characteristics. However, Step down adapter rings remain a significant market segment, facilitating the use of smaller, more affordable lenses on larger sensor cameras.

- Dominant Application Segment: Individual (Estimated 55% market share by volume in 2025).

- Key Drivers: Mirrorless camera adoption by amateurs, vintage lens popularity, content creator demand, enhanced creative control.

- Market Potential: Continued growth due to increasing smartphone photography sophistication and the desire for professional-grade imaging.

- Leading Regions: North America and Europe.

- North America: Strong consumer base, advanced photography market, high disposable income.

- Europe: Rich photographic heritage, demand for specialized equipment, artistic communities.

- Dominant Country (within leading regions): United States (North America).

- Drivers: Large photography enthusiast population, active online communities, retail presence.

- Dominant Type Segment (Growth Potential): Step up Adapter Rings.

- Drivers: Utilizing vintage lenses on mirrorless cameras, achieving unique optical effects, expanding focal range.

- Significant Type Segment: Step down Adapter Rings.

- Drivers: Lens compatibility with various sensor sizes, cost-effective lens solutions.

Adapter Ring Product Landscape

The adapter ring product landscape is characterized by a continuous stream of innovations aimed at enhancing functionality, durability, and compatibility. Manufacturers are focusing on developing adapter rings with precise machining for secure lens mounting and minimal play, ensuring optimal image quality. Key product innovations include adapter rings with electronic contacts that enable autofocus, aperture control, and image stabilization pass-through for specific lens and camera combinations. Materials science plays a crucial role, with the use of aircraft-grade aluminum alloys and advanced polymers for lightweight yet robust construction. Many adapter rings now offer integrated features like built-in filters or specialized coatings to further augment creative possibilities. The development of multi-mount adapter rings, capable of adapting one lens mount to multiple camera bodies, represents a significant advancement in versatility. Performance metrics such as the absence of vignetting, light leakage, and accurate color rendition are paramount for high-end applications.

Key Drivers, Barriers & Challenges in Adapter Ring

Key Drivers:

- Proliferation of Mirrorless Cameras: The rapid adoption of mirrorless camera systems worldwide necessitates adapter rings to utilize existing lens collections.

- Vintage Lens Resurgence: The growing trend of using classic and vintage lenses for their unique aesthetic qualities drives demand for adapter rings.

- Cost-Effectiveness: Adapter rings offer a significantly more affordable solution compared to purchasing new lenses for different camera systems.

- Technological Advancements: Development of "smart" adapter rings with electronic communication capabilities enhances functionality and user experience.

- Content Creation Boom: The increasing demand for high-quality video and photography for social media and online platforms fuels experimentation with different lens setups.

Barriers & Challenges:

- Compatibility Issues: Ensuring seamless electronic communication and physical fit across a vast array of camera bodies and lens mounts can be complex.

- Optical Quality Degradation: Poorly manufactured adapter rings can introduce vignetting, distortion, or reduce image sharpness.

- Market Saturation: The growing number of manufacturers can lead to intense price competition and a challenge in differentiating products.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of raw materials and components.

- Intellectual Property and Patent Disputes: The development of electronic adapter rings can sometimes lead to patent infringement concerns.

- Limited Demand in Specific Niches: While growing, the demand for certain highly specialized adapter rings might remain limited.

Emerging Opportunities in Adapter Ring

The adapter ring market is ripe with emerging opportunities, driven by evolving technological landscapes and niche market demands. The increasing integration of computational photography in smartphones presents an opportunity for adapter rings that can bridge the gap between smartphone imaging capabilities and professional-grade lenses, potentially through specialized attachments. The growth of virtual and augmented reality (VR/AR) applications could create a demand for adapter rings that facilitate the use of specialized lenses for immersive content creation. Furthermore, the burgeoning drone photography and videography sector presents a unique opportunity for compact and lightweight adapter rings that allow drone operators to utilize a wider range of optical solutions. The increasing interest in astrophotography and wildlife photography also opens avenues for adapter rings that enable the use of specific high-performance lenses optimized for these genres.

Growth Accelerators in the Adapter Ring Industry

Several key growth accelerators are poised to propel the adapter ring industry forward. The ongoing innovation in lens mount technology by camera manufacturers, while creating new mounts, also inherently sustains the need for adapters to maintain backward compatibility. Strategic partnerships between adapter ring manufacturers and lens makers, or even camera brands, can lead to co-branded solutions that offer guaranteed compatibility and enhanced performance, acting as significant growth catalysts. The increasing accessibility of 3D printing technology empowers smaller companies and even individual creators to develop custom adapter solutions for niche applications, fostering innovation and catering to underserved markets. Furthermore, aggressive marketing and educational campaigns by key players, highlighting the creative possibilities and cost-saving benefits of using adapter rings, will continue to drive consumer adoption and market expansion. The growing emphasis on sustainability within the manufacturing sector could also lead to the development of more eco-friendly adapter ring materials and production processes, appealing to a segment of environmentally conscious consumers.

Key Players Shaping the Adapter Ring Market

- K and F CONCEPT

- Lee Filters

- Cokin

- 7artisans

- Kase Filters

- Nisi

- Tiffen

- Haida

- REEFLEX

- URTH

- Vocas

- Computar

- Lensbaby

- Small Rig

- HOYA

- TTArtisan

- Prism Lens FX

- PolarPro

- Kamerar

- Genustech

- NOVOFLEX

- Tilta

Notable Milestones in Adapter Ring Sector

- 2019: Increased market availability of electronic adapter rings for mirrorless camera systems, enabling autofocus and aperture control.

- 2020: Rise in popularity of vintage lens adaptation for artistic photography and videography.

- 2021: Introduction of lightweight, advanced material adapter rings enhancing durability and portability.

- 2022: Emergence of adapter rings with integrated filter systems for enhanced creative control.

- 2023: Growing demand for adapter rings catering to specific niche photography applications like macro and astrophotography.

- 2024: Significant advancements in multi-mount adapter ring technology offering broader camera compatibility.

In-Depth Adapter Ring Market Outlook

The adapter ring market is projected for sustained and robust growth over the next decade, driven by the relentless evolution of digital imaging technology and shifting consumer preferences. The continued dominance of mirrorless cameras, coupled with the enduring appeal of vintage lenses, will remain the primary growth accelerators. Innovation in smart adapter rings, offering seamless electronic communication and advanced functionalities, will further enhance user experience and market penetration. Emerging opportunities in specialized sectors like drone cinematography and VR/AR content creation are expected to unlock new revenue streams. Strategic collaborations and advancements in material science will ensure the development of higher-performing, more versatile, and potentially more sustainable adapter ring solutions. The overall market outlook is exceptionally positive, positioning the adapter ring as an indispensable accessory for photographers and videographers seeking to maximize their creative potential and investment in imaging equipment. The market is expected to reach approximately $1,500 million units by 2033.

Adapter Ring Segmentation

-

1. Application

- 1.1. Individual

- 1.2. Photo Studio

- 1.3. Others

-

2. Types

- 2.1. Step up Adapter Ring

- 2.2. Step down Adapter Ring

Adapter Ring Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Adapter Ring Regional Market Share

Geographic Coverage of Adapter Ring

Adapter Ring REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Adapter Ring Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Individual

- 5.1.2. Photo Studio

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Step up Adapter Ring

- 5.2.2. Step down Adapter Ring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Adapter Ring Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Individual

- 6.1.2. Photo Studio

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Step up Adapter Ring

- 6.2.2. Step down Adapter Ring

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Adapter Ring Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Individual

- 7.1.2. Photo Studio

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Step up Adapter Ring

- 7.2.2. Step down Adapter Ring

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Adapter Ring Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Individual

- 8.1.2. Photo Studio

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Step up Adapter Ring

- 8.2.2. Step down Adapter Ring

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Adapter Ring Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Individual

- 9.1.2. Photo Studio

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Step up Adapter Ring

- 9.2.2. Step down Adapter Ring

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Adapter Ring Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Individual

- 10.1.2. Photo Studio

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Step up Adapter Ring

- 10.2.2. Step down Adapter Ring

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 K and F CONCEPT

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lee Filters

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cokin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 7artisans

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kase Filters

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nisi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tiffen

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Haida

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 REEFLEX

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 URTH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Vocas

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Computar

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Lensbaby

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Small Rig

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 HOYA

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 TTArtisan

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Prism Lens FX

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 PolarPro

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Kamerar

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Genustech

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 NOVOFLEX

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Tilta

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 K and F CONCEPT

List of Figures

- Figure 1: Global Adapter Ring Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Adapter Ring Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Adapter Ring Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Adapter Ring Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Adapter Ring Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Adapter Ring Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Adapter Ring Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Adapter Ring Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Adapter Ring Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Adapter Ring Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Adapter Ring Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Adapter Ring Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Adapter Ring Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Adapter Ring Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Adapter Ring Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Adapter Ring Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Adapter Ring Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Adapter Ring Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Adapter Ring Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Adapter Ring Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Adapter Ring Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Adapter Ring Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Adapter Ring Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Adapter Ring Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Adapter Ring Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Adapter Ring Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Adapter Ring Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Adapter Ring Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Adapter Ring Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Adapter Ring Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Adapter Ring Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Adapter Ring Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Adapter Ring Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Adapter Ring Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Adapter Ring Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Adapter Ring Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Adapter Ring Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Adapter Ring Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Adapter Ring Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Adapter Ring Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Adapter Ring Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Adapter Ring Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Adapter Ring Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Adapter Ring Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Adapter Ring Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Adapter Ring Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Adapter Ring Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Adapter Ring Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Adapter Ring Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Adapter Ring Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Adapter Ring?

The projected CAGR is approximately 15.6%.

2. Which companies are prominent players in the Adapter Ring?

Key companies in the market include K and F CONCEPT, Lee Filters, Cokin, 7artisans, Kase Filters, Nisi, Tiffen, Haida, REEFLEX, URTH, Vocas, Computar, Lensbaby, Small Rig, HOYA, TTArtisan, Prism Lens FX, PolarPro, Kamerar, Genustech, NOVOFLEX, Tilta.

3. What are the main segments of the Adapter Ring?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Adapter Ring," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Adapter Ring report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Adapter Ring?

To stay informed about further developments, trends, and reports in the Adapter Ring, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence