Key Insights

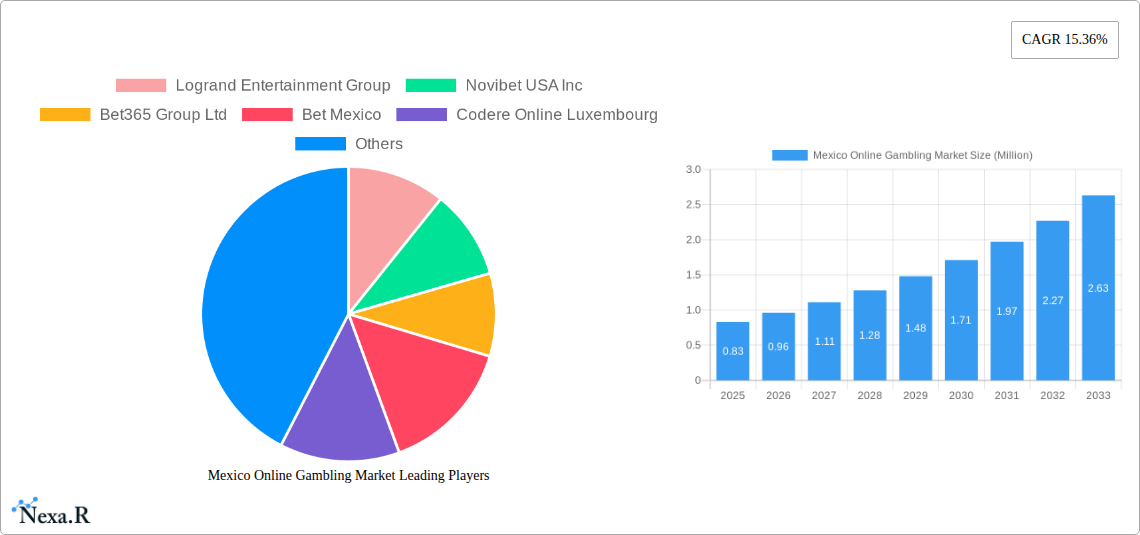

The Mexico online gambling market is poised for significant expansion, with a current market size estimated at $0.83 million and a projected CAGR of 15.36% over the forecast period of 2025-2033. This robust growth trajectory is fueled by several key drivers, including the increasing adoption of smartphones and widespread internet penetration across Mexico, making online gambling more accessible than ever. Furthermore, a growing younger demographic with a higher propensity for digital entertainment, coupled with evolving consumer attitudes towards regulated online gaming, are significant contributors to this surge. The market is experiencing a strong demand for diverse gaming options, with Sports Betting and Casino games leading the charge. The shift towards mobile platforms is particularly noteworthy, reflecting a global trend where convenience and accessibility drive consumer engagement. This burgeoning market presents substantial opportunities for both established operators and new entrants looking to capitalize on Mexico's evolving entertainment landscape.

Mexico Online Gambling Market Market Size (In Million)

The forecast period is expected to witness sustained momentum, with the market size projected to reach approximately $3.04 million by 2033, driven by continuous innovation in game offerings and platform development. While the market enjoys strong growth, certain restraints, such as evolving regulatory frameworks and the need for robust player protection measures, will require strategic navigation by operators. However, the industry's proactive approach to responsible gaming and increasing collaboration with regulatory bodies are expected to mitigate these challenges. The competitive landscape is dynamic, featuring key players like Bet365 Group Ltd, Codere Online Luxembourg, and Rush Street Interactive Inc., alongside emerging local operators like Logrand Entertainment Group and Bet Mexico. The proliferation of user-friendly mobile applications and the integration of new technologies like live dealer games and virtual reality are expected to further enhance the player experience, solidifying the market's growth and appeal.

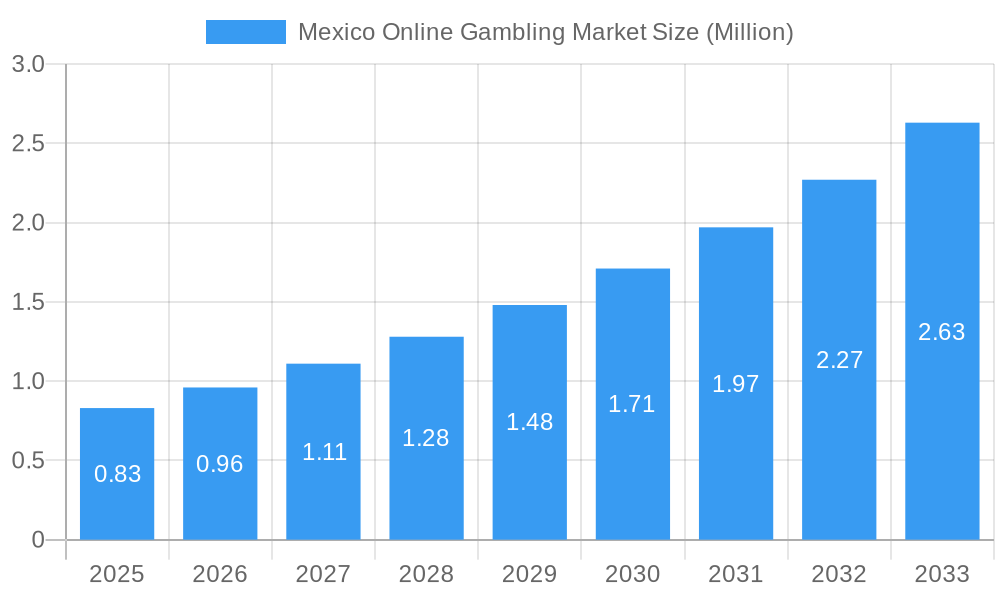

Mexico Online Gambling Market Company Market Share

Mexico Online Gambling Market: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock unparalleled insights into the burgeoning Mexico online gambling market. This definitive report delves into the intricate dynamics, growth trajectories, and future potential of this rapidly expanding sector. With a focus on high-traffic keywords like "Mexico online casino," "sports betting Mexico," "online poker Mexico," and "iGaming Mexico," this analysis is designed for industry leaders, investors, and stakeholders seeking a competitive edge. Explore parent and child market segments, quantitative data, and strategic recommendations to navigate this dynamic landscape. All monetary values are presented in millions of units.

Mexico Online Gambling Market Market Dynamics & Structure

The Mexico online gambling market is characterized by a dynamic interplay of established operators and emerging players, fostering a moderately concentrated landscape. Technological innovation is a primary driver, with advancements in mobile gaming, live dealer technologies, and payment gateways significantly enhancing user experience and accessibility. The regulatory framework, while evolving, provides a foundation for licensed operators, although it continues to adapt to new technological paradigms and player protection concerns. Competitive product substitutes, ranging from traditional land-based casinos to social gaming, exert influence, yet the convenience and accessibility of online platforms are driving significant adoption. End-user demographics are diverse, with a growing segment of younger, digitally-native consumers actively participating. Mergers and acquisitions (M&A) trends are notable, indicating consolidation and strategic expansion by key players. For instance, the market has witnessed numerous partnerships and acquisitions aimed at expanding market share and diversifying product offerings. The estimated market share of leading players is constantly shifting, with key entities holding significant portions of the sports betting and casino segments. Barriers to innovation include the need for robust cybersecurity measures and the continuous adaptation to evolving consumer preferences for more immersive and interactive gaming experiences.

- Market Concentration: Moderately concentrated with a few dominant players and a growing number of niche operators.

- Technological Innovation Drivers: Mobile-first design, live dealer advancements, secure payment gateways, and AI-powered personalization.

- Regulatory Frameworks: Evolving licensing and operational guidelines, with an increasing focus on player safety and responsible gambling.

- Competitive Product Substitutes: Land-based casinos, social gaming platforms, and alternative entertainment options.

- End-User Demographics: A broad spectrum of users, with a notable increase in younger demographics and tech-savvy individuals.

- M&A Trends: Strategic acquisitions and partnerships aimed at market consolidation and expansion, with deal volumes projected to increase in the coming years.

Mexico Online Gambling Market Growth Trends & Insights

The Mexico online gambling market is experiencing robust growth, driven by increasing internet penetration, smartphone adoption, and a growing appetite for digital entertainment. The market size has witnessed a significant expansion from XX million in 2019 to an estimated XX million in 2025, with projections indicating a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This impressive trajectory is fueled by evolving consumer behavior, with a discernible shift towards mobile-first gaming experiences and an increasing demand for a diverse range of game types. Technological disruptions, such as the integration of virtual reality (VR) and augmented reality (AR) into casino games, are further enhancing engagement. The adoption rates for online sports betting and casino games are steadily rising, mirroring global trends. Player acquisition strategies are becoming more sophisticated, focusing on personalized offers and loyalty programs. The proliferation of secure and convenient payment methods, including digital wallets and cryptocurrencies, is also contributing to the market's expansion. Furthermore, increased marketing efforts and promotional activities by operators are effectively reaching wider audiences, driving market penetration. The historical period (2019-2024) has laid a strong foundation, with substantial investments in platform development and user acquisition, setting the stage for continued exponential growth in the forecast period. This sustained growth underscores the immense potential of the Mexican iGaming market.

Dominant Regions, Countries, or Segments in Mexico Online Gambling Market

Within the Mexico online gambling market, Sports Betting currently stands as the dominant segment, capturing a significant market share estimated at XX% in 2025. This dominance is attributed to the deep-rooted passion for sports in Mexico, particularly football (soccer), which fuels substantial betting volumes. The ease of access through mobile platforms further amplifies its appeal.

- Sports Betting Dominance:

- Key Drivers: Widespread popularity of football (Liga MX, international leagues), boxing, and baseball.

- Market Share: Estimated at XX% in 2025, with a projected CAGR of XX% during the forecast period.

- Technological Integration: Real-time odds, live betting features, and extensive statistical data available on mobile apps.

- Regulatory Support: Existing frameworks that accommodate sports wagering, with ongoing efforts to enhance consumer protection and integrity.

- Operator Focus: Significant investment by major operators in sports betting platforms, marketing campaigns, and sponsorships of sports teams and events.

The Casino segment follows closely, with an estimated market share of XX% in 2025, also exhibiting strong growth potential with a CAGR of XX%. The increasing sophistication of online casino offerings, including live dealer games and innovative slot titles, is attracting a substantial player base. The Other Game Types segment, encompassing poker, bingo, and lotteries, is a growing niche, projected to capture XX% of the market in 2025, with a CAGR of XX%.

In terms of platform, the Mobile segment is unequivocally leading the charge, projected to account for XX% of the market share in 2025. The convenience of betting and playing on the go has made mobile devices the primary access point for the majority of Mexican online gamblers. The desktop platform, while still relevant, is gradually ceding ground, holding an estimated XX% market share in 2025, with a CAGR of XX%.

- Mobile Platform Dominance:

- Key Drivers: High smartphone penetration, user-friendly mobile interfaces, and the ability to play anytime, anywhere.

- Market Share: Projected at XX% in 2025, with continuous growth expected.

- Technological Advancements: Optimized streaming for live casino, push notifications for promotions, and seamless payment integration.

- Consumer Preference: A clear shift from desktop to mobile for entertainment and transaction purposes.

Mexico Online Gambling Market Product Landscape

The Mexico online gambling market's product landscape is rapidly evolving, driven by a commitment to offering diverse and engaging gaming experiences. Key innovations include the introduction of bespoke live game shows like Playtech's "Super Mega Ultra" in collaboration with bet365, featuring multi-tier payout systems and substantial multipliers, enhancing player excitement. The integration of iGaming casino games by Novibet, expanding its reach across North America, including Mexico, signifies a trend towards sophisticated and varied game portfolios. Furthermore, partnerships with game development studios are leading to the rollout of new and captivating slot titles and table games, catering to a wide array of player preferences. The emphasis is on immersive gameplay, high-definition graphics, and seamless user interfaces, particularly on mobile devices. Performance metrics such as return to player (RTP) rates and bonus feature frequency are key selling points for operators and developers alike, driving player retention and acquisition.

Key Drivers, Barriers & Challenges in Mexico Online Gambling Market

The Mexico online gambling market is propelled by several key drivers. The increasing internet penetration and smartphone adoption across the country are fundamental enablers, making online platforms accessible to a larger populace. Growing disposable income and a youthful demographic with a propensity for digital entertainment further fuel demand. Technological advancements in mobile gaming and secure payment solutions enhance user experience and trust. Favorable regulatory developments, even if evolving, provide a clearer path for licensed operators.

However, the market also faces significant barriers and challenges. Regulatory complexities and potential changes can create uncertainty for operators and investors. Intense competition from both local and international players necessitates substantial marketing and promotional investment, impacting profitability. Concerns around responsible gambling and player protection require continuous investment in robust systems and awareness campaigns. Potential for illicit activities and the need for stringent anti-money laundering (AML) measures add to operational costs and complexities. Supply chain issues, particularly in relation to software development and data security, can also pose challenges. The estimated impact of these challenges on market growth is significant, potentially slowing down expansion by XX% if not effectively managed.

Emerging Opportunities in Mexico Online Gambling Market

Emerging opportunities in the Mexico online gambling market are abundant, driven by evolving consumer preferences and technological advancements. The growing demand for live dealer casino games presents a significant avenue for expansion, offering a more immersive and social gaming experience akin to land-based casinos. The burgeoning popularity of esports betting is another key opportunity, catering to a rapidly growing and engaged audience. Untapped markets within specific demographic segments and geographical regions also represent potential growth areas, requiring targeted marketing strategies. Furthermore, the integration of innovative payment solutions, including cryptocurrencies and faster digital wallets, can attract a new segment of tech-savvy players and streamline transactions. The development of skill-based games and hybrid products that blend chance with strategy also holds promise for engaging a broader audience.

Growth Accelerators in the Mexico Online Gambling Market Industry

Several catalysts are accelerating long-term growth in the Mexico online gambling market. Continuous technological innovation, particularly in mobile gaming, AI-driven personalization, and the exploration of VR/AR integration, will enhance user engagement and retention. Strategic partnerships between operators, technology providers, and content creators are crucial for expanding game portfolios and reaching new customer segments. Market expansion strategies, including potential cross-border collaborations and the development of localized content, will drive penetration. The increasing adoption of data analytics to understand player behavior and personalize offerings will be a significant growth accelerator. Furthermore, the development of a more streamlined and supportive regulatory environment will foster increased investment and innovation.

Key Players Shaping the Mexico Online Gambling Market Market

- Logrand Entertainment Group

- Novibet USA Inc

- Bet365 Group Ltd

- Bet Mexico

- Codere Online Luxembourg

- Playdoit (Atracciones America SA de CV)

- Playuzu

- Rush Street Interactive Inc

- Winnermx

- TV Global Enterprises Limited

Notable Milestones in Mexico Online Gambling Market Sector

- October 2024: Novibet, in collaboration with OBBSworks, introduced its iGaming casino games on the Novibet platform, extending its reach across North America, including Mexico.

- July 2024: Novibet partnered with 7777gaming company to feature its casino games across Mexico, Canada, Brazil, Chile, Ecuador, and Ireland. iLottery, Jackpot, and other casinos were among the major types of casinos available in the market.

- April 2024: In a collaboration with its long-time operator partner bet365, Playtech unveiled a bespoke live game show named Super Mega Ultra. This new live game show is accessible to bet365 players in various regions, such as the UK, Mexico, and Ontario. The game boasts an innovative three-tier base system across two wheels, presenting three payout levels: Super, Mega, and Ultra. Each round is designed with maximum multipliers: ×300 for Super, ×500 for Mega, and an impressive ×2500 for Ultra.

In-Depth Mexico Online Gambling Market Market Outlook

The Mexico online gambling market is poised for sustained and substantial growth, driven by a combination of increasing digital adoption, evolving consumer preferences, and ongoing technological advancements. Future market potential lies in the continued expansion of the mobile gaming segment, the integration of more sophisticated live dealer experiences, and the exploration of emerging game types like esports betting and skill-based games. Strategic opportunities will emerge from operators who can effectively leverage data analytics to personalize player experiences, build strong brand loyalty, and adapt to the dynamic regulatory landscape. The forecast indicates a robust expansion, with key players investing heavily in platform development and marketing to capture a larger share of this lucrative market. The overall outlook for the Mexico online gambling market is exceptionally positive, presenting significant opportunities for innovation and profitability.

Mexico Online Gambling Market Segmentation

-

1. Game Type

- 1.1. Sports Betting

- 1.2. Casino

- 1.3. Other Game Types

-

2. Platform

- 2.1. Desktop

- 2.2. Mobile

Mexico Online Gambling Market Segmentation By Geography

- 1. Mexico

Mexico Online Gambling Market Regional Market Share

Geographic Coverage of Mexico Online Gambling Market

Mexico Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones

- 3.3. Market Restrains

- 3.3.1. Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones

- 3.4. Market Trends

- 3.4.1. Sports Betting Is The Preferred Game Type Amongst The Majority

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.2. Casino

- 5.1.3. Other Game Types

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Logrand Entertainment Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Novibet USA Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bet365 Group Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bet Mexico

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Codere Online Luxembourg

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Playdoit (Atracciones America SA de CV)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Playuzu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rush Street Interactive Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Winnermx

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TV Global Enterprises Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Logrand Entertainment Group

List of Figures

- Figure 1: Mexico Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: Mexico Online Gambling Market Volume Billion Forecast, by Game Type 2020 & 2033

- Table 3: Mexico Online Gambling Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Mexico Online Gambling Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 5: Mexico Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico Online Gambling Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Mexico Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 8: Mexico Online Gambling Market Volume Billion Forecast, by Game Type 2020 & 2033

- Table 9: Mexico Online Gambling Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 10: Mexico Online Gambling Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 11: Mexico Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico Online Gambling Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Online Gambling Market?

The projected CAGR is approximately 15.36%.

2. Which companies are prominent players in the Mexico Online Gambling Market?

Key companies in the market include Logrand Entertainment Group, Novibet USA Inc, Bet365 Group Ltd, Bet Mexico, Codere Online Luxembourg, Playdoit (Atracciones America SA de CV), Playuzu, Rush Street Interactive Inc, Winnermx, TV Global Enterprises Limited*List Not Exhaustive.

3. What are the main segments of the Mexico Online Gambling Market?

The market segments include Game Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones.

6. What are the notable trends driving market growth?

Sports Betting Is The Preferred Game Type Amongst The Majority.

7. Are there any restraints impacting market growth?

Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones.

8. Can you provide examples of recent developments in the market?

October 2024: Novibet, in collaboration with OBBSworks, introduced its iGaming casino games on the Novibet platform, extending its reach across North America, including Mexico.July 2024: Novibet Partnered with 7777gaming company to feature its casino games across Mexico, Canada, Brazil, Chile, Ecuador, and Ireland. iLottery, Jackpot, and other casinos were among the major types of casinos available in the market.April 2024: In a collaboration with its long-time operator partner bet365, Playtech unveiled a bespoke live game show named Super Mega Ultra. This new live game show is accessible to bet365 players in various regions, such as the UK, Mexico, and Ontario. The game boasts an innovative three-tier base system across two wheels, presenting three payout levels: Super, Mega, and Ultra. Each round is designed with maximum multipliers: ×300 for Super, ×500 for Mega, and an impressive ×2500 for Ultra.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Online Gambling Market?

To stay informed about further developments, trends, and reports in the Mexico Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence