Key Insights

The Asia-Pacific (APAC) fashion accessories market, valued at approximately 741.24 billion in 2025, is projected for significant expansion, forecasting a Compound Annual Growth Rate (CAGR) of 6.31% from 2025 to 2033. This robust growth is propelled by increasing disposable incomes, particularly within the expanding middle classes of India and China. Social media and e-commerce are accelerating market penetration by exposing consumers to diverse styles and facilitating convenient online purchases. A key trend is the escalating demand for sustainable and ethically sourced accessories, prompting brands to adopt eco-friendly practices and transparent supply chains. Potential restraints include economic fluctuations and global uncertainties that may affect consumer confidence and purchasing power. The market is segmented by end-user (men, women, kids, unisex), distribution channel (offline and online retail), and product type (footwear, apparel, wallets, handbags, watches, and other accessories). Leading players like Adidas, Nike, and Li-Ning are employing innovation, endorsements, and omnichannel strategies to boost market share and align with evolving consumer preferences. The dominance of China and India, alongside growing fashion consciousness in other APAC nations, establishes the region as a highly attractive market for fashion accessory brands.

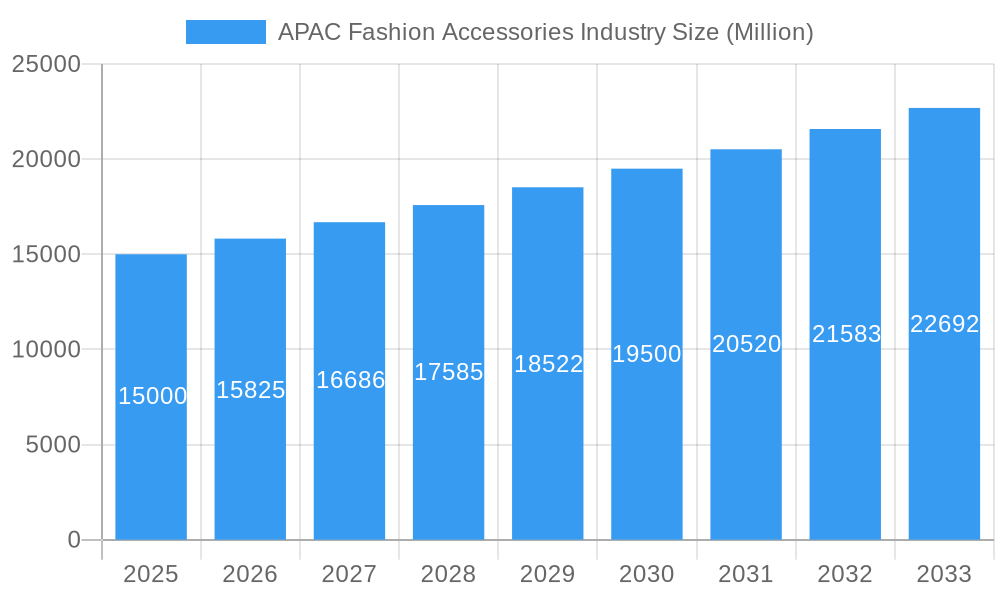

APAC Fashion Accessories Industry Market Size (In Billion)

This strong growth trajectory is further supported by the increasing adoption of online shopping, especially in regions with expanding internet penetration. The premiumization of fashion accessories, with consumers prioritizing high-quality and designer items, also fuels market expansion. Technological integration, including personalized recommendations and virtual try-on features, will enhance the consumer experience and drive sales. Intense competition exists between established international brands and local players. Successful companies will focus on brand building, product innovation, and targeted consumer segmentation to thrive in this dynamic market. Future success will hinge on effective supply chain management, adaptability to shifting consumer preferences, and leveraging digital technologies to optimize the customer journey.

APAC Fashion Accessories Industry Company Market Share

APAC Fashion Accessories Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific (APAC) fashion accessories market, covering the period from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to understand the market dynamics, growth trends, and future opportunities within this dynamic sector. The report utilizes a robust methodology incorporating both qualitative and quantitative data, with a focus on key segments and leading players. The base year is 2025, with estimations for 2025 and forecasts extending to 2033, while the historical period examined is 2019-2024. The market size is presented in million units.

APAC Fashion Accessories Industry Market Dynamics & Structure

The APAC fashion accessories market is characterized by a diverse landscape of established international players and rapidly growing domestic brands. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller companies cater to niche segments. Technological innovation, particularly in e-commerce and personalized product offerings, plays a crucial role in shaping market dynamics. Regulatory frameworks concerning product safety and labeling vary across countries, presenting both opportunities and challenges. The market sees competition from substitute products, particularly in certain segments like footwear. End-user demographics are shifting, with increasing demand from younger generations and a growing focus on sustainable and ethically sourced products. M&A activity remains significant, with an estimated xx deals in the historical period, driving consolidation and expansion within the industry.

- Market Concentration: Moderate, with top 5 players holding approximately xx% of market share in 2024.

- Technological Innovation: Key drivers include e-commerce platforms, personalized design tools, and sustainable material innovation.

- Regulatory Frameworks: Vary significantly across countries impacting product labeling, safety standards and import/export regulations.

- Competitive Product Substitutes: Increased competition from alternative materials and brands offering similar functionalities.

- End-User Demographics: Growth driven by the increasing disposable incomes and changing fashion preferences of millennials and Gen Z.

- M&A Trends: xx M&A deals recorded between 2019-2024. Consolidation is expected to continue.

APAC Fashion Accessories Industry Growth Trends & Insights

The APAC fashion accessories market exhibited robust growth during the historical period (2019-2024), driven by rising disposable incomes, increasing urbanization, and a growing preference for fashion-conscious lifestyles. The market size expanded from xx million units in 2019 to xx million units in 2024, registering a Compound Annual Growth Rate (CAGR) of xx%. The online retail channel has experienced significant adoption, impacting the market structure and accelerating growth in e-commerce. Technological disruptions, such as the rise of social media marketing and personalized recommendations, have influenced consumer behavior. Consumers are increasingly seeking unique, sustainable, and ethically produced accessories. Market penetration of online channels is projected to reach xx% by 2033. The estimated market size for 2025 is xx million units, and the forecast period (2025-2033) anticipates a CAGR of xx%.

Dominant Regions, Countries, or Segments in APAC Fashion Accessories Industry

China and India dominate the APAC fashion accessories market, accounting for a combined xx% of the total market size in 2024. Within segments, the women's segment holds the largest share, followed by the men's and kids/children segments. The online retail channel is witnessing rapid growth, although offline retail continues to play a significant role, especially in tier 2 and tier 3 cities. Footwear and handbags are the leading product types, representing xx% and xx% of the total market respectively, followed by apparel and watches.

- Key Drivers for China & India: Large consumer base, rising disposable incomes, increasing fashion awareness, and robust infrastructure.

- Women's Segment Dominance: Driven by higher spending power and diverse fashion preferences.

- Online Retail Growth: Accelerated by technological advancements and increased internet penetration.

- Footwear and Handbags Lead: Highest demand driven by changing trends and wider consumer preferences.

APAC Fashion Accessories Industry Product Landscape

The APAC fashion accessories market showcases a diverse range of products, from traditional items to innovative designs incorporating smart technologies. Product innovations focus on enhanced comfort, durability, and sustainability. Features like water-resistant materials, personalized customization options, and integrated technology are gaining popularity. Performance metrics such as customer satisfaction and product lifecycle are crucial factors driving innovation and competition. Unique selling propositions include brand storytelling, limited-edition collaborations, and ethical sourcing certifications.

Key Drivers, Barriers & Challenges in APAP Fashion Accessories Industry

Key Drivers: Rising disposable incomes across APAC, increasing urbanization, expanding e-commerce penetration, growing fashion consciousness among millennials and Gen Z, and technological advancements driving product innovation.

Challenges: Intense competition among both domestic and international brands, supply chain disruptions due to geopolitical factors, fluctuations in raw material prices impacting profitability, and evolving consumer preferences that require constant adaptation and innovation. These factors may lead to a xx% decrease in profit margins for some companies by 2033 if not addressed.

Emerging Opportunities in APAC Fashion Accessories Industry

Untapped markets in smaller cities and rural areas present significant opportunities. The growing demand for sustainable and ethical products creates space for eco-friendly brands. The integration of technology into accessories, such as wearable tech and smartwatches, presents exciting possibilities. Personalization and customization services are becoming increasingly popular, offering opportunities for brands to differentiate themselves.

Growth Accelerators in the APAC Fashion Accessories Industry

Long-term growth will be driven by strategic partnerships between brands and technology companies, further expansion into untapped markets, especially in Southeast Asia, and the development of innovative products focusing on sustainability and technology integration. Government initiatives promoting local manufacturing and sustainable practices can also act as significant catalysts for growth.

Key Players Shaping the APAC Fashion Accessories Industry Market

- Adidas AG

- Bosideng International Holdings Limited

- Li-Ning Company Limited

- Skechers USA Inc

- Zhejiang Semir Garment Co

- Aditya Birla Group

- Puma SE

- Fossil Group Inc

- Nike Inc

- Uniqlo Co Ltd

- List Not Exhaustive

Notable Milestones in APAC Fashion Accessories Industry Sector

- May 2021: Senreve launched its first pop-up store at the Takashimaya Shopping Centre, Singapore.

- December 2021: Roger Dubuis opened its first standalone store in Sydney, Australia.

- September 2022: Forever 21 and American Eagle Outfitters announced their return to the Japanese market.

In-Depth APAC Fashion Accessories Industry Market Outlook

The APAC fashion accessories market is poised for sustained growth over the forecast period (2025-2033), driven by a confluence of factors including rising disposable incomes, technological innovation, and evolving consumer preferences. Strategic partnerships, expansion into new markets, and a focus on sustainability will be crucial for success. The market presents significant opportunities for both established players and emerging brands to capture market share and drive innovation within this dynamic and ever-evolving sector.

APAC Fashion Accessories Industry Segmentation

-

1. Product Type

- 1.1. Footwear

- 1.2. Apparel

- 1.3. Wallets

- 1.4. Handbags

- 1.5. Watches

- 1.6. Other Products

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

- 2.4. Unisex

-

3. Distibution Channel

- 3.1. Offline Retail Channel

- 3.2. Online Retail Channel

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. Rest of Asia-Pacific

APAC Fashion Accessories Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

APAC Fashion Accessories Industry Regional Market Share

Geographic Coverage of APAC Fashion Accessories Industry

APAC Fashion Accessories Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Growing Preference for Luxury Fashion Accessories is Pushing the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Footwear

- 5.1.2. Apparel

- 5.1.3. Wallets

- 5.1.4. Handbags

- 5.1.5. Watches

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.2.4. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.3.1. Offline Retail Channel

- 5.3.2. Online Retail Channel

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Footwear

- 6.1.2. Apparel

- 6.1.3. Wallets

- 6.1.4. Handbags

- 6.1.5. Watches

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.2.4. Unisex

- 6.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.3.1. Offline Retail Channel

- 6.3.2. Online Retail Channel

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Footwear

- 7.1.2. Apparel

- 7.1.3. Wallets

- 7.1.4. Handbags

- 7.1.5. Watches

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.2.4. Unisex

- 7.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.3.1. Offline Retail Channel

- 7.3.2. Online Retail Channel

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Footwear

- 8.1.2. Apparel

- 8.1.3. Wallets

- 8.1.4. Handbags

- 8.1.5. Watches

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.2.4. Unisex

- 8.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.3.1. Offline Retail Channel

- 8.3.2. Online Retail Channel

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Footwear

- 9.1.2. Apparel

- 9.1.3. Wallets

- 9.1.4. Handbags

- 9.1.5. Watches

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids/Children

- 9.2.4. Unisex

- 9.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.3.1. Offline Retail Channel

- 9.3.2. Online Retail Channel

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Footwear

- 10.1.2. Apparel

- 10.1.3. Wallets

- 10.1.4. Handbags

- 10.1.5. Watches

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Kids/Children

- 10.2.4. Unisex

- 10.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.3.1. Offline Retail Channel

- 10.3.2. Online Retail Channel

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Adidas AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bosideng International Holdings Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Li-Ning Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Skechers USA Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zhejiang Semir Garment Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aditya Birla Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Puma SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fossil Group Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nike Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Uniqlo Co Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Adidas AG

List of Figures

- Figure 1: Global APAC Fashion Accessories Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: China APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: China APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: China APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: China APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 7: China APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 8: China APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 9: China APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: China APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: China APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Japan APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: Japan APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Japan APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Japan APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Japan APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 17: Japan APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 18: Japan APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 19: Japan APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Japan APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Japan APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: India APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 23: India APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: India APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 25: India APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 26: India APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 27: India APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 28: India APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 29: India APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: India APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: India APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Australia APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 33: Australia APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Australia APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 35: Australia APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: Australia APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 37: Australia APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 38: Australia APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 39: Australia APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Australia APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Australia APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 45: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 47: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 48: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 49: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 9: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 13: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 14: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 19: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 24: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 27: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 29: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Fashion Accessories Industry?

The projected CAGR is approximately 6.31%.

2. Which companies are prominent players in the APAC Fashion Accessories Industry?

Key companies in the market include Adidas AG, Bosideng International Holdings Limited, Li-Ning Company Limited, Skechers USA Inc, Zhejiang Semir Garment Co, Aditya Birla Group, Puma SE, Fossil Group Inc, Nike Inc, Uniqlo Co Ltd*List Not Exhaustive.

3. What are the main segments of the APAC Fashion Accessories Industry?

The market segments include Product Type, End User, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 741.24 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Growing Preference for Luxury Fashion Accessories is Pushing the Market.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

September 2022: Forever 21 and American Eagle Outfitters Inc. announced their comeback to the Japanese market after leaving in 2019. Forever has stated that it will begin e-commerce sales and launch a physical store in February 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Fashion Accessories Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Fashion Accessories Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Fashion Accessories Industry?

To stay informed about further developments, trends, and reports in the APAC Fashion Accessories Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence