Key Insights

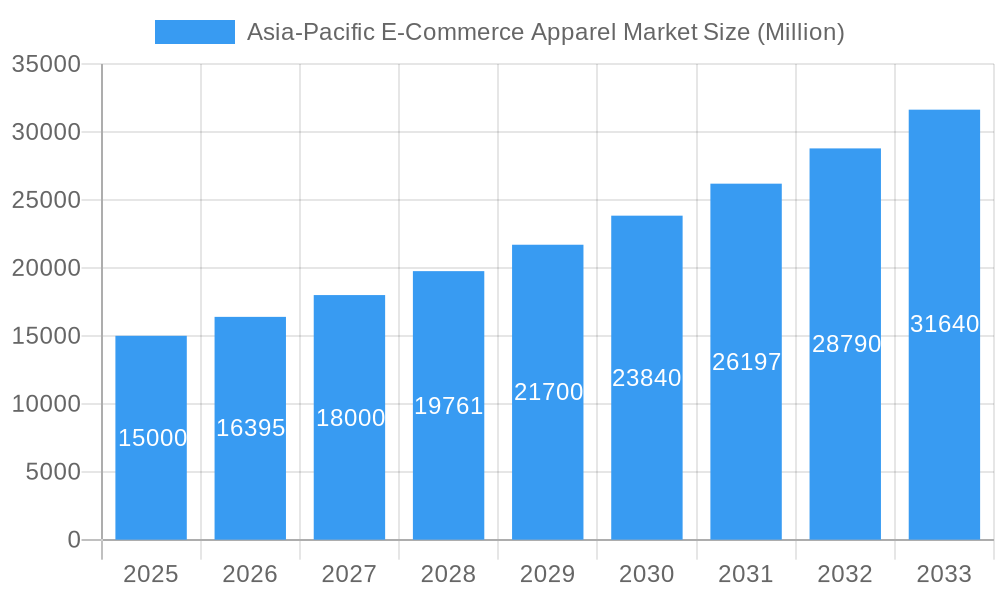

The Asia-Pacific e-commerce apparel market is poised for significant expansion, driven by a growing middle class, escalating internet and smartphone adoption, and a pronounced consumer preference for online shopping convenience. The market, valued at $779.3 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.15% from 2025 to 2033. Key growth drivers include the surge in mobile commerce, particularly in China and India, the proliferation of social commerce platforms, and effective influencer marketing strategies. Consumers are drawn to the extensive product selection and competitive pricing available online. Market segmentation reveals strong performance across men's, women's, and children's apparel, with casual, formal, and sportswear being popular categories. While third-party retailers dominate, the rise of company-owned e-commerce sites indicates a strategic shift towards direct-to-consumer models by leading brands.

Asia-Pacific E-Commerce Apparel Market Market Size (In Billion)

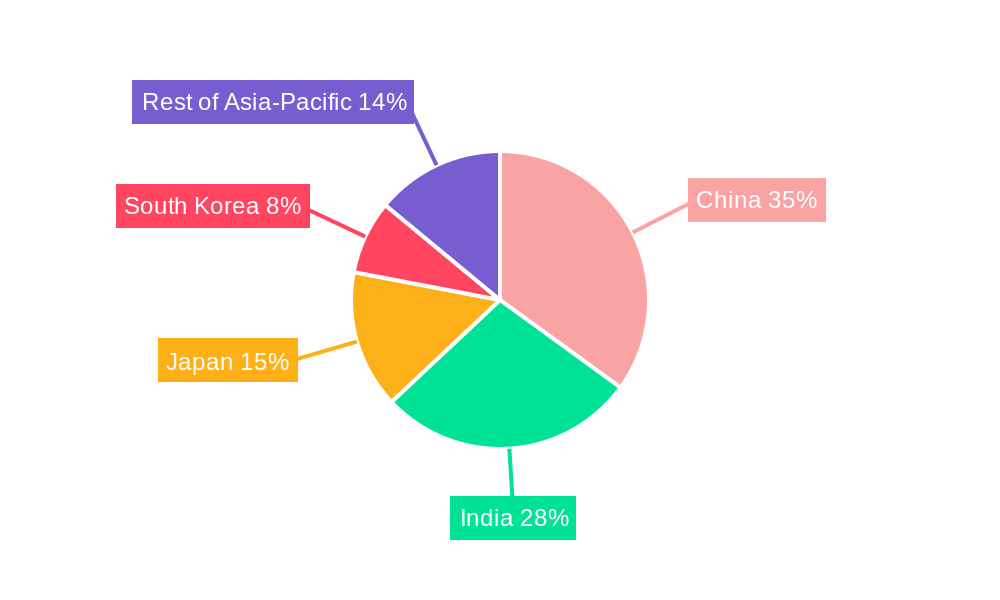

Regional analysis underscores the substantial contributions of China, India, and Japan, owing to their large populations and evolving consumer behaviors. Challenges such as logistical complexities, concerns about product authenticity, and varying payment gateway infrastructure are being addressed through ongoing investments in logistics and increasing consumer trust in online transactions. Major global players, including Adidas, Inditex, and Nike, are actively leveraging these market dynamics through strategic online investments and innovative marketing campaigns, reinforcing a competitive yet opportunity-rich landscape. The consistent CAGR signals a robust and sustainable growth trajectory for the Asia-Pacific e-commerce apparel market, presenting ample avenues for innovation and investment.

Asia-Pacific E-Commerce Apparel Market Company Market Share

Asia-Pacific E-Commerce Apparel Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific e-commerce apparel market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. Market values are presented in million units.

Asia-Pacific E-Commerce Apparel Market Dynamics & Structure

The Asia-Pacific e-commerce apparel market is characterized by a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is moderate, with a few large players dominating certain segments while numerous smaller businesses compete within niche markets. Technological innovation, particularly in areas such as augmented reality (AR) for virtual try-ons and personalized recommendations, is a key driver. However, regulatory frameworks governing data privacy and e-commerce practices vary across the region, presenting both opportunities and challenges. Competitive substitutes, such as brick-and-mortar stores and secondhand apparel platforms, exert pressure. End-user demographics, with a rapidly growing young and tech-savvy population, fuel market expansion. M&A activity is substantial; while exact deal volumes for the period are unavailable (xx), the market has witnessed significant consolidation and strategic acquisitions.

- Market Concentration: Moderate, with a few dominant players and a large number of smaller businesses. (Market share data unavailable for xx, further research required)

- Technological Innovation: AR/VR for virtual try-ons, personalized recommendations, and efficient supply chain management.

- Regulatory Frameworks: Vary significantly across countries, impacting data privacy, cross-border trade, and consumer protection.

- Competitive Substitutes: Brick-and-mortar stores, secondhand apparel platforms, and direct-to-consumer brands pose competition.

- End-User Demographics: Significant growth driven by the young and digitally-engaged population across the region.

- M&A Trends: Significant consolidation and strategic acquisitions, with exact figures currently unavailable (xx).

Asia-Pacific E-Commerce Apparel Market Growth Trends & Insights

The Asia-Pacific e-commerce apparel market has exhibited robust growth throughout the historical period (2019-2024), driven by increasing internet and smartphone penetration, rising disposable incomes, and changing consumer preferences towards online shopping convenience. The market size expanded from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. This positive trend is expected to continue during the forecast period (2025-2033), with the market size projected to reach xx million units by 2033, exhibiting a CAGR of xx%. Technological disruptions, including the rise of social commerce and mobile-first shopping experiences, are further fueling growth. Consumer behavior shifts towards personalized shopping experiences, sustainable fashion, and increased preference for online returns are also impacting market dynamics. Market penetration continues to grow, with e-commerce accounting for a significant and growing share of total apparel sales in the region. Specific data on adoption rates and penetration is unavailable for xx.

Dominant Regions, Countries, or Segments in Asia-Pacific E-Commerce Apparel Market

The Asia-Pacific e-commerce apparel market is currently spearheaded by China and India, which stand out due to their vast populations, rapidly increasing internet and smartphone penetration, and sustained economic expansion. Within the diverse product landscape, casual wear consistently captures the largest market share, followed by the growing segments of sportswear and formal wear. The women's apparel segment is demonstrating the most significant growth potential, propelled by evolving fashion trends, a desire for self-expression, and a growing comfort with online purchasing. In terms of sales channels, third-party online retailers command a substantial market share, especially for smaller brands, owing to their established customer ecosystems, sophisticated logistics, and wider market reach compared to company-owned direct-to-consumer websites.

- Key Drivers (China and India): A confluence of factors including immense populations, rising disposable incomes, pervasive internet and smartphone access, and government initiatives promoting digital commerce are fueling market growth.

- Segment Dominance:

- Product Type: Casual Wear continues to lead in market share, with Sportswear and Formal Wear showing strong secondary positions.

- End User: The Women's segment is identified as having the highest growth potential, with Men's and Kids/Children's segments also contributing to overall expansion.

- Platform Type: Third-party online retail platforms remain the dominant channel for apparel sales.

- Growth Potential: Significant untapped potential exists within developing economies across the region as digital literacy and access to online infrastructure continue to expand.

Asia-Pacific E-Commerce Apparel Market Product Landscape

The Asia-Pacific e-commerce apparel market features a diverse range of products, from basic clothing items to designer apparel. Innovations include sustainable and ethically sourced materials, personalized customization options (e.g., bespoke tailoring), and improved virtual try-on technologies. The focus on enhancing the online shopping experience through features such as high-quality product photography, detailed descriptions, and seamless returns processes is also a key aspect of the product landscape. Performance metrics concentrate on conversion rates, average order value, and customer retention. Unique selling propositions often center around brand identity, affordability, sustainability, and unique design features.

Key Drivers, Barriers & Challenges in Asia-Pacific E-Commerce Apparel Market

Key Drivers: Rising disposable incomes, increasing internet penetration, growing adoption of smartphones and mobile commerce, changing consumer preferences favoring online shopping convenience, government initiatives promoting digital economy growth.

Challenges: Intense competition, complexities in cross-border e-commerce, varying logistics infrastructure across the region, concerns about counterfeit goods, fluctuations in raw material costs, and regulatory changes. The impact of these challenges on market growth is difficult to quantify precisely (xx).

Emerging Opportunities in Asia-Pacific E-Commerce Apparel Market

The burgeoning e-commerce apparel landscape in Asia-Pacific presents a wealth of emerging opportunities. Southeast Asian markets, with their rapidly growing middle class and increasing digital adoption, represent a particularly fertile ground for expansion. Innovations are also driving new avenues for growth, including personalized styling services that cater to individual preferences, the integration of Augmented Reality (AR) and Virtual Reality (VR) technologies to enhance the virtual try-on experience, and a growing consumer demand for sustainable and ethically sourced apparel, attracting significant investment and consumer interest. Furthermore, the increasing consumer desire for unique, personalized items and a lean towards supporting niche and independent brands are creating lucrative opportunities for specialized online retailers to thrive.

Growth Accelerators in the Asia-Pacific E-Commerce Apparel Market Industry

Technological advancements in areas such as AI-powered personalized recommendations, virtual try-on technologies, and improved logistics systems are key growth catalysts. Strategic partnerships between e-commerce platforms, fashion brands, and technology providers create synergies and expand market reach. Furthermore, expansion into untapped markets within the region and diversification of product offerings to cater to evolving consumer preferences and demands will drive growth.

Key Players Shaping the Asia-Pacific E-Commerce Apparel Market Market

- Adidas AG

- Industria de Diseño Textil S A (Inditex)

- Aditya Birla Group's

- Arvind Lifestyle Brands Limited

- V Ventures (Italian colony)

- Forever 21 Inc

- PVH Corp

- Raymond Group

- Hennes & Mauritz AB

- Fast Retailing Co Ltd

- BIBA Fashion Limited

- LVMH Moët Hennessy Louis Vuitton

- Nike Inc

Notable Milestones in Asia-Pacific E-Commerce Apparel Market Sector

- February 2023: Forever 21 strategically relaunched in Japan, repositioning itself as an upscale brand with a strong emphasis on localized offerings and robust online sales channels.

- March 2023: Italian fashion house Italian Colony launched its dedicated online store in India, making affordable Italian-inspired fashion accessible to a wider Indian consumer base.

- March 2023: UNIQLO, a global apparel giant, partnered with the popular anime series "Attack on Titan" for a highly anticipated limited-edition t-shirt collection released in Japan.

- May 2023: Alessandro Vittore, a UK-based clothing company, signaled its strategic expansion plans into the significant Indian market, indicating growing international interest.

In-Depth Asia-Pacific E-Commerce Apparel Market Market Outlook

The Asia-Pacific e-commerce apparel market is projected to sustain its trajectory of robust and dynamic growth. This expansion is underpinned by a potent combination of rapid technological advancements, evolving consumer purchasing behaviors, and the increasing penetration of digital platforms across diverse demographics and geographies. Key strategic imperatives for businesses seeking to capitalize on this considerable market potential include forging strategic alliances, making targeted investments in cutting-edge technologies like AI-powered personalization and advanced logistics, and strategically expanding into underserved or emerging markets within the region. While current trends indicate significant growth, further in-depth research and granular data analysis are essential to accurately quantify precise market sizes and refine growth projections, particularly in areas where data may be less comprehensively developed.

Asia-Pacific E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

Asia-Pacific E-Commerce Apparel Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

Asia-Pacific E-Commerce Apparel Market Regional Market Share

Geographic Coverage of Asia-Pacific E-Commerce Apparel Market

Asia-Pacific E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Growth of Fashion Marketplaces; Increasing Brand Advertisements on Social Media

- 3.3. Market Restrains

- 3.3.1. Competition from Traditional Brick-and-Mortar Retail

- 3.4. Market Trends

- 3.4.1. Strong Growth of Fashion Marketplaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Formal Wear

- 9.1.2. Casual Wear

- 9.1.3. Sportswear

- 9.1.4. Nightwear

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids/Children

- 9.3. Market Analysis, Insights and Forecast - by Platform Type

- 9.3.1. Third Party Retailer

- 9.3.2. Company's Own Website

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Adidas AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Industria de Diseño Textil S A (Inditex)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aditya Birla Group's

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Arvind Lifestyle Brands Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 V Ventures (Italian colony)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Forever 21 Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PVH Corp

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Raymond Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hennes & Mauritz AB

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fast Retailing Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BIBA Fashion Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 LVMH Moët Hennessy Louis Vuitto

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Nike Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Adidas AG

List of Figures

- Figure 1: Asia-Pacific E-Commerce Apparel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 4: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 9: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 13: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 14: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 19: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 24: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific E-Commerce Apparel Market?

The projected CAGR is approximately 9.15%.

2. Which companies are prominent players in the Asia-Pacific E-Commerce Apparel Market?

Key companies in the market include Adidas AG, Industria de Diseño Textil S A (Inditex), Aditya Birla Group's, Arvind Lifestyle Brands Limited, V Ventures (Italian colony), Forever 21 Inc, PVH Corp, Raymond Group, Hennes & Mauritz AB, Fast Retailing Co Ltd, BIBA Fashion Limited, LVMH Moët Hennessy Louis Vuitto, Nike Inc.

3. What are the main segments of the Asia-Pacific E-Commerce Apparel Market?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 779.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Strong Growth of Fashion Marketplaces; Increasing Brand Advertisements on Social Media.

6. What are the notable trends driving market growth?

Strong Growth of Fashion Marketplaces.

7. Are there any restraints impacting market growth?

Competition from Traditional Brick-and-Mortar Retail.

8. Can you provide examples of recent developments in the market?

May 2023: Alessandro Vittore, a United Kingdom-based clothing company, announced its plans to launch the brand in Indian Market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific E-Commerce Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific E-Commerce Apparel Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific E-Commerce Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence