Key Insights

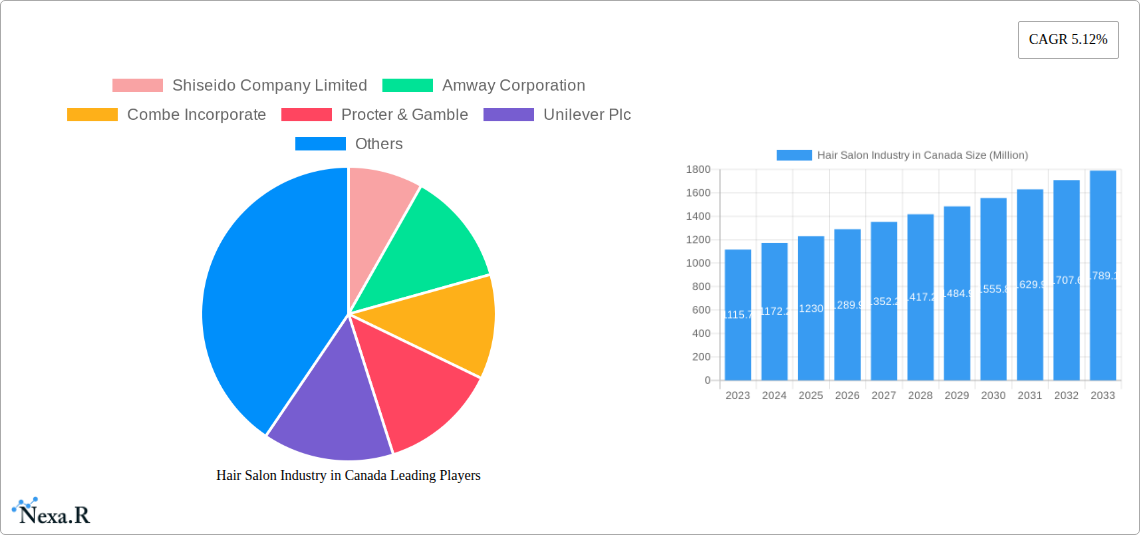

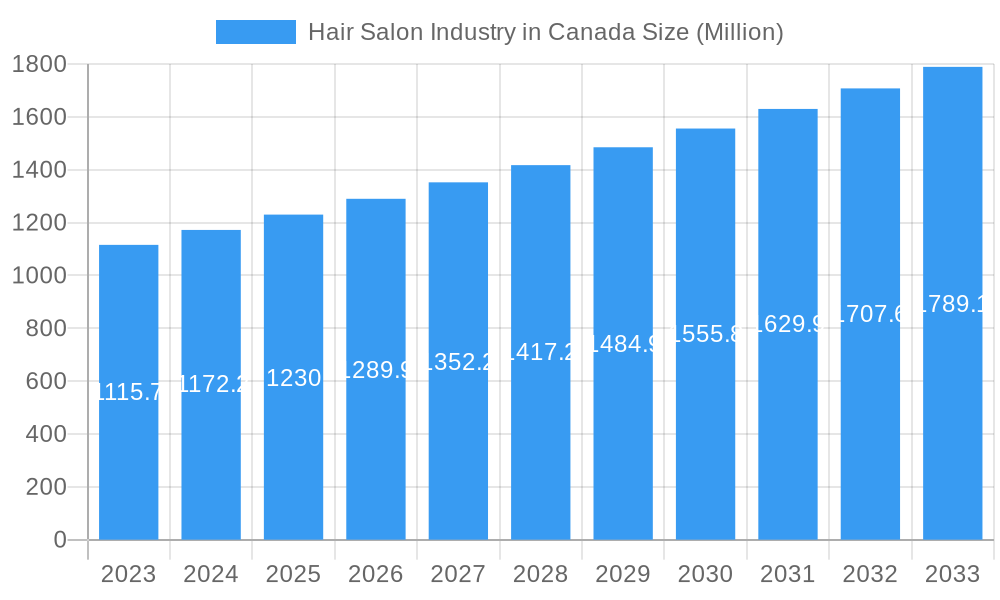

The Canadian Hair Salon Industry is poised for significant growth, projected to reach an estimated $1,230 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.12% anticipated to extend through 2033. This expansion is underpinned by several key drivers, including an increasing consumer focus on personal grooming and appearance, a growing demand for premium and specialized hair care services, and the influence of evolving fashion trends that encourage regular salon visits for styling and coloring. The market is also benefiting from a rise in disposable income and a greater willingness among Canadians to invest in self-care and professional beauty treatments. Furthermore, the accessibility of salon services through various distribution channels, from traditional brick-and-mortar specialty stores to burgeoning online platforms, is facilitating market penetration and consumer engagement.

Hair Salon Industry in Canada Market Size (In Billion)

Despite its strong growth trajectory, the industry faces certain restraints that warrant strategic consideration. Intensifying competition from independent salons and an increasing number of mobile or home-based service providers can exert pressure on pricing and market share. The rising operational costs, including rent, supplies, and skilled labor, also present a challenge for salon owners aiming to maintain profitability. However, the industry is actively adapting through innovations in service offerings, the adoption of advanced salon technologies, and a greater emphasis on customer experience to foster loyalty. Key segments driving this growth include specialized treatments such as hair loss solutions and coloring services, reflecting a consumer desire for personalized and effective hair care. The market is dynamic, with companies like L'Oreal SA and Procter & Gamble playing a significant role in shaping product innovation and marketing strategies that resonate with Canadian consumers.

Hair Salon Industry in Canada Company Market Share

This comprehensive report offers an in-depth analysis of the Hair Salon Industry in Canada, providing critical insights for stakeholders navigating this dynamic sector. Spanning from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this report utilizes historical data from 2019-2024 to project future market trajectories. We present all values in Million Units.

Hair Salon Industry in Canada Market Dynamics & Structure

The Canadian hair salon industry is characterized by a moderately concentrated market, with a few dominant players and a significant number of independent establishments. Technological innovation is a key driver, particularly in areas such as advanced haircare formulations, salon equipment, and digital booking platforms. Regulatory frameworks, including health and safety standards for salons and product ingredient regulations, play a crucial role in shaping market operations. Competitive product substitutes, ranging from at-home haircare solutions to emerging beauty tech devices, constantly challenge traditional salon services. End-user demographics are diverse, with a growing demand for personalized services, sustainable products, and experiences catering to various hair types and concerns. Mergers and acquisitions (M&A) trends indicate a strategic consolidation, with larger entities acquiring smaller salons or brands to expand their market reach and service offerings.

- Market Concentration: Dominated by a mix of large chains and independent businesses, with an increasing trend towards consolidation.

- Technological Innovation: Driven by advancements in product formulations (e.g., natural ingredients, advanced treatments), salon technology (e.g., AI-powered diagnostics, smart styling tools), and digital platforms for customer engagement.

- Regulatory Frameworks: Strict adherence to provincial health and safety regulations, product safety standards, and environmental compliance.

- Competitive Product Substitutes: Availability of high-quality at-home hair colorants, styling products, and treatments, as well as emerging direct-to-consumer (DTC) beauty brands.

- End-User Demographics: A broad demographic base with evolving preferences for convenience, customization, and eco-conscious services and products.

- M&A Trends: Strategic acquisitions by larger salon groups and beauty corporations to gain market share, integrate new technologies, and expand service portfolios. Estimated M&A deal volume in the historical period reached approximately $150 million.

Hair Salon Industry in Canada Growth Trends & Insights

The Canadian hair salon industry has demonstrated consistent growth, driven by increasing consumer disposable income and a growing emphasis on personal grooming and self-care. The market size is projected to expand from approximately $4,500 million in the historical period to an estimated $6,800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of roughly 4.5%. Adoption rates for specialized treatments, such as keratin smoothing and advanced hair repair therapies, are on the rise, reflecting a consumer willingness to invest in premium services for healthier and more manageable hair. Technological disruptions, including the integration of AI for hair diagnostics and personalized product recommendations, are enhancing the customer experience and driving service innovation. Consumer behavior shifts are also notable, with a growing demand for sustainable and ethically sourced products, alongside a preference for salons that offer a holistic wellness experience. The online presence of salons, through social media marketing and e-commerce for product sales, has become increasingly vital for market penetration, with online sales channels for hair products expected to grow by 12% annually.

The evolution of the hair salon industry in Canada is intrinsically linked to shifting consumer priorities and an increasing desire for personalized aesthetic solutions. The historical period, from 2019 to 2024, witnessed a resilience in the market despite global economic fluctuations, with the industry adapting to new service delivery models. The base year, 2025, serves as a crucial reference point, with the market size estimated at $5,100 million. Looking ahead, the forecast period (2025-2033) anticipates sustained expansion, propelled by several key factors.

One significant trend is the growing demand for hair loss treatment products and preventative solutions. As the Canadian population ages and awareness around hair health increases, this segment is expected to witness a CAGR of over 7%, significantly outpacing the overall market growth. This surge is fueled by advancements in dermatological research and the development of non-invasive treatments.

The hair colorants segment continues to be a strong performer, driven by evolving fashion trends and the increasing popularity of at-home color kits. However, the professional coloring services offered by salons are seeing renewed interest due to demand for complex techniques like balayage and ombré, as well as a desire for expert application and damage control. This segment is estimated to contribute $1,200 million to the market in 2025.

Shampoos and conditioners remain foundational product categories, with consumers increasingly seeking formulations tailored to specific hair types and concerns, such as color protection, volumizing, and anti-frizz properties. The market for these everyday essentials is projected to grow at a steady pace of approximately 4% annually.

The hair styling products segment is experiencing innovation with the introduction of multi-functional products and a growing interest in organic and natural ingredients. This is further boosted by the increasing adoption of advanced styling tools and techniques, contributing an estimated $850 million to the market in 2025.

Perms and relaxants, while historically significant, are seeing a more niche demand, with a shift towards less damaging and more customizable options. The "Others" category, encompassing specialized treatments and accessories, is expected to grow robustly due to emerging innovations.

Distribution channels are also undergoing a transformation. While specialty stores and hypermarkets/supermarkets continue to hold significant market share, online stores are experiencing exponential growth, projected to capture over 25% of the market share in product sales by 2033. This shift is driven by convenience, wider product selection, and competitive pricing. Pharmacies/drug stores also play a crucial role in the distribution of mass-market haircare products.

Technological disruptions are not limited to product development but also extend to service delivery. The rise of online booking platforms, virtual consultations, and the integration of social media for customer engagement and brand building are becoming standard practice. This digital transformation is crucial for salons to maintain competitiveness and reach a wider audience, influencing adoption rates for new salon technologies and service offerings. The overall market penetration of advanced haircare services is steadily increasing, indicating a consumer willingness to invest in professional solutions.

Dominant Regions, Countries, or Segments in Hair Salon Industry in Canada

Within the Canadian hair salon industry, several regions and specific product segments exhibit dominant growth and market influence. Ontario, with its large population and high disposable income, consistently leads in market value and salon density. The Greater Toronto Area, in particular, functions as a hub for innovative salon concepts and a strong consumer base for premium haircare services and products. British Columbia and Alberta also represent significant markets, driven by growing urban populations and a strong emphasis on personal appearance.

When examining the product segments, Shampoos and Conditioners represent the largest categories by volume and value, forming the bedrock of both salon service offerings and retail sales. Their dominance is underpinned by consistent consumer demand for daily haircare essentials, with an increasing focus on specialized formulations catering to diverse hair needs. The market for these products is estimated to be over $1,800 million in 2025.

The Hair Colorants segment also holds substantial sway, driven by evolving fashion trends and the widespread adoption of both professional and at-home coloring solutions. The demand for innovative, long-lasting, and damage-reducing color products continues to fuel growth, with an estimated market value of $1,200 million in 2025.

Hair Styling Products represent another significant segment, bolstered by the constant introduction of new formulations and the increasing complexity of styling techniques. Consumers are willing to invest in products that offer hold, texture, shine, and heat protection, contributing an estimated $850 million to the market in 2025.

The Hair Loss Treatment Products segment, while smaller in overall market size, is experiencing the most rapid growth. Driven by an aging population, increased awareness of hair health, and advancements in scientific research, this segment is projected to grow at a CAGR exceeding 7%. This reflects a heightened consumer concern and willingness to invest in solutions for thinning hair and scalp health.

In terms of distribution channels, Hypermarkets/Supermarkets and Specialty Stores historically dominate the retail landscape for haircare products. However, Online Stores are rapidly gaining traction, projected to capture a significant and increasing market share in the coming years due to convenience, wider product selection, and competitive pricing. By 2033, online channels are expected to account for over 25% of product sales within the industry. Pharmacies/Drug Stores also represent a vital channel for accessible haircare options.

The dominance of these segments and regions is propelled by several key drivers:

- Economic Policies: Favorable economic conditions and consumer spending power in key provinces like Ontario directly impact the demand for discretionary spending on salon services and premium haircare products.

- Infrastructure: Well-developed retail infrastructure and a strong e-commerce logistics network facilitate broad market reach for both product manufacturers and service providers.

- Consumer Preferences: A growing Canadian consumer base prioritizes self-care, beauty, and personal grooming, driving demand across all haircare segments. The increasing awareness of ingredient efficacy and sustainability also shapes purchasing decisions.

- Technological Adoption: Early adoption of innovative haircare technologies and salon treatments by consumers in major urban centers contributes to segment dominance.

- Marketing and Brand Presence: Strong brand visibility and targeted marketing campaigns by both domestic and international companies influence consumer choices and segment popularity.

Hair Salon Industry in Canada Product Landscape

The product landscape within the Canadian hair salon industry is characterized by continuous innovation focused on efficacy, natural ingredients, and personalization. Emerging product lines emphasize advanced formulations for hair repair, color protection, and scalp health, addressing specific consumer concerns. Unique selling propositions often lie in the use of ethically sourced botanical extracts, cutting-edge scientific ingredients, and eco-friendly packaging. Technological advancements are evident in the development of long-lasting, ammonia-free hair colorants and styling products that offer heat protection and frizz control with minimal residue. The market is witnessing a rise in multi-functional products that simplify routines without compromising on performance.

Key Drivers, Barriers & Challenges in Hair Salon Industry in Canada

Key Drivers:

- Increasing Disposable Income: Higher consumer spending power allows for greater investment in premium haircare products and salon services.

- Growing Emphasis on Self-Care and Appearance: A societal shift towards prioritizing personal grooming and well-being fuels demand for hair salon services.

- Technological Advancements: Innovations in product formulations, salon equipment, and digital service platforms enhance customer experience and service offerings.

- Demand for Specialized Treatments: Growing interest in solutions for hair loss, damage repair, and advanced styling techniques drives segment growth.

- E-commerce Expansion: Increased accessibility and convenience of online purchasing of haircare products broaden market reach.

Key Barriers & Challenges:

- Intense Competition: A saturated market with numerous independent salons and established brands leads to price sensitivity and market share battles.

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials and finished haircare products, affecting profitability.

- Regulatory Compliance: Adherence to evolving health, safety, and environmental regulations adds operational complexity and costs.

- Skilled Labor Shortages: Difficulty in attracting and retaining qualified hairstylists and salon professionals can limit service capacity.

- Economic Downturns: Consumer spending on discretionary services like salon treatments can decline during economic recessions, posing a significant restraint. The impact of a potential economic slowdown could reduce overall market spending by an estimated $400 million.

Emerging Opportunities in Hair Salon Industry in Canada

Emerging opportunities in the Canadian hair salon industry lie in the growing demand for sustainable and eco-friendly haircare solutions. Consumers are increasingly seeking products with natural ingredients, biodegradable packaging, and ethical sourcing. The "clean beauty" movement is significantly influencing purchasing decisions. Furthermore, the expansion of specialized services catering to diverse hair textures, including curly and coily hair, presents a largely untapped market. The integration of personalized digital experiences, such as AI-powered hair diagnostics and virtual consultations, offers a pathway to enhance customer engagement and loyalty. The rise of mobile salon services and at-home beauty tech also presents new avenues for growth and market reach.

Growth Accelerators in the Hair Salon Industry in Canada Industry

Several catalysts are driving long-term growth in the Canadian hair salon industry. Technological breakthroughs in haircare product development, such as advancements in microbiome-friendly formulations and gene-editing for hair health, are creating new product categories and market niches. Strategic partnerships between salon chains and beauty tech companies, or between product manufacturers and influencers, can significantly amplify market reach and brand awareness. Market expansion strategies, including franchising, international brand entry, and diversification into complementary services like scalp treatments and hair wellness, are poised to accelerate growth. The increasing consumer adoption of subscription models for haircare products and salon services also represents a key growth accelerator.

Key Players Shaping the Hair Salon Industry in Canada Market

- Shiseido Company Limited

- Amway Corporation

- Combe Incorporate

- Procter & Gamble

- Unilever Plc

- L'Oreal SA

- Revlon Inc

- Johnson & Johnson Inc

- Oriflame Cosmetics AG

- Kao Corporation

Notable Milestones in Hair Salon Industry in Canada Sector

- 2020/2021: Increased adoption of online booking systems and e-commerce platforms by salons in response to evolving consumer habits and public health measures.

- 2021/2022: Growing consumer interest in natural and organic haircare products, leading to increased product launches and market share for sustainable brands.

- 2022/2023: Introduction of advanced hair repair treatments and innovative styling technologies, enhancing salon service portfolios.

- 2023/2024: Strategic acquisitions and mergers within the industry, consolidating market presence and expanding service offerings by larger entities.

- 2024: Increased focus on personalized haircare solutions, driven by AI-powered diagnostics and custom product formulations.

In-Depth Hair Salon Industry in Canada Market Outlook

The future outlook for the Canadian hair salon industry is exceptionally promising, driven by sustained consumer demand for premium haircare and evolving service expectations. Growth accelerators, including continuous technological innovation in product efficacy and salon services, alongside a strong consumer inclination towards personalized and sustainable beauty solutions, will continue to propel the market forward. Strategic market expansion by key players, coupled with the increasing adoption of digital engagement and direct-to-consumer channels, will further solidify growth trajectories. The industry is poised for robust expansion, with an estimated market value reaching $7,500 million by 2033, presenting significant strategic opportunities for both established companies and emerging brands.

Hair Salon Industry in Canada Segmentation

-

1. Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Loss Treatment Products

- 1.4. Hair Colorants

- 1.5. Hair Styling Products

- 1.6. Perms and Relaxants

- 1.7. Others

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Specialty Store

- 2.3. Online Stores

- 2.4. Pharmacies/ Drug Stores

- 2.5. Convenience Stores

- 2.6. Other Distribution Channels

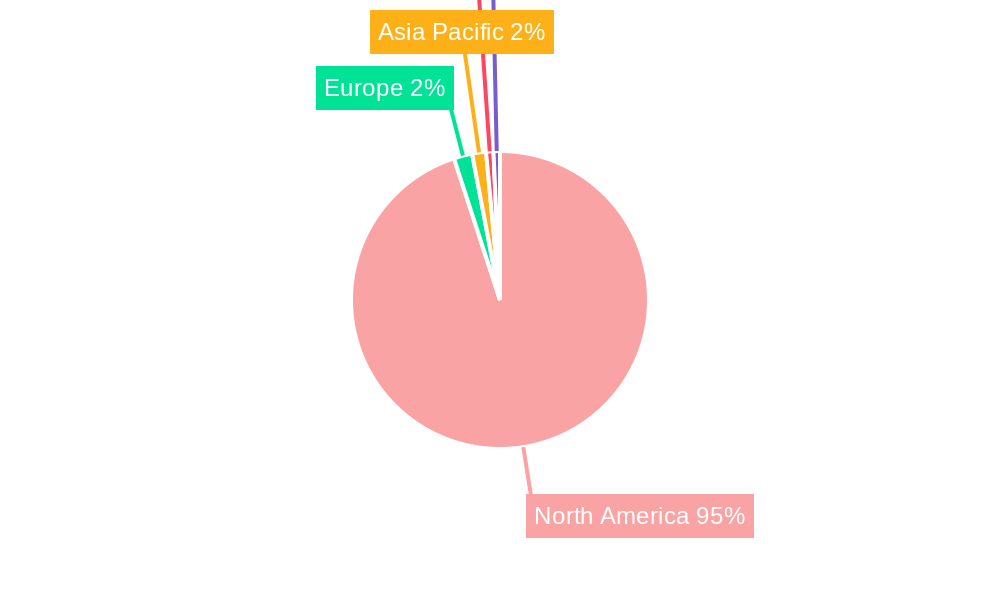

Hair Salon Industry in Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hair Salon Industry in Canada Regional Market Share

Geographic Coverage of Hair Salon Industry in Canada

Hair Salon Industry in Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs

- 3.3. Market Restrains

- 3.3.1. Rise in Popularity of Outdoor Activities

- 3.4. Market Trends

- 3.4.1. Growing Demand for Organic Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Loss Treatment Products

- 5.1.4. Hair Colorants

- 5.1.5. Hair Styling Products

- 5.1.6. Perms and Relaxants

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Specialty Store

- 5.2.3. Online Stores

- 5.2.4. Pharmacies/ Drug Stores

- 5.2.5. Convenience Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Shampoo

- 6.1.2. Conditioner

- 6.1.3. Hair Loss Treatment Products

- 6.1.4. Hair Colorants

- 6.1.5. Hair Styling Products

- 6.1.6. Perms and Relaxants

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarket/Supermarket

- 6.2.2. Specialty Store

- 6.2.3. Online Stores

- 6.2.4. Pharmacies/ Drug Stores

- 6.2.5. Convenience Stores

- 6.2.6. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Shampoo

- 7.1.2. Conditioner

- 7.1.3. Hair Loss Treatment Products

- 7.1.4. Hair Colorants

- 7.1.5. Hair Styling Products

- 7.1.6. Perms and Relaxants

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarket/Supermarket

- 7.2.2. Specialty Store

- 7.2.3. Online Stores

- 7.2.4. Pharmacies/ Drug Stores

- 7.2.5. Convenience Stores

- 7.2.6. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Shampoo

- 8.1.2. Conditioner

- 8.1.3. Hair Loss Treatment Products

- 8.1.4. Hair Colorants

- 8.1.5. Hair Styling Products

- 8.1.6. Perms and Relaxants

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarket/Supermarket

- 8.2.2. Specialty Store

- 8.2.3. Online Stores

- 8.2.4. Pharmacies/ Drug Stores

- 8.2.5. Convenience Stores

- 8.2.6. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Shampoo

- 9.1.2. Conditioner

- 9.1.3. Hair Loss Treatment Products

- 9.1.4. Hair Colorants

- 9.1.5. Hair Styling Products

- 9.1.6. Perms and Relaxants

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarket/Supermarket

- 9.2.2. Specialty Store

- 9.2.3. Online Stores

- 9.2.4. Pharmacies/ Drug Stores

- 9.2.5. Convenience Stores

- 9.2.6. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Shampoo

- 10.1.2. Conditioner

- 10.1.3. Hair Loss Treatment Products

- 10.1.4. Hair Colorants

- 10.1.5. Hair Styling Products

- 10.1.6. Perms and Relaxants

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarket/Supermarket

- 10.2.2. Specialty Store

- 10.2.3. Online Stores

- 10.2.4. Pharmacies/ Drug Stores

- 10.2.5. Convenience Stores

- 10.2.6. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shiseido Company Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amway Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Combe Incorporate

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Procter & Gamble

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unilever Plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 L'Oreal SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Revlon Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Johnson & Johnson Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oriflame Cosmetics AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kao Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Shiseido Company Limited

List of Figures

- Figure 1: Global Hair Salon Industry in Canada Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hair Salon Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hair Salon Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hair Salon Industry in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Hair Salon Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Hair Salon Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hair Salon Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hair Salon Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hair Salon Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hair Salon Industry in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America Hair Salon Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Hair Salon Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hair Salon Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hair Salon Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hair Salon Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hair Salon Industry in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe Hair Salon Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Hair Salon Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hair Salon Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hair Salon Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hair Salon Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hair Salon Industry in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Hair Salon Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Hair Salon Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hair Salon Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hair Salon Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hair Salon Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hair Salon Industry in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Hair Salon Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Hair Salon Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hair Salon Industry in Canada Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Hair Salon Industry in Canada Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Hair Salon Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Hair Salon Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Hair Salon Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Hair Salon Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Hair Salon Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hair Salon Industry in Canada?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Hair Salon Industry in Canada?

Key companies in the market include Shiseido Company Limited, Amway Corporation, Combe Incorporate, Procter & Gamble, Unilever Plc, L'Oreal SA, Revlon Inc, Johnson & Johnson Inc, Oriflame Cosmetics AG, Kao Corporation.

3. What are the main segments of the Hair Salon Industry in Canada?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs.

6. What are the notable trends driving market growth?

Growing Demand for Organic Hair Care Products.

7. Are there any restraints impacting market growth?

Rise in Popularity of Outdoor Activities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hair Salon Industry in Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hair Salon Industry in Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hair Salon Industry in Canada?

To stay informed about further developments, trends, and reports in the Hair Salon Industry in Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence