Key Insights

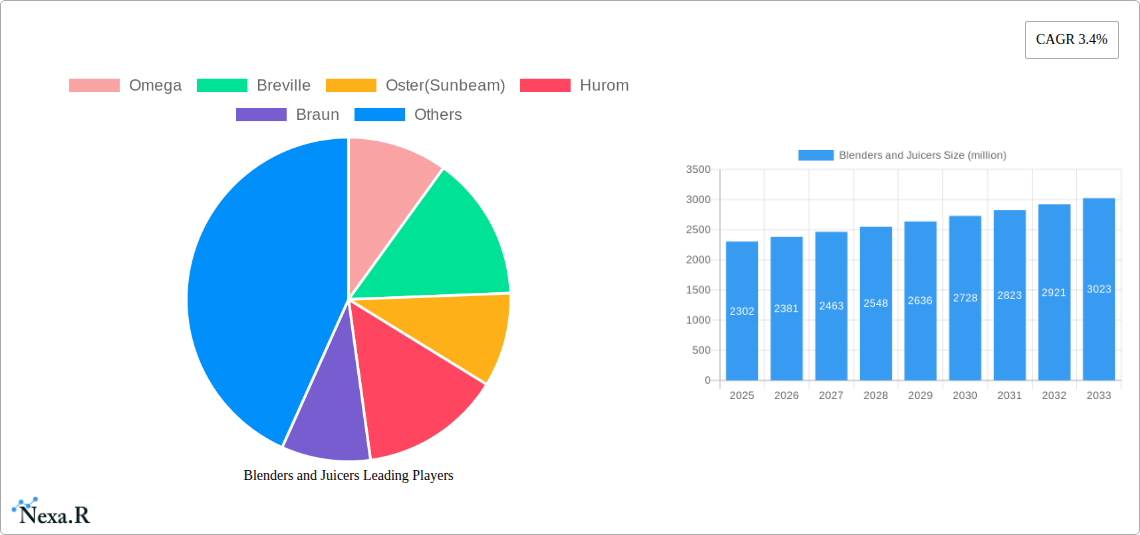

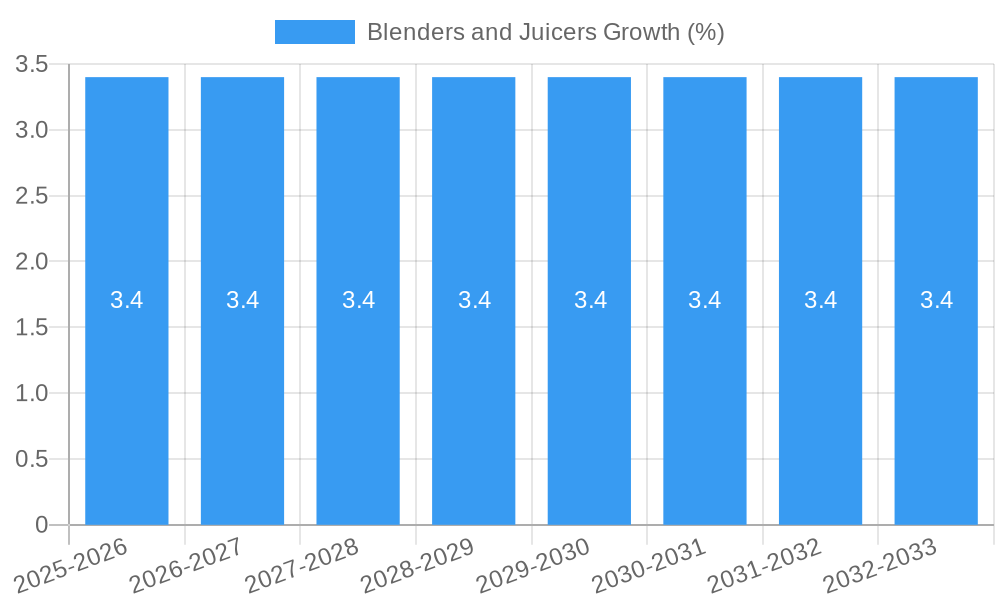

The global Blenders and Juicers market is poised for significant growth, projected to reach approximately $2302 million by 2025 with a Compound Annual Growth Rate (CAGR) of 3.4% through 2033. This expansion is fueled by a growing consumer emphasis on health and wellness, leading to increased adoption of kitchen appliances that facilitate the preparation of nutritious beverages and meals. The rising disposable incomes in emerging economies, coupled with greater awareness of the benefits of fresh juices and smoothies, are key drivers. Furthermore, technological advancements leading to more efficient, user-friendly, and aesthetically pleasing blender and juicer designs are contributing to market momentum. The "Household" application segment is expected to dominate, driven by the increasing preference for home-prepared healthy drinks.

The Blenders and Juicers market is characterized by a dynamic competitive landscape with both established global players and emerging regional brands. Innovation in product features, such as variable speed controls, pre-programmed settings, and enhanced safety mechanisms, are crucial for differentiation. The "Blenders" segment, encompassing a wide range of products from personal blenders to high-performance models, is anticipated to exhibit robust growth due to their versatility. While market growth is strong, potential restraints include the high initial cost of some premium juicer models and the increasing competition from ready-to-drink healthy beverage options. However, the inherent convenience and customization offered by blenders and juicers are likely to sustain their appeal. Key regions driving this growth include Asia Pacific, particularly China and India, due to their large populations and burgeoning middle class, alongside North America and Europe, where health consciousness is deeply ingrained.

Here's a comprehensive, SEO-optimized report description for Blenders and Juicers, integrating high-traffic keywords and market segmentation for maximum visibility and industry professional engagement.

Blenders and Juicers Market Dynamics & Structure

The global blenders and juicers market is characterized by a dynamic interplay of technological advancements, evolving consumer preferences, and increasing health consciousness. Market concentration is moderate, with key players like Breville, Omega, Hurom, Philips, Cuisinart, and Kuvings holding significant shares, particularly within the household blenders and premium juicers segments. Innovation remains a critical driver, fueled by the demand for smart appliances, multi-functional devices, and energy-efficient designs. Regulatory frameworks primarily focus on product safety and energy standards, influencing product development and manufacturing processes. Competitive product substitutes include standalone food processors, immersion blenders, and even simpler manual juicing tools, though the convenience and specialized functions of dedicated blenders and juicers continue to drive adoption. End-user demographics are broadening, encompassing health-conscious millennials, busy families, and professional chefs, all seeking convenient ways to incorporate fresh produce into their diets. Merger and acquisition (M&A) trends are moderately active, as larger conglomerates seek to expand their kitchen appliance portfolios and smaller innovative startups are acquired for their proprietary technologies.

- Market Concentration: Moderate, with key players dominating specific product categories.

- Technological Innovation Drivers: Smart features, multi-functionality, energy efficiency, sustainable materials.

- Regulatory Frameworks: Product safety certifications, energy efficiency standards.

- Competitive Substitutes: Food processors, immersion blenders, manual alternatives.

- End-User Demographics: Health-conscious individuals, families, culinary professionals.

- M&A Trends: Strategic acquisitions of innovative startups by larger appliance manufacturers.

Blenders and Juicers Growth Trends & Insights

The blenders and juicers market size is poised for substantial growth, driven by an escalating global emphasis on health and wellness. Projections indicate a robust CAGR over the forecast period, reflecting increased consumer expenditure on kitchen appliances that facilitate healthy lifestyles. The adoption rates for both blenders and juicers are on an upward trajectory, particularly in emerging economies where disposable incomes are rising, and awareness of the benefits of fresh juices and smoothies is gaining traction. Technological disruptions are reshaping the landscape, with the introduction of high-performance blenders capable of handling tougher ingredients, advanced juicer technologies that maximize nutrient extraction, and the integration of smart features such as app connectivity for recipe suggestions and usage tracking. Consumer behavior shifts are a pivotal influence; a growing segment prioritizes convenience without compromising on nutrition, leading to higher demand for easy-to-use, efficient, and easy-to-clean appliances. The "clean eating" movement and the popularity of meal-replacement smoothies continue to fuel demand for versatile kitchen appliances. Furthermore, the rising popularity of home-based fitness routines encourages individuals to invest in tools that support their dietary goals. The household blenders segment, encompassing personal blenders and high-speed blenders, is expected to lead this expansion due to its versatility and affordability. Conversely, the commercial blenders segment, serving the food service industry, is also experiencing steady growth, driven by the demand for quick and consistent preparation of beverages and food items. The analysis further reveals a significant penetration of cold press juicers and centrifugal juicers within households, catering to different price points and user needs. This period will witness a sustained surge in demand for nutritional blenders and fiber-rich juicers, as consumers become more discerning about the health benefits derived from their appliances. The market penetration of smart kitchen appliances is also projected to increase significantly, offering consumers enhanced control and customization options.

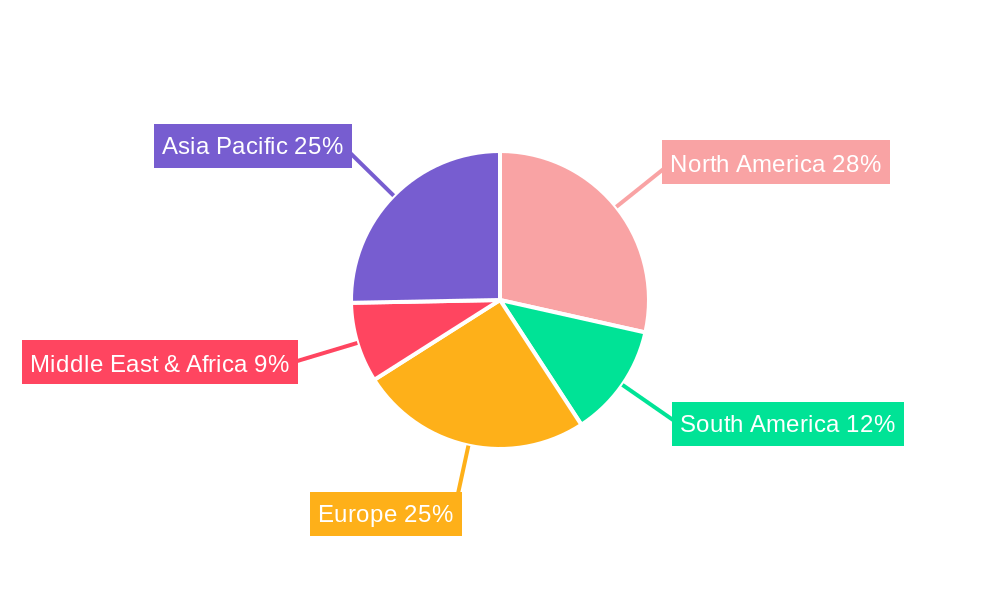

Dominant Regions, Countries, or Segments in Blenders and Juicers

The North America region is currently the dominant force in the global blenders and juicers market, driven by a deeply ingrained culture of health and wellness, high disposable incomes, and early adoption of innovative kitchen technologies. The United States stands out as a leading country, with a substantial market share attributed to its large consumer base, strong demand for kitchen appliances, and a well-established network of retailers and e-commerce platforms. The household application segment, particularly for blenders, commands the largest share within North America. This dominance is fueled by factors such as busy lifestyles necessitating quick meal and beverage preparation, a growing interest in home-based juicing for detoxification and nutritional intake, and the increasing popularity of smoothie bars and home-prepared healthy drinks. Economic policies supporting consumer spending and robust retail infrastructure facilitate widespread product availability.

The Types: Blenders segment, specifically high-performance and personal blenders, is a major growth driver in this region. Technological advancements in motor power, blade design, and material durability, championed by brands like Breville and Vitamix (though not explicitly listed as a key player in this report, their influence is noted), have propelled the demand for sophisticated blenders. The commercial blenders segment also contributes significantly, serving the extensive food service industry in the US, including cafes, restaurants, and juice bars, where efficiency and consistency are paramount.

While North America leads, Europe and Asia Pacific are demonstrating impressive growth rates. In Europe, countries like Germany, the UK, and France show strong demand for juicers, particularly in urban centers with a growing health-conscious population. Asia Pacific, led by China, is a rapidly expanding market. Factors such as a rising middle class, increasing urbanization, and a growing awareness of Western dietary trends are driving the adoption of both blenders and juicers. The household segment is experiencing explosive growth in these regions, with brands like Joyoung, Supor, and Midea gaining traction in the China blenders market. Infrastructure development and an expanding retail presence, including both brick-and-mortar stores and robust e-commerce channels, are crucial for market penetration in these dynamic regions. The growth potential in Asia Pacific is particularly high, presenting significant opportunities for market expansion.

Blenders and Juicers Product Landscape

The product landscape for blenders and juicers is characterized by continuous innovation aimed at enhancing user experience and nutritional benefits. Innovations include high-speed blenders with powerful motors capable of pulverizing tough ingredients, creating ultra-smooth textures for smoothies and soups. Juicers are evolving with advanced extraction technologies, such as slow-masticating (cold-press) juicers that preserve more nutrients and enzymes, and centrifugal juicers offering speed and convenience. Smart features, including app connectivity for pre-programmed settings and recipe guidance, are becoming more prevalent, particularly in premium models from brands like Philips and Breville. Materials science is also playing a role, with a focus on durable, BPA-free plastics and stainless steel components. Unique selling propositions often revolve around ease of cleaning, quiet operation, and specific functionalities like ice crushing or nut milk creation.

Key Drivers, Barriers & Challenges in Blenders and Juicers

The blenders and juicers market is propelled by several key drivers. The escalating global health and wellness trend, coupled with increased consumer awareness of the benefits of fresh juices and smoothies, is a primary catalyst. The growing demand for convenient and healthy meal solutions for busy lifestyles also fuels adoption. Technological advancements in appliance design, leading to more efficient, versatile, and user-friendly products, further stimulate market growth.

Conversely, several barriers and challenges exist. High initial purchase costs for premium blenders and juicers can be a restraint for some consumers, especially in price-sensitive markets. Intense competition from numerous brands, including established players and new entrants, can lead to price wars and reduced profit margins. Supply chain disruptions and the rising cost of raw materials can impact manufacturing costs and product availability. Regulatory hurdles related to product safety and energy efficiency can also pose challenges for manufacturers.

Emerging Opportunities in Blenders and Juicers

Emerging opportunities in the blenders and juicers industry lie in catering to niche consumer needs and leveraging technological integrations. The demand for specialized blenders, such as those designed for making nut butters, baby food, or specific dietary supplements, presents untapped market segments. Furthermore, the growing interest in sustainable and eco-friendly kitchen appliances offers opportunities for brands to develop products made from recycled materials or with enhanced energy efficiency. The expansion of smart home ecosystems also opens avenues for integrated blenders and juicers that can communicate with other smart devices. Increased focus on portable and personal blenders for on-the-go consumption is another significant growth area.

Growth Accelerators in the Blenders and Juicers Industry

Several factors are accelerating growth in the blenders and juicers industry. The increasing popularity of health and fitness influencers on social media platforms drives consumer demand for appliances that support healthy eating habits. Strategic partnerships between appliance manufacturers and health food brands can lead to co-branded products and promotional campaigns, expanding market reach. The continuous innovation in motor technology, enabling more power and quieter operation, enhances the appeal of high-end blenders. Furthermore, the growing e-commerce penetration, particularly in developing regions, provides a direct channel for manufacturers to reach a wider consumer base and offer a diverse range of products. The development of more compact and aesthetically pleasing designs also appeals to modern consumers.

Key Players Shaping the Blenders and Juicers Market

- Omega

- Breville

- Oster (Sunbeam)

- Hurom

- Braun

- Cuisinart

- Kuvings

- Philips

- Panasonic

- Electrolux

- Joyoung

- Supor

- Midea

- Donlim (Guangdong Xinbao)

- SKG

- Bear

- ACA (Elec-Tech)

- Deer

- Xibeile (Shuai Jia)

- Ouke

- Hanssem

Notable Milestones in Blenders and Juicers Sector

- 2019: Launch of advanced smart blenders with app connectivity and recipe integration by leading brands.

- 2020: Increased consumer focus on home-based health and wellness, boosting demand for kitchen appliances like blenders and juicers during pandemic lockdowns.

- 2021: Introduction of more powerful and durable motors in high-speed blenders, enhancing their capabilities for various culinary tasks.

- 2022: Growing market penetration of cold-press juicers, emphasizing nutrient retention and health benefits.

- 2023: Emergence of sustainable and eco-friendly appliance designs, using recycled materials and focusing on energy efficiency.

- 2024: Enhanced integration of voice control and AI-powered features in premium blender models.

In-Depth Blenders and Juicers Market Outlook

- 2019: Launch of advanced smart blenders with app connectivity and recipe integration by leading brands.

- 2020: Increased consumer focus on home-based health and wellness, boosting demand for kitchen appliances like blenders and juicers during pandemic lockdowns.

- 2021: Introduction of more powerful and durable motors in high-speed blenders, enhancing their capabilities for various culinary tasks.

- 2022: Growing market penetration of cold-press juicers, emphasizing nutrient retention and health benefits.

- 2023: Emergence of sustainable and eco-friendly appliance designs, using recycled materials and focusing on energy efficiency.

- 2024: Enhanced integration of voice control and AI-powered features in premium blender models.

In-Depth Blenders and Juicers Market Outlook

The blenders and juicers market outlook remains exceptionally positive, with continued growth fueled by sustained consumer interest in health and wellness, coupled with ongoing technological innovation. The expansion of smart home integration and the development of multi-functional appliances will further enhance consumer appeal and market penetration. Opportunities for expansion in emerging economies, driven by rising disposable incomes and a growing middle class, will be a significant growth accelerator. Strategic product development focusing on user convenience, durability, and unique functionalities will be crucial for market leaders. The industry is well-positioned for robust expansion in the coming years.

Blenders and Juicers Segmentation

-

1. Application

- 1.1. Household

- 1.2. Commercial

-

2. Types

- 2.1. Blenders

- 2.2. Juicers

Blenders and Juicers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Blenders and Juicers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blenders and Juicers Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Household

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Blenders

- 5.2.2. Juicers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Blenders and Juicers Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Household

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Blenders

- 6.2.2. Juicers

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Blenders and Juicers Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Household

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Blenders

- 7.2.2. Juicers

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Blenders and Juicers Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Household

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Blenders

- 8.2.2. Juicers

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Blenders and Juicers Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Household

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Blenders

- 9.2.2. Juicers

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Blenders and Juicers Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Household

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Blenders

- 10.2.2. Juicers

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Omega

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Breville

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Oster(Sunbeam)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hurom

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Braun

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cuisinart

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kuvings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Philips

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Panasonic

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Electrolux

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Joyoung

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Supor

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Midea

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Donlim(Guangdong Xinbao)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SKG

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Bear

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ACA(Elec-Tech)

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Deer

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Xibeile(Shuai Jia)

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Ouke

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Hanssem

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Omega

List of Figures

- Figure 1: Global Blenders and Juicers Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Blenders and Juicers Revenue (million), by Application 2024 & 2032

- Figure 3: North America Blenders and Juicers Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Blenders and Juicers Revenue (million), by Types 2024 & 2032

- Figure 5: North America Blenders and Juicers Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Blenders and Juicers Revenue (million), by Country 2024 & 2032

- Figure 7: North America Blenders and Juicers Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Blenders and Juicers Revenue (million), by Application 2024 & 2032

- Figure 9: South America Blenders and Juicers Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Blenders and Juicers Revenue (million), by Types 2024 & 2032

- Figure 11: South America Blenders and Juicers Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Blenders and Juicers Revenue (million), by Country 2024 & 2032

- Figure 13: South America Blenders and Juicers Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Blenders and Juicers Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Blenders and Juicers Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Blenders and Juicers Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Blenders and Juicers Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Blenders and Juicers Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Blenders and Juicers Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Blenders and Juicers Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Blenders and Juicers Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Blenders and Juicers Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Blenders and Juicers Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Blenders and Juicers Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Blenders and Juicers Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Blenders and Juicers Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Blenders and Juicers Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Blenders and Juicers Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Blenders and Juicers Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Blenders and Juicers Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Blenders and Juicers Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Blenders and Juicers Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Blenders and Juicers Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Blenders and Juicers Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Blenders and Juicers Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Blenders and Juicers Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Blenders and Juicers Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Blenders and Juicers Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Blenders and Juicers Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Blenders and Juicers Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Blenders and Juicers Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Blenders and Juicers Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Blenders and Juicers Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Blenders and Juicers Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Blenders and Juicers Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Blenders and Juicers Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Blenders and Juicers Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Blenders and Juicers Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Blenders and Juicers Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Blenders and Juicers Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Blenders and Juicers Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blenders and Juicers?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Blenders and Juicers?

Key companies in the market include Omega, Breville, Oster(Sunbeam), Hurom, Braun, Cuisinart, Kuvings, Philips, Panasonic, Electrolux, Joyoung, Supor, Midea, Donlim(Guangdong Xinbao), SKG, Bear, ACA(Elec-Tech), Deer, Xibeile(Shuai Jia), Ouke, Hanssem.

3. What are the main segments of the Blenders and Juicers?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 2302 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blenders and Juicers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blenders and Juicers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blenders and Juicers?

To stay informed about further developments, trends, and reports in the Blenders and Juicers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence