Key Insights

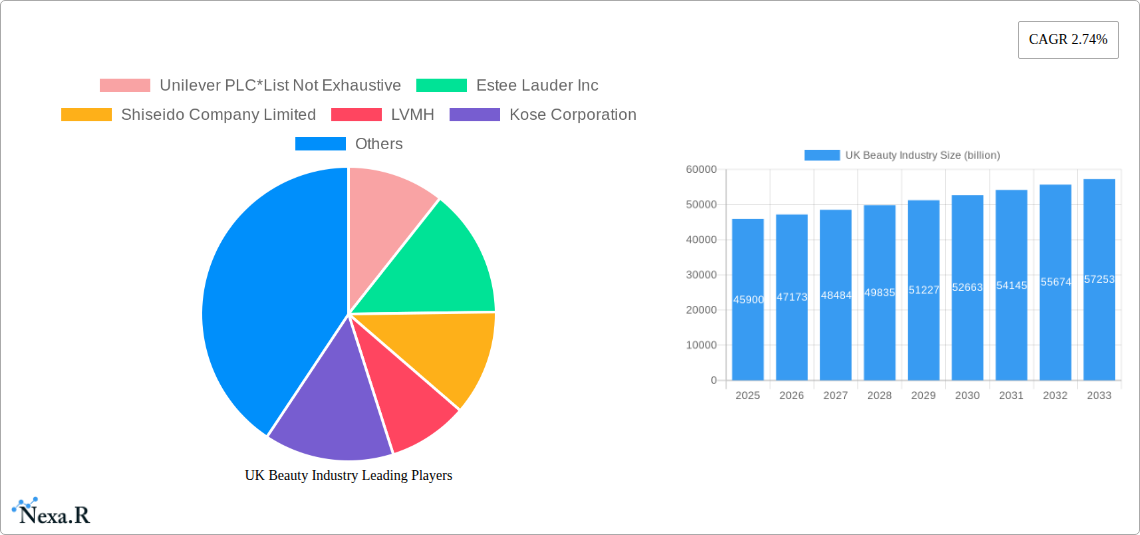

The UK beauty industry is poised for steady expansion, driven by a dynamic blend of evolving consumer preferences and innovative product development. With a market size estimated at £45.9 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 2.74% from 2025 to 2033, the sector demonstrates robust resilience and a promising future. This growth is fueled by key drivers such as the increasing demand for personalized beauty solutions, the rising influence of social media in shaping trends, and a growing consumer consciousness towards ethically sourced and sustainable beauty products. The market is segmented across various product types, including color cosmetics (facial, eye, lip, and nail makeup), and hair styling and coloring products, catering to diverse consumer needs. Furthermore, the accessibility offered by both mass and premium product categories, coupled with a widespread distribution network encompassing hypermarkets, specialty stores, pharmacies, and a rapidly expanding online retail segment, ensures broad market penetration.

UK Beauty Industry Market Size (In Billion)

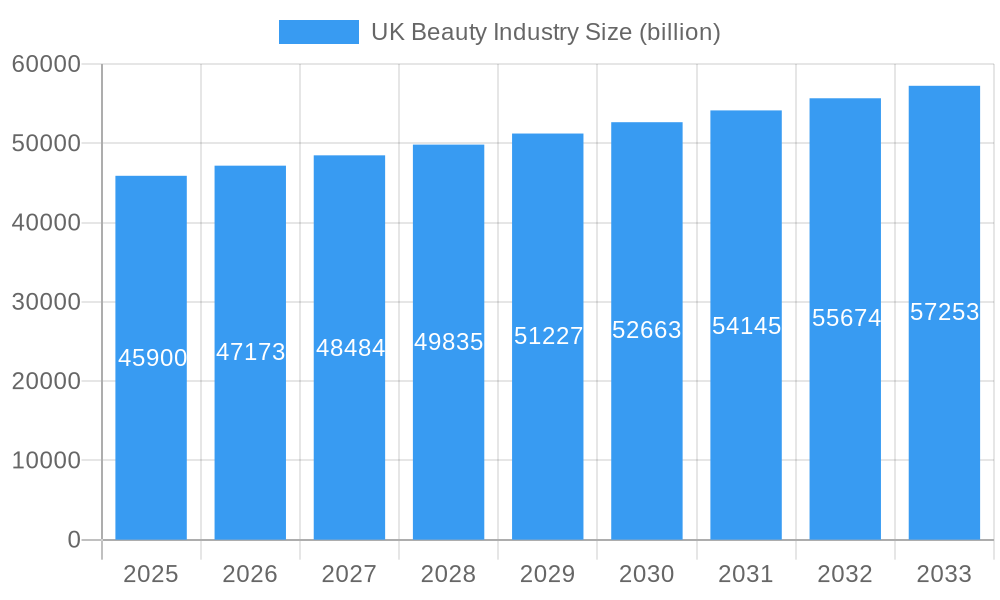

The UK beauty landscape is characterized by a healthy competitive environment, with global giants like Unilever PLC, Estee Lauder Inc., Shiseido Company Limited, LVMH, and L'Oreal SA actively shaping market dynamics. These companies are instrumental in introducing new product lines, leveraging digital marketing strategies, and responding to emerging consumer demands for efficacy, safety, and ethical production. While the market benefits from a generally positive economic outlook and high disposable incomes in key regions, potential headwinds could include fluctuations in consumer spending power, increasing competition from emerging brands, and stringent regulatory changes concerning ingredients and product claims. However, the industry's inherent adaptability, coupled with a continuous influx of innovation and a strong consumer base that values self-care and aesthetic enhancement, suggests a sustained trajectory of growth and opportunity within the United Kingdom.

UK Beauty Industry Company Market Share

UK Beauty Industry Market Dynamics & Structure

The UK beauty industry is a dynamic and evolving sector, characterized by a moderate level of market concentration. While global giants like Unilever PLC, L'Oreal SA, and Estee Lauder Inc. hold significant market share, a vibrant ecosystem of premium, niche, and indie brands continues to foster innovation and competition. Technological advancements, particularly in ingredient research, sustainable formulations, and digital customer engagement, are key drivers shaping product development and consumer interaction. The regulatory landscape, primarily governed by the EU Cosmetics Regulation (retained in UK law post-Brexit) and stringent advertising standards, ensures product safety and ethical marketing, although evolving compliance requirements present ongoing challenges. Competitive product substitutes are plentiful, ranging from traditional formulations to cutting-edge biotechnological solutions, and the increasing consumer demand for eco-friendly and ethically sourced products further diversifies the competitive landscape. End-user demographics are shifting, with a growing influence of Gen Z and Millennials driving demand for personalized, inclusive, and digitally-driven beauty experiences. Mergers and acquisitions (M&A) are a recurring theme, as larger companies strategically acquire innovative smaller brands to expand their portfolios and market reach. For example, the acquisition of Feelunique by Sephora signifies the consolidation trend in online prestige beauty retail.

- Market Concentration: Moderate, with a blend of multinational corporations and agile independent brands.

- Technological Innovation Drivers: Ingredient science, sustainable packaging, AI-driven personalization, and e-commerce integration.

- Regulatory Frameworks: EU Cosmetics Regulation (retained), Advertising Standards Authority (ASA) guidelines, and evolving sustainability mandates.

- Competitive Product Substitutes: Diverse range from natural/organic to advanced synthetic formulations; strong competition from direct-to-consumer (DTC) brands.

- End-User Demographics: Growing influence of younger demographics, demand for inclusivity, personalization, and ethical consumption.

- M&A Trends: Strategic acquisitions of emerging brands by larger players to capture innovation and market share.

UK Beauty Industry Growth Trends & Insights

The UK beauty industry is poised for sustained growth, driven by a confluence of factors including evolving consumer preferences, technological advancements, and strategic market expansions. The overall market size is projected to witness a healthy CAGR of xx% during the forecast period of 2025–2033, building upon a robust historical performance from 2019–2024. Adoption rates for innovative products, particularly in categories like sustainable skincare, personalized makeup, and advanced hair care, are on the rise. Consumers are increasingly educated and demanding, actively seeking out products that align with their values regarding environmental impact, ethical sourcing, and ingredient transparency. This shift is propelling the growth of brands that prioritize these aspects. Technological disruptions are playing a pivotal role, with AI-powered diagnostics for personalized skincare routines, augmented reality (AR) for virtual try-ons, and blockchain for enhanced supply chain transparency becoming more prevalent. These innovations not only enhance the customer experience but also create new avenues for product development and marketing. Consumer behavior is undergoing a significant transformation, moving beyond traditional purchasing habits. There's a discernible shift towards online retail, with e-commerce platforms and brand-owned websites becoming primary touchpoints for discovery and purchase. Furthermore, consumers are increasingly influenced by social media influencers and peer reviews, necessitating a strong digital presence and authentic brand storytelling. The demand for efficacy and demonstrable results is also intensifying, leading to a greater focus on scientific formulations and clinical testing. The parent market for beauty products in the UK demonstrates resilience and adaptability, with the child markets, such as skincare and color cosmetics, exhibiting distinct growth trajectories influenced by these macro trends. For instance, the skincare segment benefits from an aging population and a heightened awareness of preventative beauty, while color cosmetics are experiencing a resurgence driven by social media trends and a desire for self-expression. The hair styling and coloring products segment is also evolving, with an increasing demand for at-home solutions and salon-quality results. The premium segment continues to command significant consumer spending, driven by the desire for exclusive ingredients, advanced formulations, and superior brand experiences. However, the mass market is not to be underestimated, as it benefits from accessibility and strong brand loyalty across various distribution channels. The interplay between these segments, driven by evolving consumer purchasing power and brand accessibility, will define the overall growth narrative of the UK beauty industry. The estimated market size for the UK beauty industry in the base year of 2025 is expected to be in the region of £xx billion, with projections indicating a substantial increase by 2033.

Dominant Regions, Countries, or Segments in UK Beauty Industry

Within the UK beauty industry, Online Retail Stores have emerged as the dominant distribution channel, significantly outpacing traditional brick-and-mortar formats in terms of growth and market penetration. This ascendancy is underpinned by a fundamental shift in consumer purchasing behavior, amplified by convenience, accessibility, and the ever-expanding digital ecosystem. The historical period of 2019–2024 witnessed a rapid acceleration in e-commerce adoption, further solidified by the pandemic, which normalized online shopping for a wider demographic. The forecast period of 2025–2033 is expected to see this trend continue and strengthen, with online channels capturing an increasingly larger share of the total market spend. This dominance is not merely about transactional convenience; it encompasses a richer customer journey, from digital discovery through social media and influencer marketing to personalized recommendations and seamless purchasing experiences.

- Product Type Dominance: While Color Cosmetics (including Facial Makeup Products, Eye Makeup Products, and Lip and Nail Makeup Products) consistently perform strongly, the Skincare segment (not explicitly listed but a significant sub-category often analyzed alongside beauty) is often a larger and more consistently growing segment due to its everyday use and focus on long-term wellness. Within the provided categories, Hair Styling and Coloring Products are experiencing robust growth driven by at-home beauty trends and innovation in performance-driven formulations.

- Category Dominance: The Premium category, despite its higher price points, demonstrates remarkable resilience and growth. Consumers are increasingly willing to invest in high-quality, efficacious, and often ethically produced premium beauty products, driven by a desire for superior results and exclusive brand experiences. The perceived value, scientific backing, and aspirational nature of premium brands contribute to their sustained appeal.

- Distribution Channel Dominance: Online Retail Stores are the undisputed leaders. Their growth is fueled by:

- Convenience and Accessibility: 24/7 shopping, doorstep delivery, and a vast product selection available from anywhere.

- Digital Engagement: Integration with social media, personalized marketing, virtual try-on tools, and online reviews enhance the discovery and purchasing process.

- Niche Brand Proliferation: Online platforms provide an accessible avenue for smaller, niche, and DTC brands to reach a wide audience without the significant overhead of physical retail.

- Data Analytics: Online retailers possess rich data on consumer behavior, enabling them to personalize offers and optimize inventory.

- Market Share: Online retail channels are estimated to account for over xx% of the total beauty market sales by 2025, with projections indicating this figure will rise to over xx% by 2033.

- Key Drivers for Online Dominance:

- Technological Advancements: User-friendly e-commerce platforms, AI-powered personalization, and robust logistics.

- Consumer Behavior Shifts: Increased digital literacy, preference for convenience, and reliance on online reviews.

- Marketplace Growth: Expansion of dedicated beauty e-commerce platforms and marketplaces like Feelunique (prior to acquisition) and Lookfantastic.

- Brand DTC Strategies: Brands increasingly investing in their own online sales channels.

UK Beauty Industry Product Landscape

The UK beauty industry's product landscape is characterized by a relentless pursuit of innovation and efficacy. Consumers are increasingly seeking products that offer tangible benefits, driven by scientific advancements and a growing understanding of ingredient functionalities. This has led to a surge in the development of advanced skincare formulations leveraging cutting-edge ingredients like retinoids, peptides, and hyaluronic acid variants, promising visible improvements in skin texture, tone, and elasticity. In color cosmetics, the focus is on long-wear, transfer-proof formulas, alongside a growing demand for clean beauty options that are free from controversial ingredients. Hair styling and coloring products are witnessing innovations in scalp care, color protection, and heat damage reduction, with a parallel trend towards natural and plant-based colorants. The unique selling proposition for many brands now lies in their transparency regarding ingredient sourcing, manufacturing processes, and sustainability commitments, aligning with a conscientious consumer base.

Key Drivers, Barriers & Challenges in UK Beauty Industry

Key Drivers:

- Consumer Demand for Efficacy and Innovation: A growing awareness of ingredients and a desire for scientifically backed results drive investment in R&D and new product development.

- Digitalization and E-commerce Growth: The expanding online retail landscape and sophisticated digital marketing strategies enable wider reach and personalized customer engagement.

- Sustainability and Ethical Consumption: Increasing consumer preference for eco-friendly packaging, ethically sourced ingredients, and cruelty-free products fosters innovation in these areas.

- Focus on Inclusivity and Personalization: Brands are responding to demand for products catering to diverse skin tones, hair types, and individual needs.

Key Barriers & Challenges:

- Intense Competition and Market Saturation: The crowded market necessitates significant marketing investment and differentiation to capture consumer attention.

- Supply Chain Volatility and Rising Costs: Geopolitical factors, raw material shortages, and increased transportation costs can impact product availability and pricing.

- Regulatory Compliance and Evolving Standards: Adhering to stringent safety regulations, ingredient restrictions, and evolving environmental mandates presents an ongoing challenge.

- Consumer Skepticism and Information Overload: Navigating misleading marketing claims and discerning genuine product benefits can be challenging for consumers.

- Economic Headwinds and Consumer Spending Power: Fluctuations in economic conditions can impact discretionary spending on beauty products.

Emerging Opportunities in UK Beauty Industry

Emerging opportunities in the UK beauty industry lie in the continued expansion of personalized beauty solutions, driven by AI and data analytics, offering bespoke product recommendations and formulations. The growing demand for "skinimalism" and multi-functional products presents an avenue for simplified routines and versatile products that deliver multiple benefits. Furthermore, the burgeoning interest in the "science of wellness" is driving the demand for beauty products that integrate with overall health and well-being, such as stress-reducing skincare or ingestible beauty supplements. The increasing focus on the circular economy and refillable packaging offers a significant opportunity for brands to innovate and capture environmentally conscious consumers.

Growth Accelerators in the UK Beauty Industry Industry

Long-term growth in the UK beauty industry will be significantly accelerated by continued technological breakthroughs in biotechnology for ingredient development and the application of AI for hyper-personalized customer experiences. Strategic partnerships between traditional beauty players and tech companies, as well as the acquisition of innovative startups, will fuel product innovation and market expansion. Furthermore, a strong focus on expanding into untapped markets, such as men's grooming and specific age demographics, alongside the development of inclusive product lines, will be crucial growth catalysts. The increasing emphasis on sustainable practices and the development of closed-loop supply chains will not only meet consumer demand but also create a competitive advantage.

Key Players Shaping the UK Beauty Industry Market

- Unilever PLC

- Estee Lauder Inc

- Shiseido Company Limited

- LVMH

- Kose Corporation

- Coty Inc

- L'Oreal SA

- Revlon Inc

- Kao Corporation

- Oriflame Cosmetics Global SA

Notable Milestones in UK Beauty Industry Sector

- November 2022: Indian luxury ayurvedic beauty brand Forest Essentials strengthened its presence in the United Kingdom by launching its first standalone store in London. Last year, Forest Essentials entered the United Kingdom market by partnering with online beauty retailer Lookfantastic to sell its products online in the country.

- August 2022: Ariana Grande launched her R.E.M. beauty brand in the United Kingdom. The entire range is now available to shop in-store and online at selfridges.com.

- June 2021: Sephora signed an agreement with Palamon Capital Partners and other shareholders to acquire Feelunique, a prominent online prestige beauty retailer in the United Kingdom.

In-Depth UK Beauty Industry Market Outlook

The UK beauty industry is projected for robust future growth, fueled by a confluence of consumer-driven demand for innovation and sustainability. The market's resilience is evident in its ability to adapt to evolving consumer preferences, with a particular emphasis on personalized experiences and ethical sourcing. Strategic expansion into emerging segments like men's grooming and the continuous development of inclusive product ranges will unlock significant new revenue streams. Furthermore, the ongoing integration of technology, from AI-powered recommendations to advanced ingredient formulations, will continue to be a critical growth accelerator. Brands that prioritize transparency, sustainability, and authentic customer engagement are best positioned to capitalize on the evolving landscape and secure long-term market leadership.

UK Beauty Industry Segmentation

-

1. Product Type

-

1.1. Color Cosmetics

- 1.1.1. Facial Makeup Products

- 1.1.2. Eye Makeup Products

- 1.1.3. Lip and Nail Makeup Products

-

1.2. Hair Styling and Coloring Products

- 1.2.1. Hair Colors

- 1.2.2. Hair Styling Products

-

1.1. Color Cosmetics

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Hypermarkets/Supermarkets

- 3.2. Specialty Stores

- 3.3. Pharmacy and Drug Stores

- 3.4. Online Retail Stores

- 3.5. Convenience Stores

- 3.6. Other Distribution Channels

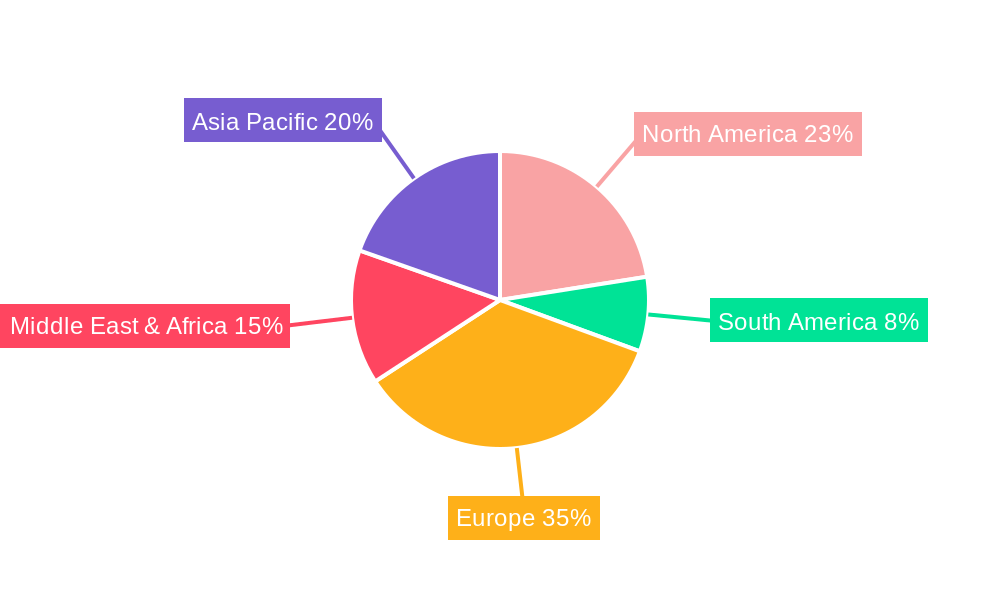

UK Beauty Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Beauty Industry Regional Market Share

Geographic Coverage of UK Beauty Industry

UK Beauty Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Vegan and Organic Cosmetic Products; Growing Consumer Inclination Towards Grooming and Appearance

- 3.3. Market Restrains

- 3.3.1. High Import Dependency Leading to High Price of the Final Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic Cosmetic Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Beauty Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Color Cosmetics

- 5.1.1.1. Facial Makeup Products

- 5.1.1.2. Eye Makeup Products

- 5.1.1.3. Lip and Nail Makeup Products

- 5.1.2. Hair Styling and Coloring Products

- 5.1.2.1. Hair Colors

- 5.1.2.2. Hair Styling Products

- 5.1.1. Color Cosmetics

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarkets/Supermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Pharmacy and Drug Stores

- 5.3.4. Online Retail Stores

- 5.3.5. Convenience Stores

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America UK Beauty Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Color Cosmetics

- 6.1.1.1. Facial Makeup Products

- 6.1.1.2. Eye Makeup Products

- 6.1.1.3. Lip and Nail Makeup Products

- 6.1.2. Hair Styling and Coloring Products

- 6.1.2.1. Hair Colors

- 6.1.2.2. Hair Styling Products

- 6.1.1. Color Cosmetics

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Mass

- 6.2.2. Premium

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hypermarkets/Supermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Pharmacy and Drug Stores

- 6.3.4. Online Retail Stores

- 6.3.5. Convenience Stores

- 6.3.6. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America UK Beauty Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Color Cosmetics

- 7.1.1.1. Facial Makeup Products

- 7.1.1.2. Eye Makeup Products

- 7.1.1.3. Lip and Nail Makeup Products

- 7.1.2. Hair Styling and Coloring Products

- 7.1.2.1. Hair Colors

- 7.1.2.2. Hair Styling Products

- 7.1.1. Color Cosmetics

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Mass

- 7.2.2. Premium

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hypermarkets/Supermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Pharmacy and Drug Stores

- 7.3.4. Online Retail Stores

- 7.3.5. Convenience Stores

- 7.3.6. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe UK Beauty Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Color Cosmetics

- 8.1.1.1. Facial Makeup Products

- 8.1.1.2. Eye Makeup Products

- 8.1.1.3. Lip and Nail Makeup Products

- 8.1.2. Hair Styling and Coloring Products

- 8.1.2.1. Hair Colors

- 8.1.2.2. Hair Styling Products

- 8.1.1. Color Cosmetics

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Mass

- 8.2.2. Premium

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hypermarkets/Supermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Pharmacy and Drug Stores

- 8.3.4. Online Retail Stores

- 8.3.5. Convenience Stores

- 8.3.6. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa UK Beauty Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Color Cosmetics

- 9.1.1.1. Facial Makeup Products

- 9.1.1.2. Eye Makeup Products

- 9.1.1.3. Lip and Nail Makeup Products

- 9.1.2. Hair Styling and Coloring Products

- 9.1.2.1. Hair Colors

- 9.1.2.2. Hair Styling Products

- 9.1.1. Color Cosmetics

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Mass

- 9.2.2. Premium

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hypermarkets/Supermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Pharmacy and Drug Stores

- 9.3.4. Online Retail Stores

- 9.3.5. Convenience Stores

- 9.3.6. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific UK Beauty Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Color Cosmetics

- 10.1.1.1. Facial Makeup Products

- 10.1.1.2. Eye Makeup Products

- 10.1.1.3. Lip and Nail Makeup Products

- 10.1.2. Hair Styling and Coloring Products

- 10.1.2.1. Hair Colors

- 10.1.2.2. Hair Styling Products

- 10.1.1. Color Cosmetics

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Mass

- 10.2.2. Premium

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hypermarkets/Supermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Pharmacy and Drug Stores

- 10.3.4. Online Retail Stores

- 10.3.5. Convenience Stores

- 10.3.6. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Unilever PLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Estee Lauder Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shiseido Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LVMH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kose Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Coty Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 L'Oreal SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Revlon Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kao Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oriflame Cosmetics Global SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Unilever PLC*List Not Exhaustive

List of Figures

- Figure 1: Global UK Beauty Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Beauty Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America UK Beauty Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America UK Beauty Industry Revenue (billion), by Category 2025 & 2033

- Figure 5: North America UK Beauty Industry Revenue Share (%), by Category 2025 & 2033

- Figure 6: North America UK Beauty Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America UK Beauty Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America UK Beauty Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America UK Beauty Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Beauty Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America UK Beauty Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America UK Beauty Industry Revenue (billion), by Category 2025 & 2033

- Figure 13: South America UK Beauty Industry Revenue Share (%), by Category 2025 & 2033

- Figure 14: South America UK Beauty Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: South America UK Beauty Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America UK Beauty Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America UK Beauty Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Beauty Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Europe UK Beauty Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe UK Beauty Industry Revenue (billion), by Category 2025 & 2033

- Figure 21: Europe UK Beauty Industry Revenue Share (%), by Category 2025 & 2033

- Figure 22: Europe UK Beauty Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Europe UK Beauty Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe UK Beauty Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe UK Beauty Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Beauty Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa UK Beauty Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa UK Beauty Industry Revenue (billion), by Category 2025 & 2033

- Figure 29: Middle East & Africa UK Beauty Industry Revenue Share (%), by Category 2025 & 2033

- Figure 30: Middle East & Africa UK Beauty Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa UK Beauty Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa UK Beauty Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Beauty Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Beauty Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Asia Pacific UK Beauty Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific UK Beauty Industry Revenue (billion), by Category 2025 & 2033

- Figure 37: Asia Pacific UK Beauty Industry Revenue Share (%), by Category 2025 & 2033

- Figure 38: Asia Pacific UK Beauty Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific UK Beauty Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific UK Beauty Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Beauty Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Beauty Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global UK Beauty Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 3: Global UK Beauty Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global UK Beauty Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global UK Beauty Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global UK Beauty Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 7: Global UK Beauty Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global UK Beauty Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global UK Beauty Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global UK Beauty Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 14: Global UK Beauty Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global UK Beauty Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global UK Beauty Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global UK Beauty Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 21: Global UK Beauty Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global UK Beauty Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Beauty Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global UK Beauty Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 34: Global UK Beauty Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global UK Beauty Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global UK Beauty Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 43: Global UK Beauty Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 44: Global UK Beauty Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global UK Beauty Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Beauty Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Beauty Industry?

The projected CAGR is approximately 2.74%.

2. Which companies are prominent players in the UK Beauty Industry?

Key companies in the market include Unilever PLC*List Not Exhaustive, Estee Lauder Inc, Shiseido Company Limited, LVMH, Kose Corporation, Coty Inc, L'Oreal SA, Revlon Inc, Kao Corporation, Oriflame Cosmetics Global SA.

3. What are the main segments of the UK Beauty Industry?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 57.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Vegan and Organic Cosmetic Products; Growing Consumer Inclination Towards Grooming and Appearance.

6. What are the notable trends driving market growth?

Increasing Demand for Organic Cosmetic Products.

7. Are there any restraints impacting market growth?

High Import Dependency Leading to High Price of the Final Products.

8. Can you provide examples of recent developments in the market?

November 2022: Indian luxury ayurvedic beauty brand Forest Essentials strengthened its presence in the United Kingdom by launching its first standalone store in London. Last year, Forest Essentials entered the United Kingdom market by partnering with online beauty retailer Lookfantastic to sell its products online in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Beauty Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Beauty Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Beauty Industry?

To stay informed about further developments, trends, and reports in the UK Beauty Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence