Key Insights

The Chinese luxury goods market, a significant global player, is experiencing substantial growth driven by an expanding affluent consumer base and a cultural shift favoring premium brands. With a projected Compound Annual Growth Rate (CAGR) of 4.49%, the market is expected to reach $316.3 billion by 2033, building from a 2024 base year. Key growth drivers include rising disposable incomes, a growing middle class seeking aspirational brands, and increased e-commerce penetration for luxury items. Market segmentation highlights strong performance in Clothing & Apparel, Footwear, and Bags. Distribution channels are diverse, featuring single-brand stores, multi-brand boutiques, and robust online marketplaces catering to digitally savvy consumers.

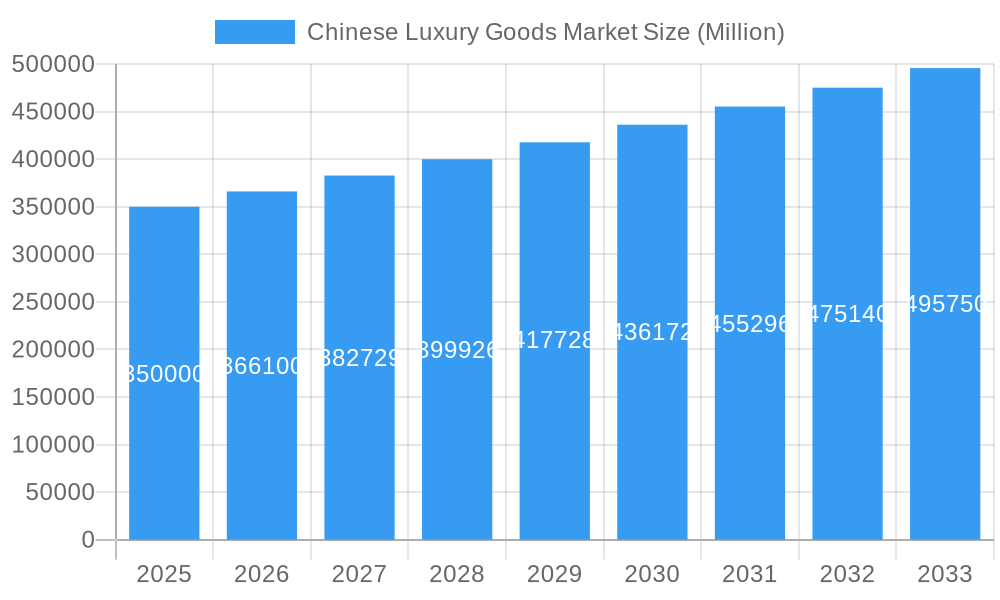

Chinese Luxury Goods Market Market Size (In Billion)

Growth is further amplified by the expansion of luxury brands into secondary cities and rural areas, supported by improved logistics and targeted marketing. Government economic reforms and a focus on domestic consumption also contribute positively. While economic fluctuations and evolving consumer preferences present potential challenges, underlying growth drivers are anticipated to dominate. The presence of major international players like LVMH, Kering, and Richemont, alongside emerging domestic brands, fosters a competitive and innovative market environment, meeting the sophisticated demands of Chinese consumers.

Chinese Luxury Goods Market Company Market Share

This comprehensive report analyzes the Chinese luxury goods market from 2019 to 2033, with a detailed forecast for 2025-2033. It segments the market by Type (Clothing & Apparel, Footwear, Bags, Jewelry, Watches, Other) and Distribution Channel (Single-brand Stores, Multi-brand Stores, Online Stores, Other), providing granular insights for strategic decision-making. The market size is valued in billions.

Chinese Luxury Goods Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Chinese luxury goods market. The market is characterized by high concentration with a few dominant players, exhibiting both intense competition and strategic collaborations.

- Market Concentration: The market is dominated by major international luxury brands like LVMH, Kering, Richemont, and others, along with a growing number of domestic luxury brands. Market share data for 2024 indicates LVMH holds approximately xx%, followed by Kering at xx%, and Richemont at xx%. The remaining share is distributed among other international and domestic players.

- Technological Innovation: E-commerce and digital marketing play a crucial role, with innovative technologies like personalized experiences and virtual try-ons increasingly adopted. However, challenges exist in balancing digitalization with the traditional luxury experience.

- Regulatory Framework: Government regulations on luxury goods imports, taxation, and counterfeit products significantly impact the market. Changes in these regulations can create both opportunities and challenges.

- Competitive Product Substitutes: The rise of affordable luxury and domestic brands presents a competitive challenge, impacting the market share of established international players.

- End-User Demographics: The key consumer base comprises affluent millennials and Gen Z, with a growing focus on personalization and unique experiences.

- M&A Trends: The luxury sector witnesses consistent M&A activity, driving consolidation and expansion. In 2024, an estimated xx M&A deals were recorded within the Chinese luxury goods market, with xx% focused on digital expansion.

Chinese Luxury Goods Market Growth Trends & Insights

The Chinese luxury goods market has witnessed substantial growth over the past few years. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, reaching a value of xx Million units in 2024. This growth is fueled by several factors: rising disposable incomes, an expanding middle class, increasing consumer spending on luxury goods, and the growing preference for premium quality and brand recognition. The market is expected to continue its robust growth trajectory, driven by ongoing economic expansion and evolving consumer preferences. We project a CAGR of xx% from 2025 to 2033, with the market valued at xx Million units by 2033. Technological advancements in e-commerce and personalized marketing further contribute to market expansion. Adoption rates of online luxury shopping have significantly increased, with a projected penetration rate of xx% by 2033.

Dominant Regions, Countries, or Segments in Chinese Luxury Goods Market

Tier 1 and Tier 2 cities in China are the primary drivers of luxury goods consumption, contributing to the majority of the market revenue. Within product segments, Bags and Watches exhibit higher growth potential compared to other types, while Single-brand stores continue to dominate the distribution channel landscape.

- Regional Dominance: Major metropolitan areas such as Beijing, Shanghai, Guangzhou, and Shenzhen lead in luxury goods consumption, driven by higher disposable incomes and concentration of affluent consumers. These regions collectively account for over xx% of the total market value.

- Segment Dominance: The Bags segment leads in market share due to high demand and diverse product offerings, while Watches demonstrate strong growth potential, propelled by the popularity of Swiss brands and domestic watchmakers.

- Distribution Channel Dominance: Single-brand stores maintain a significant market share due to their ability to create a brand-specific luxury experience. However, online stores are witnessing rapid growth, expanding access and convenience.

Chinese Luxury Goods Market Product Landscape

Product innovation in the Chinese luxury goods market focuses on personalized experiences, incorporating technology, and creating unique product narratives appealing to the younger consumer base. This includes collaborations with artists, utilizing sustainable materials, and offering customization options. Innovative features such as augmented reality (AR) experiences for virtual try-ons and personalized product recommendations enhance the customer journey. Performance metrics are closely monitored, with focus on key indicators such as conversion rates, customer lifetime value (CLTV), and customer satisfaction scores.

Key Drivers, Barriers & Challenges in Chinese Luxury Goods Market

Key Drivers: The Chinese luxury goods market is experiencing phenomenal growth fueled by several key factors. A rapidly expanding affluent population with rising disposable incomes and a burgeoning middle class are driving increased consumer spending on luxury items. This is further amplified by a strong cultural preference for premium brands and high-quality products, a perception reinforced by the allure of established international brands and sophisticated marketing strategies. Furthermore, government policies supporting the growth of domestic luxury brands contribute significantly to the market's dynamism.

Key Challenges: Despite the robust growth, the market faces significant hurdles. The prevalence of counterfeit goods remains a major challenge, severely impacting brand reputation, consumer trust, and market share for legitimate players. Supply chain vulnerabilities, exacerbated by global geopolitical events, coupled with fluctuating exchange rates and intensifying competition from both established international and emerging domestic brands, create pressure on profit margins and necessitate agile strategic responses. The evolving regulatory landscape, particularly concerning e-commerce practices and data privacy, demands significant compliance efforts and strategic adaptation.

Emerging Opportunities in Chinese Luxury Goods Market

The Chinese luxury market presents a wealth of exciting opportunities for brands willing to adapt and innovate. The growing demand for personalized luxury experiences presents a significant avenue for growth. Leveraging digital technologies to enhance customer engagement, build brand loyalty, and offer bespoke services is paramount. The metaverse and virtual reality offer exciting new frontiers for immersive brand building and product showcasing. Untapped potential exists in lower-tier cities, representing a considerable expansion opportunity. Finally, focusing on sustainability and ethical sourcing resonates deeply with the increasingly conscious luxury consumer, offering a powerful differentiator in a competitive market.

Growth Accelerators in the Chinese Luxury Goods Market Industry

Strategic partnerships between international luxury brands and well-established domestic companies are proving to be crucial growth catalysts. These collaborations provide access to invaluable local market expertise, distribution networks, and consumer insights, significantly mitigating market entry challenges. Technological advancements in e-commerce, sophisticated personalized marketing campaigns, and innovative product development are further accelerating market expansion. A multi-pronged approach that includes expanding into lower-tier cities and actively engaging with the burgeoning online luxury market opens up previously untapped market segments.

Key Players Shaping the Chinese Luxury Goods Market Market

Notable Milestones in Chinese Luxury Goods Market Sector

- January 2022: LVMH significantly expanded its presence on JD.com, a leading Chinese e-commerce platform, with Givenchy launching its own mini-program, effectively targeting a younger demographic of Chinese consumers.

- January 2022: Gucci's launch of the Gucci Tiger collection showcased the brand's agility in leveraging trending designs and cultural relevance to resonate with the Chinese market.

- May 2021: Prada's strategic opening of a pop-up store in Shanghai, showcasing its Outdoor collection, exemplified its innovative approach to retail experiences within the Chinese market, effectively engaging consumers through unique and immersive brand interactions.

- Ongoing: The continuous evolution of the Chinese consumer’s preferences and the brands' responses to these shifts represent a significant ongoing milestone, demanding constant adaptation and innovation.

In-Depth Chinese Luxury Goods Market Market Outlook

The Chinese luxury goods market is poised for sustained growth, driven by rising affluence, evolving consumer preferences, and technological advancements. Strategic partnerships, innovative product development, and expansion into lower-tier cities will play a critical role in unlocking future market potential. The market's dynamic nature presents significant opportunities for both established players and emerging brands, requiring adaptability and a deep understanding of the evolving Chinese consumer landscape.

Chinese Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Types

-

2. Distibution Channel

- 2.1. Single-brand Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Chinese Luxury Goods Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Luxury Goods Market Regional Market Share

Geographic Coverage of Chinese Luxury Goods Market

Chinese Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Emergence of E-commerce Channels

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-brand Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Chinese Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewelry

- 6.1.5. Watches

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Single-brand Stores

- 6.2.2. Multi-brand Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Chinese Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewelry

- 7.1.5. Watches

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Single-brand Stores

- 7.2.2. Multi-brand Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Chinese Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewelry

- 8.1.5. Watches

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Single-brand Stores

- 8.2.2. Multi-brand Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Chinese Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewelry

- 9.1.5. Watches

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Single-brand Stores

- 9.2.2. Multi-brand Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Chinese Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewelry

- 10.1.5. Watches

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.2.1. Single-brand Stores

- 10.2.2. Multi-brand Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 LVMH Moet Hennessy Louis Vuitton

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hermes International SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kering SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Compagnie Financiere Richemont SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Estee Lauder Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Prada SpA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 L'Oreal SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chanel SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Swatch Group*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rolex SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 LVMH Moet Hennessy Louis Vuitton

List of Figures

- Figure 1: Global Chinese Luxury Goods Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Chinese Luxury Goods Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Chinese Luxury Goods Market Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Chinese Luxury Goods Market Volume (K Units), by Type 2025 & 2033

- Figure 5: North America Chinese Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Chinese Luxury Goods Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Chinese Luxury Goods Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 8: North America Chinese Luxury Goods Market Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 9: North America Chinese Luxury Goods Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 10: North America Chinese Luxury Goods Market Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 11: North America Chinese Luxury Goods Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Chinese Luxury Goods Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Chinese Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Chinese Luxury Goods Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Chinese Luxury Goods Market Revenue (billion), by Type 2025 & 2033

- Figure 16: South America Chinese Luxury Goods Market Volume (K Units), by Type 2025 & 2033

- Figure 17: South America Chinese Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: South America Chinese Luxury Goods Market Volume Share (%), by Type 2025 & 2033

- Figure 19: South America Chinese Luxury Goods Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 20: South America Chinese Luxury Goods Market Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 21: South America Chinese Luxury Goods Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 22: South America Chinese Luxury Goods Market Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 23: South America Chinese Luxury Goods Market Revenue (billion), by Country 2025 & 2033

- Figure 24: South America Chinese Luxury Goods Market Volume (K Units), by Country 2025 & 2033

- Figure 25: South America Chinese Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Chinese Luxury Goods Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Chinese Luxury Goods Market Revenue (billion), by Type 2025 & 2033

- Figure 28: Europe Chinese Luxury Goods Market Volume (K Units), by Type 2025 & 2033

- Figure 29: Europe Chinese Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Chinese Luxury Goods Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Chinese Luxury Goods Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 32: Europe Chinese Luxury Goods Market Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 33: Europe Chinese Luxury Goods Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 34: Europe Chinese Luxury Goods Market Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 35: Europe Chinese Luxury Goods Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe Chinese Luxury Goods Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Europe Chinese Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Chinese Luxury Goods Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Chinese Luxury Goods Market Revenue (billion), by Type 2025 & 2033

- Figure 40: Middle East & Africa Chinese Luxury Goods Market Volume (K Units), by Type 2025 & 2033

- Figure 41: Middle East & Africa Chinese Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East & Africa Chinese Luxury Goods Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East & Africa Chinese Luxury Goods Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 44: Middle East & Africa Chinese Luxury Goods Market Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 45: Middle East & Africa Chinese Luxury Goods Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 46: Middle East & Africa Chinese Luxury Goods Market Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 47: Middle East & Africa Chinese Luxury Goods Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East & Africa Chinese Luxury Goods Market Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East & Africa Chinese Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Chinese Luxury Goods Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Chinese Luxury Goods Market Revenue (billion), by Type 2025 & 2033

- Figure 52: Asia Pacific Chinese Luxury Goods Market Volume (K Units), by Type 2025 & 2033

- Figure 53: Asia Pacific Chinese Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Asia Pacific Chinese Luxury Goods Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Asia Pacific Chinese Luxury Goods Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 56: Asia Pacific Chinese Luxury Goods Market Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 57: Asia Pacific Chinese Luxury Goods Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 58: Asia Pacific Chinese Luxury Goods Market Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 59: Asia Pacific Chinese Luxury Goods Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific Chinese Luxury Goods Market Volume (K Units), by Country 2025 & 2033

- Figure 61: Asia Pacific Chinese Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Chinese Luxury Goods Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chinese Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Chinese Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Global Chinese Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Global Chinese Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: Global Chinese Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Chinese Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Chinese Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Chinese Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Global Chinese Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: Global Chinese Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: Global Chinese Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Chinese Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global Chinese Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Chinese Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Global Chinese Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 22: Global Chinese Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 23: Global Chinese Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Chinese Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Brazil Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Brazil Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Argentina Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global Chinese Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Global Chinese Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 33: Global Chinese Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 34: Global Chinese Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 35: Global Chinese Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Chinese Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Germany Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: France Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Italy Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Spain Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Russia Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Benelux Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Benelux Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Nordics Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Nordics Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global Chinese Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 56: Global Chinese Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 57: Global Chinese Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 58: Global Chinese Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 59: Global Chinese Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Chinese Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Turkey Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Israel Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Israel Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: GCC Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: GCC Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: North Africa Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: North Africa Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: South Africa Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: South Africa Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Global Chinese Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 74: Global Chinese Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 75: Global Chinese Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 76: Global Chinese Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 77: Global Chinese Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 78: Global Chinese Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

- Table 79: China Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: China Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 81: India Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: India Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 83: Japan Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Japan Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 85: South Korea Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Korea Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Oceania Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Oceania Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Chinese Luxury Goods Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Chinese Luxury Goods Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Luxury Goods Market?

The projected CAGR is approximately 4.49%.

2. Which companies are prominent players in the Chinese Luxury Goods Market?

Key companies in the market include LVMH Moet Hennessy Louis Vuitton, Hermes International SA, Kering SA, Compagnie Financiere Richemont SA, The Estee Lauder Company, Prada SpA, L'Oreal SA, Chanel SA, The Swatch Group*List Not Exhaustive, Rolex SA.

3. What are the main segments of the Chinese Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 316.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items.

6. What are the notable trends driving market growth?

Emergence of E-commerce Channels.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In January 2022, LVMH has increased the raft of brands that have joined up with Chinese e-commerce giant JD.com as Givenchy launches its mini program on JD's marketplace. The mini-programs enable the brands to tap into the evergreen young Chinese luxury consumer base.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Chinese Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence