Key Insights

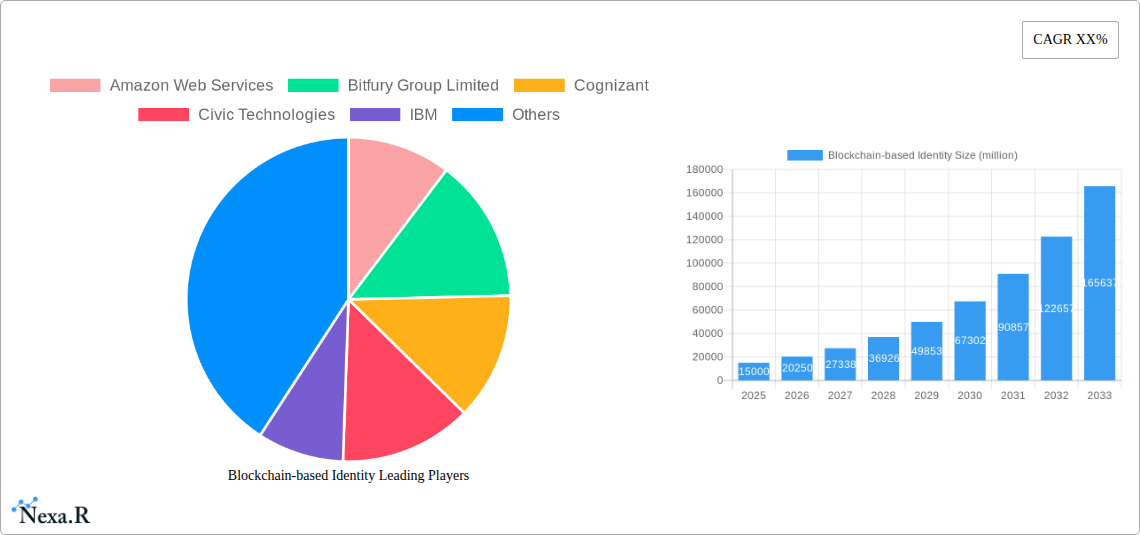

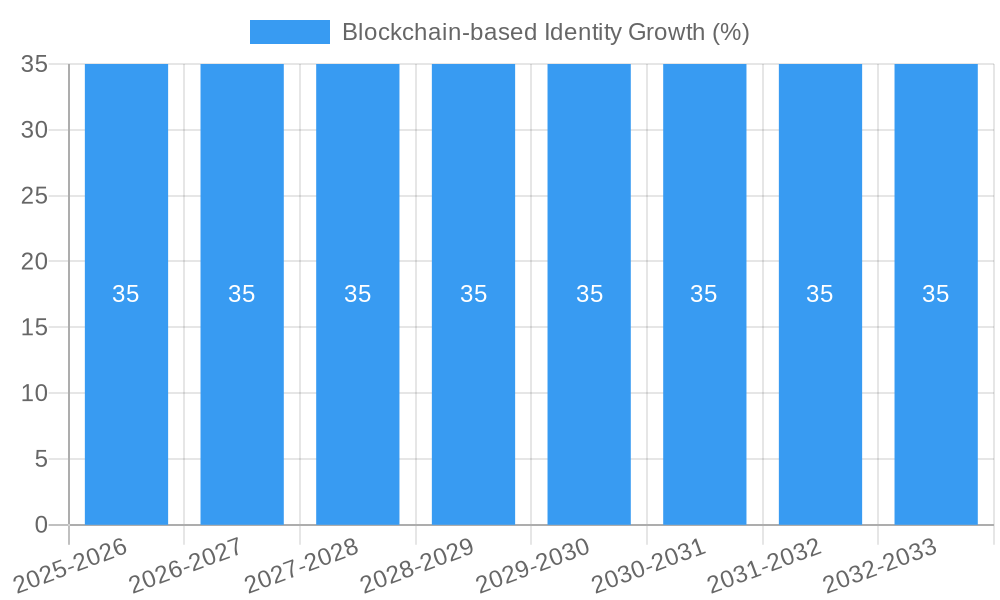

The global Blockchain-based Identity market is poised for significant expansion, projected to reach an estimated market size of approximately $15,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 35% during the forecast period of 2025-2033. This accelerated growth is fundamentally driven by the escalating need for enhanced data security, privacy, and seamless digital identity verification across a multitude of sectors. The inherent immutability and transparency offered by blockchain technology are addressing critical challenges related to identity fraud, unauthorized access, and cumbersome verification processes. As digital transformations accelerate, particularly in areas like remote work, online commerce, and digital healthcare, the demand for decentralized and user-controlled identity solutions is intensifying. This market dynamic is further fueled by increasing regulatory pressures to comply with stringent data protection laws and a growing consumer awareness regarding the ownership and control of personal information.

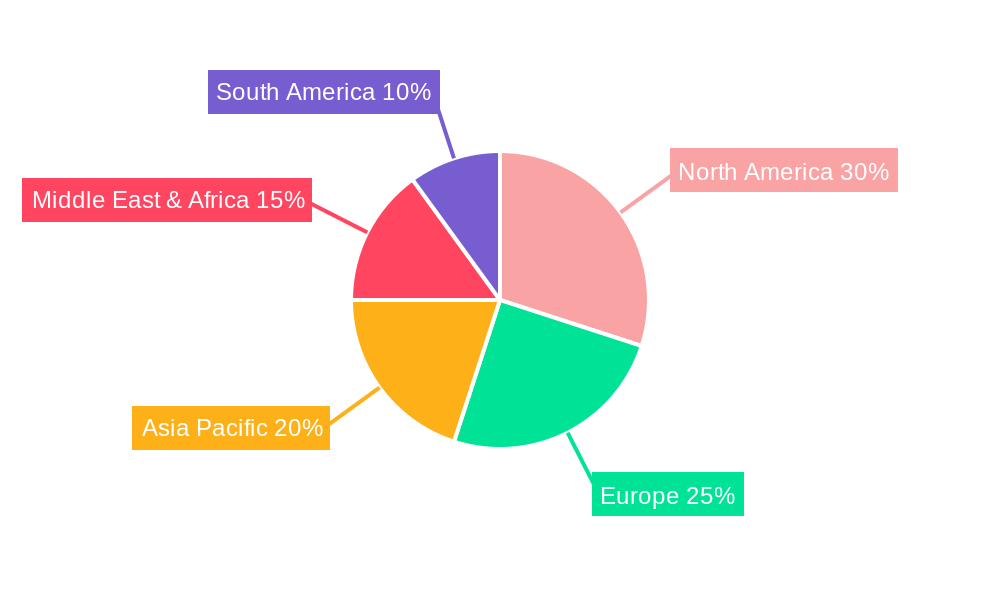

The market segmentation reveals a strong preference for cloud-based solutions, aligning with the broader trend towards cloud adoption for its scalability, accessibility, and cost-effectiveness. Geographically, North America and Europe are anticipated to lead the market, owing to advanced technological infrastructure, a high degree of digital adoption, and the presence of key regulatory frameworks that encourage blockchain innovation. However, the Asia Pacific region is expected to witness the most rapid growth, propelled by the large, digitally-evolving populations in countries like China and India, and increasing government initiatives to embrace blockchain for public services and digital identity management. Key players like Amazon Web Services, IBM, and Accenture are actively investing in R&D and strategic partnerships to capture market share, offering a diverse range of solutions tailored to various industry applications, including healthcare, government, and the rapidly expanding retail and e-commerce sectors. Despite the promising outlook, potential restraints include the complexity of integration with legacy systems, evolving regulatory landscapes in certain regions, and the need for greater public understanding and trust in blockchain-based identity solutions.

Here's a comprehensive, SEO-optimized report description for Blockchain-based Identity, designed to maximize visibility and engagement:

Report Title: Blockchain-based Identity Market: Dynamics, Growth Trends, and Future Outlook 2019–2033

Report Description:

Unlock critical insights into the rapidly evolving blockchain-based identity market. This in-depth report provides a definitive analysis of decentralized identity solutions, self-sovereign identity (SSI) platforms, and digital identity management powered by blockchain technology. Essential for IT leaders, blockchain developers, government officials, and financial institutions, this report navigates the intricate market dynamics, identifies key growth drivers, and forecasts future market potential through 2033. With a focus on parent and child market segments, this research offers a holistic view of the decentralized identity ecosystem, its adoption drivers, and the competitive landscape. Discover how blockchain is revolutionizing secure, privacy-preserving digital identities across critical sectors.

Blockchain-based Identity Market Dynamics & Structure

The blockchain-based identity market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and increasing demand for secure digital identification. Market concentration is currently moderate, with a growing number of specialized startups and established tech giants like Amazon Web Services, IBM, and Accenture investing heavily in decentralized identity solutions. Technological innovation is primarily driven by the pursuit of enhanced security, data privacy, and user control over personal information. Key drivers include the development of advanced cryptographic techniques, interoperability standards, and user-friendly decentralized applications (dApps).

- Market Concentration: Moderate, with increasing fragmentation and strategic alliances.

- Technological Innovation Drivers: Enhanced security, privacy-by-design, user control, interoperability, and fraud reduction.

- Regulatory Frameworks: Emerging global regulations (e.g., GDPR, eIDAS) are shaping the development and adoption of blockchain-based identity solutions, encouraging compliance and trust.

- Competitive Product Substitutes: Traditional centralized identity systems, federated identity models, and emerging zero-knowledge proof technologies pose indirect competition.

- End-User Demographics: A broad spectrum ranging from individual consumers seeking control over their data to enterprises requiring robust KYC/AML solutions and governments implementing digital citizen identification.

- M&A Trends: Strategic acquisitions and partnerships are on the rise as larger players seek to integrate blockchain identity capabilities into their existing portfolios. In the historical period 2019-2024, an estimated 50+ M&A deals valued at over $500 million were observed, indicating consolidation and strategic investment.

Blockchain-based Identity Growth Trends & Insights

The blockchain-based identity market is poised for exponential growth, driven by the inherent advantages of decentralization, immutability, and enhanced security offered by blockchain technology. The global market size for blockchain-based identity solutions is projected to surge from approximately $1,500 million in the base year 2025 to an estimated $25,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 35%. This significant expansion is fueled by the increasing need for tamper-proof digital identities that empower individuals and organizations with greater control over sensitive data. Adoption rates are accelerating across various sectors as businesses and governments recognize the potential of blockchain to streamline processes, reduce fraud, and build stronger trust with their stakeholders.

Technological disruptions, such as advancements in zero-knowledge proofs, verifiable credentials, and decentralized identifiers (DIDs), are continuously enhancing the capabilities and usability of blockchain identity solutions. These innovations are fostering a shift towards a more privacy-centric digital landscape where users can selectively share their verified information without compromising their overall anonymity. Consumer behavior is also evolving, with individuals becoming more conscious of data privacy and seeking decentralized alternatives that offer them agency over their digital footprints. The integration of blockchain-based identity into everyday applications, from online authentication to secure access in the metaverse, is expected to further drive market penetration and mainstream adoption. Early adoption in niche markets is rapidly expanding to broader applications, indicating a strong upward trajectory for the foreseeable future. The estimated market penetration is expected to grow from less than 5% in 2025 to over 30% by 2033 in relevant sectors.

Dominant Regions, Countries, or Segments in Blockchain-based Identity

The IT and Telecommunication segment stands out as a dominant force in the blockchain-based identity market, driven by the sector's intrinsic need for secure authentication, identity verification, and seamless data management. This segment is expected to capture a significant market share, estimated at over 30% of the total market value by 2025, and projected to expand further. The rapid digitalization of services, proliferation of connected devices, and the increasing threat of cyberattacks necessitate robust and verifiable digital identities, making blockchain solutions highly attractive. Companies like Cognizant, Accenture, and IBM are actively developing and deploying blockchain-based identity solutions for telecommunication providers and IT service companies, focusing on secure customer onboarding, fraud prevention, and personalized service delivery.

Among regions, North America and Europe are currently leading the adoption of blockchain-based identity solutions. North America's dominance is attributed to a mature technological ecosystem, significant venture capital investment in blockchain startups, and proactive government initiatives exploring digital identity frameworks. For instance, initiatives focused on secure digital credentials for citizens and employees are gaining traction. Europe follows closely, propelled by stringent data protection regulations like GDPR and the growing emphasis on cross-border digital identity interoperability through initiatives like eIDAS 2.0. Countries like Switzerland, with companies like Civic Technologies and KYC Chain at the forefront, are actively fostering innovation in decentralized identity. Asia-Pacific is emerging as a high-growth region, driven by a burgeoning digital economy, increasing smartphone penetration, and government-led digital transformation programs. The Government application segment, particularly in areas like e-governance, digital voting, and secure public service access, is another major growth driver, expected to represent approximately 25% of the market by 2025. The Healthcare sector, with its stringent data privacy requirements and the need for secure patient record management, is also demonstrating strong adoption potential, projected to account for around 18% of the market.

Blockchain-based Identity Product Landscape

The blockchain-based identity product landscape is characterized by a surge in innovative solutions offering decentralized identifiers (DIDs), verifiable credentials (VCs), and self-sovereign identity (SSI) platforms. Key offerings include cloud-based solutions from providers like Amazon Web Services and IBM, which facilitate easier integration and scalability for enterprises. Concurrently, local-based identity solutions are emerging for specific use cases requiring on-device or private network management. Companies such as BTL Group and DigiShares are developing platforms that enable secure, privacy-preserving authentication, KYC/AML compliance, and credential management. These products differentiate themselves through advanced cryptographic protocols, intuitive user interfaces, and robust interoperability features, aiming to replace traditional, vulnerable centralized identity systems with a more secure and user-centric paradigm.

Key Drivers, Barriers & Challenges in Blockchain-based Identity

Key Drivers:

- Enhanced Security & Privacy: The immutable nature of blockchain and cryptographic advancements provide unparalleled security against data breaches and unauthorized access.

- User Control & Empowerment: Decentralized identity empowers individuals with sovereign control over their personal data, deciding who to share it with and for how long.

- Regulatory Compliance: Growing demand for robust KYC/AML solutions and adherence to data privacy regulations (e.g., GDPR) are accelerating adoption.

- Cost Reduction & Efficiency: Streamlining identity verification processes and reducing manual effort leads to significant operational cost savings.

- Interoperability: Development of standards like DIDs and VCs enables seamless identity exchange across different platforms and ecosystems.

Barriers & Challenges:

- Scalability Concerns: While improving, some blockchain networks still face scalability limitations, impacting the speed and volume of transactions.

- Regulatory Uncertainty: The evolving nature of blockchain regulations globally can create ambiguity and hinder widespread adoption.

- Interoperability Standards: While progress is being made, achieving universal interoperability across different blockchain protocols and legacy systems remains a challenge.

- Technical Complexity & User Adoption: Educating users about decentralized identity and ensuring user-friendly interfaces are crucial for mass adoption.

- Initial Implementation Costs: High initial investment in infrastructure and integration can be a deterrent for some organizations.

- Data Recovery Mechanisms: Ensuring robust and secure data recovery processes in a decentralized environment is critical. The estimated impact of these challenges on market growth could reduce the projected CAGR by up to 5%.

Emerging Opportunities in Blockchain-based Identity

Emerging opportunities in the blockchain-based identity sector are vast and transformative. The metaverse presents a significant frontier, where unique, verifiable digital identities will be paramount for secure interaction, ownership of digital assets, and personalized experiences. Decentralized finance (DeFi) applications stand to benefit immensely from robust, blockchain-verified identities for enhanced Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance, mitigating risks and fostering wider institutional adoption. Furthermore, the convergence of blockchain identity with Artificial Intelligence (AI) opens avenues for hyper-personalized and secure services, where individuals can grant granular access to their verified attributes for tailored AI-driven applications. The development of decentralized marketplaces for verified credentials, allowing individuals to monetize their skills and reputation, is another promising avenue.

Growth Accelerators in the Blockchain-based Identity Industry

Several catalysts are accelerating the growth of the blockchain-based identity industry. Technological breakthroughs in zero-knowledge proofs and homomorphic encryption are enabling even greater privacy and data protection, addressing key user concerns. Strategic partnerships between established tech giants like Amazon Web Services, IBM, and Accenture and innovative blockchain startups are driving market penetration and product development. Governments worldwide are increasingly exploring and implementing national digital identity frameworks built on blockchain, providing a strong impetus for adoption. The growing awareness among consumers about data privacy rights and the desire for greater control over their digital selves is a powerful market pull. Moreover, the development of industry-specific consortia and standards is fostering collaboration and interoperability, paving the way for a more cohesive and scalable decentralized identity ecosystem.

Key Players Shaping the Blockchain-based Identity Market

- Amazon Web Services

- Bitfury Group Limited

- Cognizant

- Civic Technologies

- IBM

- BTL Group

- KYC Chain

- LeewayHertz

- DigiShares

- Accenture

Notable Milestones in Blockchain-based Identity Sector

- 2019: Launch of Sovrin Network, a global public utility for self-sovereign identity.

- 2020: W3C publishes standards for Decentralized Identifiers (DIDs).

- 2021: European Union begins piloting a digital identity wallet framework.

- 2022: Major cloud providers like AWS and IBM enhance their blockchain identity services.

- 2023: Increased adoption of Verifiable Credentials (VCs) in academic and professional settings.

- 2024: Significant investment rounds for several leading decentralized identity startups, indicating growing investor confidence.

In-Depth Blockchain-based Identity Market Outlook

The future of the blockchain-based identity market is exceptionally promising, fueled by the relentless drive towards a more secure, private, and user-centric digital world. Growth accelerators such as enhanced privacy technologies, robust governmental initiatives for digital citizenship, and increasing enterprise adoption for KYC/AML compliance will continue to propel market expansion. Strategic partnerships and the establishment of interoperable standards will be critical in fostering broader ecosystem development. The market is expected to witness significant growth in emerging applications within the metaverse, DeFi, and the Internet of Things (IoT), where secure and verifiable digital identities are foundational. The transition from fragmented solutions to integrated, user-friendly platforms will be key to unlocking mass market adoption and realizing the full potential of blockchain-powered decentralized identity.

Blockchain-based Identity Segmentation

-

1. Application

- 1.1. Healthcare

- 1.2. Government

- 1.3. IT and Telecommunication

- 1.4. Retail and E-commerce

- 1.5. Transport and Logistics

- 1.6. Others

-

2. Types

- 2.1. Cloud Based

- 2.2. Local Based

Blockchain-based Identity Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Blockchain-based Identity REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blockchain-based Identity Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Healthcare

- 5.1.2. Government

- 5.1.3. IT and Telecommunication

- 5.1.4. Retail and E-commerce

- 5.1.5. Transport and Logistics

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud Based

- 5.2.2. Local Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Blockchain-based Identity Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Healthcare

- 6.1.2. Government

- 6.1.3. IT and Telecommunication

- 6.1.4. Retail and E-commerce

- 6.1.5. Transport and Logistics

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud Based

- 6.2.2. Local Based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Blockchain-based Identity Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Healthcare

- 7.1.2. Government

- 7.1.3. IT and Telecommunication

- 7.1.4. Retail and E-commerce

- 7.1.5. Transport and Logistics

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud Based

- 7.2.2. Local Based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Blockchain-based Identity Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Healthcare

- 8.1.2. Government

- 8.1.3. IT and Telecommunication

- 8.1.4. Retail and E-commerce

- 8.1.5. Transport and Logistics

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud Based

- 8.2.2. Local Based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Blockchain-based Identity Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Healthcare

- 9.1.2. Government

- 9.1.3. IT and Telecommunication

- 9.1.4. Retail and E-commerce

- 9.1.5. Transport and Logistics

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud Based

- 9.2.2. Local Based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Blockchain-based Identity Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Healthcare

- 10.1.2. Government

- 10.1.3. IT and Telecommunication

- 10.1.4. Retail and E-commerce

- 10.1.5. Transport and Logistics

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud Based

- 10.2.2. Local Based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Amazon Web Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bitfury Group Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cognizant

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Civic Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BTL Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KYC Chain

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LeewayHertz

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DigiShares

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accenture

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Amazon Web Services

List of Figures

- Figure 1: Global Blockchain-based Identity Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Blockchain-based Identity Revenue (million), by Application 2024 & 2032

- Figure 3: North America Blockchain-based Identity Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Blockchain-based Identity Revenue (million), by Types 2024 & 2032

- Figure 5: North America Blockchain-based Identity Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Blockchain-based Identity Revenue (million), by Country 2024 & 2032

- Figure 7: North America Blockchain-based Identity Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Blockchain-based Identity Revenue (million), by Application 2024 & 2032

- Figure 9: South America Blockchain-based Identity Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Blockchain-based Identity Revenue (million), by Types 2024 & 2032

- Figure 11: South America Blockchain-based Identity Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Blockchain-based Identity Revenue (million), by Country 2024 & 2032

- Figure 13: South America Blockchain-based Identity Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Blockchain-based Identity Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Blockchain-based Identity Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Blockchain-based Identity Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Blockchain-based Identity Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Blockchain-based Identity Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Blockchain-based Identity Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Blockchain-based Identity Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Blockchain-based Identity Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Blockchain-based Identity Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Blockchain-based Identity Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Blockchain-based Identity Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Blockchain-based Identity Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Blockchain-based Identity Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Blockchain-based Identity Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Blockchain-based Identity Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Blockchain-based Identity Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Blockchain-based Identity Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Blockchain-based Identity Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Blockchain-based Identity Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Blockchain-based Identity Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Blockchain-based Identity Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Blockchain-based Identity Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Blockchain-based Identity Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Blockchain-based Identity Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Blockchain-based Identity Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Blockchain-based Identity Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Blockchain-based Identity Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Blockchain-based Identity Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Blockchain-based Identity Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Blockchain-based Identity Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Blockchain-based Identity Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Blockchain-based Identity Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Blockchain-based Identity Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Blockchain-based Identity Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Blockchain-based Identity Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Blockchain-based Identity Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Blockchain-based Identity Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Blockchain-based Identity Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blockchain-based Identity?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Blockchain-based Identity?

Key companies in the market include Amazon Web Services, Bitfury Group Limited, Cognizant, Civic Technologies, IBM, BTL Group, KYC Chain, LeewayHertz, DigiShares, Accenture.

3. What are the main segments of the Blockchain-based Identity?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blockchain-based Identity," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blockchain-based Identity report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blockchain-based Identity?

To stay informed about further developments, trends, and reports in the Blockchain-based Identity, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence