Key Insights

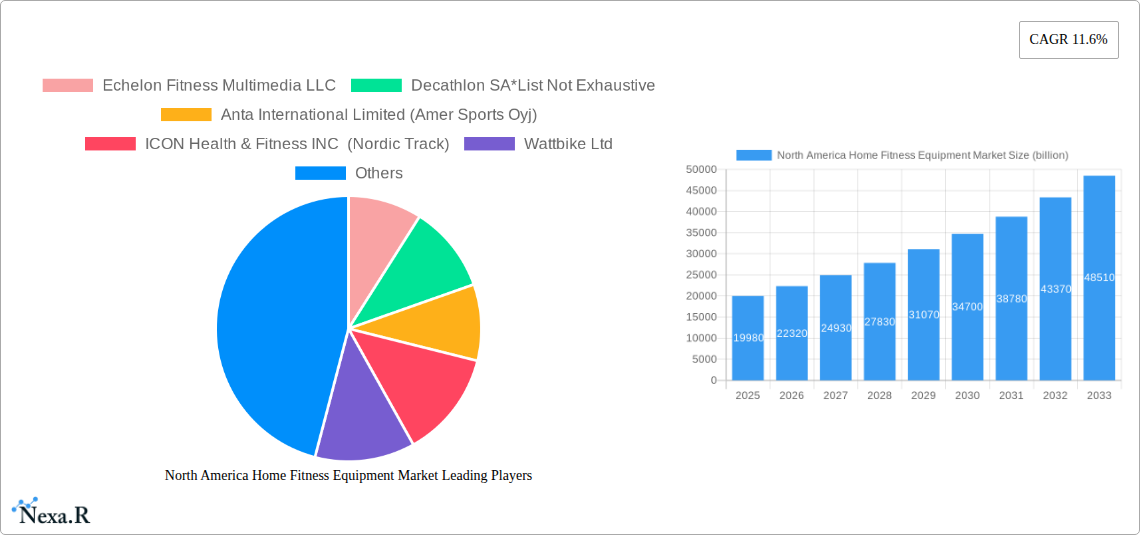

The North America Home Fitness Equipment Market is poised for robust expansion, projected to reach an estimated USD 19.98 billion in 2025. This significant growth is driven by an anticipated Compound Annual Growth Rate (CAGR) of 11.6% over the forecast period of 2025-2033. A primary catalyst for this surge is the increasing consumer awareness regarding the importance of personal health and wellness, amplified by the lingering effects of global health concerns that have normalized at-home fitness routines. Furthermore, rising disposable incomes across the region enable consumers to invest in premium home fitness solutions, fostering a demand for advanced and feature-rich equipment. The market is also benefiting from technological advancements, with the integration of smart features, AI-powered coaching, and interactive platforms becoming a standard expectation for many consumers. This trend is particularly evident in the growing popularity of connected fitness solutions that offer personalized workouts and community engagement, further solidifying the market's upward trajectory.

North America Home Fitness Equipment Market Market Size (In Billion)

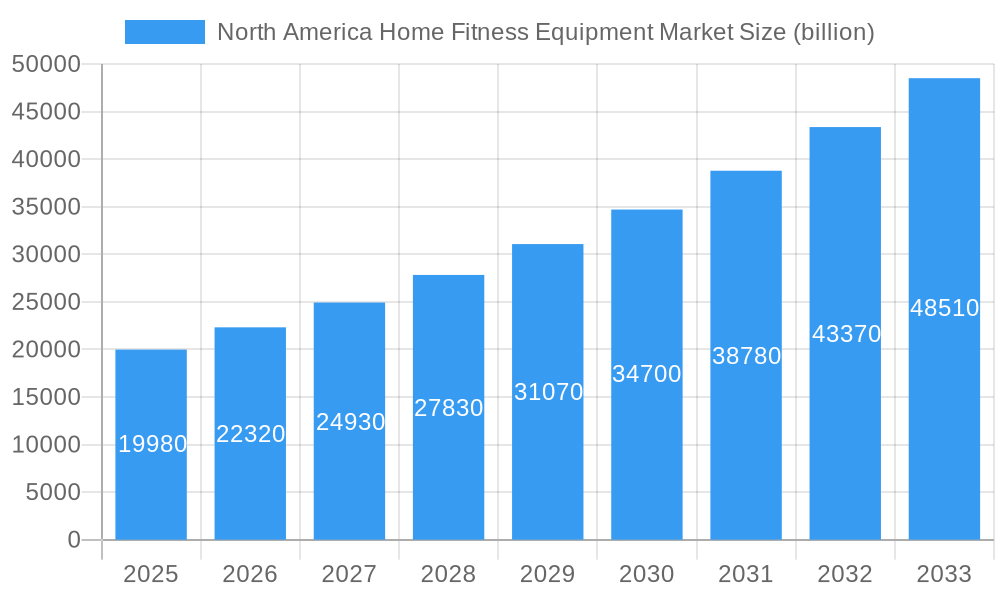

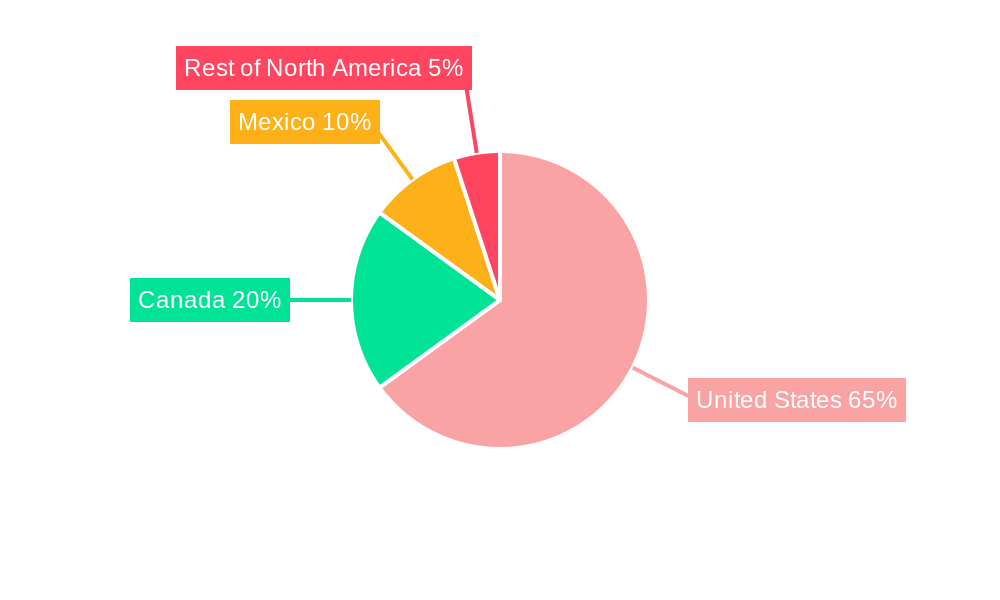

Key segments contributing to this expansion include Treadmills, Elliptical Machines, and Stationary Cycles, which consistently lead in consumer preference due to their effectiveness and accessibility. The increasing adoption of connected fitness ecosystems further fuels demand for these core products. Distribution channels are also evolving, with online retail stores experiencing substantial growth, catering to the convenience-seeking consumer. Direct selling models, facilitated by digital platforms and brand-led communities, are also gaining traction. Geographically, the United States represents the largest market within North America, followed by Canada and Mexico, all exhibiting strong growth potential. Major players like Peloton Interactive Inc., ICON Health & Fitness INC (Nordic Track), and Echelon Fitness Multimedia LLC are at the forefront, innovating and expanding their product portfolios to capture market share. The market is characterized by a dynamic competitive landscape, with both established brands and emerging players vying for consumer attention through product differentiation and strategic marketing initiatives.

North America Home Fitness Equipment Market Company Market Share

North America Home Fitness Equipment Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the North America Home Fitness Equipment Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, and strategic insights. With a comprehensive study period from 2019 to 2033, including a base year of 2025, this report leverages extensive data to equip industry professionals with actionable intelligence. We delve into the parent market encompassing all fitness equipment and child markets, specifically focusing on home fitness equipment. Quantified market values are presented in billion units throughout.

North America Home Fitness Equipment Market Market Dynamics & Structure

The North America home fitness equipment market is characterized by a moderately concentrated landscape, with a few dominant players alongside a growing number of innovative startups. Technological innovation serves as a primary driver, fueled by advancements in connected fitness, smart equipment integration, and personalized workout experiences. Regulatory frameworks, primarily concerning product safety and data privacy, play a role in shaping market entry and product development. Competitive product substitutes, ranging from basic free weights to advanced smart gym systems, exert continuous pressure on manufacturers to differentiate their offerings. End-user demographics are shifting towards health-conscious millennials and an aging population seeking convenient and accessible fitness solutions. Mergers and acquisitions (M&A) are a significant trend, with larger companies acquiring innovative startups to expand their product portfolios and market reach. For instance, KPS Capital Partners’ acquisition of Life Fitness signifies a consolidation trend. Barriers to innovation include high R&D costs, the need for robust software development, and the challenge of creating truly engaging at-home fitness experiences that rival traditional gym settings.

Market Concentration: Moderate, with leading players like Peloton Interactive Inc. and ICON Health & Fitness INC.

Technological Innovation: Driven by AI-powered coaching, virtual reality fitness, and advanced sensor technology.

Regulatory Frameworks: Focus on product safety standards (e.g., ASTM F2219-05) and data security compliance.

Competitive Substitutes: A wide spectrum from basic dumbbells to interactive fitness platforms.

End-User Demographics: Growing demand from health-conscious individuals, remote workers, and seniors.

M&A Trends: Strategic acquisitions to enhance product lines and market presence.

North America Home Fitness Equipment Market Growth Trends & Insights

The North America home fitness equipment market is poised for robust growth, driven by an increasing emphasis on personal health and wellness, coupled with the persistent demand for convenient fitness solutions. The market size evolution showcases a steady upward trajectory, transitioning from approximately $XX billion in 2019 to an estimated $XX billion in 2025, with projections indicating a significant expansion to $XX billion by 2033. Adoption rates for smart and connected fitness equipment have surged, particularly following the global pandemic, as consumers prioritized in-home exercise routines. Technological disruptions, such as the integration of AI for personalized training plans and the rise of immersive virtual reality fitness experiences, are transforming user engagement and product innovation. Consumer behavior shifts are evident in the growing preference for subscription-based fitness content that complements equipment purchases, creating a recurring revenue stream for manufacturers and service providers. The CAGR for the forecast period (2025-2033) is projected to be XX%. Market penetration continues to deepen, with an increasing percentage of households investing in dedicated home fitness setups. The convenience of 24/7 access, personalized workout options, and the avoidance of commuting to gyms are key factors influencing these adoption patterns. Furthermore, advancements in ergonomic design and space-saving solutions are making home fitness equipment more accessible to a broader consumer base, irrespective of living space limitations. The economic landscape, including disposable income and consumer spending on health and wellness, directly influences the market's growth trajectory, with higher disposable incomes correlating with increased expenditure on premium home fitness solutions.

Dominant Regions, Countries, or Segments in North America Home Fitness Equipment Market

The United States stands as the dominant region within the North America home fitness equipment market, accounting for a substantial market share estimated at XX% in 2025. This dominance is driven by a confluence of factors including a highly health-conscious population, high disposable incomes, and a well-established infrastructure for retail and e-commerce. Economic policies that support consumer spending on health and wellness, coupled with extensive marketing efforts by leading brands, further bolster its position. The sheer volume of consumer demand for a wide array of fitness equipment, from basic to sophisticated, ensures the US remains the primary growth engine.

Product Type Dominance: Within the product landscape, Treadmills consistently hold the largest market share, driven by their versatility and appeal to a broad range of fitness enthusiasts. Their ability to simulate outdoor running experiences makes them a perennial favorite. Strength Training Equipment also exhibits significant growth, fueled by the increasing awareness of the importance of muscle building and overall physical conditioning. The introduction of smart strength training devices, offering guided workouts and progress tracking, is further accelerating this segment's expansion.

Distribution Channel Dominance: The Online Retail Stores channel is witnessing rapid growth and is projected to surpass traditional channels in the coming years. The convenience of browsing, comparing, and purchasing home fitness equipment online, often with direct-to-consumer shipping, aligns perfectly with modern consumer purchasing habits. This channel is particularly effective for reaching a wider demographic across different geographical locations within the US. However, Offline Retail Stores continue to play a crucial role, especially for consumers who prefer to physically inspect equipment before purchase, offering an experiential advantage.

Key Drivers of Dominance in the United States:

- High Disposable Income: Enables greater consumer spending on premium fitness equipment.

- Health and Wellness Culture: A deeply ingrained societal focus on physical fitness and well-being.

- Advanced E-commerce Infrastructure: Facilitates seamless online purchasing and delivery.

- Technological Adoption: Early and widespread acceptance of smart and connected fitness devices.

- Prominent Brand Presence: A large number of well-established and innovative fitness equipment manufacturers operating in the US.

North America Home Fitness Equipment Market Product Landscape

The product landscape of the North America home fitness equipment market is dynamic and innovation-driven. Key product types include treadmills, elliptical machines, stationary cycles, rowing machines, and strength training equipment, each offering distinct benefits and catering to diverse fitness needs. Recent product innovations focus on enhanced user engagement through interactive displays, personalized workout programs driven by AI, and seamless connectivity with fitness apps. For instance, advancements in treadmill cushioning systems and incline capabilities aim to mimic real-world running conditions. Similarly, smart stationary cycles now offer immersive virtual cycling experiences and real-time performance analytics. The integration of energy-generating features in equipment, like SportsArt's ECO-POWR line, highlights a growing trend towards sustainability and energy efficiency, enhancing the unique selling propositions of these products.

Key Drivers, Barriers & Challenges in North America Home Fitness Equipment Market

Key Drivers: The North America home fitness equipment market is propelled by several significant drivers. The escalating global health consciousness and a proactive approach to personal well-being are paramount. The convenience and flexibility offered by home-based workouts, amplified by the rise of remote work, continue to fuel demand. Technological advancements, including the integration of smart features, AI-powered personalized coaching, and immersive virtual reality experiences, are creating more engaging and effective fitness solutions. Furthermore, an aging population seeking accessible and low-impact exercise options also contributes to market growth.

Key Barriers & Challenges: Despite the positive outlook, the market faces notable barriers and challenges. High upfront costs for premium fitness equipment can deter a segment of the consumer base, particularly in an environment of economic uncertainty. Intense competition among numerous brands, both established and emerging, leads to price pressures and the constant need for product differentiation. Supply chain disruptions, as experienced globally, can impact manufacturing and delivery timelines, affecting product availability and profitability. Regulatory hurdles related to product safety and data privacy require continuous compliance, adding to operational complexities. Moreover, maintaining long-term user engagement with home fitness equipment can be challenging, with a risk of devices becoming underutilized after the initial novelty wears off.

Emerging Opportunities in North America Home Fitness Equipment Market

Emerging opportunities in the North America home fitness equipment market are abundant, driven by evolving consumer preferences and technological advancements. The increasing demand for personalized and adaptive fitness solutions presents a significant avenue for growth. Companies that can offer intelligent equipment that adjusts to individual fitness levels and goals, coupled with engaging digital content, will likely capture a larger market share. The integration of gamification and social connectivity within fitness apps is another burgeoning opportunity, transforming workouts into more enjoyable and community-driven experiences. Furthermore, the growing interest in holistic wellness, encompassing mental health and recovery, opens doors for equipment that offers features beyond traditional cardio and strength training, such as guided meditation integration or advanced recovery tools. The expansion of rental and subscription models for home fitness equipment is also gaining traction, making high-end solutions more accessible to a wider audience and creating recurring revenue streams.

Growth Accelerators in the North America Home Fitness Equipment Market Industry

Several catalysts are accelerating long-term growth in the North America home fitness equipment industry. Breakthroughs in AI and machine learning are enabling the development of highly personalized and adaptive training programs, enhancing user engagement and effectiveness. Strategic partnerships between equipment manufacturers and digital fitness content providers are creating comprehensive fitness ecosystems that offer a seamless user experience. Market expansion strategies, including the penetration into underserved demographics and geographical regions, are also crucial growth drivers. The increasing focus on sustainability and eco-friendly product designs is resonating with environmentally conscious consumers, creating a competitive advantage for brands that prioritize these aspects. Finally, the continuous innovation in wearable technology and its seamless integration with home fitness equipment allows for more accurate data tracking and personalized feedback, further enhancing the value proposition for consumers.

Key Players Shaping the North America Home Fitness Equipment Market Market

- Echelon Fitness Multimedia LLC

- Decathlon SA

- Anta International Limited (Amer Sports Oyj)

- ICON Health & Fitness INC (Nordic Track)

- Wattbike Ltd

- Johnson Health Tech Co Ltd

- Nautilus Inc

- Technogym SpA

- TRUE Fitness

- Peloton Interactive Inc (Precor Incorporated)

- SportsArt

- KPS Capital Partners (Life Fitness)

Notable Milestones in North America Home Fitness Equipment Market Sector

- November 2022: Nautilus Inc. launched the Bowflex BXT8J Treadmill with JRNY adaptive fitness app, available through major retailers like Amazon, Dick's Sporting Goods, and Best Buy. This launch highlighted a focus on accessible smart fitness solutions with advanced cushioning and incline features.

- September 2022: Peloton Interactive Inc. introduced a new line of rowing machines, starting at USD 3,195, signaling an expansion into a popular home fitness category. The company also announced a strategic partnership with Amazon to broaden its e-commerce reach and customer base.

- June 2022: SportsArt enhanced its ECO-POWR line with the addition of the G866 Front-Drive Elliptical. This development underscored the company's commitment to durable, energy-generating fitness equipment, offering improved accessibility compared to traditional models.

In-Depth North America Home Fitness Equipment Market Market Outlook

The North America home fitness equipment market is on an upward trajectory, fueled by a persistent and growing demand for personalized, convenient, and engaging health and wellness solutions. Growth accelerators such as the advancement of AI-driven fitness platforms, the integration of immersive technologies like VR, and the increasing adoption of subscription-based fitness models are setting the stage for significant market expansion. Strategic partnerships between hardware manufacturers and digital content providers are creating compelling, end-to-end fitness experiences. Furthermore, the growing consumer awareness regarding preventative healthcare and the long-term benefits of regular physical activity will continue to drive investment in home fitness equipment. The market's future potential lies in its ability to adapt to evolving consumer needs, offering a blend of high-performance equipment, intelligent features, and accessible pricing strategies to cater to a diverse range of users.

North America Home Fitness Equipment Market Segmentation

-

1. Product Type

- 1.1. Treadmills

- 1.2. Elliptical Machines

- 1.3. Stationary Cycles

- 1.4. Rowing Machines

- 1.5. Strength Training Equipment

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

- 2.3. Direct Selling

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Home Fitness Equipment Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Home Fitness Equipment Market Regional Market Share

Geographic Coverage of North America Home Fitness Equipment Market

North America Home Fitness Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Private Label and Indigenous Brands; Internet Penetration Proliferated the eCommerce Sales of Hair Care Products

- 3.3. Market Restrains

- 3.3.1. Counterfeiting In Hair Care Products

- 3.4. Market Trends

- 3.4.1. Consumers’ Interest in Customized Workout Regimes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Treadmills

- 5.1.2. Elliptical Machines

- 5.1.3. Stationary Cycles

- 5.1.4. Rowing Machines

- 5.1.5. Strength Training Equipment

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.2.3. Direct Selling

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Treadmills

- 6.1.2. Elliptical Machines

- 6.1.3. Stationary Cycles

- 6.1.4. Rowing Machines

- 6.1.5. Strength Training Equipment

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.2.3. Direct Selling

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Treadmills

- 7.1.2. Elliptical Machines

- 7.1.3. Stationary Cycles

- 7.1.4. Rowing Machines

- 7.1.5. Strength Training Equipment

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.2.3. Direct Selling

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Treadmills

- 8.1.2. Elliptical Machines

- 8.1.3. Stationary Cycles

- 8.1.4. Rowing Machines

- 8.1.5. Strength Training Equipment

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.2.3. Direct Selling

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Treadmills

- 9.1.2. Elliptical Machines

- 9.1.3. Stationary Cycles

- 9.1.4. Rowing Machines

- 9.1.5. Strength Training Equipment

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.2.3. Direct Selling

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Echelon Fitness Multimedia LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Decathlon SA*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Anta International Limited (Amer Sports Oyj)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ICON Health & Fitness INC (Nordic Track)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Wattbike Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Johnson Health Tech Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nautilus Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Technogym SpA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 TRUE Fitness

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Peloton Interactive Inc (Precor Incorporated)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SportsArt

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 KPS Capital Partners (Life Fitness)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Echelon Fitness Multimedia LLC

List of Figures

- Figure 1: North America Home Fitness Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Home Fitness Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: North America Home Fitness Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Home Fitness Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 19: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 35: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home Fitness Equipment Market?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the North America Home Fitness Equipment Market?

Key companies in the market include Echelon Fitness Multimedia LLC, Decathlon SA*List Not Exhaustive, Anta International Limited (Amer Sports Oyj), ICON Health & Fitness INC (Nordic Track), Wattbike Ltd, Johnson Health Tech Co Ltd, Nautilus Inc, Technogym SpA, TRUE Fitness, Peloton Interactive Inc (Precor Incorporated), SportsArt, KPS Capital Partners (Life Fitness).

3. What are the main segments of the North America Home Fitness Equipment Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Private Label and Indigenous Brands; Internet Penetration Proliferated the eCommerce Sales of Hair Care Products.

6. What are the notable trends driving market growth?

Consumers’ Interest in Customized Workout Regimes.

7. Are there any restraints impacting market growth?

Counterfeiting In Hair Care Products.

8. Can you provide examples of recent developments in the market?

In November 2022, Nautilus Inc. launched the Bowflex BXT8J Treadmill with JRNY adaptive fitness app in limited retail outlets such as Amazon, Dick's Sporting Goods, Academy, Best Buy, and Nebraska Furniture Mart. The product has a wide range of running belts, a Comfort Tech cushioning system, speeds up to 12 mph, and a 15% motorized incline.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home Fitness Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home Fitness Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home Fitness Equipment Market?

To stay informed about further developments, trends, and reports in the North America Home Fitness Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence