Key Insights

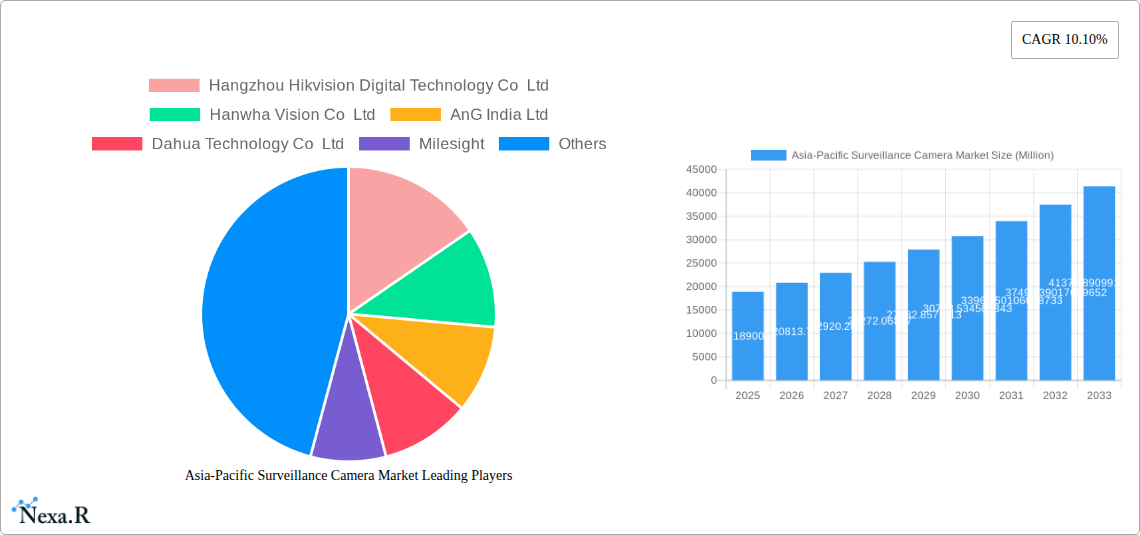

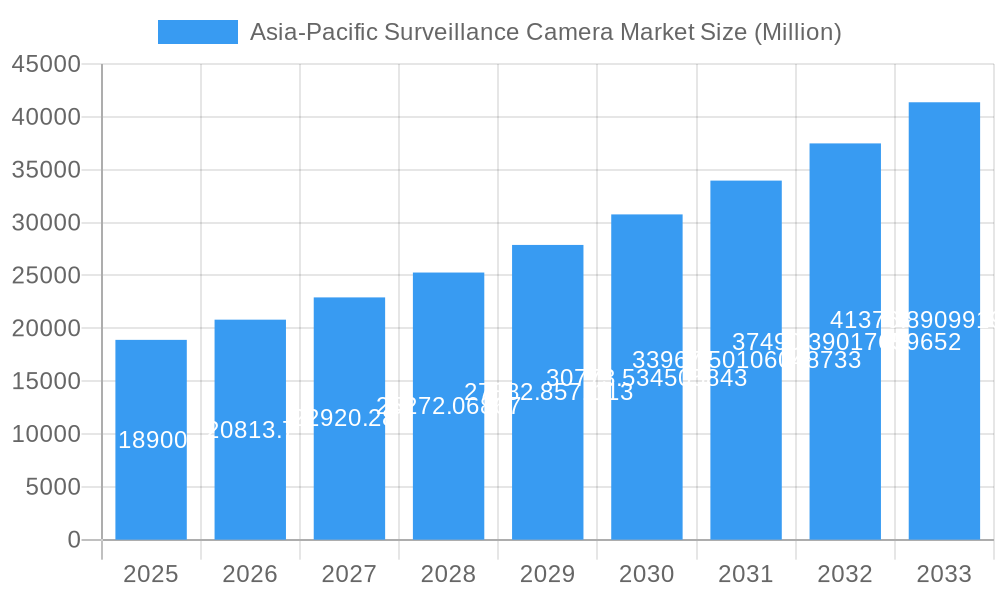

The Asia-Pacific Surveillance Camera Market is poised for significant expansion, driven by increasing security concerns across various sectors and the rapid adoption of advanced technologies. With an estimated market size of USD 18.90 billion in 2025, the market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 10.10% through 2033. This growth is fueled by the escalating demand for sophisticated surveillance solutions in government initiatives, financial institutions, healthcare facilities, and transportation networks. The rising crime rates and the need for enhanced public safety are primary catalysts, pushing both public and private entities to invest in cutting-edge camera systems. Furthermore, the increasing integration of artificial intelligence (AI) and machine learning (ML) in surveillance technologies, enabling features like facial recognition, behavioral analysis, and anomaly detection, is a key trend that will continue to shape market dynamics. The shift from traditional analog systems to IP-based and hybrid solutions, offering higher resolution, better connectivity, and more advanced analytics, further underpins this optimistic growth trajectory.

Asia-Pacific Surveillance Camera Market Market Size (In Billion)

The market's expansion is further supported by increasing urbanization and the development of smart city projects across the region, necessitating comprehensive security infrastructure. Key players such as Hangzhou Hikvision Digital Technology Co. Ltd., Dahua Technology Co. Ltd., and Axis Communications AB are at the forefront, introducing innovative products and expanding their market reach. The government sector, in particular, is a major contributor, driven by national security mandates and smart city investments. The banking and finance sector is also a significant adopter, focusing on fraud prevention and asset protection. While the market is on a strong upward trend, potential restraints could include the high initial investment cost for advanced systems, evolving data privacy regulations, and the need for skilled personnel for installation and maintenance. However, the continuous technological advancements and the growing awareness of the benefits of robust surveillance systems are expected to outweigh these challenges, ensuring sustained growth and market leadership for the Asia-Pacific region in the global surveillance camera landscape.

Asia-Pacific Surveillance Camera Market Company Market Share

Here is a comprehensive, SEO-optimized report description for the Asia-Pacific Surveillance Camera Market, designed for maximum visibility and industry engagement:

Asia-Pacific Surveillance Camera Market: Growth, Trends, and Innovations (2019-2033)

Gain unparalleled insights into the dynamic Asia-Pacific surveillance camera market with this in-depth report. Covering the historical period from 2019-2024 and projecting to 2033, with a base and estimated year of 2025, this analysis delves into market size, growth drivers, technological advancements, and key player strategies. Explore critical segments including Analog-based, IP-based, and Hybrid camera types, alongside end-user industries such as Government, Banking, Healthcare, Transportation and Logistics, Industrial, and Other Enterprises. Uncover the impact of disruptive innovations like AI-powered video analytics and high-resolution imaging, and understand how companies like Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision Co Ltd, and Dahua Technology Co Ltd are shaping the future of security and surveillance across the region.

Asia-Pacific Surveillance Camera Market Market Dynamics & Structure

The Asia-Pacific surveillance camera market is characterized by a moderate to high level of concentration, with leading players like Hikvision and Dahua holding significant market shares. Technological innovation is a primary driver, fueled by advancements in Artificial Intelligence (AI), machine learning, and edge computing, enabling smarter analytics and more efficient data processing. Regulatory frameworks, particularly concerning data privacy and cybersecurity, are increasingly influential, impacting product development and deployment strategies across countries like China, Japan, and South Korea. Competitive product substitutes are emerging with the rise of integrated smart home security systems and cloud-based video management solutions, though dedicated surveillance systems maintain a strong foothold due to their specialized functionalities and robust security features. End-user demographics are evolving, with a growing demand for sophisticated, scalable, and user-friendly surveillance solutions across both commercial and residential sectors. Mergers and acquisitions (M&A) activity, while present, is often focused on acquiring niche technologies or expanding market reach rather than outright consolidation of major players.

- Market Concentration: Dominated by a few key global players, with a growing presence of regional specialists.

- Technological Innovation Drivers: AI for intelligent analytics, edge computing for localized processing, higher resolution sensors, and enhanced cybersecurity features.

- Regulatory Frameworks: Evolving data privacy laws, cross-border data transfer regulations, and national security standards.

- Competitive Product Substitutes: Smart home security systems, cloud-based VMS, and integrated access control solutions.

- End-User Demographics: Increasing demand for tailored solutions in sectors like smart cities, retail, and critical infrastructure.

- M&A Trends: Strategic acquisitions of technology firms and partnerships to enhance product portfolios.

Asia-Pacific Surveillance Camera Market Growth Trends & Insights

The Asia-Pacific surveillance camera market is experiencing robust growth, driven by escalating security concerns, increasing urbanization, and the proliferation of smart city initiatives across the region. The market size is projected to witness a significant upward trajectory from an estimated value of $XX Million units in 2025, growing at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. Adoption rates for IP-based cameras continue to surge, eclipsing analog-based systems due to their superior image quality, advanced features, and network connectivity. Technological disruptions, particularly in AI-powered video analytics, are revolutionizing the industry by enabling proactive threat detection, facial recognition, object tracking, and behavioral analysis. These advancements are transforming surveillance from a passive recording tool into an active security and operational management system. Consumer behavior shifts are evident, with a growing preference for integrated, cloud-connected, and remotely accessible surveillance solutions that offer convenience and enhanced security. The increasing investment in public safety infrastructure by governments in countries like China, India, and Southeast Asian nations is a significant catalyst. Furthermore, the expansion of the transportation and logistics sector, coupled with the growing need for enhanced security in retail and industrial environments, is further propelling market penetration. The development of more affordable yet feature-rich camera options is also broadening the market's appeal to small and medium-sized enterprises (SMEs) and residential users. The demand for high-resolution cameras, including 4K and even 8K, is also on the rise, driven by the need for greater detail and clarity in critical surveillance scenarios.

Dominant Regions, Countries, or Segments in Asia-Pacific Surveillance Camera Market

The IP-based camera segment is currently the dominant force within the Asia-Pacific surveillance camera market, showcasing rapid adoption and innovation that outpaces its analog and hybrid counterparts. This dominance is driven by the inherent advantages of IP technology, including higher resolution imaging, superior scalability, network integration capabilities, and the integration of advanced analytics features. Within the end-user industries, the Government sector emerges as a primary growth engine, propelled by significant investments in public safety, smart city projects, and national security infrastructure across countries like China, India, Japan, and South Korea. Government initiatives aimed at crime prevention, traffic management, and border surveillance necessitate the widespread deployment of sophisticated surveillance systems. The Transportation and Logistics sector is another key contributor, with an increasing demand for advanced monitoring solutions to ensure cargo security, optimize supply chain operations, and enhance passenger safety in airports, ports, and railway networks.

- Dominant Segment (Type): IP-based cameras continue to lead due to their technological superiority, offering higher resolution, enhanced connectivity, and AI capabilities.

- Dominant Segment (End-User Industry): The Government sector drives significant demand, fueled by smart city projects and public safety initiatives.

- Key Country Drivers: China remains a powerhouse due to its massive domestic market and advanced technological ecosystem. India is experiencing rapid growth driven by increasing security consciousness and government investments.

- Emerging Growth Areas: The Transportation and Logistics sector is increasingly adopting advanced IP cameras for real-time tracking and security.

- Market Share Dynamics: IP-based cameras are estimated to hold over XX% of the market share in 2025, with strong growth projected through 2033.

- Growth Potential: The government and transportation sectors are expected to exhibit a CAGR of over XX% during the forecast period.

Asia-Pacific Surveillance Camera Market Product Landscape

The product landscape of the Asia-Pacific surveillance camera market is characterized by continuous innovation aimed at enhancing functionality, efficiency, and user experience. Key product advancements include the development of AI-powered cameras with integrated video analytics capabilities, such as facial recognition, object detection, and anomaly detection, which offer proactive security solutions. High-resolution imaging, with 4K and even higher resolutions becoming more common, provides exceptional clarity for detailed monitoring and evidence collection. The integration of edge computing allows for data processing directly on the camera, reducing bandwidth requirements and enabling real-time analytics. Furthermore, advancements in low-light performance and thermal imaging technology are expanding the applicability of surveillance cameras in diverse environmental conditions. The emergence of specialized cameras, such as panoramic cameras and multi-lens cameras like Hanwha Vision's dual-lens BCR camera, cater to specific industry needs by offering wider coverage and integrated functionalities.

Key Drivers, Barriers & Challenges in Asia-Pacific Surveillance Camera Market

Key Drivers:

- Rising Security Concerns: Increasing crime rates, terrorism threats, and the need for public safety are paramount drivers.

- Smart City Initiatives: Government investments in smart cities, urban development, and traffic management systems fuel demand for integrated surveillance.

- Technological Advancements: AI, machine learning, IoT integration, and higher resolution imaging enable smarter and more effective surveillance solutions.

- Growing Industrialization and Commercialization: Expansion of manufacturing, retail, and logistics sectors requires enhanced security and operational monitoring.

- Cost-Effectiveness of IP Cameras: Declining prices and superior features of IP cameras are driving their adoption over analog systems.

Barriers & Challenges:

- Data Privacy and Regulations: Stringent data privacy laws and evolving regulatory landscapes pose compliance challenges for manufacturers and users.

- Cybersecurity Vulnerabilities: The increasing connectivity of surveillance systems makes them susceptible to cyber-attacks, demanding robust security measures.

- High Initial Investment: For certain advanced systems and large-scale deployments, the initial capital expenditure can be a barrier for some organizations.

- Integration Complexity: Integrating diverse surveillance systems with existing IT infrastructure can be complex and require specialized expertise.

- Talent Shortage: A lack of skilled professionals for installation, maintenance, and data analysis of advanced surveillance systems.

Emerging Opportunities in Asia-Pacific Surveillance Camera Market

Emerging opportunities in the Asia-Pacific surveillance camera market are diverse and poised for significant growth. The burgeoning adoption of AI-powered analytics presents a lucrative avenue for enhanced threat detection, predictive policing, and intelligent crowd management. The smart home security segment is witnessing increasing demand for integrated, easy-to-use surveillance solutions that offer remote monitoring and seamless connectivity with other smart devices. Furthermore, the expansion of the healthcare sector, with its growing need for patient monitoring and facility security, offers untapped potential. The increasing focus on border security and critical infrastructure protection across various Asia-Pacific nations will also drive the demand for specialized, high-performance surveillance systems. The development of advanced cloud-based Video Management Systems (VMS) offers scalability, accessibility, and cost-effectiveness for businesses of all sizes.

Growth Accelerators in the Asia-Pacific Surveillance Camera Market Industry

Several key catalysts are accelerating the growth of the Asia-Pacific surveillance camera market. The relentless pace of technological innovation, particularly in AI and machine learning, is continuously introducing more intelligent and capable surveillance solutions. Government initiatives promoting smart city development and public safety infrastructure are creating sustained demand. Strategic partnerships between camera manufacturers, software providers, and system integrators are fostering the development of comprehensive and tailored solutions. The increasing affordability of advanced IP cameras, coupled with a growing awareness of their benefits, is driving wider market penetration, especially among small and medium-sized enterprises. Furthermore, the growing trend towards remote work and the need for decentralized monitoring are boosting the demand for cloud-enabled surveillance systems.

Key Players Shaping the Asia-Pacific Surveillance Camera Market Market

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision Co Ltd

- AnG India Ltd

- Dahua Technology Co Ltd

- Milesight

- Genetec Inc

- Anviz Global Inc

- Bosch Security Systems GmbH

- D-Link India Limited

- Secureye

- Teledyne FLIR LLC

- Milestone Systems

- Honeywell International Inc

- Axis Communications AB

- Eagle Eye Network

Notable Milestones in Asia-Pacific Surveillance Camera Market Sector

- May 2024: Hanwha Vision debuted the industry's inaugural dual-lens barcode reader (BCR) camera, merging barcode recognition and video capture into a singular, efficient device. This innovation equips logistics firms with a streamlined approach to cutting costs, curbing losses, and enhancing operational efficiency. The AI-powered BCR camera adeptly tracks and identifies parcel barcodes on swift conveyors, boasting a remarkable speed of 2 m/s. Its image sensors, tailored for both barcode recognition and video monitoring, deliver crisp 4K resolution and a broad field-of-view (FoV) courtesy of a 25 mm lens. The camera seamlessly integrates with Hanwha Vision's cutting-edge vision logistics tracking software (VLTS).

- August 2023: Hikvision launched a 16 MP, 180-degree network camera, PanoVU. This camera adds to the existing range of PanoVU cameras from Hikvision, giving customers even more options regarding video security. According to the company, the camera was designed to withstand extreme weather conditions. Furthermore, these cameras offer intelligent human density counting and foot traffic analysis, allowing monitoring and analyzing people flow trends, facilitating proactive safety measures, and efficient crowd management.

In-Depth Asia-Pacific Surveillance Camera Market Market Outlook

The future outlook for the Asia-Pacific surveillance camera market is exceptionally promising, driven by the pervasive integration of Artificial Intelligence, the expansion of smart city projects, and an unwavering commitment to enhancing public and private sector security. The continuous evolution of IP camera technology, offering higher resolutions, advanced analytics, and seamless network connectivity, will solidify its market dominance. Emerging applications in sectors like retail analytics, smart farming, and enhanced industrial automation will create new revenue streams. Strategic collaborations and the development of robust cybersecurity measures will be critical for sustained growth. The market is poised to witness substantial expansion as governments and enterprises across the region prioritize intelligent, efficient, and scalable surveillance solutions to address evolving security challenges and operational needs.

Asia-Pacific Surveillance Camera Market Segmentation

-

1. Type

- 1.1. Analog-based

- 1.2. IP-based

- 1.3. Hybrid

-

2. End-user Industry

- 2.1. Government

- 2.2. Banking

- 2.3. Healthcare

- 2.4. Transportation and Logistics

- 2.5. Industrial

- 2.6. Other En

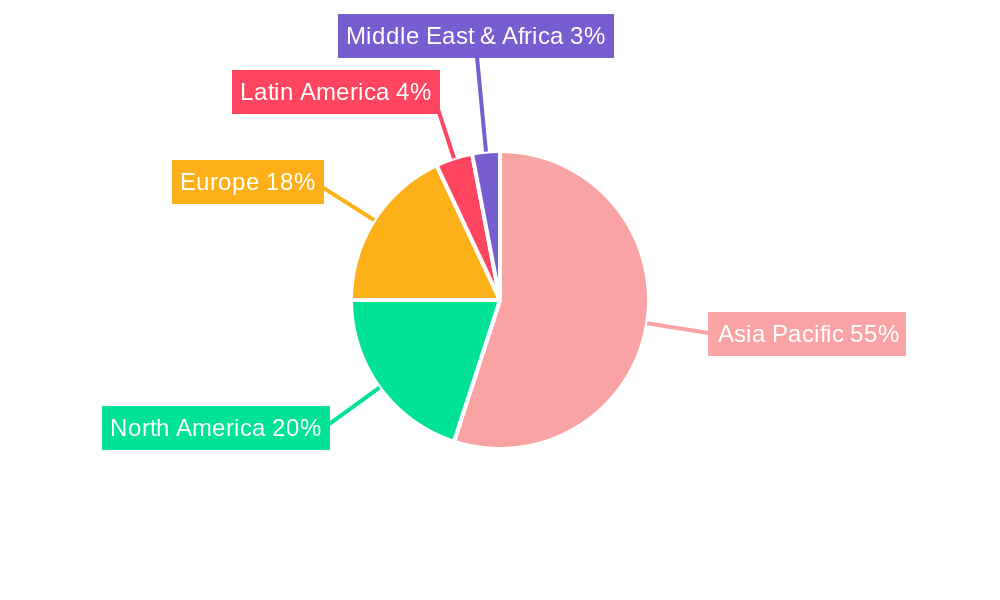

Asia-Pacific Surveillance Camera Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Surveillance Camera Market Regional Market Share

Geographic Coverage of Asia-Pacific Surveillance Camera Market

Asia-Pacific Surveillance Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Advancements in Technology and Functionality

- 3.2.2 like High-resolution Cameras; Increasing Demand for Cloud-based Storage; Strict Government Regulations for the Mandatory Installation of Surveillance Cameras

- 3.3. Market Restrains

- 3.3.1 Advancements in Technology and Functionality

- 3.3.2 like High-resolution Cameras; Increasing Demand for Cloud-based Storage; Strict Government Regulations for the Mandatory Installation of Surveillance Cameras

- 3.4. Market Trends

- 3.4.1. IP-based Cameras are Gaining Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Surveillance Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog-based

- 5.1.2. IP-based

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Government

- 5.2.2. Banking

- 5.2.3. Healthcare

- 5.2.4. Transportation and Logistics

- 5.2.5. Industrial

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hanwha Vision Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AnG India Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dahua Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Milesight

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genetec Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Anviz Global Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch Security Systems GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 D-Link India Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Secureye

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Teledyne FLIR LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Milestone Systems

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Honeywell International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Axis Communications AB

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Eagle Eye Network

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

List of Figures

- Figure 1: Asia-Pacific Surveillance Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Surveillance Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Surveillance Camera Market?

The projected CAGR is approximately 10.10%.

2. Which companies are prominent players in the Asia-Pacific Surveillance Camera Market?

Key companies in the market include Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision Co Ltd, AnG India Ltd, Dahua Technology Co Ltd, Milesight, Genetec Inc, Anviz Global Inc, Bosch Security Systems GmbH, D-Link India Limited, Secureye, Teledyne FLIR LLC, Milestone Systems, Honeywell International Inc, Axis Communications AB, Eagle Eye Network.

3. What are the main segments of the Asia-Pacific Surveillance Camera Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in Technology and Functionality. like High-resolution Cameras; Increasing Demand for Cloud-based Storage; Strict Government Regulations for the Mandatory Installation of Surveillance Cameras.

6. What are the notable trends driving market growth?

IP-based Cameras are Gaining Momentum.

7. Are there any restraints impacting market growth?

Advancements in Technology and Functionality. like High-resolution Cameras; Increasing Demand for Cloud-based Storage; Strict Government Regulations for the Mandatory Installation of Surveillance Cameras.

8. Can you provide examples of recent developments in the market?

May 2024 - Hanwha Vision debuted the industry's inaugural dual-lens barcode reader (BCR) camera, merging barcode recognition and video capture into a singular, efficient device. This innovation equips logistics firms with a streamlined approach to cutting costs, curbing losses, and enhancing operational efficiency. The AI-powered BCR camera adeptly tracks and identifies parcel barcodes on swift conveyors, boasting a remarkable speed of 2 m/s. Its image sensors, tailored for both barcode recognition and video monitoring, deliver crisp 4K resolution and a broad field-of-view (FoV) courtesy of a 25 mm lens. The camera seamlessly integrates with Hanwha Vision's cutting-edge vision logistics tracking software (VLTS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Surveillance Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Surveillance Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Surveillance Camera Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Surveillance Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence